The global paint and coatings market is experiencing steady expansion, driven by rising demand from construction, automotive, and industrial sectors. According to Grand View Research, the global paints and coatings market size was valued at USD 187.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth directly fuels the need for reliable, high-performance storage solutions, particularly for the safe handling and transportation of liquid paints and solvents. As environmental regulations tighten and operational efficiency becomes paramount, manufacturers of painting containers and storage systems are innovating with sustainable materials, smart monitoring features, and modular designs. In this competitive landscape, identifying the top suppliers capable of meeting stringent quality, scalability, and compliance demands is crucial for distributors, industrial buyers, and procurement professionals. Based on market presence, manufacturing capability, and product innovation, the following list highlights the top 10 painting container storage manufacturers shaping the industry.

Top 10 Painting Containers Storage Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dyco Inc.

Domain Est. 1998

Website: dyco-inc.com

Key Highlights: We are today’s trusted designer, manufacturer, & installer of specialized plastic container handling systems….

#2 Industrials

Domain Est. 2021

Website: albers.aero

Key Highlights: Providing multi-site full spectrum standard and advanced manufacturing capabilities and chemical processing services. learn more. turn-key container solutions….

#3 Custom Shipping Container Painting

Domain Est. 1994

Website: iport.com

Key Highlights: Use paint modifications to personalize your office container, to blend your storage unit into its surroundings, or to promote your own unique style or brand….

#4 Storage Container with Custom Paint Colors

Domain Est. 1996

Website: eagleleasing.com

Key Highlights: We can paint your Storage Container any color you wish! Paint your container to match your building, to blend in with trees and shrubbery or represent your ……

#5 Martin Container – Customized containers

Domain Est. 1997

Website: container.com

Key Highlights: Our dry storage containers range in length from 10 to 45 feet and are made from 14-gauge Corten steel. Featuring marine-grade plywood floors, certified ……

#6 Snyder Industries: Poly Tanks

Domain Est. 1998

Website: snydernet.com

Key Highlights: Snyder Industries manufactures plastic & steel tanks, IBC totes, bins, containers, pallets & more including custom products….

#7 Paint Storage Containers

Domain Est. 1998

#8 Heat Protection for Shipping Containers

Domain Est. 2002

Website: spicoatings.com

Key Highlights: Explore effective heat protection solutions for shipping containers with SPI Coatings, reducing internal temperatures, preventing damage, and improving ……

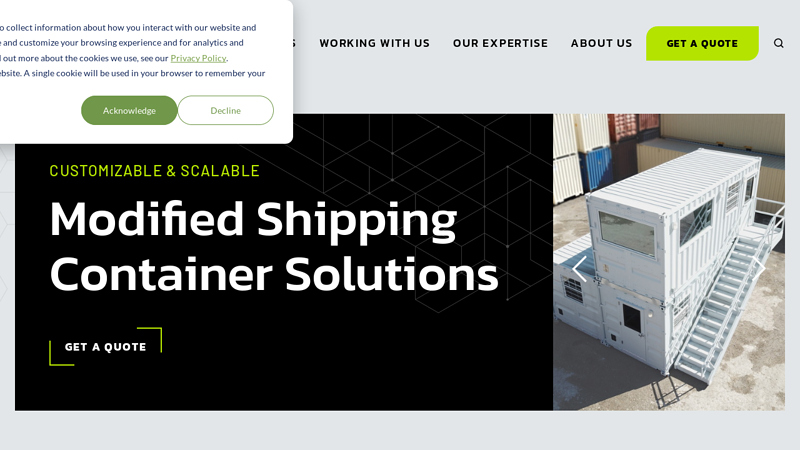

#9 Customizable & Scalable Modified Shipping Container Solutions

Domain Est. 2009

Website: falconstructures.com

Key Highlights: Falcon Structures is the leader in repurposing shipping containers that are fully customized or ordered at scale for a variety of organizations nationwide….

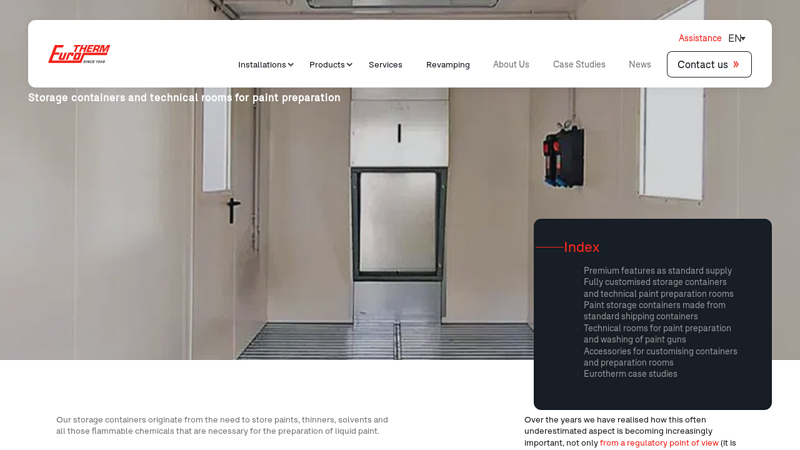

#10 Safe Paint Storage Containers and Technical Rooms

Website: eurotherm.eu

Key Highlights: Discover Eurotherm’s containers and technical rooms: modular, safe, and custom solutions for paint storage, preparation, and plant integration….

Expert Sourcing Insights for Painting Containers Storage

H2: 2026 Market Trends for Painting, Containers, and Storage

The global market for painting, containers, and storage is poised for significant transformation by 2026, driven by technological innovation, sustainability mandates, evolving consumer preferences, and industrial digitization. Each segment—painting materials, container solutions, and storage systems—exhibits unique yet interconnected trends that are reshaping supply chains, manufacturing processes, and end-user applications.

1. Sustainable and Eco-Friendly Materials

A dominant trend across all three sectors is the shift toward sustainability. In the painting industry, demand for low-VOC (volatile organic compounds), water-based, and bio-based paints is accelerating, especially in residential and commercial construction. Regulatory pressures in the EU, North America, and parts of Asia are pushing manufacturers to reformulate products to meet stricter environmental standards. Similarly, container and storage industries are increasingly adopting recyclable materials such as recycled steel, bioplastics, and compostable coatings. By 2026, eco-certifications and circular economy models are expected to become key differentiators in procurement decisions.

2. Smart Storage and IoT Integration

The integration of IoT (Internet of Things) and smart technologies into storage and container systems is gaining momentum. By 2026, smart storage solutions—equipped with sensors for monitoring temperature, humidity, and inventory levels—are expected to become standard in industrial, pharmaceutical, and art conservation applications. These systems enable real-time tracking and predictive maintenance, minimizing waste and optimizing space utilization. In painting storage, smart cabinets with environmental controls will help preserve paint quality in professional and retail settings, reducing spoilage and improving supply chain efficiency.

3. Customization and Modular Design

Growing demand for flexible and modular storage and container systems reflects changing workspace and logistical needs. In both residential and industrial environments, modular paint storage units that adapt to limited spaces or mobile workstations are becoming popular. Similarly, customizable container solutions—offered in scalable sizes and configurations—are meeting the needs of diverse sectors, from construction to e-commerce. This trend is supported by advances in digital design tools and on-demand manufacturing, allowing for rapid prototyping and personalized product offerings.

4. Growth in E-Commerce and Last-Mile Delivery Solutions

The expansion of online retail is influencing container and storage design. As more paint products are sold directly to consumers, manufacturers are investing in durable, spill-proof, and stackable containers suitable for shipping. By 2026, lightweight composite materials and tamper-evident packaging will be standard for e-commerce shipments. Additionally, urban logistics demand compact, reusable storage bins and containers that support efficient last-mile delivery and reduce environmental impact.

5. Industrial Automation and Robotics

Automation is transforming the manufacturing and handling of painting materials and storage systems. Robotics are increasingly used in paint mixing, filling, and container labeling processes, improving precision and reducing labor costs. In warehousing, automated guided vehicles (AGVs) and robotic arms interact with intelligent storage units to streamline inventory management. These technologies are expected to become more accessible to mid-sized enterprises by 2026, democratizing efficiency across the supply chain.

6. Resilient Supply Chains and Regionalization

Post-pandemic supply chain disruptions have prompted companies to regionalize production and diversify sourcing. By 2026, localized manufacturing of paint and storage containers—especially in North America, Europe, and Southeast Asia—is expected to reduce dependency on global logistics. This shift supports faster delivery times, lowers carbon footprint, and enhances supply chain resilience, particularly for time-sensitive construction and industrial projects.

7. Rising Demand in Emerging Markets

Infrastructure development in regions such as India, Southeast Asia, and parts of Africa is driving demand for painting and storage solutions. Urbanization and government-led construction initiatives are increasing the need for durable paints and efficient storage systems. By 2026, multinational companies are likely to expand their footprint in these markets, offering cost-effective, climate-adaptive products tailored to local conditions.

Conclusion

By 2026, the painting, containers, and storage market will be defined by sustainability, digital integration, and customer-centric innovation. Companies that invest in green materials, smart technologies, and agile supply chains will be best positioned to capitalize on emerging opportunities. As environmental regulations tighten and consumer expectations evolve, the convergence of these trends will not only drive growth but also redefine industry standards across global markets.

Common Pitfalls When Sourcing Painting, Containers, and Storage (Quality & IP)

Sourcing painting services, containers, and storage solutions involves significant risks related to both quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to project delays, cost overruns, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Inadequate Quality Standards and Specifications

Failing to define clear quality requirements for painting (e.g., coating thickness, surface preparation, durability) or container/storage specifications (e.g., material grade, load capacity, corrosion resistance) often results in subpar deliverables. Suppliers may interpret vague requirements differently, leading to inconsistencies or non-compliance with industry standards (e.g., ISO, ASTM, NACE).

Lack of Supplier Vetting and Audits

Engaging with suppliers without thorough due diligence increases the risk of poor workmanship or use of counterfeit materials. Skipping on-site audits, quality management system reviews (e.g., ISO 9001), or past performance evaluations can expose your project to unreliable vendors.

Insufficient Inspection and Testing Protocols

Relying solely on supplier certifications without independent third-party inspections or in-process quality checks can allow defects to go unnoticed until later stages. For painting, this includes adhesion tests and holiday detection; for containers, it may involve structural integrity and weld inspections.

Poor Documentation and Traceability

Inadequate record-keeping of materials used, certifications, inspection reports, and process parameters compromises traceability. This becomes critical during audits, failure investigations, or warranty claims, especially when regulatory compliance is required.

Overlooking Intellectual Property Risks in Designs and Processes

Using proprietary designs, coatings, or manufacturing methods without proper licensing or IP agreements can expose your organization to infringement claims. This is particularly relevant when custom paint finishes, branded container designs, or patented storage systems are involved.

Incomplete or Ambiguous Contracts Regarding IP Ownership

Failing to clearly define IP ownership in contracts—especially for custom-developed solutions—can lead to disputes. For example, if a supplier develops a unique coating formulation or container design for your project, ownership may default to the supplier unless explicitly assigned in writing.

Unauthorized Use or Replication by Suppliers

Suppliers may misuse your proprietary designs, templates, or technical specifications for other clients or commercial gain if non-disclosure agreements (NDAs) and usage restrictions are not enforced. This is a common risk in regions with weak IP enforcement.

Inadequate Protection of Trade Secrets

Sharing sensitive information (e.g., paint formulations, storage system layouts) without proper safeguards increases the risk of trade secret theft. Ensure access is limited and data is encrypted or shared under strict confidentiality terms.

Non-Compliance with International IP Regulations

When sourcing globally, differences in IP laws across jurisdictions can create vulnerabilities. A design protected in one country may not be enforceable in the supplier’s location, making it easier for third parties to replicate or reverse-engineer your assets.

Failure to Conduct IP Due Diligence on Supplier Offerings

Using a supplier’s pre-existing container or coating solution without verifying its freedom to operate (FTO) may inadvertently infringe third-party patents. Always request FTO opinions or conduct patent landscape analyses before adoption.

By proactively addressing these pitfalls through robust contracts, supplier management, quality controls, and IP protection strategies, organizations can mitigate risks and ensure reliable, compliant, and legally secure sourcing outcomes.

Logistics & Compliance Guide for Painting Containers Storage

Proper storage of painting containers—such as paint cans, solvent drums, and aerosol cans—is essential for safety, regulatory compliance, and environmental protection. This guide outlines key logistics practices and regulatory requirements to ensure safe and compliant storage operations.

Regulatory Compliance Requirements

Adherence to local, national, and international regulations is mandatory when storing painting materials. Key regulations include:

- OSHA (Occupational Safety and Health Administration): Requires proper labeling, ventilation, and employee training for handling hazardous materials.

- EPA (Environmental Protection Agency): Regulates storage of hazardous waste under the Resource Conservation and Recovery Act (RCRA). Containers must be in good condition, labeled correctly, and stored in designated areas with secondary containment.

- NFPA 30 (National Fire Protection Association): Specifies standards for flammable and combustible liquid storage, including maximum quantities, separation distances, and fire protection systems.

- DOT (Department of Transportation): Applies when containers are prepared for transport; proper packaging, labeling, and documentation are required.

Ensure all storage practices align with these standards to avoid fines, environmental incidents, and safety hazards.

Container Handling and Inspection

Regular inspection and proper handling of containers are critical for safety and compliance:

- Inspect containers for dents, leaks, rust, or bulging before storage.

- Store containers upright with tightly sealed lids to prevent spills and vapor release.

- Do not mix incompatible materials (e.g., oxidizers with flammables).

- Use compatible secondary containment (e.g., spill pallets or berms) capable of holding at least 110% of the largest container’s volume.

- Replace damaged containers immediately using approved transfer procedures.

Storage Area Design and Management

Design the storage area to minimize risk and facilitate compliance:

- Designate a well-ventilated, dry, and temperature-controlled area away from direct sunlight and ignition sources.

- Clearly mark storage zones with appropriate hazard signage (e.g., “Flammable,” “No Smoking”).

- Segregate paint types: store flammable liquids separately from corrosives, oxidizers, and water-based paints.

- Limit quantities stored on-site to what is operationally necessary.

- Install fire suppression systems (e.g., sprinklers) and explosion-proof lighting where required.

Labeling and Inventory Control

Maintain accurate records and clear labeling:

- Label all containers with contents, hazard symbols, date received, and expiration (if applicable).

- Maintain an up-to-date inventory log with chemical names, quantities, and storage locations.

- Use a first-in, first-out (FIFO) system to prevent material degradation and waste.

- Keep Safety Data Sheets (SDS) readily accessible to personnel.

Spill Prevention and Emergency Response

Prepare for potential incidents:

- Provide spill kits containing absorbents, neutralizers, and PPE near storage areas.

- Train employees on spill response procedures and evacuation routes.

- Establish containment protocols to prevent runoff into drains or soil.

- Report significant spills to regulatory authorities as required.

Training and Documentation

Ensure staff are informed and prepared:

- Conduct regular training on hazard communication, fire safety, and emergency procedures.

- Document all training sessions, inspections, and compliance audits.

- Retain records for the duration required by law (typically 3–5 years).

By following this guide, facilities can ensure the safe, efficient, and legally compliant storage of painting containers while protecting personnel, property, and the environment.

Conclusion: Sourcing Painting Containers and Storage

In conclusion, sourcing appropriate painting containers and storage solutions is a critical step in maintaining paint quality, ensuring workplace efficiency, and promoting safety and sustainability. By selecting durable, well-sealed, and appropriately sized containers—such as reusable metal cans, airtight plastic jars, or specialized airless paint containers—organizations can minimize waste, extend shelf life, and reduce environmental impact. Proper labeling, compatibility with various paint types (water-based, oil-based, etc.), and stackable or modular designs further enhance organizational efficiency, especially in industrial, construction, or art studio environments.

Additionally, considering factors such as supplier reliability, cost-effectiveness, and eco-friendly materials supports long-term operational success. Whether sourcing for small-scale art projects or large industrial operations, investing in high-quality storage solutions ultimately leads to improved workflow, reduced material loss, and compliance with safety standards. Therefore, a strategic approach to sourcing painting containers and storage not only safeguards valuable materials but also contributes to operational excellence and sustainability goals.