The global optical link module market is experiencing robust expansion, driven by increasing demand for high-speed data transmission in data centers, telecommunications, and enterprise networks. According to a 2023 report by Mordor Intelligence, the market was valued at USD 10.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 13.2% from 2023 to 2028, reaching an estimated USD 23.5 billion by the end of the forecast period. This growth is fueled by the proliferation of cloud services, 5G deployment, and rising bandwidth requirements across industries. As data traffic continues to surge, optical transceivers have become critical components in enabling efficient, high-capacity connectivity. In this competitive landscape, a select group of manufacturers lead in innovation, volume, and technology adoption—setting the standard for performance and reliability. Here are the top 10 optical link module manufacturers shaping the future of optical communication.

Top 10 Optical Link Module Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fiber Optic Modules and Components

Domain Est. 1994

Website: broadcom.com

Key Highlights: Broadcom offers industrial-grade fiber optic modules and components as well as optical components for broadband networking….

#2 Flyin Group Co.,Ltd

Domain Est. 2004

Website: opticres.com

Key Highlights: Flyin Group Co.,Ltd, established in Nov, 2005, is a leading worldwide manufacturer of fiber optic components with 750 employees and 10000sqm factory….

#3 Source Photonics

Domain Est. 2007

Website: sourcephotonics.com

Key Highlights: As a leading global provider of advanced technology solutions for communications and data connectivity, we embrace the need to be nimble….

#4 Agiltron Inc.: Industry

Domain Est. 2000

Website: agiltron.com

Key Highlights: We make best-in-class optic/electro-optic products based on over 25 years of intensive R&D and rigorous engineering. We strive to provide premium product….

#5 YOFC

Domain Est. 2002

Website: en.yofc.com

Key Highlights: YOFC is the only company in the world that has independently possessed the manufacturing technology of all three mainstream preforms (PCVD, VAD and OVD), and ……

#6 Optical Transceiver Module : Products & Solutions

Domain Est. 1986

Website: nec.com

Key Highlights: NEC has been developing and manufacturing optical transceivers for more than 30 years since the dawn of the optical communications era….

#7 OZ Optics Ltd.

Domain Est. 1995 | Founded: 1985

Website: ozoptics.com

Key Highlights: Located in Canada’s capital city of Ottawa and established in 1985, OZ Optics Limited is a leading worldwide supplier of fiber optic products for existing ……

#8 US Conec

Domain Est. 1997

Website: usconec.com

Key Highlights: State-of-the-art connector with unmatched density, simple insertion/extraction, and field configurability….

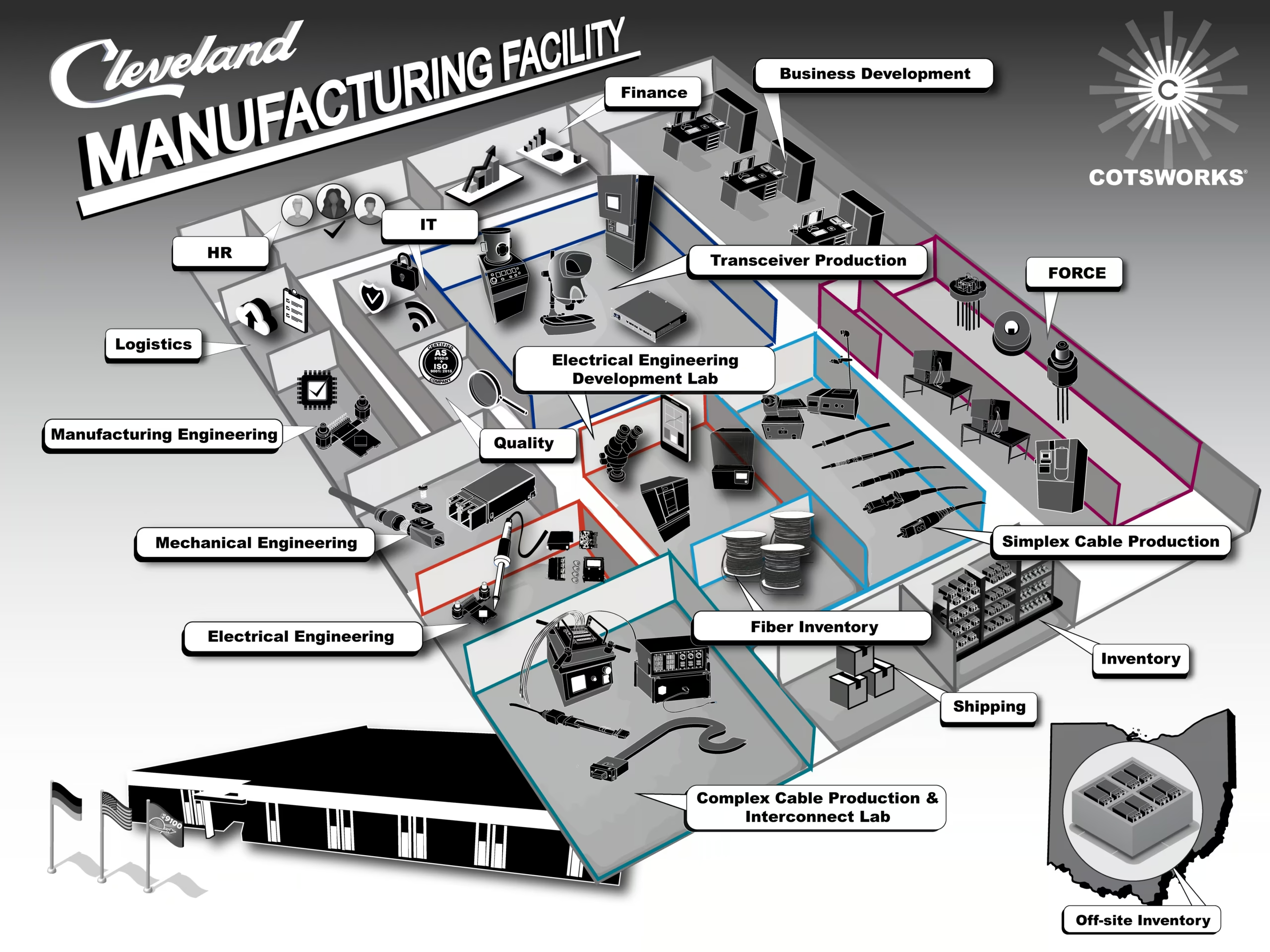

#9 COTSWORKS

Domain Est. 2005

Website: cotsworks.com

Key Highlights: COTSWORKS designs and manufactures rugged optical components and subsystems to operate in harsh environments….

#10 Page

Domain Est. 2022

Website: e-s-tel.com

Key Highlights: We deliver high-performance 100G, 400G and 800G optical transceivers optimized for data centers, metro transport and long-haul links. Our modules meet the ……

Expert Sourcing Insights for Optical Link Module

2026 Market Trends for Optical Link Modules

The optical link module market is poised for significant transformation by 2026, driven by escalating data demands, technological advancements, and evolving infrastructure needs. Several key trends are expected to shape the industry landscape in the coming years.

Surging Demand from Data Centers and AI Infrastructure

The exponential growth of cloud computing, artificial intelligence (AI), and machine learning (ML) is the primary driver of optical module adoption. Hyperscale data centers are rapidly upgrading to higher-speed interconnects to support AI workloads, which require massive bandwidth for GPU-to-GPU communication. By 2026, 800G modules are expected to dominate new deployments, with early adoption of 1.6T modules beginning in select high-performance computing (HPC) environments. Pluggable optics such as QSFP-DD and OSFP form factors will be critical in enabling flexible, scalable architectures.

Co-Packaged Optics (CPO) and Advanced Integration

As power efficiency and density become paramount, the industry is shifting toward co-packaged optics (CPO) and other integrated photonics solutions. CPO moves optical engines closer to the switch ASIC, reducing power consumption and electrical losses associated with traditional pluggable modules. By 2026, CPO is expected to gain traction in next-generation data center switches, particularly for 51.2 Tbps and higher systems. While pluggable modules will remain dominant due to their flexibility, CPO will emerge as a strategic solution for specific high-density applications.

Expansion Beyond Data Centers: Telecom and 5G/6G

The rollout of 5G and the early development of 6G networks are increasing demand for optical modules in telecom infrastructure. Fronthaul, midhaul, and backhaul networks require high-speed, cost-effective optical links to connect base stations and core networks. By 2026, 400G ZR and ZR+ coherent modules will be widely deployed in metro and edge networks, enabling efficient long-haul transmission over existing fiber. Additionally, passive optical networks (PON) will continue to drive volume in access networks, with advancements toward 25G and 50G PON.

Material and Technology Innovations

Silicon photonics (SiPh) is becoming increasingly prevalent as a cost-effective and scalable platform for optical modules. By 2026, SiPh-based transceivers are expected to capture a growing market share, especially in mid-to-high-speed applications. Concurrently, advancements in indium phosphide (InP) and lithium niobate (LiNbO₃) modulators are enabling higher performance in coherent systems. The integration of electronic and photonic components through advanced packaging (e.g., 2.5D/3D integration) will further enhance module performance and reduce footprint.

Sustainability and Energy Efficiency

Energy efficiency is a critical competitive factor. With data centers accounting for a growing share of global electricity use, there is strong pressure to reduce power per bit. Optical modules are expected to achieve sub-10 pJ/bit efficiency by 2026, driven by innovations in laser design, modulation schemes (e.g., PAM4, coherent DSP), and thermal management. Vendors will increasingly highlight sustainability metrics as part of their product roadmaps.

Supply Chain Resilience and Regionalization

Geopolitical dynamics and supply chain disruptions have prompted a reevaluation of manufacturing and sourcing strategies. By 2026, there will be greater regional diversification in optical module production, with increased investments in North America and Europe to complement existing Asian manufacturing hubs. Vertical integration and strategic partnerships between component suppliers, module makers, and system vendors will strengthen supply chain resilience.

In conclusion, the 2026 optical link module market will be defined by higher speeds, greater integration, and smarter, more efficient designs. While data centers remain the core growth engine, expanding applications in telecom and enterprise networks will broaden the market. Success will depend on innovation, scalability, and the ability to meet evolving performance and sustainability demands.

Common Pitfalls Sourcing Optical Link Modules: Quality and Intellectual Property Risks

Sourcing Optical Link Modules (such as transceivers, transponders, or active optical cables) involves navigating complex supply chains where quality inconsistencies and intellectual property (IP) concerns can significantly impact performance, reliability, and legal compliance. Being aware of these common pitfalls is critical for procurement teams, system integrators, and network operators.

Quality Inconsistencies and Counterfeit Components

One of the most prevalent risks when sourcing optical modules is receiving products that fail to meet advertised specifications or are outright counterfeit. This often stems from opaque supply chains, especially when dealing with third-party or “compatible” modules.

- Performance Variability: Modules may claim compliance with standards (e.g., IEEE, MSA), but actual performance—such as optical power, signal integrity, or temperature tolerance—may fall short, leading to network instability or increased bit error rates.

- Use of Recycled or Refurbished Parts: Some suppliers may repackage used or salvaged components, which degrade faster and have shorter lifespans than genuine new modules.

- Lack of Rigorous Testing: Reputable manufacturers conduct extensive burn-in and environmental testing. Inferior suppliers may skip these steps, increasing the risk of early field failures.

- Firmware Incompatibility: Poorly coded firmware in third-party modules can cause issues with host equipment, including compatibility errors, false diagnostics, or unexpected shutdowns.

Intellectual Property (IP) and Compliance Violations

Optical modules often incorporate proprietary technologies protected by patents, trademarks, and firmware. Sourcing from unverified vendors increases the risk of IP infringement, which can lead to legal action or supply chain disruptions.

- Unauthorized Cloning or Reverse Engineering: Some manufacturers produce “compatible” modules by reverse-engineering original equipment manufacturer (OEM) designs, potentially violating patents related to optical design, control circuitry, or firmware algorithms.

- Firmware Lockouts and Legal Action: Major OEMs (e.g., Cisco, Juniper, Arista) actively protect their IP through digital authentication (e.g., DOM, firmware checks). Using non-compliant modules can trigger warnings, disable ports, or expose buyers to legal liability if the modules violate licensing agreements.

- Trademark Infringement: Mislabeling or using OEM branding—even inadvertently—can result in trademark violations, leading to shipment seizures or legal penalties.

- Lack of Licensing Agreements: Legitimate third-party vendors often license key technologies or comply with Multi-Source Agreements (MSAs). Sourcing from vendors without proper licensing increases exposure to IP disputes.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Source from reputable, certified suppliers with transparent supply chains.

– Require test reports, compliance certificates (e.g., RoHS, REACH), and warranty terms.

– Audit firmware and perform interoperability testing with host systems.

– Consult legal counsel when procuring third-party modules to assess IP risks.

– Prefer vendors who openly comply with industry MSAs and avoid those making dubious compatibility claims.

By addressing quality and IP concerns proactively, buyers can ensure reliable network performance while minimizing legal and operational risks.

Logistics & Compliance Guide for Optical Link Module

This guide outlines the key logistics and compliance considerations for the safe, legal, and efficient handling, transportation, storage, and use of Optical Link Modules. Adherence to these guidelines ensures product integrity, regulatory compliance, and personnel safety.

Regulatory Compliance

Optical Link Modules are subject to various international, national, and industry-specific regulations. Compliance is mandatory for legal market access and safe operation.

Laser Safety (IEC 60825-1 / FDA 21 CFR 1040.10)

- Optical Link Modules emit laser radiation and must comply with laser safety standards such as IEC 60825-1 (international) or FDA 21 CFR 1040.10 (USA).

- Devices must be classified (typically Class 1 or Class 1M for compliant systems) based on output power and accessibility.

- Appropriate warning labels must be affixed to modules and equipment housing them.

- End-user documentation must include laser safety information and precautions.

Electromagnetic Compatibility (EMC)

- Modules must comply with EMC standards such as:

- CISPR 32 (emissions)

- IEC 61000-4-X series (immunity)

- Compliance ensures the module does not interfere with other equipment and is immune to common electromagnetic disturbances.

RoHS and REACH Compliance

- All materials must comply with:

- RoHS (Restriction of Hazardous Substances): Limits on lead, mercury, cadmium, etc.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Requires disclosure and restriction of certain substances.

- Suppliers must provide material declarations (e.g., IPC-1752) to confirm compliance.

Product Certification and Marking

- Required certifications may include:

- CE Marking (for European Economic Area)

- FCC Declaration of Conformity (for USA)

- UKCA Marking (for UK)

- Certifications must be obtained and maintained through accredited testing laboratories.

Packaging and Handling

Proper packaging and handling are critical to prevent electrostatic discharge (ESD) damage, physical shock, and contamination.

ESD Protection

- Optical Link Modules are sensitive to electrostatic discharge.

- Use ESD-safe packaging (e.g., conductive foam, metallized shielding bags).

- Handle modules only at ESD-protected workstations using grounded wrist straps and mats.

- Avoid contact with pins and optical ports.

Protective Packaging

- Use sealed, antistatic bags with desiccant for moisture protection.

- Include cushioning material (e.g., foam inserts) within shipping containers to absorb shock.

- Clearly label packages with “Fragile,” “ESD Sensitive,” and “Do Not Bend” warnings.

Labeling Requirements

- Each module must have a permanent label including:

- Manufacturer name and part number

- Serial number (if applicable)

- Laser classification

- Date of manufacture

- Compliance marks (e.g., CE, FCC)

Storage Conditions

Improper storage can degrade performance or cause permanent damage.

Environmental Conditions

- Temperature: Store between -10°C to +45°C (14°F to 113°F)

- Humidity: Maintain relative humidity below 60%, non-condensing

- Avoid exposure to direct sunlight, dust, and corrosive gases.

Shelf Life

- Follow manufacturer-recommended shelf life (typically 12 months from date of manufacture).

- Modules beyond shelf life may require functional retesting before deployment.

Transportation

Transport logistics must ensure product safety and regulatory adherence.

Domestic and International Shipping

- Comply with IATA, IMDG, or ADR regulations as applicable.

- Although Optical Link Modules are generally not classified as hazardous goods, verify with regulations if batteries or other components are included.

- Use UN-certified packaging if required.

Cold Chain Considerations

- Avoid freezing during transit; use insulated packaging in extreme climates.

- Include temperature monitoring devices for high-value or sensitive shipments.

Documentation

- Include commercial invoice, packing list, and certificates of compliance (RoHS, REACH, etc.).

- For export: ensure proper HS code classification (e.g., 8517.70 for optical communication modules) and obtain export licenses if required.

Import and Customs Clearance

Ensure smooth customs processing by providing accurate and complete documentation.

Required Documentation

- Bill of Lading / Air Waybill

- Commercial Invoice with detailed product description and value

- Packing List

- Certificates of Compliance (CE, FCC, RoHS, etc.)

- Import licenses (if applicable)

Duty and Tariff Classification

- Use correct Harmonized System (HS) code for optical transceivers/modules (e.g., 8517.70.00 in many jurisdictions).

- Leverage free trade agreements (e.g., USMCA, EU-Japan EPA) where applicable to reduce duties.

Country-Specific Requirements

- USA: FCC certification required; ensure importers register with the U.S. FDA for laser products.

- EU: CE marking and EU Declaration of Conformity required; appoint an Authorized Representative if manufacturer is outside the EU.

- China: Requires CCC certification for certain networking equipment; check MIIT regulations.

- India: BIS certification may be required; check Electronics & IT Ministry guidelines.

End-of-Life and Recycling

Environmental responsibility is a key compliance requirement.

WEEE Compliance (EU)

- Optical Link Modules fall under Waste Electrical and Electronic Equipment (WEEE) Directive.

- Provide take-back programs or partner with certified e-waste recyclers.

- Label products with the “crossed-out wheeled bin” symbol.

Recycling Instructions

- Clearly communicate recycling procedures to customers.

- Partner with certified recyclers who follow R2 or e-Stewards standards.

Note: Always refer to the manufacturer’s datasheet, compliance declarations, and local regulations for the most accurate and up-to-date information. Regulatory requirements may vary by country and product variant.

Conclusion for Sourcing Optical Link Modules

In conclusion, sourcing optical link modules requires a comprehensive evaluation of technical specifications, supplier reliability, cost-effectiveness, and long-term compatibility with existing network infrastructure. The selection process should prioritize performance parameters such as data rate, transmission distance, wavelength, and power consumption to ensure seamless integration and optimal network efficiency. Additionally, choosing reputable suppliers that adhere to industry standards (e.g., IEEE, MSA) and provide adequate support, warranty, and scalability options is critical for maintaining network reliability and minimizing downtime.

By balancing upfront costs with total cost of ownership—including maintenance, energy usage, and future upgradeability—organizations can make informed procurement decisions that support both current needs and future growth. Ultimately, a strategic sourcing approach to optical link modules enhances network performance, ensures interoperability, and contributes to a resilient, high-speed communication infrastructure.