The global paper cup market is experiencing robust growth, driven by increasing consumer demand for convenient, disposable foodservice packaging and a shift toward eco-friendly alternatives to plastic. According to Grand View Research, the global paper cup market size was valued at USD 9.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is propelled by stringent regulations on single-use plastics, rising on-the-go consumption, and growing environmental awareness among consumers and businesses alike. As sustainability becomes a key purchasing criterion, paper cup manufacturers are investing heavily in innovations such as water-based barrier coatings and FSC-certified raw materials to meet evolving market demands. In this dynamic landscape, identifying the leading paper cup paper manufacturers is essential for converters, brand owners, and foodservice providers seeking reliable, high-performance, and sustainable materials. Below, we present the top 10 manufacturers shaping the future of paper cup production through technological advancement, global reach, and commitment to environmental stewardship.

Top 10 Paper Cup Paper Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Jiun Yo Co., Ltd.

Domain Est. 2007

Website: jiunyo.com

Key Highlights: We are a food packaging company dedicated to making biodegradable food containers for over 25 years, offering custom solutions to meet your needs….

#2 Paper Cup Supplier & Manufacturer

Domain Est. 2022

Website: getbiopak.com

Key Highlights: We offer eco-friendly, water-based ink printing on custom cups and insulated coffee cups with lids in sizes from 1 oz to 32 oz. With 70 high-speed cup machines ……

#3 WinCup

Domain Est. 1995

Website: wincup.com

Key Highlights: Explore our wide range lineup of food service products, designed for simple and economical one-time use….

#4 Paper Cups

Domain Est. 1995

Website: dartcontainer.com

Key Highlights: Paper Cups · Solo® Paper Hot Cups · Anthora™ Solo® Paper Hot Cups · SOLO® Recycled Content* Paper Hot Cups (PCF) · ThermoGuard® Insulated Paper Hot Cups · Solo® DSP ……

#5 International Paper

Domain Est. 1997

Website: internationalpaper.com

Key Highlights: We transform renewable resources into innovative and sustainable packaging solutions, corrugated cardboard boxes, pulp and paper products, ……

#6 Nine Dragons Paper (Holdings) Limited

Domain Est. 1999

Website: ndpaper.com

Key Highlights: Overview · Products · Containerboard Products · Printing and Writing Paper · Specialty Paper · High Performance Corrugated Cardboard Products ……

#7 Yespac

Domain Est. 2011

Website: yespac.com

Key Highlights: YesPac is a US manufacturing leader providing the service industry with high-quality cups and food containers….

#8 phade® Compostable Paper Cups

Domain Est. 2019

Website: phadeproducts.com

Key Highlights: Free delivery 30-day returns100% compostable and completely plastic-free. It’s the first truly sustainable paper cup option, and it’s only from phade®….

#9 Paper Drink Cups

Domain Est. 2021

Website: hg-cups.com

Key Highlights: We are also wholesale paper cup suppliers and offer custom paper drink cup printing services. Paper cups can be customized with your logo or other design….

#10 THE GOOD CUP

Website: thegoodcup.world

Key Highlights: GOOD-BYE plastic lid. THE GOOD CUP is the industry’s most recent cutting-edge innovation that is revolutionizing single-use paper cup, one lid at a time….

Expert Sourcing Insights for Paper Cup Paper

H2: 2026 Market Trends for Paper Cup Paper

The global paper cup paper market is poised for significant transformation by 2026, driven by heightened environmental consciousness, regulatory pressures, technological advancements, and shifting consumer behaviors. Here’s an analysis of the key trends expected to shape the landscape:

-

Accelerated Shift Towards Sustainable & Compostable Solutions: The most dominant trend will be the intense focus on sustainability. Demand for paper cup paper compatible with industrial composting (meeting standards like EN13432/ASTM D6400) will surge. This requires:

- Replacement of PFAS/Fluorocarbons: Regulatory bans (e.g., EU, US states) and consumer pressure will force the near-elimination of per- and polyfluoroalkyl substances (PFAS) used for oil/grease resistance. Manufacturers will scale up PFAS-free barrier technologies (e.g., PLA coatings, water-based coatings, hybrid solutions).

- Increased Recycled Fiber Content: While technically challenging due to food safety and barrier requirements, advancements in deinking and purification will allow higher percentages of post-consumer recycled (PCR) fiber in paper cup base stock, reducing reliance on virgin fiber.

- Focus on Fiber Sourcing: Demand for paper cup paper with FSC/PEFC certification will become standard, ensuring responsible forestry practices.

-

Regulatory Pressure as a Key Driver: Governments worldwide will implement stricter regulations:

- Single-Use Plastics Directives: Expansions of bans on single-use plastics (e.g., EU SUP Directive) will explicitly target composite packaging like traditional plastic-lined paper cups, accelerating the adoption of certified compostable alternatives.

- Extended Producer Responsibility (EPR): EPR schemes will hold producers financially responsible for collection and recycling/composting, incentivizing design for recyclability/compostability and investment in end-of-life infrastructure.

- Landfill Bans: More regions will implement bans on organic waste (including compostable cups) in landfills, boosting industrial composting infrastructure and creating demand for certified compostable paper cup solutions.

-

Technological Innovation in Barrier Coatings & Paper Grades:

- PFAS-Free Coatings: Significant R&D investment will yield improved performance, cost-effectiveness, and processability of alternatives like PLA, water-based polymers, and bio-based coatings. Multi-layer solutions combining different technologies may become more common.

- Enhanced Recyclability: Development of paper cup grades designed for easier separation of fiber from coatings in standard paper recycling streams (e.g., through improved coating delamination) will gain traction, though compostability remains the primary end-of-life route near-term.

- Performance Optimization: Paper grades will be engineered for better runnability on high-speed cup forming machines, improved moisture resistance, and enhanced printability.

-

Consolidation & Vertical Integration in the Supply Chain: The complexity of meeting new sustainability demands (certifications, compliance, R&D costs) will favor larger players. Expect:

- Mergers & Acquisitions: Consolidation among paper cup paper manufacturers and between paper makers and coating specialists.

- Vertical Integration: Major paper producers may acquire coating companies or develop in-house coating capabilities to offer fully integrated, certified sustainable solutions.

- Strategic Partnerships: Collaborations between paper mills, coating suppliers, cup converters, and waste management companies to ensure closed-loop solutions.

-

Cost Pressures and Price Volatility: The transition to sustainable solutions involves significant investment:

- Higher Input Costs: PFAS-free coatings, certified sustainable virgin fiber, and recycled fiber with food-grade suitability often carry premiums.

- Infrastructure Investment Costs: Investments in new coating lines or retrofitting existing ones will impact pricing.

- Price Sensitivity: End consumers (cup converters, brands) remain sensitive to cost increases, creating tension between sustainability goals and profitability, potentially slowing adoption in price-sensitive markets.

-

Growth in Emerging Markets with Caveats: Markets in Asia-Pacific, Latin America, and Africa will see volume growth due to urbanization and rising coffee/foodservice culture. However:

- Sustainability Lag: Adoption of high-sustainability paper cup paper (compostable, PFAS-free) may be slower due to cost sensitivity and underdeveloped waste infrastructure.

- Regulatory Divergence: Pace of regulatory change will vary significantly by country.

- Opportunity: Significant potential for leapfrogging to sustainable solutions as these markets develop.

-

Consumer Demand Driving Brand Commitments: Consumer awareness of plastic pollution and “greenwashing” will increase. Major foodservice brands (QSRs, coffee chains) will make ambitious sustainability pledges (e.g., “compostable by 2025/2026”), directly driving demand for certified sustainable paper cup paper and pushing suppliers to innovate.

Conclusion for 2026: The paper cup paper market in 2026 will be fundamentally different, defined by the imperative for true sustainability. Success will hinge on the ability of paper manufacturers to deliver cost-effective, high-performance paper grades with certified compostable, PFAS-free barriers, sourced from responsibly managed forests, while navigating complex regulations and supply chain dynamics. The market will be segmented, with premium sustainable solutions dominating in regulated regions and among major brands, while cost-effective conventional options may persist longer in emerging markets. Innovation, compliance, and supply chain resilience will be critical competitive advantages.

Common Pitfalls Sourcing Paper Cup Paper (Quality, IP)

Sourcing paper cup paper involves navigating several critical challenges, particularly around quality consistency and intellectual property (IP) concerns. Overlooking these pitfalls can lead to production delays, compromised product performance, reputational damage, or legal risks.

Inconsistent or Substandard Quality

One of the most frequent issues is receiving paper that fails to meet required specifications. This includes variations in basis weight, coating uniformity, porosity, or moisture resistance—each of which can directly impact cup integrity, leak prevention, and printing quality. Suppliers in competitive markets may cut corners to reduce costs, resulting in inconsistent batches. Without rigorous quality control and clear technical specifications, buyers risk ending up with paper that cannot withstand hot or cold beverages, leading to customer complaints and safety concerns.

Lack of Coating Performance Validation

Paper cup paper typically features a polyethylene (PE) or bio-based coating to provide liquid resistance. A common pitfall is assuming all coatings perform equally. Some suppliers may use inferior coating materials or apply them unevenly, leading to delamination, poor heat seal strength, or failure during use. Buyers often neglect to validate coating performance through independent testing (e.g., hot/cold fill tests, seal strength analysis), which can result in field failures and costly product recalls.

Insufficient Food Safety Compliance

Ensuring the paper and its coatings comply with food contact regulations (such as FDA, EU 10/2011, or LFGB) is essential. A major risk arises when suppliers provide falsified or outdated compliance documentation. Some may source raw materials from unverified sub-suppliers that contain harmful substances like mineral oils (MOSH/MOAH) or non-compliant additives. Failure to audit the full supply chain increases the likelihood of regulatory non-compliance and potential health hazards.

Intellectual Property Infringement

When sourcing proprietary or high-performance paper grades (e.g., innovative barrier coatings or sustainable alternatives), there’s a risk of inadvertently acquiring materials that infringe on third-party patents. Some suppliers—particularly in regions with weak IP enforcement—may reverse-engineer patented technologies or use licensed processes without proper authorization. Buyers who incorporate such materials into their products could face legal action, supply chain disruption, or forced redesigns.

Inadequate Transparency in Supply Chain

Many suppliers lack visibility into their own raw material sources, making it difficult to trace fiber origins or coating formulations. This opacity increases vulnerability to sustainability claims that cannot be substantiated (e.g., false FSC/PEFC certifications) and exposes buyers to reputational risks related to deforestation or unethical sourcing. Without full traceability, verifying environmental or social compliance becomes nearly impossible.

Overreliance on Supplier Claims Without Verification

Vendors often make bold claims about performance, sustainability, or exclusivity. A frequent mistake is accepting these at face value without conducting on-site audits, reviewing test reports, or performing pilot trials. This trust-based approach can result in mismatched expectations, especially when scaling up production or launching new cup designs.

Avoiding these pitfalls requires thorough due diligence, clear contractual agreements, independent testing, and ongoing supplier monitoring—especially when IP protection and consistent quality are mission-critical.

Logistics & Compliance Guide for Paper Cup Paper

This guide outlines key considerations for the logistics and regulatory compliance associated with the transportation, handling, and use of paper cup paper—a specialized paperboard used in manufacturing disposable paper cups.

Material Specifications and Handling

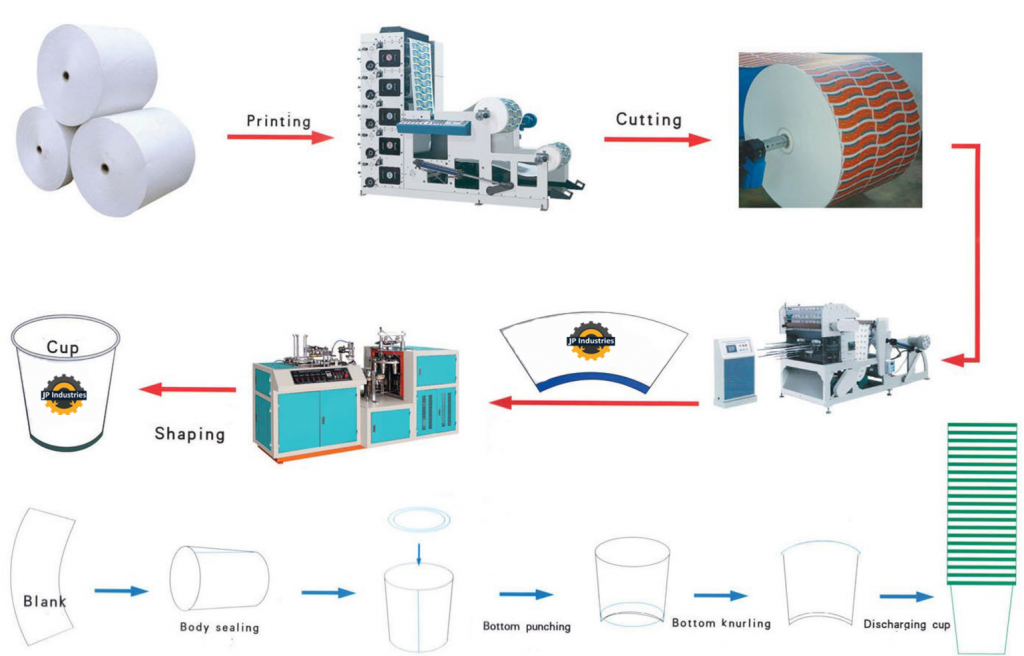

Paper cup paper is typically a multi-layered paperboard with a food-grade polyethylene (PE) or bioplastic (e.g., PLA) coating to provide liquid resistance. It is supplied in jumbo rolls or sheets and requires careful handling to prevent damage.

- Storage Conditions: Store in a dry, temperature-controlled environment (15–25°C, 50–60% RH) to avoid moisture absorption, warping, or coating degradation.

- Stacking and Handling: Avoid excessive stacking height to prevent roll deformation. Use proper lifting equipment and protective wrapping to avoid edge damage.

- Shelf Life: Generally 6–12 months; monitor expiration dates to ensure coating integrity.

Packaging and Transportation

Proper packaging and transport are critical to prevent contamination, moisture exposure, and physical damage.

- Primary Packaging: Rolls or sheets are typically wrapped in polyethylene film and placed on wooden or recyclable pallets, secured with stretch wrap.

- Transport Mode: Suitable for road, rail, sea, and air freight. Use enclosed, dry vehicles to prevent exposure to weather.

- Labeling: Pallets must be labeled with product name, batch/lot number, net weight, dimensions, handling instructions (e.g., “Keep Dry,” “Do Not Stack”), and manufacturer details.

Regulatory Compliance

Paper cup paper must comply with food contact material (FCM) regulations in target markets.

United States (FDA)

- Must comply with 21 CFR §176.170 (Components of paper and paperboard used in food packaging).

- Coatings (e.g., PE, PLA) must be listed in FDA’s indirect food additive regulations (e.g., 21 CFR 177.1520).

- Supplier must provide a Statement of Compliance (SoC) or FDA Letter of Guarantee.

European Union (EU)

- Complies with Regulation (EU) No 10/2011 on plastic materials and articles in contact with food (for coated paper).

- Base paperboard must follow national or EU-specific guidelines (e.g., BfR Recommendations in Germany).

- Full Declaration of Compliance (DoC) required, including substance lists and migration testing results.

- REACH and SCIP notifications may apply if substances of very high concern (SVHCs) are present.

Other Regions

- China (GB 4806.8-2016): Sets standards for food contact paper and paperboard.

- Japan (Food Sanitation Act): Requires compliance with positive lists for food packaging materials.

- Canada (CFIA): Follows the Food and Drug Regulations, particularly Division 23.

Sustainability and Environmental Compliance

With growing emphasis on eco-friendly packaging, compliance includes environmental standards.

- Recyclability and Compostability:

- PE-coated paper cups are generally not recyclable due to plastic contamination.

- PLA-coated or water-based barrier papers may be compostable; verify certifications (e.g., TÜV OK Compost, BPI).

- Labeling Requirements: Include disposal instructions and certification logos (e.g., “Industrial Compostable”).

- Regulatory Trends: Monitor evolving bans on single-use plastics (e.g., EU Single-Use Plastics Directive) affecting coated paper products.

Supply Chain Documentation

Maintain complete documentation to ensure traceability and compliance.

- Certificates:

- Food Contact Compliance Certificate (FDA, EU DoC)

- FSC or PEFC (for sustainably sourced fiber)

- ISO 9001/14001 (quality and environmental management)

- Lot Traceability: Maintain batch records for raw materials, coating resins, and finished rolls.

- Customs and Import: Provide commercial invoice, packing list, certificate of origin, and compliance certificates for international shipments.

Quality Control and Audits

Implement regular QC checks and supplier audits.

- Incoming Inspection: Verify roll dimensions, coating weight, basis weight, and absence of defects.

- Migration Testing: Conduct periodic testing for heavy metals, primary aromatic amines (for polyurethane coatings), and overall migration.

- Audits: Third-party audits (e.g., BRCGS Packaging Materials) to validate compliance and manufacturing practices.

Incident Response and Non-Conformance

Establish procedures for handling non-compliant shipments.

- Quarantine and Notification: Isolate suspect material and notify supplier and relevant authorities if contamination or compliance failure is detected.

- Corrective Actions: Root cause analysis and process improvement plans.

- Recall Preparedness: Maintain traceability systems to support rapid product recall if necessary.

By adhering to this logistics and compliance guide, businesses can ensure the safe, legal, and sustainable handling of paper cup paper across global supply chains.

Conclusion: Sourcing Paper Cup Paper Suppliers

In conclusion, sourcing reliable and high-quality paper cup paper suppliers is a critical step in ensuring the success and sustainability of a paper cup manufacturing or packaging business. A comprehensive supplier evaluation should consider factors such as raw material quality, compliance with food safety and environmental standards (e.g., FDA, FSC, or BPI certifications), production capacity, cost-efficiency, and logistical reliability.

Sustainable sourcing practices—not only align with increasing environmental regulations but also meet growing consumer demand for eco-friendly products—make suppliers who offer responsibly sourced, recyclable, or compostable paper particularly valuable. Establishing long-term partnerships with suppliers who demonstrate transparency, innovation, and ethical production methods can enhance product quality, reduce supply chain risks, and support brand reputation.

Ultimately, a strategic and well-researched approach to supplier selection will lead to improved operational efficiency, cost savings, and a stronger competitive advantage in the evolving foodservice packaging market. Regular reassessment of supplier performance and market trends will further ensure continued alignment with business goals and sustainability commitments.