The global market for specialty textiles, including organdy fabric, has experienced steady growth driven by rising demand in the fashion, home décor, and bridal industries. According to a 2023 report by Grand View Research, the global textile market was valued at USD 1.1 trillion and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. Within this segment, lightweight, sheer fabrics such as organdy—known for its crisp hand feel and translucency—have gained traction, particularly in premium apparel and ceremonial textiles. Mordor Intelligence further projects that increasing consumer preference for sustainable and high-quality natural fiber-based fabrics will continue to influence manufacturing trends. As demand rises, especially across Asia-Pacific and North America, a select group of manufacturers have emerged as leaders in producing high-grade organdy fabric, balancing innovation, scale, and consistency. Based on production capacity, global reach, and product quality, here are the top 8 organdy fabric manufacturers shaping the industry.

Top 8 Organdy Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 organdy fabric Manufacturers and Suppliers

Domain Est. 2015

Website: textileinfomedia.com

Key Highlights: Rating 4.6 (165) Best Organdy fabrics manufacturers offers latest collection of organdy fabrics. You can get the list of organdy fabrics suppliers here….

#2 Robert Kaufman Fabrics

Domain Est. 1997 | Founded: 1942

Website: robertkaufman.com

Key Highlights: Wholesale supplier of quality textiles and fabrics for quilting, fashion and manufacturing since 1942….

#3 White Cotton Organdy Fabric

Domain Est. 2000

#4 White Cotton Organdy Fabric by the Yard

Domain Est. 2001

#5 Acorn Fabrics UK

Domain Est. 2005 | Founded: 1975

Website: acornfabrics.com

Key Highlights: Acorn Fabrics have been leading suppliers of quality cotton shirt fabrics in the UK since 1975. Buy online. Worldwide delivery. Fabric samples available!…

#6 Cotton Organdy Fabric

Domain Est. 2012

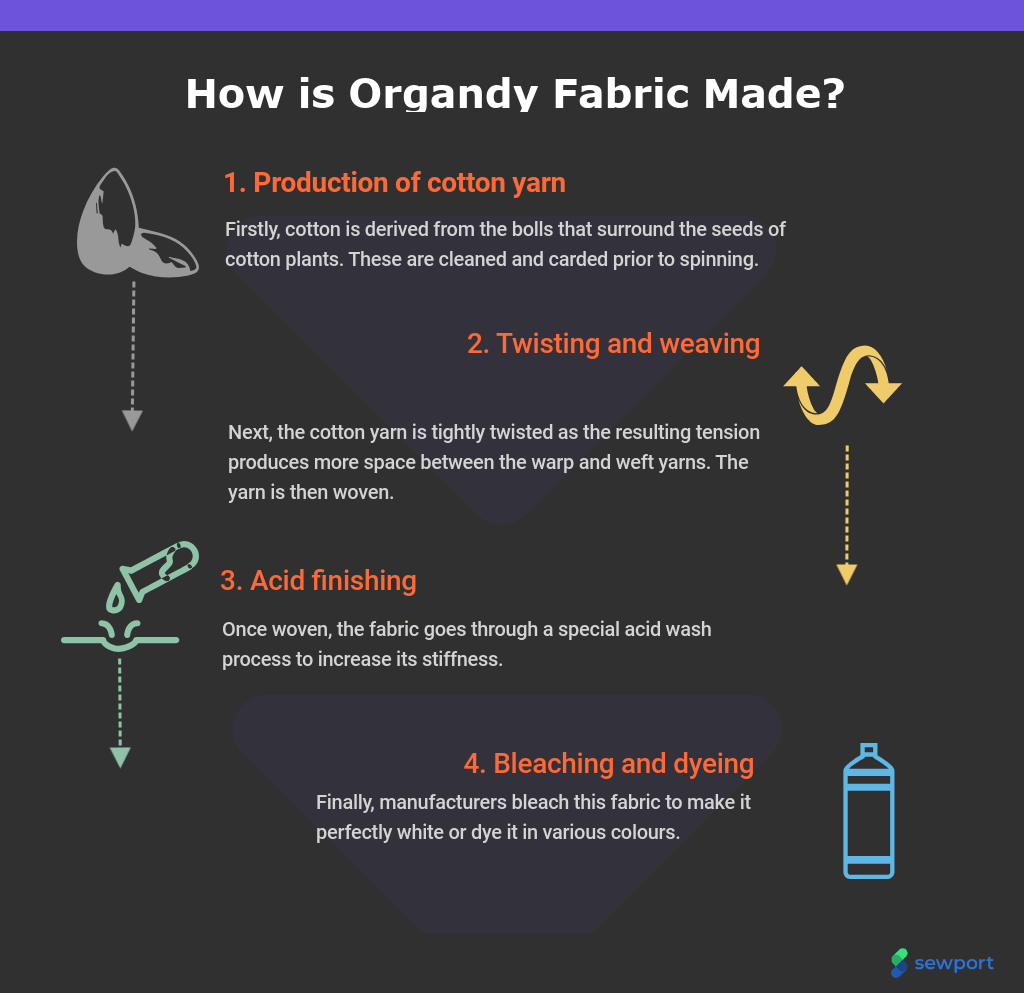

#7 What is Organdy Fabric

Domain Est. 2015

Website: sewport.com

Key Highlights: Organdy is the crispest type of cotton fabric. This textile is semi-transparent, and it is relatively delicate….

#8 Mood Fabrics

Domain Est. 2001

Website: moodfabrics.com

Key Highlights: Free delivery over $150 30-day returnsShop premium fabrics by the yard at Mood Fabrics – the go-to online store for designers and sewers. Find the best selection and shop with conf…

Expert Sourcing Insights for Organdy Fabric

2026 Market Trends for Organdy Fabric

Rising Demand in Bridal and Evening Wear

Organdy fabric is expected to maintain strong demand in the bridal and evening wear sectors through 2026. Its crisp texture, sheer finish, and ability to hold structured silhouettes make it a preferred choice for wedding gowns, veils, and formal attire. Designers continue to favor organdy for creating voluminous skirts, delicate overlays, and intricate ruffles. The ongoing popularity of romantic, vintage-inspired fashion—especially in Western and Middle Eastern markets—is projected to sustain this demand, with increased customization and luxury finishes driving growth.

Growth in Sustainable and Eco-Friendly Variants

By 2026, sustainability will play a pivotal role in the organdy fabric market. Consumers and brands are increasingly prioritizing eco-conscious materials, leading to innovations in organic cotton and recycled fiber-based organdy. Manufacturers are investing in low-impact dyeing processes and biodegradable treatments to meet environmental standards. This shift is particularly evident in Europe and North America, where regulations and consumer awareness are accelerating the adoption of green textiles. Organdy produced with sustainable methods is likely to command premium pricing and gain market share.

Expansion in Home Décor and Lifestyle Applications

Beyond apparel, organdy is gaining traction in home décor, including window treatments, lampshades, and decorative overlays. Its lightweight, translucent quality offers aesthetic appeal while allowing light diffusion, making it ideal for minimalist and Scandinavian-inspired interiors. The growing trend of blending indoor and outdoor living spaces has boosted demand for sheer, breathable fabrics like organdy in drapery and room dividers. This diversification into home textiles is expected to open new revenue streams for producers by 2026.

Regional Production Shifts and Supply Chain Optimization

Asia, particularly India and China, remains the dominant hub for organdy fabric production due to established weaving infrastructure and cost efficiency. However, by 2026, there will be a noticeable shift toward localized and nearshored manufacturing in response to supply chain disruptions and rising logistics costs. Countries like Turkey and Mexico are emerging as alternative production bases, offering faster turnaround for North American and European fashion brands. Digital textile printing integration is also enhancing customization and reducing waste, further optimizing production.

Influence of Fast Fashion and Digital Commerce

The rise of fast fashion and e-commerce platforms is reshaping organdy consumption patterns. While traditionally associated with high-end fashion, organdy is increasingly being used in affordable, trend-driven collections targeting younger demographics. Online retailers are leveraging social media and influencer marketing to promote organdy-based seasonal items, leading to shorter product life cycles. By 2026, agility in design-to-market timelines and responsive supply chains will be critical for brands to capitalize on fleeting trends.

Challenges: Competition from Synthetic Alternatives

Despite its appeal, organdy faces competition from synthetic sheer fabrics like polyester organza and nylon tulle, which offer lower cost and higher durability. These alternatives are widely used in mass-market apparel and décor, posing a challenge to traditional cotton organdy. Innovations in finishing technologies and performance enhancements—such as wrinkle resistance and moisture-wicking properties—will be necessary for organdy to maintain its competitive edge in a crowded textile market.

Conclusion

The organdy fabric market in 2026 will be shaped by a balance of tradition and innovation. While rooted in luxury and craftsmanship, its future growth hinges on sustainability, production efficiency, and diversification into new applications. Brands that adapt to evolving consumer values and leverage digital tools will be best positioned to thrive in this dynamic landscape.

Common Pitfalls When Sourcing Organdy Fabric (Quality, IP)

Sourcing organdy fabric—especially for fashion, bridal wear, or home décor—can present several challenges, particularly in ensuring consistent quality and protecting intellectual property (IP). Below are common pitfalls to watch for during the sourcing process.

Quality Inconsistencies

One of the most frequent issues when sourcing organdy fabric is variability in quality. Organdy, a crisp, sheer, plain-woven fabric typically made from tightly twisted yarns, requires precise manufacturing to maintain its signature stiffness and transparency.

- Inconsistent Sheerness and Crispness: Not all organdy fabrics are created equal. Poorly spun or inadequately twisted yarns can result in a limp or uneven texture, undermining the fabric’s intended structure.

- Shrinkage and Dye Bleeding: Low-quality organdy may shrink significantly after washing or release dyes during processing, leading to production delays or customer complaints.

- Lack of Standard Testing: Suppliers may skip or falsify quality assurance tests (e.g., shrinkage, colorfastness, tensile strength). Without third-party certification or in-house lab testing, brands risk receiving subpar material.

Counterfeit or Misrepresented Materials

Be cautious of suppliers mislabeling fabrics as “organdy” when they are actually low-grade voile or polyester blends. True organdy is traditionally made from 100% cotton, though modern versions may include silk or synthetic fibers.

- Blended Fabrics Sold as Pure Cotton: Some suppliers pass off cotton-polyester blends as cotton organdy, which affects breathability, drape, and environmental claims.

- Artificial Stiffening: Chemical finishes may be used to mimic the crisp hand of genuine organdy, but these can wash out quickly, reducing garment longevity.

Intellectual Property Risks

When sourcing custom-printed or specialty-dyed organdy, especially from overseas manufacturers, IP protection becomes critical.

- Design Theft: Sharing unique prints, embroidery patterns, or technical specifications with suppliers without legal safeguards increases the risk of design replication for third parties.

- Lack of IP Clauses in Contracts: Many sourcing agreements fail to include clauses assigning IP ownership or prohibiting unauthorized use, leaving brands vulnerable.

- Unregistered Designs: Failing to register original patterns or prints in key markets (e.g., EU, US, China) limits legal recourse in case of infringement.

Supply Chain Transparency Issues

Opaque supply chains make it difficult to verify ethical practices, material origins, or manufacturing conditions.

- Unknown Fiber Sources: Without traceability, brands cannot confirm whether the cotton used is sustainably grown or compliant with environmental regulations.

- Unethical Labor Practices: Some suppliers may subcontract work to unmonitored facilities, risking reputational damage if labor violations are exposed.

Mitigation Strategies

To avoid these pitfalls:

– Request physical swatches and lab test reports before placing bulk orders.

– Use NDAs and IP assignment agreements with suppliers, especially for custom designs.

– Audit suppliers regularly or use third-party inspection services.

– Verify certifications such as OEKO-TEX®, GOTS, or BCI for sustainable sourcing.

By proactively addressing quality and IP concerns, brands can ensure reliable organdy fabric sourcing that aligns with their standards and protects their creative assets.

Logistics & Compliance Guide for Organdy Fabric

Organdy fabric, a lightweight, sheer, and crisp cotton material often used in formal wear, curtains, and decorative applications, requires careful handling throughout the supply chain to maintain its delicate structure and meet international trade regulations. This guide outlines key logistics and compliance considerations for manufacturers, importers, and distributors.

Material Characteristics and Handling

Organdy is highly sensitive to moisture, creasing, and physical stress. Proper handling begins at the production stage:

– Store in dry, climate-controlled environments to prevent mildew and fiber degradation.

– Roll fabric with tissue paper interlining to avoid abrasion and snagging.

– Avoid folding; use cardboard tubes for rolling to prevent permanent creases.

– Handle with clean gloves to minimize oil transfer from skin.

Packaging Requirements

Proper packaging ensures the fabric arrives in pristine condition:

– Wrap rolls in waterproof, breathable polyethylene film to protect against moisture without trapping humidity.

– Seal ends with tape and label clearly with product details, batch number, and handling instructions (e.g., “Fragile,” “Do Not Fold”).

– Use sturdy outer cartons or export crates for shipping. Reinforce edges to prevent crushing during transit.

– Include desiccant packs in humid climates to control internal moisture.

Transportation and Storage

Transport organdy under controlled conditions:

– Use temperature- and humidity-controlled containers or vehicles, especially for long-distance or maritime shipping.

– Avoid exposure to direct sunlight, extreme temperatures, and high humidity.

– Stack packages vertically and limit height to prevent compression damage.

– Rotate stock using FIFO (First In, First Out) to reduce the risk of prolonged storage-related deterioration.

Regulatory Compliance

Ensure adherence to international and destination-country standards:

– Textile Labeling Laws: Comply with regulations such as the U.S. Textile Fiber Products Identification Act (TFPIA) or EU Textile Regulation (EU) No 1007/2011. Labels must accurately state fiber content (e.g., 100% Cotton Organdy), country of origin, and care instructions.

– REACH & AZO Dyes: Confirm compliance with EU REACH regulations, particularly restrictions on hazardous chemicals and banned azo dyes.

– Proposition 65 (California): Verify that organdy fabric does not contain chemicals listed under California’s Proposition 65 requiring consumer warnings.

– Customs Documentation: Provide accurate HS Code classification (typically 5208.xx for cotton fabrics), commercial invoices, packing lists, and certificates of origin. Organdy generally falls under HS Code 5208.21 or 5208.29 depending on construction and finish.

Sustainability and Environmental Standards

Increasingly important for market access and brand reputation:

– Certifications such as GOTS (Global Organic Textile Standard) may be required if marketing as organic organdy.

– Ensure dyes and finishing processes comply with Oeko-Tex Standard 100, guaranteeing low levels of harmful substances.

– Maintain documentation for sustainable sourcing and ethical manufacturing practices, especially if supplying eco-conscious markets.

Import/Export Restrictions

Check for specific country requirements:

– Some countries impose import duties or quotas on cotton textiles; verify current trade agreements.

– Phytosanitary certificates are typically not required for finished cotton fabric, but raw cotton regulations may affect upstream sourcing.

– Sanctions and restricted party screening should be conducted for all business partners.

Quality Assurance and Traceability

Implement robust QA protocols:

– Conduct pre-shipment inspections for defects, color consistency, and fabric integrity.

– Maintain batch traceability from raw material to finished product for compliance and recall readiness.

– Use QR codes or RFID tags on packaging for supply chain transparency, where applicable.

By adhering to this logistics and compliance framework, stakeholders can ensure organdy fabric is transported safely, meets all regulatory requirements, and maintains its premium quality from production to end use.

In conclusion, sourcing organdy fabric requires careful consideration of quality, supplier reliability, cost-efficiency, and sustainability. Organdy, known for its crisp texture, sheer transparency, and stiffness, is ideal for delicate garments, overlays, and decorative applications. To ensure consistent results, buyers should establish relationships with reputable suppliers—preferably those with proven experience in fine cotton or specialty fabrics—and request physical or digital samples before bulk ordering. Evaluating factors such as fiber content (100% cotton vs. synthetic blends), finishing processes, colorfastness, and certifications (e.g., OEKO-TEX or GOTS) can further support informed decision-making. Additionally, staying mindful of lead times, minimum order quantities, and ethical sourcing practices contributes to a more responsible and efficient supply chain. With the right approach, sourcing organdy fabric can successfully meet both aesthetic and functional requirements for a wide range of fashion and interior design applications.