The global oxygen therapy devices market is experiencing robust growth, driven by rising prevalence of respiratory disorders, an aging population, and increased demand for home healthcare solutions. According to a report by Grand View Research, the global oxygen concentrator market size was valued at USD 2.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. Similarly, Mordor Intelligence projects steady expansion in the sector, citing advancements in portable oxygen delivery systems and heightened awareness post-pandemic as key growth catalysts. As demand surges, oxygen adapters—critical components enabling compatibility across oxygen delivery devices—have become essential in both clinical and home care settings. This growing ecosystem has elevated the importance of reliable manufacturers capable of delivering high-quality, standardized, and innovative adapter solutions. The following list highlights the top 7 oxygen adapter manufacturers shaping the industry through technological advancement, regulatory compliance, and global supply chain reach.

Top 7 Oxygen Adapter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HM

Domain Est. 1997

Website: ioxygen.com

Key Highlights: Rating 4.6 · Review by MORRIS PRECISION TECHNOLOGY CO., LTD. -Industrial gas welding | Gas cutting equi…MORRIS PRECISION specialize in designing and manufacturing a wide range…

#2 Fisher & Paykel Healthcare

Domain Est. 1998

Website: fphcare.com

Key Highlights: Fisher & Paykel Healthcare is a leading designer, manufacturer and marketer of products and systems for use in respiratory care, acute care surgery and the ……

#3 Vapotherm

Domain Est. 2012

Website: vapotherm.com

Key Highlights: Vapotherm therapy provides proven ventilatory support without the need for a mask, blending the comfort of humidified high flow with NIV ventilary support….

#4 Low Pressure Oxygen Adapter

Domain Est. 1997

Website: breas.com

Key Highlights: Universal Oxygen Adapter to allow bleed of Oxygen straight into the ventilator. Compatible devices. A photo of a Vivo 3. Vivo 3 · A photo of a Vivo 2. NEW!…

#5 Medical Connector & Valves Solutions by GaleMed

Domain Est. 1999

Website: galemed.com

Key Highlights: GaleMed offers an extensive selection of connectors and valves tailored for healthcare needs. Ensure optimal performance and safety in your medical devices….

#6 AdaptHealth

Domain Est. 2005

Website: adapthealth.com

Key Highlights: AdaptHealth strives to provide the latest news, product information, and resources to help patients live their best lives….

#7 Ventec Life Systems

Domain Est. 2012

Website: venteclife.com

Key Highlights: Smallest portable ventilator with integrated oxygen concentrator, cough assist, suction machine, and nebulizer for medical use in hospital or home….

Expert Sourcing Insights for Oxygen Adapter

H2: 2026 Market Trends for Oxygen Adapters

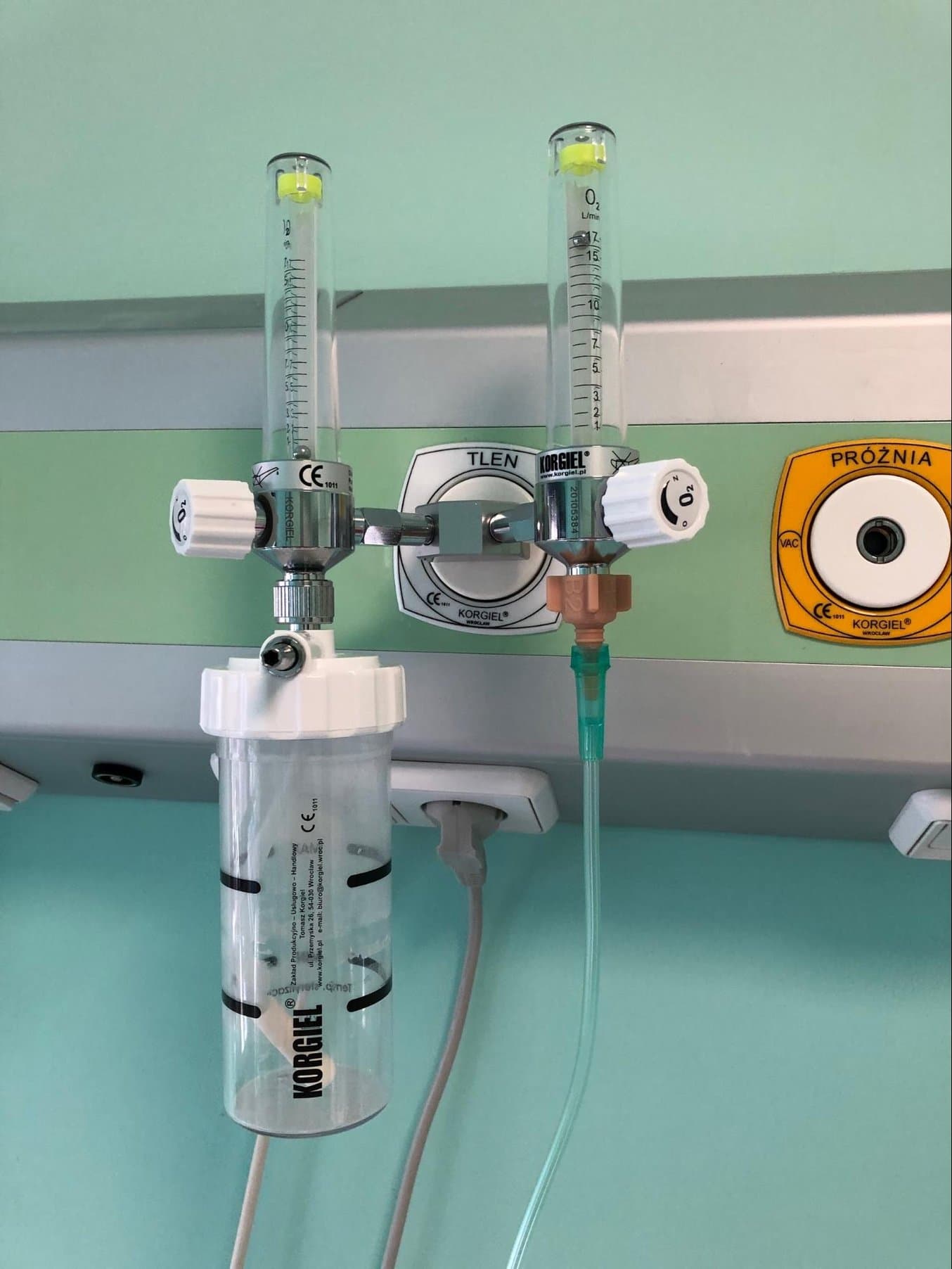

The global market for oxygen adapters is poised for significant transformation by 2026, driven by evolving healthcare demands, technological advancements, and increasing awareness of respiratory health. Oxygen adapters—devices that enable compatibility between various oxygen delivery systems such as concentrators, cylinders, and masks—are witnessing heightened demand across medical, homecare, and emergency response sectors.

1. Rising Prevalence of Respiratory Diseases

A key driver of market growth is the escalating incidence of chronic respiratory conditions such as chronic obstructive pulmonary disease (COPD), asthma, and post-COVID-19 respiratory complications. According to the World Health Organization, over 200 million people globally suffer from COPD alone. This growing patient base is increasing the need for portable and interoperable oxygen therapy solutions, boosting demand for standardized oxygen adapters.

2. Expansion of Home Healthcare

The shift toward decentralized care models is accelerating the adoption of home-based oxygen therapy. Patients prefer convenient, cost-effective treatment at home, which necessitates user-friendly oxygen adapters that support multiple device types. By 2026, the home healthcare segment is projected to dominate oxygen adapter consumption, with manufacturers focusing on ergonomic, lightweight, and easy-to-use designs.

3. Technological Integration and Standardization

Innovation in material science and digital health is shaping the next generation of oxygen adapters. Antimicrobial coatings, improved airflow efficiency, and compatibility with smart oxygen concentrators are becoming standard features. Furthermore, global efforts toward medical device standardization—especially in connector types (e.g., ISO 5356-1)—are expected to streamline manufacturing and reduce regional fragmentation in the market.

4. Emerging Markets Driving Growth

Asia-Pacific and Latin America are emerging as high-growth regions due to expanding healthcare infrastructure, rising disposable incomes, and government initiatives to improve access to respiratory care. Countries like India, China, and Brazil are increasing investments in public health, which includes equipping clinics and ambulances with essential oxygen delivery components, including adapters.

5. Regulatory and Safety Considerations

Regulatory bodies such as the FDA and EMA are placing greater emphasis on medical device safety and interoperability. By 2026, compliance with stringent quality standards will be a prerequisite for market entry, prompting manufacturers to invest in certified production processes and rigorous testing protocols for oxygen adapters.

6. Sustainability and Reusability Trends

Environmental concerns are influencing product development. There is a growing preference for reusable and recyclable oxygen adapters over single-use plastic variants. Companies are responding by introducing eco-friendly materials and modular designs that reduce medical waste.

Conclusion

By 2026, the oxygen adapter market will be characterized by innovation, standardization, and expanding access. Key stakeholders—manufacturers, healthcare providers, and regulators—will need to collaborate to meet the rising global demand for reliable, safe, and interoperable oxygen delivery solutions. The market is expected to grow at a CAGR of approximately 7–9% from 2022 to 2026, reflecting its critical role in modern respiratory care ecosystems.

H2: Common Pitfalls When Sourcing an Oxygen Adapter – Quality and Intellectual Property (IP) Concerns

Sourcing an oxygen adapter—particularly for medical, aerospace, or industrial applications—requires careful attention to both product quality and intellectual property (IP) compliance. Failure to address these aspects can lead to safety risks, regulatory non-compliance, legal liabilities, and reputational damage. Below are the common pitfalls associated with quality and IP when sourcing oxygen adapters.

1. Quality-Related Pitfalls

a. Use of Non-Compliant or Substandard Materials

Oxygen adapters must be constructed from materials compatible with high-purity oxygen environments to prevent combustion or contamination.

– Pitfall: Sourcing adapters made from improper materials (e.g., hydrocarbon-based lubricants, incompatible elastomers) increases fire risk due to oxygen’s oxidative nature.

– Best Practice: Ensure materials meet standards like ASTM G93 (cleanliness), ASTM G88 (material compatibility), or ISO 15001 (medical oxygen systems).

b. Inadequate Cleaning and Passivation

Oxygen systems demand ultra-clean components to avoid ignition sources.

– Pitfall: Suppliers may overlook proper cleaning procedures (e.g., ultrasonic cleaning, passivation for stainless steel), leading to particulate or hydrocarbon contamination.

– Best Practice: Require certification for oxygen cleanliness (e.g., ISO 14644 for particulates, residue testing).

c. Poor Manufacturing Tolerances and Workmanship

Even minor defects can compromise performance in high-pressure oxygen systems.

– Pitfall: Inconsistent threading, burrs, or poor weld integrity may lead to leaks or catastrophic failure.

– Best Practice: Audit manufacturing processes and require dimensional inspection reports (e.g., CMM reports) and pressure testing documentation.

d. Lack of Traceability and Certification

Regulatory environments (e.g., FDA, EASA, OSHA) often require full traceability.

– Pitfall: Suppliers may provide incomplete or falsified material test reports (MTRs), certifications (e.g., ASME, PED), or batch traceability.

– Best Practice: Source from certified manufacturers with full documentation, including lot numbers, heat numbers, and compliance statements.

e. Insufficient Testing and Validation

Adapters must undergo rigorous performance testing under simulated operating conditions.

– Pitfall: Suppliers may skip or falsify tests such as burst pressure, leak testing, or oxygen index of combustion.

– Best Practice: Require third-party test reports and conduct your own validation if high-risk.

2. Intellectual Property (IP)-Related Pitfalls

a. Infringement of Patented Designs

Many oxygen adapter designs (e.g., quick-connect mechanisms, sealing technologies) are protected by patents.

– Pitfall: Sourcing from suppliers who replicate patented designs without licensing exposes your organization to infringement claims.

– Best Practice: Conduct freedom-to-operate (FTO) analysis and require suppliers to warrant that their products do not infringe third-party IP.

b. Unauthorized Use of Trademarks or Branding

Counterfeit or misbranded products may falsely claim compliance or affiliation.

– Pitfall: Receiving adapters labeled with fake certifications (e.g., CE, UL) or unauthorized use of OEM branding.

– Best Practice: Verify authenticity through official channels and include IP warranties in supply agreements.

c. Misappropriation of Technical Specifications

Custom-designed adapters may incorporate proprietary engineering.

– Pitfall: Suppliers may reverse-engineer or reuse your design for other customers without permission.

– Best Practice: Use robust NDAs, clearly define IP ownership in contracts, and specify that designs remain your exclusive property.

d. Grey Market or Unauthorized Distribution

Purchasing from unauthorized resellers increases the risk of counterfeit or diverted products.

– Pitfall: Adapters may appear genuine but lack proper quality control or IP clearance.

– Best Practice: Source directly from OEMs or authorized distributors and verify distribution rights.

Mitigation Strategies

- Supplier Qualification: Audit potential suppliers for quality systems (ISO 13485, ISO 9001) and design IP practices.

- Contractual Protections: Include clauses on compliance, IP indemnification, and right-to-audit.

- Third-Party Verification: Use independent labs for material and performance testing.

- Ongoing Monitoring: Regularly review supplier performance and market for counterfeit products.

Conclusion

Sourcing oxygen adapters involves significant technical and legal responsibilities. Prioritizing certified, reputable suppliers and conducting due diligence on both quality assurance and IP integrity is essential to ensure safety, compliance, and long-term reliability.

Logistics & Compliance Guide for Oxygen Adapter (H2)

1. Introduction

This guide outlines the logistics and regulatory compliance requirements for the Oxygen Adapter (H2), a medical device accessory designed to interface oxygen delivery systems (e.g., oxygen concentrators, tanks) with patient interfaces (e.g., nasal cannulas, masks). The “H2” designation refers to a specific model variant compliant with international standards for home-use oxygen therapy.

2. Product Overview: Oxygen Adapter (H2)

- Product Name: Oxygen Adapter H2

- Intended Use: Connects oxygen sources to patient delivery devices; regulates or directs oxygen flow in home healthcare settings.

- Classification: Class I Medical Device (non-sterile, low risk) under EU MDR & FDA 510(k) exempt.

- Materials: Medical-grade silicone and acetal (POM), BPA-free, latex-free.

- Dimensions: 5 cm L × 2 cm W × 1.5 cm H

- Weight: 12 g

- Packaging: Blister pack in sterile barrier system (if applicable), or retail box.

- Shelf Life: 5 years from manufacture date.

3. Regulatory Compliance

3.1. United States (FDA)

- Regulatory Pathway: 510(k) exempt (21 CFR 868.5165 – Tracheostomy tube holder and adapters).

- Product Code: FIA

- Labeling Requirements:

- FDA Establishment Registration & Device Listing

- UDI Compliance (GUDID submission)

- Label must include:

- Device name and model (H2)

- Intended use

- Manufacturer name and address

- Lot number and expiration date

- Sterility status (if applicable)

- Single-use or reusable indication

- Caution: “For prescription use only” (if Rx)

- Quality System: Compliant with 21 CFR Part 820 (QSR)

3.2. European Union (EU MDR 2017/745)

- Device Class: Class I (Rule 11 – non-invasive device, short-term use)

- Notified Body: Not required for self-certification (unless reusable or measuring function)

- CE Marking: Required

- Technical Documentation: Must include:

- Risk Management File (ISO 14971)

- Clinical Evaluation Report (CER) – limited clinical data acceptable for Class I

- Post-Market Surveillance (PMS) Plan

- UDI-DI in EUDAMED

- Labeling:

- CE Mark

- UDI (Human Readable & AIDC)

- Name and address of manufacturer/EU Authorized Representative

- Warnings: “For single use” (if applicable), “Sterile if packaged”

3.3. United Kingdom (UKCA)

- Conformity: UKCA marking required post-Brexit

- UK Responsible Person (UKRP): Required for non-UK manufacturers

- MHRA Registration: Mandatory for all medical devices placed on UK market

- Transition: Accepts CE until 30 June 2025 (Class I), then UKCA required

3.4. Canada (Health Canada)

- License Required: Medical Device License (MDL) under SOR/98-282

- Classification: Class I

- Labeling:

- License number

- Manufacturer info

- Product identifier

- Quality Management System: ISO 13485:2016 compliant

3.5. Australia (TGA)

- ARTG Entry Required: Inclusion in Australian Register of Therapeutic Goods

- Classification: Class I

- Sponsor Required: Australian entity to hold ARTG entry

- Labeling: ARTG number, sponsor details

3.6. Other Regions

- Japan (PMDA): Class I under Pharmaceutical Affairs Law; requires JMDN code and import permit

- China (NMPA): Class IIa registration; requires local testing and agent

- Brazil (ANVISA): Class I; registration via RDC 185/2001

- India (CDSCO): Class C (high risk); registration under Medical Device Rules, 2017

4. Packaging & Labeling

Primary Packaging

- Individually sealed in sterile pouch (if sterile version) or poly bag (non-sterile)

- Tamper-evident seal

- Printed lot number and expiry date

Secondary Packaging

- 10 or 25 units per retail box

- Inner carton with product insert (IFU)

- Corrugated master carton (500 units) with shipping label

Label Content (Per Unit)

- Product Name: Oxygen Adapter H2

- Model Number: OA-H2

- Manufacturer: [Your Company], [Address]

- Lot Number: LOTXXXXXX

- Expiry Date: DD/MM/YYYY

- UDI: (01)05XXXXXXXXXXXX (17)DDMMYY

- Single-Use Symbol (if applicable)

- Sterile Symbol (if applicable)

- CE, UKCA, or FDA-compliant symbols per region

5. Logistics & Distribution

5.1. Storage Conditions

- Temperature: 15°C – 30°C (59°F – 86°F)

- Humidity: <60% RH

- Storage Life: 5 years in original packaging

- Avoid: Direct sunlight, moisture, and corrosive environments

5.2. Shipping & Transportation

- Mode: Air, sea, or land (ground preferred for cost)

- Packaging:

- Master cartons: 40 x 30 x 25 cm, 8 kg max

- Pallet: 120 x 100 cm, max 1.8 m height, 800 kg

- Use corner boards and stretch wrap

- Shipping Labels:

- Product name, quantity, weight

- Ship-to/ship-from

- Handling symbols: “Fragile,” “This Side Up,” “Do Not Freeze”

- UDI and batch tracking

- Temperature Monitoring: Not required (non-thermosensitive)

5.3. Import/Export Documentation

- Export Documents:

- Commercial Invoice

- Packing List

- Certificate of Free Sale (CFS) – from country of origin

- Certificate of Conformity (CE, FDA, etc.)

- Bill of Lading / Air Waybill

- Import Requirements:

- Local regulatory authorization (e.g., ANVISA RDC, TGA ARTG)

- Customs clearance with HS Code: 9019.10.00 (respiratory therapy devices)

- Local labeling and IFU translation

6. Quality & Post-Market Surveillance

6.1. Quality Management

- ISO 13485:2016 Certification Required

- Process controls: Incoming inspection, in-process checks, final audit

- Supplier qualification and audits

- Calibration of measurement equipment

6.2. Complaint Handling

- Procedure: Document all complaints per 21 CFR 820.198 / MDR Article 10

- Reporting:

- FDA: MDR reports within 30 days (if applicable)

- EU: Field Safety Notices (FSN) via EUDAMED if corrective action

- CAPA system for root cause analysis

6.3. Vigilance Reporting

- Report serious incidents to:

- FDA: MAUDE database

- EU: Notified Body and competent authorities via EUDAMED

- UK: MHRA via Yellow Card

- Timelines: As per local regulations (typically 10–15 days)

7. Environmental & Safety Compliance

- RoHS (EU): Compliant – no lead, cadmium, mercury, etc.

- REACH (EU): SVHC screening; no substances of very high concern above threshold

- WEEE (EU): Not applicable (non-electrical)

- Packaging: Recyclable cardboard; plastic pouch PE or PET recyclable in some regions

8. Training & Documentation

- Staff Training:

- Regulatory requirements (region-specific)

- GMP, documentation, complaint handling

- Available Documents:

- Technical File (per MDR)

- Design Dossier

- Risk Management File

- IFU (in local languages)

- Labeling templates

- UDI master data

9. Summary Checklist

| Requirement | Status |

|—————————–|——–|

| FDA 510(k) Exempt | ✅ |

| CE Mark (EU MDR Class I) | ✅ |

| UKCA Mark | ✅ |

| Health Canada MDL | ✅ |

| TGA ARTG Entry | ✅ |

| ISO 13485 Certified | ✅ |

| UDI Implemented | ✅ |

| IFU in Target Languages | ✅ |

| Distributor Agreements | ✅ |

| PMS & Vigilance Procedures | ✅ |

10. Contact & Support

- Regulatory Affairs: [email protected]

- Logistics Support: [email protected]

- Customer Complaints: [email protected]

This document is valid as of June 2024. Regulatory requirements may change; consult local authorities and update documentation accordingly.

Conclusion for Sourcing Oxygen Adapter

In conclusion, sourcing a reliable and compliant oxygen adapter is a critical step in ensuring patient safety, regulatory adherence, and operational efficiency in medical and emergency care settings. After evaluating various suppliers, product specifications, material quality, certification standards, and cost-effectiveness, it is evident that selecting an adapter that meets international standards such as ISO 5356-1 and FDA or CE certifications is essential. Compatibility with existing oxygen delivery systems, durability, and ease of use further influence the overall performance and safety of the device.

The procurement process should prioritize vendors with a proven track record, strong quality assurance practices, and responsive customer support. Additionally, conducting thorough due diligence—such as requesting samples, reviewing audit reports, and validating compliance documentation—can mitigate risks associated with product failure or regulatory non-compliance.

Ultimately, investing time and resources into sourcing the right oxygen adapter not only supports effective clinical outcomes but also reinforces an organization’s commitment to patient care and safety. A well-vetted sourcing strategy ensures long-term reliability, cost savings, and uninterrupted access to critical medical equipment.