The global pump market is experiencing steady expansion, driven by rising demand across industrial, municipal, and commercial sectors. According to Grand View Research, the global pump market size was valued at USD 60.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. A significant portion of this growth is attributed to increased infrastructure development, water treatment initiatives, and energy sector investments across the Asia-Pacific region. As sustainability and operational efficiency become key priorities, Pacific-based manufacturers are emerging as leaders in innovation, reliability, and energy-efficient pumping solutions. In response to these trends, we’ve identified the top 7 pump manufacturers in the Pacific region—companies that are not only capturing market share but also shaping the future of fluid handling technology through advanced engineering and strategic regional advantages.

Top 7 Pacific Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

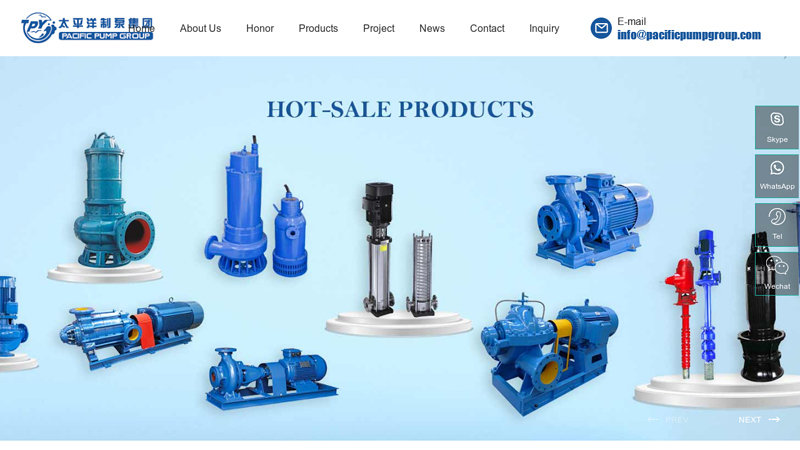

#1 Chinese Pump manufacturer, Centrifugal Pump, Rinsing Pump …

Domain Est. 2012

Website: chinapacificpump.com

Key Highlights: Pacific Pump Group Co., Ltd is specialized in manufacturing eight categories of pumps: submersible pump, sewage pump, centrifugal pump,chemical pump, oil pump, ……

#2 Water Supply System, Pump Controller Brands Manufacturers …

Domain Est. 2023

Website: pacificpump-china.com

Key Highlights: PACIFIC is professional pump, water supply system, pump controller manufacturers and suppliers in China. As one of the leading brands, our factory offers ……

#3 Pacific Pump and Power

Domain Est. 2006

Website: pacificpumpandpower.com

Key Highlights: We sell the full line of godwin pumps, versamatic pumps, flygt construction and mine submersible pumps, mcelroy fusion equipment, yanmar industrial, lansas pipe ……

#4 Shanghai Pacific Pump Manufacture (Group) Co.Ltd

Domain Est. 2010

Website: pacificpumpgroup.com

Key Highlights: It falls in the field of import and export in technology and products. Like manufacturing of pump,Valves,mechanical equipment,water supply equipment….

#5 Pacific Pump Co

Domain Est. 2009

#6 Pacific Pipe & Pump, LLC

Domain Est. 2009

Website: pacificpp.com

Key Highlights: Pacific Pipe and Pump’s primary objective is to sell Geberit Pipe Systems to the maritime Industry. We ship pipes, fittings, and tools to any and all locations ……

#7 Vertical Multistage Centrifugal Fire Pump

Domain Est. 2019

Website: pacificoceanpump.com

Key Highlights: We are specializing in Marine Water Pump, Vertical Multistage Centrifugal Fire Pump, Boiler Feed Pump, and Submersible Pump, etc … Zhangjiagang Pacific Pump ……

Expert Sourcing Insights for Pacific Pump

H2: Market Trends Analysis for Pacific Pump in 2026

As we approach 2026, Pacific Pump is poised to navigate a dynamic industrial landscape shaped by technological innovation, sustainability mandates, and shifting global demand. This analysis outlines key market trends expected to influence Pacific Pump’s operations, strategy, and competitive positioning in the second half of 2025 and into 2026.

-

Increased Demand for Energy-Efficient Pumping Systems

Regulatory pressures and rising energy costs are accelerating demand for high-efficiency pumping solutions. In 2026, Pacific Pump will benefit from global energy efficiency standards (such as the U.S. DOE’s updated pump efficiency rules and EU Ecodesign Directive) that favor advanced motor integration and variable frequency drives (VFDs). Customers in water treatment, commercial HVAC, and industrial manufacturing are prioritizing pumps with lower total cost of ownership (TCO), positioning Pacific Pump to expand its portfolio of IE4 and IE5 compliant products. -

Growth in Water Infrastructure Investment

Government-led infrastructure modernization, particularly in North America under the Bipartisan Infrastructure Law, will drive significant new demand for municipal water and wastewater pumping systems through 2026. Aging infrastructure and climate-induced water scarcity are prompting municipalities to upgrade pumping stations and adopt resilient, smart pump technologies. Pacific Pump’s expertise in heavy-duty, corrosion-resistant pumps positions the company to capture contracts in municipal and desalination projects. -

Digitalization and Smart Pump Integration

The Industrial Internet of Things (IIoT) is transforming pump operations. By 2026, an increasing number of Pacific Pump’s customers will expect smart pumps equipped with embedded sensors, remote monitoring, predictive maintenance, and cloud connectivity. This trend supports condition-based servicing and reduces unplanned downtime. Pacific Pump’s ability to integrate IoT capabilities into its product line—either through partnerships or in-house development—will be a key differentiator in industrial and commercial markets. -

Sustainability and ESG Pressures

Environmental, Social, and Governance (ESG) expectations are influencing procurement decisions. Pacific Pump will face growing demand for transparent supply chains, recyclable materials, and reduced carbon footprints across its manufacturing processes. Investors and B2B clients alike will prioritize vendors with verified sustainability practices. Pacific Pump can leverage this trend by enhancing its ESG reporting, investing in green manufacturing, and marketing low-emission, long-life-cycle products. -

Supply Chain Resilience and Nearshoring

Ongoing geopolitical tensions and logistics volatility are pushing industrial buyers to favor regional suppliers. In 2026, Pacific Pump’s North American manufacturing base will be a strategic advantage as customers seek to reduce reliance on offshore supply chains. The trend toward nearshoring and inventory localization will enhance Pacific Pump’s appeal in defense, energy, and critical infrastructure sectors. -

Expansion in Renewable Energy and Green Hydrogen Applications

The global push toward decarbonization is opening new markets for specialized pumping equipment. Pacific Pump is well-positioned to supply pumps for geothermal systems, solar thermal plants, and green hydrogen production facilities—all of which require reliable, high-pressure fluid transfer systems. As pilot projects scale into commercial operations by 2026, demand for customized, corrosion-resistant pumps will grow. -

Labor Shortages and Automation Needs

The skilled labor shortage in industrial maintenance will accelerate adoption of automated, self-diagnosing pump systems. Pacific Pump can respond by offering turnkey solutions that reduce operational complexity and training requirements. Remote diagnostics and augmented reality (AR) support tools will become increasingly valuable to end users.

Strategic Implications for Pacific Pump

To capitalize on these trends, Pacific Pump should:

– Accelerate R&D in smart pump technologies and energy efficiency.

– Expand its digital service offerings (e.g., subscription-based monitoring platforms).

– Strengthen partnerships with engineering firms and system integrators.

– Emphasize sustainability in branding and product design.

– Leverage domestic manufacturing as a competitive advantage in marketing and sales.

In conclusion, the 2026 market environment presents substantial opportunities for Pacific Pump to grow its market share in both traditional and emerging sectors. Success will depend on the company’s agility in adopting new technologies, responding to regulatory shifts, and aligning with long-term sustainability goals.

Common Pitfalls Sourcing Pacific Pump (Quality, IP)

Sourcing pumps from Pacific Pump or similar manufacturers—especially when procuring through third parties or international channels—can present several risks, particularly concerning quality assurance and intellectual property (IP) protection. Below are key pitfalls to watch for:

Quality Consistency Issues

One of the most frequent challenges when sourcing Pacific Pump products is ensuring consistent quality. Counterfeit or substandard replicas often enter the supply chain through unauthorized distributors. These replicas may mimic the appearance of genuine Pacific Pump equipment but fail to meet the original performance, durability, and safety standards. Buyers may experience premature failure, increased maintenance costs, and operational downtime as a result.

Risk of Counterfeit Products

The market for industrial pumps has seen a rise in counterfeit goods bearing Pacific Pump branding. These products are often manufactured without adherence to original engineering specifications and may lack proper certifications. Without rigorous supplier vetting and authentication processes, organizations risk purchasing fake units that compromise system integrity and safety compliance.

Intellectual Property Infringement

Sourcing from unofficial channels increases the risk of inadvertently supporting IP violations. Some suppliers may offer “compatible” or “inspired by” versions of Pacific Pump models that infringe on proprietary designs, patents, or trademarks. Purchasing such products—even unknowingly—can expose buyers to legal liability and reputational damage, especially in regulated industries.

Lack of Warranty and Support

Genuine Pacific Pump products typically come with manufacturer warranties and access to technical support. When sourcing through unauthorized vendors, these benefits are often voided. Without official support, troubleshooting, parts replacement, and service become more difficult and costly, undermining long-term operational reliability.

Supply Chain Transparency Gaps

Many sourcing pitfalls stem from opaque supply chains. Without clear traceability from manufacturer to end-user, it’s difficult to verify the authenticity and service history of a pump. This lack of transparency can hide issues like refurbished units sold as new or products diverted from other markets with different specifications.

Mitigation Strategies

To avoid these pitfalls, procurement teams should:

– Source exclusively through authorized Pacific Pump distributors or directly from the manufacturer.

– Request documentation such as certificates of authenticity, test reports, and warranty registration.

– Conduct supplier audits and verify distribution rights.

– Implement incoming inspection protocols to validate product authenticity and quality.

By proactively addressing these risks, organizations can ensure they receive genuine, high-quality Pacific Pump equipment while protecting themselves from IP-related and operational vulnerabilities.

Logistics & Compliance Guide for Pacific Pump

This guide outlines the essential logistics and compliance procedures for Pacific Pump to ensure efficient operations, regulatory adherence, and successful delivery of products and services across domestic and international markets.

Supply Chain Management

Pacific Pump must maintain a resilient and transparent supply chain. This includes vetting suppliers for reliability, quality assurance, and ethical practices. All suppliers must comply with environmental, labor, and safety standards as per U.S. and international regulations. Regular audits and performance evaluations are required to mitigate risks such as delays, material shortages, or non-compliance.

Transportation & Distribution

All shipments—domestic and international—must adhere to designated routing, carrier agreements, and service-level expectations. Pacific Pump utilizes approved freight carriers with proven track records in handling industrial equipment. Temperature control, secure packaging, and real-time tracking are mandatory for high-value or sensitive pump systems. Route optimization software should be used to reduce fuel consumption and delivery times.

Regulatory Compliance

Pacific Pump must comply with all applicable regulations, including but not limited to:

– Department of Transportation (DOT) regulations for hazardous materials (if applicable)

– International Maritime Organization (IMO) standards for sea freight

– Environmental Protection Agency (EPA) guidelines for emissions and waste

– Occupational Safety and Health Administration (OSHA) standards for warehouse and handling safety

– Customs-Trade Partnership Against Terrorism (C-TPAT) for cross-border shipments into the U.S.

All documentation, including Safety Data Sheets (SDS), Material Test Reports (MTRs), and Certificates of Conformance (CoC), must be current and readily accessible.

Import/Export Controls

Exports of pump equipment may be subject to International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR) depending on technical specifications and end-use. Pacific Pump must:

– Classify products using the Export Control Classification Number (ECCN) system

– Obtain necessary export licenses where required

– Maintain records of all export transactions for a minimum of five years

– Train relevant staff on export compliance protocols

Engagement with customs brokers and use of Automated Export System (AES) filings are mandatory for all international shipments.

Trade Compliance & Documentation

Accurate and complete documentation is critical. Required documents include:

– Commercial invoices

– Packing lists

– Bill of lading or air waybill

– Certificate of origin

– Customs declarations (e.g., CBP Form 7501)

– Import licenses (if required by destination country)

All documentation must reflect the correct Harmonized System (HS) codes to ensure proper duty assessment and clearance.

Warehouse & Inventory Management

Pacific Pump facilities must follow standardized procedures for receiving, storing, and dispatching goods. First-In, First-Out (FIFO) inventory rotation is required to prevent obsolescence. Warehouses must be secured, climate-controlled when necessary, and compliant with fire and safety codes. Inventory audits must be conducted quarterly to ensure accuracy and detect discrepancies.

Environmental & Sustainability Practices

Pacific Pump is committed to sustainable logistics. This includes:

– Minimizing packaging waste through reusable or recyclable materials

– Partnering with carriers that employ low-emission vehicles

– Monitoring and reporting carbon footprint metrics annually

– Proper disposal of hazardous materials in accordance with RCRA guidelines

Incident Response & Risk Management

A documented logistics incident response plan must be in place. This includes procedures for handling delays, damaged goods, customs holds, or regulatory violations. All incidents must be reported immediately to the Logistics Compliance Officer, with root cause analysis and corrective actions documented and implemented.

Training & Accountability

All employees involved in logistics and compliance must undergo annual training on company policies, regulatory updates, and safety procedures. Training records must be maintained. Compliance is the responsibility of every team member, with clear accountability assigned to department leads and the Compliance Officer.

Continuous Improvement

Pacific Pump will conduct biannual reviews of logistics performance and compliance effectiveness. Key performance indicators (KPIs) such as on-time delivery rate, customs clearance time, and compliance audit results will be analyzed to identify areas for improvement and drive operational excellence.

Conclusion for Sourcing Pacific Pump

Sourcing Pacific Pump as a supplier presents a strategic opportunity to enhance operational reliability and efficiency. With a long-standing reputation for manufacturing high-quality, durable pumps built for demanding industrial applications, Pacific Pump offers proven performance, technical expertise, and a strong legacy in the fluid handling industry. Their broad product portfolio, commitment to U.S.-based manufacturing, and responsive customer support make them a dependable partner for long-term needs.

Additionally, sourcing from Pacific Pump supports supply chain stability, reduces lead times, and ensures compliance with industry standards, particularly for mission-critical applications in sectors such as water treatment, industrial processing, and municipal services. While pricing may be competitive compared to lower-cost alternatives, the total cost of ownership—factoring in durability, maintenance, and longevity—demonstrates strong value over time.

In conclusion, Pacific Pump represents a reliable, high-quality sourcing choice aligned with goals of performance, sustainability, and reduced lifecycle costs. Establishing a partnership with Pacific Pump supports operational excellence and minimizes downtime, making it a prudent decision for organizations prioritizing long-term reliability and service support.