The global demand for oil in container manufacturing has surged in recent years, driven by rising industrial automation, increased focus on lubrication efficiency, and stringent performance standards across automotive and manufacturing sectors. According to Grand View Research, the global industrial lubricants market was valued at USD 52.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. This growth is further fueled by the increasing adoption of packaged lubricants, which offer enhanced shelf life, reduced contamination risk, and improved logistics handling—key factors favoring established oil-in-container manufacturers. With Mordor Intelligence forecasting continued momentum in the specialty chemicals and packaged oils segment, particularly in emerging economies, the competitive landscape is evolving rapidly. In this dynamic environment, identifying the top players who combine scale, innovation, and distribution excellence becomes critical. Here’s a data-driven look at the top 10 oil in container manufacturers shaping the industry in 2024.

Top 10 Oil In Container Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bulk Containers

Domain Est. 2005

Website: rppcontainers.com

Key Highlights: RPP is a leading manufacturer of reusable bulk containers. Available in collapsible and straight wall styles with lids. Contact us today for an immediate ……

#2 Vidrala: Glass Packaging

Website: vidrala.com

Key Highlights: Design and manufacture of glass packaging. Information and sales on glass bottles and jars. Ask for our catalog without any commitment….

#3 to Alemite

Domain Est. 1996

Website: skf.com

Key Highlights: Modular Oil-Mist Generator Models 3115X-X and 3230X-X. Oil-Mist System Components. Manual Refill Pump and Hose/Filter Assembly · Oil Mist Collection Containers….

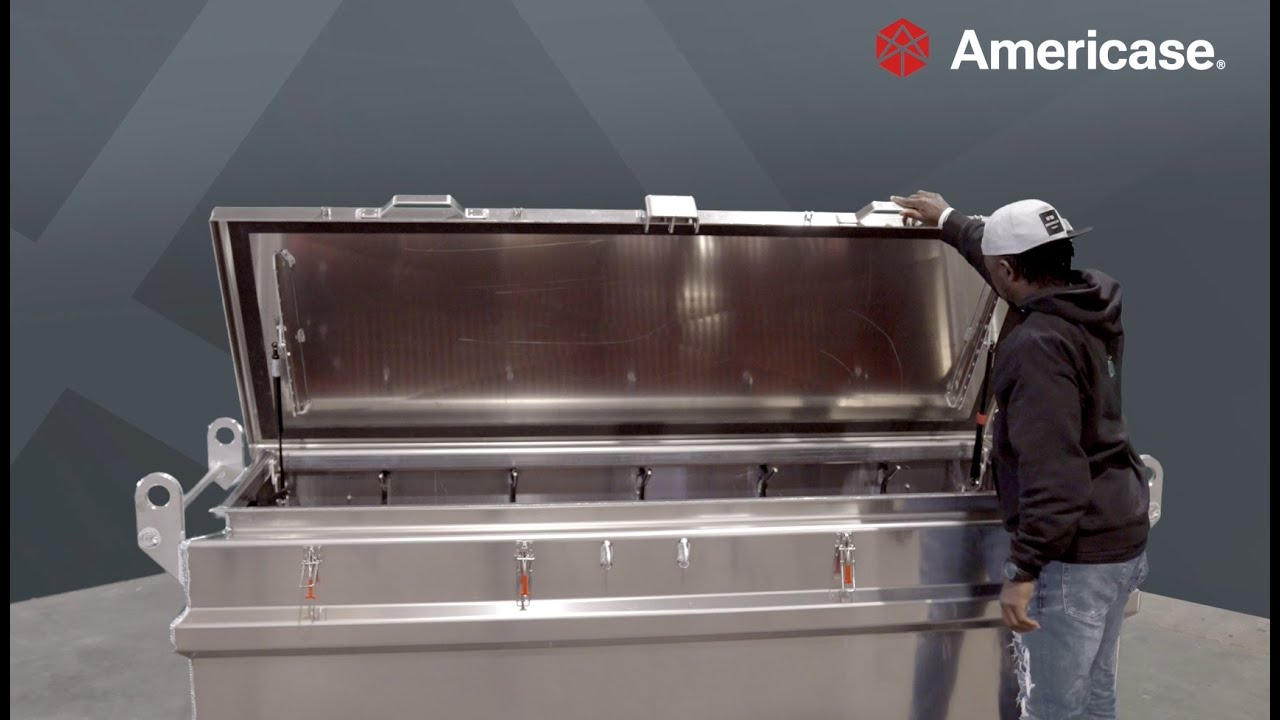

#4 Americase

Domain Est. 1996

Website: americase.com

Key Highlights: At Americase, our team believes companies of all industries deserve containers customized to solve their unique problems through smart, practical thinking….

#5 Glass Oil Bottles » premium Food Packaging Solutions

Domain Est. 1997

Website: stoelzle.com

Key Highlights: Our oil bottles are available as mini glass bottles from 10 ml or also as larger bottles up to 1,000 ml. You can request all our products ……

#6 Oil Transfer Equipment

Domain Est. 2000

Website: oilsafe.com

Key Highlights: Color-coded range of OILSAFE containers and accessories to reduce contamination. OilSafe Color-Coded Transfer Containers are preferred by leading companies ……

#7 Products

Domain Est. 2001

Website: waterloocontainer.com

Key Highlights: We proudly stock a comprehensive variety of glass bottles, caps, corks and closures. We are your one stop shop for everything you need to get your beverage out ……

#8 Spectrum Oil Containers, Lubricant Storage

Domain Est. 2005

Website: tricocorp.com

Key Highlights: The Spectrum Oil Containers line of products provide a simple, easy-to-use and error-free solution to identify, store, transport and dispense lubricants….

#9 Oil Storage & Transfer Containers

Domain Est. 2008

Website: lelubricants.com

Key Highlights: Sealable, reusable oil storage containers are the solution to prevent contamination. They make lubricant storage and handling easy, efficient and clean….

#10 Premium Oil Containers for Fresh Edible Oils

Domain Est. 2014

Website: oelwerk.com

Key Highlights: 12–26 day deliveryOur oil containers, ranging from 5 to 100 liters in capacity, are crafted from top-grade, rust-proof stainless steel 18/10….

Expert Sourcing Insights for Oil In Container

H2: 2026 Market Trends for Oil in Container

The global market for oil in container is poised for significant transformation by 2026, driven by evolving logistics dynamics, shifting energy policies, and growing demand for flexible, small-batch oil transportation. As traditional pipeline and tanker-based distribution face infrastructure and environmental constraints, containerized oil transport is emerging as a strategic alternative across crude, refined, and specialty oil segments.

1. Growth in Containerized Crude and Refined Oil Shipments

By 2026, the use of intermodal containers for transporting crude and refined petroleum products is expected to expand, particularly in regions with underdeveloped pipeline networks or geopolitical volatility. Modular container solutions allow producers—especially in North America and West Africa—to access niche markets and bypass port congestion. The rise of “pop-up” refiners and decentralized processing units increases demand for flexible logistics, making ISO tank containers a preferred choice for short-haul and transcontinental moves.

2. Adoption of ISO Tank Containers and Composite Solutions

The market will see accelerated adoption of ISO tank containers due to their standardization, reusability, and compatibility with multimodal transport (rail, truck, sea). Innovations in composite and lightweight materials will enhance safety and reduce tare weight, improving payload efficiency. By 2026, smart tank containers equipped with IoT sensors for real-time monitoring of temperature, pressure, and location will become mainstream, improving supply chain transparency and compliance.

3. Expansion in Specialized Oil Segments

Beyond fossil fuels, containerized transport of specialty oils—such as base oils, lubricants, and biofuels—will grow steadily. The shift toward sustainable aviation fuel (SAF) and renewable diesel will drive demand for clean, sealed container transport to prevent contamination. Asia-Pacific and Latin America will emerge as high-growth regions due to expanding industrial activity and investment in downstream infrastructure.

4. Regulatory and Environmental Pressures

Stringent emissions regulations, including IMO 2023 and EU Green Deal initiatives, are pushing shippers to evaluate cleaner transport options. While container shipping has a higher carbon footprint per barrel than VLCCs, its flexibility supports modal shifts to rail and short-sea shipping, reducing last-mile emissions. By 2026, carbon accounting and ESG reporting will influence oil-in-container logistics decisions, with operators investing in greener fleets and circular container pooling models.

5. Digitalization and Supply Chain Resilience

The oil-in-container sector will leverage digital platforms for dynamic routing, container tracking, and predictive maintenance. Blockchain-based documentation will streamline customs clearance, particularly for cross-border movements in regions like the Middle East and Eastern Europe. Supply chain resilience, underscored by recent global disruptions, will favor containerization for its ability to reroute quickly and serve distributed markets.

6. Competitive Landscape and Investment Outlook

Major logistics providers (e.g., Lineas, Ermewa, and Tiphook) are expanding their tank container fleets, while oil majors like Shell and BP are piloting container-based distribution for downstream products. Private equity interest in container leasing firms is expected to rise, signaling strong confidence in the asset class. By 2026, the global oil-in-container market is projected to grow at a CAGR of 5–7%, reaching an estimated value of USD 8–10 billion.

Conclusion

By 2026, oil in container will transition from a niche logistics solution to a critical component of the global energy supply chain. Enabled by technological innovation, regulatory adaptation, and demand for agility, containerized oil transport will play a pivotal role in connecting producers with emerging markets, supporting energy transition efforts, and enhancing operational resilience in an unpredictable global landscape.

Common Pitfalls Sourcing Oil in Container (Quality, IP)

Sourcing bulk oil products—such as lubricants, edible oils, or crude oil—in containers (e.g., ISO tanks, drums, flexitanks) presents several critical challenges, particularly concerning quality assurance and intellectual property (IP) protection. Failing to address these can lead to financial losses, regulatory violations, or reputational damage.

Quality Degradation and Contamination

One of the most frequent risks is the deterioration or contamination of oil during storage and transport. Improperly cleaned containers—especially reused ISO tanks or flexitanks—can retain residues from previous cargoes, leading to cross-contamination. For instance, a tank previously used for chemicals or biodiesel can compromise the purity and performance of fresh lubricant or edible oil. Additionally, exposure to extreme temperatures, moisture, or prolonged storage can accelerate oxidation or microbial growth, particularly in vegetable oils. Without rigorous pre-shipment inspections and standardized cleaning certificates (e.g., COTIF), buyers may receive substandard product.

Inadequate or Falsified Certifications

Suppliers may provide misleading or forged quality documentation such as Certificates of Analysis (CoA), origin, or food-grade compliance. This is especially prevalent in markets with weak regulatory oversight. Buyers relying solely on paper-based certifications without third-party verification risk receiving oil that doesn’t meet technical specifications (e.g., viscosity, flash point, FFA levels). Independent lab testing upon loading and discharge is essential to validate claims and detect discrepancies.

Misrepresentation of Origin and Specifications

Some suppliers mislabel the source or grade of oil to command higher prices. For example, palm oil may be labeled as sustainably sourced (RSPO-certified) without valid certification, or lower-grade base oil may be passed off as Group II/III. This not only affects quality but also exposes the buyer to sustainability and compliance risks. Verifying supply chain traceability through blockchain or audited chain-of-custody systems can mitigate this.

Intellectual Property (IP) Theft and Brand Infringement

When sourcing private-label or proprietary oil formulations, there is a significant risk of IP theft. Unscrupulous manufacturers may replicate or reverse-engineer custom blends and sell them to competitors. Additionally, packaging and branding materials shared with suppliers could be duplicated, leading to counterfeit products entering the market. Without strong legal agreements (e.g., NDAs, IP clauses in contracts) and audits of supplier facilities, protecting proprietary formulations and brand integrity becomes difficult.

Lack of Supply Chain Transparency

Complex, multi-tiered supply chains obscure visibility, making it hard to monitor quality control practices or ethical sourcing standards. Intermediaries may substitute products or dilute batches without the buyer’s knowledge. Implementing supplier audits, requiring full disclosure of sub-contractors, and using digital tracking tools can enhance transparency and accountability.

Inconsistent Batch-to-Batch Quality

Even with a trusted supplier, inconsistencies in production processes can lead to variability in oil quality between batches. Without clear quality control protocols and minimum specification tolerances defined in supply agreements, buyers may face performance issues in end-use applications. Regular sampling and strict acceptance criteria are necessary to ensure consistency.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence, enforce robust contractual terms, require independent testing, and maintain active oversight of the supply chain. Prioritizing transparency, verification, and IP protection is critical when sourcing oil in containers.

Logistics & Compliance Guide for Oil in Containers

Introduction

Transporting oil in containers—whether crude oil, refined petroleum products, or specialty oils—requires strict adherence to international regulations, safety protocols, and logistical best practices. This guide outlines key considerations for the safe, efficient, and compliant shipping of oil using intermodal containers.

Classification and Regulatory Framework

Oil transported in containers is typically classified under the International Maritime Dangerous Goods (IMDG) Code, depending on its flash point, toxicity, and other hazardous properties. Proper classification is essential for regulatory compliance and safety.

– UN Numbers & Proper Shipping Names: Examples include UN1267 (Petroleum crude oil) or UN1268 (Fuel oil).

– Hazard Classes: Most oils fall under Class 3 (Flammable Liquids), though some may be Class 9 (Miscellaneous) depending on characteristics.

– Applicable Regulations:

– IMDG Code (maritime)

– ADR (road, Europe)

– RID (rail, Europe)

– 49 CFR (U.S. DOT regulations)

Packaging and Container Requirements

Containers used for oil must meet rigorous standards to prevent leaks, spills, and contamination.

– Container Type: Use IMO Type 1 or 2 portable tanks, or UN-certified Intermediate Bulk Containers (IBCs) placed inside standard 20’ or 40’ dry freight containers.

– Tank Certification: Tanks must be UN-certified and bear the proper markings (UN mark, test pressure, manufacture date, etc.).

– Secondary Containment: The outer container must feature a watertight sump or tray capable of holding 100% of the tank’s capacity to contain leaks.

– Venting and Closure Systems: Properly designed to prevent pressure build-up and leakage during transport.

Documentation and Declarations

Accurate documentation is critical for customs clearance and regulatory inspections.

– Dangerous Goods Declaration (DGD): Must accompany the shipment, signed by a certified individual.

– Bill of Lading (B/L): Clearly indicate hazardous nature and UN number.

– Material Safety Data Sheet (MSDS/SDS): Required for emergency response and handling instructions.

– Container Packing Certificate: Confirming compliance with packing standards.

– Customs Documentation: Include Harmonized System (HS) codes, origin, and value.

Labeling and Marking

All containers must be clearly marked to alert handlers and emergency responders.

– Proper Shipping Name and UN Number: Displayed on two opposing sides.

– Hazard Class Labels (Class 3 Flammable Liquid): Diamond-shaped, red and white.

– Orientation Arrows: Indicate correct upright position.

– Marine Pollutant Mark: If applicable (e.g., certain crude oils).

– Container Placards: 250 mm x 250 mm, affixed to all four sides if gross weight exceeds thresholds.

Handling and Stowage

Safe handling minimizes risks of fire, spillage, and contamination.

– Segregation Requirements: Keep away from oxidizers (Class 5), acids (Class 8), and foodstuffs. Refer to IMDG segregation table.

– Stowage Position: Preferably on deck or in well-ventilated areas; avoid proximity to heat sources.

– Lashing and Securing: Ensure tanks are immobilized within the container to prevent shifting.

– Temperature Control: Some oils may require thermal insulation or monitoring in extreme climates.

Carrier and Terminal Compliance

Engage only carriers authorized for dangerous goods transport.

– Carrier Certification: Verify IMDG and national regulatory compliance.

– Terminal Acceptance: Confirm terminal accepts Class 3 cargo and has spill response capabilities.

– Advance Notification: Provide detailed shipment info to carrier and terminal prior to arrival.

Emergency Preparedness and Response

Be prepared for incidents during transit.

– Spill Kits: Equip containers and transport vehicles with oil-absorbent materials and PPE.

– Emergency Contacts: Include shipper, consignee, and local response agencies on documentation.

– Reporting Requirements: Immediate reporting of leaks, spills, or accidents per local and international rules (e.g., MARPOL Annex I).

Environmental and Sustainability Considerations

Oil transport carries environmental risks; responsible practices are essential.

– Spill Prevention: Double-walled tanks and regular inspections reduce risk.

– Waste Management: Recycle used containers and absorbents according to local laws.

– Carbon Footprint: Optimize routes and consolidate shipments to reduce emissions.

Training and Certification

Personnel involved in oil container logistics must be trained.

– IMDG Code Training: Required for shippers, packers, and freight forwarders.

– Hazardous Materials Handling Certification: Mandatory under 49 CFR or ADR.

– Internal Audits: Conduct regular reviews of compliance procedures.

Conclusion

Transporting oil in containers demands meticulous planning, regulatory adherence, and safety vigilance. By following this guide, stakeholders can ensure secure, compliant, and efficient movement of oil across global supply chains. Always consult the latest IMDG Code and local regulations for updates and specific requirements.

In conclusion, sourcing oil in containers offers a practical, flexible, and cost-effective solution for businesses requiring smaller volumes or those without access to bulk storage and transportation infrastructure. Containerized oil shipments provide ease of handling, enhanced traceability, and reduced risk of contamination, making them ideal for niche markets, remote locations, or companies testing new products. Additionally, the use of standardized containers facilitates global logistics and integration with existing supply chains. However, it is essential to consider factors such as higher per-unit costs compared to bulk shipments, proper sealing and storage to maintain quality, and compliance with international regulations for hazardous materials. With careful supplier selection, quality control, and logistics planning, sourcing oil in containers can be a reliable and efficient strategy for meeting specific operational and market demands.