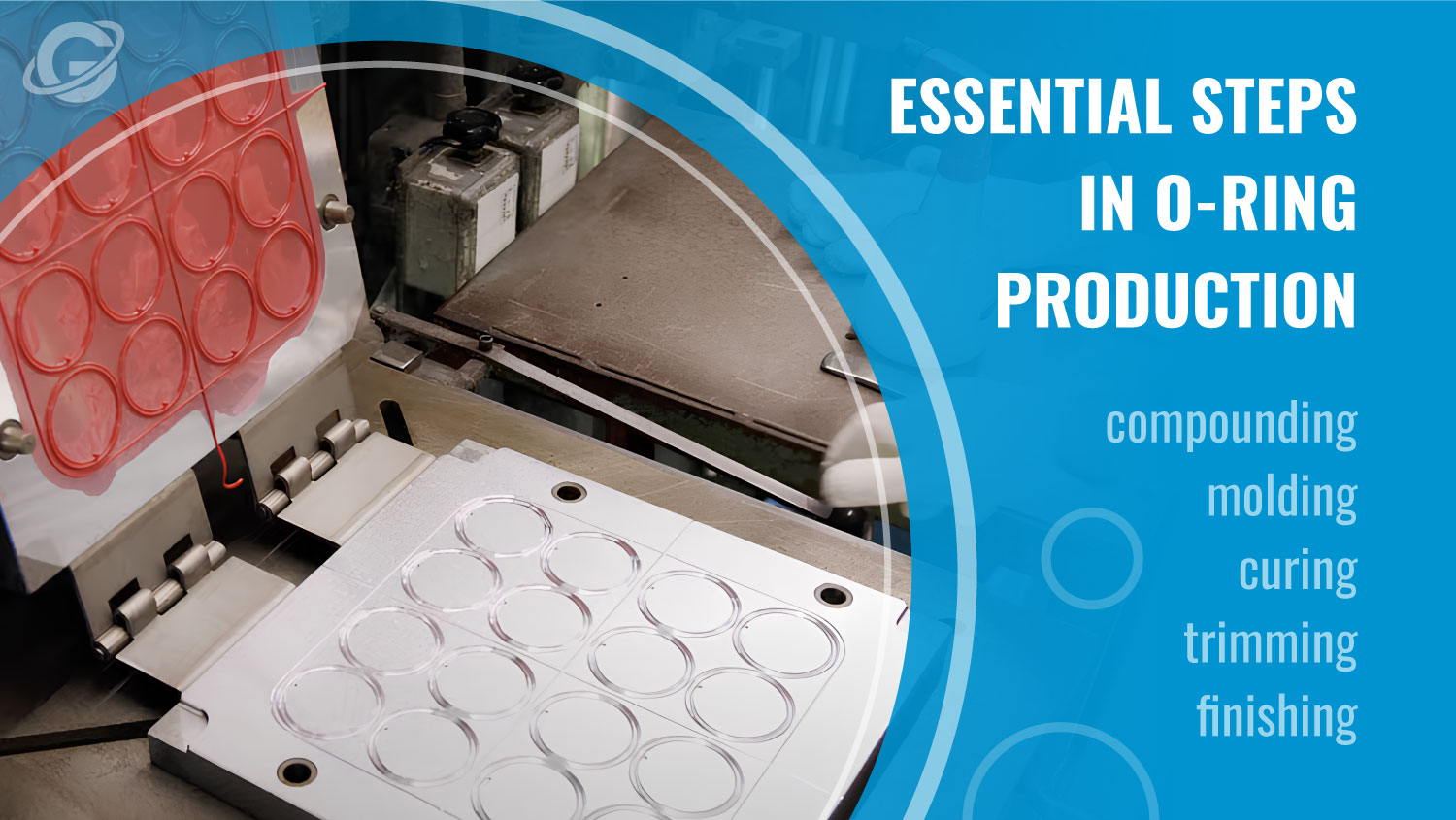

The global O-ring and sealing solutions market is experiencing steady growth, driven by increasing demand across automotive, aerospace, industrial manufacturing, and oil & gas sectors. According to Mordor Intelligence, the global mechanical seals market, which includes critical components like O-rings and associated tooling, was valued at USD 5.47 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion underscores the rising need for precision components and maintenance tools, including O-ring removal tools, that ensure equipment reliability and reduce downtime. As industries prioritize efficiency and leak prevention, manufacturers specializing in O-ring tooling are gaining prominence. With increasing automation and tighter performance tolerances, the demand for high-quality, durable O-ring removal tools has never been higher. Below, we highlight the top 10 manufacturers leading innovation and market share in this niche but essential segment of industrial maintenance.

Top 10 O Ring Tool Removal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 LTI TOOLS

Domain Est. 1999

Website: ltitools.com

Key Highlights: LTI develops problem solving and time saving tools that allow the technician to be more productive. LTI Tools sells worldwide to the automotive, locksmith, ……

#2 O

Domain Est. 2004

Website: ereplacementparts.com

Key Highlights: Buy the official Chicago Pneumatic O-ring C105693 replacement – Use our model diagrams, repair help, and video tutorials to help get the job done….

#3 Seals and O-Rings

Domain Est. 1995

Website: ph.parker.com

Key Highlights: … and Gas Filters, Particulate Removal”,”document-type”:”Static File”,”document-url”:”https://www.parker.com/content/dam/Parker-com/Literature/IGFG/PDF-Files ……

#4 Installation Instructions

Domain Est. 1996

Website: trelleborg.com

Key Highlights: e-Learning: Installation Instructions. This module features five intuitive lessons that demonstrate the installation of different types of seals….

#5 Moroso Performance Products

Domain Est. 1997

Website: moroso.com

Key Highlights: 5-day deliveryFeatured Categories · Oil Pans & Accessories · Valve Covers & Accessories · Ignition Wire · Electrical System · Dry Sump Tanks · Tools · Dry Sump Pumps · Wet Sump Pum…

#6 O

Domain Est. 2000

Website: o-ringsales.com

Key Highlights: O-Rings Splicing Kits. O-Ring removal tools – This set of American-made tools is the absolute solution for your packing maintenence needs….

#7 O

Domain Est. 2008

#8 Cal

Domain Est. 2009

Website: cal-vantools.com

Key Highlights: 30-day returnsWe make tough jobs easier. Cal-Van Tools is a specialty tool brand in the automotive market that meets the needs of technicians, mechanics and DIYers….

#9 Transmission Tools 9pcs O Ring Pick Tool Removal Oil Seal Tools …

Domain Est. 2023

Website: marevokram.com

Key Highlights: Perform well in removing gaskets, springs, oil seals, O-rings, and other small gadgets From motorcycle or automobile 【 What You Get】Includes 1” Flat shovel, ……

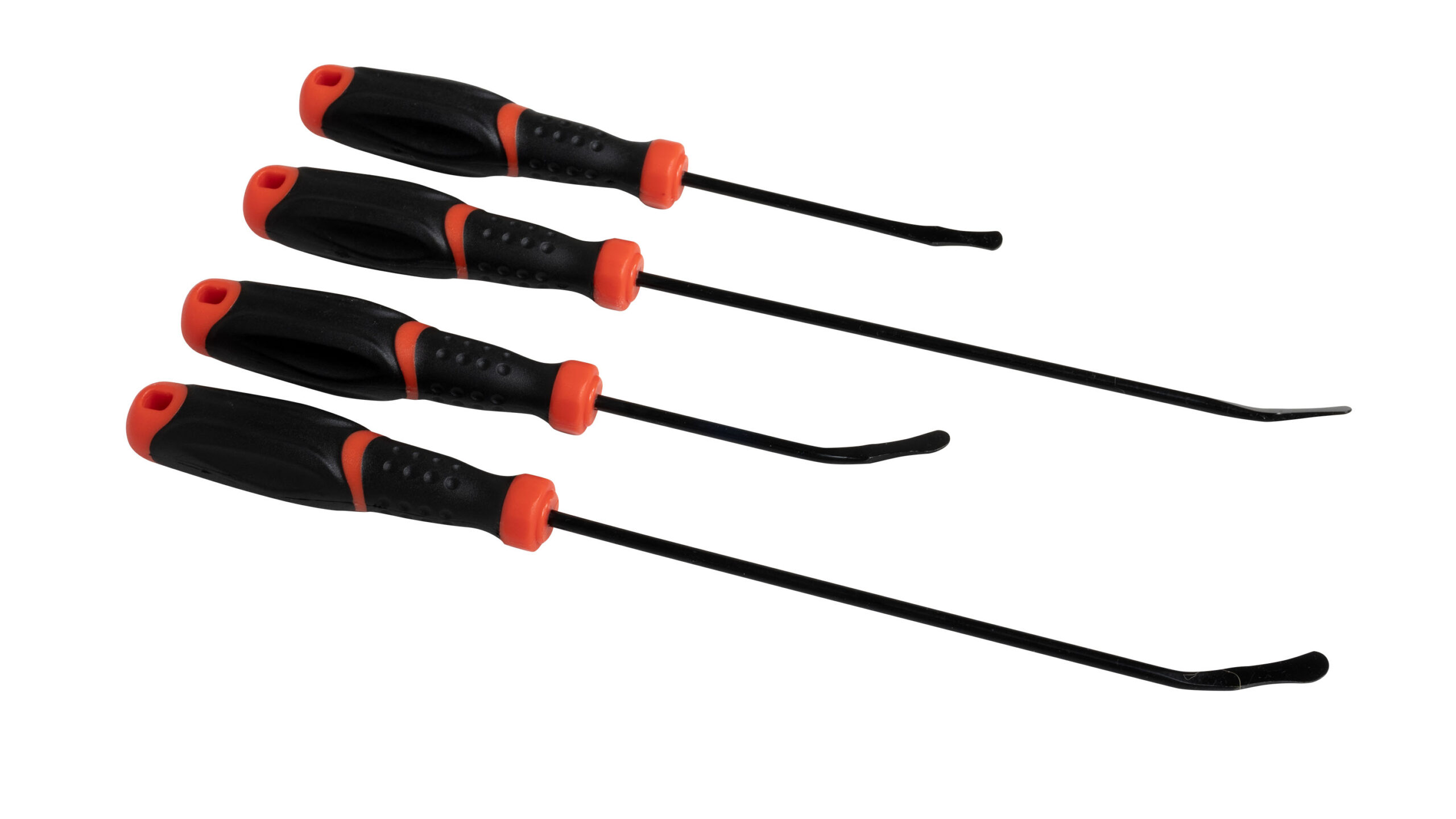

#10 BlueSpot Pick & Hook Probe Set

Website: hipandknee.com.au

Key Highlights: Every DIY mechanic needs a good set of picks and hooks – and this BlueSpot 4-piece set is just the ticket! These tools are super handy for all sorts of jobs: ……

Expert Sourcing Insights for O Ring Tool Removal

2026 Market Trends for O-Ring Removal Tools

The market for O-ring removal tools is poised for notable evolution by 2026, driven by increasing demands for precision, efficiency, and safety across key industrial sectors. As manufacturing, automotive, aerospace, and industrial maintenance continue to emphasize operational reliability and reduced downtime, the need for specialized, high-performance O-ring removal tools is gaining traction. Several converging trends are expected to shape the landscape of this niche but critical tooling segment.

Advancements in Tool Design and Material Innovation

By 2026, O-ring removal tools are anticipated to incorporate advanced materials such as high-strength polymers, corrosion-resistant alloys, and ergonomic composites. These materials will enhance tool durability, reduce operator fatigue, and prevent damage to sensitive sealing surfaces during removal. Innovations like micro-beveled tips, non-marring coatings, and modular designs will allow for greater precision in tight or delicate assemblies—particularly in aerospace and medical device maintenance. Additionally, manufacturers are likely to invest in tooling with anti-static or ESD-safe properties to meet growing requirements in electronics and cleanroom environments.

Growing Emphasis on Preventive Maintenance and Downtime Reduction

As industries adopt predictive and preventive maintenance strategies to minimize equipment failure, the role of reliable O-ring service tools becomes more strategic. By 2026, companies will increasingly view O-ring removal tools not just as consumables but as integral components of maintenance efficiency. This shift will drive demand for kits that offer versatility across multiple O-ring sizes and configurations, reducing the need for multiple specialized tools. Smart toolkits with inventory tracking and usage analytics may begin to emerge, aligning with Industry 4.0 trends.

Expansion in High-Growth Sectors

The electric vehicle (EV) and renewable energy sectors are expected to significantly contribute to market growth. EV battery packs, power electronics, and charging infrastructure require reliable sealing solutions, increasing the frequency of O-ring service operations. Similarly, hydraulic systems in wind turbines and solar tracking mechanisms will necessitate durable and specialized removal tools capable of withstanding harsh environmental conditions. These emerging applications will push manufacturers to develop rugged, weather-resistant tools tailored to field service requirements.

Regional Market Dynamics and Supply Chain Localization

Asia-Pacific, particularly China, India, and Southeast Asia, is projected to experience robust growth in demand due to expanding manufacturing bases and infrastructure development. By 2026, localized production of O-ring removal tools is likely to increase to reduce lead times and logistics costs, especially in automotive and industrial equipment hubs. Meanwhile, North America and Europe will focus on premium, high-precision tools compliant with ISO and ASTM standards, driven by stringent regulatory environments in aerospace and pharmaceutical industries.

Sustainability and Reusability Trends

Environmental considerations will influence tool design, with a growing preference for reusable, recyclable tools over disposable plastic picks. Manufacturers may adopt sustainable packaging and promote tool longevity through modular, repairable designs. This aligns with broader corporate sustainability goals and could become a differentiating factor in competitive bidding for industrial contracts.

In summary, the 2026 market for O-ring removal tools will be characterized by innovation in materials and design, integration with smart maintenance ecosystems, and expansion into high-tech and green energy sectors. Companies that prioritize precision, durability, and adaptability will be well-positioned to capture value in this evolving niche.

Common Pitfalls When Sourcing O-Ring Removal Tools (Quality and Intellectual Property)

Sourcing O-ring removal tools may seem straightforward, but overlooking key quality and intellectual property (IP) concerns can lead to significant operational, legal, and financial risks. Being aware of these common pitfalls helps ensure reliable tool performance and protects your organization from liability.

Poor Material Quality and Durability

One of the most frequent issues is procuring tools made from substandard materials. Low-quality metals or plastics can bend, break, or deform during use, especially when removing tightly seated O-rings. This not only reduces tool lifespan but also increases the risk of damaging the O-ring groove or surrounding components, leading to costly repairs and downtime.

Inconsistent Tool Dimensions and Tolerances

Generic or counterfeit O-ring removal tools often lack precise engineering. Variations in tip geometry, thickness, or curvature can prevent proper engagement with the O-ring, making removal difficult or impossible without causing damage. Tools that don’t conform to OEM specifications compromise maintenance efficiency and can void equipment warranties.

Lack of Surface Finish and Coating Standards

High-quality removal tools typically feature smooth, polished surfaces or protective coatings (e.g., chrome or nickel plating) to prevent scratching mating surfaces. Sourcing tools without these finishes increases the likelihood of gouging housings or bores—particularly in sensitive applications like hydraulics or aerospace systems—undermining system integrity.

Counterfeit or Imitation Tools Infringing IP

Many reputable manufacturers hold design patents, trademarks, or trade dress rights on their O-ring tool designs. Sourcing from unauthorized suppliers may result in purchasing counterfeit products that infringe on these intellectual property rights. Using such tools exposes your company to legal action, customs seizures, and reputational damage, especially in regulated industries.

Absence of Certification and Traceability

Reputable tools often come with certification of material origin, manufacturing standards (e.g., ISO), and batch traceability. Tools sourced from unreliable vendors frequently lack documentation, making it difficult to verify compliance with industry standards or conduct root cause analysis if tool failure leads to equipment damage.

Misrepresentation of Compatibility and Use

Some suppliers market removal tools as “universal” or “OEM-equivalent” without validating performance across different O-ring sizes or materials. This misrepresentation can lead to tool misuse, ineffective removal, or component damage—particularly when dealing with elastomers like Viton®, EPDM, or silicone that require careful handling.

Supply Chain Transparency and Ethical Concerns

Sourcing from suppliers with opaque supply chains may inadvertently involve tools manufactured using unethical labor practices or non-compliant environmental processes. Beyond reputational risk, this can conflict with corporate sustainability policies and complicate audits in regulated sectors.

Avoiding these pitfalls requires due diligence: vetting suppliers, verifying certifications, testing sample tools, and ensuring IP compliance. Investing in high-quality, legally sourced O-ring removal tools ultimately supports safer, more efficient maintenance operations.

Logistics & Compliance Guide for O-Ring Tool Removal

Purpose and Scope

This guide outlines the logistical procedures and compliance requirements for the safe and effective removal of O-rings using specialized tools. It applies to maintenance, repair, and operations (MRO) personnel, supervisors, and procurement teams involved in equipment servicing across industrial, automotive, aerospace, and manufacturing environments.

Tools and Equipment Requirements

Approved O-ring removal tools include hook tools, dental picks, plastic scrapers, and non-marring extraction implements. Tools must be clean, undamaged, and compatible with the O-ring material and housing dimensions. Use of improper tools (e.g., screwdrivers, sharp metal objects) is strictly prohibited to prevent component damage and safety hazards.

Safety Precautions

Personnel must wear appropriate personal protective equipment (PPE), including safety glasses and cut-resistant gloves. Work areas must be well-lit and free of clutter. Ensure equipment is depressurized and isolated from energy sources prior to O-ring removal. Follow Lockout/Tagout (LOTO) procedures as per OSHA 29 CFR 1910.147.

Removal Procedure

- Inspect Assembly: Visually confirm O-ring location and condition.

- Select Tool: Choose the correct removal tool based on O-ring size and housing depth.

- Gentle Extraction: Insert tool beneath O-ring edge and slowly lift or pull circumferentially to avoid gouging.

- Inspect for Residue: Check groove for leftover fragments and clean thoroughly before installation.

- Document: Record removal date, component ID, and condition of removed O-ring in maintenance logs.

Material Handling and Disposal

Removed O-rings must be segregated by material type (e.g., Nitrile, Viton, Silicone). Comply with local environmental regulations for disposal—non-hazardous elastomers may be disposed of as general waste; fluorinated materials may require special handling under EPA or REACH guidelines. Recycle where possible through certified vendors.

Compliance and Documentation

All O-ring removal activities must comply with applicable industry standards such as ISO 9001 (Quality Management), AS9100 (Aerospace), and API 6A (Oil & Gas). Maintain detailed records for traceability, including:

– Component serial number

– O-ring part number and material

– Date and technician ID

– Tool used

– Observations (e.g., extrusion, cracking, chemical degradation)

Training and Competency

Only trained and authorized personnel may perform O-ring removal. Initial and annual refresher training must cover tool use, safety protocols, and regulatory compliance. Training records shall be retained for audit purposes.

Audit and Continuous Improvement

Internal audits should be conducted quarterly to verify adherence to this guide. Non-conformances must be reported and addressed through corrective action plans. Feedback from field technicians is encouraged to improve tool selection and removal techniques.

Regulatory References

- OSHA 29 CFR 1910.147 – Control of Hazardous Energy

- EPA Resource Conservation and Recovery Act (RCRA) – Waste Management

- REACH Regulation (EC 1907/2006) – Chemical Substances

- ISO 3601 – Fluid power systems – O-rings and accessories

For questions or updates, contact the Maintenance Compliance Office or EHS Department.

Conclusion on Sourcing O-Ring Removal Tools

In conclusion, sourcing the right O-ring removal tool is essential for maintaining equipment integrity, minimizing downtime, and ensuring efficient maintenance operations. Selecting appropriate tools—such as hook pick sets, precision tweezers, specialized O-ring pullers, or custom-made tools—depends on factors including the application environment, O-ring size and material, accessibility of the seal, and industry standards. It is crucial to prioritize high-quality, durable tools from reliable suppliers to prevent damage to sensitive components and ensure operator safety. Additionally, considering cost-effectiveness, availability, and compatibility with existing systems will optimize maintenance workflows. By carefully evaluating supplier reputation, tool specifications, and end-use requirements, organizations can effectively source O-ring removal tools that enhance reliability, prolong equipment lifespan, and support smooth operational performance.