The global organic milk market is experiencing robust growth, driven by rising consumer awareness of health and wellness, increasing demand for sustainably produced dairy, and growing concerns over synthetic additives in conventional milk. According to a report by Grand View Research, the global organic milk market was valued at USD 19.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 8.6% from 2023 to 2030. This surge is further reinforced by shifting preferences toward clean-label products and expanding distribution channels, including e-commerce and specialty retail. As demand escalates across North America, Europe, and emerging markets in Asia-Pacific, a select group of manufacturers have emerged as leaders in production, innovation, and sustainability. Below, we spotlight the top 9 organic milk manufacturers shaping the industry, evaluated based on market presence, certifications, production scale, and consumer trust.

Top 9 Organic Milk Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Northeast Organic Dairy Producers Alliance

Domain Est. 2001

Website: nodpa.com

Key Highlights: The largest grass roots organization of organic dairy producers. The goal is to protect the integrity of the USDA Organic regulations….

#2 Our Milk Supply

Domain Est. 1995

Website: stonyfield.com

Key Highlights: We buy our organic milk from small farms rather than corporate farms with large-scale operations—we buy from farmers whom we’ve come to know and trust over the ……

#3 Dairy Farmers of America

Domain Est. 1998

Website: dfamilk.com

Key Highlights: As a farmer-owned dairy cooperative, our dairy farmers focus on making high-quality milk and we do the rest — from farm to table. See the dairy journey….

#4 Real Milk

Domain Est. 1998

Website: realmilk.com

Key Highlights: Raw Milk is Safe! real-milk-is-safe Raw Milk is Healthy! Good News for Allergies Allergies Protection from Infection protection-from-infections…

#5 The a2 Milk Company

Domain Est. 2000

#6 Organic Valley

Domain Est. 2001 | Founded: 1988

Website: organicvalley.coop

Key Highlights: Founded in 1988, Organic Valley is a cooperative of farmers producing award-winning organic milk, cheese, butter, produce, healthy snacks & more….

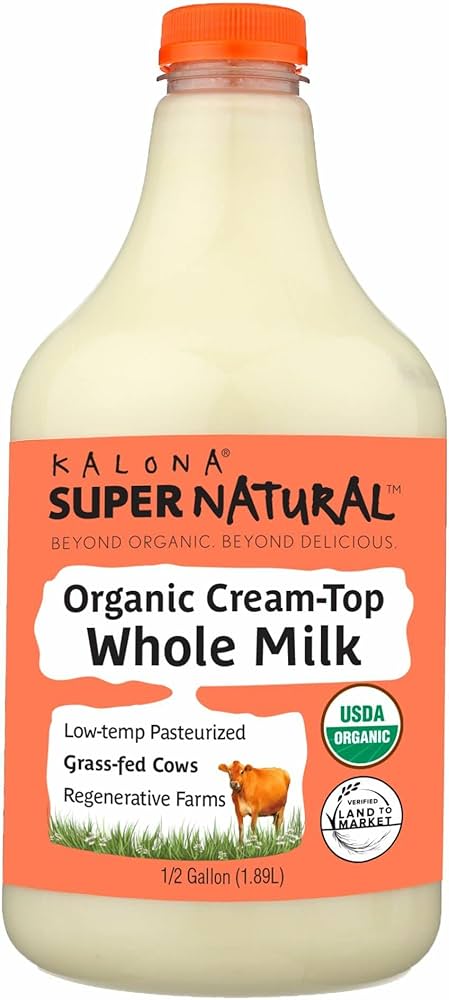

#7 Kalona SuperNatural

Domain Est. 2010

Website: kalonasupernatural.com

Key Highlights: #AlmostRaw | You’ll taste the difference. Our organic milk comes from grass-fed cows on small family farms that never use GMOs, herbicides, or pesticides. We ……

#8 ORIGIN Milk

Domain Est. 2013

Website: originmilk.com

Key Highlights: ORIGIN is the only regenerative dairy brand in America focused exclusively on superlative-quality golden milk from the famed heritage breeds….

#9 Clover Sonoma

Domain Est. 2016

Website: cloversonoma.com

Key Highlights: Clover Sonoma dairy comes from right here in California from independently-owned family farms who have been in the business for generations. From pasture raised ……

Expert Sourcing Insights for Organic Milk

H2: Projected 2026 Market Trends for Organic Milk

The organic milk market in 2026 is expected to continue its trajectory of growth, driven by evolving consumer preferences, technological advancements, and shifting regulatory landscapes. Key trends shaping the sector include:

1. Accelerated Demand Driven by Health and Sustainability Consciousness

By 2026, consumer demand for organic milk is projected to rise steadily, fueled by heightened awareness of health benefits (e.g., no synthetic hormones, antibiotics, and reduced pesticide exposure) and environmental sustainability. Younger demographics—Millennials and Gen Z—are prioritizing clean-label, ethically sourced products, directly boosting organic dairy sales. Increased scrutiny of food systems post-pandemic will further cement trust in organic certification as a marker of quality and transparency.

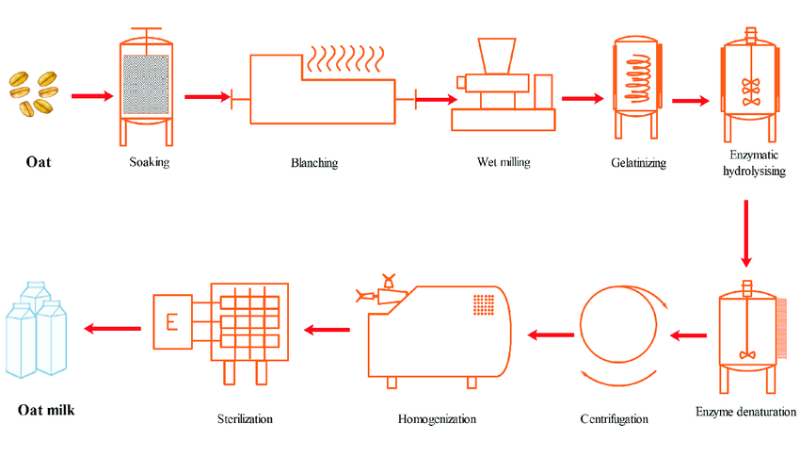

2. Expansion of Product Diversification

Organic milk brands will continue broadening their offerings beyond traditional whole and 2% milk. Anticipated 2026 innovations include enhanced shelf-life UHT (ultra-high temperature) organic milk, functional variants (e.g., fortified with omega-3s or probiotics), and organic milk-based plant-animal hybrids (e.g., blends with oats or almonds for improved taste and nutrition). These products cater to convenience, functional health, and evolving dietary flexibility.

3. Supply Chain Resilience and Regionalization

To mitigate climate and geopolitical risks, organic dairy producers are investing in localized supply chains. In 2026, expect increased emphasis on regional organic dairies serving local markets, reducing transportation emissions and enhancing freshness. Blockchain traceability tools will become more prevalent, allowing consumers to verify farm practices, feed sources, and animal welfare standards via QR codes.

4. Price Stabilization and Accessibility

Historically high price premiums for organic milk are expected to moderate by 2026 due to economies of scale, improved feed efficiency, and competitive pressure from private label organic brands in major retailers. This increased affordability will make organic milk more accessible to middle-income consumers, expanding market penetration beyond affluent urban centers.

5. Regulatory and Certification Tightening

Global regulatory bodies are anticipated to strengthen organic standards, particularly around pasture access, antibiotic use, and feed sourcing. The U.S. National Organic Program (NOP) and EU organic regulations may introduce stricter verification protocols, potentially raising compliance costs but reinforcing consumer trust. Harmonization of international standards could also facilitate cross-border trade.

6. Environmental Impact and Carbon Labeling

Sustainability reporting will become standard. By 2026, leading organic dairy brands are likely to adopt carbon footprint labeling, showcasing their lower greenhouse gas emissions compared to conventional dairy. Regenerative organic agriculture practices—such as rotational grazing and soil health enhancement—will gain traction as tools for carbon sequestration and long-term farm viability.

Conclusion

The 2026 organic milk market will be defined by innovation, transparency, and sustainability. While challenges remain—such as feed cost volatility and scalability—growing consumer demand, technological integration, and stronger environmental commitments position the sector for sustained growth. Brands that prioritize traceability, affordability, and ecological stewardship will lead the market.

Common Pitfalls in Sourcing Organic Milk: Quality and Integrity Protection (IP)

Sourcing organic milk presents unique challenges beyond conventional procurement, particularly concerning consistent quality and maintaining the integrity of the organic claim throughout the supply chain. Overlooking these pitfalls can lead to compliance failures, product recalls, reputational damage, and loss of consumer trust.

Inadequate Verification of Organic Certification and Chain of Custody

One of the most critical pitfalls is relying solely on a supplier’s claim of organic status without robust, ongoing verification. This includes failing to validate the legitimacy and current status of organic certifications (e.g., USDA NOP, EU Organic, or other regional standards) for all entities in the supply chain – farms, processors, transporters, and distributors. A lapse or fraud at any point compromises the entire batch. Furthermore, inadequate documentation of the chain of custody (from farm to final product) makes it impossible to trace the organic origin reliably, especially during audits or recalls, leaving the buyer vulnerable to accepting non-compliant milk.

Insufficient Supplier Audits and On-Farm Inspections

Relying only on paper certification without conducting regular, unannounced on-farm and facility audits is a major risk. This can allow non-compliance with organic standards to go undetected, such as the use of prohibited pesticides or synthetic fertilizers on feed crops, lack of adequate pasture access during the grazing season, improper animal health management (e.g., overuse of prohibited medications), or commingling of organic and non-organic milk or feed. Without direct observation and verification, buyers cannot ensure practices align with organic principles.

Poor Management of Cross-Contamination Risks

Maintaining physical and procedural separation between organic and non-organic milk is paramount for IP. A common pitfall is inadequate segregation in storage tanks, transportation vehicles (tankers), processing lines, and packaging equipment. Residues or carryover from non-organic milk can lead to contamination, invalidating the organic status. Sourcing from facilities that lack rigorous cleaning protocols (e.g., validated cleaning procedures between organic and non-organic runs) or use shared equipment without proper safeguards significantly increases this risk.

Inconsistent Milk Quality Due to Variable Farming Practices

Organic milk quality (e.g., fat, protein, somatic cell count, microbial load) can be more variable than conventional milk due to factors like pasture-based systems, seasonal fluctuations in forage quality, and restrictions on certain veterinary treatments. Sourcing strategies that don’t account for this inherent variability can lead to supply issues or inconsistent product performance. Failure to establish clear, mutually agreed quality specifications and robust testing protocols upon intake can result in receiving milk that doesn’t meet processing or shelf-life requirements.

Lack of Transparency and Traceability Systems

A fragmented or opaque supply chain hinders the ability to trace milk back to its source farm(s). This lack of transparency makes it difficult to verify claims, investigate quality issues or contamination events, and respond effectively to consumer inquiries or regulatory requirements. Sourcing without demanding and verifying robust traceability systems (e.g., batch tracking, farm identification) undermines both quality control and IP efforts.

Overlooking Feed Sourcing and Integrity

The organic integrity of milk starts with organic feed. A significant pitfall is not scrutinizing the sourcing and certification of the feed (forage, grain, supplements) given to the cows. This includes ensuring all feed components are certified organic, verifying the origin and chain of custody for feed ingredients, and confirming feed storage prevents contamination. Non-organic feed, even in small amounts, compromises the organic status of the milk produced.

Failure to Plan for Supply Chain Disruptions

Organic milk supply can be more vulnerable to disruptions like adverse weather impacting pasture, disease outbreaks (where treatment options are limited organically), or certification issues at a key supplier. Sourcing without contingency plans or diversified supplier bases increases the risk of shortages, potentially forcing a switch to non-organic milk and damaging brand consistency and consumer trust.

Logistics & Compliance Guide for Organic Milk

Overview of Organic Milk Standards and Regulations

Organic milk must comply with strict national and international standards to ensure authenticity, quality, and consumer trust. In the United States, the USDA National Organic Program (NOP) governs organic certification, requiring that milk comes from cows not treated with synthetic hormones or antibiotics, fed 100% certified organic feed, and given access to pasture for at least 120 days per year. Equivalent standards exist under the EU Organic Regulation (Regulation (EU) 2018/848) and other regional frameworks. Compliance begins at the farm and extends throughout the supply chain.

Farm-Level Certification and Animal Management

All dairy farms producing organic milk must be certified by an accredited agency. Certification requires detailed record-keeping on herd health, feed sourcing, pasture management, and breeding practices. Prohibited substances such as synthetic pesticides, growth hormones (e.g., rBGH), and routine antibiotics are strictly forbidden. If an animal requires antibiotic treatment, it must be removed from the organic herd permanently. Pasture access must meet minimum grazing requirements (e.g., 30% of dry matter intake from pasture during the grazing season under USDA NOP).

Organic Feed Sourcing and Storage

Organic livestock must be fed 100% certified organic feed, including forage, grains, and supplements. Feed must be sourced from certified organic suppliers and accompanied by transaction certificates (TCs) to verify organic status. Cross-contamination with conventional feed must be prevented through dedicated storage bins, transport vehicles, and handling equipment. Feed storage areas should be clean, dry, and pest-controlled, with clear labeling and inventory logs to support traceability.

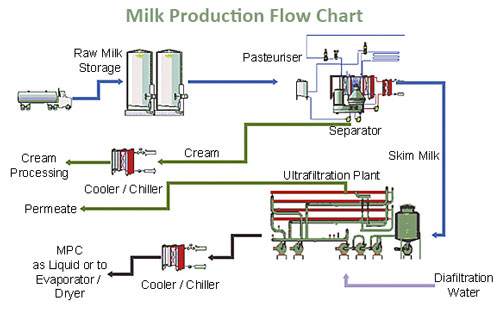

Milk Collection and Transportation

Milk must be collected using sanitized equipment dedicated to organic production or thoroughly cleaned between organic and non-organic runs. Transport vehicles must be cleaned and documented to prevent commingling with non-organic milk. Organic milk must be segregated during loading, transit, and unloading. Transport records—including vehicle cleaning logs, route details, and time/temperature data—must be maintained for audit purposes. Refrigerated transport is required to maintain milk at or below 4°C (40°F) from farm to processing facility.

Processing Facility Requirements

Processing facilities handling organic milk must also be certified organic and implement a written Organic System Plan (OSP). Organic and non-organic production lines must be physically or temporally separated, with thorough cleaning and sanitation procedures between runs. All ingredients (e.g., cultures, enzymes) must be certified organic or approved on the National List of Allowed and Prohibited Substances. Finished products must contain at least 95% organic ingredients to be labeled “organic.”

Labeling and Documentation Compliance

Organic milk packaging must comply with labeling regulations, including the USDA Organic seal (or equivalent), ingredient list, certifying agent, and percentage of organic content. Labels cannot misrepresent the product (e.g., “natural” vs. “organic”). Documentation such as batch records, organic certificates, transaction documents, and shipping logs must be retained for a minimum of five years and made available during inspections.

Traceability and Audit Preparedness

Robust traceability systems are essential to track organic milk from farm to consumer. Each batch should be assigned a unique identifier, with records linking it to the farm, transport, processing, and distribution. Internal audits should be conducted regularly to ensure compliance with organic standards. Facilities must be prepared for unannounced inspections by certifying agents or regulatory bodies, with all records organized and accessible.

Import/Export Considerations

For international trade, organic milk must meet the importing country’s organic standards. The USDA has equivalency agreements with the EU, Canada, and others, allowing mutual recognition of organic certification. Exporters must provide organic certificates, transaction documents, and customs declarations that confirm compliance. Non-equivalent markets may require additional certification or inspection upon entry.

Cold Chain Management and Shelf-Life Monitoring

Maintaining an unbroken cold chain is critical for food safety and product quality. Temperature logs must be recorded at all stages—farm, transport, processing, warehousing, and retail. Any deviation must be documented and assessed for impact. Expiry dates should be clearly marked, and inventory managed using a first-expired, first-out (FEFO) system to minimize waste and ensure freshness.

Continuous Improvement and Training

Personnel at all levels—farmers, haulers, processors, and warehouse staff—should receive regular training on organic standards, hygiene practices, and documentation requirements. Continuous improvement practices, such as updating SOPs and investing in traceability technology (e.g., blockchain or barcoding systems), help maintain compliance and build consumer confidence in organic milk products.

In conclusion, sourcing organic milk requires a strategic approach that balances quality, sustainability, compliance, and cost-effectiveness. After evaluating potential suppliers, it is essential to prioritize those that are certified organic by recognized authorities, maintain transparent supply chains, and adhere to high animal welfare and environmental standards. Building strong relationships with reliable suppliers not only ensures a consistent supply of premium organic milk but also supports long-term brand integrity and consumer trust. Additionally, considering geographic proximity, scalability, and the supplier’s commitment to innovation and sustainability can provide a competitive advantage. Ultimately, selecting the right organic milk supplier is a critical step in delivering a trustworthy, high-quality product that meets both regulatory requirements and consumer expectations in the growing organic marketplace.