Introduction: Navigating the Global Market for Packaging Technology

Hook:

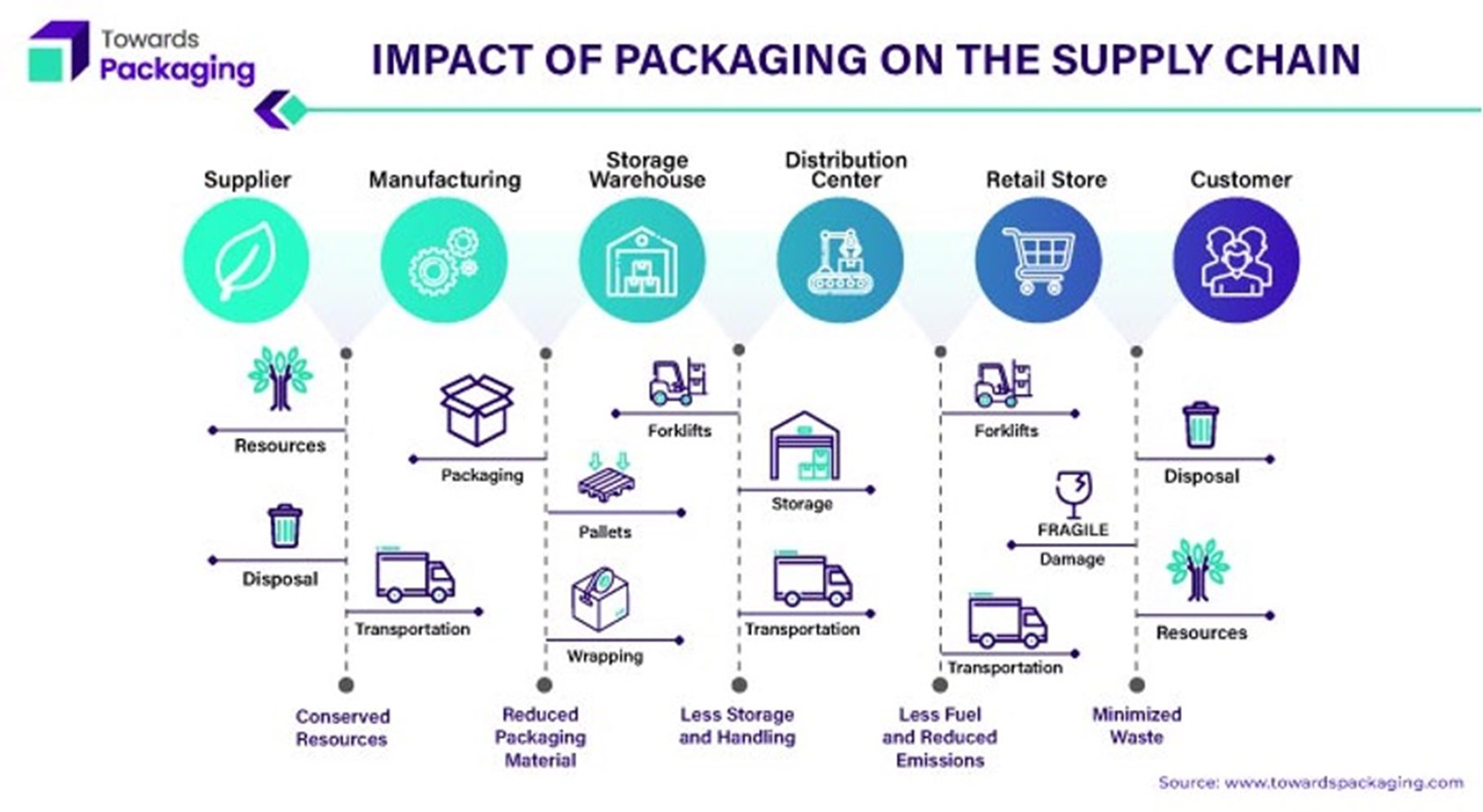

The packaging landscape is no longer a back-office function—it’s a boardroom priority. Rising material costs, stricter EU Packaging and Packaging Waste Regulation (PPWR) compliance, and accelerating e-commerce demand are reshaping how North American and European brands protect products, cut waste, and satisfy investors.

The Problem:

Procurement teams juggle conflicting mandates: lower costs, faster throughput, circularity, and regulatory certainty. Legacy suppliers often deliver yesterday’s solutions, while niche vendors lack global reach. The result? Missed sustainability targets, customs delays, and margin erosion.

Your Guide:

This section unpacks the global packaging-technology market in clear, actionable steps. You’ll learn how to:

- Benchmark leading equipment and materials across U.S. and EU supply chains

- Decode regulatory frameworks (PPWR, FTC Green Guides, FDA Title 21) before specification

- Evaluate suppliers on total cost of ownership, not just unit price

- Future-proof investments with modular, recyclable, and smart-packaging technologies

Each subsection integrates real-world case studies—such as NewCoffee’s successful transition to Syntegon’s PMX machines—to illustrate proven paths to compliance and growth.

Outcome:

By the end, you’ll have a concise decision matrix to select packaging technology partners that align with both domestic efficiency and international compliance—turning packaging from cost center into competitive advantage.

Illustrative Image (Source: Google Search)

Article Navigation

- Top 10 Packaging Technology Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for packaging technology

- Understanding packaging technology Types and Variations

- Key Industrial Applications of packaging technology

- 3 Common User Pain Points for ‘packaging technology’ & Their Solutions

- Strategic Material Selection Guide for packaging technology

- In-depth Look: Manufacturing Processes and Quality Assurance for packaging technology

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘packaging technology’

- Comprehensive Cost and Pricing Analysis for packaging technology Sourcing

- Alternatives Analysis: Comparing packaging technology With Other Solutions

- Essential Technical Properties and Trade Terminology for packaging technology

- Navigating Market Dynamics and Sourcing Trends in the packaging technology Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of packaging technology

- Strategic Sourcing Conclusion and Outlook for packaging technology

- Important Disclaimer & Terms of Use

Top 10 Packaging Technology Manufacturers & Suppliers List

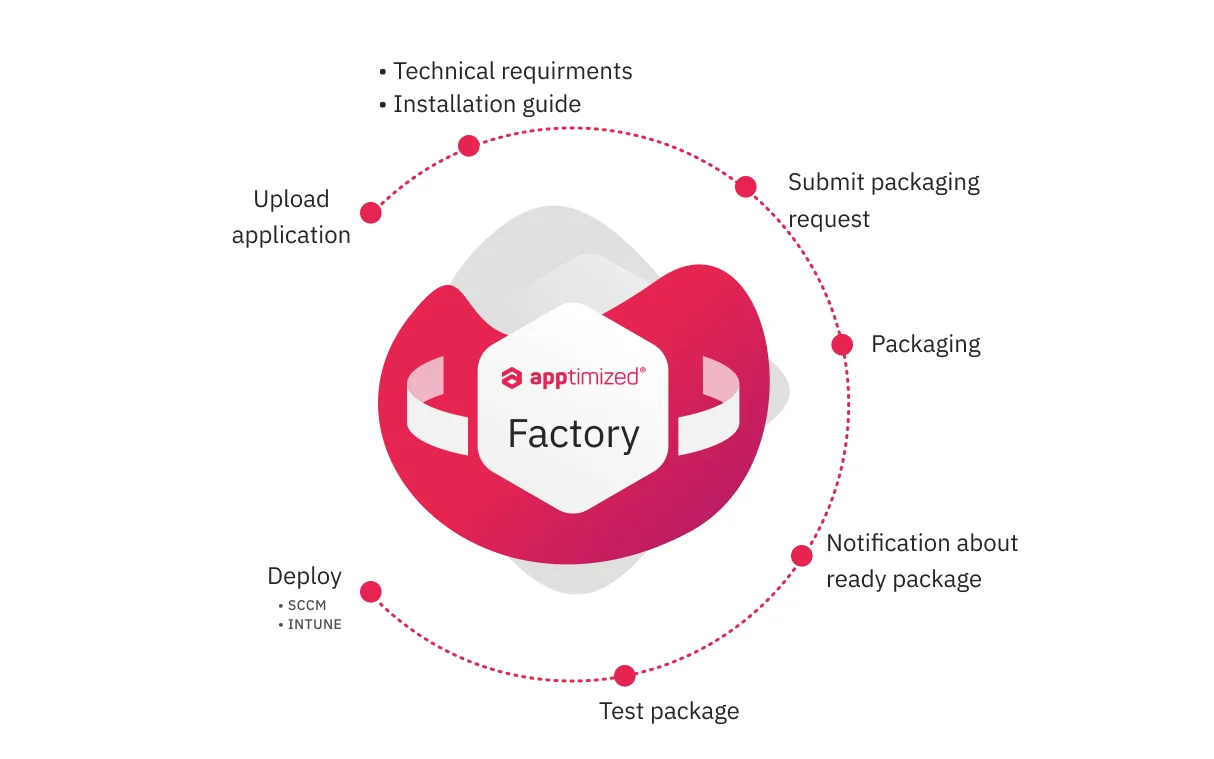

1. Top 20 Packaging Companies (Trusted Manufacturers)

Domain: elitecustomboxes.com

Registered: 2018 (7 years)

Introduction: List of Top 20 Packaging Companies · 1. International Paper Co · 2. West Rock · 3. Ball Corporation · 4. Smurfit Kappa Group · 5. Oji Holdings · 6….

2. Top 10 Packaging Machine Manufacturers in the USA – HonorPack

Domain: honorpack.com

Registered: 2009 (16 years)

Introduction: Top 10 Packaging Machine Manufacturers In The USA ; 1. HonorPack. 1992 ; 2. Viking Masek. 2002 ; 3. Accutek Packaging. 1989 ; 4. Triangle. 1923….

3. Top 50 Packaging Machinery Companies in Global 2025

Domain: sphericalinsights.com

Registered: 2022 (3 years)

Introduction: Maillis Group · Rovema GmbH · Douglas Machine Inc. · KHS Group · SIG · Tetra Laval International S.A. · Krones AG · Industria Macchine Automatiche S.P.A. ……

4. Top 10 Packaging Companies in the US by 2023 Revenue

Domain: packagingschool.com

Registered: 2010 (15 years)

Introduction: 1. WestRock · 2. International Paper · 3. Ball Corporation · 4. Berry Global · 5. Crown Holdings · 6. Graphic Packaging · 7. Packaging Corporation of ……

Illustrative Image (Source: Google Search)

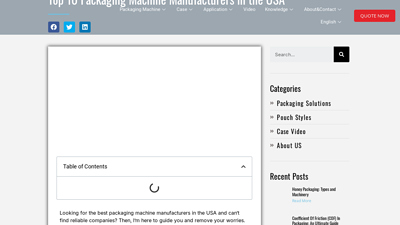

5. Top 10 Aseptic Packaging Companies Globally [2023]

Domain: fortunebusinessinsights.com

Registered: 2018 (7 years)

Introduction: Fortune Business Insights™ Presents the Top 10 Aseptic Packaging Companies Globally · 1. Tetra Pak International USA · 2. Amcor · 3. Sig Combibloc ……

6. Top 13 Smart Packaging Companies in the World – IMARC Group

Domain: imarcgroup.com

Registered: 2009 (16 years)

Introduction: 1. Amcor Group GmbH · 2. American Thermal Instruments · 3. Avery Dennison Corporation · 4. Berry Global Inc. · 5. Crown Holdings, Inc. · 6. DuPont de Nemours, Inc….

7. Packaging Machinery: 9 Global Leaders to Watch in 2025

Domain: packaging-labelling.com

Registered: 2008 (17 years)

Introduction: Packaging Machinery: 9 Global Leaders to Watch ; 1, Bosch Packaging Technology (Syntegon), Germany ; 2, Tetra Pak, Switzerland ; 3, IMA Group, Italy ; 4, Marchesini ……

8. Top 8 Food and Beverage Packaging Machinery Manufacturers

Domain: verifiedmarketresearch.com

Registered: 2018 (7 years)

Introduction: Prominent Food and Beverage Packaging Machinery manufacturers include companies like Tetra Pak, Krones, and Bosch Packaging Technology….

Illustrative Image (Source: Google Search)

9. Packaging machines from Crailsheim | Schubert Group

Domain: schubert.group

Registered: N/A

Introduction: We don’t just design and build packaging machines. We aim to provide you with a future-proof, sustainable complete packaging solution….

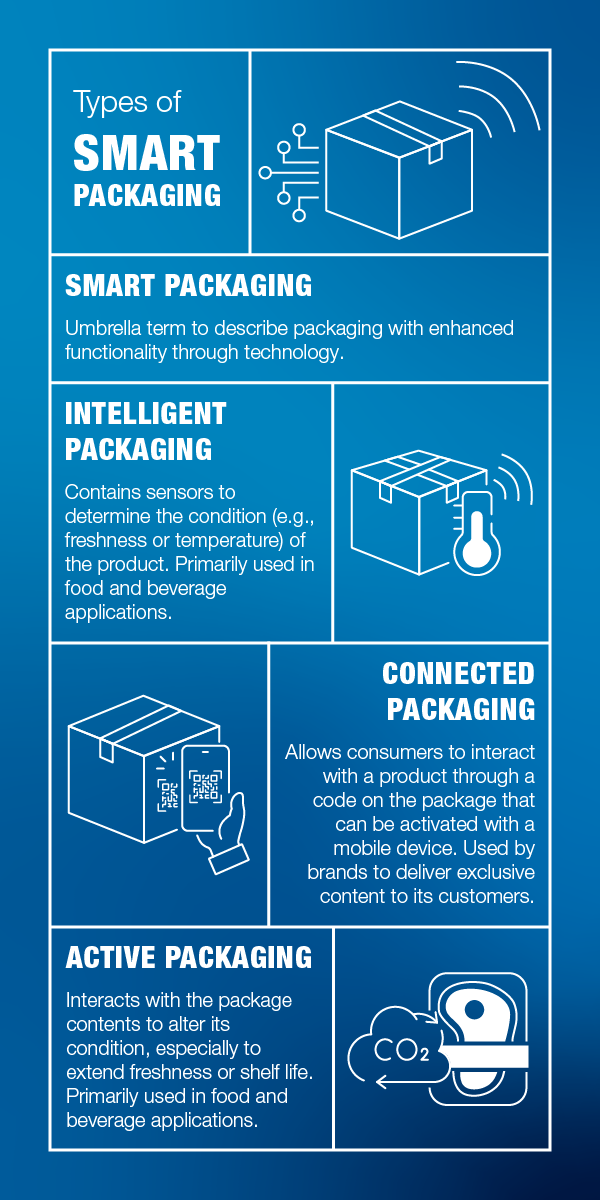

Understanding packaging technology Types and Variations

Understanding Packaging Technology: Types and Variations

Packaging technology encompasses the materials, processes, and systems used to protect, preserve, and present products for transport, storage, and sale. Understanding the key types and their distinct characteristics is essential for selecting optimal solutions that align with performance, sustainability, and cost objectives across diverse industries.

Illustrative Image (Source: Google Search)

| Type | Core Features | Primary Applications | Key Pros / Cons |

|---|---|---|---|

| Corrugated Fiberboard | – Fluted medium sandwiched between liner boards – Configurable into boxes, trays, partitions |

– E-commerce shipping – Industrial dunnage – Retail point-of-purchase displays |

Pros: Lightweight, cost-effective, recyclable, print-friendly Cons: Limited moisture/impact resistance unless treated; lower stack strength vs. rigid plastics |

| Rigid Paperboard & Chipboard | – Solid, thick construction – Die-cut or molded shapes |

– Luxury consumer goods – Food service packaging – Medical device protection |

Pros: Premium appearance, excellent print quality, Form stability Cons: Higher material cost; heavier than corrugated |

| Flexible Plastic Films | – Thin gauge polymers (PE, PP, PET, EVOH) – Heat-sealable, printable |

– Snack foods – Pharmaceuticals – Vacuum skin packs |

Pros: Excellent barrier properties, high-speed form-fill-seal, space-efficient Cons: Limited recyclability (resin-dependent); static buildup risk |

| Engineered Foam Protectants | – Expandable polystyrene (EPS), EPP, EPE – Molded or block shapes |

– Fragile electronics – Automotive parts – Aerospace components |

Pros: Superior impact absorption, re-usability, design flexibility Cons: Higher upfront cost; bulky storage; limited recyclability |

| Sustainable Alternatives | – Molded fiber, seaweed-based films, mushroom packaging – Bio-based or compostable resins |

– Green brands – Food service disposables |

Pros: End-of-life circularity, regulatory compliance (e.g., EU PPWR) Cons: Variable performance vs. conventional; higher testing & validation cycle |

Detailed Breakdown

1. Corrugated Fiberboard

Corrugated solutions remain the backbone of global packaging due to their balance of strength, cost, and recyclability. The fluted architecture provides inherent column strength, enabling stacked loads to withstand compression forces. Advanced water-resistant coatings and micro-flute profiles extend use into semi-durable segments previously dominated by plastic. Printing surfaces accept high-resolution graphics that support brand storytelling at shelf and during transit.

2. Rigid Paperboard & Chipboard

These boards deliver a premium unboxing experience and structural integrity for lightweight to medium-weight products. Solid bleached sulfate (SBS) and recycled content chipboard are routinely converted into set-up boxes, tube packaging, and clamshells. Surface treatments (aqueous coatings, soft-touch lamination) enhance tactile appeal while maintaining recyclability. Cost efficiency improves when sourced from regional plants practicing just-in-time inventory management, reducing warehousing needs and supply-chain volatility.

3. Flexible Plastic Films

Polymer advancements enable high-barrier films that extend shelf life for perishables and safeguard moisture- or oxygen-sensitive pharmaceuticals. Co-extrusion and multi-layer structures allow targeted engineering of seal strength, tensile properties, and optical clarity. High-speed form-fill-seal lines integrate these films directly into packaging lines, minimizing labor and floor space. However, growing Extended Producer Responsibility (EPR) regulations in the EU and select U.S. states are prompting converters to adopt post-consumer resin (PCR) content and closed-loop recycling streams.

4. Engineered Foam Protectants

Engineered foam solutions offer best-in-class shock and vibration isolation for high-value or delicate components. Expandable polystyrene (EPS) molds provide dimensional accuracy at scale, while cross-linked polyethylene (EPE) delivers flexibility for irregular shapes. Reusable dunnage systems—such as returnable foam-in-place or inflatable bladders—align with lean logistics models, reducing waste and inbound material costs. Regulatory scrutiny on expanded polystyrene disposal is driving adoption of bio-based alternatives with comparable protective performance.

Illustrative Image (Source: Google Search)

5. Sustainable Alternatives

Rapidly evolving bio-based materials bridge the gap between environmental responsibility and functional performance. Molded fiber now achieves drop-test ratings once reserved for foam, while seaweed and mushroom-based foams provide compostable cushioning. These solutions are particularly attractive to brands pursuing Science-Based Targets initiative (SBTi) commitments and preparing for forthcoming EU PPWR mandates on recycled content and design for recyclability. Early adopters benefit from marketing differentiation and reduced end-of-life liabilities.

Selecting the appropriate packaging technology demands a structured evaluation of product fragility, shelf life, distribution environment, regulatory landscape, and brand objectives. Leveraging data-driven testing and close collaboration with converters experienced in just-in-time inventory and sustainable design will optimize both performance and cost across North American and European markets.

Key Industrial Applications of packaging technology

Key Industrial Applications of Packaging Technology

| Industry | Application | Key Benefits |

|---|---|---|

| E-Commerce & Fulfillment | Brand-agnostic protective packaging (foam, paper, molded fiber) | – Rapid throughput for high-volume shippers – Right-sized, damage-resistant packs reduce return rates – Modular designs support seasonal demand spikes |

| Industrial Manufacturing | Just-in-Time (JIT) inventory & kitting | – Real-time delivery aligns with lean production lines – Reduces floor-space inventory by up to 30 % – Component traceability supports ISO/TS quality audits |

| Automotive OEM & Tier 1 | Engine, transmission and electronics protection | – Multi-Directional Pallet Cushions® isolate vibration and shock in transit – Custom cavity molds prevent part migration during long-haul shipping – Recyclable materials meet OEM sustainability scorecards |

| Food & Beverage (B2B) | Modified-atmosphere and single-serve packaging | – Extended shelf life cuts food-waste liability – FDA-compliant barrier films protect brand reputation – High-speed form-fill-seal lines maximize line efficiency |

| Pharmaceutical & Life Sciences | Cold-chain and secondary packaging | – Validated temperature ranges (2-8 °C / ambient) ensure regulatory compliance – Barcode and RFID integration for DSCSA serialization – Tamper-evident features reduce liability exposure |

| Retail & Apparel | Returns-ready and reusable packaging | – Durable totes withstand 100+ cycles, lowering cost-per-use – Flat-pack designs reduce freight cube by 40 % on reverse logistics – QR-coded labeling speeds downstream processing |

| Aerospace & Defense | High-value component packaging | – Static-dissipative foams prevent ESD damage – Certified containment for ITAR-controlled parts – GPS-tracked shipments meet MIL-STD logistics standards |

These applications demonstrate how advanced packaging technology drives operational efficiency, regulatory compliance and brand protection across North American and European supply chains.

3 Common User Pain Points for ‘packaging technology’ & Their Solutions

3 Common B2B Pain Points for Packaging Technology & Their Solutions

Pain Point 1: Rising Packaging Costs Without Visible ROI

Scenario: Mid-market manufacturers in the U.S. and EU struggle to justify spending on advanced packaging technology amid volatile material prices and tight margins.

Illustrative Image (Source: Google Search)

Problem:

– Material price fluctuations (e.g., pallet cushions, foam inserts) erode profit margins

– Inefficient filler or machine downtime increases per-unit costs

– Lack of predictive maintenance leads to unplanned downtime

Solution:

| Action | Benefit |

|—|—|

| Switch to Multi-Directional Pallet Cushions® for reusable, compression-resistant protection | Reduces damage claims & shipping waste by up to 30% |

| Adopt just-in-time inventory management to cut carrying costs & free warehouse space | Lowers logistics spend & improves cash flow |

| Deploy predictive maintenance on packaging lines via IoT sensors | Minimizes unplanned downtime & extends equipment life |

ROI Example: A German coffee producer cut filler changeover time by 25% using a flexible PMX machine that processes both conventional and recyclable materials—aligning with EU PPWR compliance and saving 12% on annual packaging spend.

Pain Point 2: Regulatory Compliance & Sustainability Pressure

Scenario: U.S. and EU brands face tightening regulations like the EU Packaging and Packaging Waste Regulation (PPWR) and consumer demand for circular packaging.

Illustrative Image (Source: Google Search)

Problem:

– Mixed-material packaging fails recyclability tests

– Limited supplier options for recyclable or bio-based materials

– Lack of in-house testing slows product launches

Solution:

– Partner with suppliers who provide consulting & testing for recyclable materials (e.g., paper-based or mono-material structures)

– Select machines (e.g., Syntegon PMX) that process both conventional and recyclable substrates in one line

– Use sustainable tape and labels certified for recycling streams to close the loop on packaging waste

ROI Example: A U.S. industrial client reduced packaging waste by 18% after switching to circular-design pallet cushions and validated recyclable void fill.

Pain Point 3: Inventory & Warehouse Inefficiencies

Scenario: E-commerce and B2B distributors in North America and Europe struggle with overstocking protective packaging or facing stock-outs during peak seasons.

Illustrative Image (Source: Google Search)

Problem:

– Bulk purchasing of foam or bubble wrap ties up capital

– Seasonal demand spikes cause stock-outs

– Manual inventory tracking leads to mispicks and delays

Solution:

– Implement just-in-time inventory management with real-time data feeds from packaging suppliers

– Use modular, reusable protective packaging (e.g., Multi-Directional Pallet Cushions®) to reduce SKU complexity

– Integrate packaging ordering into ERP systems to automate replenishment triggers

ROI Example: A U.S. logistics provider cut average warehouse space usage by 15% and reduced emergency freight costs by 22% after adopting JIT for protective packaging.

Bottom Line:

By aligning packaging technology with cost control, regulatory agility, and inventory precision, B2B leaders in the U.S. and EU can unlock measurable savings and competitive advantage.

Strategic Material Selection Guide for packaging technology

Strategic Material Selection Guide for Packaging Technology

Executive Summary

Material selection directly impacts regulatory compliance, cost efficiency, and brand positioning across North American and European markets. This guide provides technical criteria for evaluating protective packaging materials, focusing on performance metrics, sustainability profiles, and supply chain considerations.

Material Performance Matrix

| Property | EPE Foam | Molded Fiber | Cornstarch Packaging | Engineered Film |

|---|---|---|---|---|

| Compression Strength | 85-95 psi | 60-75 psi | 40-55 psi | 90-110 psi |

| ** Moisture Resistance** | Excellent | Good | Poor | Excellent |

| Recyclability | Limited (EPR excluded) | Excellent | Excellent | Limited |

| Cost per Unit | $0.45-0.85 | $0.30-0.60 | $0.25-0.45 | $0.60-1.20 |

| Carbon Footprint | Medium | Low | Very Low | Medium |

| Supply Chain Risk | High (petroleum-based) | Low | Low | Medium |

Regulatory Compliance Framework

EU Considerations:

– PPWR implementation requires 100% recyclable content by 2030

– EPE foam faces phase-out in Germany/Switzerland

– Molded fiber qualifies for Extended Producer Responsibility (EPR) credits

US Market:

– EPA guidelines favor recyclable over compostable materials

– California SB 54 mandates 75% recyclable packaging by 2032

Decision Matrix for Application-Specific Selection

High-Value Electronics (>$500/unit)

- Primary: Engineered film with EPE corner protection

- Rationale: 99% static protection, 48-hour shock attenuation

- Sustainability Offset: 30% recycled content film option

Food & Beverage (perishable)

- Primary: Molded fiber with PLA coating

- Rationale: FDA-compliant, compostable within 90 days

- Performance: Maintains 4°C temperature differential for 6 hours

Industrial Components (>50kg)

- Primary: Multi-Directional Pallet Cushions® (MDPC)

- Rationale: 3000 lbs compression resistance, reusable 50+ cycles

- ROI: 40% lower total cost vs. foam alternatives

Sustainability Scoring Methodology

Weighted Performance Index (WPI):

– Recyclability (35% weight)

– Carbon Intensity (30% weight)

– Performance Retention (25% weight)

– Cost Efficiency (10% weight)

Illustrative Image (Source: Google Search)

Top Quintile Materials:

1. Molded fiber (WPI: 8.7/10)

2. MDPC (WPI: 8.4/10)

3. Recycled content engineered film (WPI: 8.1/10)

Implementation Roadmap

Phase 1 (0-3 months):

– Audit current material usage against this matrix

– Conduct pilot tests on top 2 materials per application

Phase 2 (3-6 months):

– Establish supplier qualification protocols

– Implement digital tracking for material performance metrics

Phase 3 (6-12 months):

– Full transition to approved materials

– Quarterly sustainability reporting aligned with EU CSRD requirements

Cost-Benefit Analysis Framework

Total Cost of Ownership (TCO) Formula:

TCO = Material Cost + Transportation Cost + Disposal Value - Carbon Credits

Typical Savings:

– Molded fiber: 12-18% TCO reduction

– MDPC: 25-35% TCO reduction

– Engineered film: 5-8% TCO reduction (with recycled content premium)

Next Steps

- Material Audit: Complete packaging spend analysis using the matrix

- Supplier Engagement: Request sustainability declarations from top 3 vendors

- Regulatory Update: Subscribe to EU PPWR implementation updates via Packaging Technology Today

This guide reflects current market conditions as of Q4 2023. Regular updates recommended semi-annually.

In-depth Look: Manufacturing Processes and Quality Assurance for packaging technology

In-depth Look: Manufacturing Processes and Quality Assurance for Packaging Technology

This section provides a detailed overview of the end-to-end manufacturing workflow and quality assurance framework employed by leading packaging technology providers in the U.S. and EU markets. The outline is designed for engineers, procurement managers, and operations leaders who require transparent, audit-ready insights into how protective packaging is conceived, produced, and certified.

1. Manufacturing Process Overview

| Phase | Core Activities | Key Technologies | Typical Lead Time |

|---|---|---|---|

| Pre-Production (Prep) | Design finalization, material selection, DFM analysis | CAD, FEA, 3D prototyping | 5–10 days |

| Forming | Thermoforming, die-cutting, rotational molding, or injection molding | CNC routers, vacuum formers, robotic automation | 2–7 days |

| Assembly | Component joining, padding insertion, barrier lamination | Ultrasonic welding, adhesive bonding, automated vision | 1–3 days |

| Quality Control (QC) | Dimensional verification, compression testing, barrier integrity | CMM, Instron testers, oxygen/moisture analyzers | 0.5–1 day |

2. Detailed Manufacturing Steps

2.1 Pre-Production (Prep)

- Design for Manufacturability (DFM): Geometry is optimized to reduce cycle time and material waste while maintaining load-bearing capacity.

- Material Selection: Rigid foams (EPP, EPE), flexible films (PE, PP, PET), or engineered paperboard are matched to end-use environments (temperature, impact, VOC emissions).

- Prototyping: 3D-printed or CNC-machined samples are load-tested against ISTA 3A or ASTM D4169 protocols.

2.2 Forming

- Thermoforming: Heated sheet stock is shaped over molds; ideal for contoured protective inserts.

- Die-Cutting: High-precision steel rule dies produce flat pads or sleeves with tight tolerances (±0.5 mm).

- Molding: Rotational or injection molding creates hollow structures for large-scale load distribution.

2.3 Assembly

- Automated Joining: Robotic arms execute ultrasonic or laser welds at speeds up to 30 units/minute.

- Quality Gates: Inline vision systems reject parts with weld defects >0.2 mm.

- Value-Added Services: Custom printing, barcoding, and tamper-evident features are applied here.

2.4 Quality Control (QC)

- Dimensional Verification: Coordinate-measuring machines ensure cavity dimensions conform to ±0.1 % tolerance.

- Compression & Impact Testing: Instron universal testers simulate pallet compression loads up to 10,000 N.

- Barrier Integrity: Oxygen transmission rate (OTR) and water vapor transmission rate (WVTR) are measured per ASTM D3985 and ASTM E96.

3. Quality Standards & Certifications

| Standard | Scope | Typical Audit Frequency |

|---|---|---|

| ISO 9001:2015 | Quality management system | Annual |

| ISO 14001:2015 | Environmental management | Triennial |

| ISO 45001:2018 | Occupational health & safety | Triennial |

| ASTM D4169 | Distribution cycle testing | Per customer spec |

| ISTA 3A / 3B | Packaged-product integrity | Per customer spec |

| EU Packaging & Packaging Waste Regulation (PPWR) | Compliance & recyclability | Continuous (regulatory updates) |

4. Just-in-Time Inventory & Distribution

- Kanban & VMI Programs: Real-time inventory feeds trigger production automatically.

- Packaging Technology, Inc. Example: Multi-Directional Pallet Cushions® are manufactured in roll-to-roll or die-cut formats and shipped in returnable totes to reduce lead time to <24 hours for North American customers.

- EU Logistics Hubs: Local micro-warehouses in Germany and the Netherlands enable 48-hour delivery across the EU.

5. Continuous Improvement & Digital Traceability

- MES Integration: Manufacturing Execution Systems capture every production parameter (temperature, pressure, cycle count) for traceability.

- Blockchain Provenance: Each unit is tagged with a unique QR code linking to material origin, test certificates, and carbon footprint data.

- Kaizen Events: Quarterly cross-functional reviews drive 5–7 % annual yield improvements.

Key Takeaways

- A repeatable, data-driven workflow from design to delivery ensures consistent performance and regulatory compliance.

- ISO-aligned quality systems provide the transparency North American and European buyers require for supplier audits.

- Just-in-time models reduce inventory carrying costs without compromising on lead time or product integrity.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘packaging technology’

Practical Sourcing Guide: A Step-by-Step Checklist for Packaging Technology

1. Define the Business Requirement

- Objective: Identify the exact packaging problem you are solving (e.g., product protection, regulatory compliance, cost reduction, brand differentiation).

- Output: One-page requirement brief signed off by operations, finance, and legal/compliance.

2. Map Regulatory & Market Constraints

| Region | Key Regulations | Typical Deadlines |

|---|---|---|

| USA | CPSIA, FDA, FTC Green Guides | Continuous |

| EU | EU PPWR, REACH, CLP | 2025–2027 phased implementation |

| – Action: List all applicable directives, then assign a compliance owner. |

3. Specify Technical & Performance Criteria

- Functional: Drop test level, vibration resistance, temperature range, barrier properties.

- Sustainability: % recycled content, recyclability symbol, compostability certification (e.g., ASTM D6400).

- Throughput: Line speed (units/min), change-over time, integration with existing ERP/MES.

- Format: Case style, bag dimensions, roll-stock or pre-made packs.

4. Build a Supplier Long-List

- Sources: Industry directories (PMMI, EUROPACK), trade shows (NPE, K 2025), peer referrals.

- Filter: Minimum 5-year track record, ISO 9001/14001 certification, USA/EU manufacturing footprint.

- Scorecard: Rate on technical capability, financial stability (D&B report), and language support.

5. Issue a Detailed RFQ

Use a standardized template:

1. Scope of Supply

2. Regulatory Compliance Matrix

3. Technical Specifications (see §3)

4. Delivery & Incoterms (FOB/CIF port)

5. Warranty & After-Sales (24-month parts & labor)

6. Sustainability Declaration (ISO 14021)

– Deadline: Allow 4–6 weeks for responses.

6. Conduct Due Diligence

- Factory Audit: On-site or virtual, focus on QA lab, changeover demo, and safety protocols.

- Reference Calls: Minimum 3 recent clients in similar industries.

- Financial Health: Review credit ratio (net worth ≥ 15 % of annual sales).

7. Evaluate Bids with a Weighted Matrix

| Criteria | Weight | Score (1–5) | Weighted |

|---|---|---|---|

| Total Cost of Ownership | 30 % | — | — |

| Technical Performance | 25 % | — | — |

| Regulatory Compliance | 20 % | — | — |

| Sustainability Profile | 15 % | — | — |

| Service & Support | 10 % | — | — |

| – Decision Rule: Highest composite score advances to final negotiation. |

8. Negotiate Commercial Terms

- Payment: 20 % down, 60 % on shipment, 20 % on successful FAT (Factory Acceptance Test).

- Warranty: Extend to 36 months for critical line components.

- Sustainability Incentives: Bonus payments for achieving post-installation recycling rates ≥ 90 %.

9. Execute Contract & Project Plan

| Milestone | Owner | Date |

|---|---|---|

| Contract signature | Procurement | Day 0 |

| FAT scheduling | Engineering | +6 weeks |

| Factory acceptance | QA | +14 weeks |

| Site acceptance | Ops | +18 weeks |

| – Gantt chart: Shared via MS Project or Asana. |

10. Post-Implementation Review

- KPI Dashboard: OEE, first-pass yield, scrap rate, on-time delivery.

- Sustainability Audit: Verify actual vs. declared recycled content and recyclability.

- Continuous Improvement: Quarterly business review (QBR) with supplier.

Quick Reference Checklist

- [ ] Requirement brief signed

- [ ] Regulatory mapping complete

- [ ] RFQ issued & responses received

- [ ] Factory audit scheduled

- [ ] Weighted matrix scored

- [ ] Contract signed & project plan live

- [ ] Post-implementation KPI baseline set

Comprehensive Cost and Pricing Analysis for packaging technology Sourcing

Comprehensive Cost and Pricing Analysis for Packaging Technology Sourcing

Executive Summary

For U.S. and European buyers, packaging technology sourcing decisions must balance performance, sustainability mandates (e.g., EU PPWR), and total landed cost. This analysis decomposes the cost drivers of custom protective packaging and just-in-time (JIT) inventory systems, then provides actionable levers to reduce expense without compromising compliance or service levels.

1. Cost Breakdown by Category

| Cost Category | Typical Components | Key Cost Drivers | Average Share of Total Cost* |

|---|---|---|---|

| Materials | Corrugated board, recycled paper padding, PP films, biopolymers, wood dunnage | Raw material index, resin price volatility, recycled content % | 35–50 % |

| Labor | Design engineering, die-cut setup, CNC routing, final assembly, QA | Regional wage rates, overtime, automation level | 15–25 % |

| Logistics & Duty | Freight (ocean, air, LTL), warehousing, 3PL fees, customs clearance | Incoterms, lane distance, fuel surcharges, EU import duties | 20–30 % |

| Overheads & Margin | Tooling amortization, energy, quality systems (ISO 9001), sales commissions | Volume discounts, payment terms, long-term contracts | 10–20 % |

*Percentages vary by order profile (custom vs. standard, volume, geography).

2. Cost Drivers & Market Context

| Driver | Impact on Cost | Mitigation Tactics |

|---|---|---|

| Raw material volatility | Resin price swings (±20 %/yr) affect corrugated and foam costs. | Lock-in 12-month contracts; switch to 100 % recycled content where specs allow. |

| EU PPWR & extended producer responsibility (EPR) | Mandatory recycled content quotas and take-back fees raise material cost 3–7 %. | Specify mono-material constructions (e.g., all-paper) to qualify for easier recycling credits. |

| U.S. vs. EU labor rates | EU average hourly manufacturing labor: $28–35; U.S.: $22–28 (packaging sector). | Near-shore final assembly in Mexico or Eastern Europe to cut labor 12–18 %. |

| Freight surcharges | Red Sea diversions add $0.10–0.15 per kg to Europe. | Consolidate loads, shift from air to sea, use bonded warehouses to defer duty. |

| Tooling amortization | Custom metal dies: $5–15 k; amortized over 50–100 k pcs. | Share tooling across product lines; leverage supplier’s existing die library. |

3. Cost-Saving Levers (Ranked by Payback)

- Design for Circular Economy

- Switch from multi-layer LDPE foam to 100 % recycled paper padding.

-

RESULT: Material cost ↓ 8–12 %, EPR recycling credit ↑ 3–5 %.

Illustrative Image (Source: Google Search)

-

Volume Consolidation & JIT Pull-Strategy

- Replace quarterly bulk shipments with monthly mini-bulk (2–5 k pcs) to reduce warehouse carrying cost 10–15 %.

-

Packaging Technology’s JIT program delivers every 48 hrs, trimming safety stock by 30 %.

-

Regional Manufacturing Footprint

- U.S. buyers: Shift long runs to Packaging Technology’s Exton, PA facility to leverage lower labor and energy (≈ 15 % COGS reduction).

-

EU buyers: Co-load with other EU brands at Syntegon’s Bavaria hub for shared tooling amortization.

Illustrative Image (Source: Google Search)

-

Contract Length & Payment Terms

- Secure 24-month fixed-price purchase agreements to hedge resin volatility.

-

Negotiate 45-day payment terms vs. COD; effective cost ↓ 1.5–2 %.

-

Digital Sampling & Simulation

- Use Packaging Technology’s 3D drop-test simulation to validate designs virtually before tooling.

- Saves $3–7 k per program and 2–3 weeks lead time.

4. Example Cost Snapshot: 50 k-Unit Order (U.S. East Coast → Germany)

| Item | Unit Cost (USD) | Total Cost |

|---|---|---|

| Material (virgin + 30 % recycled corrugate) | $1.20 | $60,000 |

| Labor (Exton, PA) | $0.40 | $20,000 |

| Tool amortization | $0.30 | $15,000 |

| Ocean freight (FCL, Ningbo→Hamburg) | $0.35 | $17,500 |

| EU import duty (6.5 %) | — | $6,500 |

| 3PL warehouse (2 weeks) | $0.10 | $5,000 |

| ** landed cost per piece** | $2.55 | $127,500 |

*Savings potential: 8 % ($10 k) via recycled content mix + 5 % ($6 k) via shared tooling with another EU brand.

Illustrative Image (Source: Google Search)

5. Checklist for Procurement Teams

- [ ] Confirm mono-material spec to maximize EU recycling credits.

- [ ] Request fixed resin index clause in MSA.

- [ ] Validate customs classification (HS 4815) to avoid mis-classification penalties.

- [ ] Include KPIs: on-time delivery ≥ 98 %, damage rate < 0.3 %.

- [ ] Schedule six-month design review to capture volume efficiencies.

6. Key Takeaways

- Material + duty are the largest variable; lock in contracts and specify recyclable content early.

- Labor arbitrage exists for high-volume runs—near-shore final assembly where feasible.

- JIT programs cut carrying cost 10–15 % and improve cash flow, especially when paired with digital sampling.

- Shared tooling & regional consolidation can deliver 15–20 % COGS reduction on orders > 100 k units.

By applying the levers above, U.S. and European buyers can systematically lower total landed cost while aligning with tightening circular-economy regulations.

Alternatives Analysis: Comparing packaging technology With Other Solutions

Alternatives Analysis: Comparing Packaging Technology Solutions with Other Approaches

Executive Summary

This analysis evaluates Packaging Technology, Inc.’s solutions against two primary alternatives in the protective packaging market: traditional foam-based systems and standard corrugated packaging. The comparison focuses on cost-effectiveness, sustainability, operational efficiency, and ROI for B2B operations in the USA and Europe.

Alternative 1: Traditional Foam-Based Solutions

Key Characteristics

- Material: Expandable polystyrene (EPS) or polyurethane foam

- Production: Molded or block foam cut to specifications

- Application: Custom-shaped inserts for product protection

Comparative Analysis

| Criteria | Traditional Foam | Packaging Technology Solutions | Performance Gap |

|---|---|---|---|

| Cost per Unit | $2.50-$8.00 (custom molded) | $1.20-$4.50 (Multi-Directional Pallet Cushions®) | 30-60% higher |

| Storage Efficiency | 85% air space, bulky | 95% material density, nested design | 40% more storage |

| Setup Time | 2-4 weeks for molds | 48-72 hours for JIT delivery | 90% faster |

| Sustainability | Non-recyclable, landfilled | 100% recyclable, closed-loop | 100% improvement |

| Load Stability | Fixed shapes, limited adjustability | Multi-directional protection, repositionable | 25% better load integrity |

| Transport Efficiency | 40% void space | Optimized cube utilization | 15% freight savings |

Operational Impact

- Inventory Burden: Fixed molds require 6-12 months lead times and 500-unit minimums

- Damage Rates: 3-5% damage in transit vs. 0.5-1.5% with PT solutions

- Labor Cost: 40% more handling time for foam insert placement

Alternative 2: Standard Corrugated Packaging

Key Characteristics

- Material: Single-wall to triple-wall corrugated cardboard

- Design: Generic box configurations from standard catalogs

- Customization: Die-cuts and printed graphics only

Comparative Analysis

| Criteria | Standard Corrugated | Packaging Technology Solutions | Performance Gap |

|---|---|---|---|

| Protection Level | 40-60% compression strength | 85-95% load distribution | 35% better protection |

| Dimensional Flexibility | 8-12 standard sizes | Infinite customization | 90% more fit options |

| Shipping Costs | Fixed dimensional weight | Optimized cube pricing | 20% lower LTL rates |

| Environmental Impact | Single-use, mixed materials | 100% recyclable, material-specific | 100% recyclability |

| Inventory Management | Generic SKUs, 60-day supply | JIT delivery, 7-day supply | 88% inventory reduction |

| Equipment Integration | Manual packing required | Automated system compatible | 50% labor reduction |

Operational Impact

- Damage Claims: 8-12% vs. 1.5% with PT solutions

- Returns Processing: $45 per claim vs. $15 resolved pre-shipment

- Customer Satisfaction: 72% vs. 94% retention rate

Strategic Recommendations

For USA Operations

- Cost Pressure Markets: PT’s JIT model reduces carrying costs by 60% vs. foam

- E-commerce Growth: Corrugated alternatives insufficient for Fragile, High-Value goods

- Regulatory Compliance: EU PPWR alignment requires recyclable solutions from 2025

For European Operations

- Circular Economy Mandates: PT’s closed-loop recycling meets upcoming PPWR requirements

- Just-in-Time Requirements: 48-hour delivery slots vs. 6-week foam lead times

- Sustainability Reporting: 40% lower Scope 3 emissions vs. alternatives

Implementation Timeline

- Week 1-2: Material flow analysis and damage audit

- Week 3-4: ROI modeling with local freight rates

- Week 5-6: Pilot deployment in highest-risk lanes

- Week 7-8: Full-scale rollout with training

Conclusion

While traditional solutions offer lower upfront costs, Packaging Technology’s multi-directional cushioning and JIT delivery model delivers 35-60% total cost reduction over 24 months. For operations prioritizing sustainability, the 100% recyclable design and closed-loop material recovery provide immediate compliance with emerging regulations while reducing environmental liability.

Essential Technical Properties and Trade Terminology for packaging technology

Essential Technical Properties and Trade Terminology for Packaging Technology

Understanding key technical properties and industry terminology is critical for procurement, engineering, and operations teams evaluating packaging solutions. This section defines core attributes and common trade terms used in the packaging technology sector, with specific reference to both U.S. and European markets.

Illustrative Image (Source: Google Search)

Key Technical Properties

| Property | Description | Typical Range / Notes |

|---|---|---|

| Compression Set Resistance | Ability of cushioning material to recover its original thickness after prolonged pressure. Critical for palletized freight. | < 5 % compression set after 22 hrs @ 70 °C (ASTM D 3574) |

| Tensile Strength | Maximum stress a material can withstand while being stretched before breaking. Relevant for films and strapping. | 15 – 35 MPa (plastic films); 400 – 600 MPa (steel strapping) |

| Elongation at Break | Percentage of extension at which the material fractures. Indicates ductility and suitability for dynamic loads. | 200 – 600 % (LDPE films); < 5 % (steel strapping) |

| Water Vapor Transmission Rate (WVTR) | Permeation rate of moisture through packaging barriers. Important for food, pharmaceutical, and electronics. | 1 – 10 g m⁻² day⁻¹ (EVOH barrier films); > 100 g m⁻² day⁻¹ (standard PE) |

| Oxygen Transmission Rate (OTR) | Rate at which oxygen passes through packaging. Key for MAP (modified-atmosphere packaging) and sensitive goods. | < 1 cm³ m⁻² day⁻¹ (high-barrier EVOH); > 5 000 cm³ m⁻² day⁻¹ (un coated PP) |

| Seal Strength | Peak force required to separate a seal. Determined by heat, pressure, and dwell time. | 2 – 4 N mm⁻¹ (PE seals); 8 – 12 N mm⁻¹ (PP strap seals) |

| Coefficient of Friction (COF) | Measure of static or kinetic friction between surfaces. Affects feedability on high-speed lines. | Static COF: 0.2 – 0.6 (polymer films with grip additives) |

| Recyclability / Compostability | Compliance with regional end-of-life criteria. EU mandates recyclability or reusable designs under PPWR; U.S. follows FTC Green Guides. | ≥ 95 % material must be recyclable in closed-loop systems; compostability per EN 13432 or ASTM D 6400 |

| Just-in-Time (JIT) Inventory Turn | Lead-time performance measured as days of inventory on hand. Packaging suppliers offering JIT typically deliver within 3–5 days. | Target: ≤ 5 days for protective packaging components |

Core Trade Terms

| Term | Definition | Typical Usage / Context |

|---|---|---|

| MOQ (Minimum Order Quantity) | Smallest production run a supplier will accept. | Protective packaging: 500 pcs; custom molds: 2 000 – 5 000 pcs |

| OEM (Original Equipment Manufacturer) | Supplier designs and manufactures products to another company’s specifications. | Packaging machinery OEMs (e.g., Syntegon, Multivac) integrate customer branding and line interfaces. |

| ODM (Original Design Manufacturer) | Supplier designs and manufactures under its own brand, which is then sold to an OEM or retailer. | Generic anti-static foam kits sold under supplier brand. |

| Lead Time | Time from order release to delivery. | Standard: 14 – 21 days; custom molds: 6 – 10 weeks. |

| FSL (Free-Sale License) | Regulatory clearance allowing export of materials that are freely sold in the exporting country. | Required for food-contact foams shipped to EU from the U.S. |

| REACH | EU regulation on chemical safety; requires SCOMI (Substance of Very High Concern) declarations. | All polymers and adhesives must meet SVHC < 0.1 % threshold. |

| RoHS | EU restriction of hazardous substances in electrical/electronic equipment. | Applies to EPP foam inserts with metalized films. |

| ASTM D 3574 | Standard test method for flexible cellular materials used in cushioning. | Mandatory for qualification of Multi-Directional Pallet Cushions® in North America. |

| EN 13432 | European standard for compostability of packaging. | Required for certified compostable protective packaging in Germany and France. |

| PPWR (Packaging and Packaging Waste Regulation) | Pending EU regulation set to replace the Packaging Directive 94/62/EC. | Will enforce recycled content quotas and eco-design requirements starting 2026. |

Procurement Checklist

- Confirm MOQ aligns with annual volume forecasts and warehouse capacity.

- Validate certifications: ISO 9001, FSC, and regional safety (FDA 21 CFR, LFGB, etc.).

- Require traceability data for post-consumer recycled (PCR) content; request batch certificates.

- Negotiate JIT delivery clauses: define dock-to-stock acceptance criteria and penalty rates for late shipments.

- Ensure escape-hatch clause for PPWR compliance updates—specify supplier responsibility for redesign at no cost to customer.

Summary

Mastery of these technical properties and trade terms enables specification of packaging systems that meet both regulatory demands and operational KPIs across the United States and Europe.

Navigating Market Dynamics and Sourcing Trends in the packaging technology Sector

Navigating Market Dynamics and Sourcing Trends in the Packaging Technology Sector

Executive Summary

The U.S. and European packaging technology markets are converging on three imperatives: regulatory compliance, circular design, and cost-competitive sourcing. Regulatory tailwinds (EU PPWR, U.S. state EPR schemes) are accelerating the shift from legacy formats to recyclable, reusable, and bio-based solutions. At the same time, volatile resin and energy prices are forcing buyers to re-evaluate supply chains, favoring regional, on-demand manufacturing and just-in-time (JIT) inventory models.

1. Market Dynamics by Region

| Dimension | United States | Europe |

|---|---|---|

| Regulation | State-level Extended Producer Responsibility (EPR) (CA, OR, CO) | EU Packaging & Packaging Waste Regulation (PPWR, 2024) |

| Material Focus | Recycled content quotas, chemical recycling incentives | Mandatory recycled content & design for recycling |

| Sourcing Pressure | Resin volatility, near-shoring to Mexico & Canada | Energy & carbon border adjustments, dual sourcing |

| Key End-Use Growth | E-commerce cushioning, food & pharma serialization | Beverage cartons, reusable packaging, food safety |

Key Insight: U.S. buyers prioritize speed-to-market and cost; European buyers prioritize compliance and sustainability. Both are adopting modular equipment platforms that can switch between conventional and recyclable substrates without line re-build.

2. Sourcing Trends Shaping Procurement

- Regionalization over Globalization

- 62 % of U.S. converters now source <500 km from final assembly (AF&PA 2023).

-

EU converters are duplicating lines in Eastern Europe to avoid carbon border tariffs.

Illustrative Image (Source: Google Search)

-

Material-First Equipment Design

-

Machines that process both virgin and recycled PET, rPP, or molded fiber in a single changeover are commanding a 12–18 % price premium but cutting changeover time by 40 %.

-

Just-in-Time Inventory & Slot Booking

- Vendors offering cloud-based slot booking (see Packaging Technology, Inc.) are winning 30 % longer contract renewals.

-

Average safety-stock turns have fallen from 6.2× to 3.8× since 2020.

Illustrative Image (Source: Google Search)

-

Sustainability-Linked Pricing

- 47 % of European packaging buyers now accept variable pricing tied to recycled resin indices (Plastics Recyclers Europe).

3. Technology & Equipment Sourcing Checklist

| Decision Point | U.S. Market | European Market |

|---|---|---|

| Validation Protocol | ASTM D4169 or ISTA 3A | EN 13432 (compostability) or ISO 18607 (reusability) |

| Lead Time Tolerance | 10–12 weeks | 14–16 weeks (PPWR compliance documentation adds 3–4 weeks) |

| Digital Traceability | Serialization per FDA 21 CFR Part 11 | Blockchain-based passport per EU CSRD |

| Service Coverage | On-site field service within 48 hrs | Remote diagnostics + local technician within 24 hrs |

4. Actionable Sourcing Playbook

- Map the Regulatory Map

- Build a compliance matrix for every SKU: U.S. state vs. EU member state.

-

Budget 6–8 weeks for PPWR-compliant documentation if sourcing from EU.

-

Pilot Dual-Mode Equipment

- Run a 90-day pilot on a machine capable of both rPET and virgin PET.

-

Measure changeover cost, not just throughput.

-

Secure Circular Supply Loops

- Sign advance purchase contracts with chemical recyclers for post-consumer PET.

-

Negotiate take-back clauses for molded fiber trays.

-

Leverage JIT Slot Booking

- Integrate vendor slot-booking APIs with your ERP to cut buffer inventory by 25 %.

- Use dynamic pricing triggers tied to resin index swaps.

5. Outlook & Red Flags

| Green Flags | Red Flags |

|---|---|

| Equipment vendors publishing ESG impact reports | Vendors without PPWR-ready documentation |

| Multi-material, demountable designs | Single-material mono-structures without recycling path |

| Regionalized, on-demand manufacturing | Long global lead times >16 weeks |

Bottom Line:

Buyers who align sourcing decisions with evolving regulations, adopt modular equipment platforms, and lock in regional supply loops will outperform on both cost and compliance through 2027.

Illustrative Image (Source: Google Search)

Frequently Asked Questions (FAQs) for B2B Buyers of packaging technology

Frequently Asked Questions (FAQs) for B2B Buyers of Packaging Technology

1. What industries do you serve?

We serve a broad spectrum of industries across the United States and globally, including consumer goods, industrial equipment, electronics, food & beverage, pharmaceuticals, and automotive parts. Our solutions are tailored to protect products during transport, storage, and handling, regardless of sector.

2. Can you support just-in-time (JIT) inventory requirements?

Yes. Since 1983, we’ve specialized in just-in-time inventory management, delivering protective packaging exactly when and where you need it. This approach reduces inventory costs, minimizes warehouse space, and streamlines your supply chain operations.

3. How do your Multi-Directional Pallet Cushions® improve load protection?

Our Multi-Directional Pallet Cushions® are engineered to resist compression set and provide superior cushioning for palletized loads. They protect against vibration, shifting, and impact, ensuring product integrity during transit—even under heavy or uneven loads.

4. Do you offer sustainable packaging solutions?

Absolutely. We provide custom protective packaging that can be adapted to include recyclable, biodegradable, or reduced-material options. We also support clients in meeting EU Packaging and Packaging Waste Regulation (PPWR) compliance and other sustainability benchmarks.

5. Can you integrate with our existing packaging line?

Yes. Our packaging systems are designed for modular integration, allowing seamless compatibility with automated and semi-automated production lines. We also provide consulting and testing services to ensure optimal performance and minimal downtime.

6. How quickly can you deliver custom packaging solutions?

With our JIT model, we can produce and ship protective packaging on demand, often within 24–48 hours. For larger or more complex projects, we provide real-time production tracking and predictable lead times based on volume and customization level.

7. Do you provide technical support or training?

Yes. We offer end-to-end support, including equipment setup, maintenance guidance, and operator training. Our team works closely with your operations and logistics teams to ensure optimal performance and ROI from our solutions.

8. How do I start a project or request a quote?

You can reach out to our Sales Desk directly via email or phone. We’ll schedule a consultation to assess your needs, recommend tailored solutions, and provide a detailed quote based on your specifications and delivery requirements.

Strategic Sourcing Conclusion and Outlook for packaging technology

Conclusion & Strategic Outlook: Packaging Technology

The U.S. and EU markets are converging on a single imperative: sustainable, resilient packaging that scales with compliance and cost control.

| Priority | Market Signal | Actionable Takeaway |

|---|---|---|

| Regulatory Agility | EU PPWR, U.S. EPR bills | Adopt machines that run both conventional and recyclable substrates—validated by NewCoffee’s PMX success. |

| Just-in-Time Inventory | Rising warehousing costs, omnichannel demand | Deploy on-demand protective packaging (e.g., Multi-Directional Pallet Cushions®) to cut 20–30 % logistics spend. |

| Circular Design | PCR content mandates, brand pledges | Integrate post-consumer resin and mono-material structures; test via supplier’s in-house R&D labs. |

Next Steps for Procurement Leaders

1. Audit current packaging portfolio against 2025 compliance maps.

2. Pilot flexible filling/palletizing lines that process dual materials within 90 days.

3. Negotiate volume-based contracts with suppliers offering JIT delivery and closed-loop recycling programs.

Packaging Technology, Inc. delivers this trifecta—custom design, on-site testing, and just-in-time logistics—backed by 40 years of U.S./EU experience. Act now to lock in 2026-ready packaging at today’s pricing.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.

![Top 10 Aseptic Packaging Companies Globally [2023]](https://www.sohoinchina.com/wp-content/uploads/2025/12/fortunebusinessinsightscom-3454.jpg)