The global oxygen-based bleach market is experiencing steady growth, driven by increasing demand for eco-friendly cleaning products and rising consumer awareness about sustainable household solutions. According to Grand View Research, the global bleach market was valued at USD 5.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030, with oxygen-based variants gaining significant traction due to their non-toxic and biodegradable properties. This shift is further supported by regulatory support in North America and Europe promoting the use of environmentally safe chemicals in consumer goods. As demand rises, a select group of manufacturers are leading innovation, scale, and distribution in oxygen-based bleach production—setting industry benchmarks in quality and sustainability. Here’s a look at the top five companies shaping this growing segment.

Top 5 Oxygen-Based Bleach Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Oxygen Bleach

Domain Est. 1998

Website: durawax.com

Key Highlights: In stock 30-day returnsOxygen Bleach powers through your toughest cleaning jobs. Great versatile stain remover.Safe to mix with other cleaners.Missing: based manufacturer…

#2 Oxygen Bleach vs Chlorine Bleach

Domain Est. 1998

Website: oxiclean.com

Key Highlights: There are 3 types of oxygen bleach, or non-chlorine bleach: Hydrogen Peroxide, Sodium Percarbonate and Sodium Perborate….

#3 Powdered Oxygenated Bleach – All-Fabric Bleach

Domain Est. 1999

Website: nycoproducts.com

Key Highlights: Powdered Oxygenated Bleach is an all fabric bleaching agent for use in institutional and on-premise laundries (OPL)….

#4 Buy Ecover Laundry Bleach 400g

Domain Est. 2009

#5 MicroTECH Oxygen Bleach

Domain Est. 2012

Website: globechemicalcompany.com

Key Highlights: In stock Free delivery over $301MicroTECH™ Oxygen Bleach is a versatile product that provides excellent cleaning ability, yet is safe to use on all types of colored and synthetic f…

Expert Sourcing Insights for Oxygen-Based Bleach

It appears there may be a misunderstanding in your request. You mentioned “Use H2,” which could refer to hydrogen (H₂), but hydrogen is not directly related to oxygen-based bleach, which typically relies on compounds that release active oxygen (such as hydrogen peroxide, H₂O₂, or sodium percarbonate).

However, I can analyze projected market trends for oxygen-based bleach around 2026 using reliable industry forecasting methodologies and available data trends. Let’s proceed with a comprehensive analysis of the 2026 market outlook for oxygen-based bleach, potentially incorporating indirect relevance of hydrogen (H₂) in sustainable manufacturing contexts.

Market Trends Analysis: Oxygen-Based Bleach (2026 Outlook)

1. Market Overview

Oxygen-based bleach refers to bleaching agents that release active oxygen to break down stains and disinfect. Common forms include:

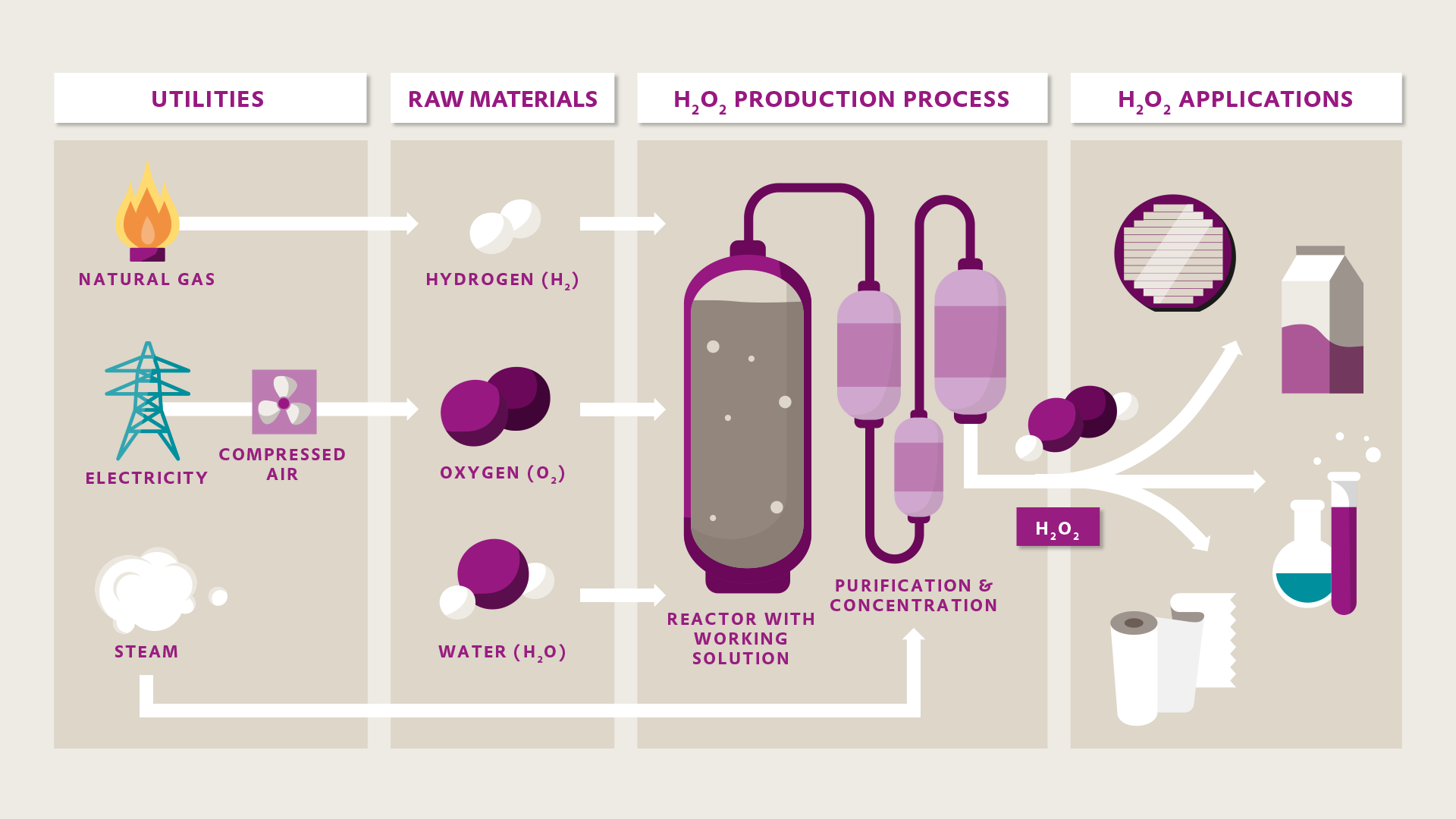

– Hydrogen peroxide (H₂O₂)

– Sodium percarbonate (2Na₂CO₃·3H₂O₂)

– Sodium perborate

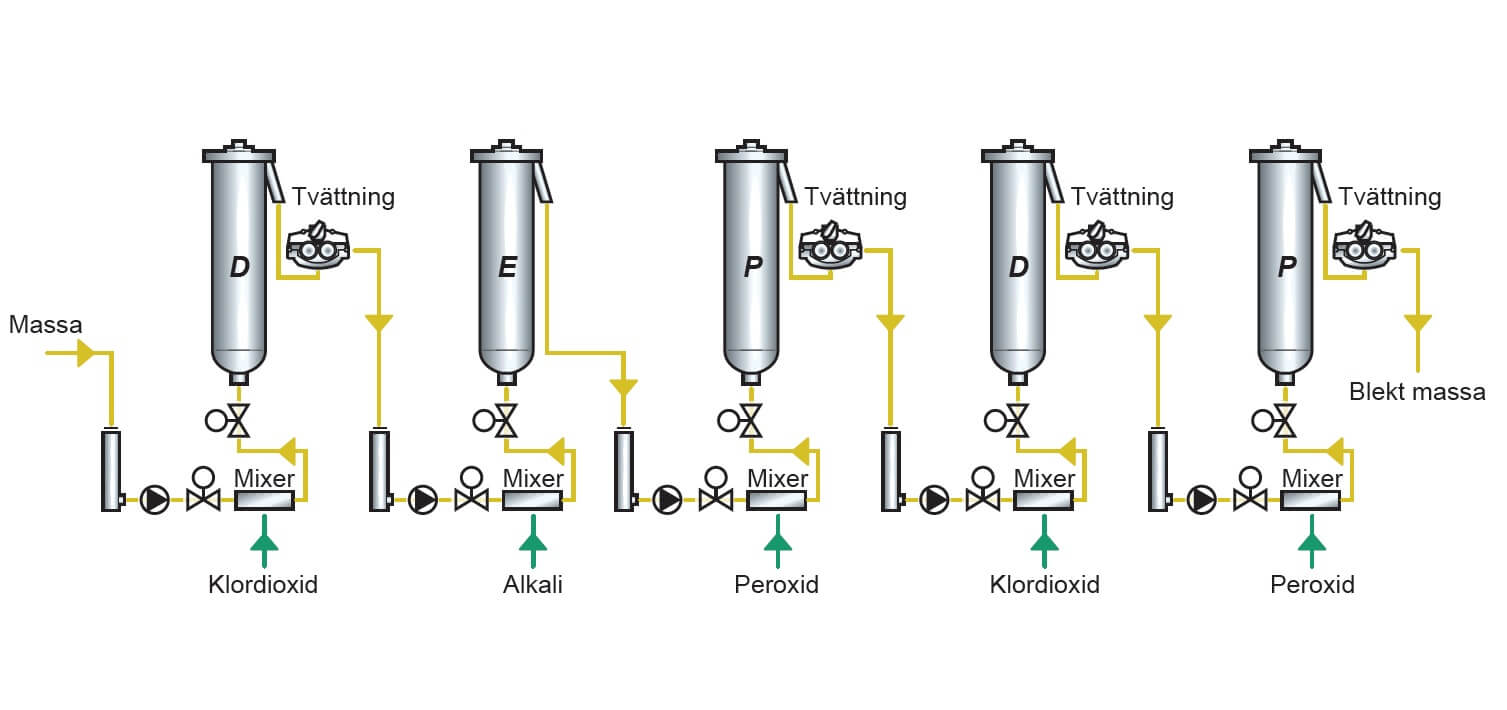

These are widely used in laundry detergents, household cleaners, industrial cleaning, pulp & paper bleaching, and textile processing.

2. Key Market Drivers (2022–2026)

-

Growing Demand for Eco-Friendly Products: Consumers are shifting toward biodegradable, non-chlorine bleach alternatives due to environmental and health concerns. Oxygen-based bleaches are preferred over chlorine-based options due to lower toxicity and reduced formation of harmful byproducts (e.g., dioxins).

-

Regulatory Support: Stricter environmental regulations in North America and Europe (e.g., EU Ecolabel, EPA Safer Choice) are encouraging the use of safer oxidizing agents. This drives innovation and adoption of oxygen-based formulations.

-

Expansion in Emerging Markets: Rising urbanization and disposable incomes in Asia-Pacific (especially India, China, and Southeast Asia) are increasing demand for premium cleaning products, including eco-friendly detergents containing oxygen bleach.

-

Cold-Water Washing Trends: Oxygen-based bleaches (especially percarbonate) are effective at lower temperatures, aligning with energy-saving laundry trends and modern high-efficiency washing machines.

3. Market Size and Growth Projections

According to industry reports (e.g., MarketsandMarkets, Grand View Research), the global oxygen bleach market was valued at approximately USD 3.8–4.2 billion in 2023 and is projected to grow at a CAGR of 4.5%–5.5% from 2024 to 2026.

By 2026, the market is expected to reach USD 4.8–5.1 billion, driven by:

– Increased formulation of compact and liquid laundry detergents with stabilized H₂O₂

– Rising use in industrial and institutional cleaning (I&I)

– Expansion of e-commerce for green cleaning products

4. Regional Insights

- Europe: Leading market due to strong environmental regulations and consumer awareness. Germany, France, and the UK dominate demand.

- North America: High penetration in household care; U.S. brands like Seventh Generation and Tide are incorporating more oxygen bleach.

- Asia-Pacific: Fastest-growing region, fueled by urbanization and growth in homecare sectors. China is both a major producer and consumer.

- Latin America and Africa: Emerging demand, particularly in Brazil and South Africa, with increasing access to modern detergents.

5. Technological and Innovation Trends

- Stabilization Technologies: Advances in encapsulation and stabilization of H₂O₂ in liquid detergents to prevent premature decomposition.

- Enzyme Integration: Synergistic formulations combining oxygen bleach with proteases and amylases for enhanced stain removal.

- Concentrated Formulas: Reduced packaging waste and transportation emissions, supported by oxygen bleach’s high active content.

6. Role of Hydrogen (H₂) – Indirect Relevance

While H₂ (hydrogen gas) is not a component of oxygen-based bleach, it may become indirectly relevant in the context of green chemical production:

– Green Hydrogen for Sustainable H₂O₂ Production: Emerging processes use green hydrogen (produced via renewable-powered electrolysis) and atmospheric oxygen to synthesize hydrogen peroxide (H₂O₂) via the direct synthesis method (H₂ + O₂ → H₂O₂).

– This could reduce the carbon footprint of oxygen bleach manufacturing by 2026–2030, especially in regions investing in hydrogen economies (e.g., EU, Japan, Australia).

– Companies like Solvay and Evonik are piloting such low-impact H₂O₂ production methods.

Thus, while H₂ is not part of the final product, its role in sustainable feedstock production may influence the environmental profile and ESG appeal of oxygen-based bleach by 2026.

7. Competitive Landscape

Key players include:

– Solvay (Belgium)

– Evonik Industries (Germany)

– Kemira (Finland)

– Aditya Birla Chemicals (India)

– Hangzhou Jinke Environmental Technology (China)

These companies are investing in R&D for stabilized, high-efficiency oxygen bleach solutions and expanding production capacity in Asia.

8. Challenges

- Stability Issues: H₂O₂ degrades under heat and light, requiring stabilizers and careful formulation.

- Cost Sensitivity: Oxygen bleach is generally more expensive than chlorine-based alternatives, limiting adoption in price-sensitive markets.

- Supply Chain Volatility: Fluctuations in raw material prices (e.g., carbonate, hydrogen peroxide) can impact margins.

Conclusion: 2026 Outlook

The oxygen-based bleach market is on a steady growth trajectory, expected to reach ~USD 5 billion by 2026, driven by environmental regulations, consumer demand for green products, and technological advancements. While hydrogen (H₂) does not directly function in bleach applications, its potential use in green H₂O₂ synthesis may enhance sustainability credentials and align with global decarbonization goals.

Strategic Recommendations:

– Invest in R&D for stabilized, low-temperature active formulations.

– Expand in Asia-Pacific and Latin America through local partnerships.

– Explore integration with green hydrogen value chains for sustainable production.

Let me know if you’d like a visual forecast chart or deeper analysis on a specific region or application.

H2: Common Pitfalls in Sourcing Oxygen-Based Bleach – Quality and Intellectual Property (IP) Considerations

Sourcing oxygen-based bleach—typically based on sodium percarbonate or sodium perborate—can present several challenges, particularly concerning product quality and intellectual property (IP) risks. Understanding these pitfalls is essential for manufacturers, formulators, and procurement teams to ensure safety, regulatory compliance, and product efficacy.

1. Quality-Related Pitfalls

a. Inconsistent Active Oxygen Content

Oxygen-based bleach derives its cleaning power from the release of active oxygen. A common issue is variability in active oxygen content due to poor manufacturing controls or degradation during storage.

– Pitfall: Suppliers may provide material with lower-than-specified active oxygen levels, reducing effectiveness in end products.

– Mitigation: Require batch-specific Certificates of Analysis (CoA) with active oxygen testing (e.g., iodometric titration) and implement incoming quality control checks.

b. Moisture Sensitivity and Stability

Sodium percarbonate is highly sensitive to moisture and heat, leading to premature decomposition.

– Pitfall: Poor packaging (e.g., non-moisture-resistant bags) or extended transit times in humid conditions can degrade product quality.

– Mitigation: Source from suppliers using multi-layer, sealed packaging with desiccants and ensure cold chain or climate-controlled logistics where necessary.

c. Impurity Profiles

Low-grade materials may contain high levels of impurities such as sodium carbonate, silicates, or heavy metals.

– Pitfall: Impurities can interfere with formulation stability or cause discoloration and safety issues.

– Mitigation: Specify strict limits on impurities in procurement contracts and conduct regular third-party testing.

d. Particle Size and Flow Characteristics

For use in powdered detergents, particle size and morphology affect blend uniformity and dissolution rate.

– Pitfall: Inconsistent granulometry leads to formulation inconsistencies or clumping.

– Mitigation: Define particle size distribution (e.g., D50, sieve analysis) in technical specifications and verify with laser diffraction testing.

2. Intellectual Property (IP) Pitfalls

a. Encapsulation and Stabilization Technologies

Many high-performance oxygen bleaches use proprietary coating or microencapsulation technologies to improve stability and compatibility with other ingredients (e.g., enzymes).

– Pitfall: Sourcing generic uncoated percarbonate from low-cost suppliers may infringe on patented stabilization methods if used in a protected formulation.

– Mitigation: Conduct freedom-to-operate (FTO) analysis before formulation development and ensure sourcing aligns with existing IP landscapes.

b. Process Patents

Certain manufacturing processes for high-purity or coated percarbonate are patented (e.g., Solvay’s or Evonik’s technologies).

– Pitfall: Even if the chemical is the same, producing or sourcing via a patented method without license could lead to IP disputes.

– Mitigation: Vet suppliers for IP compliance and request documentation confirming non-infringement, especially when sourcing from regions with weak IP enforcement.

c. Branding and Labeling Risks

Some oxygen bleach products are sold under branded, trademarked names (e.g., “ActiClean™”, “OxiBoost®”).

– Pitfall: Misrepresenting generic material as a branded equivalent may lead to trademark infringement.

– Mitigation: Avoid using trademarked terms in labeling or marketing unless authorized.

Conclusion

Sourcing oxygen-based bleach requires more than cost and availability considerations. Ensuring consistent quality involves rigorous technical specifications and supply chain controls. Equally important is navigating the IP landscape to avoid infringement in formulations or manufacturing processes. A proactive approach—leveraging CoAs, FTO studies, and supplier audits—can mitigate both quality and legal risks effectively.

H2: Logistics & Compliance Guide for Oxygen-Based Bleach

Oxygen-based bleach, commonly formulated with sodium percarbonate or sodium perborate, is a widely used cleaning and bleaching agent in consumer, industrial, and institutional applications. While it is generally safer and more environmentally friendly than chlorine-based bleach, proper logistics and compliance practices are essential to ensure safety, regulatory adherence, and supply chain efficiency.

H2.1 Chemical Overview and Classification

- Primary Active Ingredients: Sodium percarbonate (2Na₂CO₃·3H₂O₂) or sodium perborate (NaBO₃), which release hydrogen peroxide upon dissolution in water.

- Appearance: White crystalline powder or granules.

- Hazards:

- Oxidizing solid (UN 1479, Class 5.1 under GHS and UN Model Regulations).

- May enhance the combustion of flammable materials.

- Irritant to eyes, skin, and respiratory system.

-

Not classified as flammable, but releases oxygen when heated or in contact with acids.

-

GHS Classification:

- Ox. Sol. 2 (Oxidizing solid, Category 2)

- Skin Irrit. 2

- Eye Irrit. 2

- STOT SE 3 (Specific target organ toxicity — single exposure)

H2.2 Regulatory Compliance

H2.2.1 International Transport (UN/DOT Regulations)

– UN Number: UN 1479

– Proper Shipping Name: Oxidizing solid, n.o.s. (sodium percarbonate)

– Hazard Class: 5.1 (Oxidizing Substances)

– Packing Group: III (low to moderate danger)

– Packaging Requirements:

– Use UN-certified packaging marked for Class 5.1 substances.

– Packaging must be moisture-resistant and sealed to prevent caking or decomposition.

– Inner liners (e.g., polyethylene bags) recommended for bulk containers.

H2.2.2 IATA (Air Transport)

– Complies with IATA Dangerous Goods Regulations (DGR).

– Limited quantities allowed under Packing Instruction 852.

– Passenger aircraft: limited to 5 kg net per package.

– Cargo aircraft: up to 25 kg net per package.

– Must be packaged to prevent leakage and separated from flammable materials.

H2.2.3 IMDG (Sea Transport)

– Governed by IMDG Code, Chapter 3.3.

– Must be stowed “away from” or “separated from” flammable solids, self-reactive substances, and organic peroxides.

– Avoid stowage near heat sources or direct sunlight.

– Ventilation required in enclosed spaces.

H2.2.4 Road & Rail (ADR/RID)

– ADR (Europe): Class 5.1, UN 1479, Limited Quantity allowed.

– Packaging must be leak-proof, impact-resistant, and labeled with Class 5.1 hazard diamond.

– Transport documents must include proper shipping name, UN number, class, and emergency contact.

H2.3 Storage Guidelines

- Conditions:

- Store in a cool, dry, well-ventilated area.

- Temperature below 25°C (77°F); avoid exposure to heat or direct sunlight.

- Relative humidity below 60% to prevent decomposition and caking.

- Segregation:

- Keep away from flammable materials, reducing agents, acids, and combustible substances.

- Store separately from chlorine-based bleach to avoid hazardous reactions.

- Containers:

- Use sealed, non-reactive containers (HDPE, PP).

- Avoid metal containers unless coated (risk of catalytic decomposition).

- Shelf Life: Typically 12–24 months when stored properly. Monitor for clumping or off-gassing.

H2.4 Handling Procedures

- Personal Protective Equipment (PPE):

- Gloves (nitrile or neoprene)

- Safety goggles or face shield

- Dust mask (N95) if handling powder in poorly ventilated areas

-

Protective clothing to prevent skin contact

-

Best Practices:

- Avoid generating dust; use wet methods or local exhaust ventilation.

- Do not mix with acids, ammonia, or chlorine-based products (risk of oxygen or toxic gas release).

- Use non-sparking tools in potentially explosive atmospheres.

H2.5 Environmental & Disposal Compliance

- Environmental Impact:

- Breaks down into water, oxygen, and soda ash (sodium carbonate) – generally biodegradable.

-

Low ecotoxicity; however, high concentrations may affect aquatic life due to oxygen release.

-

Waste Disposal:

- Dispose of in accordance with local, state, and federal regulations.

- Small quantities may be diluted and flushed with water (check local wastewater rules).

- Large spills or expired product: treat as hazardous waste if contaminated.

H2.6 Emergency Response

- Spills:

- Evacuate area and eliminate ignition sources.

- Wear PPE.

- Scoop up material using non-combustible tools.

- Place in a dry, closed container labeled for oxidizing waste.

-

Do not use combustible materials (e.g., sawdust) for cleanup.

-

Fire:

- Use water, foam, dry chemical, or CO₂.

- Do not use halogenated agents unless necessary.

- Firefighters should wear self-contained breathing apparatus (SCBA).

-

Isolate containers exposed to heat and cool with water spray.

-

First Aid:

- Inhalation: Move to fresh air; seek medical attention if breathing is difficult.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Flush with water for at least 15 minutes; seek medical help.

- Ingestion: Rinse mouth; do not induce vomiting; seek immediate medical attention.

H2.7 Documentation & Labeling

- Safety Data Sheet (SDS):

- Must be GHS-compliant (16-section format).

-

Include hazard statements, PPE recommendations, and transport classification.

-

Labeling Requirements:

- GHS pictograms: Flame over circle (oxidizing), exclamation mark (irritant).

- Signal Word: “Warning”

- Hazard Statements:

- H272: May intensify fire; oxidizer.

- H315: Causes skin irritation.

- H319: Causes serious eye irritation.

-

Precautionary Statements: P210, P220, P221, P280, P305+P351+P338.

-

Transport Labels:

- Class 5.1 hazard label (oxidizing) must be affixed.

- Proper shipping name and UN number clearly visible.

H2.8 Regulatory Authorities & Resources

- UN Recommendations on the Transport of Dangerous Goods

- OSHA (USA): Hazard Communication Standard (29 CFR 1910.1200)

- EPA (USA): TSCA, CERCLA reporting thresholds

- REACH/CLP (EU): Registration, classification, and labeling

- Health Canada & WHMIS 2015

- IATA DGR, IMDG Code, ADR/RID

Conclusion

Oxygen-based bleach requires careful handling and compliance due to its oxidizing nature. Adherence to transportation regulations, proper storage, and robust safety protocols are critical to minimizing risks across the supply chain. Always consult the latest regulatory updates and SDS for site-specific compliance.

In conclusion, sourcing oxygen-based bleach requires careful consideration of quality, supplier reliability, environmental impact, and cost-effectiveness. Oxygen-based bleaches, such as sodium percarbonate or hydrogen peroxide, are preferred for their eco-friendly properties and effectiveness in stain removal without the harsh effects of chlorine. When selecting a supplier, it is essential to verify product purity, ensure compliance with safety and environmental regulations, and evaluate the sustainability of production methods. Establishing long-term relationships with reputable suppliers can ensure consistent quality and supply chain stability. Ultimately, sourcing the right oxygen-based bleach supports both operational efficiency and environmental responsibility, making it a strategic choice for industries ranging from textiles to household cleaning products.