The global hand tools market, which includes both pneumatic (P) and hand (H) tools, is experiencing steady expansion driven by increasing demand across automotive, construction, and industrial maintenance sectors. According to Mordor Intelligence, the global hand tools market was valued at USD 11.68 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2029. This upward trajectory reflects heightened infrastructure development, coupled with rising DIY (do-it-yourself) culture in both developed and emerging economies. As demand surges, wholesale manufacturers specializing in P and H tools are scaling production, enhancing distribution networks, and investing in durable, ergonomic designs to capture market share. In this competitive landscape, the top four P and H wholesale manufacturers have distinguished themselves through innovation, cost-efficiency, and global supply chain reliability—positioning them as key contributors to the industry’s projected growth.

Top 4 P And H Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hajoca

Domain Est. 1997

Website: hajoca.com

Key Highlights: Hajoca is one of the country’s largest privately-held wholesale distributors of plumbing, heating & cooling, pool, and industrial supplies.Missing: p h…

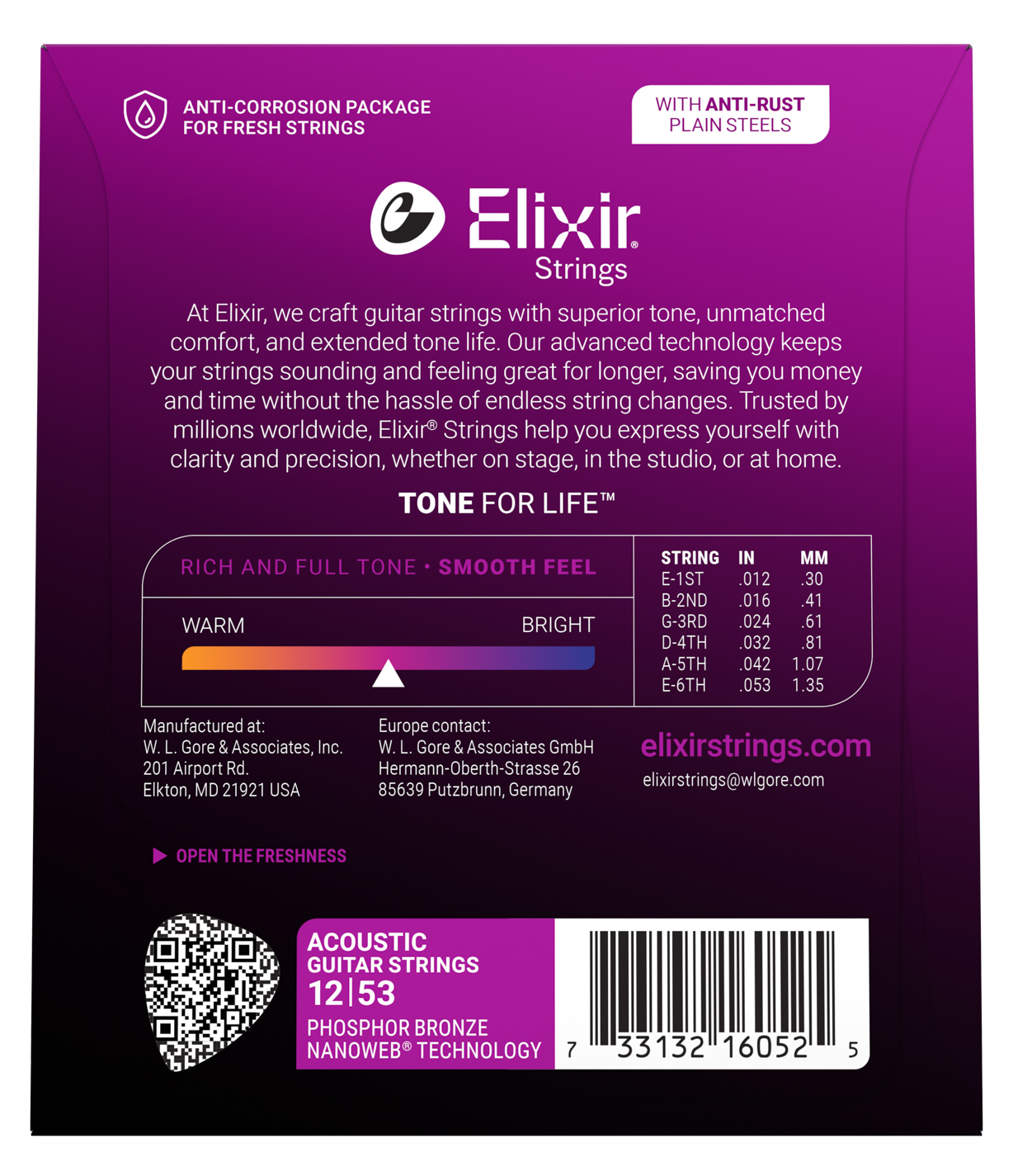

#2 to Elixir Strings

Domain Est. 1997

Website: elixirstrings.com

Key Highlights: Our strings offer the perfect blend of great tone, comfort, and reliable performance. So every note you play resonates with clarity and precision to match your ……

#3

Domain Est. 2001

Website: pandhwholesale.com

Key Highlights: Locations 800-779-4422. We are making updates to our main navigation. Some products, categories and subcategories might be relocated during this time….

#4 The Hillman Group

Domain Est. 2001

Website: hillmangroup.com

Key Highlights: Hillman is an industry leader in builder solutions, committed to building stronger partnerships with the customers we serve….

Expert Sourcing Insights for P And H Wholesale

H2 2026 Market Trends Analysis for P & H Wholesale

As P & H Wholesale prepares for the second half of 2026, the wholesale distribution landscape will be shaped by several converging macroeconomic, technological, and consumer-driven trends. Success will depend on agility, data-driven strategies, and enhanced customer value. Here’s a breakdown of key H2 2026 trends and their implications:

1. Continued Economic Volatility & Inflation Management

* Trend: While global inflation is expected to moderate from peak levels, persistent cost pressures—particularly in energy, transportation, and labor—will remain. Interest rates may stabilize but remain higher than pre-2022 levels, impacting borrowing costs and business investment.

* Implication for P & H: Margin compression will be a critical challenge. P & H must prioritize:

* Dynamic Pricing & Cost Pass-Through: Implement more sophisticated, real-time pricing models based on input costs and market demand.

* Supply Chain Resilience: Diversify supplier base, renegotiate contracts, and explore nearshoring or regional sourcing where feasible to reduce exposure to global disruptions and freight spikes.

* Operational Efficiency: Double down on automation (warehousing, order processing) and lean logistics to reduce internal costs.

2. Acceleration of Digital Transformation & E-Commerce Integration

* Trend: Digital B2B commerce will become the dominant channel. Buyers expect seamless, Amazon-like experiences: real-time inventory visibility, instant quotes, easy reordering, integrated payment options, and robust self-service portals.

* Implication for P & H: Digital maturity is no longer optional.

* Invest in Platform Modernization: Upgrade or replace legacy ERP and e-commerce platforms to handle complex B2B transactions, personalized pricing, and omnichannel integration (online, phone, EDI).

* Enhance Data Analytics: Leverage customer purchase data for predictive analytics (demand forecasting, churn prediction) and hyper-personalized marketing/sales outreach.

* Mobile-First & API Integration: Ensure platforms are mobile-responsive and offer APIs for easy integration with customers’ procurement systems (e.g., SAP Ariba, Coupa).

3. Supply Chain Resilience & Sustainability as Competitive Advantages

* Trend: Disruptions (geopolitical, climate-related) remain a top risk. Simultaneously, ESG (Environmental, Social, Governance) pressures intensify, with customers (especially larger corporations) demanding sustainable practices and transparent supply chains.

* Implication for P & H: Proactive risk management and sustainability are value drivers.

* Build Resilience: Utilize AI/ML for predictive risk modeling, map multi-tier supplier dependencies, and establish buffer stocks for critical SKUs.

* Embrace Sustainability: Audit carbon footprint (Scope 1, 2, 3), optimize logistics (route planning, EV adoption in fleet), source sustainable packaging, and report transparently. Offer “green” product lines or bundles to meet customer demand.

* Transparency: Provide visibility into product origins and ethical sourcing practices.

4. Evolving Customer Expectations: Personalization & Value-Added Services

* Trend: Customers seek partnerships, not just transactions. They demand personalized experiences, faster fulfillment (including same-day/next-day options), and value-added services (kitting, light assembly, technical support, inventory management).

* Implication for P & H: Move beyond being a commodity supplier.

* Segment & Personalize: Use data to segment customers (e.g., by industry, size, buying pattern) and tailor offerings, pricing, and communication.

* Expand Service Portfolio: Offer bundled solutions, consignment inventory, VMI (Vendor Managed Inventory), or technical advisory services, particularly for high-margin or complex product lines.

* Optimize Fulfillment: Invest in warehouse automation (AS/RS, robotics) and explore micro-fulfillment centers or partnerships with last-mile providers to meet speed expectations.

5. Talent Strategy & Workforce Evolution

* Trend: The “war for talent” persists, particularly in logistics, technology, and data analytics. Automation will change roles, requiring upskilling. Remote/hybrid work expectations remain.

* Implication for P & H: Culture and skills are critical.

* Upskill Workforce: Train employees in data analysis, digital tools, and new technologies (e.g., managing automated warehouses).

* Focus on Retention: Invest in competitive compensation, career development, safety, and a positive work culture, especially in warehousing and driving roles.

* Leverage Technology: Use automation to handle repetitive tasks, freeing staff for higher-value customer service and problem-solving roles.

Strategic Recommendations for P & H Wholesale (H2 2026 Focus):

- Double Down on Digital: Prioritize the e-commerce platform upgrade and data analytics capability. This is foundational for competing.

- Optimize for Resilience & Cost: Conduct a comprehensive supply chain risk assessment and implement mitigation strategies. Aggressively pursue operational efficiencies.

- Launch Value-Added Initiatives: Pilot VMI or kitting services for key strategic customers in H2 2026 to build stickiness and margin.

- Embed Sustainability: Develop and publish a clear ESG roadmap, starting with measurable goals for emissions and packaging reduction.

- Invest in Talent: Launch targeted upskilling programs and review compensation/benefits packages to retain critical talent.

Conclusion:

H2 2026 presents both significant challenges (costs, competition, disruption) and opportunities (digital growth, service expansion, sustainability leadership) for P & H Wholesale. The winners will be those who leverage technology not just for efficiency, but to build deeper, more resilient, and value-driven relationships with their customers. Proactive adaptation in digitalization, supply chain strategy, and customer service will be paramount for P & H to maintain competitiveness and drive sustainable growth in the latter half of 2026.

Common Pitfalls Sourcing P&H Wholesale: Quality and Intellectual Property Risks

Sourcing products from P&H (Private Label and House Brand) wholesalers can offer cost savings and faster time-to-market, but it also introduces significant risks—especially concerning product quality and intellectual property (IP). Understanding these common pitfalls is essential for protecting your brand and ensuring customer satisfaction.

Quality Inconsistencies and Lack of Oversight

One of the most frequent challenges when sourcing from P&H wholesalers is inconsistent product quality. Since these suppliers often manufacture for multiple brands using the same base product, there can be variances in materials, workmanship, and durability. Without direct oversight or robust quality control agreements, businesses may receive subpar goods that damage their reputation. Additionally, limited transparency into the manufacturing process makes it difficult to verify compliance with safety standards or sustainability claims.

Intellectual Property Infringement Risks

Sourcing P&H products increases exposure to intellectual property violations. Wholesalers may unknowingly—or sometimes knowingly—use designs, logos, or product features that infringe on existing patents, trademarks, or copyrights. If your company distributes such items, you could face legal action, product seizures, or costly recalls. Furthermore, generic P&H items might be sold to competing retailers, diluting your brand’s uniqueness and leading to market saturation.

Limited Customization and Brand Differentiation

P&H wholesale models typically offer minimal customization, making it difficult to establish a distinctive brand identity. The lack of unique design elements increases the likelihood of your products appearing nearly identical to competitors’ offerings—often sourced from the same supplier. This commoditization can erode brand loyalty and reduce pricing power in the marketplace.

Inadequate Supplier Accountability and Contractual Gaps

Many P&H wholesalers operate with standard contracts that lack strong clauses around quality assurance, IP indemnification, or remedies for non-compliance. Without detailed agreements specifying performance standards and liability, businesses have little recourse when issues arise. Verifying supplier credentials and insisting on enforceable contractual terms is critical to mitigating these risks.

Supply Chain Opacity and Compliance Concerns

P&H wholesalers may source components or finished goods from subcontractors with questionable labor or environmental practices. This lack of supply chain visibility can expose your business to reputational damage or regulatory penalties, especially in regions with strict import compliance laws. Ensuring ethical sourcing and regulatory adherence requires due diligence that many P&H suppliers are unwilling or unable to provide.

By recognizing these pitfalls, businesses can take proactive steps—such as conducting thorough audits, negotiating stronger contracts, and investing in independent quality testing—to safeguard their brand and deliver reliable, legally compliant products to market.

Logistics & Compliance Guide for P And H Wholesale

This guide outlines the essential logistics and compliance procedures for P And H Wholesale to ensure efficient operations, regulatory adherence, and customer satisfaction.

Supply Chain Management

P And H Wholesale manages a streamlined supply chain that includes supplier coordination, inventory management, warehousing, and timely delivery. All partners must meet agreed-upon quality and delivery standards. Regular performance reviews ensure reliability and service continuity.

Inventory Control & Warehousing

Maintain accurate inventory records using real-time tracking systems. Conduct routine cycle counts and scheduled audits to verify stock levels. Store products in a clean, secure, climate-appropriate environment, following FIFO (First In, First Out) principles to minimize spoilage and obsolescence.

Transportation & Distribution

Partner with licensed and insured carriers that comply with DOT regulations. Optimize delivery routes to reduce fuel consumption and transit times. Ensure all shipments are properly labeled, documented, and secured. Temperature-sensitive goods must be transported in climate-controlled vehicles when required.

Regulatory Compliance

Adhere to all federal, state, and local regulations, including:

– FDA guidelines (for food, supplements, or consumable goods)

– OSHA safety standards in warehouse operations

– EPA standards for handling hazardous materials (if applicable)

– FTC labeling and advertising requirements

Ensure all required licenses and permits are current and accessible for inspection.

Documentation & Recordkeeping

Maintain complete records for a minimum of seven years, including:

– Bills of lading

– Invoices and purchase orders

– Safety Data Sheets (SDS)

– Inspection reports

– Customs documentation (for imported goods)

All records must be securely stored and easily retrievable for audits or compliance reviews.

Product Labeling & Packaging

Ensure all products are correctly labeled with:

– Product name and description

– Net weight or volume

– Manufacturer or distributor information

– Expiration or “best by” dates (if applicable)

– Allergen and ingredient disclosures (where required)

Packaging must be durable, tamper-evident, and compliant with shipping and safety standards.

Import & Export Procedures

For international shipments, comply with U.S. Customs and Border Protection (CBP) regulations. Accurately classify goods using HTS codes, complete required forms (e.g., commercial invoices, certificates of origin), and pay applicable duties. Utilize a licensed customs broker when necessary.

Health & Safety Protocols

Implement safety training for all warehouse and logistics staff. Enforce proper use of PPE, safe lifting techniques, and equipment handling procedures. Maintain emergency response plans and conduct regular safety drills.

Sustainability Initiatives

Reduce environmental impact by:

– Optimizing packaging to minimize waste

– Recycling cardboard, plastic, and pallets

– Choosing eco-friendly transportation options when feasible

– Partnering with sustainable suppliers

Audit & Continuous Improvement

Conduct internal compliance audits annually. Address non-conformities promptly and update policies as regulations evolve. Encourage feedback from employees and partners to improve logistics efficiency and compliance practices.

For questions or reporting concerns, contact the Compliance Officer at [email protected].

Conclusion for Sourcing P&H Wholesale:

Sourcing P&H (Pick & Heavy, or commonly interpreted as Plumbing & Heating) wholesale supplies requires a strategic approach that balances cost-efficiency, product quality, reliability, and supply chain consistency. After evaluating potential suppliers, logistics, pricing models, and service levels, it is evident that establishing strong partnerships with reputable wholesale distributors is crucial for long-term success.

Key takeaways include the importance of verifying supplier credentials, negotiating favorable terms based on volume, ensuring compliance with industry standards, and leveraging technology for inventory and order management. Additionally, diversifying suppliers can mitigate risks related to supply disruptions, while building relationships with suppliers who offer value-added services—such as technical support, delivery options, and returns—can enhance operational efficiency.

Ultimately, effective sourcing in the P&H wholesale sector not only reduces costs but also supports project timelines and customer satisfaction. A proactive, well-researched procurement strategy positions businesses to remain competitive, scalable, and resilient in a demanding market.