The global optical IC market is experiencing robust expansion, driven by escalating demand for high-speed data transmission in data centers, telecommunications, and enterprise networks. According to a 2023 report by Mordor Intelligence, the optical transceiver market—central to optical IC applications—is projected to grow at a CAGR of over 13.5% from 2023 to 2028, reaching a valuation of USD 26.8 billion by the end of the forecast period. This growth is fueled by the proliferation of cloud computing, 5G deployments, and the increasing adoption of AI and machine learning workloads that necessitate faster, more efficient interconnectivity solutions. Grand View Research further underscores this trajectory, noting that advancements in silicon photonics and the integration of optical components into ICs are key enablers of next-generation optical networks. As bandwidth requirements surge, leading semiconductor and photonics companies are racing to innovate, positioning optical ICs as critical enablers in the evolution of modern communication infrastructure. In this dynamic landscape, the following ten manufacturers stand out for their technological leadership, product breadth, and market influence.

Top 10 Optical Ic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ZEISS United States

Domain Est. 1995

Website: zeiss.com

Key Highlights: Renowned worldwide, ZEISS is a leading manufacturer of eyeglass lenses, camera and cine lenses, and binoculars. Many ZEISS offices in the United States operate ……

#2 Corning Optical Communications

Domain Est. 1991

Website: corning.com

Key Highlights: We deliver optical connectivity solutions for every segment of the network, including carriers, data centers, in-building networks, and original equipment ……

#3 ASML

Domain Est. 1994

Website: asml.com

Key Highlights: ASML gives the world’s leading chipmakers the power to mass produce patterns on silicon, helping to make computer chips smaller, faster and greener….

#4 PHIX Photonics Assembly

Domain Est. 1995

Website: phix.com

Key Highlights: PHIX provides an assembly and packaging service for photonic integrated circuits (PICs). We support chip prototypes as well as high-volume manufacturing….

#5 IC Optical Systems

Domain Est. 2000

Website: icopticalsystems.com

Key Highlights: ICOS manufactures special-purpose state-of-the-art Fabry-Perot interferometers, ET Series etalons and CS100 Controllers and precision optical systems….

#6 Syntec Optics

Domain Est. 2006

Website: syntecoptics.com

Key Highlights: Syntec Optics offers plastic and glass molding, diamond turning, precision machining, assembly, and coating services for optics and photonics….

#7 VLC Photonics

Domain Est. 2010

Website: vlcphotonics.com

Key Highlights: At VLC Photonics we specialize in pure-play photonic design and testing services. Welcome to our home….

#8 Lightmatter®

Domain Est. 2012

Website: lightmatter.co

Key Highlights: Rethinking the limits of AI, Lightmatter merges photonics and computing to build a future where speed, efficiency, and intelligence converge….

#9 SCINTIL Photonics

Domain Est. 2018

Website: scintil-photonics.com

Key Highlights: SCINTIL Photonics is a fabless company developing and commercializing silicon photonics with integrated lasers for the AI datacenters….

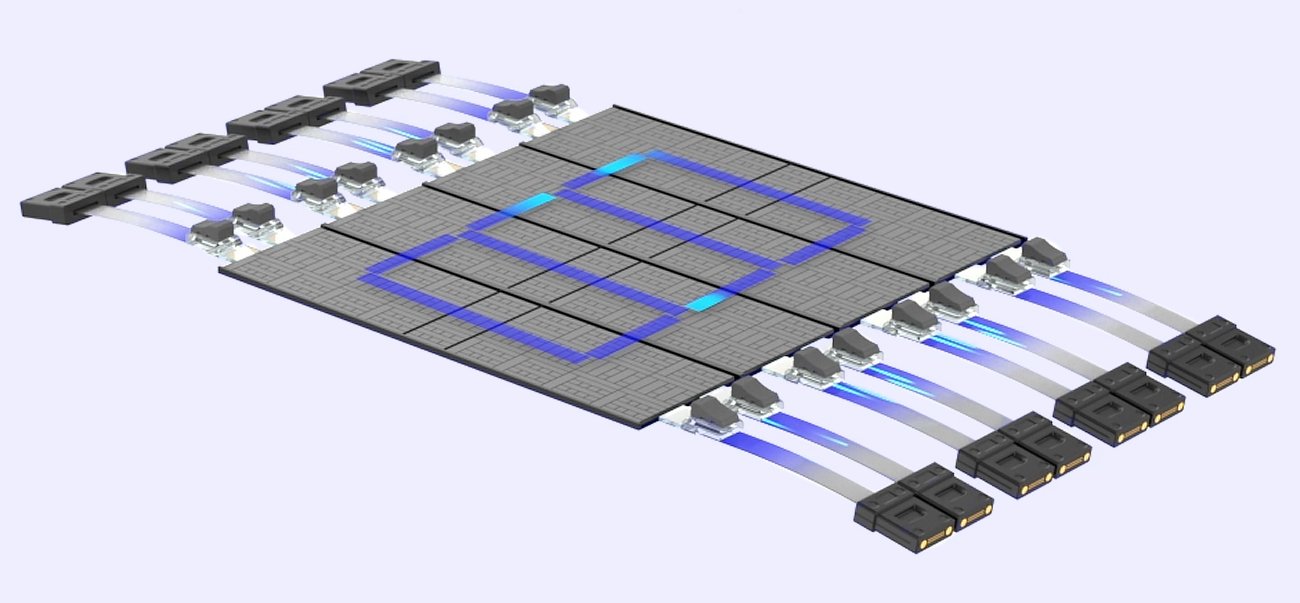

#10 NewPhotonics optical IC chips for the AI scale data center

Domain Est. 2019

Website: newphotonics.com

Key Highlights: NewPhotonics designs highly integrated photonic IC chips with optical signal processing for pluggables and co-packaged optics in AI scale data centers….

Expert Sourcing Insights for Optical Ic

H2 2026 Market Trends for Optical ICs: Accelerating the Data Revolution

The second half of 2026 is poised to be a pivotal period for the Optical Integrated Circuit (Optical IC or PIC – Photonic Integrated Circuit) market, driven by insatiable data demands, technological maturation, and strategic industry shifts. Here’s a breakdown of the key H2 2026 trends:

-

Data Center Interconnect (DCI) & AI/ML Workloads Dominate Demand:

- AI/ML Cluster Scaling: The explosive growth of large-scale AI/ML training clusters (thousands of GPUs/TPUs) will push the boundaries of traditional copper interconnects. H2 2026 will see accelerated adoption of co-packaged optics (CPO) and near-packaged optics (NPO) solutions integrating Optical ICs directly with AI/ML ASICs and switches. This is essential to overcome power, density, and bandwidth bottlenecks within racks and between racks.

- 800G & 1.6T Migration: Deployment of 800G transceivers (using 4x200G or 8x100G per lane PICs) will become mainstream in hyperscale data centers. Crucially, H2 2026 will mark the critical ramp-up of 1.6T transceivers (leveraging 8x200G or 4x400G PICs) for intra-data-center and DCI links, driven by AI cluster backplanes and core networking upgrades. This will be a major volume driver for advanced PICs.

- Increased Integration: Demand will shift from discrete transceiver modules towards higher levels of integration (e.g., multi-channel drivers, TIAs, lasers integrated with the PIC) to reduce power and footprint, particularly for CPO/NPO.

-

Silicon Photonics (SiPh) Solidifies Leadership, but InP Advances:

- SiPh Dominance: Silicon Photonics will remain the dominant platform, especially for datacom (800G/1.6T transceivers, CPO/NPO). H2 2026 will see maturation of high-volume manufacturing (HVM) on established 300mm CMOS lines, driving down costs and improving yield. Expect wider adoption beyond hyperscalers into enterprise and telecom.

- InP for Performance-Critical Apps: Indium Phosphide (InP) PICs will maintain critical importance for applications requiring higher output power, superior linearity, and native light emission. H2 2026 will see growth in InP PICs for:

- Long-Haul & Coherent Access: Higher baud rates (e.g., 130+ GBaud) and advanced modulation formats for longer reach (>100km) in metro and access networks.

- LiDAR & Sensing: Integration for automotive and industrial 3D sensing.

- Quantum Computing: As quantum systems scale, InP-based PICs for control and readout will see increased R&D and early commercial traction.

- Heterogeneous Integration Gains Traction: The integration of InP gain elements (lasers, amplifiers) onto SiPh platforms will move beyond R&D into early commercial production, enabling best-of-both-worlds solutions (CMOS cost/scalability + InP performance).

-

Co-Packaged Optics (CPO) & Near-Packaged Optics (NPO) Enter Commercial Reality:

- H2 2026 Milestone: This period is expected to see the first significant commercial deployments of CPO solutions in high-end AI/ML clusters and next-generation switches. While still facing yield and thermal challenges, the performance/power benefits will outweigh the complexities for leading adopters.

- NPO as a Stepping Stone: NPO, offering many benefits of CPO with lower integration risk, will see wider deployment in H2 2026, acting as a bridge technology for customers hesitant about full CPO.

- Standardization Focus: Industry consortia (like COBO, OIF) will intensify efforts on CPO/NPO standards (mechanical, electrical, thermal, management), crucial for ecosystem development and multi-sourcing.

-

Expansion Beyond Data Centers: Telecom & Sensing Accelerate:

- 5G/6G Fronthaul & Midhaul: Deployment of denser 5G networks and early 6G trials will drive demand for low-power, high-bandwidth optical modules using PICs for fronthaul (e.g., CPRI/eCPRI) and midhaul connections.

- Coherent PON (C-PON) & 25G/50G PON: As access networks evolve beyond 10G, PICs will enable cost-effective, high-performance coherent and high-speed PON solutions for fiber-to-the-home (FTTH) upgrades in H2 2026.

- Integrated Sensing PICs: Growth in automotive LiDAR (especially for L3+ autonomy), medical diagnostics (e.g., lab-on-a-chip), and industrial process monitoring will fuel demand for application-specific PICs integrating sources, detectors, and signal processing.

-

Supply Chain & Manufacturing Evolution:

- Foundry Model Expansion: Pure-play PIC foundries (e.g., GlobalFoundries, Tower Semiconductor, IMEC) will see increased utilization and revenue as fabless PIC design houses and integrated device manufacturers (IDMs) leverage their capacity for HVM. Multi-project wafer (MPW) runs will remain vital for prototyping.

- Packaging Dominates Cost & Challenge: The cost and complexity of advanced packaging (e.g., flip-chip bonding, micro-bumps, thermal management for CPO) will become an even larger portion of the total module cost. Innovation in automated active alignment and hybrid bonding will be critical.

- Material & Process Innovation: Continued R&D on alternative materials (e.g., Lithium Niobate on Insulator – LNOI for ultra-high-speed modulators) and processes (e.g., 3D integration) will progress, potentially setting the stage for the next wave of innovation post-2026.

-

Consolidation and Ecosystem Maturation:

- Market Consolidation: The competitive landscape may see further consolidation as companies seek scale, broader portfolios (e.g., combining PIC design with electronic ICs, packaging, or full modules), and access to manufacturing capacity.

- Design Automation (EDA) Maturity: EDA tools for PIC design, simulation, and verification will become more sophisticated and integrated with electronic design flows, reducing design cycles and improving first-pass success, especially for complex CPO/NPO designs.

Conclusion for H2 2026:

The Optical IC market in H2 2026 will be characterized by acceleration and commercialization. Driven overwhelmingly by the data center boom, particularly AI/ML, the market will see the critical ramp of 1.6T transceivers and the first meaningful deployment of CPO/NPO solutions. Silicon Photonics will solidify its lead in volume applications, while InP and heterogeneous integration address performance-critical niches. The expansion into telecom access and sensing will broaden the market base. Success will hinge on overcoming packaging and thermal challenges, scaling manufacturing efficiently, and continued innovation in integration and design tools. H2 2026 will be less about pure research and more about proving the viability and scalability of next-generation optical interconnects at volume.

Common Pitfalls in Sourcing Optical ICs: Quality and Intellectual Property Risks

Sourcing optical integrated circuits (ICs) presents unique challenges due to the complexity of photonics technology and tight integration with electronic components. Two critical areas where companies often encounter pitfalls are quality assurance and intellectual property (IP) protection.

Quality-Related Pitfalls

-

Inadequate Testing and Characterization

Optical ICs require rigorous optical and electrical testing under real-world conditions (e.g., temperature, humidity, signal integrity). Many suppliers, especially smaller or offshore foundries, may lack the specialized test equipment or standardized processes to fully characterize performance, leading to inconsistent yields or field failures. -

Lack of Process Control and Traceability

Inconsistent fabrication processes—especially in hybrid integration (e.g., combining silicon photonics with III-V materials)—can result in significant device-to-device variation. Poor traceability makes it difficult to isolate defects or conduct root-cause analysis when failures occur. -

Counterfeit or Recycled Components

The high cost and long lead times of optical ICs make them targets for counterfeiting. Using recycled or remarked components can lead to premature failures, unreliable performance, and compliance issues in safety-critical applications like medical or aerospace systems. -

Insufficient Qualification for Target Environment

Optical ICs used in harsh environments (e.g., automotive, industrial, or aerospace) must undergo qualification testing (e.g., AEC-Q102 for automotive). Sourcing parts without proper qualification increases the risk of in-field degradation or failure. -

Hidden Defects Due to Packaging Complexity

The packaging of optical ICs (e.g., fiber alignment, hermetic sealing) is often as critical as the die itself. Poor packaging can introduce stress, misalignment, or contamination that degrades optical performance over time—defects not always detectable during initial inspection.

Intellectual Property (IP)-Related Pitfalls

-

Unclear IP Ownership and Licensing

Many optical ICs incorporate third-party IP (e.g., modulator designs, driver circuits, or process technology). Sourcing from vendors without clear IP licensing agreements can expose buyers to infringement risks, especially in export-controlled or highly competitive markets. -

Reverse Engineering and Design Cloning

Foundries or subcontractors in certain regions may lack strong IP protections, increasing the risk that proprietary designs are copied or shared without authorization. This is particularly concerning when using offshore manufacturing partners. -

Lack of Design Secrecy Agreements

Failing to establish strong NDAs and secure design transfer protocols can lead to unintentional IP leaks. Optical IC designs often involve sensitive performance trade-offs and layout optimizations that competitors could exploit. -

Dependency on Proprietary Process Technology

Some optical ICs rely on proprietary fabrication processes (e.g., specific silicon photonics platforms). Sourcing from a single supplier with exclusive access to such technology can create long-term IP and supply chain lock-in, limiting flexibility and increasing costs. -

Inadequate Protection in Joint Development Agreements

Collaborative development with vendors can blur IP ownership lines. Without precise contractual terms, companies may lose rights to improvements or derivative designs, undermining competitive advantage.

Mitigating these pitfalls requires thorough due diligence, strong vendor qualification processes, robust legal agreements, and investment in supply chain transparency—especially for mission-critical or high-volume optical IC applications.

Logistics & Compliance Guide for Optical IC

This guide outlines the essential logistics and compliance considerations for handling, transporting, and managing Optical Integrated Circuits (Optical ICs) in accordance with international regulations, industry standards, and best practices.

Overview of Optical ICs

Optical Integrated Circuits (Optical ICs) are semiconductor devices that integrate photonic components for the generation, modulation, detection, and routing of light signals. Commonly used in telecommunications, data centers, and sensing applications, these components require specialized handling due to their sensitivity and regulatory classifications.

Regulatory Classifications

Export Control Regulations

Optical ICs may be subject to export control regulations due to their potential dual-use (civilian and military) applications. Key regulatory frameworks include:

- EAR (Export Administration Regulations) – Administered by the U.S. Department of Commerce, Bureau of Industry and Security (BIS).

- ITAR (International Traffic in Arms Regulations) – Applies if the Optical ICs are designed for defense applications.

- Wassenaar Arrangement – Multilateral export control regime that includes controls on photonics and laser-related technologies.

Ensure proper classification using the ECCN (Export Control Classification Number). Common ECCNs for Optical ICs include 3A001 (lasers and related equipment) or 5A001 (telecommunications equipment), depending on performance specifications.

REACH and RoHS Compliance

Optical ICs must comply with environmental and chemical regulations:

- RoHS (Restriction of Hazardous Substances) – Limits use of lead, mercury, cadmium, and other hazardous materials in electronic components.

- REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) – Applies to substances used in manufacturing, particularly within the EU.

Manufacturers and importers must provide compliance documentation, including Declarations of Conformity (DoC).

Packaging and Handling Requirements

ESD (Electrostatic Discharge) Protection

Optical ICs are highly sensitive to electrostatic discharge. Use:

- Conductive or static-dissipative packaging (e.g., metalized shielding bags).

- ESD-safe handling tools and workstations.

- Personnel grounding via wrist straps and ESD footwear.

Environmental Protection

- Store and transport in dry, temperature-controlled environments (typically 15–30°C, 30–60% RH).

- Avoid exposure to moisture using moisture barrier bags (MBBs) with desiccants and humidity indicator cards.

- Follow JEDEC standards (e.g., J-STD-033) for moisture sensitivity levels (MSL).

Transportation and Shipping

Domestic and International Shipping

- Label packages clearly with component name, part number, and handling instructions (e.g., “Fragile,” “ESD Sensitive”).

- Use UN-certified packaging if shipping under hazardous materials regulations (rare for Optical ICs unless laser-powered).

- For air freight, comply with IATA Dangerous Goods Regulations (check for laser classifications).

Customs Documentation

Prepare accurate documentation for customs clearance:

- Commercial invoice with detailed technical specifications.

- Packing list.

- Certificate of Origin.

- ECCN and license information (if required).

- RoHS/REACH compliance statement.

Storage and Inventory Management

- Store in a clean, climate-controlled warehouse.

- Implement FIFO (First-In, First-Out) inventory rotation.

- Monitor shelf life; some Optical ICs have limited storage durations before bake-out or reconditioning is required.

- Use barcode or RFID tracking for traceability and compliance auditing.

Quality and Traceability

- Maintain full lot/batch traceability from manufacturer to end-user.

- Keep records of testing, calibration, and handling procedures.

- Comply with ISO 9001 (quality management) and ISO 13485 (if used in medical devices).

End-of-Life and Disposal

Dispose of non-conforming or obsolete Optical ICs in accordance with:

- WEEE (Waste Electrical and Electronic Equipment) Directive (EU).

- Local e-waste regulations.

- Manufacturer’s take-back programs.

Ensure data security if components contain embedded firmware or memory.

Summary

Proper logistics and compliance management for Optical ICs requires attention to export controls, environmental regulations, ESD protection, and documentation. Adhering to this guide ensures legal compliance, product integrity, and operational efficiency across the supply chain.

Conclusion on Sourcing Optical ICs

Sourcing optical ICs (Integrated Circuits) requires a strategic approach due to their specialized nature and critical role in high-speed communication, data centers, telecommunications, and optical sensing applications. A successful sourcing strategy hinges on understanding technical specifications, supply chain reliability, manufacturer reputation, and compliance with industry standards.

Key considerations include selecting components with the appropriate performance characteristics—such as data rate, power consumption, and compatibility with optical interfaces (e.g., PON, Coherent optics, or Silicon Photonics). Engaging with reputable suppliers and original component manufacturers (OCMs) like Broadcom, Intel (formerly Acacia), Marvell, or Inphi helps ensure authenticity, quality, and long-term availability.

Due to market volatility and potential supply constraints, especially in advanced nodes or high-demand sectors, building relationships with multiple distributors and monitoring lead times are essential. Additionally, evaluating newer technologies and alternative components can mitigate risks and support innovation.

In conclusion, effective sourcing of optical ICs combines technical diligence, supply chain awareness, and proactive vendor management. By prioritizing quality, availability, and future scalability, organizations can ensure reliable integration of optical ICs into next-generation optical systems and maintain a competitive edge in high-performance applications.