The global market for bioactive peptides in cosmetics and skincare has experienced robust growth, driven by increasing consumer demand for scientifically backed anti-aging ingredients. According to Mordor Intelligence, the global cosmetic peptides market was valued at USD 1.12 billion in 2023 and is projected to grow at a CAGR of 8.6% through 2029, fueled by advancements in peptide synthesis and rising R&D investments by cosmetic ingredient manufacturers. Among the emerging stars in this space, Palmitoyl Tetrapeptide-20 has gained attention for its efficacy in reducing the appearance of wrinkles and enhancing skin firmness by stimulating collagen production. As innovation accelerates and demand for high-performance skincare ingredients surges, a select group of manufacturers are leading the charge in producing high-purity, bioavailable forms of Palmitoyl Tetrapeptide-20. This list highlights the top seven manufacturers shaping the supply landscape with strong R&D capabilities, regulatory compliance, and scalable production capacity.

Top 7 Palmitoyl Tetrapeptide 20 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Palmitoyl Tetrapeptide

Domain Est. 2020

Website: mobelbiochem.com

Key Highlights: Palmitoyl Tetrapeptide-20 is an active ingredient that boosts Melanin production and helps stimulate the natural pigmentation of hair during regrowth….

#2 China Palmitoyl Tetrapeptide

Domain Est. 2023

Website: alfa-industry.com

Key Highlights: It can be used for hair anti-aging, covering premature gray hair, post-dye care, natural hair color enhancer, and gentler scalp and beard care than chemical ……

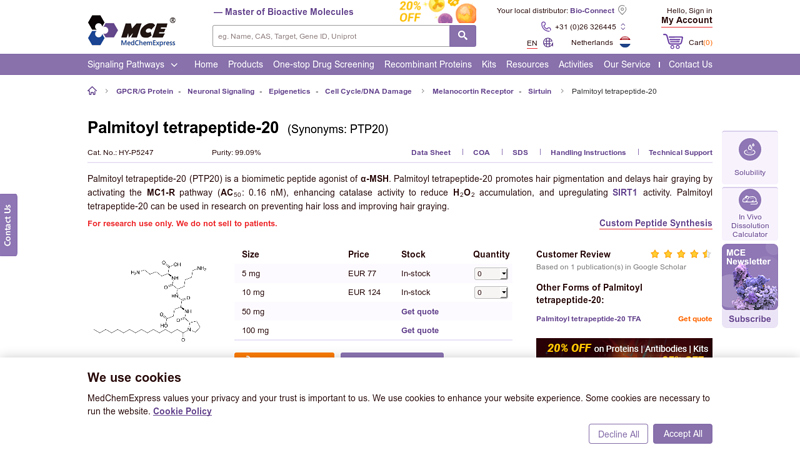

#3 Palmitoyl tetrapeptide-20 (PTP20)

Domain Est. 2009

Website: medchemexpress.com

Key Highlights: Rating 4.5 (1) · Free delivery · 30-day returns…

#4 All about Palmitoyl Tetrapeptide

Domain Est. 2013

Website: revivserums.com

Key Highlights: Greyverse is the first anti-grey hair biomimetic peptide. Clinically effective, it helps men and women suffering from greying hair look naturally younger….

#5 SpecPed® PT20P

Domain Est. 2014

Website: ulprospector.com

Key Highlights: SpecPed® PT20P is a biomimetic peptide that boosts Melanin production and helps stimulating the natural pigmentation of hair during regrowth ……

#6 Palmitoyl tetrapeptide

Domain Est. 2018

#7 Palmitoyl Tetrapeptide

Domain Est. 2019

Website: gtpeptide.com

Key Highlights: Description. Palmitoyl tetrapeptide 20 (PTP20) is a biomimetic peptide derived from α-melanocyte-stimulating hormone (α-MSH). This sequence was selected to ……

Expert Sourcing Insights for Palmitoyl Tetrapeptide 20

H2: Market Trends for Palmitoyl Tetrapeptide-20 in 2026

As of 2026, the market for Palmitoyl Tetrapeptide-20 is experiencing robust growth, driven by increasing consumer demand for advanced anti-aging skincare solutions and the expanding adoption of peptide-based actives in cosmetic formulations. This tetrapeptide, known for its purported ability to support skin elasticity and firmness by stimulating collagen production and reducing the appearance of fine lines, is gaining prominence in premium skincare segments.

One of the key trends shaping the 2026 market is the rising emphasis on clean, science-backed beauty. Consumers are increasingly scrutinizing ingredient lists, favoring products with clinically proven, bioactive components. Palmitoyl Tetrapeptide-20 benefits from its reputation as a stable, effective, and non-irritating peptide, making it a preferred choice for brands targeting sensitive skin and dermatological efficacy.

In parallel, the global anti-aging skincare market continues to expand, particularly in Asia-Pacific and North America, where aging populations and heightened awareness of preventive skincare drive product innovation. Major cosmetic manufacturers are incorporating Palmitoyl Tetrapeptide-20 into serums, eye creams, and night treatments, often combining it with other peptides or hyaluronic acid to enhance synergistic effects.

Additionally, regulatory support and advancements in sustainable peptide synthesis are reducing production costs and improving supply chain reliability. This enables broader access for mid-tier and indie beauty brands, democratizing high-performance ingredients once limited to luxury lines.

By 2026, digital skincare personalization platforms and AI-driven beauty advisors are also promoting Palmitoyl Tetrapeptide-20 through tailored regimens, further boosting its visibility and adoption. Overall, the convergence of scientific validation, consumer education, and formulation innovation positions Palmitoyl Tetrapeptide-20 as a cornerstone ingredient in the next generation of anti-aging skincare.

Common Pitfalls in Sourcing Palmitoyl Tetrapeptide-20: Quality and Intellectual Property (IP) Concerns

Sourcing Palmitoyl Tetrapeptide-20, a cosmetic peptide valued for its anti-aging and skin-renewal properties, involves navigating several critical challenges related to product quality and intellectual property rights. Buyers, formulators, and brands must be vigilant to avoid common pitfalls that could compromise product efficacy, regulatory compliance, and legal safety.

1. Quality-Related Pitfalls

a. Inconsistent Purity and Impurity Profiles

One of the most significant quality concerns is variability in purity. Palmitoyl Tetrapeptide-20 is a complex molecule, and improper synthesis or purification can result in low active content (<95%) or harmful impurities (e.g., residual solvents, truncated peptides, or endotoxins). Suppliers may provide misleading certificates of analysis (CoA), making independent third-party testing essential.

b. Poor Peptide Stability and Degradation

This peptide is susceptible to degradation due to heat, moisture, and improper storage. Sourcing from suppliers without validated cold-chain logistics or inadequate packaging (e.g., non-nitrogen flushed vials) increases the risk of receiving a degraded product with reduced bioactivity.

c. Lack of Batch-to-Batch Consistency

Inconsistent manufacturing processes—especially among less-reputable peptide manufacturers—can lead to variability in performance. Without strict quality control (e.g., HPLC, MS verification), brands risk formulation instability or inconsistent consumer results.

d. Mislabeling and Adulteration

Some suppliers may dilute the peptide with fillers (e.g., mannitol, glycine) or substitute it with cheaper analogs. Without robust analytical verification, buyers may unknowingly purchase substandard or counterfeit materials.

2. Intellectual Property (IP) Pitfalls

a. Infringement of Patented Formulations or Uses

While Palmitoyl Tetrapeptide-20 itself may be out of patent in some jurisdictions, specific uses, delivery systems, or synergistic combinations (e.g., with other actives) may still be protected. Sourcing and using the peptide in formulations covered by active patents—especially in markets like the U.S. or EU—can expose companies to infringement claims.

b. Unclear or Unverified IP Ownership by Supplier

Suppliers, particularly those in regions with weak IP enforcement, may not have legitimate rights to manufacture or sell the peptide. Using materials sourced from such vendors could indirectly involve buyers in IP violations, especially if the supplier is producing a patented compound without licensing.

c. Lack of Freedom-to-Operate (FTO) Analysis

Brands often overlook conducting a thorough FTO assessment before launching products containing Palmitoyl Tetrapeptide-20. Without this, they risk costly litigation or product recalls, particularly if major cosmetic companies (e.g., Estée Lauder, L’Oréal) hold relevant patents in their target markets.

d. Misuse of Brand Names and Trade Dress

Some suppliers market the peptide using proprietary brand names (e.g., “Matrixyl” analogs) to imply equivalence or endorsement. However, using such names without authorization—even if the molecule is chemically identical—can lead to trademark or unfair competition claims.

Recommendations to Mitigate Risks:

- Require full analytical reports (HPLC, MS, TLC, water content, endotoxin) from ISO-certified labs.

- Audit suppliers for GMP compliance and traceable synthesis routes.

- Conduct independent third-party testing upon receipt.

- Perform a patent landscape analysis and consult IP counsel before product launch.

- Ensure supply agreements include IP indemnification clauses.

By proactively addressing these quality and IP pitfalls, stakeholders can ensure both the efficacy and legal safety of products containing Palmitoyl Tetrapeptide-20.

H2: Logistics & Compliance Guide for Palmitoyl Tetrapeptide-20

1. Chemical Identity & Classification

– INCI Name: Palmitoyl Tetrapeptide-20

– CAS Number: 940778-38-7

– Molecular Formula: C₄₀H₇₄N₈O₉

– Appearance: Off-white to white powder or lyophilized solid

– Solubility: Soluble in water and aqueous solutions; may require mild warming or sonication

– Stability: Sensitive to heat, light, and extreme pH. Store in a cool, dry place protected from light.

– Classification: Cosmetic peptide ingredient; not classified as hazardous under GHS for transport or storage under typical conditions.

2. Regulatory & Compliance Requirements

a. Global Regulations

– EU (EC) No 1223/2009 (Cosmetics Regulation):

– Requires full ingredient disclosure on product labels (INCI name).

– Must undergo safety assessment by a qualified assessor as part of the Product Safety Report (PSR).

– Not listed in Annexes II (prohibited substances) or III (restricted substances).

– No CMR (Carcinogenic, Mutagenic, Toxic to Reproduction) classification at typical use levels.

- USA (FDA):

- Regulated under the Federal Food, Drug, and Cosmetic Act (FD&C Act) as a cosmetic ingredient.

- No pre-market approval required, but must be safe for intended use.

- Labeling must comply with 21 CFR Part 701 (INCI naming, ingredient listing).

-

No specific restrictions; general safety and labeling requirements apply.

-

China (NMPA):

- Listed in the Cosmetic Ingredient Inventory (China IECIC) – confirm current status before import.

- Requires notification or registration depending on product type (ordinary vs. special use).

-

Imported cosmetics must be registered and undergo safety evaluation.

-

Canada (Health Canada):

- Must be listed in the Cosmetic Notification System (CNS).

- Comply with the Cosmetic Regulations under the Food and Drugs Act.

-

INCI name required on label.

-

ASEAN / Australia / Japan:

- Confirm inclusion in respective inventories (e.g., ASEAN ICS, NICNAS/AICIS, Japan’s Standards for Cosmetics).

- Adhere to local concentration limits and labeling rules.

b. Safety & Testing

– Recommended use concentration: Typically 0.0001% to 0.001% in final formulations.

– Perform challenge testing when used in water-based formulations due to potential microbial growth.

– Stability testing (accelerated and real-time) recommended to confirm peptide integrity.

– Patch testing advised to assess dermal tolerance.

3. Logistics & Handling

a. Storage

– Temperature: Store at 2–8°C (refrigerated) for long-term stability; short-term ambient storage (≤25°C) acceptable if protected.

– Light: Protect from light; store in amber vials or opaque containers.

– Moisture: Keep container tightly sealed; use desiccant if necessary.

– Shelf Life: Typically 24–36 months when stored properly. Confirm with CoA.

b. Transportation

– Classification: Not regulated as dangerous goods under IATA, IMDG, or ADR when shipped in non-hazardous form.

– Packaging: Use leak-proof, sealed containers with secondary packaging. Include desiccant and cold packs if required.

– Cold Chain: For extended shipping, use insulated packaging with refrigerant (e.g., gel packs). Monitor temperature with data loggers if critical.

– Documentation: Include Safety Data Sheet (SDS), Certificate of Analysis (CoA), and commercial invoice.

c. Packaging & Labeling (Shipment)

– Primary container: Sealed vial or bottle with tamper-evident seal.

– Outer packaging: Clearly labeled with:

– Product name (Palmitoyl Tetrapeptide-20)

– Batch number

– Net weight

– Storage conditions (e.g., “Protect from light,” “Store at 2–8°C”)

– Supplier information

– GHS-compliant label (if applicable) – typically not required for non-hazardous peptides

4. Documentation Requirements

– Safety Data Sheet (SDS): Provide GHS-compliant SDS (16 sections). Although low risk, SDS is required for occupational safety.

– Certificate of Analysis (CoA): Must include:

– Assay (% purity)

– Appearance

– Solubility

– Identity (HPLC, MS)

– Microbial limits (if applicable)

– Water content (Karl Fischer)

– Declaration of Compliance (DoC): Confirm compliance with REACH, TSCA, and other regional regulations.

– Origin Certificate: May be required for customs in certain countries (e.g., China, Russia).

5. Import & Export Considerations

– HS Code: Typically 2937.22 (Peptides) or 3303.00 (Beauty/cosmetic preparations) – confirm based on form (raw material vs. formulation).

– Import Licenses: Check destination country requirements (e.g., China NMPA, India CDSCO).

– Customs Clearance: Ensure accurate declaration of quantity, value, and end-use (cosmetic ingredient).

– Restricted Regions: Verify no import bans or additional requirements in target markets (e.g., South Korea K-REACH, Brazil ANVISA).

6. Best Practices

– Audit suppliers for ISO 22716 (GMP for cosmetics) or ISO 9001 certification.

– Conduct supplier qualification and batch testing upon receipt.

– Maintain traceability (batch tracking) throughout the supply chain.

– Train personnel on proper handling, storage, and spill response (though risk is minimal).

7. Disposal

– Dispose of according to local, regional, and national regulations for non-hazardous chemical waste.

– Do not release into the environment. Follow facility SOPs for laboratory/industrial waste.

Note: Always verify current regulatory status and consult local authorities before commercialization. This guide is for informational purposes and does not constitute legal advice.

Conclusion for Sourcing Palmitoyl Tetrapeptide-20:

Sourcing Palmitoyl Tetrapeptide-20 requires a strategic approach focused on supplier reliability, product quality, regulatory compliance, and cost-efficiency. As a specialized cosmetic peptide with anti-aging and skin-firming properties, it is essential to partner with reputable suppliers who provide high-purity, scientifically validated ingredients. Key considerations include verifying certification standards (such as GMP, ISO, and dermatological testing), ensuring transparency in sourcing and manufacturing processes, and conducting rigorous quality control through third-party testing.

Additionally, consistent supply chain reliability and scalability for future production needs are crucial, especially for brands targeting premium skincare markets. While pricing is a factor, prioritizing quality and safety over cost alone helps maintain product efficacy and consumer trust. Ultimately, establishing long-term relationships with vetted suppliers, staying informed about regulatory requirements in target markets, and monitoring advancements in peptide technology will support successful and sustainable sourcing of Palmitoyl Tetrapeptide-20.