The global fiber laser marking machine market is experiencing robust expansion, driven by rising demand for high-precision, permanent marking solutions across industries such as automotive, electronics, medical devices, and aerospace. According to a 2023 report by Mordor Intelligence, the market was valued at USD 850 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2028, reaching an estimated USD 1.67 billion by the end of the forecast period. This growth is fueled by the increasing adoption of Industry 4.0 technologies, automation advancements, and the need for traceability in manufacturing processes. Fiber laser systems, known for their durability, low maintenance, and exceptional performance on metals and engineering plastics, have become the preferred choice over traditional marking methods. As demand intensifies, several manufacturers have emerged as leaders, combining innovation, reliability, and scalability to serve a global clientele. The following list highlights the top nine optical fiber laser marking machine manufacturers shaping the future of industrial identification and traceability.

Top 9 Optical Fiber Laser Marking Machine Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Focus on laser

Website: hanslaser.net

Key Highlights: 2. The fiber optic laser oscillator marker has advantage of high beam quality and high reliability. It is suitable for processing fields that need high marking ……

#2 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#3 Laser Marking for All Industries

Website: lasermarktech.com

Key Highlights: Discover innovative laser marking solutions tailored for various industries. Explore our cutting-edge technology as leaders in laser marking and engraving….

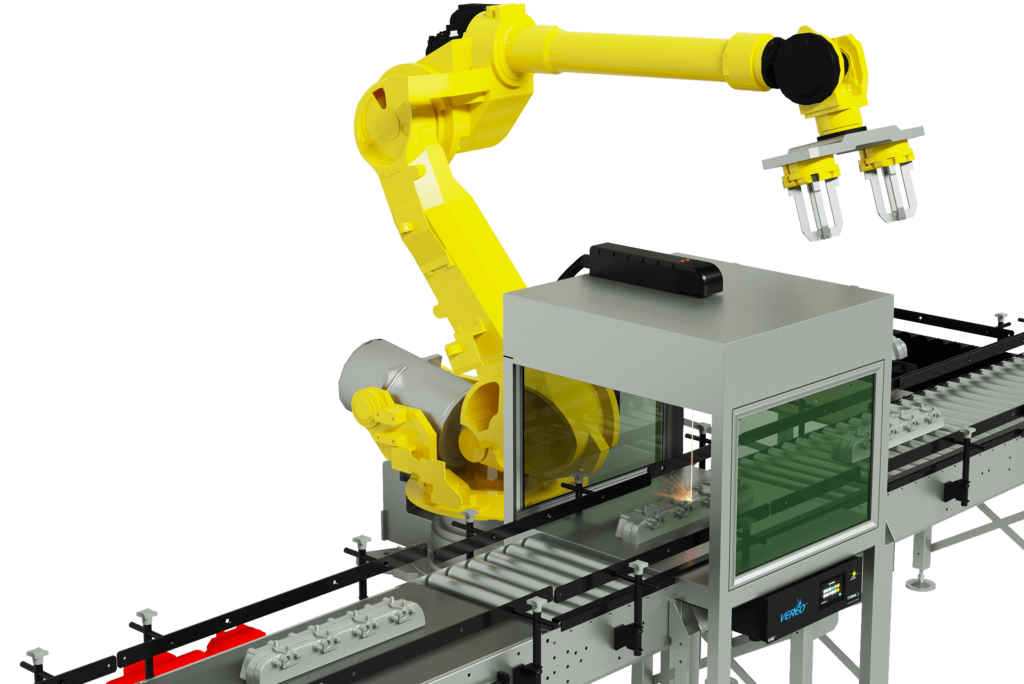

#4 MECCO

Website: mecco.com

Key Highlights: Manufacturers rely on MECCO engraving and marking systems to help problem-solve and ensure part traceability. Learn about our products for laser and pin ……

#5 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#6 Beamer Laser Marking Systems

Website: beamerlasermarking.com

Key Highlights: We offer a wide range of powerful standard, engineered, and inline 1064nm IR laser marking solutions with unmatched 100,000+ hour lifespan….

#7 Fiber Laser Marker

Website: telesis.com

Key Highlights: Discover Telesis fiber laser markers: reliable, high-speed solutions for product identification, traceability, & branding. Request a quote!…

#8 Full Spectrum Laser

#9 Fiber Laser Marking

Website: keyence.com

Key Highlights: Explore high-speed, precision-focused fiber laser marking machines by KEYENCE. Achieve accurate and permanent markings across a wide range of materials….

Expert Sourcing Insights for Optical Fiber Laser Marking Machine

H2: 2026 Market Trends for Optical Fiber Laser Marking Machines

The global market for optical fiber laser marking machines is poised for significant evolution by 2026, driven by technological advancements, expanding industrial automation, and rising demand for precision marking across key sectors. Several macro- and micro-level trends are shaping the trajectory of this market:

-

Increased Adoption in Manufacturing and Industrial Automation

By 2026, the integration of fiber laser marking machines into smart factories and Industry 4.0 ecosystems is expected to accelerate. These machines offer high-speed, permanent, and non-contact marking capabilities essential for product traceability, batch coding, and compliance with regulatory standards (e.g., UDI in healthcare, QR codes in logistics). As manufacturers prioritize automation and digitalization, demand for reliable and efficient marking solutions will rise. -

Growth in High-Precision Applications

Industries such as electronics, medical devices, and aerospace are increasingly relying on fiber laser marking for its ability to produce fine, durable marks on sensitive or hard materials (e.g., stainless steel, titanium, ceramics). The trend toward miniaturization in electronics and the need for tamper-proof identification will drive demand for ultra-precise and high-resolution marking systems. -

Technological Advancements in Fiber Laser Systems

Innovations such as higher power outputs (up to 100W+), improved beam quality, and hybrid systems combining marking with engraving or cleaning functions are enhancing machine versatility. Additionally, integration with AI-driven software for real-time monitoring, predictive maintenance, and adaptive marking settings is expected to become standard by 2026, improving operational efficiency and reducing downtime. -

Expansion in Emerging Markets

Rapid industrialization in Asia-Pacific (particularly China, India, and Southeast Asia), coupled with government initiatives promoting domestic manufacturing (e.g., “Make in India,” “Made in China 2025”), will fuel demand for fiber laser marking machines. Local production of electronics, automotive components, and consumer goods will create sustained market growth in these regions. -

Sustainability and Energy Efficiency Focus

Fiber lasers are inherently more energy-efficient than CO₂ or UV lasers, with lower maintenance and longer lifespans. As industries adopt greener manufacturing practices, the environmental and cost advantages of fiber laser systems will make them the preferred choice, supporting market penetration. -

Competitive Landscape and Pricing Pressure

The market is becoming increasingly competitive, with a growing number of Chinese manufacturers offering cost-effective models. While this drives affordability and accessibility, it also pressures global players to innovate and differentiate through value-added services, software integration, and customization options. -

Regulatory and Compliance Drivers

Stricter global regulations on product traceability—especially in automotive, aerospace, and medical industries—are compelling manufacturers to adopt permanent laser marking. Standards such as ISO 9001, IATF 16949, and FDA UDI requirements are accelerating the shift from ink-based to laser marking methods.

In summary, by 2026, the optical fiber laser marking machine market will be characterized by technological sophistication, deeper integration with digital manufacturing systems, and strong growth in both developed and emerging economies. Companies that invest in R&D, sustainability, and application-specific solutions will be best positioned to capture market share in this dynamic landscape.

Common Pitfalls When Sourcing Optical Fiber Laser Marking Machines (Quality and Intellectual Property)

Sourcing an optical fiber laser marking machine involves more than just comparing prices and specifications. Buyers often encounter significant challenges related to quality inconsistencies and intellectual property (IP) risks. Being aware of these pitfalls can help avoid costly mistakes and ensure a reliable, legally compliant investment.

Poor Build Quality and Component Sourcing

Many low-cost suppliers compromise on the quality of critical components such as laser sources (e.g., using counterfeit or reconditioned IPG or Raycus modules), scanners, and control systems. These machines may fail prematurely or deliver inconsistent marking results. Look for suppliers that transparently disclose component origins and offer verifiable warranties.

Misrepresented Laser Specifications

Some vendors exaggerate key performance metrics such as laser power (e.g., advertising a 50W laser that actually performs at 30W), beam quality (M² factor), and marking speed. This misrepresentation leads to underperforming machines that can’t meet production demands. Always request third-party test reports or conduct on-site demonstrations before purchasing.

Lack of Genuine Intellectual Property (IP) Compliance

A major concern is the proliferation of machines that infringe on patented technologies. Some manufacturers copy control software, mechanical designs, or optical configurations from established brands without licensing. Purchasing such equipment exposes buyers to legal risks, including import restrictions or cease-and-desist orders, particularly in regulated markets like the EU or North America.

Inadequate After-Sales Support and Technical Training

Many suppliers, especially those based in regions with weak service infrastructure, offer limited technical support, spare parts availability, or operator training. This can result in extended downtime and increased total cost of ownership. Ensure the supplier provides comprehensive support, including remote diagnostics, on-site service options, and accessible training materials.

Hidden Software Limitations and Licensing Issues

Some machines come with proprietary software that restricts functionality or requires expensive annual licenses for updates and features. Others use pirated or reverse-engineered software, which poses security vulnerabilities and potential legal liabilities. Verify software legitimacy and understand licensing terms before finalizing a purchase.

Insufficient Safety and Regulatory Certification

Non-compliant machines may lack proper safety features (e.g., interlocks, laser shielding) or fail to meet international standards such as CE, FDA, or IEC 60825. Using uncertified equipment can lead to workplace safety violations, insurance issues, and import denials. Confirm that the machine carries valid, up-to-date certifications relevant to your region.

Supply Chain and Warranty Enforcement Challenges

Sourcing from distant or unknown manufacturers can make warranty claims difficult. Some suppliers disappear after the sale or refuse support due to vague warranty terms. Conduct due diligence on the supplier’s business history, customer reviews, and local representation to mitigate this risk.

By carefully evaluating these aspects—component quality, accurate specifications, IP legitimacy, support infrastructure, software compliance, safety certifications, and supplier reliability—buyers can avoid common pitfalls and select a fiber laser marking machine that delivers long-term value and operational safety.

Logistics & Compliance Guide for Optical Fiber Laser Marking Machine

This guide outlines the key logistics considerations and compliance requirements for the safe, efficient, and legal international shipment and operation of Optical Fiber Laser Marking Machines.

Packaging & Handling

- Secure Packaging: The machine must be packed in a robust, wooden export crate (ISPM 15 compliant) with internal shock-absorbing materials (e.g., foam, corner protectors) to protect sensitive optical and electronic components.

- Moisture Protection: Include desiccant packs and use moisture barrier bags for control units and spare parts to prevent condensation during transit.

- Labeling: Clearly label the package with:

- “Fragile”

- “This Side Up”

- “Do Not Stack”

- Machine model and serial number

- Weight and dimensions

- Handling pictograms as per ISO 780

- Internal Components: Secure all moving parts (e.g., Z-axis, rotary unit) with transit locks or brackets. Remove or secure the laser head if recommended by the manufacturer.

Transportation & Shipping

- Mode of Transport: Suitable for air, sea, or land freight. Air freight is recommended for urgent deliveries; sea freight for cost-effective bulk shipments.

- Temperature & Humidity: Maintain storage and transport conditions within the manufacturer’s specified range (typically 0°C to 40°C and 10–80% non-condensing humidity).

- Shock & Vibration: Use cushioned transport and avoid rough handling. Monitor for excessive shocks using data loggers if required.

- Documentation: Prepare a complete shipping package including:

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- Manufacturer’s Test Certificate or Conformity Declaration

Export Compliance

- Export Classification: Determine the correct ECCN (Export Control Classification Number) under the U.S. Commerce Control List (CCL) or equivalent (e.g., EU Dual-Use List). Fiber laser markers may fall under 6A003.b.4 or similar, depending on power and specifications.

- Laser Safety Classification: Confirm the laser class (typically Class 1 or Class 4 when open). Class 4 lasers may require a license for export to certain countries.

- ITAR/EAR Compliance: Verify whether the machine or its components are subject to ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations). Most industrial fiber lasers are EAR-controlled.

- Destination Restrictions: Screen end-users and destinations against denied parties lists (e.g., U.S. BIS Denied Persons List, EU Consolidated List).

Import Compliance

- Customs Tariff Classification: Use the correct HS Code (Harmonized System code). Common classifications include:

- 8456.11: Electro-discharge machines, laser or other light/photonic beam processing machines

- 8515.21: Machines for flame or arc welding, laser or other light/photonic beam

(Confirm with local customs authority) - Import Duties & Taxes: Calculate applicable import duties, VAT, or GST based on the destination country and declared value.

- Local Approvals: Some countries require pre-shipment inspection, certification, or import permits (e.g., SONCAP for Nigeria, SASO for Saudi Arabia).

Regulatory & Safety Compliance

- Laser Safety Standards:

- IEC 60825-1: Safety of laser products – Equipment classification and requirements

- FDA 21 CFR 1040.10 (USA): Performance standard for laser products

- Ensure compliance with local laser safety regulations (e.g., CE marking in EU, RCM in Australia)

- Electromagnetic Compatibility (EMC):

- IEC 61326-1 (Industrial equipment)

- FCC Part 15 (USA)

- CE marking under EMC Directive 2014/30/EU

- Electrical Safety:

- IEC 61010-1: Safety requirements for electrical equipment for measurement, control, and laboratory use

- UL/CSA certification may be required for North America

- CE Marking (EU): Required for placing on the EU market. Includes conformity with:

- Machinery Directive 2006/42/EC

- EMC Directive 2014/30/EU

- RoHS Directive 2011/65/EU (Restriction of Hazardous Substances)

- Laser Product Safety (under 2014/35/EU or Machinery Directive)

Installation & Operational Compliance

- Installation Site: Ensure proper ventilation, stable power supply (correct voltage and grounding), and laser-safe enclosure or interlocks if Class 4.

- User Training: Provide operator training on safe operation, emergency shutdown, and maintenance procedures.

- Maintenance Records: Keep logs of service, calibration, and repairs as required by local regulations or quality standards (e.g., ISO 9001).

- Waste Disposal: Follow WEEE (Waste Electrical and Electronic Equipment) Directive for end-of-life disposal in applicable regions.

Documentation & Recordkeeping

- Retain copies of:

- Technical files and risk assessments

- Declaration of Conformity (DoC)

- Test reports (laser, EMC, safety)

- Export licenses (if applicable)

- Shipping and customs documents for a minimum of 5 years

Adhering to this logistics and compliance guide ensures safe transportation, regulatory approval, and legal operation of Optical Fiber Laser Marking Machines worldwide. Always consult local authorities and legal counsel for jurisdiction-specific requirements.

Conclusion for Sourcing an Optical Fiber Laser Marking Machine

In conclusion, sourcing an optical fiber laser marking machine is a strategic investment that enhances production efficiency, ensures high-quality permanent marking, and supports long-term cost savings. These machines offer superior performance in terms of precision, speed, and durability, making them ideal for a wide range of industrial applications—from automotive and aerospace to medical devices and electronics.

When sourcing, it is essential to evaluate key factors such as laser power, marking speed, software compatibility, beam quality, after-sales support, and the supplier’s reputation. Opting for a reputable manufacturer with proven technical expertise and service reliability ensures consistent performance and minimal downtime.

Additionally, considering future scalability and integration capabilities with existing production lines will maximize return on investment. With advancements in fiber laser technology, modern machines are more energy-efficient, require less maintenance, and offer greater versatility across various materials, including metals and some plastics.

Ultimately, selecting the right optical fiber laser marking machine involves balancing performance requirements with budget constraints while prioritizing quality and support. A well-chosen system not only improves product traceability and branding but also strengthens operational competitiveness in today’s precision-driven manufacturing landscape.