The global copper pipe market continues to demonstrate steady growth, driven by rising infrastructure development, increasing demand in plumbing and HVAC systems, and the material’s inherent durability and corrosion resistance. According to a 2023 report by Mordor Intelligence, the copper pipes and tubes market was valued at approximately USD 51.2 billion in 2022 and is projected to grow at a CAGR of over 6.8% from 2023 to 2028. This expansion is supported by urbanization trends, particularly in Asia-Pacific and Latin America, where construction activity and industrial applications are on the rise. As demand persists, a select group of long-established manufacturers have maintained leadership through innovation, quality control, and global supply reach. These legacy producers not only shaped the industry’s evolution but continue to influence modern standards in copper piping. Below are six of the most prominent old-world copper pipe manufacturers that remain central to the sector’s ongoing growth trajectory.

Top 6 Old Copper Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hirsch Pipe & Supply

Domain Est. 1995 | Founded: 1933

Website: hirsch.com

Key Highlights: Founded in 1933, Hirsch Pipe and Supply offers a huge selection of plumbing supplies from leading manufacturers, backed with exceptional service to save you ……

#2 Copper tubes for heating, air

Domain Est. 1997

Website: silmet.com

Key Highlights: Silmet is the world leader in the production of copper tubes for water, heating, air-conditioning and sanitary applications and industrial use in Level Wound ……

#3 Steel Dynamics

Domain Est. 1999

Website: steeldynamics.com

Key Highlights: We are a leading industrial metals solutions company. We operate using a circular manufacturing model, producing lower-carbon-emission, quality products with ……

#4 Copper & Copper Alloy Business Unit, MITSUBISHI MATERIALS

Domain Est. 2020

Website: mitsubishi-copper.com

Key Highlights: Built status as general copper alloy manufacturer covering all copper alloy products such as sheet and plate, strip, pipe, rod and bar, and wire….

#5 Copper Brass Tube Maker Souvenirs

Domain Est. 2000

Website: oldcopper.org

Key Highlights: The centrepiece is an engraved copper tube into which are fitted three copper inkwells with decorated caps….

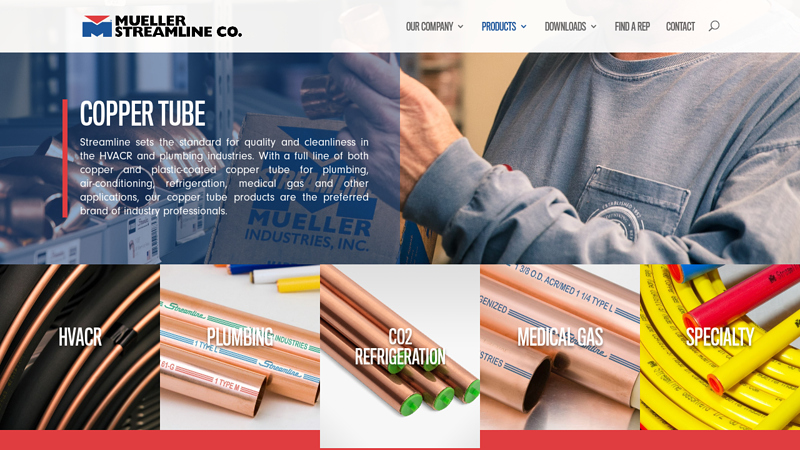

#6 Copper Tube

Domain Est. 2013

Website: muellerstreamline.com

Key Highlights: A full line of both copper and plastic-coated copper tube for plumbing, air-conditioning, refrigeration, medical gas and other applications….

Expert Sourcing Insights for Old Copper Pipe

H2: 2026 Market Trends for Old Copper Pipe

As we approach 2026, the market for old copper pipe—primarily reclaimed or scrap copper piping from demolition, renovation, and industrial decommissioning—is expected to be shaped by a confluence of economic, environmental, and technological factors. Here’s an in-depth analysis of key trends influencing the old copper pipe market:

-

Rising Demand for Recycled Materials

Environmental sustainability goals are driving industries and governments toward circular economy models. Old copper pipe, as a highly recyclable material (retaining up to 95% of its original value when recycled), is gaining renewed interest. Construction and plumbing sectors are increasingly specifying recycled copper content, boosting demand for reclaimed copper piping in green building projects certified by LEED or BREEAM. -

Fluctuating Base Metal Prices

Copper prices have historically been volatile, influenced by global supply chains, mining output, and geopolitical tensions. In 2026, expectations of constrained primary copper supply due to underinvestment in mining and rising electrification needs (especially in EVs and renewable infrastructure) may keep copper prices elevated. This trend supports higher scrap values, making old copper pipe more valuable to collectors, recyclers, and scrapyards. -

Growth in Urban Renovation and Infrastructure Upgrades

Many developed nations are investing heavily in aging infrastructure renovation—particularly water systems and HVAC retrofits—creating a surge in the supply of old copper pipe. In the U.S. and Europe, government stimulus programs tied to infrastructure modernization (e.g., replacing lead pipes) are expected to generate significant volumes of recoverable copper, feeding both domestic recycling streams and export markets. -

Technological Advancements in Recycling

Improved sorting and refining technologies, including AI-powered scrap separation and advanced pyrometallurgical processes, are increasing the efficiency and purity of recycled copper. These innovations enhance the economic viability of processing old copper pipe, reducing contamination risks and improving profit margins for recyclers. -

Regulatory and Compliance Pressures

Stringent regulations on metal theft and documentation for scrap transactions are tightening globally. In 2026, many regions may enforce traceability systems for copper scrap, requiring sellers of old copper pipe to provide proof of ownership. While this could deter illicit trade, it may also increase operational costs for small-scale recyclers. -

Shift Toward Copper Substitutes in New Construction

Although demand for recycled copper remains strong, new construction is seeing increased use of PEX (cross-linked polyethylene) and other synthetic piping, potentially reducing long-term reliance on copper. However, this shift reinforces the value of existing copper infrastructure as a future scrap resource, creating a “legacy reservoir” of old copper pipe poised for recovery. -

Emerging Markets as Key Export Destinations

Developing economies in Asia and Africa, undergoing rapid urbanization, are becoming major importers of processed scrap copper. In 2026, exporters of cleaned, sorted old copper pipe may find growing opportunities in countries like India, Vietnam, and Turkey, where domestic demand for copper outpaces local recycling capacity.

Conclusion:

By 2026, the old copper pipe market is expected to remain robust, supported by high copper prices, green building incentives, and infrastructure renewal. While competition from alternative materials may affect new copper demand, the secondary market for reclaimed copper piping will likely expand due to sustainability mandates and supply chain constraints. Stakeholders—from demolition contractors to recyclers—should prepare for increased regulatory scrutiny and invest in efficient sorting and compliance systems to capitalize on this evolving landscape.

Common Pitfalls When Sourcing Old Copper Pipe (Quality, IP)

Sourcing old copper pipe—often reclaimed or salvaged from demolition sites—can be a cost-effective and sustainable option for certain plumbing or restoration projects. However, several critical pitfalls related to quality and intellectual property (IP) concerns must be carefully navigated to avoid performance issues, safety hazards, or legal complications.

1. Degraded Material Quality

One of the most significant risks when sourcing old copper pipe is encountering material that has degraded over time. Corrosion, pitting, or scaling inside the pipe can drastically reduce flow capacity and structural integrity. Pipes exposed to harsh environments or contaminated water may have internal buildup or micro-fractures that are not visible externally. Using compromised pipe can lead to leaks, bursts, or contamination in potable water systems.

2. Unknown Service History

Old copper pipes often come without documentation of their prior use. Pipes previously used in industrial settings might have carried chemicals or gases that left residual deposits or caused embrittlement. Without knowing the history, there is a risk of introducing hazardous substances into new systems, especially in residential or medical applications where purity is critical.

3. Inconsistent Dimensions and Standards

Vintage copper piping may not conform to current dimensional standards (e.g., Type K, L, M). Older manufacturing tolerances or obsolete sizing can create compatibility issues with modern fittings and fixtures. Attempting to connect mismatched components increases the risk of joint failure and leaks, undermining system reliability.

4. Presence of Lead or Contaminants

Some older copper systems were joined using lead-based solder, especially in installations pre-1986. Even if the pipe itself is copper, residual lead in joints poses a serious health risk in potable water applications. Additionally, external contamination (e.g., paint, oils, or mold) on salvaged pipe may require extensive cleaning, adding cost and labor.

5. Intellectual Property and Brand Misrepresentation

While copper as a material is not protected by IP, specific branding, trademarks, or patented manufacturing processes associated with original pipe manufacturers may still be active. Representing reclaimed pipe as “original [Brand Name]” without authorization could lead to trademark infringement claims, particularly in restoration or heritage projects where brand authenticity is marketed as a value proposition.

6. Lack of Certification and Traceability

New copper pipe typically comes with mill certifications confirming compliance with ASTM or other standards. Old or salvaged pipe lacks such documentation, making it difficult to verify material grade, purity, or suitability for regulated applications. This absence of traceability can disqualify reclaimed pipe from use in code-compliant or inspected installations.

7. Mislabeling and Fraudulent Claims

The reclaimed materials market is vulnerable to misrepresentation. Sellers may falsely advertise pipe as “virgin copper” or “never installed,” when it has actually been used or repaired. Without third-party verification or testing, buyers risk purchasing substandard or misrepresented products.

8. Environmental and Legal Liability

Improper sourcing—such as acquiring copper pipe from illegal demolition or theft—can expose buyers to legal liability. In some regions, buying scrap metal without verifying provenance is regulated to deter metal theft. Additionally, improper handling or disposal of contaminated pipe may trigger environmental compliance issues.

In conclusion, while sourcing old copper pipe offers economic and ecological benefits, due diligence is essential. Buyers should prioritize material testing, verify provenance, assess compatibility, and remain cautious about IP and regulatory compliance to avoid costly or dangerous outcomes.

Logistics & Compliance Guide for Old Copper Pipe

Overview

Old copper pipe refers to discarded or decommissioned copper piping typically recovered from plumbing, HVAC systems, or industrial applications. Due to its high scrap value and recyclability, proper logistics and regulatory compliance are essential during handling, transportation, and disposal. This guide outlines best practices and regulatory requirements to ensure safe, legal, and efficient management of old copper pipe.

Classification and Regulatory Status

Old copper pipe is generally classified as non-hazardous recyclable scrap metal under most environmental regulations. However, if contaminated with substances such as lead-based solder, residual chemicals, or hazardous insulation materials, it may require special handling under local, state, or federal environmental laws (e.g., EPA regulations in the U.S.). Always assess and document contamination status prior to transport or recycling.

Handling and Storage Requirements

- Segregation: Store old copper pipe separately from other scrap metals and hazardous materials to maintain purity and prevent cross-contamination.

- Containment: Use designated storage areas with spill containment or secondary containment if oils or residues are present.

- Labeling: Clearly label storage containers or pallets as “Scrap Copper – Non-Hazardous Recyclable” if uncontaminated; include hazard warnings if contamination is suspected.

- Worker Safety: Provide appropriate personal protective equipment (PPE) such as gloves, safety glasses, and steel-toed boots due to sharp edges and heavy weight.

Transportation Guidelines

- Packaging: Securely bundle pipes using metal strapping or netting to prevent shifting during transit. Avoid overloading vehicles.

- Vehicle Requirements: Use enclosed trailers or flatbeds with side rails to prevent material loss. Cover loads when transporting in public areas.

- Documentation: Maintain a manifest or bill of lading detailing the type and weight of copper being transported. If shipped across state lines or internationally, ensure compliance with Department of Transportation (DOT) or equivalent regulatory bodies.

- Weight Limits: Adhere to local axle and gross vehicle weight restrictions to avoid fines or road safety issues.

Regulatory Compliance

- Scrap Metal Regulations: Comply with the U.S. Scrap Metal Theft Prevention Act (or equivalent regional laws) by maintaining records of sellers, including identification and transaction details, especially when acquiring copper from third parties.

- Environmental Compliance: Ensure no unauthorized discharge of contaminants during handling. Follow RCRA (Resource Conservation and Recovery Act) guidelines if contamination is suspected.

- Export Controls: If exporting copper scrap internationally, comply with U.S. Census Bureau reporting requirements (e.g., AES filing) and verify destination country import regulations.

Recycling and Disposal

- Certified Recyclers: Partner only with certified scrap metal recyclers who follow environmental and safety standards (e.g., ISRI certification in the U.S.).

- Chain of Custody: Maintain records of recycling transactions, including weight tickets and certificates of recycling, for audit and compliance purposes.

- Prohibited Disposal: Never dispose of copper pipe in landfills unless explicitly permitted—copper is a valuable recyclable resource and landfilling may violate waste diversion laws.

Recordkeeping and Auditing

- Retain all transaction records, transportation logs, and recycling certificates for a minimum of three years.

- Conduct periodic audits to ensure compliance with internal policies and external regulations.

- Train staff annually on scrap metal handling, theft prevention, and environmental compliance procedures.

Conclusion

Proper logistics and compliance management for old copper pipe reduces legal risks, supports environmental sustainability, and maximizes material value. By following this guide, organizations can ensure safe, legal, and efficient handling of copper scrap throughout the supply chain.

In conclusion, sourcing old copper pipe can be a practical and cost-effective option for certain plumbing, HVAC, or DIY projects, particularly when matching existing systems or seeking materials with proven durability. However, it is essential to carefully evaluate the condition, purity, and compliance of reclaimed copper with current building codes and safety standards. Potential challenges such as corrosion, leaks, or outdated sizing should be thoroughly assessed before reuse. Additionally, sourcing from reputable suppliers or salvage yards and considering environmental and economic benefits—like reducing waste and conserving resources—can enhance the sustainability of the project. With proper inspection and due diligence, reclaimed copper pipe can offer a reliable, eco-friendly solution while preserving historical integrity in restoration work.