The global demand for decorative and functional flooring materials continues to rise, with the vinyl and specialty flooring market—commonly referred to in Portuguese-speaking markets as papel para piso—experiencing significant growth. According to Grand View Research, the global vinyl flooring market size was valued at USD 37.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. This expansion is driven by increasing construction activities, rising demand for aesthetically versatile, and low-maintenance flooring solutions in residential and commercial sectors. Additionally, Mordor Intelligence projects steady growth in the laminated and specialty flooring segment, particularly in emerging economies where urbanization and infrastructure development are accelerating. As demand intensifies, a select group of manufacturers has emerged as leaders in innovation, quality, and market reach. Below are the top 7 papel para piso manufacturers shaping the industry’s future.

Top 7 Papel Para Piso Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MURESCO

Domain Est. 1997

Website: muresco.com

Key Highlights: Productos. MURESCO PRO. Empapelados · Papel Base · Pisos · Murales · Adhesivos. MURESCO LIFE. Cerámicos y wallstickers · Placas 3D · Vinilo Deco ……

#2 Eucatex

Domain Est. 1997

Website: eucatex.com.br

Key Highlights: Desde 1951 como um dos maiores fabricantes de pisos, divisórias, portas, tintas, chapas e painéis, a Eucatex atende aos mais variados ramos da indústria….

#3 Bucalo Papéis de Parede

Domain Est. 1999

Website: bucalo.com.br

Key Highlights: Há mais de 65 anos no mercado, a Bucalo é a pioneira em importação de papéis de parede, a marca garante produtos de alta qualidade e durabilidade……

#4 Orlean Revestimentos de Parede e Tecidos

Domain Est. 2000

Website: orlean.com

Key Highlights: Papel de Parede Orlean Tendências e lançamentos traduzidos em coleções exclusivas. Papel de parede e tecidos para decoração….

#5 Cemex México: Lideres en Construcción

Domain Est. 2000

Website: cemexmexico.com

Key Highlights: Cotiza tus productos Cemex. Cotiza hoy mismo todo lo que necesitas para tu proyecto de construcción: cemento, concreto, agregados, aditivos y más….

#6 Softys

Domain Est. 2005

Website: softys.com

Key Highlights: Productos Tissue para el consumo masivo, de alta calidad, absorción, suavidad y rendimiento. El material que se utiliza para los productos proviene de fibras ……

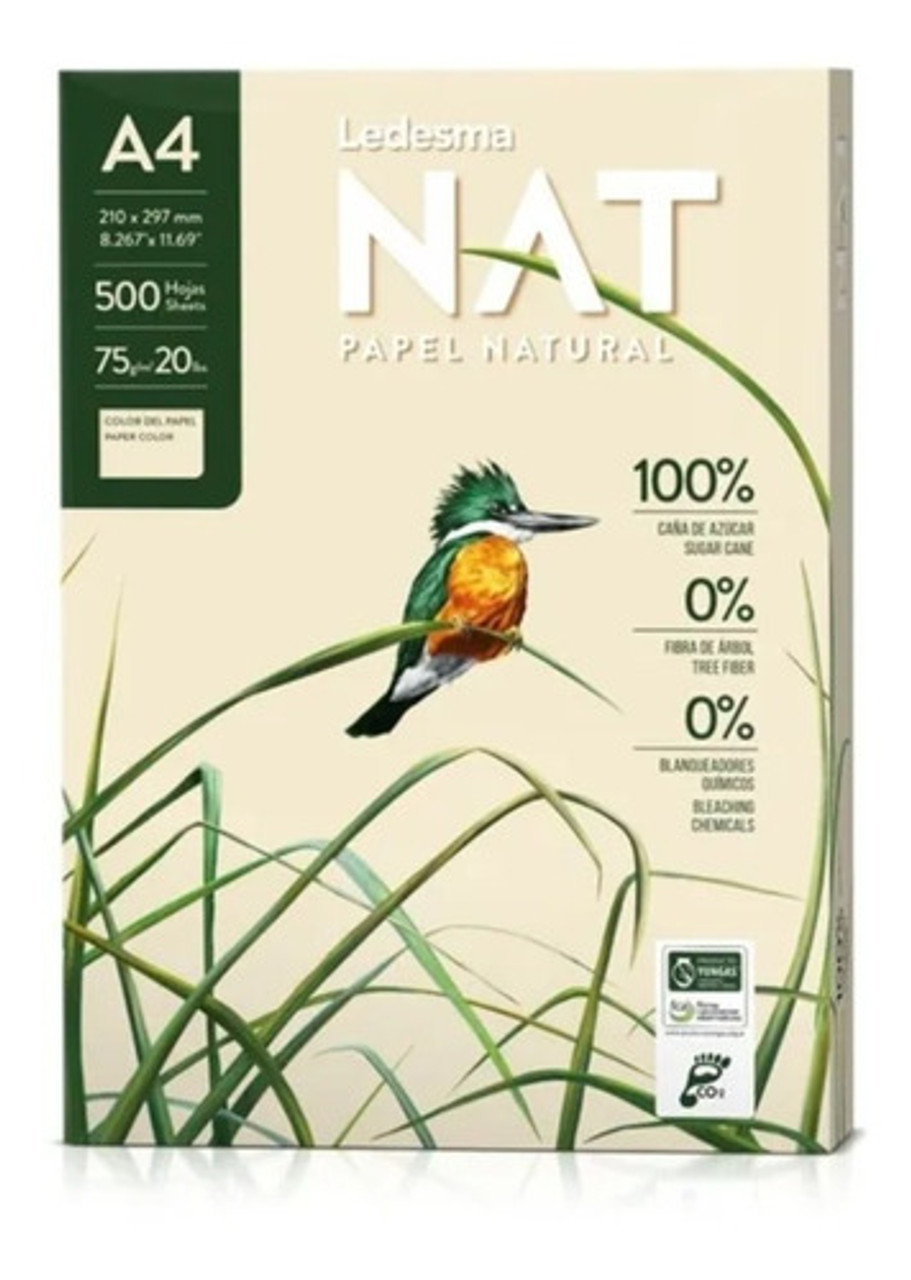

#7 Ledesma

Domain Est. 2013

Website: ledesma.com.ar

Key Highlights: Ledesma impulsa la bioeconomía argentina desde hace más de 115 años. Producimos energía renovable, alimentos, papel y soluciones sustentables que generan ……

Expert Sourcing Insights for Papel Para Piso

H2: 2026 Market Trends for Papel Para Piso (Floor Paper)

The global market for papel para piso (floor paper), also known as floor protection paper or rosin paper, is projected to experience steady growth and transformation by 2026, driven by construction activity, sustainability concerns, and evolving industry standards. Below is an analysis of key trends shaping the market in the H2 period of 2026:

1. Increasing Demand from Construction and Renovation Sectors

The residential and commercial construction boom, particularly in North America and parts of Latin America, continues to fuel demand for floor protection materials. With renovations and remodeling projects on the rise post-pandemic, contractors are prioritizing cost-effective and reliable temporary floor coverings. Papel para piso remains a preferred choice due to its durability, ease of installation, and protective qualities against dust, scratches, and moisture during construction phases.

2. Shift Toward Eco-Friendly and Recyclable Materials

Sustainability is a dominant trend influencing material selection across industries. By H2 2026, manufacturers are increasingly offering papel para piso made from recycled fibers and biodegradable components. End-users, including green building contractors and environmentally conscious developers, are favoring products with lower carbon footprints. Certifications such as FSC (Forest Stewardship Council) and recyclability labels are becoming key differentiators in product marketing.

3. Regional Market Growth in Latin America

Latin American countries, especially Mexico and Brazil, are witnessing increased adoption of floor protection paper due to rising infrastructure investments and urban development. The term papel para piso is widely used in Spanish-speaking markets, and local suppliers are expanding production to meet domestic and export demand. Regional distribution networks are improving, reducing lead times and costs.

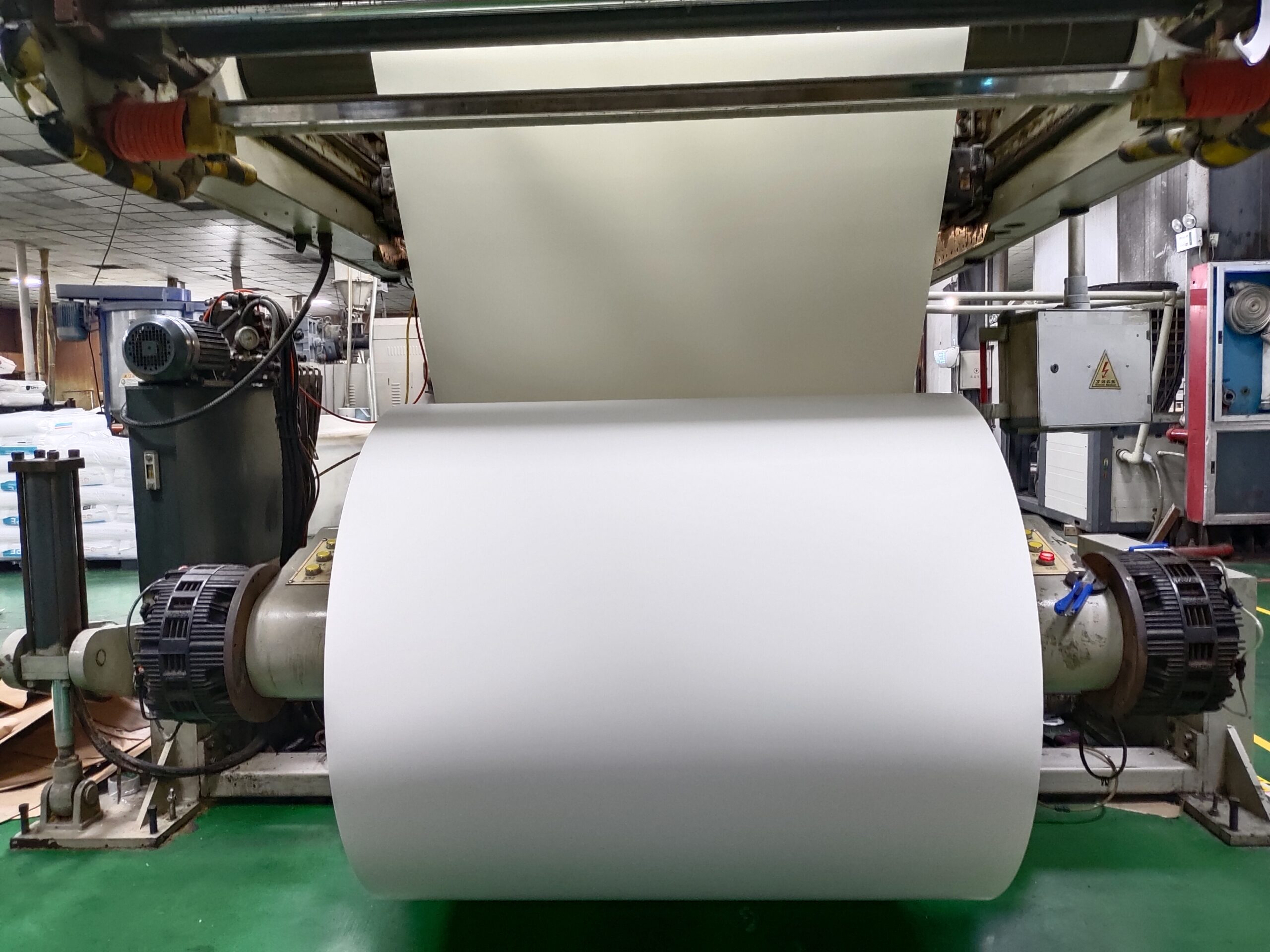

4. Innovation in Product Performance and Formats

In response to competitive pressures, manufacturers are introducing enhanced versions of floor paper with improved tear resistance, water repellency, and longer surface coverage per roll. Some brands are exploring laminated or coated variants for high-traffic areas. Additionally, pre-cut rolls and easy-tear perforations are being adopted to improve user convenience and reduce waste on job sites.

5. Price Volatility and Supply Chain Adjustments

Fluctuations in raw material costs—particularly wood pulp and recycled paper—have impacted pricing throughout 2025 and into H2 2026. However, supply chains have stabilized compared to previous years, thanks to diversified sourcing and regional manufacturing investments. Companies are also adopting just-in-time inventory models to mitigate storage costs and respond swiftly to market demand.

6. E-Commerce and Digital Procurement Growth

Online B2B platforms are playing a larger role in the distribution of papel para piso. Contractors and suppliers are increasingly purchasing floor protection materials through digital marketplaces, which offer competitive pricing, bulk discounts, and fast delivery. This trend is accelerating transparency and competition in the market.

Conclusion

By H2 2026, the papel para piso market is characterized by robust demand, innovation, and a strong push toward sustainability. While challenges such as raw material costs persist, advancements in product quality and distribution are positioning the market for long-term growth. Companies that prioritize eco-friendly production, regional market expansion, and digital engagement are likely to gain a competitive edge.

Common Pitfalls When Sourcing Papel Para Piso (Floor Paper) – Quality and Intellectual Property Considerations

Sourcing Papel Para Piso (floor paper), commonly used in construction, renovation, and protective covering applications, involves several potential pitfalls, particularly concerning product quality and intellectual property (IP). Being aware of these issues can help buyers avoid costly mistakes, legal complications, and project delays.

Quality-Related Pitfalls

1. Inconsistent Material Thickness and Durability

One of the most frequent quality issues is inconsistent thickness or low tear resistance. Substandard floor paper may tear easily during installation or fail to protect flooring from spills, scratches, or foot traffic. Buyers should verify basis weight (grams per square meter) and tensile strength specifications to ensure adequate performance.

2. Poor Moisture Resistance

Some floor papers marketed as “water-resistant” may degrade quickly when exposed to moisture. This is especially problematic in humid environments or during wet construction phases. Always request independent test reports or certifications (e.g., ASTM standards) to confirm moisture barrier claims.

3. Use of Recycled or Contaminated Materials

Lower-cost suppliers may use recycled paper with impurities that can stain or damage finished floors (e.g., hardwood or tile). Insist on material disclosure statements and conduct sample testing before large-scale procurement.

4. Inadequate Roll Length and Width Accuracy

Discrepancies in roll dimensions can lead to material shortages or installation inefficiencies. Verify roll specifications through pre-shipment inspections and ensure packaging clearly states dimensions and tolerances.

Intellectual Property (IP) Pitfalls

1. Unauthorized Use of Branded or Patented Designs

Some floor papers feature trademarked patterns (e.g., logo-printed paper) or patented materials (e.g., composite laminates with special coatings). Sourcing generic versions that mimic protected designs can lead to IP infringement claims, especially in regulated markets like the U.S. or EU.

2. Counterfeit Certification Marks

Suppliers may falsify compliance labels (e.g., fire resistance, eco-certifications) to appear compliant with safety or environmental regulations. Always verify certifications through official databases or third-party auditors.

3. Lack of Documentation for IP Clearance

When sourcing private-label or OEM versions of floor paper, ensure the supplier provides IP indemnification and documentation proving rights to use any designs, trademarks, or technical innovations. Without this, buyers may face liability in case of disputes.

4. Grey Market Imports and Distribution Rights

Purchasing from unauthorized distributors—even if the product appears authentic—can violate regional IP or distribution agreements. Confirm the supplier is an authorized distributor or manufacturer, especially when sourcing from international markets like China or India.

Best Practices to Avoid Pitfalls

- Conduct third-party quality inspections before shipment.

- Request material safety data sheets (MSDS) and certifications.

- Perform due diligence on suppliers, including IP compliance history.

- Include quality and IP warranties in procurement contracts.

- Use pilot batches to test performance and compliance before full-scale orders.

By addressing these common pitfalls proactively, businesses can ensure they source high-quality, legally compliant Papel Para Piso that meets both performance standards and regulatory requirements.

Logistics & Compliance Guide for Papel Para Piso

This guide outlines key logistics considerations and regulatory compliance requirements for the import, distribution, and sale of “Papel Para Piso” (floor paper), commonly used in cleaning, temporary floor protection, or construction. Adhering to these standards ensures smooth operations, legal compliance, and product safety.

Product Classification and Documentation

Proper classification and documentation are essential for customs clearance and regulatory compliance. Papel Para Piso is typically categorized as sanitary paper or industrial paper, depending on its composition and intended use.

- HS Code Determination: Identify the correct Harmonized System (HS) code for your specific product. Common codes include 4818 (sanitary or household paper) or 4806 (other paper and paperboard). Confirm with local customs authorities.

- Commercial Invoice: Must include product description, quantity, value, weight, country of origin, and Harmonized System (HS) code.

- Packing List: Detail contents per package, dimensions, gross/net weight, and shipping marks.

- Certificate of Origin: Required by many countries to determine tariff eligibility and trade agreements.

- Bill of Lading (B/L) or Air Waybill (AWB): Legal document issued by the carrier detailing shipment terms and ownership.

Import Regulations and Customs Clearance

Understanding and complying with destination country regulations prevents delays and penalties.

- Customs Duties and Taxes: Research applicable import duties, VAT, or GST based on the product’s HS code and country of import.

- Prohibited or Restricted Materials: Ensure the product does not contain banned substances (e.g., certain dyes, heavy metals, or recycled materials from restricted sources).

- Labeling Requirements: Products must often be labeled in the local language with product name, net weight, manufacturer/importer information, and country of origin.

- Pre-Arrival Documentation: Submit electronic customs declarations in advance, where required (e.g., U.S. ACE, EU Import Control System).

Packaging and Handling Standards

Effective packaging ensures product integrity during transit and storage.

- Moisture Protection: Use moisture-resistant packaging (e.g., polyethylene wrap or shrink film) to prevent degradation during shipping.

- Palletization: Secure rolls or sheets on standard pallets (e.g., EUR/ISO) with stretch wrap or strapping. Label each pallet clearly.

- Stacking and Weight Limits: Follow safe stacking guidelines to prevent crushing. Do not exceed maximum container or truck load limits.

- Handling Instructions: Mark packaging with “Fragile,” “This Side Up,” or “Protect from Moisture” as needed.

Transportation and Storage

Proper logistics planning ensures timely delivery and product quality.

- Mode of Transport: Choose between sea, air, or land freight based on cost, volume, and delivery timeline. Sea freight is typically used for bulk shipments.

- Temperature and Humidity Control: Store and transport in dry, well-ventilated areas. Avoid exposure to high humidity or temperature extremes that can weaken paper integrity.

- Inventory Management: Rotate stock using FIFO (First In, First Out) to prevent aging or moisture absorption in long-term storage.

- Load Securing: Use appropriate dunnage and braces to prevent shifting during transit, especially for container loads.

Regulatory and Environmental Compliance

Meet health, safety, and environmental standards in target markets.

- REACH (EU): Ensure no restricted substances (e.g., SVHCs) are present in paper or coatings.

- FDA Compliance (USA): If used in food-handling areas, verify the product meets FDA standards for indirect food contact.

- FSC or PEFC Certification: If marketing as sustainable, provide chain-of-custody certification for responsibly sourced paper.

- Waste Disposal Regulations: Comply with local waste classification; most floor paper is recyclable or compostable, but adhesive-coated versions may require special handling.

Safety and Labeling Compliance

Ensure user safety and meet labeling laws across jurisdictions.

- GHS Compliance: If the product includes chemical treatments (e.g., antimicrobial coatings), provide Safety Data Sheets (SDS) and follow GHS labeling.

- Consumer Warnings: Include usage instructions and warnings (e.g., “Keep dry,” “Not for food use”) where applicable.

- Accessibility: Labels and packaging should meet local accessibility standards, including language and font size requirements.

Record Keeping and Audits

Maintain accurate records to support compliance and traceability.

- Retention Period: Store shipping, customs, and compliance documents for at least 5–7 years, depending on local regulations.

- Audit Readiness: Prepare for inspections by customs, environmental, or health agencies with organized documentation.

- Traceability: Implement batch or lot tracking to manage recalls or quality issues efficiently.

By following this guide, businesses involved in the logistics of Papel Para Piso can ensure regulatory compliance, optimize supply chain efficiency, and maintain product quality from origin to end-user.

Conclusión sobre el sourcing de papel para piso

El proceso de sourcing de papel para piso requiere una evaluación estratégica que combine calidad, costo, disponibilidad y sostenibilidad. Tras analizar proveedores locales e internacionales, se observa que es fundamental establecer criterios claros en función del uso final del producto (industrial, comercial o residencial), ya que esto influye directamente en los requisitos de resistencia, durabilidad y acabado del material.

Los proveedores locales ofrecen ventajas en logística, tiempos de entrega y adaptabilidad, mientras que los proveedores internacionales pueden presentar costos unitarios más bajos, aunque con mayor exposición a riesgos logísticos y fluctuaciones cambiarias. Además, adquiere cada vez mayor relevancia la certificación del papel (como FSC o PEFC), que garantiza la procedencia responsable de la materia prima y responde a las crecientes demandas de sostenibilidad por parte de consumidores y normativas.

En conclusión, una estrategia de sourcing eficiente para papel para piso debe basarse en la diversificación de proveedores, la negociación de contratos flexibles, la evaluación continua del desempeño de los suministradores y la integración de criterios ambientales y sociales. Esto no solo optimiza los costos y asegura el abastecimiento continuo, sino que también fortalece la responsabilidad corporativa y la competitividad en un mercado cada vez más consciente del impacto ambiental.