The global marine oily water separator market is experiencing steady growth, driven by increasingly stringent international environmental regulations such as those set by the International Maritime Organization (IMO) and rising emphasis on marine pollution control. According to a report by Mordor Intelligence, the oily water separator market was valued at USD 5.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5.8% during the forecast period from 2024 to 2029. This growth is further supported by the expansion of global shipping fleets, increased offshore oil and gas activities, and the retrofitting of older vessels to meet updated MARPOL Annex I standards. Additionally, regional regulatory enforcement and the rising adoption of advanced separation technologies—such as membrane-based and centrifugal systems—are accelerating demand across commercial shipping, offshore platforms, and port facilities. As compliance becomes non-negotiable, manufacturers are innovating to deliver efficient, compact, and automated solutions. In this evolving landscape, the following ten companies have emerged as leading oily water separator manufacturers in the marine sector, combining technological expertise, global reach, and proven performance.

Top 10 Oily Water Separator Marine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GenOil Inc.

Domain Est. 2001

Website: genoil.ca

Key Highlights: A filter-less operation, separating oil from water to below 2ppm! This design can be run continuously for years requiring NO down time and has the lowest cost ……

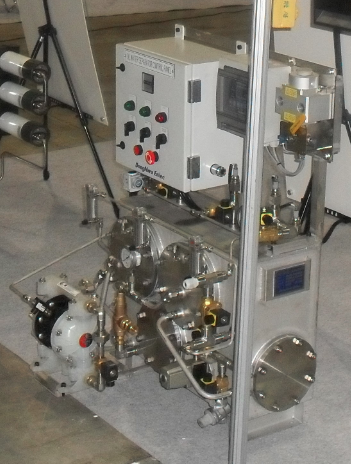

#2 Oil Water Separator Technologies

Domain Est. 2013

Website: owstech.com

Key Highlights: Oil Water Separator Technologies (OWS Tech) is an environmental manufacturer of high-quality, cost effective oil water separators, oil stop valves, oil ……

#3 Industrial Oil

Domain Est. 2017

Website: facetfiltration.com

Key Highlights: Our Oil-Water Separators are designed to help you manage oil-contaminated water across a wide range of critical environments—from industrial process water and ……

#4 Oil/Water Separators

Domain Est. 1996

Website: highlandtank.com

Key Highlights: Our separators are designed to remove oil, grease, light petroleum products, and oily-coated solids from a variety of wastewater discharges….

#5 detegasa

Domain Est. 1997

Website: detegasa.com

Key Highlights: Detegasa designs, manufactures and markets high-tech water and waste management solutions for Navy, Marine & Offshore Industries….

#6 SKIMOIL, LLC

Domain Est. 1998

Website: skimoil.com

Key Highlights: SkimOIL specializes in oil skimmers, oil water separators and oil removal controls & equipment for the oil/gas,general manufacturing, and commercial marine…

#7 Oily Water Separators

Domain Est. 2001

Website: llalco.com

Key Highlights: Our units are used to separate oil from bilge water to the required international standard of 15 ppm (parts per million) oil content before discharge overboard….

#8 BOSS Oily Water Separators from H2O Water Treatment Systems

Domain Est. 2003

Website: h2oinc.com

Key Highlights: BOSS Separators by H2O provide bilge water treatment systems that you can depend upon for years of low-maintenance use….

#9 Different types of Marine Oily Water Separators

Domain Est. 2009

Website: separatorequipment.com

Key Highlights: Marine Oil Water Separator (OWS) | Separate Oil and Water Proper bilgewater management is essential for ship safety and regulatory environmental compliance….

#10 Marine Oil Water Separator

Domain Est. 2009

Website: hiseamarine.com

Key Highlights: The marine oil water separator is used for the treatment of bilge water of various ships. The treated bilge water will be able to meet the standard specified ……

Expert Sourcing Insights for Oily Water Separator Marine

H2: Projected 2026 Market Trends for Oily Water Separators in the Marine Industry

The global market for marine oily water separators (OWS) is poised for significant evolution by 2026, driven by tightening environmental regulations, advancements in separation technology, and increasing maritime activity. Below are the key market trends expected to shape the industry:

1. Stricter Environmental Regulations Driving Demand

By 2026, enforcement of international maritime environmental standards—particularly those set by the International Maritime Organization (IMO)—will be more rigorous. The revised MARPOL Annex I regulations, mandating oil discharge limits of 15 ppm or less, will continue to compel shipowners to upgrade or replace outdated OWS systems. Regional initiatives such as the EU’s FuelEU Maritime and the U.S. Coast Guard’s enhanced compliance monitoring are expected to further accelerate demand for high-efficiency OWS units.

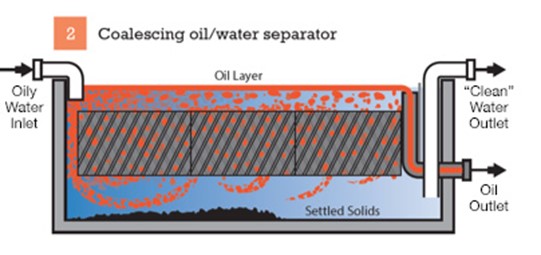

2. Increased Adoption of Advanced Separation Technologies

Traditional gravity-based separators are being supplemented or replaced by advanced systems incorporating membrane filtration, electrocoalescence, and ultrasonic separation. By 2026, these next-generation OWS units are projected to gain over 30% market share due to their ability to achieve <5 ppm effluent levels. Integration with digital monitoring and real-time data logging will also become standard, supporting compliance with IMO’s Ship Energy Efficiency Management Plan (SEEMP) and enabling remote auditing.

3. Growth in Retrofitting and Fleet Modernization

A significant portion of the global commercial fleet remains equipped with aging OWS systems. As classification societies and port state control intensify inspections, shipowners are increasingly investing in retrofitting. The retrofit segment is expected to grow at a CAGR of 7.2% from 2023 to 2026, particularly in regions like Asia-Pacific, where cost-effective upgrade solutions are in high demand.

4. Expansion in Offshore and Auxiliary Vessel Applications

Beyond commercial shipping, offshore support vessels (OSVs), fishing fleets, and offshore platforms are emerging as high-growth segments. With increased offshore energy exploration (including wind and oil & gas), demand for compact, robust OWS systems capable of handling variable waste streams will rise. This trend is particularly evident in the North Sea, Gulf of Mexico, and Southeast Asia.

5. Regional Market Shifts and Supply Chain Dynamics

Asia-Pacific will remain the largest market for marine OWS systems by 2026, driven by China, South Korea, and Singapore’s dominance in shipbuilding and repair. However, localized manufacturing and supply chain resilience will gain importance due to geopolitical uncertainties and post-pandemic logistics challenges. European and North American manufacturers are increasingly partnering with regional suppliers to ensure compliance with regional content requirements and reduce lead times.

6. Sustainability and Circular Economy Integration

By 2026, there will be growing interest in OWS systems that not only treat bilge water but also recover reusable oil. Technologies enabling oil reclamation for reuse in lubrication or as fuel in waste-to-energy systems will gain traction, aligning with broader maritime sustainability goals. This shift supports the circular economy model and reduces operational waste disposal costs.

7. Digitalization and Smart OWS Systems

The integration of IoT-enabled sensors and predictive maintenance platforms into OWS units will become mainstream. These smart systems will provide real-time performance analytics, automatic alarm triggering, and seamless reporting to flag states and environmental authorities. By 2026, over 40% of newly installed OWS units are expected to be connected to vessel-wide digital monitoring ecosystems.

Conclusion

The 2026 marine oily water separator market will be characterized by regulatory compliance, technological innovation, and digital integration. Stakeholders—including manufacturers, shipowners, and regulators—must adapt to these trends to ensure environmental stewardship and operational efficiency in an increasingly scrutinized maritime sector.

Common Pitfalls When Sourcing Oily Water Separator (OWS) Systems for Marine Applications (Quality & IP)

Sourcing an Oily Water Separator (OWS) for marine use involves navigating complex technical, regulatory, and commercial challenges. Overlooking key aspects related to quality and intellectual property (IP) can lead to significant operational, financial, and legal risks. Below are common pitfalls to avoid:

Inadequate Verification of Regulatory Compliance and Certification

One of the most critical pitfalls is assuming a supplier’s claims about compliance without rigorous independent verification. Many OWS units are marketed as “MEPC.107(49) compliant” or “IMO Type Approved,” but actual performance and certification validity can vary significantly.

- Pitfall: Accepting self-declared compliance or outdated certificates. Some suppliers may provide certificates that have expired, are from unaccredited bodies, or only cover specific components rather than the complete system.

- Risk: Non-compliant systems lead to port state control detentions, fines, operational disruptions, and potential environmental violations.

- Mitigation: Demand valid, current Type Approval certificates from recognized classification societies (e.g., DNV, LR, ABS). Verify the scope of approval covers the exact model and configuration being supplied. Cross-check with the issuing authority’s public database if possible.

Overlooking Build Quality and Material Standards

The marine environment is harsh, with constant vibration, saltwater exposure, and wide temperature fluctuations. Using substandard materials or poor construction compromises system longevity and performance.

- Pitfall: Prioritizing low cost over material suitability. For example, using non-marine-grade stainless steel (e.g., 304 instead of 316L), inadequate corrosion protection, or low-quality seals and gaskets.

- Risk: Premature failure of critical components (pumps, sensors, coalescer plates), leaks, increased maintenance costs, and system downtime.

- Mitigation: Specify material requirements in the procurement contract (e.g., ASTM/EN standards for stainless steel, IP66/NEMA 4X enclosures). Request detailed material test reports (MTRs) and conduct factory acceptance tests (FAT) to inspect build quality firsthand.

Ignoring Intellectual Property (IP) and Design Authenticity

The OWS market includes original manufacturers, licensed producers, and unauthorized copycats. Sourcing from sources with questionable IP rights can lead to legal issues and reliability problems.

- Pitfall: Procuring systems that infringe on patented designs or trade secrets. Some suppliers offer cheaper “equivalent” or “compatible” units that closely mimic leading brands without proper licensing.

- Risk: Legal liability for IP infringement, lack of technical support, unavailability of genuine spare parts, and unreliable performance due to untested design modifications.

- Mitigation: Source directly from authorized distributors or OEMs. Request documentation proving the supplier’s right to manufacture and sell the design. Avoid “too good to be true” pricing that may indicate counterfeit or cloned products.

Underestimating the Importance of After-Sales Support and Spare Parts Availability

OWS systems require regular maintenance, calibration, and occasional part replacement. Poor support can render even a high-quality system ineffective.

- Pitfall: Failing to confirm the availability and lead time of critical spares (e.g., coalescer packs, oil sensors, control modules) and technical support in key global ports.

- Risk: Extended vessel downtime during breakdowns, inability to pass inspections due to non-functional alarms or monitoring systems, increased operational costs.

- Mitigation: Require a detailed support plan in the contract, including spare parts lists with pricing, global service network details, and response time guarantees. Prefer suppliers with a proven track record in marine after-sales service.

Relying Solely on Manufacturer Specifications Without Real-World Performance Data

Datasheets often present idealized performance under controlled conditions. Real-world performance, especially under varying oil types, emulsions, and operational loads, can differ drastically.

- Pitfall: Trusting lab-test results without field validation. Some systems perform well with clean test oil but fail with bilge water containing surfactants, detergents, or fuel emulsions.

- Risk: System fails to meet 15 ppm discharge standard in actual operation, leading to non-compliance.

- Mitigation: Request references from existing customers with similar vessel types and operating profiles. If possible, conduct a trial installation or pilot testing under realistic conditions before full-scale procurement.

Neglecting Integration and Installation Requirements

An OWS doesn’t operate in isolation. Poor integration with existing bilge systems, control networks, or power supplies can undermine performance.

- Pitfall: Not verifying compatibility with the vessel’s electrical system (voltage, frequency), control interfaces (e.g., Modbus, NMEA 2000), or physical installation constraints (space, weight, inlet/outlet locations).

- Risk: Costly retrofits, system malfunctions due to control conflicts, inefficient operation, or inability to install as planned.

- Mitigation: Provide full system integration specifications during the sourcing phase. Engage the shipyard or technical team early to review installation drawings and interface requirements.

By proactively addressing these quality and IP-related pitfalls, marine operators and procurement teams can ensure they invest in a reliable, compliant, and legally sound Oily Water Separator system that supports both environmental stewardship and operational efficiency.

Logistics & Compliance Guide for Oily Water Separator (OWS) Marine

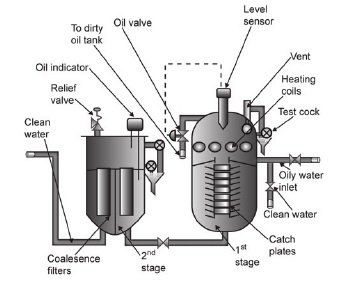

Introduction to Oily Water Separators (OWS)

An Oily Water Separator (OWS) is a critical marine pollution prevention system installed on ships to separate oil from bilge water before discharge into the sea. These systems ensure compliance with international maritime regulations, primarily under MARPOL Annex I. This guide outlines the logistics and compliance requirements associated with the installation, operation, maintenance, and monitoring of marine OWS systems.

Applicable Regulations and Standards

MARPOL Annex I – Prevention of Pollution by Oil

Under the International Convention for the Prevention of Pollution from Ships (MARPOL), Annex I regulates the discharge of oil and oily mixtures. Key requirements include:

- Oily water separators must be installed on all ships of 400 gross tonnage and above.

- Discharge of oily mixtures is prohibited within Special Areas (e.g., Mediterranean, Baltic Sea, Antarctic).

- Outside Special Areas, discharge is permitted only if the oil content is below 15 parts per million (ppm) and the ship is en route.

- The OWS must be equipped with an Oil Content Meter (OCM) and a 15 ppm alarm/automatic stopping device.

IMO Resolutions and Guidelines

- MEPC.107(49): Sets performance standards for OWS and OCM systems, including testing procedures and certification requirements.

- MEPC.2/Circ.685: Provides guidance on the operation and maintenance of OWS systems.

- ISM Code: Requires procedures for the safe operation of pollution prevention equipment, including OWS.

Classification Society Requirements

All OWS systems must be approved by recognized classification societies such as:

– American Bureau of Shipping (ABS)

– Lloyd’s Register (LR)

– DNV GL

– Bureau Veritas (BV)

These organizations certify that the OWS meets international standards and is suitable for the vessel type and operational profile.

Equipment Specifications and Installation Logistics

Design and Technical Requirements

- Separation Efficiency: Must reduce oil content to ≤15 ppm.

- Flow Rate: Sized according to the vessel’s maximum bilge water generation.

- Materials: Corrosion-resistant materials (e.g., stainless steel) for seawater exposure.

- Automation: Must include automatic shutdown if oil content exceeds 15 ppm.

- Oil Content Meter (OCM): Must be type-approved and calibrated annually.

Installation Considerations

- Location: OWS should be installed in an accessible area with proper drainage and ventilation.

- Piping: Bilge suction lines must be segregated from other systems; non-return valves are recommended.

- Power Supply: Requires stable electrical supply with backup options where feasible.

- Alarm and Monitoring Systems: Connected to the ship’s alarm panel and bridge notification system.

Operational Procedures and Recordkeeping

Standard Operating Procedures (SOPs)

- Bilge water should be allowed to settle in the bilge holding tank before processing.

- OWS must be operated only when the vessel is underway.

- Manual operation is allowed only in emergencies with proper documentation.

- Crew must monitor OCM readings continuously during operation.

Oil Record Book Part I (ORB-I)

Mandatory entries include:

– Date, time, and position of discharge.

– Quantity of oily mixture discharged.

– Oil content (ppm) at discharge.

– Automatic stopping activation (if occurred).

– Malfunctions or bypassing of OWS.

Entries must be signed by the officer in charge and the master.

Maintenance and Inspection Requirements

Routine Maintenance

- Daily: Visual inspection, check for leaks, verify alarm functionality.

- Weekly: Clean filters and coalescer plates; check pump operation.

- Monthly: Inspect OCM calibration status; test automatic stop function.

- Annually: Full system overhaul; recertification of OCM and OWS by authorized personnel.

Certification and Surveys

- Initial Survey: Before OWS is put into service.

- Periodic Surveys: Conducted every 12 months during Safety Equipment Surveys.

- Type Approval Certificate: Must be onboard and valid; issued by the manufacturer and approved by the flag state or classification society.

Crew Training and Competency

- All engineering officers and crew responsible for OWS operation must receive training per STCW requirements.

- Training should cover:

- MARPOL regulations and discharge limits.

- Proper operation and emergency procedures.

- Calibration and troubleshooting of OCM.

- Oil Record Book entries and legal implications of non-compliance.

Penalties for Non-Compliance

Violations of OWS regulations may result in:

– Fines and port state control detentions.

– Criminal charges against crew or ship operators.

– Vessel blacklisting or loss of insurance coverage.

– Environmental damage claims.

Recent cases (e.g., “The Princess” case) highlight strict enforcement and significant penalties for deliberate bypassing of OWS systems.

Environmental Best Practices

- Minimize bilge water generation through leak detection and maintenance.

- Use absorbents and filtration where appropriate.

- Consider advanced treatment systems (e.g., ultrafiltration, membrane separation) for enhanced performance.

- Regularly audit bilge management practices during internal safety audits.

Conclusion

Proper logistics and compliance with oily water separator systems are essential for environmental protection and regulatory adherence. Ship operators must ensure that OWS systems are correctly installed, operated, maintained, and documented in accordance with MARPOL and flag state requirements. Continuous crew training and vigilant recordkeeping are key to avoiding penalties and promoting sustainable maritime operations.

Conclusion on Sourcing an Oily Water Separator for Marine Applications:

Sourcing an oily water separator (OWS) for marine use is a critical step in ensuring environmental compliance, operational efficiency, and adherence to international maritime regulations such as MARPOL Annex I. Selecting the right OWS involves evaluating several key factors, including treatment efficiency (ensuring effluent meets the 15 ppm oil content standard), compact design suitable for vessel space constraints, durability under harsh marine conditions, ease of maintenance, and certification by recognized classification societies (e.g., IMO, DNV, ABS).

It is essential to partner with reputable suppliers offering proven technology, after-sales support, and compliance documentation. Additionally, considering integrated monitoring systems like oil content meters (OCMs) and automatic stopping devices enhances regulatory compliance and reduces the risk of pollution incidents.

Ultimately, a well-sourced oily water separator not only safeguards the marine environment but also protects the vessel operator from legal penalties, reputational damage, and costly downtime. Investing in a reliable and certified OWS is a proactive measure towards sustainable and responsible maritime operations.