The global optical brightener market is experiencing steady expansion, driven by growing demand across industries such as textiles, paper, detergents, and plastics. According to a report by Mordor Intelligence, the market was valued at USD 1.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2029. This growth is fueled by increasing consumer preference for vibrant, clean-looking fabrics and paper products, alongside rising industrial automation and manufacturing output in emerging economies. Additionally, stringent environmental regulations are prompting manufacturers to develop eco-friendly, high-performance optical brightening agents, reshaping competitive dynamics. As innovation and sustainability become key differentiators, a select group of manufacturers are leading the industry through advanced R&D, global supply chain integration, and strategic partnerships. Below, we highlight the top 10 optical brightener manufacturers shaping the market landscape in 2024.

Top 10 Optical Brightener Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Raytop Chemical

Domain Est. 2021

Website: raytopoba.com

Key Highlights: We are the most professional optical brightener suppliers and manufacturers in China. We have a optical brightener factory,special advantage products….

#2 Optical Whitener Manufacturers USA

Domain Est. 2005

Website: chemworldintl.com

Key Highlights: Chemworld International is a leading optical brightener supplier based in the USA. The primary goal is to supply customers with the highest quality OBA’s….

#3 Optical Brightener Masterbatches Manufacturer, Supplier & Exporter

Domain Est. 2005

Website: perfectcolourants.com

Key Highlights: Perfect Colourants & Plastics Pvt.Ltd is a leading optical brightener masterbatches manufacturer. Our OB masterbatch improves the optical properties and ……

#4 Optical Brighteners

Domain Est. 2015

Website: 3vsigmausa.com

Key Highlights: Enhance whiteness and brightness with top-tier optical brighteners. Ideal for paper, textiles, & plastics, ensuring products appear vibrant….

#5 Optical Brightening Agent suppliers

Domain Est. 2022

Website: vinipulchemicals.com

Key Highlights: Optical Brightening Agent is a chemical compound used to enhance the appearance of color in different materials such as fabric and paper….

#6 Antioxidants & Optical Brighteners

Domain Est. 1995

Website: dispersions-resins.basf.com

Key Highlights: We will work with you to find the ideal antioxidants and optical brigtheners for your formulations and even co-innovate to develop novel solutions….

#7 DayGlo Optical Brighteners for Fluorescent Plastics

Domain Est. 1996

Website: dayglo.com

Key Highlights: Highly-fluorescent under UV light, these brighteners make plastics shine like never before and have broad applications across adhesives, leak detection, product ……

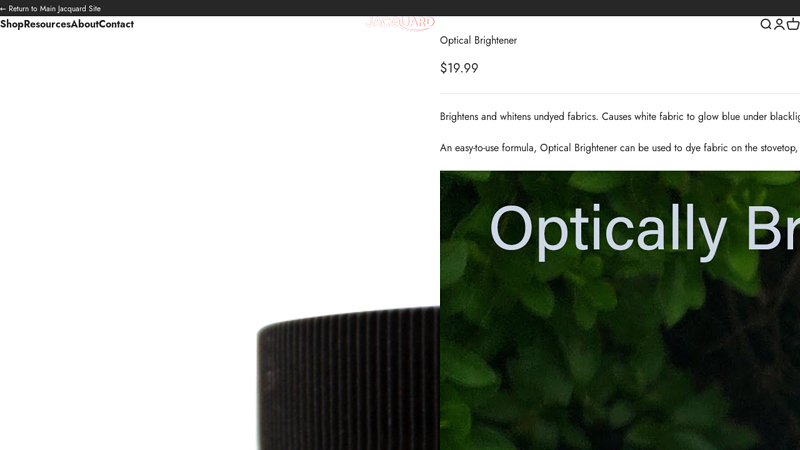

#8 Optical Brightener

Domain Est. 1997

Website: store.jacquardproducts.com

Key Highlights: In stock $16.60 deliveryAn easy-to-use formula, Optical Brightener can be used to dye fabric on the stovetop, in a washing machine, or using the soda ash batching method as in tie …

#9 Optical Brighteners

Domain Est. 1998

Website: mayzo.com

Key Highlights: Optical brighteners, or fluorescent whitening agents, are used to make plastics, fibers, coatings, inks, and detergents appear whiter and brighter….

#10 Cesa™ Bright Optical Brighteners

Domain Est. 2003

Website: avient.com

Key Highlights: Cesa™ bright masterbatches convert UV radiation into visible, bluish light in order to improve the long-term, white appearance of finished plastic products. A ……

Expert Sourcing Insights for Optical Brightener

H2: Analysis of 2026 Market Trends for Optical Brighteners

The global optical brightener market is poised for steady growth by 2026, driven by rising demand across key end-use industries such as textiles, paper, detergents, and personal care. These fluorescent compounds, also known as fluorescent whitening agents (FWAs), enhance the visual whiteness and brightness of materials by absorbing ultraviolet light and re-emitting it as blue visible light. As sustainability and performance efficiency become central themes across industries, the optical brightener market is undergoing transformation in terms of product innovation, regional dynamics, and regulatory influences.

1. Growth Drivers in Key End-Use Sectors

By 2026, the textile industry remains a dominant consumer of optical brighteners, particularly in emerging economies with expanding apparel manufacturing, such as India, Bangladesh, and Vietnam. The increasing consumer preference for brighter, whiter fabrics in casual and technical wear continues to boost demand. Similarly, the paper and pulp industry leverages optical brighteners to improve the appearance of printing paper, packaging materials, and tissue products, with growth supported by e-commerce-driven packaging needs.

In the household and industrial cleaning sector, optical brighteners are critical additives in laundry detergents and dishwashing products. As detergent manufacturers reformulate for high-performance, low-temperature washing (aligned with energy-saving trends), optical brighteners help maintain fabric whiteness. This segment is expected to contribute significantly to market expansion through 2026.

2. Innovation and Product Development

The 2026 landscape reflects a trend toward eco-friendly and biodegradable optical brighteners. Traditional brighteners such as stilbene derivatives (e.g., DSBP and DAS1) face scrutiny over environmental persistence and aquatic toxicity. In response, manufacturers are investing in next-generation, non-ionic, and enzyme-compatible brighteners with improved biodegradability. Companies like BASF, Huntsman Corporation, and Kiri Industries are leading R&D efforts to develop sustainable alternatives compliant with EU REACH and U.S. EPA guidelines.

Additionally, nano-encapsulation technologies are being explored to enhance the durability and efficiency of optical brighteners in textiles and plastics, particularly for technical textiles and automotive interiors.

3. Regional Market Dynamics

Asia-Pacific is projected to maintain its position as the largest and fastest-growing market for optical brighteners by 2026, fueled by industrialization, urbanization, and rising disposable incomes in China and Southeast Asia. North America and Europe will experience moderate growth, with emphasis on regulatory compliance and green chemistry. However, stricter environmental regulations in these regions may limit the use of certain optical brightener types, encouraging a shift toward safer formulations.

Latin America and the Middle East show emerging opportunities, particularly in construction (for brightened gypsum boards) and personal care (in whitening toothpastes and cosmetics), albeit from a smaller market base.

4. Challenges and Regulatory Pressures

Environmental concerns remain a critical challenge. Some optical brighteners are resistant to degradation and can accumulate in water systems, prompting regulatory bodies to impose usage restrictions. The European Union’s ongoing evaluation of certain FWAs under REACH could influence global supply chains. As a result, market players are focusing on transparency in sourcing and lifecycle assessments to maintain market access.

5. Competitive Landscape

The market is moderately consolidated, with key players expanding production capacities and engaging in strategic partnerships. Mergers and acquisitions, particularly targeting specialty chemical firms with green portfolios, are expected to increase through 2026. Digitalization and AI-driven formulation tools are also being adopted to accelerate product development and reduce time-to-market.

Conclusion

By 2026, the optical brightener market will be shaped by a balance between performance demands and environmental responsibility. Growth will be sustained by innovation in sustainable chemistries, regional industrial expansion, and evolving consumer preferences. Companies that proactively adapt to regulatory trends and invest in eco-efficient technologies are likely to gain competitive advantage in this evolving marketplace.

Common Pitfalls When Sourcing Optical Brighteners: Quality and Intellectual Property Risks

Sourcing optical brighteners (OBs), also known as fluorescent whitening agents (FWAs), presents unique challenges, particularly concerning product quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to performance failures, supply chain disruptions, legal disputes, and reputational damage. Below are the most common pitfalls in these two critical areas.

Quality-Related Pitfalls

1. Inconsistent Purity and Composition

Optical brighteners are complex organic compounds where even minor impurities or variations in isomer ratios can drastically affect performance. Common issues include:

– Batch-to-batch variability due to poor manufacturing control, leading to inconsistent brightness, shade, or fluorescence intensity.

– Presence of harmful by-products such as heavy metals (e.g., lead, arsenic) or carcinogenic amines (especially in benzoxazolyl-based OBs), which may violate REACH, OEKO-TEX, or other regulatory standards.

– Counterfeit or adulterated products where cheaper, inferior dyes or fillers are blended into the OB to reduce cost.

2. Insufficient Performance Testing

Relying solely on supplier-provided certificates of analysis (CoA) without independent verification is risky. Pitfalls include:

– Lack of application-specific testing—an OB that works well in paper may fail in detergents or plastics due to differences in pH, temperature, or matrix compatibility.

– Inadequate fastness testing for light, heat, or washing, leading to premature degradation and loss of whitening effect.

3. Poor Solubility and Dispersion

Many OBs are poorly soluble in water or processing media. Sourcing without evaluating:

– Dispersibility under actual processing conditions can lead to spotting, streaking, or uneven whitening.

– Stability of dispersions over time, especially in liquid formulations like laundry detergents.

Intellectual Property-Related Pitfalls

1. Infringement of Patented Chemistry or Processes

Many high-performance optical brighteners are protected by active patents, especially newer or specialty OBs used in technical textiles, plastics, or high-end paper. Sourcing from generic manufacturers without due diligence can lead to:

– Use of patented molecules without license, exposing the buyer to infringement claims.

– Reverse-engineered products that mimic branded OBs but violate formulation or process patents.

2. Lack of Freedom-to-Operate (FTO) Analysis

Buyers, especially in regulated industries (e.g., food packaging, medical textiles), often fail to conduct FTO assessments, risking:

– Legal action from patent holders, resulting in injunctions, fines, or product recalls.

– Supply chain liability, where downstream users (brand owners) hold suppliers accountable for IP violations.

3. Unclear IP Ownership in Custom Formulations

When co-developing or sourcing custom OB blends:

– Ambiguous contractual terms may leave IP rights (e.g., formulation know-how, application methods) with the supplier, limiting the buyer’s ability to switch vendors or scale production.

– Risk of supplier lock-in, where the supplier controls critical IP needed for product performance.

Mitigation Strategies

- Demand full technical dossiers including CoA, safety data sheets (SDS), and regulatory compliance statements (e.g., REACH, FDA).

- Conduct independent third-party testing for purity, performance, and regulatory compliance.

- Perform due diligence on supplier IP status—request patent certifications or conduct FTO searches.

- Include IP indemnification clauses in supply agreements.

- Qualify multiple suppliers to reduce dependency and enhance leverage.

By proactively addressing quality and IP risks, companies can ensure reliable performance, regulatory compliance, and legal security when sourcing optical brighteners.

Logistics & Compliance Guide for Optical Brightener

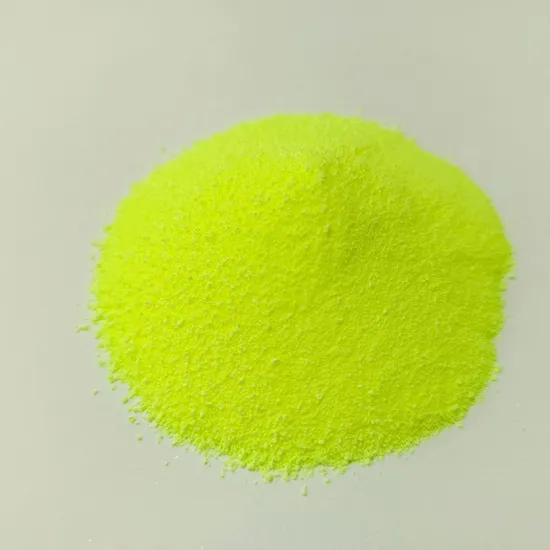

Overview of Optical Brightener

Optical brighteners, also known as fluorescent whitening agents (FWAs), are chemical compounds used to enhance the visual appearance of materials by absorbing ultraviolet light and re-emitting it as visible blue light. This process makes substances appear whiter and brighter. They are widely used in textiles, paper, detergents, and plastics.

Due to their chemical nature, proper handling, storage, transportation, and regulatory compliance are essential to ensure safety, environmental protection, and legal adherence.

Classification and Regulatory Status

Chemical Identification

- Common Names: Optical Brightener, Fluorescent Whitening Agent (FWA), Tinopal, Blankophor

- CAS Numbers: Vary by specific compound (e.g., Optical Brightener 184: 7128-64-5; Optical Brightener 220: 1533-45-5)

- EC Number: Substance-specific (e.g., EC 230-451-5 for OB-1)

Regulatory Classification

Optical brighteners are generally classified under:

– GHS (Globally Harmonized System): May be labeled with hazard statements depending on form and concentration (e.g., Skin Irritation, Eye Irritation, Aquatic Toxicity).

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – Most optical brighteners require registration.

– TSCA (USA): Listed under the Toxic Substances Control Act – verify current status via EPA TSCA Inventory.

– CLP Regulation (EU): Classified based on physical, health, and environmental hazards.

Note: Always consult the Safety Data Sheet (SDS) for the specific optical brightener in use.

Packaging and Labeling Requirements

Packaging

- Use tightly sealed, leak-proof containers made of compatible materials (e.g., high-density polyethylene, HDPE).

- Ensure packaging is resistant to moisture and UV degradation.

- For bulk transport, use lined intermediate bulk containers (IBCs) or drums with proper venting if needed.

Labeling

- Primary Label: Include product identifier, supplier information, GHS pictograms, signal word, hazard statements, precautionary statements, and batch number.

- Transport Label: Comply with UN transport regulations (e.g., UN3077 for environmentally hazardous substances, solid, n.o.s. if applicable).

- Language: Labels must be in the official language(s) of the destination country.

Storage Guidelines

Environmental Conditions

- Store in a cool, dry, and well-ventilated area.

- Protect from direct sunlight and UV exposure to prevent degradation.

- Maintain temperatures between 5°C and 30°C unless otherwise specified.

Segregation

- Store away from strong oxidizers, acids, and bases.

- Keep separated from food, feed, and pharmaceuticals.

- Use dedicated storage areas with spill containment (e.g., bunded pallets).

Shelf Life

- Typical shelf life: 12–24 months when stored properly.

- Monitor for clumping, discoloration, or moisture absorption.

Transportation Requirements

Modes of Transport

- Road (ADR): Classify as UN3077, Class 9 (Miscellaneous Dangerous Goods) if environmentally hazardous. Use appropriate placards.

- Marine (IMDG Code): Listed under Class 9, UN3077, PG III if applicable. Provide proper marine pollutant marking.

- Air (IATA): Generally permitted under limited quantities or excepted quantities if below thresholds. Verify concentration and packaging.

Documentation

- Safety Data Sheet (SDS): Provide up-to-date SDS (ISO 11014 or REACH-compliant).

- Transport Documents: Include proper shipping name, UN number, hazard class, packaging group, and emergency contact.

- Customs Documentation: Accurate HS Code (e.g., 3204.20 for synthetic organic coloring matter).

Handling and Personal Protection

Safe Handling Practices

- Use in well-ventilated areas or with local exhaust ventilation.

- Avoid dust formation; use wet methods or closed systems when possible.

- Prohibit eating, drinking, or smoking in handling areas.

Personal Protective Equipment (PPE)

- Respiratory Protection: NIOSH-approved dust mask (N95) if airborne concentrations exceed limits.

- Eye Protection: Safety goggles or face shield.

- Skin Protection: Chemical-resistant gloves (nitrile or neoprene), lab coat or protective clothing.

- Hygiene Measures: Wash hands thoroughly after handling.

Environmental and Disposal Compliance

Environmental Hazards

- Many optical brighteners are persistent and potentially toxic to aquatic life.

- Avoid release into drains, waterways, or soil.

Waste Disposal

- Dispose of waste in accordance with local, national, and international regulations (e.g., Basel Convention if exporting waste).

- Use licensed hazardous waste disposal facilities.

- Do not incinerate without proper air pollution control.

Spill Management

- Containment: Use absorbent materials (e.g., sand, vermiculite) to prevent spread.

- Cleanup: Collect spill material and place in labeled, sealed container for disposal.

- Decontamination: Wash area with water and detergent; avoid runoff.

Regulatory Compliance by Region

European Union

- REACH registration required.

- CLP-compliant labeling.

- Notify under SCIP database if in articles above threshold.

United States

- Report under TSCA; check CDR requirements if manufacturing/importing in large quantities.

- OSHA Hazard Communication Standard (HCS 2012) compliance.

- EPA regulations for water discharge (Clean Water Act).

China

- Registered under the New Chemical Substance Environment Management (IECSC).

- Follow GB standards for labeling and transport (e.g., GB 13690).

Other Regions

- Canada: DSL/NDSL compliance; WHMIS 2015 labeling.

- India: BIS and Chemical Import Policy compliance.

- ASEAN: Follow ASEAN CSDS and GHS implementation guidelines.

Training and Documentation

Employee Training

- Conduct regular training on:

- Hazard recognition

- Safe handling and storage

- Emergency response

- Use of PPE

- Maintain training records.

Required Documentation

- Safety Data Sheets (SDS)

- Transport documents

- REACH/CLP/TSCA compliance records

- Waste disposal manifests

- Incident reports (if applicable)

Emergency Response

In Case of Exposure

- Inhalation: Move to fresh air; seek medical attention if symptoms persist.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Rinse gently with water for at least 15 minutes; consult physician.

- Ingestion: Rinse mouth; do not induce vomiting; seek immediate medical help.

Emergency Contacts

- Include poison control center, local emergency services, and supplier technical support on SDS and labels.

Disclaimer: This guide provides general information. Always consult the specific Safety Data Sheet (SDS) and local regulatory authorities for compliance with current laws and best practices.

Conclusion for Sourcing Optical Brightener:

Sourcing optical brighteners requires a strategic approach that balances quality, cost, regulatory compliance, and supplier reliability. These additives play a crucial role in enhancing the visual appeal of textiles, paper, plastics, and detergents by improving whiteness and brightness. When selecting a supplier, it is essential to evaluate factors such as product specifications (e.g., fluorescence efficiency, stability, and compatibility), adherence to environmental and safety standards (such as REACH, OEKO-TEX, or FDA regulations), and consistent supply capacity.

Establishing long-term partnerships with reputable manufacturers—particularly those with proven experience and certifications—can ensure a steady supply of high-performing optical brighteners while minimizing risks related to quality fluctuations or regulatory non-compliance. Additionally, considering sustainable and eco-friendly alternatives may support corporate social responsibility goals and meet evolving market demands.

In conclusion, successful sourcing hinges on thorough due diligence, clear communication of technical requirements, and ongoing supplier assessment to maintain product quality, operational efficiency, and compliance across the supply chain.