The global paper sheeting market is experiencing steady growth, driven by rising demand across packaging, printing, and converting industries. According to Grand View Research, the global paper and paperboard market size was valued at USD 408.8 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. This growth is fueled by increasing e-commerce activities, sustainable packaging trends, and the continued preference for renewable materials over plastics. As demand for precision-cut, custom-sized paper products rises, manufacturers are scaling operations, investing in advanced slitting and sheeting technologies, and expanding distribution networks. In this evolving landscape, identifying the leading paper sheeting manufacturers becomes critical for businesses seeking reliability, scalability, and innovation. The following list highlights the top 10 companies shaping the industry through technological expertise, global reach, and consistent quality.

Top 10 Paper Sheeting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Greif

Domain Est. 1997

Website: greif.com

Key Highlights: Greif’s network of dedicated sheet feeders manufacture corrugated sheets, from single to triple wall board constructions, with an array of flutes, paper grades, ……

#2 Global Packaging Manufacturer Driving Sustainable Packaging

Domain Est. 1997

Website: westrock.com

Key Highlights: Smurfit Westrock, a Global Leader in Sustainable Packaging, Operating in 40 Countries with 500+ Packaging Converting Operations and 63 Paper Mills….

#3 Specialty Paper by delfort

Domain Est. 2006

Website: delfortgroup.com

Key Highlights: We are delfort and we are revolutionizing the specialty paper industry. Discover our paper products & learn more about paper-based ……

#4 Paper Manufacturing and Printing Products

Domain Est. 1988

Website: 3m.com

Key Highlights: Products for paper manufacturing include: Tapes for web handling: Core starting, roll closing, and splicing; Advanced ceramics for highly durable wear ……

#5 Sappi

Domain Est. 1995

Website: sappi.com

Key Highlights: Global leader in sustainable paper, pulp and packaging solutions. Sappi delivers high-quality woodfibre products, advanced biomaterials and innovative ……

#6 Inland Empire Paper Company

Domain Est. 1996 | Founded: 1911

Website: iepco.com

Key Highlights: IEP, founded in 1911, is a USA family owned fully integrated pulp and paper mill located in Millwood, Washington….

#7 International Paper

Domain Est. 1997

Website: internationalpaper.com

Key Highlights: We transform renewable resources into innovative and sustainable packaging solutions, corrugated cardboard boxes, pulp and paper products, ……

#8 Billerud

Domain Est. 1999

Website: billerud.com

Key Highlights: Billerud is a world leading company in high-performing paper and packaging materials – passionately committed to sustainability, quality, and customer value….

#9 arcticpaper.com

Domain Est. 2000

Website: arcticpaper.com

Key Highlights: At Arctic Paper, we offer premium paper and packaging products and services built on inventiveness, reliable quality and sustainability….

#10 Smurfit Westrock

Domain Est. 2023

Website: smurfitwestrock.com

Key Highlights: We create, design and manufacture paper-based packaging made from renewable materials that protect and promote our customers’ products. In 2024, we manufactured ……

Expert Sourcing Insights for Paper Sheeting

2026 Market Trends for Paper Sheeting

The paper sheeting market is undergoing a significant transformation as it approaches 2026, shaped by sustainability demands, digital disruption, evolving consumer preferences, and technological innovation. While traditional applications face challenges, niche and specialty sectors are driving growth and redefining the industry’s trajectory.

Sustainability and Circular Economy Driving Innovation

Environmental concerns remain the foremost influence on the paper sheeting market. By 2026, regulatory pressures and consumer demand for eco-friendly packaging are accelerating the shift toward recyclable, compostable, and biodegradable solutions. Paper sheeting—particularly uncoated and lightly coated grades—is benefiting as a sustainable alternative to plastic in retail, food service, and industrial applications. Expect increased investment in closed-loop recycling systems, higher use of post-consumer waste (PCW) fiber, and certifications such as FSC and PEFC becoming standard. Manufacturers are also adopting waterless coating and energy-efficient drying technologies to reduce carbon footprints.

E-Commerce and Protective Packaging Fueling Demand

The continued expansion of e-commerce is a key growth driver for paper sheeting, especially in protective packaging. Paper-based void fill, cushioning pads, and wrapping sheets are replacing plastic bubble wrap and foam peanuts. By 2026, demand for kraft paper and molded fiber sheeting will rise as brands seek customizable, branded, and sustainable unboxing experiences. Innovations such as water-resistant coatings and enhanced tensile strength are expanding paper’s utility in shipping environments, making it a preferred choice for logistics companies aiming to meet sustainability targets.

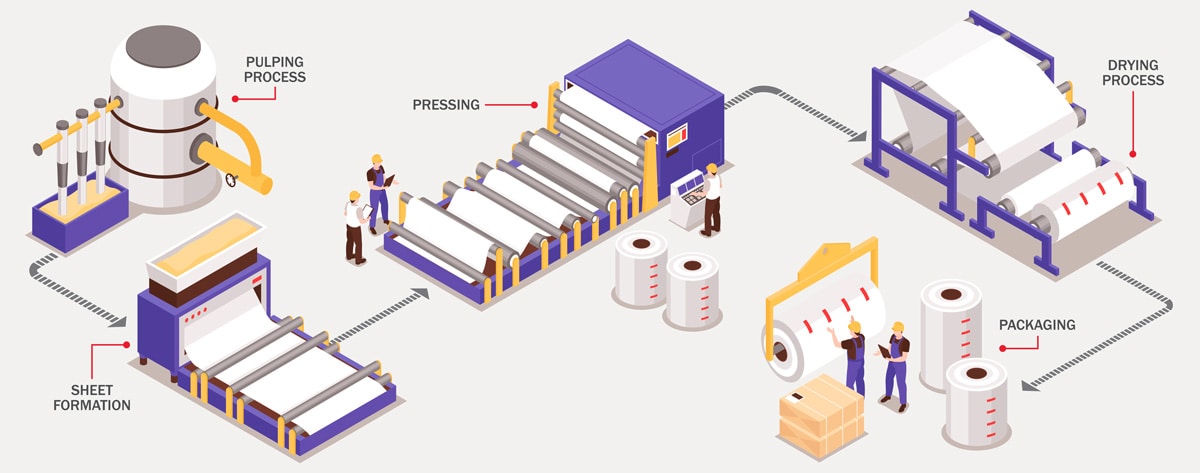

Digital Transformation and Automation in Production

Paper converting facilities are embracing Industry 4.0 technologies to improve precision, reduce waste, and meet just-in-time delivery demands. In 2026, smart factories equipped with AI-driven quality control, predictive maintenance, and automated slitting/rewinding systems will be commonplace. Real-time data analytics enable tighter tolerances in sheet dimensions, consistent caliper control, and faster changeovers—critical for serving high-mix, low-volume specialty markets like printing, label stock, and technical papers.

Shift Toward Specialty and High-Performance Applications

Commoditized printing and writing paper markets continue to decline due to digitalization, but specialty paper sheeting is gaining momentum. Applications in technical papers (e.g., filtration, electrical insulation, release liners), food-grade packaging, and medical disposables are expanding. These high-margin segments demand customized sheeting solutions with specific surface treatments, barrier properties, or thermal resistance. By 2026, converters who offer value-added services—such as precision cutting, laminating, or antimicrobial coatings—will capture greater market share.

Regional Divergence and Supply Chain Resilience

Market dynamics vary significantly by region. North America and Europe prioritize sustainability and are investing in domestic recycling infrastructure, supporting local paper sheeting production. In contrast, Asia-Pacific—led by China and India—sees strong growth due to rising consumerism, urbanization, and packaging demand. However, global supply chain volatility will persist, prompting manufacturers to regionalize production and build strategic inventory buffers. Nearshoring trends may benefit mid-sized sheeting plants capable of agile, small-batch runs.

Conclusion

By 2026, the paper sheeting market will be defined by sustainability, customization, and technological integration. While traditional volumes may stagnate or decline, innovation in materials, processes, and applications will open new revenue streams. Success will depend on agility, environmental stewardship, and the ability to meet the precise needs of high-growth niche markets.

Common Pitfalls in Sourcing Paper Sheeting (Quality, IP)

Sourcing paper sheeting involves more than just selecting a supplier and placing an order. Companies often encounter critical challenges related to quality consistency and intellectual property (IP) risks. Overlooking these pitfalls can lead to production delays, reputational damage, and legal complications. Below are the most common issues to watch for.

Inconsistent Material Quality

One of the most frequent problems in paper sheeting procurement is variability in quality. Paper sourced from different batches or suppliers may differ in weight, thickness, brightness, or moisture content. These inconsistencies can disrupt downstream manufacturing processes—especially in precision applications like printing, packaging, or medical uses—where even minor deviations impact performance. Failing to define and enforce strict quality specifications increases the risk of product defects and customer complaints.

Lack of Supplier Certification and Traceability

Many buyers overlook the importance of supplier certifications such as ISO 9001 (quality management), FSC or PEFC (sustainable sourcing), or industry-specific standards. Without verified certifications, it’s difficult to ensure that paper meets regulatory or sustainability requirements. Additionally, poor traceability makes it challenging to identify the origin of raw materials, increasing exposure to supply chain disruptions and reputational risks, particularly in regulated industries.

Intellectual Property (IP) Infringement Risks

Custom-designed or specialty paper sheeting—especially with unique coatings, textures, or security features—may involve proprietary technology. Sourcing such materials from unauthorized or unvetted suppliers raises the risk of IP infringement. Some suppliers may replicate patented processes or use protected designs without proper licensing, exposing the buyer to legal liability, product seizures, or costly litigation.

Inadequate Contractual Protections

Weak or ambiguous contracts often fail to address critical quality benchmarks, IP ownership, or confidentiality clauses. Without clear terms outlining material specifications, testing protocols, and IP rights, companies lack recourse if a supplier delivers substandard products or if proprietary information is misused. This is especially critical when working with offshore suppliers where enforcement of legal agreements can be more difficult.

Insufficient Due Diligence on Suppliers

Rushing the supplier selection process can result in partnering with vendors who lack the technical capability or ethical standards required. Skipping audits, reference checks, or sample testing increases the likelihood of partnering with suppliers who may cut corners, use recycled content not disclosed, or outsource production to unauthorized third parties—jeopardizing both quality and IP integrity.

Overlooking Environmental and Compliance Standards

Paper sourcing must comply with environmental regulations such as REACH, RoHS, or TSCA, particularly when used in food packaging or consumer goods. Sourcing from suppliers who do not adhere to these standards can result in non-compliant materials entering the supply chain, leading to recalls, fines, or customer backlash.

Avoiding these pitfalls requires thorough due diligence, clear specifications, robust contracts, and ongoing supplier management—ensuring both quality integrity and IP protection throughout the sourcing lifecycle.

Logistics & Compliance Guide for Paper Sheeting

Proper logistics and compliance management are essential for the safe, efficient, and legal transportation and handling of paper sheeting. This guide outlines key considerations across the supply chain to ensure product integrity, regulatory adherence, and operational efficiency.

Product Characteristics and Handling Requirements

Paper sheeting—available in various grades, weights, sizes, and finishes—requires careful handling to prevent damage such as creasing, curling, moisture absorption, and edge bruising. Key characteristics impacting logistics include:

– Sensitivity to moisture and humidity: Exposure can lead to warping, cockling, or mold.

– Fragility of edges and surfaces: Rough handling may cause tears or scuffing.

– Stacking and weight distribution: Improper stacking can result in crushing or deformation.

Best practices:

– Store and transport in dry, temperature-controlled environments.

– Use protective packaging (e.g., stretch wrap, edge protectors, pallet covers).

– Handle with clean, properly maintained forklifts and pallet jacks.

Packaging and Palletization Standards

Secure packaging ensures paper sheeting arrives undamaged. Standard practices include:

– Unit Load Formation: Sheets are typically stacked and secured on wooden or recyclable pallets.

– Wrapping: Use stretch film to stabilize loads; apply moisture-resistant covers if needed.

– Labeling: Include product details (grade, size, weight), batch/lot numbers, handling symbols (e.g., “This Way Up”, “Protect from Moisture”), and safety information.

Industry standards such as ISO 18185 (unit load stability) and ISTA 3A (packaging performance) may apply depending on shipment type.

Transportation and Shipping Considerations

Selecting the appropriate transport mode and carrier is critical:

– Trucking (Most Common): Ideal for regional and domestic distribution. Use enclosed, dry vans to protect from weather.

– Rail and Intermodal: Suitable for high-volume, long-distance shipments with proper moisture and shock protection.

– Maritime Shipping: Requires compliance with IMDG Code if hazardous inks or coatings are present; use desiccants and moisture barriers in containers.

Ensure vehicles are clean, dry, and free of contaminants. Secure loads to prevent shifting during transit.

Regulatory Compliance

Paper sheeting may be subject to various local, national, and international regulations:

Environmental and Safety Regulations

- REACH/CLP (EU): If chemicals (e.g., coatings, dyes) are used, compliance with substance registration and labeling is required.

- TSCA (USA): Ensure no restricted chemical substances are present in the paper or coatings.

- FSC/PEFC Certification: If marketing as sustainable or recycled, chain-of-custody documentation must be maintained.

Customs and Trade Compliance

- HS Codes: Use correct Harmonized System codes (e.g., 4802 or 4806 for uncoated or coated paper) for import/export.

- Country of Origin Labeling: Required in many jurisdictions for trade documentation.

- Phytosanitary Requirements: Wooden pallets must meet ISPM 15 standards (heat-treated and stamped) for international shipments.

Workplace Safety

- Comply with OSHA (USA) or equivalent local regulations regarding manual handling, forklift operation, and warehouse safety.

- Provide training on proper lifting techniques and use of PPE.

Documentation and Traceability

Maintain accurate records throughout the supply chain:

– Bill of Lading (BOL): Details shipment contents, origin, destination, and terms.

– Packing List: Itemizes each package, including sheet count, dimensions, and weight.

– Certificates of Conformity: Provide upon request, especially for eco-labels or regulatory compliance.

– Batch Tracking: Essential for quality control and recalls; record production dates and customer shipments.

Sustainability and Reverse Logistics

- Recyclable Packaging: Use recyclable stretch wrap and pallets where possible.

- Waste Management: Partner with certified recyclers for damaged or excess paper.

- Returnable Pallet Programs: Reduce waste and logistics costs through reusable pallet systems.

Conclusion

Effective logistics and compliance for paper sheeting require attention to product sensitivity, secure packaging, regulatory adherence, and environmental responsibility. By following these guidelines, businesses can ensure safe delivery, maintain customer satisfaction, and remain compliant across global markets. Regular audits and staff training are recommended to continuously improve logistics performance.

Conclusion for Sourcing Paper Sheeting

In conclusion, the successful sourcing of paper sheeting requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. Through careful evaluation of suppliers, consideration of material specifications, and alignment with environmental and regulatory standards, organizations can secure a consistent supply of paper sheeting that meets both operational needs and sustainability goals. Partnering with reputable suppliers who demonstrate transparency, innovation, and responsiveness will not only mitigate risks but also support long-term efficiency and brand integrity. As market demands and environmental priorities evolve, ongoing assessment and collaboration with suppliers will be key to maintaining a resilient and responsible sourcing strategy for paper sheeting.