The global oil seals market is experiencing steady growth, driven by rising demand across automotive, industrial machinery, and manufacturing sectors. According to Grand View Research, the global mechanical seals market, which includes oil seals, was valued at USD 4.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by increasing industrialization, the need for energy-efficient sealing solutions, and stringent environmental regulations requiring leakage prevention. As applications become more diverse and performance demands rise, manufacturers are focusing on precision engineering and material innovation—particularly in seals categorized by standardized sizes. In this competitive landscape, a select group of manufacturers has emerged, consistently delivering high-quality oil seals tailored to exact dimensional specifications. Below is a data-driven look at the top nine oil seals by size manufacturers shaping the industry’s future.

Top 9 Oil Seals By Size Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 M Seals

Domain Est. 2004

Website: m-seals.com

Key Highlights: M Seals specialises in industrial seals, ensuring high quality in all our products. With over 50000 items readily available in our stock, we can deliver ……

#2 Industrial Seals Distributor and Manufacturer

Domain Est. 2007

Website: espint.com

Key Highlights: Engineered Seal Products is a global industrial seals and o-rings distributor and manufacturer with in-house expertise in engineering, supply chain, ……

#3 Seal Search Tool

Domain Est. 1994

Website: engineering.timken.com

Key Highlights: Search, select, and access catalog data for Timken small bore industrial seals. Here you can search by specification, Timken part number, or interchange….

#4 Seal Manufacturer

Domain Est. 1996

Website: clarkseals.com

Key Highlights: Clark Seals designs and manufacturers custom shaft seals that are perfectly matched to each application, ensuring maximum reliability and performance….

#5 Seals and O-Rings

Domain Est. 1995

Website: ph.parker.com

Key Highlights: … Oil Coolers, LAC”,”document-type”:”Static File”,”document-url”:”https://www … Size Pilot Poston Cavity Catalog Page (MSG15-3504)”,”document-type ……

#6 Oil Seals

Domain Est. 1996

Website: trelleborg.com

Key Highlights: Oil Seals, also known as radial oil seals, radial shaft seals or rotary shaft lip seals, are round sealing devices used to seal between two machine parts….

#7 Seals

Domain Est. 1996

Website: skf.com

Key Highlights: We offer seals for engines, drivelines, suspensions, and wheel-end applications in traditional and hybrid/electric vehicles and two-wheelers….

#8 Hercules Sealing Products

Domain Est. 2006

Website: herculesus.com

Key Highlights: Hercules Sealing Products is a leading supplier of aftermarket hydraulic seals, seal kits, hydraulic cylinders, and cylinder repair parts….

#9 Martin Fluid Power

Domain Est. 1999

Website: mfpseals.com

Key Highlights: MFP Seals is a manufacturer and distributor of the highest quality sealing devices, gaskets, O-Rings, hydraulic seals, oil seals, wear rings, bearings, ……

Expert Sourcing Insights for Oil Seals By Size

H2: 2026 Market Trends for Oil Seals by Size

The global oil seals market in 2026 is expected to exhibit distinct growth patterns segmented by size, driven by evolving industrial demands, technological advancements, and sector-specific applications. While comprehensive data specifically isolating 2026 size trends is still emerging, current trajectories and industry analyses point to the following key developments for the major size categories:

1. Small Diameter Seals (<25mm): Steady Growth in Precision Industries

This segment is anticipated to maintain robust growth, primarily fueled by the expanding electronics, medical devices, and small appliance sectors. The miniaturization trend in consumer electronics and the rising demand for precision machinery in automation and robotics will drive the need for reliable, compact sealing solutions. Additionally, the growing electric vehicle (EV) market will boost demand for small seals in motors, sensors, and auxiliary systems. The emphasis on energy efficiency and durability will favor high-performance elastomers like FKM and FFKM in this size category, despite higher costs.

2. Medium Diameter Seals (25mm – 100mm): Dominant Market Share with Broad Industrial Demand

The medium size range is expected to remain the largest segment by volume and value in 2026. This dominance stems from widespread use across key industries including automotive (engine, transmission, axle seals), general industrial machinery (pumps, compressors, gearboxes), and agriculture. Continued production of internal combustion engine (ICE) vehicles, especially in developing economies, alongside hybrid vehicle platforms, will sustain demand. Growth in industrial automation and infrastructure development globally will further bolster this segment. Cost-effective materials like NBR and HNBR will remain prevalent, with increasing adoption of premium materials for enhanced performance.

3. Large Diameter Seals (>100mm): High-Growth Potential in Heavy-Duty Applications

This segment is projected to experience the highest growth rate by 2026, driven by increasing demand in heavy industries. Key drivers include:

* Renewable Energy: Significant expansion in wind turbine installations globally necessitates large, durable seals for gearboxes and pitch/yaw systems, often requiring specialized materials (e.g., PTFE, advanced elastomers) for harsh conditions.

* Oil & Gas: Resurgence in offshore drilling and pipeline maintenance projects, particularly with a focus on reliability and reduced downtime, will increase demand for large, high-pressure seals.

* Construction & Mining: Growth in large-scale infrastructure projects and mining operations requires robust seals for heavy machinery like excavators and haul trucks.

* Marine: Modernization of commercial and naval fleets drives demand for large seals in propulsion and auxiliary systems.

Cross-Cutting Trends Influencing Size Segments by 2026:

- Material Innovation: Across all sizes, there is a shift towards advanced materials (FKM, FFKM, PTFE, PEEK) offering superior resistance to heat, chemicals, and wear, especially in demanding applications (EVs, renewables, oil & gas).

- Customization & Engineering: Demand for application-specific, engineered sealing solutions is rising, particularly for non-standard or large sizes in critical applications.

- Sustainability: Increased focus on seal longevity, recyclability, and reduced environmental impact is influencing material selection and design, impacting manufacturing processes across size ranges.

- Supply Chain Localization: Geopolitical factors and supply chain resilience concerns may lead to regional manufacturing shifts, affecting the production and availability of seals of various sizes, particularly large, complex ones.

Conclusion:

By 2026, the oil seals market by size will reflect a diversified landscape. While medium-sized seals will dominate due to broad industrial applicability, small seals will grow steadily with technological miniaturization, and large seals will see accelerated growth propelled by heavy industries like renewable energy and oil & gas. Success for manufacturers will hinge on material innovation, customization capabilities, and strategic positioning within these evolving high-growth segments, particularly in large-diameter, high-performance applications.

Common Pitfalls When Sourcing Oil Seals by Size (Quality and IP Considerations)

Sourcing oil seals by size alone—without due consideration for quality and Ingress Protection (IP) ratings—can lead to significant operational failures, safety hazards, and increased costs. Below are the most common pitfalls buyers encounter:

Overreliance on Dimensional Accuracy Alone

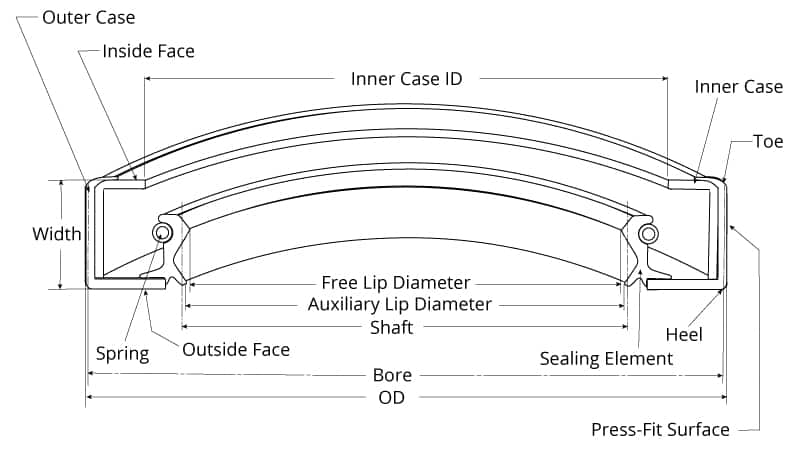

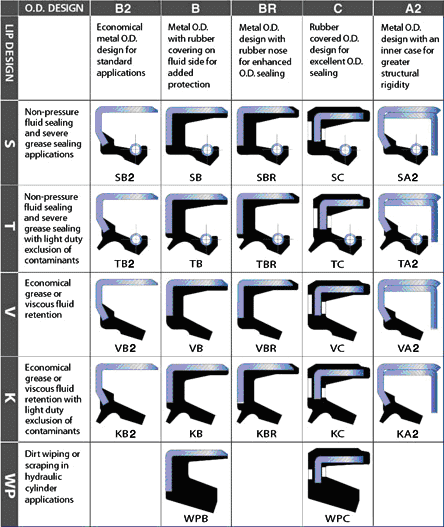

Many procurement teams prioritize exact size matching (inner diameter, outer diameter, and height) while neglecting the material quality, sealing lip design, and manufacturing tolerances. A seal that fits dimensionally but is made from inferior rubber or lacks proper reinforcement may fail prematurely due to extrusion, compression set, or poor heat resistance.

Ignoring Material Compatibility with Operating Environment

Oil seals are exposed to various media (e.g., hydraulic oils, greases, coolants) and environmental conditions (temperature, UV, ozone). Selecting a seal based solely on size without verifying elastomer compatibility (e.g., NBR, FKM, EPDM) can result in swelling, hardening, or degradation, leading to leakage and system contamination.

Misunderstanding IP Ratings and Sealing Performance

Ingress Protection (IP) ratings indicate a seal’s ability to resist dust and water ingress. However, oil seals are not typically rated using the standard IP code like electrical enclosures. Assuming a dimensional match ensures equivalent protection can be misleading. The sealing efficiency depends on lip geometry, spring tension, and surface finish of the shaft—factors not captured by size alone.

Sourcing from Unqualified or Non-Certified Suppliers

To cut costs, buyers may turn to uncertified suppliers offering “generic” oil seals. These products often lack traceability, quality control, and compliance with international standards (e.g., ISO 6195, SAE AS5711). This increases the risk of counterfeit or substandard parts that compromise system integrity.

Neglecting Dynamic Application Requirements

Oil seals operate under dynamic conditions involving shaft speed, misalignment, and pressure differentials. A seal sized correctly but not rated for the application’s RPM or pressure may experience excessive heat buildup, lip lift-off, or blowout—issues invisible during initial installation.

Inconsistent Tolerances and Batch Variability

Low-cost manufacturers may exhibit wide variance in critical dimensions and material properties between production batches. Even if one seal fits perfectly, the next batch might cause leakage or premature wear due to inconsistent lip interference or durometer hardness.

Failure to Validate with Application-Specific Testing

Relying on catalog specifications without field or bench testing under real operating conditions is risky. A seal may appear suitable on paper but fail under actual load, temperature, or contamination levels—leading to unplanned downtime and repair costs.

To avoid these pitfalls, always source oil seals based on a holistic specification that includes size, material, operating environment, performance standards, and supplier credibility—not dimensions alone.

Logistics & Compliance Guide for Oil Seals by Size

Overview

This guide outlines the logistics and compliance considerations for the storage, handling, transportation, and regulatory adherence of oil seals categorized by size. Proper management ensures product integrity, supply chain efficiency, and compliance with international and regional regulations.

Classification by Size

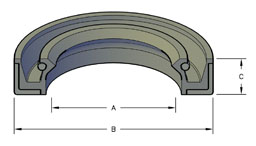

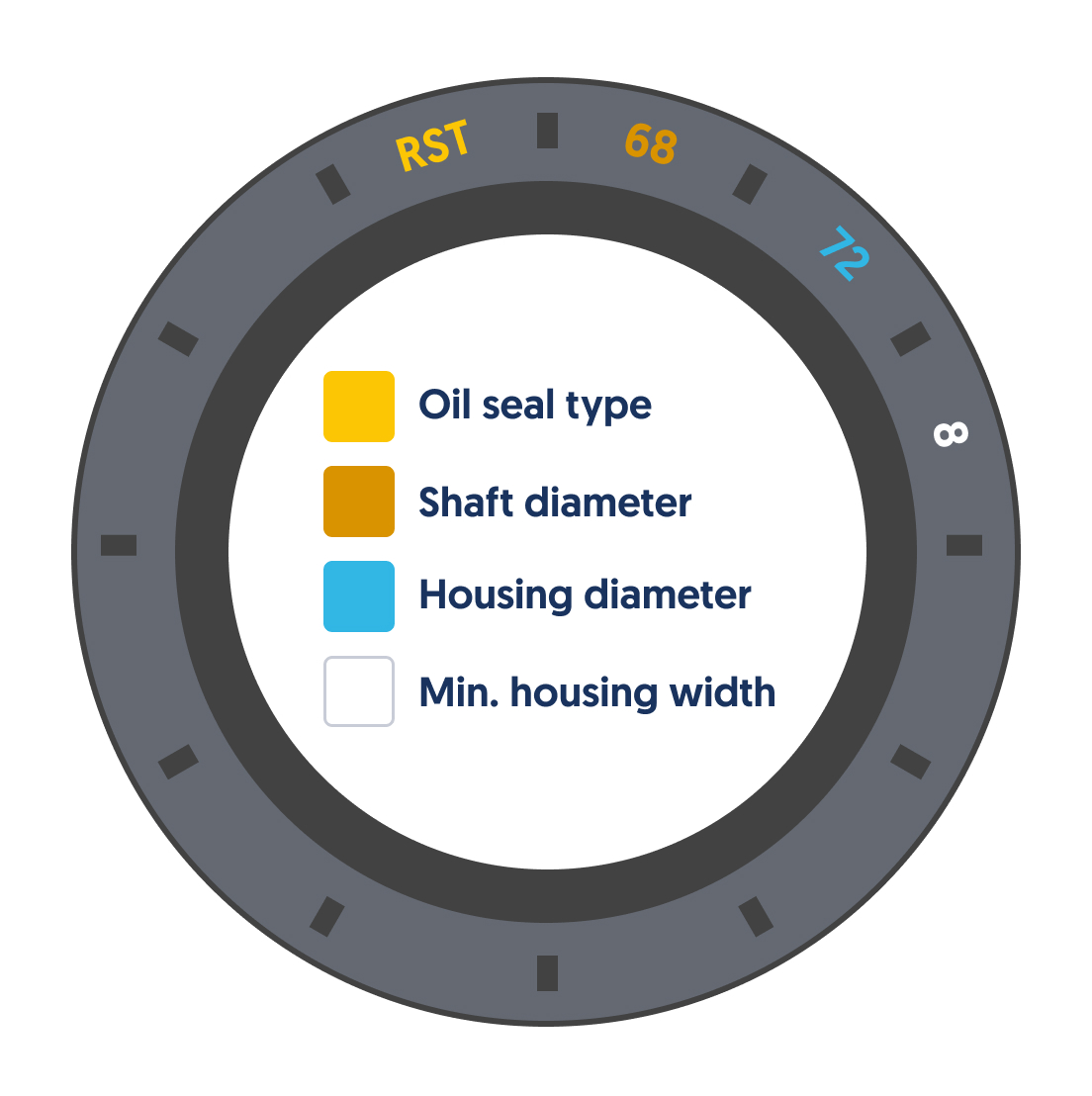

Oil seals are commonly categorized by their inner diameter (ID), outer diameter (OD), and height (thickness). Standard size classifications include:

– Small: ID < 25 mm

– Medium: ID 25–100 mm

– Large: ID > 100 mm

Size-based classification affects packaging, shipping, and handling requirements.

Packaging Requirements

- Small Seals: Packed in moisture-resistant blister packs or sealed polybags, grouped in bulk containers or partitioned trays to prevent deformation.

- Medium Seals: Individually wrapped or grouped in labeled boxes with internal cushioning to avoid edge damage.

- Large Seals: Packaged with rigid support (e.g., plastic rings or custom molds) and placed in wooden or reinforced cardboard crates to maintain shape.

- All packaging must be labeled with size, material type, batch number, and handling symbols (e.g., “Do Not Stack,” “Protect from Moisture”).

Storage Conditions

- Temperature: Store between 5°C and 35°C; avoid direct sunlight and heat sources.

- Humidity: Maintain relative humidity below 70% to prevent material degradation (especially in rubber compounds).

- Shelving: Store seals flat or vertically using proper supports; do not hang or stretch.

- Shelf Life: Most rubber seals have a shelf life of 5–10 years; follow manufacturer guidelines and implement FIFO (First In, First Out) inventory rotation.

- Segregation: Store by size and material type to prevent cross-contamination and ensure traceability.

Transportation Guidelines

- Domestic Shipping: Use padded containers and secure loads to prevent shifting. Clearly label packages with size category and handling instructions.

- International Shipping:

- Comply with IATA (air), IMDG (sea), and ADR (road) regulations if seals contain regulated materials.

- Use climate-controlled containers if shipping through extreme environments.

- Ensure proper documentation, including commercial invoices with accurate HS codes (e.g., 8484.10 for mechanical seals).

- Stacking Limits: Respect weight limits based on size—small seals may allow higher stacking; large seals require flat, single-layer transport.

Regulatory Compliance

- HS Code Classification:

- 8484.10 – Gaskets, washers, and other seals of metal, reinforced or combined with other materials.

- 4016.93 – Other articles of vulcanized rubber (non-hardened), including oil seals.

- Accurate classification by size and material ensures correct tariffs and customs clearance.

- REACH & RoHS Compliance: Ensure seal materials (e.g., NBR, FKM) comply with EU regulations on restricted substances. Documentation must be available upon request.

- Country-Specific Requirements:

- USA: Comply with EPA and OSHA standards for material safety; provide SDS (Safety Data Sheets) if requested.

- EU: Adhere to CE marking requirements where applicable and maintain EU Declaration of Conformity.

- China: Follow CCC certification if seals are part of regulated machinery assemblies.

Labeling & Traceability

- Each package must include:

- Size designation (ID × OD × Height in mm)

- Material type (e.g., Nitrile, Viton)

- Manufacturer part number

- Lot/batch number

- Manufacturing and expiry dates (if applicable)

- Use barcodes or QR codes for efficient inventory tracking across logistics systems.

Quality Assurance & Inspection

- Conduct pre-shipment inspections based on size categories:

- Small: Random sampling (AQL 1.0) for dimensional accuracy.

- Large: 100% visual inspection for cracks, warping, or surface defects.

- Retain inspection records for at least 5 years for compliance audits.

Returns & Reverse Logistics

- Define size-specific return procedures:

- Seals must be returned in original packaging.

- Inspect for contamination or damage before restocking.

- Non-conforming large seals may require special disposal due to material content.

Conclusion

Efficient logistics and compliance for oil seals by size require structured packaging, climate-appropriate storage, accurate documentation, and adherence to international standards. Implementing size-based protocols ensures product reliability and regulatory alignment across global supply chains.

In conclusion, sourcing oil seals by size is a practical and efficient approach that ensures compatibility, optimal performance, and longevity in mechanical applications. By accurately measuring key dimensions—such as inner diameter (ID), outer diameter (OD), and thickness—procurement teams and maintenance professionals can identify the correct seal for their specific equipment. This method simplifies inventory management, reduces downtime, and minimizes the risk of premature seal failure due to improper fit. Additionally, standardized sizing facilitates interchangeability among different manufacturers, promoting cost-effective sourcing and supplier flexibility. However, while size is a critical factor, it is equally important to consider operating conditions such as temperature, pressure, speed, and fluid compatibility to select the most suitable material and design. Therefore, while sourcing by size provides a solid foundation, a comprehensive understanding of the application environment ensures the best sealing solution and overall system reliability.