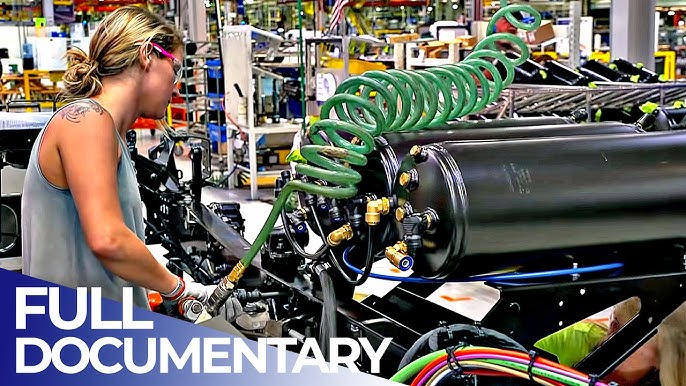

The global OEM truck parts manufacturing industry is experiencing robust growth, driven by rising commercial vehicle production, increasing demand for fuel-efficient and technologically advanced components, and stringent government regulations around safety and emissions. According to Mordor Intelligence, the global truck parts market was valued at approximately USD 430 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5.8% through 2029. This expansion is further supported by advancements in electric and connected vehicle technologies, as well as the growing aftermarket demand for authentic OEM components that ensure vehicle performance and warranty compliance. As fleet operators and OEMs prioritize reliability and supply chain resilience, leading manufacturers are investing heavily in R&D and global production footprints. In this evolving landscape, identifying the top OEM truck parts manufacturers becomes essential for stakeholders aiming to align with innovation, quality, and long-term sustainability.

Top 10 Oem Truck Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 PAI Industries, Inc.

Domain Est. 1993

Website: pai.com

Key Highlights: PAI Industries manufactures and distributes quality service parts to the heavy-duty truck industry. For over 40 years we’ve been supplying distributors ……

#2 Genuine Parts Company

Domain Est. 1995 | Founded: 1928

Website: genpt.com

Key Highlights: Established in 1928, Genuine Parts Company is a leading global service provider of automotive and industrial replacement parts and value-added solutions….

#3 ACDelco: OEM & Aftermarket Auto Parts

Domain Est. 1996

Website: gmparts.com

Key Highlights: ACDelco offers the only aftermarket parts backed by GM. ACDelco’s Gold and Silver lines of premium aftermarket parts offer a precise fit for GM vehicles….

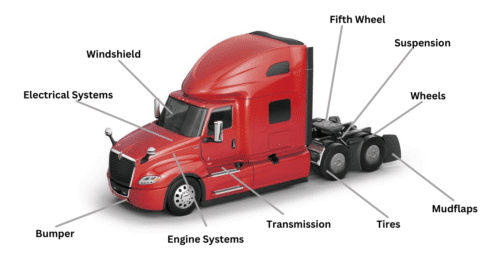

#4 Quality OEM Parts

Domain Est. 2005

Website: thepetestore.com

Key Highlights: Keep your fleet moving with trusted OEM parts from The Pete Store. We offer an extensive selection from top brands like Dana, Eaton, Bendix, Meritor, ……

#5 Heavy Duty Truck Parts

Domain Est. 2008

Website: class8truckparts.com

Key Highlights: Free delivery over $200 · 30-day returnsOur truck parts catalog is searchable by part number, manufacturer, category, and other key terms. Just enter your search in the search bar…

#6 OEM Parts Online

Domain Est. 2015

Website: oempartsonline.com

Key Highlights: At OEM Parts Online, we make it easier to shop for auto parts online. Find the right part at the right price by searching our collection of OEM catalogs….

#7 OEM Truck Equipment

Domain Est. 2017

Website: oemtruckequipment.com

Key Highlights: OEM Truck Equipment is your one-stop shop for all of your commercial truck equipment, van interiors and custom application needs….

#8 Shop GM Genuine Parts & ACDelco Parts for Chevrolet Vehicles

Domain Est. 1994

#9 PACCAR Parts

Domain Est. 1996

Website: paccarparts.com

Key Highlights: PACCAR Parts is a global leader in the distribution, sales and marketing of aftermarket parts for heavy and medium-duty trucks, trailers, buses, and engines….

#10 Commercial Trucks, Buses, Engines & Parts

Domain Est. 1998

Website: international.com

Key Highlights: Proud makers of trucks, buses, engines, parts, and history….

Expert Sourcing Insights for Oem Truck Parts

H2: 2026 Market Trends for OEM Truck Parts

The global OEM (Original Equipment Manufacturer) truck parts market is poised for significant transformation by 2026, driven by technological advancements, regulatory changes, and evolving logistics demands. Key trends shaping the industry include the rise of electric and connected trucks, increased emphasis on sustainability, supply chain resilience, and growing demand in emerging markets.

Electrification and Advanced Technologies

A major driver in the 2026 outlook is the accelerated adoption of electric trucks, particularly in North America and Europe. As governments implement stricter emissions regulations, OEMs are investing heavily in electric drivetrains, battery systems, and charging infrastructure. This shift increases demand for specialized OEM parts such as electric motors, power electronics, and thermal management systems. Additionally, the integration of telematics, advanced driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication is boosting demand for high-precision sensors, control modules, and software-compatible components.

Sustainability and Circular Economy

Environmental regulations are pushing OEMs to develop more sustainable manufacturing processes and parts. By 2026, there will be heightened demand for lightweight materials like high-strength steel and aluminum to improve fuel efficiency and reduce emissions. Moreover, circular economy principles are gaining traction, with OEMs exploring remanufactured parts and recyclable components to reduce waste and meet corporate sustainability goals.

Supply Chain Reengineering

The ongoing globalization challenges and recent disruptions have prompted OEMs to localize production and diversify supply chains. By 2026, nearshoring and regional manufacturing hubs are expected to become more prevalent, especially in North America and Southeast Asia. This trend enhances supply chain resilience and reduces lead times for critical truck components such as axles, transmissions, and braking systems.

Growth in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa are experiencing rapid infrastructure development and freight transportation growth. This expansion fuels demand for heavy-duty and medium-duty trucks, directly benefiting the OEM truck parts market. Local assembly partnerships and government incentives are encouraging OEMs to establish stronger footholds in these regions.

Digitalization and Predictive Maintenance

The integration of IoT and data analytics into fleet management systems is enabling predictive maintenance, which increases the demand for reliable, high-quality OEM parts. By 2026, OEMs are expected to offer value-added services such as real-time diagnostics and part lifecycle monitoring, strengthening customer loyalty and aftermarket sales.

In conclusion, the 2026 OEM truck parts market will be defined by innovation, sustainability, and adaptability. OEMs that embrace electrification, digital transformation, and regional supply chain strategies will be best positioned to capture growth in an increasingly competitive and dynamic global landscape.

Common Pitfalls When Sourcing OEM Truck Parts (Quality, IP)

Sourcing OEM (Original Equipment Manufacturer) truck parts can offer reliability and compatibility, but it also comes with significant risks—especially concerning quality and intellectual property (IP). Falling into these common pitfalls can lead to operational disruptions, legal liabilities, and reputational damage.

Misidentifying Genuine OEM Parts

One of the most frequent issues is mistaking counterfeit or imitation parts for authentic OEM components. Unscrupulous suppliers may label non-OEM parts as “OEM quality” or use misleading packaging to mimic genuine products. This deception compromises part performance and safety, leading to increased downtime, higher maintenance costs, and potential safety hazards on the road.

Compromised Quality from Unauthorized Suppliers

Even when parts are labeled correctly, sourcing from unauthorized distributors or gray market channels increases the risk of receiving substandard or refurbished components. These parts may have been stored improperly, mishandled, or diverted from legitimate supply chains, affecting their integrity and longevity. Without proper quality control and traceability, fleets and repair shops face unreliable performance and shortened service life.

Intellectual Property Infringement Risks

Purchasing counterfeit or knockoff parts often involves the unauthorized use of trademarks, logos, and patented designs. Using such parts can expose buyers—especially commercial fleets and service centers—to indirect IP infringement claims. Manufacturers aggressively protect their IP and may pursue legal action against entities that knowingly or unknowingly distribute or install counterfeit components, resulting in fines or litigation.

Lack of Warranty and Support

Genuine OEM parts typically come with manufacturer warranties and technical support. When sourcing through unofficial channels, buyers often forfeit these benefits. If a part fails prematurely, the absence of warranty coverage means full financial responsibility for replacement and labor. Additionally, OEM technical support may be denied if the part’s authenticity cannot be verified.

Inadequate Traceability and Documentation

Authentic OEM parts include lot numbers, date codes, and certification documentation essential for compliance and recall management. Parts from dubious sources often lack proper documentation, making it difficult to trace origins or respond to safety recalls. This lack of traceability poses regulatory risks, especially in heavily regulated industries like commercial transportation.

Overreliance on “OEM-Spec” or “OEM-Compatible” Claims

Many suppliers advertise parts as “OEM-spec” or “compatible,” suggesting equivalent performance without being genuine OEM. While some aftermarket parts meet high standards, others cut corners on materials or engineering. Assuming equivalence without rigorous vetting can lead to premature failures, especially under the heavy-duty demands of trucking operations.

Failure to Verify Supplier Credentials

Not all suppliers are equally reliable. Buyers often overlook the importance of auditing suppliers for authenticity, certifications, and distribution rights. Skipping due diligence increases exposure to fraudulent operations. Establishing relationships only with authorized distributors or certified resellers significantly reduces the risk of counterfeit or subpar parts entering the supply chain.

Avoiding these pitfalls requires diligence: verify supplier authenticity, demand proper documentation, understand the difference between genuine OEM and imitation parts, and remain vigilant for IP red flags. Proactive sourcing strategies protect both operational efficiency and legal compliance.

Logistics & Compliance Guide for OEM Truck Parts

Overview of OEM Truck Parts Supply Chain

Original Equipment Manufacturer (OEM) truck parts are components produced by the same manufacturer that supplied the parts for the original vehicle assembly. These parts are critical for maintaining vehicle performance, safety, and warranty compliance. Ensuring efficient logistics and strict regulatory compliance throughout the supply chain is essential for distributors, repair centers, and fleet operators.

Regulatory Compliance Requirements

Federal Motor Vehicle Safety Standards (FMVSS)

All OEM truck parts must comply with FMVSS set by the National Highway Traffic Safety Administration (NHTSA). Parts such as braking systems, lighting, mirrors, and airbags must meet specific safety performance criteria. Distributors must verify FMVSS certification through documentation provided by the OEM.

Environmental Protection Regulations

The Environmental Protection Agency (EPA) enforces emissions-related standards for components like diesel particulate filters (DPFs), catalytic converters, and engine control modules. Tampering with or selling non-compliant emissions parts is prohibited under the Clean Air Act. OEM parts must carry EPA certification labels.

Department of Transportation (DOT) Regulations

Parts impacting vehicle operation—such as tires, suspension systems, and coupling devices—must adhere to DOT standards. Compliance ensures that truck parts meet durability, load capacity, and safety benchmarks. Proper DOT markings must be present on applicable components.

Import and Export Compliance

Harmonized System (HS) Codes

Accurate classification of OEM truck parts using HS codes is critical for international shipping. Common codes include:

– 8708: Parts and accessories of motor vehicles

– 8409: Engine parts

– 8512: Electrical lighting/signaling equipment

Misclassification can lead to customs delays, fines, or seizure.

Import Documentation

Required documents include:

– Commercial Invoice

– Bill of Lading

– Packing List

– Certificate of Origin

– EPA/DOT Compliance Certificates (if applicable)

Ensure all documentation reflects OEM authenticity and compliance.

Export Controls

Certain high-tech OEM components (e.g., electronic control units with embedded software) may be subject to export controls under the Export Administration Regulations (EAR). Verify if a license is required based on destination and part specifications.

Domestic Logistics Best Practices

Inventory Management

Maintain real-time inventory tracking using Warehouse Management Systems (WMS) integrated with OEM data feeds. Prioritize just-in-time (JIT) inventory models to reduce holding costs while ensuring availability of critical parts.

Packaging and Labeling

Use OEM-standard packaging to prevent damage and deter counterfeiting. Labels must include:

– OEM Part Number

– Serial/lot number

– Compliance marks (DOT, EPA, FMVSS)

– Country of origin

– Barcodes/QR codes for traceability

Transportation and Handling

Partner with carriers experienced in automotive freight. Use enclosed or secure trailers for high-value or sensitive components. Monitor temperature and humidity for parts susceptible to environmental damage (e.g., electronic modules).

Traceability and Recall Management

Implement a robust traceability system using serialized part data linked to shipment records. In the event of a recall, OEMs issue notifications through the NHTSA or direct channels. Distributors must:

– Immediately quarantine affected stock

– Notify downstream customers

– Report return and disposal actions as required

Maintain logs for at least seven years for audit purposes.

Anti-Counterfeiting Measures

Counterfeit parts pose safety and liability risks. Mitigate risk by:

– Sourcing exclusively from authorized OEM distributors

– Verifying authenticity via OEM holograms, QR codes, or blockchain tracking

– Training staff to identify fake packaging or inconsistent part markings

– Reporting suspicious activity to the OEM and authorities (e.g., U.S. Customs and Border Protection)

Warranty and Documentation Compliance

OEM parts often come with warranties tied to proper installation and use. Maintain documentation proving:

– Chain of custody from OEM to end user

– Compliance with installation guidelines

– Use of certified technicians (where required)

Failure to maintain records may void warranties and impact liability in case of part failure.

Conclusion

Effective logistics and compliance for OEM truck parts require strict adherence to federal regulations, accurate documentation, and proactive risk management. By partnering directly with OEMs, leveraging technology for traceability, and maintaining rigorous quality controls, stakeholders can ensure the safe, legal, and efficient distribution of genuine truck components.

Conclusion for Sourcing OEM Truck Parts

Sourcing OEM (Original Equipment Manufacturer) truck parts is a strategic decision that ensures reliability, compatibility, and long-term performance for commercial and heavy-duty vehicles. While OEM parts may come at a higher initial cost compared to aftermarket alternatives, their adherence to exact manufacturer specifications guarantees optimal fit, function, and durability. This reduces the risk of mechanical failures, minimizes downtime, and supports fleet safety and compliance.

Establishing relationships with authorized suppliers, leveraging digital procurement platforms, and maintaining a clear understanding of part numbers and warranties further enhance the sourcing process. Additionally, considering total cost of ownership—not just upfront price—reinforces the value of investing in genuine OEM components.

In conclusion, sourcing OEM truck parts is a prudent approach for fleet operators and repair professionals seeking quality assurance, operational efficiency, and prolonged vehicle lifespan. By prioritizing authenticity and supplier credibility, businesses can ensure the sustained performance and reliability of their trucking assets.