The global ornamental ironwork market is experiencing steady growth, driven by rising demand in residential, commercial, and infrastructure sectors for durable, aesthetically appealing architectural elements. According to a report by Mordor Intelligence, the global architectural metal market—encompassing ornamental iron products—is projected to grow at a CAGR of approximately 5.8% from 2023 to 2028. This expansion is fueled by increasing construction activities, urbanization, and a growing preference for customized metalwork in both modern and traditional building designs. Additionally, Grand View Research highlights the resilience of metal fabrication in outdoor applications, citing corrosion-resistant finishes and low maintenance as key adoption drivers. As demand for intricate gates, railings, facades, and decorative features continues to rise, a select group of manufacturers have emerged as leaders in quality, craftsmanship, and innovation. Based on production capacity, market reach, technological integration, and design expertise, the following list outlines the top 10 ornamental iron work manufacturers shaping the industry today.

Top 10 Ornamental Iron Work Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mueller Ornamental Iron Works manufacturer of railings stairs gates …

Domain Est. 1999

Website: ornamentaliron.net

Key Highlights: Mueller Ornamental Iron Works, Inc. • 655 Lively Blvd., Elk Grove Village, IL 60007 Phone: 847.758.9941 • Fax: 847.758.9945 • Email: [email protected]…

#2 Metal Fabrication

Domain Est. 1999

Website: clemsironworks.com

Key Highlights: Clem’s Ornamental Iron Works, inc. specializes in custom aluminum railings, fencing, gates, and more, delivering exceptional craftsmanship for over 65 years….

#3 Fortin Ironworks

Domain Est. 2000 | Founded: 1946

Website: fortinironworks.com

Key Highlights: Fortin Ironworks is a family owned and operated ornamental iron and metal fabrication company based in Columbus, Ohio since 1946….

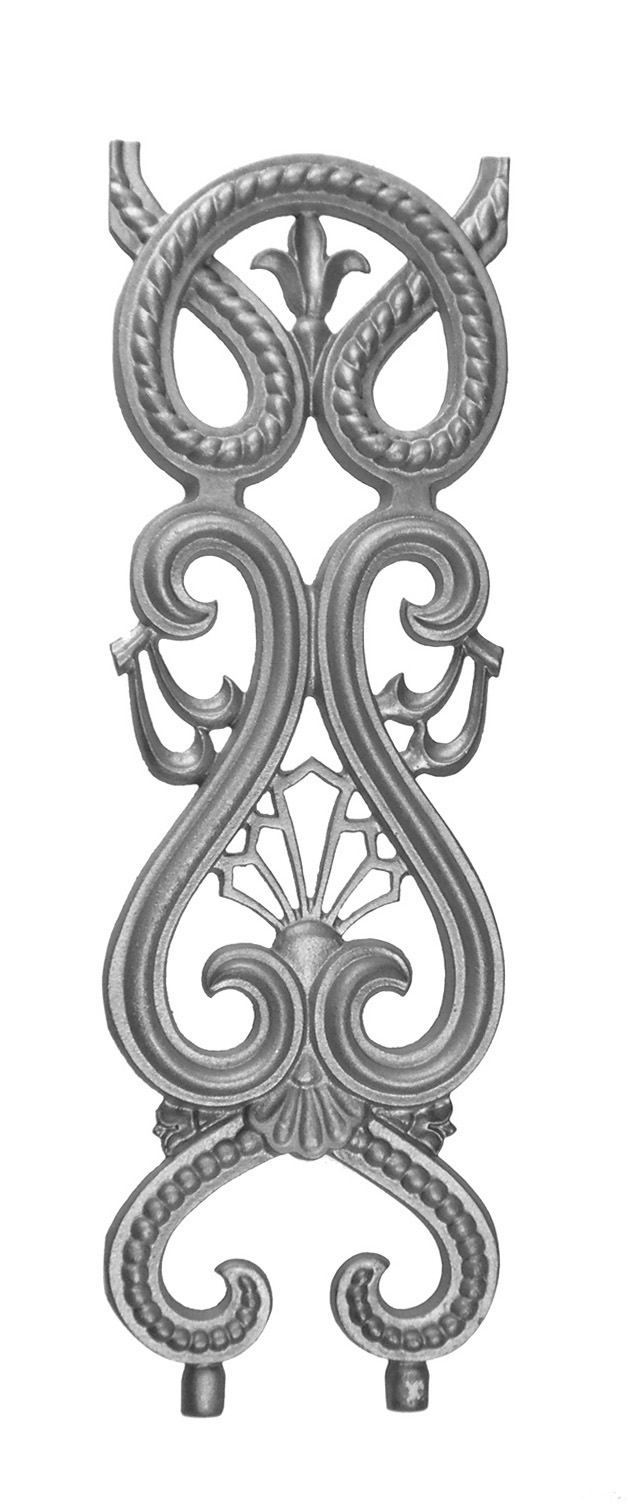

#4 Orleans Ornamental Iron & Casting Distributors, Inc.

Domain Est. 2000 | Founded: 1974

Website: orleansornamental.com

Key Highlights: One stop supply house for all your ornamental iron needs. Serving america’s Fabricator, since 1974, quality castings, steel forgings & top of the line ……

#5 Custom Ornamental Iron Works

Domain Est. 1998

Website: customironworks.com

Key Highlights: A one-stop shop for high-quality stair balusters and wrought iron parts. With various styles and finishes, you can create a railing that reflects your taste….

#6 Edwards Ornamental Iron

Domain Est. 1999

Website: edwardsornamental.com

Key Highlights: We specialize in creating beautiful iron and other metal furnishings, including driveway gate systems, custom iron railings, fencing solutions, and custom ……

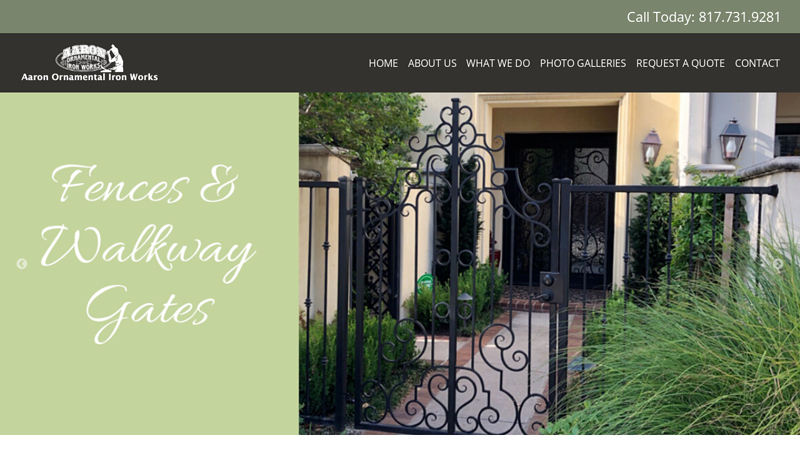

#7 Aaron Ornamental Iron Works

Domain Est. 2000

Website: aaronornamental.com

Key Highlights: Aaron Ornamental Iron Works provides High Quality Automatic Driveway Gates, Iron Doors, Iron Fences, Stairways, Balcony Boxes, Railings, Step Rails, and ……

#8 Ornamental Iron of Houston

Domain Est. 2003

Website: ornamentalironworks.net

Key Highlights: We at Ornamental Iron of Houston – Manufacture Wrought Iron Gates, Railings, Balcony Rails, Stainless Steel Cable Railings and Staircases in Houston, Texas….

#9 Ornamental Iron Works

Domain Est. 2014

Website: ironworks1.com

Key Highlights: Ornamental Iron Works – Providing beautiful, artistic, and secure custom iron works for residential and commercial properties or projects….

#10 Ornamental Ironwork

Website: ornamentalironwork.com.au

Key Highlights: Ornamental Ironwork manufactures traditional and modern ironwork for interior and exterior commercial, residential and architectural requirements….

Expert Sourcing Insights for Ornamental Iron Work

2026 Market Trends for Ornamental Iron Work

As we approach 2026, the ornamental iron work industry is poised for dynamic shifts driven by evolving consumer preferences, technological advancements, and broader economic and environmental trends. While rooted in tradition, the sector is adapting to meet modern demands for customization, sustainability, and smart integration. Below are the key market trends expected to shape the ornamental iron landscape in 2026.

Increasing Demand for Customization and Artistic Design

Consumers and architects are increasingly seeking unique, handcrafted ironwork that reflects individual style and architectural harmony. In 2026, the market will continue to favor bespoke designs over mass-produced options. Homeowners investing in high-end residential properties are commissioning intricate gates, railings, and decorative elements that serve as both functional components and works of art. This trend is supported by a growing appreciation for artisanal craftsmanship and the rise of social media platforms showcasing custom metalwork, inspiring new design aspirations.

Integration of Smart Home Technology

Ornamental iron is no longer just about aesthetics and durability—it’s becoming smarter. By 2026, we expect increased integration of iron elements with smart home systems. For example, iron gates and entryways are being equipped with automated openers, biometric access controls, and security cameras seamlessly embedded into metal frameworks. Manufacturers and fabricators who collaborate with tech providers to offer “smart” iron solutions will gain a competitive advantage, particularly in the luxury residential and commercial security markets.

Sustainability and Use of Recycled Materials

Environmental concerns are influencing material choices across construction sectors, and ornamental iron is no exception. In 2026, demand for ironwork made from recycled or sustainably sourced metals will grow, driven by green building certifications like LEED and consumer preference for eco-conscious products. Fabricators are adopting energy-efficient forging techniques and minimizing waste through precision cutting technologies. Additionally, the inherent longevity and recyclability of iron make it a favorable material in sustainable design narratives.

Growth in Restoration and Historic Preservation Projects

As cities prioritize heritage conservation, there is a rising need for skilled artisans capable of restoring ornate ironwork in historic buildings, bridges, and public spaces. The 2026 market will see continued investment in restoration projects, particularly in urban centers with rich architectural histories. This trend supports specialized ironworkers who combine traditional techniques with modern corrosion-resistant treatments to preserve authenticity while ensuring durability.

Expansion in Commercial and Public Infrastructure Applications

Beyond residential use, ornamental iron is gaining traction in commercial, hospitality, and public sector projects. In 2026, expect increased use of decorative iron in retail spaces, hotels, and municipal buildings where aesthetic appeal and security are both priorities. Urban beautification initiatives—such as decorative street railings, park gates, and transit station accents—are also contributing to market growth, supported by public funding and urban development programs.

Adoption of Advanced Fabrication Technologies

Digital fabrication tools such as CNC plasma cutting, 3D modeling, and robotic welding are becoming standard in forward-thinking iron shops. By 2026, these technologies will enable faster production, greater design complexity, and improved consistency—without sacrificing the hand-finished quality clients expect. Augmented reality (AR) tools may also emerge as a way for clients to visualize iron installations in their spaces before fabrication begins, enhancing client engagement and reducing revisions.

Labor Shortages and the Rise of Training Initiatives

A persistent challenge for the industry is the shortage of skilled metalworkers. As older artisans retire, the industry faces a talent gap. In response, vocational training programs, apprenticeships, and partnerships with trade schools are expected to expand by 2026. Companies investing in workforce development will be better positioned to meet growing demand and maintain high-quality craftsmanship standards.

Regional Market Variations

Market growth will not be uniform across regions. Areas with strong construction booms—such as the Sun Belt in the U.S., parts of Europe embracing urban renewal, and developing luxury markets in the Middle East and Asia—will see heightened demand for ornamental iron. Climate-resilient finishes and coatings will be especially important in coastal and high-humidity regions, where corrosion resistance is critical.

Conclusion

By 2026, the ornamental iron work market will be characterized by a blend of tradition and innovation. The demand for personalized, durable, and aesthetically compelling metalwork will persist, supported by technological integration and sustainability goals. Fabricators who embrace customization, smart features, ecological practices, and workforce development will be best positioned to thrive in this evolving landscape. Ornamental iron, once seen as a niche craft, is emerging as a vital component of modern architectural expression and secure, sustainable design.

Common Pitfalls Sourcing Ornamental Iron Work (Quality, IP)

Sourcing ornamental iron work requires careful attention to both craftsmanship and legal considerations. Overlooking key factors can lead to compromised quality, project delays, or intellectual property disputes. Below are common pitfalls to avoid:

Poor Material Quality and Workmanship

Substandard iron or inadequate fabrication techniques can result in rust, warping, weak joints, and premature failure. Buyers often overlook metallurgical specifications, finishing processes (like powder coating or galvanization), and welding standards. Always request material certifications, inspect samples, and verify the fabricator’s experience with similar projects.

Inadequate Design Verification

Ornamental iron pieces are often custom-designed. Without thorough design review and mock-ups, discrepancies in dimensions, proportions, or structural integrity may go unnoticed until installation. Ensure detailed shop drawings are approved and prototypes are evaluated before full production.

Lack of Intellectual Property Due Diligence

Many ornamental designs are protected by copyrights, design patents, or trademarks. Sourcing replicated or “inspired-by” pieces from unverified suppliers can expose buyers to IP infringement claims. Always confirm that designs are either original, licensed, or in the public domain. Contracts should include IP indemnification clauses.

Insufficient Protection Against Counterfeits

Low-cost suppliers, especially overseas, may produce counterfeit versions of proprietary designs. Without proper vetting, buyers risk receiving unauthorized copies. Conduct supplier audits, request provenance documentation, and work with reputable fabricators who respect IP rights.

Inconsistent Finishes and Color Matching

Aesthetic consistency is critical in ornamental work. Variations in paint, powder coating, or patina can ruin visual harmony across a project. Specify finish standards (e.g., ASTM or AAMA), require batch testing, and approve color samples under relevant lighting conditions.

Failure to Address Installation Requirements

Ornamental iron must be designed for proper mounting and load-bearing. Poor integration with surrounding structures leads to instability or damage. Ensure the fabricator coordinates with architects and contractors, and provides detailed installation guidelines.

Overlooking Long-Term Maintenance Needs

Some finishes and designs require specific upkeep to prevent corrosion or wear. Buyers may underestimate maintenance costs if durability isn’t addressed upfront. Discuss expected lifecycle and maintenance protocols during procurement.

By proactively addressing these pitfalls, buyers can ensure high-quality, legally compliant ornamental iron work that enhances both aesthetics and value.

Logistics & Compliance Guide for Ornamental Iron Work

Overview

Ornamental iron work—encompassing gates, railings, fences, and decorative features—requires careful planning for both logistics and regulatory compliance. Proper handling from fabrication to installation ensures product integrity, worker safety, and adherence to industry standards. This guide outlines key considerations for managing logistics and maintaining compliance throughout the lifecycle of ornamental iron projects.

Material Sourcing and Procurement

Ensure all raw materials (e.g., wrought iron, mild steel, stainless steel) are sourced from certified suppliers compliant with ASTM (American Society for Testing and Materials) standards. Maintain documentation for material traceability, including mill test reports (MTRs) for strength, composition, and corrosion resistance. Verify that coatings (such as powder coating or galvanization) meet environmental and durability standards (e.g., AAMA 2604 or ASTM A123).

Fabrication Standards and Quality Control

Fabrication must comply with AWS D1.1 (Structural Welding Code – Steel) for weld integrity and joint design. Implement an internal quality assurance program that includes welder certification, dimensional accuracy checks, and finish inspections. Document all quality control measures for audit readiness and client transparency.

Transportation and Handling

Ornamental iron pieces are often large, heavy, and susceptible to damage. Use padded trailers, secure load straps, and cradles to prevent deformation during transit. Label all components clearly and provide handling instructions. For oversized loads, obtain necessary permits and coordinate with local transportation authorities to ensure compliance with road regulations.

Installation and Site Safety

Installation crews must follow OSHA (Occupational Safety and Health Administration) guidelines for fall protection, heavy lifting, and equipment use. Confirm that anchor systems and structural connections meet engineering specifications and local building codes. Perform site assessments to identify underground utilities and ensure safe drilling or anchoring practices.

Regulatory and Building Code Compliance

Verify that designs and installations comply with local building codes, such as the International Building Code (IBC) and International Residential Code (IRC). Guardrails and stair systems must meet IBC Section 1015 and IRC R311.7 for height, spacing, and load requirements. Accessibility standards under the ADA (Americans with Disabilities Act) apply where relevant, particularly for public installations.

Environmental and Coating Compliance

Use environmentally responsible finishing methods. Volatile Organic Compound (VOC) emissions from paints and coatings must comply with EPA and local air quality regulations (e.g., SCAQMD Rule 1113). For outdoor installations, ensure anti-corrosion treatments meet regional environmental exposure standards.

Documentation and Certification

Maintain comprehensive records including design approvals, material certifications, welder qualifications, inspection reports, and as-built drawings. Provide clients with a compliance package upon project completion for warranty and regulatory purposes.

Conclusion

Effective logistics and strict compliance are essential for the successful delivery of ornamental iron work. By adhering to industry standards, regulatory requirements, and best practices in handling and installation, fabricators and contractors ensure safety, durability, and customer satisfaction in every project.

In conclusion, sourcing ornamental ironwork requires careful consideration of design specifications, material quality, craftsmanship, and supplier reliability. Whether for residential, commercial, or restoration projects, selecting the right vendor involves evaluating their experience, portfolio, customization capabilities, and adherence to timelines and budgets. Additionally, balancing aesthetic appeal with structural integrity and durability is essential to ensure long-term satisfaction. By conducting thorough research, obtaining multiple quotes, and establishing clear communication with suppliers, clients can secure high-quality ornamental ironwork that enhances the visual appeal and value of their project while meeting functional and safety standards.