The global market for oil burner components, including Pyrex sight glasses and viewports, is experiencing steady growth, driven by increasing demand for efficient and reliable combustion systems in residential, commercial, and industrial heating applications. According to Grand View Research, the global oil burner market size was valued at USD 8.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by rising energy demands, modernization of heating infrastructure, and the need for components that ensure safe and efficient fuel combustion. Among the critical parts in these systems, Pyrex components—used for flame observation due to their thermal resistance and optical clarity—have gained importance for their durability and performance under high temperatures. As the market evolves, a select group of manufacturers has emerged as leaders in producing high-quality, precision-engineered oil burner Pyrex parts, meeting stringent safety and regulatory standards across regions. These top four manufacturers distinguish themselves through innovation, material quality, and global supply capabilities, positioning them at the forefront of a growing and technically demanding niche.

Top 4 Oil Burner Pyrex Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

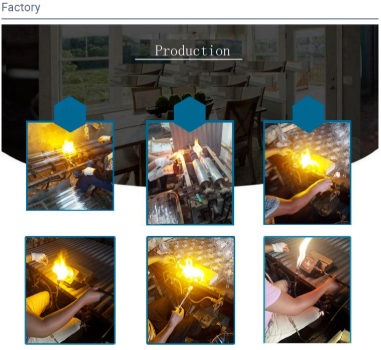

#1 pyrex glass oil burner manufacturers

Domain Est. 2011

Website: glasswater-pipes.sell.everychina.com

Key Highlights: Pyrex Glass Oil Burners Mini Helix Oil Burning Ball Smoking Pipe Product Specification: Helix Oil Burner Length:5.5 inches Glass oil burner for glass ……

#2 6″ Ceramic Skull heavy pyrex glass Oil burner pipe

Domain Est. 2018

Website: smokingcats.com

Key Highlights: 6″ Ceramic Skull heavy pyrex glass Oil burner pipe, ceramic skull in the middle section for handholds, Made in USA, think glass tubes, unit each….

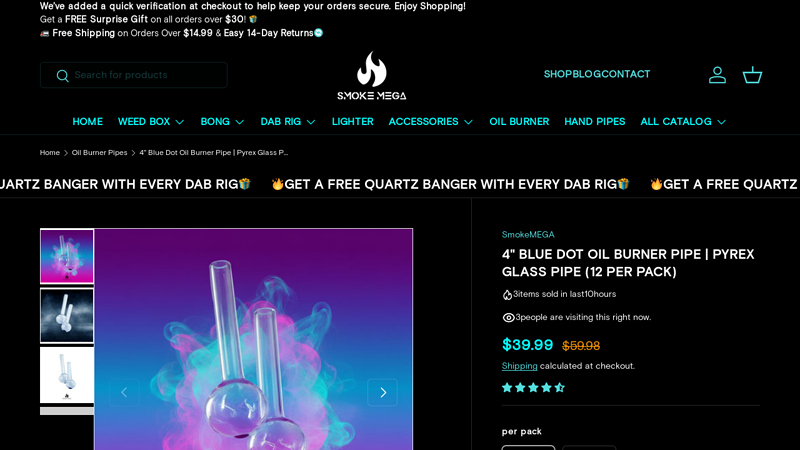

#3 4″ Blue Dot Oil Burner Pipe

Domain Est. 2023

Website: smokemega.com

Key Highlights: Each pipe is made from heat-resistant Pyrex glass, finished with a signature blue dot head for quick identification and a clean look. If you need a dependable ……

#4 Multi

Website: pyrex.eu

Key Highlights: Pyrex® borosilicate glass also offers notable advantages: resistance to extreme temperatures from -40°C to +350°C, ability to withstand thermal shocks up to ……

Expert Sourcing Insights for Oil Burner Pyrex

H2: Projected 2026 Market Trends for Oil Burner Pyrex

The global market for Oil Burner Pyrex—referring to heat-resistant glass components used in oil-burning appliances such as furnaces, boilers, and heaters—is expected to experience moderate but steady growth by 2026, driven by several interrelated factors across energy, construction, and manufacturing sectors.

1. Increasing Demand in Residential and Commercial Heating Systems

As colder climate regions continue to rely on oil-based heating—particularly in parts of North America and Europe—there is sustained demand for durable, high-performance components like Pyrex viewing windows and flame sensors in oil burners. The longevity and thermal resistance of Pyrex make it a preferred material for these applications. In 2026, aging infrastructure and the need for replacement parts in legacy oil heating systems will support market stability.

2. Impact of Energy Transition and Regulatory Pressures

While the long-term trend favors renewable energy and electrification, the transition is gradual. In regions where natural gas is unavailable or where energy security concerns persist, heating oil remains a fallback. However, tightening emissions regulations may limit new installations of oil burners, indirectly constraining demand growth for Pyrex components. Manufacturers may respond by innovating more efficient burner designs that still utilize Pyrex, helping maintain relevance.

3. Material Innovation and Durability Advantages

Pyrex (borosilicate glass) retains a competitive edge due to its ability to withstand repeated thermal cycling, resist chemical corrosion from fuel byproducts, and provide clear flame visibility for maintenance and safety. By 2026, advancements in coated or reinforced Pyrex formulations could enhance performance and lifespan, opening opportunities in high-efficiency or industrial-grade burners.

4. Regional Market Dynamics

North America, particularly the U.S. Northeast, will remain a key market due to the high penetration of oil heating in older homes. Europe, especially in rural areas of the UK, Ireland, and Eastern Europe, will also sustain demand. Growth in emerging markets is limited due to lower adoption of oil heating, but niche industrial applications (e.g., backup generators, remote facilities) could offer incremental opportunities.

5. Supply Chain and Raw Material Considerations

Fluctuations in the cost of raw materials (e.g., silica, boron) and energy-intensive manufacturing processes may impact Pyrex production costs. However, established suppliers are likely to mitigate risks through long-term contracts and process optimization, ensuring stable supply into 2026.

6. Competitive Landscape and Aftermarket Demand

The market is characterized by a few specialized glass manufacturers and burner OEMs. The aftermarket for replacement Pyrex components—driven by maintenance cycles and part failures—will constitute a significant share of revenue. Online distribution channels and HVAC service networks are expected to expand, improving accessibility.

Conclusion

While the Oil Burner Pyrex market faces headwinds from the global shift toward cleaner energy, its niche importance in existing infrastructure ensures continued relevance through 2026. Growth will be primarily replacement-driven, supported by material reliability and regional dependence on oil heating. Stakeholders should focus on product durability, aftermarket support, and potential adaptation to hybrid or dual-fuel systems to remain competitive.

Common Pitfalls When Sourcing Oil Burner Pyrex: Quality and Intellectual Property Risks

Sourcing Oil Burner Pyrex components—especially glassware like sight glasses, gauge glasses, or flame observation ports—requires careful attention to both material quality and intellectual property (IP) compliance. Overlooking these aspects can lead to safety hazards, equipment failure, legal disputes, and reputational damage.

Quality-Related Pitfalls

-

Substandard Glass Composition

- Risk: Authentic Pyrex (trademarked by Corning Inc. and licensed manufacturers) uses borosilicate glass (e.g., Borofloat 33, Pyrex 7740), renowned for high thermal shock resistance, chemical durability, and optical clarity. Sourced components may use cheaper soda-lime glass or inferior borosilicate substitutes.

- Consequence: Components can crack or shatter under rapid temperature changes common in oil burner environments, leading to leaks, fires, or injury. Reduced chemical resistance accelerates degradation from fuels or cleaning agents.

-

Inconsistent Manufacturing Tolerances

- Risk: Low-cost suppliers may lack precision manufacturing controls. Dimensions (diameter, thickness, length) or tolerances for mounting flanges/seals may deviate from specifications.

- Consequence: Poor fit compromises seals, causing fuel leaks, air ingress (affecting combustion efficiency), or difficulty in installation. Uneven wall thickness creates weak points prone to failure.

-

Poor Surface Finish and Optical Clarity

- Risk: Inferior polishing or molding processes result in surface defects (scratches, bubbles, striations) or reduced transparency.

- Consequence: Obscured view impedes critical flame monitoring or fuel level observation, increasing the risk of undetected operational issues like flame instability or fuel starvation.

-

Inadequate Quality Control and Certification

- Risk: Suppliers may lack rigorous QC procedures, batch testing, or provide falsified/misleading certifications (e.g., claiming ASTM E438 compliance without evidence).

- Consequence: Unreliable performance, unexpected failures, and difficulty proving compliance with safety standards (e.g., ASME, boiler codes). Traceability is lost if issues arise.

Intellectual Property (IP) and Branding Pitfalls

-

Trademark Infringement (“Pyrex” Brand Misuse)

- Risk: The term “Pyrex” is a registered trademark (primarily Corning Inc. and subsidiaries like World Kitchen). Suppliers may falsely label generic borosilicate or soda-lime glass as “Pyrex” to imply authenticity and quality.

- Consequence: Purchasing and using infringing goods exposes the buyer to potential legal liability (contributory infringement), supply chain disruption if seized, and reputational harm associated with counterfeit parts. End-users may be misled.

-

Counterfeit or “Look-Alike” Components

- Risk: Suppliers may produce exact replicas of proprietary Pyrex components (e.g., specific sight glass assemblies with patented fittings) without authorization.

- Consequence: Direct infringement of design patents or utility patents. Legal action from the IP holder can halt operations, result in damages, and necessitate costly component replacement.

-

Lack of Licensing Transparency

- Risk: It’s often unclear if a supplier is an authorized licensee of Corning’s Pyrex technology or trademarks, or if they are merely using the term generically (which is legally risky).

- Consequence: Buyers cannot verify the legitimacy or quality assurance backing the “Pyrex” claim. Sourcing from unauthorized parties increases IP risk and may void equipment warranties.

-

Ambiguity in Specifications and Documentation

- Risk: Supplier specifications may vaguely state “Pyrex glass” or “borosilicate glass equivalent to Pyrex” without confirming the exact material standard (e.g., ISO 3585, ASTM E438 Type I) or providing material test reports (MTRs) from a certified source.

- Consequence: Creates uncertainty about actual material properties and potential IP status. Makes it difficult to audit compliance or defend against IP claims.

Mitigation Strategies

- Specify Material Precisely: Require “Borosilicate Glass, meeting ASTM E438 Type I, Class A” or “ISO 3585” instead of just “Pyrex.”

- Demand Certification: Require valid Material Test Reports (MTRs) traceable to the glass manufacturer.

- Verify Supplier Legitimacy: Source directly from Corning/authorized Pyrex industrial suppliers or reputable industrial glass specialists with proven quality systems. Conduct due diligence.

- Audit and Inspect: Perform incoming inspections for dimensions, clarity, and surface quality. Consider third-party testing for critical applications.

- Clarify IP Status: Explicitly ask suppliers about their rights to use the “Pyrex” trademark. Prefer suppliers who avoid the trademark if unauthorized, using technical material names instead.

- Include Warranties: Contractually require warranties on material composition, dimensions, and non-infringement of IP rights.

By proactively addressing these quality and IP pitfalls, organizations can ensure the safety, reliability, and legal compliance of their oil burner systems while protecting their supply chain integrity.

H2: Logistics & Compliance Guide for Oil Burner Pyrex

Transporting, storing, and handling Oil Burner Pyrex components—commonly used in oil heating systems—requires strict adherence to safety, environmental, and regulatory standards. This guide outlines key logistics and compliance considerations to ensure safe and legal operations.

1. Regulatory Compliance

-

DOT (Department of Transportation) Regulations (USA)

Oil Burner Pyrex components are generally non-hazardous unless contaminated with residual fuels or oils. If free from hazardous residues, they can be shipped under standard freight rules. If contaminated, classify and ship according to 49 CFR regulations for hazardous materials. -

REACH & RoHS (EU Compliance)

Ensure Pyrex components comply with EU directives on chemical safety (REACH) and restriction of hazardous substances (RoHS), especially if containing metal fittings or coatings. -

Customs & Import/Export Requirements

Verify tariff codes (HS Code: typically 7010 or 7020 for glassware) when shipping internationally. Maintain documentation such as commercial invoices, packing lists, and certificates of origin.

2. Packaging & Handling

-

Fragility Protection

Pyrex is heat-resistant but susceptible to thermal shock and mechanical breakage. Use double-walled corrugated boxes with bubble wrap, foam inserts, or molded pulp to prevent impact damage. -

Labeling Requirements

Clearly label packages with: - “Fragile – Handle With Care”

- “This Way Up” arrows

- Product identification (e.g., “Oil Burner Sight Glass – Pyrex”)

-

Weight and dimensions

-

Stacking & Palletization

Limit stack height to prevent crushing. Secure pallet loads with stretch wrap and avoid overhang. Use edge protectors for added stability.

3. Storage Conditions

-

Environmental Controls

Store in a dry, temperature-stable environment (15–25°C / 59–77°F). Avoid rapid temperature changes to prevent thermal stress cracking. -

Shelf Life & Inventory Rotation

Pyrex has an indefinite shelf life if stored properly. Use FIFO (First-In, First-Out) inventory practices to maintain quality and traceability.

4. Transportation

-

Mode of Transport

Suitable for road, rail, air, and sea freight. Air transport requires IATA-compliant packaging if shipped as cargo with other goods. -

Carrier Selection

Choose carriers experienced in handling fragile or technical glassware. Ensure they provide tracking, insurance, and temperature-controlled options if needed. -

Insurance

Declare full value of goods and obtain freight insurance covering breakage and transit delays.

5. Environmental & Safety Considerations

-

Waste Disposal

Broken Pyrex should be disposed of as non-hazardous solid waste unless contaminated. Follow local regulations (e.g., EPA, ECHA) for disposal of contaminated parts. -

Worker Safety

Train personnel in safe handling techniques. Provide cut-resistant gloves and eye protection when unpacking or installing components.

6. Documentation & Traceability

- Maintain records including:

- Material Safety Data Sheets (MSDS/SDS), if applicable

- Certificates of Conformance (CoC)

- Batch or lot numbers for traceability

- Shipping manifests and customs documentation

Conclusion

Proper logistics and compliance management for Oil Burner Pyrex ensures product integrity, regulatory adherence, and operational safety. Always verify local, national, and international requirements based on shipping routes and end-use applications.

Conclusion for Sourcing Oil Burner Pyrex:

Sourcing oil burner Pyrex requires careful consideration of quality, compatibility, safety, and supplier reliability. As a critical component in oil burners—commonly used in essential oil diffusers and aromatherapy devices—the Pyrex glass must withstand heat and repeated use without cracking or degrading. After evaluating potential suppliers, it is evident that sourcing from manufacturers or distributors specializing in laboratory-grade or borosilicate glass ensures durability and thermal resistance.

Key factors in the sourcing decision include material certification (such as genuine borosilicate glass), compliance with safety standards, cost-effectiveness, and consistent supply capacity. Additionally, building relationships with reputable suppliers—preferably those with proven track records in the wellness or aromatherapy industry—helps mitigate risks related to product failure or supply chain disruptions.

In conclusion, a strategic sourcing approach that prioritizes quality, reliability, and long-term partnerships will ensure the procurement of high-performance Pyrex components, supporting the production of safe and effective oil burners for end users.