The global aluminium boats market is experiencing robust growth, driven by increasing demand for fuel-efficient, durable, and low-maintenance vessels across commercial, recreational, and governmental sectors. According to Grand View Research, the global aluminum boats market size was valued at USD 6.2 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. This growth is fueled by rising offshore and coastal activities, including marine tourism, fisheries modernization, and offshore energy operations, particularly in emerging economies. As operators seek cost-effective and corrosion-resistant solutions, offshore manufacturing hubs have become pivotal in meeting global demand. Countries such as China, Thailand, Turkey, and Mexico have emerged as key production centers, offering competitive pricing, scalable infrastructure, and advanced fabrication capabilities. In this evolving landscape, identifying the top offshore manufacturers of aluminium boats is critical for procurement leaders, marine developers, and government agencies aiming to balance quality, compliance, and total cost of ownership. The following analysis highlights the top 10 offshore manufacturers based on production capacity, export volume, technological capabilities, and customer footprint.

Top 10 Offshore Aluminium Boats Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Excel Boats

Domain Est. 1998

Website: excelboats.com

Key Highlights: Excel Boats is the nation’s premier aluminum boat manufacturer of an affordable and tough line of boats for outdoor enthusiasts….

#2 Aluminum Boats

Domain Est. 2000

Website: stabicraft.com

Key Highlights: Stabicraft® is a world-renowned designer and manufacturer of aluminum boats that feature an airtight chambered hull ideal for both freshwater and sea use….

#3 Xpress Boats

Domain Est. 1996 | Founded: 1966

Website: xpressboats.com

Key Highlights: Family-owned and operated, Xpress Boats has been building best-in-class aluminum boats in Hot Springs, Arkansas since 1966….

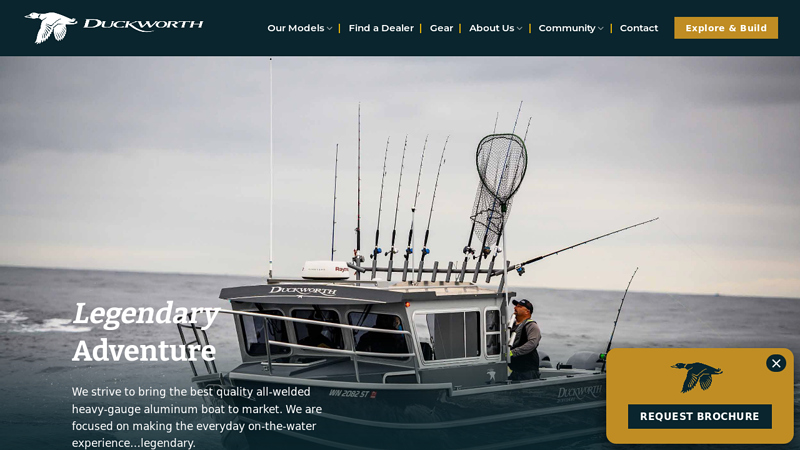

#4

Domain Est. 1997

Website: duckworthboats.com

Key Highlights: We strive to bring the best quality all-welded heavy-gauge aluminum boat to market. We are focused on making the everyday on-the-water experience legendary….

#5 KingFisher Welded Aluminum Boats

Domain Est. 2004

Website: kingfisherboats.com

Key Highlights: KingFisher Boats is the fastest growing brand of all welded heavy-gauge aluminum adventure boats. With 22 models for lake, river and ocean, we build tough boats ……

#6 Metal Shark

Domain Est. 2006

Website: metalsharkboats.com

Key Highlights: Metal Shark Logo. ADVANCED CRAFT FOR CRITICAL MISSIONS. A MAGNET DEFENSE COMPANY. NEW WEBSITE COMING SOON. PHONE: +1.337.364.0777 • EMAIL: SALES DEPARTMENT ……

#7 Jasper Marine

Domain Est. 2016

Website: jaspermarine.ca

Key Highlights: Aluminium Boats, Vessels, Custom Boat Builder, Jasper Vermeulen, Sunshine Coast, Gibsons, Vancouver, Defender 22….

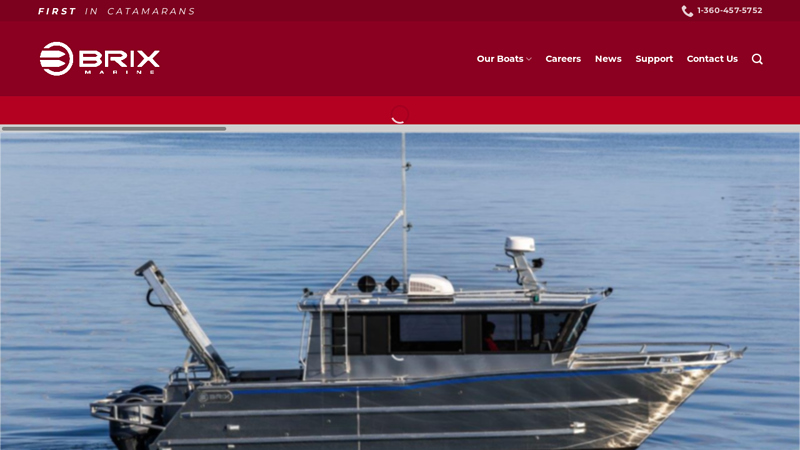

#8 BRIX Marine

Domain Est. 2020 | Founded: 1991

Website: brixmarine.com

Key Highlights: BRIX Marine has earned a solid reputation for pioneering and crafting the world’s most rugged aluminum catamarans and workboats since 1991….

#9 Crestliner

Domain Est. 1995

Website: crestliner.com

Key Highlights: Crestliner has an all-welded aluminum boat that will bring your adventures to life. Our advanced line of Deep-V boats are equally adept at multi-species big- ……

#10 Best Value Aluminum Boat by Starcraft Marine

Domain Est. 1998

Website: starcraftmarine.com

Key Highlights: We’re proud to be the largest name in aluminum fishing and pleasure boats, with five trusted brands you know and love—Smoker Craft, Starcraft, Sylvan, SunChaser ……

Expert Sourcing Insights for Offshore Aluminium Boats

H2: 2026 Market Trends for Offshore Aluminium Boats

The offshore aluminium boat market is poised for significant transformation by 2026, driven by advances in materials, shifting consumer preferences, and growing demand across commercial and recreational sectors. This analysis outlines key trends shaping the industry in the coming years.

1. Rising Demand in Commercial and Government Sectors

By 2026, commercial operators—including offshore oil & gas support services, coastal patrol units, and fisheries—will increasingly adopt aluminium boats for their durability, fuel efficiency, and low maintenance. Governments worldwide are investing in maritime security and surveillance, boosting procurement of high-speed aluminium patrol vessels. Additionally, search-and-rescue (SAR) fleets are modernizing with lightweight aluminium craft to improve response times and operational range.

2. Growth in Recreational and Luxury Sportfishing Markets

The recreational offshore boating segment is witnessing a surge in demand for high-performance aluminium vessels, particularly in North America, Australia, and parts of Europe. Anglers and adventure enthusiasts are drawn to the corrosion resistance, stability, and long lifespan of aluminium hulls. Premium manufacturers are responding with luxury-finished aluminium center consoles and sportfishing yachts, integrating advanced electronics and hybrid propulsion systems.

3. Sustainability and Environmental Regulations

Environmental mandates are accelerating the shift from steel and fiberglass to aluminium. With higher recyclability rates (over 90% of aluminium can be recycled without quality loss) and lower lifecycle emissions, aluminium aligns with global decarbonization goals. Regulatory pressures under IMO 2030/2050 targets are prompting shipbuilders to prioritize lightweight materials that enhance fuel efficiency and reduce carbon footprints—key selling points for aluminium boats.

4. Technological Innovations and Design Advancements

By 2026, advancements in naval architecture and fabrication techniques—such as laser welding, CNC cutting, and modular construction—are enabling more complex and efficient hull designs. These innovations improve seakeeping abilities, reduce drag, and allow for larger, more customizable offshore models. Integration of smart navigation systems, solar-assisted power, and electric-hybrid propulsion is also expected to become standard in premium aluminium boats.

5. Supply Chain and Raw Material Dynamics

While aluminium offers long-term cost benefits, the market faces near-term volatility in raw material prices and supply chain constraints. Geopolitical factors and energy costs may impact aluminium production, but regional manufacturing hubs in Australia, the U.S., and Scandinavia are investing in local sourcing and recycling infrastructure to mitigate risks.

6. Regional Market Expansion

Asia-Pacific is emerging as a high-growth region, with increasing maritime activity in countries like Indonesia, the Philippines, and India driving demand for durable offshore vessels. Meanwhile, Latin America and Africa are seeing infrastructure development and fisheries modernization projects that create new opportunities for aluminium boat providers.

Conclusion

By 2026, the offshore aluminium boat market will be characterized by innovation, sustainability, and diversification across sectors. As performance, environmental, and economic advantages gain prominence, aluminium is set to solidify its position as the material of choice for next-generation offshore vessels. Manufacturers who invest in technology, customization, and green manufacturing practices will lead the market in this evolving landscape.

Common Pitfalls When Sourcing Offshore Aluminium Boats: Quality and Intellectual Property

Sourcing offshore aluminium boats can offer cost advantages, but it also introduces significant risks related to quality control and intellectual property protection. Understanding these pitfalls is crucial for making informed procurement decisions.

Quality Control Challenges

Offshore manufacturing often involves complex supply chains and varying standards, making consistent quality difficult to ensure.

- Inconsistent Material Standards: Suppliers may use substandard or non-certified aluminium alloys (e.g., not meeting marine-grade standards like 5083 or 5086), leading to reduced corrosion resistance, structural weakness, and premature failure in harsh marine environments.

- Poor Welding and Fabrication Practices: Inadequate welding techniques, lack of certified welders, and insufficient inspection processes can result in weak joints, leaks, and compromised hull integrity. This is especially critical in offshore conditions with high stress and wave impact.

- Lack of Independent Quality Assurance: Without third-party inspections or rigorous on-site audits, defects may go undetected until after delivery, increasing repair costs and downtime.

- Inadequate Finishing and Corrosion Protection: Poor surface preparation, incorrect paint systems, or missing anti-fouling and cathodic protection (e.g., sacrificial anodes) can accelerate corrosion and reduce vessel lifespan.

Intellectual Property Risks

Sourcing from certain offshore regions may expose buyers to intellectual property (IP) vulnerabilities, particularly when using proprietary designs or custom engineering.

- Design Copying and Unauthorized Replication: Suppliers may reverse-engineer or copy boat designs, molds, or technical specifications to produce and sell identical or similar vessels without permission, especially in markets with weak IP enforcement.

- Lack of Legal Recourse: Enforcing IP rights across international borders can be costly, time-consuming, and ineffective in jurisdictions with limited IP protection laws or enforcement mechanisms.

- Contractual Gaps in IP Ownership: Agreements that fail to clearly assign ownership of design modifications, tooling, or custom engineering work may leave the buyer without legal rights to their own innovations.

- Supply Chain Leakage: Components or molds produced offshore may be duplicated and sold to competitors, diluting market advantage and brand integrity.

To mitigate these risks, buyers should conduct thorough due diligence, require third-party certifications (e.g., DNV, ABS, or ISO), include robust IP clauses in contracts, and consider partnering with reputable manufacturers in jurisdictions with stronger regulatory and legal frameworks.

Logistics & Compliance Guide for Offshore Aluminium Boats

Overview of Offshore Aluminium Boats

Offshore aluminium boats are designed for durability, fuel efficiency, and performance in open-sea environments. Typically used for fishing, patrol, offshore support, and recreational cruising, these vessels require careful planning in logistics and adherence to strict compliance standards due to their operational environment and construction materials.

Regulatory Compliance Requirements

Aluminium boats operating offshore must meet international and national maritime regulations. Key compliance frameworks include:

– International Maritime Organization (IMO) standards, particularly for safety (SOLAS), pollution prevention (MARPOL), and load line conventions.

– Classification Society Rules (e.g., ABS, DNV, Lloyd’s Register) for structural integrity and material specifications.

– Flag State Regulations governing registration, crewing, and safety equipment.

– Coast Guard Requirements (e.g., U.S. Coast Guard, AMSA in Australia) for vessel documentation and operational certification.

Ensure all aluminium welding and fabrication meet approved marine-grade standards (e.g., ISO 15614-2, AWS D1.2).

Material and Construction Standards

Aluminium used in offshore boats must comply with marine-grade alloy specifications such as 5083, 5086, or 6061-T6, chosen for corrosion resistance and strength. Fabrication must follow:

– Approved welding procedures and certified welders.

– Cathodic protection (e.g., sacrificial anodes) to prevent galvanic corrosion.

– Surface treatments like anodizing or marine-grade coatings where applicable.

Documentation of material certificates (Mill Test Reports) and Non-Destructive Testing (NDT) reports must be maintained.

Transport and Logistics Planning

Shipping offshore aluminium boats—whether new builds or during relocation—requires specialized logistics:

– Overland Transport: Use low-bed trailers with proper cradles to prevent hull deformation. Secure with marine-grade straps and ensure route clearance (bridges, weight limits).

– Sea Freight: For international delivery, consider RORO (Roll-on/Roll-off) or lift-on/lift-off vessels. Protect against saltwater exposure during transit using shrink-wrapping and desiccants.

– Handling Precautions: Avoid contact between aluminium hulls and steel surfaces (risk of galvanic corrosion); use insulating pads during lifting and storage.

Customs and Import/Export Procedures

Cross-border movement of aluminium boats involves:

– Proper Classification: Use correct HS codes (e.g., 8901.20 for motor yachts and other vessels for pleasure or sports).

– Documentation: Prepare bill of lading, commercial invoice, packing list, certificate of origin, and vessel documentation (registration, build certificate).

– Duties and VAT: Research import tariffs and exemptions (some countries offer relief for recreational or commercial vessels under temporary import schemes).

– Pre-Arrival Notifications: Comply with customs pre-arrival filing requirements (e.g., AMS in the U.S., ICS in the EU).

Environmental and Safety Compliance

Offshore operations demand strict environmental stewardship:

– Install and maintain oil-water separators, sewage treatment systems, or holding tanks per MARPOL Annex IV and V.

– Carry spill kits and follow Vessel General Permit (VGP) or equivalent discharge regulations.

– Equip boats with required life-saving appliances (LSA), fire-fighting systems, and EPIRBs/GMDSS as per SOLAS or applicable national rules.

Crew Certification and Training

Crew operating offshore aluminium boats must hold valid certifications:

– STCW (Standards of Training, Certification and Watchkeeping) certification for professional mariners.

– Vessel-specific training on aluminium boat handling, emergency procedures, and corrosion monitoring.

– For commercial operations, ensure compliance with local labor and maritime employment laws.

Maintenance and Inspection Regimes

Implement a scheduled maintenance program to ensure compliance and longevity:

– Conduct regular inspections for corrosion, weld integrity, and anode depletion.

– Perform dry-docking and hull inspections as required by classification societies (typically every 2.5 to 5 years).

– Maintain logs for all repairs, modifications, and compliance audits.

Conclusion

Successfully managing the logistics and compliance of offshore aluminium boats involves adherence to international standards, careful transport planning, and diligent documentation. By following this guide, operators and builders can ensure safety, regulatory compliance, and operational efficiency in offshore environments.

Conclusion: Sourcing Offshore Aluminium Boats

Sourcing offshore aluminium boats presents a compelling opportunity for operators seeking durable, cost-effective, and high-performance vessels for marine and coastal operations. Aluminium’s inherent advantages—such as lightweight construction, excellent corrosion resistance, and low maintenance requirements—make it an ideal material for boats operating in demanding offshore environments.

Engaging with reputable international suppliers can offer significant cost savings, access to advanced manufacturing technologies, and faster production timelines, particularly when compared to domestic alternatives. However, successful sourcing requires careful due diligence, including verification of material standards (e.g., marine-grade 5083 or 6082 aluminium), adherence to international safety and classification requirements (e.g., DNV, ABS, or RINA), and clear contractual terms regarding design, delivery, and after-sales support.

Additionally, logistical considerations such as shipping, import regulations, and potential warranty or service challenges must be factored into the decision-making process. Building strong partnerships with trusted manufacturers, conducting site audits, and involving naval architects or marine consultants can mitigate risks and ensure the final product meets operational demands.

In conclusion, offshore aluminium boats sourced internationally can deliver excellent value and performance when approached strategically. With proper planning, quality control, and long-term support structures in place, sourcing offshore becomes not only a viable but advantageous option for expanding or upgrading a marine fleet.