The global market for coal tar oil, a critical byproduct of coal processing used in applications ranging from road paving to pharmaceuticals and industrial coatings, is experiencing steady expansion. According to Grand View Research, the global coal tar market was valued at USD 5.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030, driven by rising demand in the aluminum, steel, and construction industries. Similarly, Mordor Intelligence forecasts sustained growth, citing increased infrastructure development in emerging economies and the irreplaceable role of coal tar pitch in anode production for aluminum smelting. As demand climbs, the competitive landscape is shaped by a select group of manufacturers dominating production, quality, and innovation. This list highlights the top nine oil of tar manufacturers leading the sector through scale, technological advancement, and strategic market positioning.

Top 9 Oil Of Tar Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Distilled Coal Tar & Petroleum Products

Domain Est. 2007

Website: lonestarspecialties.net

Key Highlights: Lone Star Specialties is a manufacturer of many different coal tar and petroleum products that include various carbon pitches and refined tars along with the ……

#2 Tar Oil

Domain Est. 1996

Website: dakotagas.com

Key Highlights: Dakota Gas tar oil is used as a blend stock into the residual fuel oil market. Tar oil can also be used as a specialty carbon black feedstock….

#3 Pitch and tar oils –

Domain Est. 1997

Website: deza.cz

Key Highlights: Tar pitch is produced in different specifications based on customers’ requests. Tar Oil. Various tar oils and tar pitch are the result of distillation of tar….

#4 Kearl

Domain Est. 2000

Website: imperialoil.ca

Key Highlights: Kearl is considered one of Canada’s highest-quality oil sands deposits and is being developed using next-generation mining techniques….

#5 Coal Tar Pitch, Tar Oils, USP Tar, Phenol

Domain Est. 2000

Website: zeninternational.net

Key Highlights: COAL TAR CREOSOTE OIL BS144 Type B grade Creosote Oil from coal tar distillation, wood impregnating oil for wood preservation in railway lines, electric poles ……

#6 Himadri Speciality Chemical Ltd

Domain Est. 2002

Website: himadri.com

Key Highlights: Our diverse product portfolio includes speciality carbon black, coal tar pitch, refined naphthalene, new energy materials, SNF, speciality oils, power, etc….

#7 Wood Tar Oil

Domain Est. 2006

Website: foreverest.net

Key Highlights: Foreverest supply wood tar oil (pine tar) for over 20years, the tar oil is prepared by the high temperature carbonization of pine wood under anoxic conditions….

#8 TAR OIL

Domain Est. 2020

Website: atamanchemicals.com

Key Highlights: Tar oil is an oily liquid with a burning taste,obtained by distilling coal and woodtar, used as an antiseptic and wood preservative….

#9 Birch Tar “Signature” Oil, Clear

Domain Est. 2022

Website: fraterworks.com

Key Highlights: In stock Rating 5.0 (10) Birch Tar Clear is the scent of pipe ash, cigars and warm hearths — and it’s IFRA compliant too! This clear oil is also about 50% lighter in colour than …

Expert Sourcing Insights for Oil Of Tar

H2: Projected 2026 Market Trends for Oil of Tar

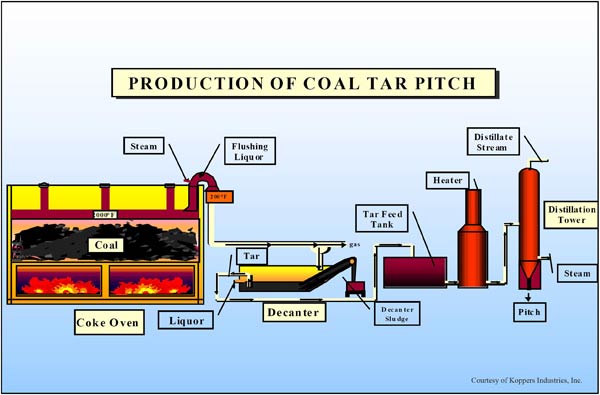

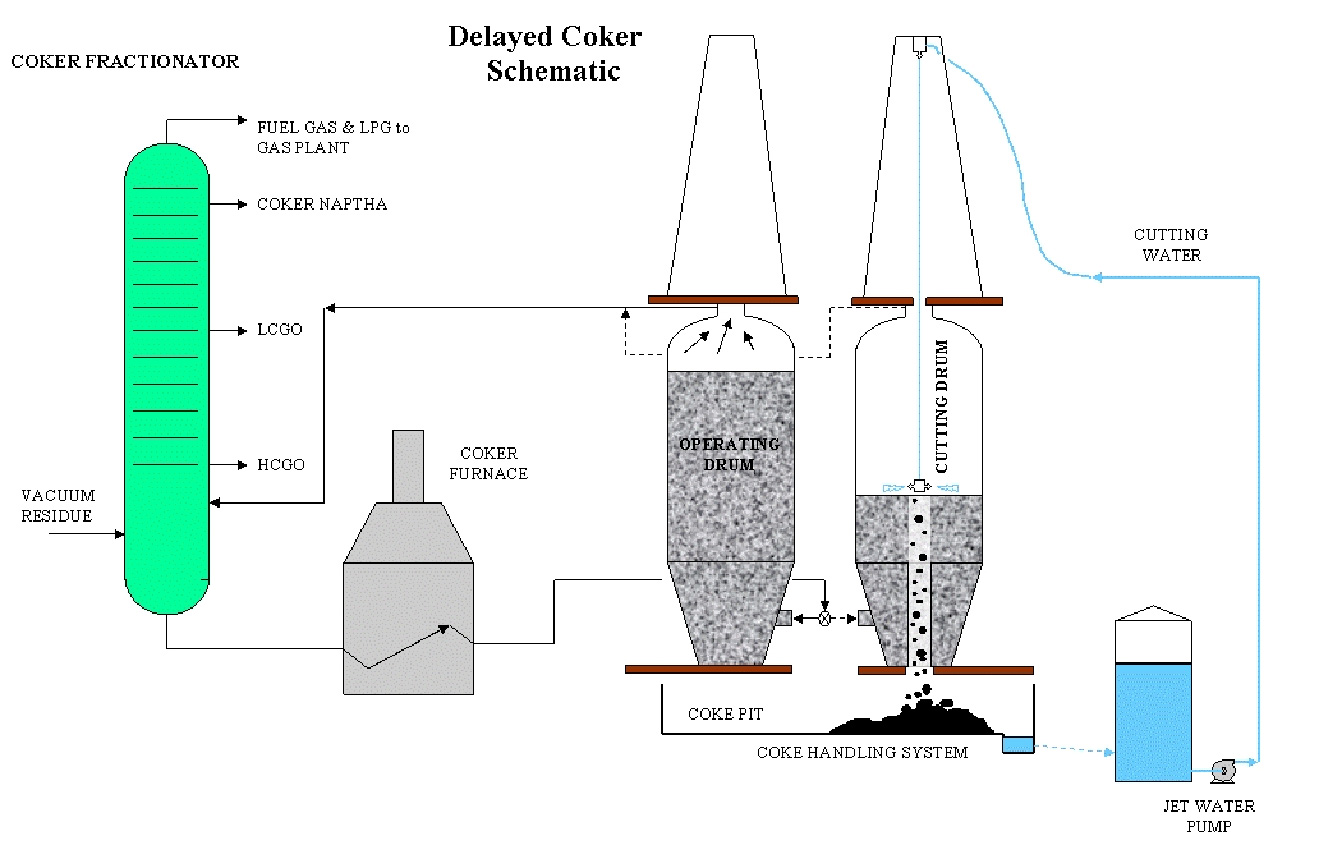

The market for Oil of Tar, a byproduct derived primarily from the destructive distillation of coal tar, is expected to experience modest but strategically significant shifts by 2026. Historically used in medicinal applications (such as in anti-dandruff shampoos and psoriasis treatments) and industrial coatings, the Oil of Tar sector faces evolving dynamics driven by regulatory, environmental, and consumer trend pressures.

-

Regulatory and Environmental Pressures

Increasing global regulations targeting polycyclic aromatic hydrocarbons (PAHs)—known carcinogens found in coal tar—are expected to constrain the expansion of Oil of Tar applications, particularly in consumer healthcare. The European Union’s REACH regulations and similar frameworks in North America may further limit concentrations or mandate labeling, reducing demand in over-the-counter dermatological products. As a result, manufacturers are likely to reformulate products or seek synthetic alternatives by 2026. -

Decline in Pharmaceutical Use

The pharmaceutical and personal care sectors, once major consumers of Oil of Tar, are shifting toward safer, plant-based, or synthetic substitutes (e.g., salicylic acid, ketoconazole, or coal tar-free botanical extracts). Consumer preference for “clean beauty” and transparency in ingredient sourcing is accelerating this transition. By 2026, medical-grade Oil of Tar usage is projected to decline by 3–5% annually in developed markets. -

Industrial Applications Remain Stable

In contrast, industrial uses—such as wood preservatives, specialty coatings, and roofing materials—will likely sustain demand. These applications benefit from Oil of Tar’s natural resistance to water and microbial degradation. Emerging markets in Asia and Africa, where infrastructure development continues, may support steady industrial consumption through 2026. -

Sustainability and Circular Economy Challenges

As industries move toward sustainability, the fossil-fuel-derived nature of coal tar presents a reputational and operational challenge. However, advancements in carbon capture and utilization (CCU) technologies may offer pathways to reprocess tar byproducts more responsibly, potentially reviving interest in value-added derivatives. -

Market Consolidation and Niche Positioning

The Oil of Tar market is expected to consolidate, with fewer but more specialized producers focusing on high-purity grades for niche medical or technical applications. Customized formulations for dermatology in regulated environments may persist, supported by clinical evidence of efficacy in treating chronic skin conditions.

In summary, the 2026 outlook for Oil of Tar reflects a bifurcated market: shrinking in consumer-facing sectors due to health and environmental concerns, yet resilient in industrial contexts where performance justifies continued use. Strategic adaptation, regulatory compliance, and innovation in derivative applications will determine long-term viability.

Common Pitfalls Sourcing Oil of Tar: Quality and Intellectual Property (IP) Issues

Sourcing Oil of Tar—a complex mixture derived from the destructive distillation of coal, wood, or other organic materials—presents unique challenges, particularly concerning quality consistency and intellectual property considerations. Failing to address these pitfalls can lead to regulatory non-compliance, product failure, or legal exposure.

Quality-Related Pitfalls

1. Inconsistent Composition and Purity

Oil of Tar is not a single compound but a variable blend of polycyclic aromatic hydrocarbons (PAHs), phenols, and other constituents. A major pitfall is assuming uniform quality across suppliers. Variations in raw materials, distillation processes, and refining methods result in batch-to-batch inconsistencies that can affect performance, safety, and regulatory compliance—especially in pharmaceutical or cosmetic applications where specifications are strict.

2. Lack of Standardized Specifications

Unlike synthetic chemicals, Oil of Tar lacks universally harmonized quality standards. Suppliers may use differing analytical methods (e.g., GC-MS, HPLC) or reference outdated pharmacopoeial monographs (e.g., USP, Ph. Eur.). Without clearly defined and mutually agreed-upon specifications—including PAH profile, moisture content, and heavy metal limits—buyers risk receiving substandard or non-conforming material.

3. Contamination and Adulteration

Due to its complex origin and high value in niche markets, Oil of Tar is prone to adulteration with cheaper substitutes (e.g., petroleum-derived tars or synthetic mixtures). Poor handling or storage can also introduce contaminants. Without rigorous supplier qualification and batch testing (including fingerprinting techniques), detecting such issues becomes difficult.

4. Regulatory Non-Compliance

Regulations governing Oil of Tar—especially in dermatological or medicinal products—are stringent due to the presence of potentially carcinogenic PAHs. Sourcing from suppliers unaware of or non-compliant with REACH, IARC classifications, or FDA guidelines can expose the buyer to legal and reputational risks. Ensuring up-to-date regulatory documentation (e.g., Safety Data Sheets, Statements of Compliance) is critical.

Intellectual Property (IP)-Related Pitfalls

1. Misuse of Proprietary Formulations

Oil of Tar is often incorporated into patented formulations (e.g., medicated shampoos for psoriasis or eczema). Sourcing the raw material without understanding the end-use IP landscape can inadvertently lead to infringement. For example, using a specific purified fraction of tar in a product that replicates a patented composition—even if the tar itself is generic—may violate formulation patents.

2. Ambiguity in Supplier IP Rights

Some suppliers may claim proprietary processing methods (e.g., purification or detoxification techniques) that improve tar quality. If these methods are patented, buyers using the material in certain applications may need licenses. Failing to conduct IP due diligence on the supplier’s processes can expose downstream users to infringement claims.

3. Lack of Freedom-to-Operate (FTO) Analysis

Before sourcing Oil of Tar for commercial products, especially in regulated markets, a thorough FTO analysis is essential. This assesses whether the intended use—such as in a branded therapeutic product—encroaches on existing patents related to composition, method of use, or manufacturing. Skipping this step risks costly litigation or product recalls.

4. Inadequate Documentation and Traceability

Robust IP and quality assurance require full traceability of the material’s origin and processing history. Suppliers that cannot provide batch-specific documentation, process validation data, or proof of non-infringement may pose both quality and IP risks. Clear contractual terms regarding IP warranties and indemnification are advisable.

Conclusion

Successfully sourcing Oil of Tar demands a dual focus on rigorous quality control and proactive IP management. Buyers must implement stringent supplier audits, enforce detailed specifications, and conduct thorough regulatory and IP due diligence to mitigate risks associated with this complex and regulated material.

Logistics & Compliance Guide for Oil of Tar

Overview of Oil of Tar

Oil of Tar, also known as coal tar oil or coal tar distillate, is a viscous black liquid derived from the destructive distillation of coal. It is commonly used in industrial applications such as wood preservatives, roofing materials, and medicinal treatments for skin conditions like psoriasis and eczema. Due to its hazardous nature, strict logistics and compliance protocols must be observed during handling, transportation, storage, and disposal.

Regulatory Classification

Oil of Tar is classified as a hazardous material under multiple regulatory frameworks:

- UN Number: UN 1999

- Proper Shipping Name: Coal tar, Coal tar oils, or Coal tar pitch, high temperature (depending on exact composition)

- Hazard Class: 6.1 (Toxic Substances) and/or Class 9 (Miscellaneous Dangerous Goods)

- Packing Group: II or III (based on toxicity and flammability)

- GHS Classification:

- Acute Toxicity (Oral, Dermal, Inhalation) – Category 4

- Skin Corrosion/Irritation – Category 2

- Serious Eye Damage/Eye Irritation – Category 2

- Carcinogenicity – Category 1B or 2

- Environmental Hazard – Category 2 (Aquatic Toxicity)

Regulatory agencies such as OSHA (USA), REACH/CLP (EU), and Transport Canada require proper labeling, safety data sheets (SDS), and handling procedures.

Packaging & Labeling Requirements

Proper packaging and labeling are essential to ensure safe transport and regulatory compliance:

- Packaging:

- Use UN-certified containers suitable for liquid hazardous materials (e.g., steel drums, IBCs).

- Ensure containers are tightly sealed to prevent leakage and vapor release.

-

Compatible materials (e.g., stainless steel, HDPE) must resist corrosion.

-

Labeling:

- Affix GHS-compliant hazard labels: skull and crossbones, exclamation mark, health hazard, and environmental hazard.

- Include proper shipping name, UN number, and technical name(s) on outer packaging.

-

Provide orientation arrows to indicate correct upright positioning.

-

Marking:

- All packages must display the shipper’s and consignee’s full address.

- Include emergency contact information.

Transportation Guidelines

Oil of Tar is subject to stringent transportation regulations depending on the mode:

Road Transport (e.g., ADR – Europe, 49 CFR – USA)

- Use vehicles with spill containment and proper ventilation.

- Transport documentation must include a Dangerous Goods Note (DGN) or Shipper’s Declaration.

- Drivers must have appropriate training (e.g., ADR certification).

- Placard vehicles with Class 6.1 and/or Class 9 hazard diamonds.

Rail & Air Transport

- IATA (air) and RID (rail) regulations apply.

- Air transport is highly restricted; special permits may be required.

- Quantity limits apply per package and consignment.

Maritime Transport (IMDG Code)

- Must comply with the International Maritime Dangerous Goods (IMDG) Code.

- Packages stowed away from foodstuffs and passenger areas.

- Provide detailed marine pollutant marking if applicable.

Storage Requirements

Safe storage minimizes risks of fire, exposure, and environmental contamination:

- Location: Store in a cool, dry, well-ventilated area away from direct sunlight and ignition sources.

- Containers: Keep in original, tightly sealed containers; secondary containment (e.g., spill pallets) is mandatory.

- Segregation: Isolate from oxidizers, acids, and foodstuffs.

- Signage: Post “No Smoking,” “Toxic,” and “Flammable” warning signs.

- Monitoring: Install vapor detection systems if stored in bulk.

Handling & Worker Safety

Personnel must be trained in hazardous material handling:

- Personal Protective Equipment (PPE):

- Chemical-resistant gloves (nitrile or neoprene)

- Goggles or face shield

- Respiratory protection (NIOSH-approved for organic vapors)

-

Impermeable apron or suit

-

Procedures:

- Use grounding and bonding when transferring liquids to prevent static discharge.

- Avoid skin contact and inhalation of vapors.

-

Prohibit eating, drinking, or smoking in handling areas.

-

Training:

- Conduct regular HAZCOM and emergency response training.

- Ensure workers understand SDS and emergency protocols.

Emergency Response

Prepare for potential incidents:

- Spill Response:

- Contain spill with absorbent materials (e.g., vermiculite, spill kits).

- Do not flush into sewers or waterways.

-

Collect contaminated material as hazardous waste.

-

Fire Response:

- Use foam, dry chemical, or CO₂ extinguishers.

- Water may be ineffective; cool exposed containers.

-

Evacuate area and wear full SCBA in fire conditions.

-

First Aid:

- Inhalation: Move to fresh air; seek medical attention.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Flush with water for at least 15 minutes; consult physician.

- Ingestion: Do not induce vomiting; seek immediate medical help.

Disposal & Environmental Compliance

Oil of Tar is persistent and toxic to aquatic life:

- Waste Classification:

- Regulated as hazardous waste (e.g., EPA Hazardous Waste Codes: U042, U055).

-

Follow RCRA (USA), Waste Framework Directive (EU), or equivalent.

-

Disposal Methods:

- Incineration in licensed hazardous waste facilities.

-

Never dispose of in drains, soil, or regular trash.

-

Reporting:

- Maintain manifests for waste shipment.

- Report spills exceeding reportable quantities (e.g., 1 lb under CERCLA in the U.S.).

Documentation & Recordkeeping

Maintain compliance through proper documentation:

- Safety Data Sheet (SDS) – updated and accessible.

- Shipping papers with accurate hazard declarations.

- Training records for personnel.

- Spill and incident reports.

- Waste disposal manifests.

Retention period: Minimum 3–5 years (varies by jurisdiction).

International Considerations

When shipping across borders:

- Verify import/export licenses (e.g., under EPA, ECHA, or national agencies).

- Comply with REACH registration (EU) and TSCA (USA) requirements.

- Some countries restrict or ban coal tar products in consumer goods (e.g., cosmetics).

Conclusion

Oil of Tar poses significant health, safety, and environmental risks. Compliance with global and local regulations in packaging, labeling, transport, storage, and disposal is essential. Employ strict safety protocols, train personnel thoroughly, and maintain accurate records to ensure safe and legal handling throughout the supply chain.

Conclusion on Sourcing Oil of Tar

The sourcing of oil of tar, commonly derived from the destructive distillation of coal or wood, presents both historical significance and modern-day challenges. While once widely used in medicinal, industrial, and cosmetic applications—particularly for treating skin conditions such as psoriasis and eczema—its use has declined due to health and environmental concerns. The presence of polycyclic aromatic hydrocarbons (PAHs), many of which are carcinogenic, has led to strict regulations in many countries regarding its production, sourcing, and application.

Sourcing oil of tar today requires careful consideration of regulatory compliance, ethical sourcing practices, and safety standards. Sustainable alternatives and synthetic substitutes are increasingly favored in pharmaceuticals and personal care products to minimize health risks and environmental impact. Therefore, while oil of tar may still have niche applications, its sourcing must be approached with caution, prioritizing safety, legality, and responsible supply chain management. In conclusion, the future of oil of tar lies not in expanded use, but in controlled, regulated application with a strong emphasis on safer alternatives and continuous evaluation of risk versus benefit.