The global fiber optic cable (OFC) market is undergoing rapid expansion, driven by escalating demand for high-speed data transmission, 5G network rollouts, and widespread infrastructure development in both urban and rural areas. According to a 2023 report by Mordor Intelligence, the fiber optic cable market was valued at USD 8.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 9.3% from 2023 to 2028, reaching an estimated USD 14.2 billion by 2028. This growth trajectory is further supported by Grand View Research, which highlights the increasing adoption of FTTH (Fiber-to-the-Home) networks and government-led broadband initiatives as key market drivers. With Asia-Pacific emerging as both the largest consumer and producer of OFC, manufacturers are scaling production and investing heavily in R&D to meet rising bandwidth demands. As the competitive landscape intensifies, identifying leading players becomes crucial for stakeholders in telecom, enterprise networks, and smart city development. The following list highlights the top 10 fiber optic cable manufacturers shaping this dynamic market through innovation, global reach, and technological leadership.

Top 10 Ofc Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Optical Cable Corporation

Domain Est. 1996

Website: occfiber.com

Key Highlights: OCC is dedicated to being a diverse manufacturer of high-performance connectivity products and solutions in the world….

#2 Broadcast Fiber Optic Cable Solutions and Accessories

Domain Est. 1997

Website: camplex.com

Key Highlights: A leading US manufacturer and provider of fiber optic cable solutions and accessories for the Broadcast, Pro-Audio, and Pro-AV markets….

#3 Fibertronics, Inc.

Domain Est. 2000

Website: fibertronics.com

Key Highlights: 2–12 day deliveryFibertronics, Inc. is an SBA certified woman-owned small business providing USA manufactured customized fiber optic and low voltage cable assemblies, ……

#4 Prysmian

Domain Est. 2005

Website: na.prysmian.com

Key Highlights: Prysmian North America is a global leader in cable manufacturing, energy solutions, and telecommunications cables and systems. Learn more!…

#5 Incab America LLC

Domain Est. 2017

Website: incabamerica.com

Key Highlights: Discover Incab America, a fiber optic cable manufacturer in the US and leading fiber optic cable company for aerial, ADSS and OPGW cables….

#6 Fiber Optic Cable Manufacturers

Domain Est. 2021

Website: usa.proterial.com

Key Highlights: Proterial Cable America is among the leading manufacturers of fiber optic cable. Renowned for our expertly designed optical fiber cables, we prioritize ……

#7 Fiber Optic Cables

Domain Est. 1991

Website: corning.com

Key Highlights: Corning has fiber optic cables for outdoor, indoor/outdoor, and indoor environments in a variety of types and applications….

#8 Fiber Optic Cables

Domain Est. 1994

Website: commscope.com

Key Highlights: CommScope designs and manufactures a comprehensive line of fiber optic cables—from outside plant to indoor/outdoor and fire-rated indoor fiber ……

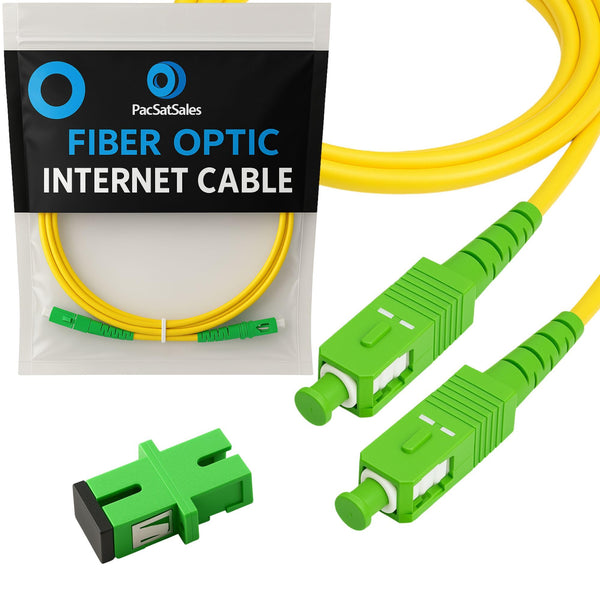

#9 Fiber Optic Cables, Adaptors, & Accessories

Domain Est. 1994

Website: panduit.com

Key Highlights: Our extensive offering of fiber optic cables, connectors, cassettes, enclosures, patch cords, cable assemblies, cable distribution products and accessories…

#10 Fiber Optic Cable Solutions

Domain Est. 2008

Website: aflglobal.com

Key Highlights: AFL’s specialty fiber optic cables are a perfect solution in high pressure and high temperature applications such as subsea and refineries….

Expert Sourcing Insights for Ofc Cable

H2 2026 Market Trends for OFC Cable

As we look toward the second half of 2026, the global Optical Fiber Cable (OFC) market is poised for sustained growth, driven by escalating global bandwidth demands, the maturation of 5G networks, and increasing government support for digital infrastructure. The H2 2026 landscape will be shaped by technological innovation, regional dynamics, and evolving market demands.

1. Accelerated 5G and 5.5G Network Expansion

By H2 2026, 5G networks will be well-established in most major economies, prompting telecom operators to shift focus toward densification and the early rollout of 5.5G (also known as 5G-Advanced). This transition will significantly boost demand for OFC, particularly in:

– Urban and suburban areas, where small cell deployment requires extensive fiber backhaul.

– Indoor and enterprise environments, pushing demand for high-density, bend-insensitive fiber cables.

– Rural connectivity projects, supported by government subsidies to bridge the digital divide.

Operators are increasingly adopting fiber deep architectures, moving the fiber point closer to end users, thereby increasing the volume of OFC deployed per subscriber.

2. Surge in Data Center Interconnect (DCI) Demand

Hyperscale data centers are expanding their footprints globally to support AI, cloud computing, and edge applications. In H2 2026, this will drive robust demand for high-fiber-count cables (3,456+ fibers) and submarine fiber systems for inter-data center connectivity. Key trends include:

– Increased deployment of space-division multiplexing (SDM) and multi-core fibers to maximize capacity.

– Growth in private optical networks connecting cloud campuses and enterprise data centers.

– Strong demand for low-latency, high-reliability cables in financial and AI-driven applications.

3. Government-Led Broadband Initiatives

Many governments are finalizing or accelerating national broadband plans in H2 2026, with OFC as the backbone technology. Notable programs include:

– U.S. BEAD (Broadband Equity, Access, and Deployment) Program, with significant funding reaching deployment phase.

– EU Digital Decade 2030 targets, driving fiber-to-the-home (FTTH) rollouts across Eastern and Southern Europe.

– India’s BharatNet Phase III, aiming to connect remaining rural clusters with OFC.

– ASEAN Digital Masterplan 2025–2030, supporting cross-border fiber infrastructure.

These initiatives are creating sustained public procurement opportunities and improving market visibility for OFC manufacturers.

4. Technological Advancements and Product Innovation

In H2 2026, innovation will focus on improving efficiency, durability, and installation speed:

– Micro and micro-duct cables enabling faster, less disruptive deployments.

– Bend-insensitive fibers (e.g., ITU-T G.657.A2/B3) becoming standard in FTTH networks.

– Self-supporting ADSS (All-Dielectric Self-Supporting) cables gaining traction in aerial installations, especially in disaster-prone areas.

– Eco-friendly cables with recyclable materials and lower carbon footprints, driven by ESG regulations.

5. Supply Chain Resilience and Regionalization

After years of volatility, OFC supply chains are stabilizing. However, H2 2026 will see continued emphasis on:

– Nearshoring and friend-shoring of fiber and cable production, particularly in North America and Europe.

– Vertical integration among major players to secure access to preforms and raw materials.

– Diversification of sourcing away from single geographies to mitigate geopolitical and logistical risks.

6. Competitive Landscape and Pricing Trends

The market remains competitive, with consolidation among Tier-2 and Tier-3 manufacturers. Key dynamics in H2 2026 include:

– Price stabilization following material cost normalization (notably for silica and polymers).

– Increased competition in emerging markets (Africa, Latin America, Southeast Asia).

– RFPs emphasizing lifecycle cost, sustainability, and technical compliance, rather than lowest price.

Conclusion

H2 2026 will mark a phase of maturation and expansion for the OFC cable market. Driven by 5G evolution, data center growth, and public infrastructure investments, demand will remain strong across developed and emerging economies. Success will depend on the ability of manufacturers to innovate, adapt to regional requirements, and deliver sustainable, high-performance solutions. The optical fiber backbone will continue to underpin the global digital transformation, making OFC a critical enabler of future technologies.

Common Pitfalls When Sourcing OFC Cable (Quality and IP)

Poor Cable Quality Due to Substandard Materials

One of the most frequent issues when sourcing OFC (Optical Fiber Cable) is receiving cables made with inferior materials. Some suppliers may use impure copper or even copper-clad aluminum (CCA) instead of true oxygen-free copper, which significantly reduces conductivity and signal integrity. These substandard materials lead to higher signal loss, overheating, and reduced lifespan, undermining the performance of the entire network infrastructure.

Lack of Genuine Certification and Compliance

Many suppliers offer OFC cables that claim to meet international standards (e.g., ISO, TIA/EIA, RoHS) but lack valid certifications. Without proper documentation or third-party testing, it’s difficult to verify compliance. Sourcing uncertified cables increases the risk of deployment failures, safety hazards, and non-compliance with regulatory requirements in enterprise or telecom environments.

Counterfeit or Grey Market Products

The OFC market is vulnerable to counterfeit products that mimic reputable brands. These cables may look identical but fail under real-world conditions. Grey market imports—genuine products sold outside authorized channels—may also lack proper warranty or technical support, exposing buyers to reliability and liability issues.

Inadequate Testing and Quality Control

Some manufacturers skip rigorous quality testing procedures such as tensile strength, attenuation, and thermal stress tests. Without batch-level testing reports (e.g., Certificate of Conformance), buyers cannot ensure consistent performance. Poor quality control often results in intermittent connectivity issues and higher field failure rates.

Intellectual Property (IP) Infringement Risks

Sourcing cables from unverified manufacturers, especially in regions with lax IP enforcement, can expose buyers to legal risks. Using cables that replicate patented designs, trademarks, or proprietary technologies may lead to IP disputes, shipment seizures, or liability for contributory infringement.

Misrepresentation of Specifications

Suppliers may exaggerate cable performance metrics—such as bandwidth capacity, transmission distance, or shielding effectiveness—without technical validation. This misrepresentation can lead to network design flaws, costly upgrades, or service outages when the cable fails to deliver as promised.

Inconsistent Batch-to-Batch Quality

Even with a reliable supplier, inconsistent manufacturing processes can result in variations between production batches. Differences in jacket thickness, fiber alignment, or conductor purity may affect performance and complicate large-scale deployments where uniformity is critical.

Lack of Traceability and Documentation

Reputable OFC cables should come with full traceability—batch numbers, manufacture dates, and material sourcing data. Without this documentation, diagnosing field failures becomes difficult, and warranty claims may be denied. Poor traceability also complicates compliance audits and end-of-life recycling efforts.

Choosing the Wrong Cable Type for the Application

Not all OFC cables are suitable for every environment. Sourcing without considering factors like indoor vs. outdoor use, fire ratings (e.g., LSZH, plenum), or mechanical protection can result in safety hazards or premature degradation. For example, using a non-armored cable in a high-interference or rodent-prone area leads to frequent damage.

Overlooking Supplier Reliability and Support

A low initial price may be tempting, but unreliable suppliers often lack technical support, long-term availability, or responsive customer service. This becomes a major issue during troubleshooting, scaling, or when replacement parts are needed, potentially disrupting business operations.

Logistics & Compliance Guide for OFC (Optical Fiber Cable)

This guide outlines key logistics considerations and compliance requirements for the transportation, handling, and deployment of Optical Fiber Cables (OFC). Adherence ensures product integrity, regulatory conformity, and operational efficiency.

Packaging and Handling Requirements

Optical fiber cables are sensitive to physical stress and environmental conditions. Proper packaging and handling are critical:

- Use manufacturer-approved reels or drums designed for OFC to prevent bending beyond minimum bend radius.

- Protect cable ends with sealed caps or boots to prevent moisture and dust ingress.

- Clearly label all reels with cable type, length, manufacturing date, and directional markings (A/B ends).

- Handle reels with forklifts or cable dollies; never roll reels over uneven surfaces or drop them.

- Store cables in dry, temperature-controlled environments (typically -10°C to +60°C unless specified otherwise).

Transportation Guidelines

Ensure safe and compliant transit from manufacturer to installation site:

- Secure reels upright on transport vehicles using straps or chocks to prevent rolling or shifting.

- Avoid exposure to extreme temperatures, UV radiation, or moisture during transit.

- Use cushioning materials to minimize vibration and impact.

- Comply with national and international freight regulations (e.g., ADR for hazardous goods if applicable, though OFC is generally non-hazardous).

- Maintain a chain-of-custody documentation for accountability.

Import/Export Compliance

OFC shipments crossing international borders must meet customs and trade requirements:

- Prepare accurate commercial invoices, packing lists, and certificates of origin.

- Classify OFC under the correct HS (Harmonized System) code (e.g., 8544.70 for optical fiber cables).

- Verify import duties, taxes, and any trade restrictions in destination countries.

- Ensure compliance with export control regulations (e.g., EAR in the U.S.) if technology contains controlled components.

- Use Incoterms® clearly (e.g., FOB, CIF) to define responsibilities between buyer and seller.

Regulatory and Safety Standards

OFC installations and logistics must align with regional and international standards:

- Safety: Comply with OSHA (U.S.), COSHH (UK), or equivalent workplace safety regulations during handling and installation.

- Electrical Clearance: Maintain safe distances from high-voltage lines during deployment.

- Environmental Regulations: Adhere to RoHS (Restriction of Hazardous Substances) and REACH (EU) for material content.

- Fire Safety: Use OFC with appropriate fire ratings (e.g., OFNR, OFNP, LSZH) based on installation environment (plenum, riser, outdoor).

- National Codes: Follow local building and telecom codes (e.g., NEC in the U.S., IEC standards internationally).

Documentation and Traceability

Maintain comprehensive records throughout the supply chain:

- Keep batch/lot numbers, test reports (e.g., OTDR results), and quality certifications (ISO 9001) on file.

- Track cable deployment with as-built documentation, including splice points and slack locations.

- Retain shipping manifests, customs filings, and compliance certificates for audit purposes.

Environmental and Disposal Considerations

Address sustainability and end-of-life responsibilities:

- Recycle cable reels (wood, steel, plastic) through certified waste management partners.

- Dispose of damaged or scrap OFC per local e-waste regulations; fiber itself is non-toxic but may have jacketing materials requiring special handling.

- Minimize packaging waste and use recyclable materials where possible.

By following this guide, stakeholders can ensure that OFC is handled safely, delivered efficiently, and deployed in full compliance with applicable regulations and industry best practices.

Conclusion for Sourcing OFC (Optical Fiber Cable):

Sourcing high-quality Optical Fiber Cable (OFC) is a critical step in ensuring the reliability, efficiency, and future-readiness of modern telecommunications and data network infrastructure. The selection process must encompass a thorough evaluation of technical specifications, such as fiber type (single-mode or multi-mode), bandwidth capacity, attenuation levels, and environmental durability. Equally important is choosing reputable manufacturers and suppliers who adhere to international standards (e.g., ITU-T, IEC) and offer consistent product quality, technical support, and warranty services.

Cost should not be the sole deciding factor; long-term performance, low maintenance, and scalability are essential considerations. Additionally, local regulations, lead times, logistical support, and after-sales service play a vital role in the sourcing decision. By adopting a strategic and comprehensive sourcing approach—balancing quality, cost, and reliability—organizations can build robust, high-speed networks capable of meeting current and future digital demands efficiently and sustainably.