The global organic food market is expanding rapidly, driven by rising consumer awareness around health, wellness, and sustainable agriculture. According to Mordor Intelligence, the global organic food market was valued at USD 225.26 billion in 2023 and is projected to grow at a CAGR of 13.2% from 2024 to 2029. A key segment within this trend is organic wheat bran—a nutrient-rich byproduct of whole grain milling that is increasingly in demand for its high dietary fiber, antioxidants, and functional properties in natural and organic food formulations. With the clean-label movement gaining momentum across the bakery, breakfast cereals, and health supplements industries, manufacturers are prioritizing traceable, certified organic ingredients. As demand outpaces supply, a select group of organic wheat bran producers have emerged as leaders in quality, scalability, and sustainability. Here are the top six organic wheat bran manufacturers shaping the future of this high-growth niche.

Top 6 Organic Wheat Bran Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Organic Wheat Bran

Domain Est. 1996

Website: glorybee.com

Key Highlights: In stock 1–2 day deliveryOrganic wheat bran is most commonly used to enrich breads, baked goods such as muffins and breakfast cereals….

#2 Heavy White Wheat Bran

Domain Est. 1996

Website: grainmillers.com

Key Highlights: Grain Millers is a supplier of both medium and heavy white wheat bran, soft white wheat bran can be used in muffins and other bakery products….

#3 Wheat Bran

Domain Est. 1998

Website: siemermilling.com

Key Highlights: Siemer Milling Company is a bulk wheat bran supplier and offers food-grade coarse wheat bran or fine grind wheat bran made from soft red winter wheat….

#4 Fine Wheat Bran

Domain Est. 2007

Website: shilohfarms.com

Key Highlights: SHILOH FARMS Fine Wheat Bran is an easy and convenient way of adding important dietary fiber (approximately 80% insoluble and 20% soluble) to your diet. Packed ……

#5 Wheat Bran

Domain Est. 2012

Website: ardentmills.com

Key Highlights: Try our wheat bran for fiber, vitamins and minerals in your cereals, crackers, nutrition bars, and bakery mixes. Ardent Mills….

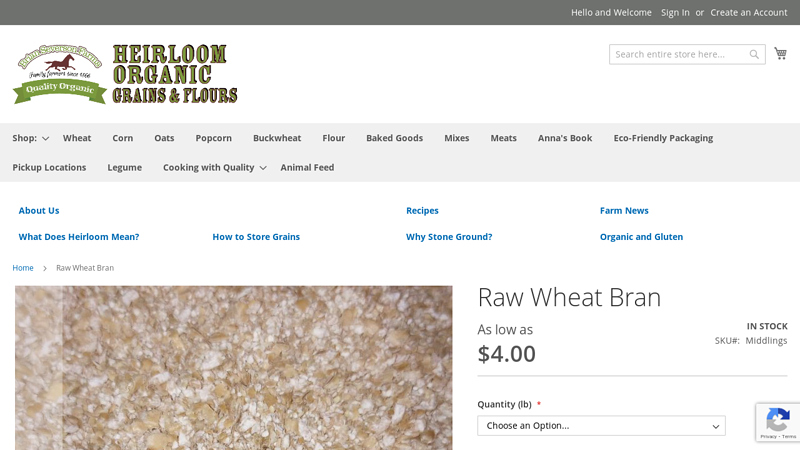

#6 Raw Wheat Bran

Domain Est. 2020

Expert Sourcing Insights for Organic Wheat Bran

H2: Projected Market Trends for Organic Wheat Bran in 2026

The global organic wheat bran market is poised for significant growth by 2026, driven by rising consumer awareness of health and wellness, increased demand for clean-label food products, and expanding applications in functional foods and animal feed. Key market trends shaping the organic wheat bran industry include:

-

Growing Health Consciousness: Consumers are increasingly prioritizing dietary fiber intake due to its proven benefits in digestive health, weight management, and chronic disease prevention. Organic wheat bran, as a rich source of insoluble fiber, is gaining traction among health-focused demographics. This shift is particularly evident in North America and Western Europe, where functional and fortified foods are mainstream.

-

Expansion of the Organic Food Sector: The broader organic food industry continues to expand, supported by stricter certification standards and greater retail availability. As consumers seek minimally processed, non-GMO, and pesticide-free ingredients, organic wheat bran is becoming a preferred additive in cereals, bakery products, and plant-based foods.

-

Clean-Label and Plant-Based Product Innovation: Food manufacturers are reformulating products to meet clean-label demands, replacing synthetic additives with natural, recognizable ingredients. Organic wheat bran fits this criterion and is being incorporated into gluten-free products, vegan snacks, and high-fiber energy bars. The rise of plant-based diets further amplifies demand for nutrient-dense, sustainable ingredients like organic wheat bran.

-

Sustainability and Circular Economy Practices: With increasing pressure on food systems to reduce waste, the utilization of wheat bran—a byproduct of milling—aligns with circular economy principles. Organic wheat bran valorization supports sustainable agriculture and reduces environmental impact, appealing to eco-conscious consumers and ESG-focused investors.

-

Regulatory Support and Certification Growth: Governments and international bodies are strengthening organic certification frameworks, enhancing consumer trust and facilitating global trade. Regions such as the EU and North America are implementing policies that support organic farming, indirectly boosting raw material supply, including organic wheat bran.

-

Emerging Markets and Distribution Channels: While North America and Europe lead current demand, Asia-Pacific is expected to witness the fastest growth by 2026, driven by urbanization, rising disposable incomes, and growing awareness of functional foods in countries like China, India, and Japan. E-commerce platforms are also expanding access to organic ingredients, enabling direct-to-consumer sales and niche market penetration.

-

Price Volatility and Supply Chain Challenges: Despite positive trends, the market may face challenges related to inconsistent supply of organic wheat, climate variability affecting crop yields, and higher production costs. Investments in organic farming infrastructure and supply chain transparency will be critical to maintaining stable market growth.

In conclusion, the organic wheat bran market in 2026 is expected to benefit from strong tailwinds in health, sustainability, and food innovation. Stakeholders who prioritize quality, traceability, and strategic partnerships across the value chain are likely to capture significant market share in this evolving landscape.

Common Pitfalls Sourcing Organic Wheat Bran: Quality and Identity Preservation (IP)

Sourcing organic wheat bran requires careful attention to both quality specifications and identity preservation (IP) protocols. Failure to address these aspects can lead to supply chain disruptions, regulatory non-compliance, and compromised end-product integrity. Below are key pitfalls to avoid.

Quality-Related Pitfalls

Inconsistent Nutritional Profile

Organic wheat bran can vary significantly in fiber, protein, and ash content depending on the wheat variety, growing conditions, and milling process. Without strict supplier specifications and batch testing, inconsistencies can affect product performance in food formulations.

Contamination with Mycotoxins

Organic grains are more susceptible to mold and mycotoxin contamination (e.g., deoxynivalenol or DON) due to limited use of synthetic fungicides. Sourcing without verified mycotoxin testing increases the risk of receiving contaminated lots, leading to costly rejections or safety issues.

Poor Shelf Life and Rancidity

Wheat bran contains lipids that can oxidize quickly, especially in warm or humid conditions. Organic suppliers may lack adequate stabilization (e.g., heat treatment) or packaging (e.g., nitrogen flushing), leading to rancidity and off-flavors. This is often overlooked during supplier evaluation.

Excessive Foreign Material or Ash Content

Low-quality bran may contain high levels of mineral ash or foreign matter due to inadequate cleaning or poor milling practices. High ash levels can indicate contamination with flour or soil, reducing purity and affecting functionality.

Identity Preservation (IP) Pitfalls

Lack of Organic Certification Traceability

A major IP risk is sourcing from suppliers who cannot provide full documentation from farm to mill. Without certified organic handling and segregation records, there is a risk of commingling with conventional wheat bran, jeopardizing organic integrity and compliance with USDA NOP or EU organic regulations.

Cross-Contact During Processing and Transport

Even if the source is organic, shared equipment, storage silos, or transport vehicles can lead to contamination. Suppliers without dedicated organic lines or cleaning protocols pose a serious IP breach risk.

Insufficient Lot Segregation and Traceability

Many suppliers fail to maintain lot-specific traceability, making it difficult to investigate quality issues or conduct recalls. Effective IP systems require batch coding, harvest date tracking, and full supply chain mapping.

Geopolitical and Seasonal Supply Risks

Organic wheat production is limited in certain regions, leading to reliance on a few suppliers. Seasonal variability and export restrictions can disrupt supply. Without diversified sourcing or forward contracting, companies may face shortages or quality compromises during peak demand.

Recommendations

- Require third-party organic certification (e.g., USDA, EU, or equivalent) with annual audits.

- Implement mandatory testing for mycotoxins, fat acidity, fiber content, and ash.

- Specify stabilization methods and packaging requirements to ensure shelf stability.

- Audit suppliers for dedicated organic handling and IP protocols.

- Use contracts with clear quality specifications and traceability requirements.

Avoiding these pitfalls ensures consistent quality and maintains the integrity of organic claims in the final product.

Logistics & Compliance Guide for Organic Wheat Bran

Overview of Organic Wheat Bran

Organic wheat bran is a byproduct of milling organic whole wheat grains, consisting primarily of the outer layers (bran) of the wheat kernel. As a high-fiber, nutrient-rich ingredient, it is widely used in organic food products, animal feed, and dietary supplements. Due to its organic status, strict adherence to production, handling, and transportation standards is essential to maintain certification and ensure market compliance.

Regulatory Framework and Certification Requirements

All organic wheat bran must be produced and handled in accordance with national and international organic standards. In the United States, this includes compliance with the USDA National Organic Program (NOP) under 7 CFR Part 205. In the European Union, Regulation (EU) 2018/848 applies. Key requirements include:

– Certification of farms and handling facilities by an accredited organic certifier.

– Prohibition of synthetic pesticides, fertilizers, GMOs, and irradiation.

– Implementation of an Organic System Plan (OSP) detailing production and handling practices.

– Maintenance of detailed records for traceability, including seed sources, input usage, and transaction history.

Imported organic wheat bran must meet equivalency standards or carry recognized certification (e.g., USDA NOP, EU Organic, Canada Organic).

Sourcing and Supplier Verification

Procurement of organic wheat bran must begin with vetted, certified suppliers. Buyers should:

– Request and verify current organic certification documents.

– Conduct supplier audits or request third-party audit reports (e.g., SQF, GFSI).

– Ensure suppliers comply with identity preservation (IP) protocols to prevent commingling with conventional or non-organic materials.

– Confirm use of approved cleaning and sanitation agents (e.g., non-synthetic, non-GMO).

A written Organic Integrity Agreement is recommended to formalize compliance responsibilities.

Storage and Handling Protocols

To maintain organic integrity, organic wheat bran must be stored and handled under controlled conditions:

– Use dedicated, clean storage bins or silos to prevent cross-contact with non-organic materials.

– Clearly label all containers with “ORGANIC” and include lot numbers and certification details.

– Maintain a buffer zone or physical barrier if storing near non-organic products.

– Monitor temperature and humidity to prevent spoilage, mold, or pest infestation. Ideal storage conditions: below 70°F (21°C) and relative humidity under 65%.

– Implement a first-in, first-out (FIFO) inventory system.

All handling equipment (conveyors, sifters, etc.) must be thoroughly cleaned before use with organic products.

Transportation and Shipping Compliance

Transportation of organic wheat bran must prevent contamination and commingling:

– Use dedicated organic-compliant vehicles or ensure thorough cleaning of shared transport (e.g., tanker trailers, railcars) using approved cleaning agents.

– Obtain written cleaning verification or transportation affidavits from carriers.

– Use sealed containers or bulk trailers with tamper-evident seals.

– Maintain segregation during loading, transit, and unloading.

– Temperature-controlled transport may be required in extreme climates.

Documentation such as a Bill of Lading and Organic Transport Certificate should accompany shipments.

Documentation and Traceability

Robust recordkeeping is essential for compliance and audits:

– Maintain batch-specific records including:

– Certificate of Analysis (CoA) for each lot

– Organic Transaction Certificate (OTC) for international shipments

– Bills of lading, invoices, and delivery receipts

– Cleaning logs for equipment and transport

– Inventory movement records (receiving, storage, dispatch)

– Implement a traceability system capable of tracking each lot from farm to final customer (one-up, one-down).

– Retain records for a minimum of five years, as required by most organic programs.

Pest Control and Sanitation

Pest management in organic facilities must use only NOP- or EU-approved substances:

– Prohibit synthetic pesticides; use physical traps, temperature treatment, or approved natural agents (e.g., diatomaceous earth).

– Conduct regular facility inspections and maintain pest logs.

– Sanitation must use non-GMO, non-synthetic cleaning agents (e.g., vinegar, alcohol, soap).

– Develop and document a written Integrated Pest Management (IPM) plan.

Quality Control and Testing

Regular testing ensures product safety and compliance:

– Test for mycotoxins (e.g., deoxynivalenol, aflatoxin), heavy metals, and pesticide residues.

– Conduct microbiological testing (e.g., total plate count, E. coli, Salmonella) as needed.

– Verify non-GMO status through PCR testing if required by buyer or regulation.

– Retain samples (minimum 500g) from each lot for at least one year.

Import and Export Considerations

For cross-border trade:

– Verify organic equivalency agreements between exporting and importing countries.

– Obtain required import permits and notify the relevant organic authority (e.g., USDA AMS, EU Competent Authority).

– Include accurate labeling: organic claim, certifier code, country of origin, and lot number.

– Ensure all export documentation (e.g., phytosanitary certificate, OTC) is complete and certified.

Labeling Requirements

Final packaging or bulk shipment labels must include:

– “Organic” or “100% Organic” claim per USDA or EU standards.

– Name and address of the handler or distributor.

– Certification body and code (e.g., “Certified Organic by ABC Certifiers, USDA NOP”).

– Lot number or batch identifier.

– Net weight.

– Storage instructions if applicable.

For bulk shipments, accompanying documents must contain all required labeling information.

Contingency and Non-Conformance Management

Establish procedures for handling deviations:

– Define corrective actions for contamination, mislabeling, or transport failures.

– Quarantine affected lots immediately.

– Notify certifier of any incident that may compromise organic status.

– Document root cause analysis and preventive measures.

– Recall plan must be in place for consumer-facing products.

Conclusion

Successful logistics and compliance for organic wheat bran depend on rigorous adherence to organic standards at every stage—from sourcing to delivery. Continuous training, documentation, and verification are critical to maintaining certification, ensuring product integrity, and meeting customer and regulatory expectations. Regular internal audits and third-party assessments are recommended to ensure ongoing compliance.

In conclusion, sourcing organic wheat bran requires a strategic approach that balances quality, sustainability, cost, and reliability. Partnering with certified organic suppliers ensures compliance with regulatory standards and maintains the integrity of the final product. Prioritizing transparency, traceability, and strong relationships with suppliers enhances supply chain resilience and supports long-term sourcing goals. Additionally, considering environmental impact and ethical farming practices aligns with growing consumer demand for clean, responsibly sourced ingredients. By conducting thorough due diligence and staying informed about market trends, businesses can successfully secure a consistent supply of high-quality organic wheat bran that meets both operational needs and sustainability commitments.