The global O-ring market is experiencing steady growth, driven by increasing demand across key industries such as automotive, aerospace, oil & gas, and medical devices. According to Grand View Research, the global seals market—of which O-rings are a critical component—was valued at USD 9.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of approximately 4.8% for the industrial seals market through 2028, citing rising industrial automation and the need for reliable fluid and gas sealing solutions in harsh operating environments.

As demand for high-performance, durable sealing components grows, so does the importance of selecting reputable O-ring manufacturers who deliver precision-engineered products across diverse materials, including Nitrile (NBR), Fluorocarbon (FKM), Silicone (VMQ), and EPDM. These materials must meet stringent international standards (e.g., ASTM, ISO, SAE) and perform reliably under extreme temperatures, pressures, and chemical exposures.

In this data-driven landscape, a select group of manufacturers has emerged as industry leaders—combining innovation, quality control, and global supply chain reach. Below, we explore the top 8 O-ring manufacturers shaping the future of sealing technology, based on market presence, production capabilities, material expertise, and adherence to industry certifications.

Top 8 O Ring Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 O

Website: cog.de

Key Highlights: As an independent manufacturer, we are one of Germany’s leading suppliers of precision seals. We advise, develop and manufacture for you….

#2 O-Ring Manufacturers

Domain Est. 2002 | Founded: 1989

Website: o-rings.org

Key Highlights: Since 1989, we have been an o-ring distributor. We offer commercial, FDA, military, metric o-rings, caps, plugs, gaskets & more….

#3 O-Rings, Caps, Gaskets and Plugs

Domain Est. 2004

Website: azseal.com

Key Highlights: Arizona Sealing Devices, Inc. is a Distributor of Military and Standard Rings, Gaskets, Sheeting, Back Up Rings, Quad Rings, Oil Seals, Clamps, Cord Stock, ……

#4 Captain O

Domain Est. 2009

Website: captainoring.com

Key Highlights: Captain O-Ring LLC is a manufacturer and worldwide supplier of o-rings, custom design o-rings & rubber parts, custom plastic parts, and o-ring kits….

#5 Cost

Domain Est. 1996

Website: trelleborg.com

Key Highlights: Our O-Rings are both cost-effective and perform highly in almost every environment. No matter if you need metric or inch, standard or custom-made O-Rings….

#6 O

Domain Est. 1997

Website: marcorubber.com

Key Highlights: Order O-Rings Online from the world’s largest o-ring and seal inventory and production network. Get quick delivery and service with simple online ordering….

#7 OringsUSA

Domain Est. 2002

Website: oringsusa.com

Key Highlights: We are the world’s leading supplier of quality O-Rings to our most valued customers. We serve global iconic customers in more than 125 markets….

#8 O

Domain Est. 2008

Website: theoringstore.com

Key Highlights: We stock millions of standard and metric O-Rings, vulcanized O-Rings, engineered O-Ring compounds, oil seals, hydraulic seals, and custom seals ready to ship ……

Expert Sourcing Insights for O Ring

H2: 2026 Market Trends for O-Rings

The global O-ring market in 2026 is expected to be shaped by a confluence of technological advancements, evolving industry demands, and macroeconomic factors. Building on pre-existing trends, the market will likely exhibit significant shifts in materials, applications, regional dynamics, and sustainability focus.

1. Advanced Materials Driving Performance & Longevity:

* High-Performance Elastomers: Demand will surge for O-rings made from specialty materials like perfluoroelastomers (FFKM), perfluorocarbon (PFC), and advanced fluorosilicones. These offer superior resistance to extreme temperatures (-60°C to +327°C), aggressive chemicals (acids, bases, solvents), and high pressure, crucial for aerospace, semiconductor manufacturing, and next-generation energy applications (e.g., hydrogen fuel cells, geothermal).

* Thermoplastic Elastomers (TPEs): TPEs will gain traction due to their recyclability, faster processing times (injection molding), and good flexibility. They are particularly attractive for consumer goods, medical devices, and less extreme industrial applications, aligning with circular economy goals.

* Nanocomposite & Filled Polymers: Incorporating nanoparticles (e.g., silica, graphene) into base elastomers will enhance mechanical properties like tensile strength, abrasion resistance, and gas permeation resistance, extending service life in demanding environments.

2. Sector-Specific Growth Drivers:

* Semiconductor & Electronics: The relentless miniaturization and complexity of semiconductor fabrication (fabs) will drive demand for ultra-high-purity, low-outgassing, and ultra-clean O-rings (especially FFKM, PTFE) capable of maintaining vacuums and resisting aggressive plasma etching gases in advanced lithography and deposition tools.

* Electric Vehicles (EVs) & Hydrogen Economy:

* EVs: Growth in battery electric and fuel cell vehicles will boost demand for O-rings in battery packs (sealing coolant systems, cell housings), power electronics (inverters, DC-DC converters), and electric motors. Materials must resist lithium battery electrolytes and high-voltage arcing.

* Hydrogen: The nascent but rapidly developing hydrogen economy will create a critical need for O-rings resistant to hydrogen embrittlement, permeation, and high pressures (700 bar+) in production, storage, transportation (pipelines, tube trailers), and refueling stations. Materials like specific FKM grades and PTFE will be essential.

* Aerospace & Defense: Continued development of hypersonic vehicles, advanced propulsion systems (including electric/hybrid), and next-gen aircraft will require O-rings with exceptional performance at extreme temperatures and pressures, pushing the boundaries of material science (e.g., advanced silicones, FFKM).

* Life Sciences & Medical Devices: Stringent biocompatibility and sterilization requirements (autoclave, gamma, ETO) will maintain demand for high-purity silicone, EPDM, and FKM O-rings. Growth in minimally invasive devices and wearable tech will drive miniaturization needs.

3. Sustainability & Circular Economy:

* Material Sourcing: Increased pressure for sustainable sourcing of raw materials (e.g., bio-based rubbers, recycled content) and reduced environmental impact during manufacturing will grow. Transparency in the supply chain will be paramount.

* Recyclability & End-of-Life: While thermoset elastomers (like standard NBR, EPDM) are challenging to recycle, the industry will see greater investment in take-back programs, chemical recycling technologies, and the design for disassembly. TPEs offer a significant advantage here.

* Durability & Longevity: Extending O-ring service life directly reduces waste and resource consumption. This will be a key selling point, driving demand for higher-performance materials.

4. Digitalization & Smart Sealing:

* Predictive Maintenance: Integration of sensors (e.g., pressure, temperature, strain) into O-ring assemblies or surrounding components will enable monitoring of seal health and predicting failure. This “smart sealing” will gain traction in critical applications (oil & gas, power gen) to reduce unplanned downtime.

* Digital Twins & Simulation: Advanced CAE (Computer-Aided Engineering) tools will allow for highly accurate simulation of O-ring performance under complex, real-world conditions, optimizing design and material selection virtually, reducing prototyping costs and time-to-market.

* Additive Manufacturing (3D Printing): While not mainstream for final parts yet, 3D printing will be increasingly used for rapid prototyping of complex O-ring glands and potentially for producing custom, low-volume, or intricate seal geometries using specialized elastomeric filaments.

5. Regional Dynamics & Supply Chain Resilience:

* Asia-Pacific Dominance: The APAC region (led by China, India, Japan, South Korea) will remain the largest market and manufacturing hub, driven by robust industrialization, electronics production, and automotive growth, particularly in EVs.

* Reshoring & Nearshoring: Geopolitical tensions and supply chain disruptions (post-pandemic, geopolitical) will accelerate efforts in North America and Europe to reshore or nearshore critical manufacturing, including sealing solutions. This could benefit local O-ring producers focused on high-value, complex applications.

* Consolidation: The market may see continued consolidation among material suppliers and O-ring manufacturers to achieve economies of scale, enhance R&D capabilities, and offer broader material portfolios.

6. Cost Pressures & Value Engineering:

* Despite demand for high-performance materials, intense competition, especially in automotive and general industrial sectors, will keep cost pressures high. Manufacturers will focus on value engineering – optimizing designs, materials, and processes to deliver required performance at the lowest total cost of ownership.

* Automation in manufacturing (molding, inspection) will be crucial to maintain competitiveness.

Conclusion:

By 2026, the O-ring market will be characterized by a clear bifurcation: one segment focused on cost-optimized, standardized solutions for mature industries, and another driven by innovation in high-performance materials and smart technologies for cutting-edge applications in semiconductors, EVs, hydrogen, aerospace, and medical devices. Success will depend on the ability of manufacturers to innovate in materials science, embrace digitalization, prioritize sustainability, and navigate complex global supply chains while meeting the increasingly stringent performance demands of advanced technologies.

Common Pitfalls When Sourcing O-Rings: Quality and Intellectual Property (IP) Concerns

Sourcing O-rings may seem straightforward, but several critical pitfalls can lead to performance failures, safety risks, or legal issues—especially when compromising on quality or inadvertently violating intellectual property rights. Below are key considerations to avoid these common mistakes.

Quality-Related Pitfalls

1. Using Substandard Materials

One of the most frequent issues is selecting O-rings made from inferior or incorrect elastomer materials. Using a material not suited for the operating environment (e.g., temperature, pressure, chemical exposure) leads to premature failure. For example, using NBR in high-temperature applications where FKM (Viton®) is required can cause rapid degradation.

2. Inconsistent Dimensional Tolerances

Low-cost suppliers may not adhere to international standards such as ISO 3601 or AS568. Poorly manufactured O-rings with inconsistent cross-sections or inner diameters can result in leaks, improper sealing, or installation damage.

3. Lack of Certification and Traceability

Reputable applications (e.g., aerospace, medical, oil & gas) require certifications like ASTM, FDA, or NSF. Sourcing from suppliers without proper documentation or material traceability increases the risk of non-compliance and liability.

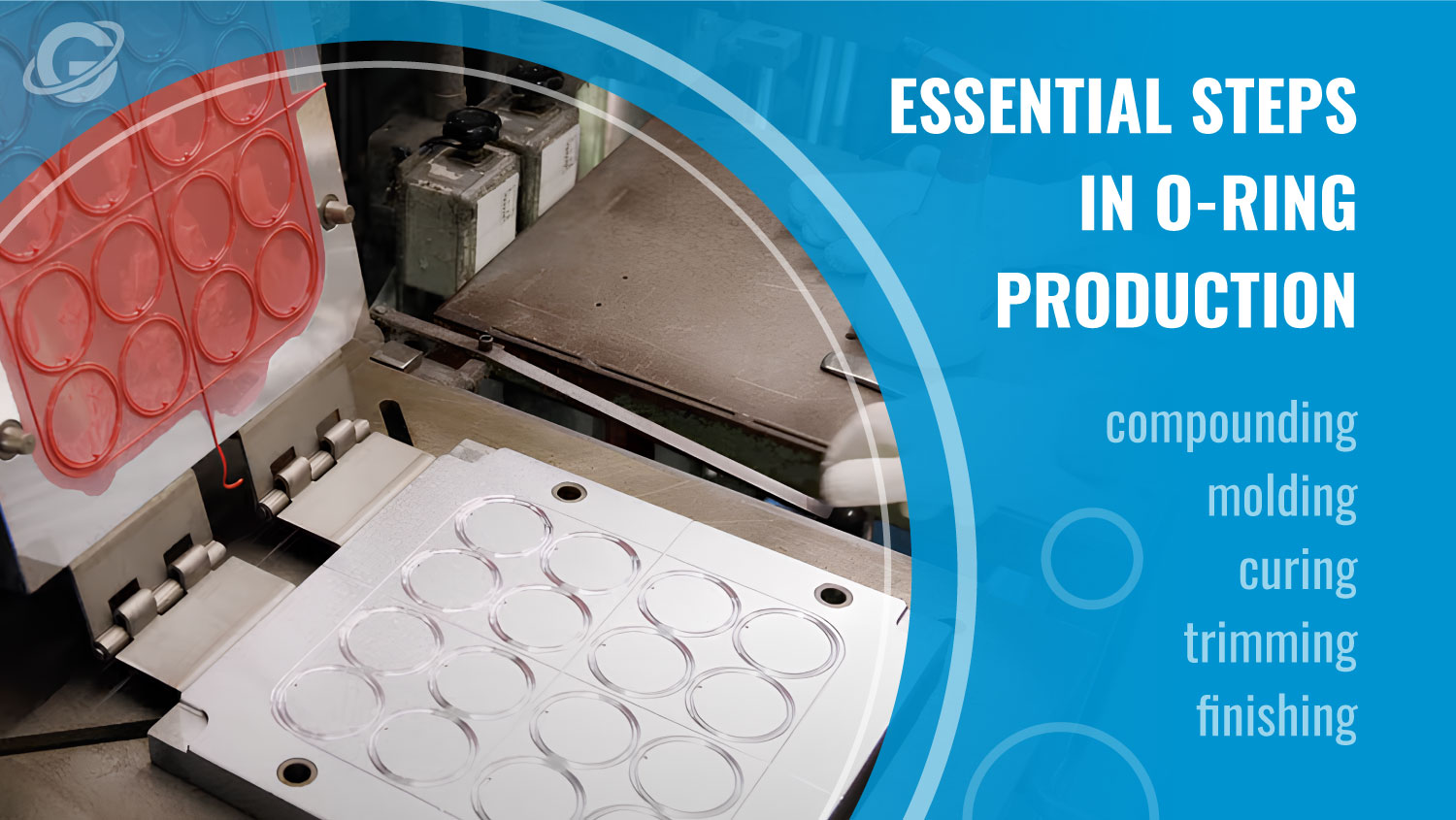

4. Poor Manufacturing Processes

Inadequate curing (vulcanization), contamination during production, or improper flash removal can compromise O-ring integrity. These defects may not be visible during inspection but can cause field failures.

5. Counterfeit or Gray Market Products

Purchasing from unauthorized distributors increases the risk of receiving counterfeit O-rings—products that mimic well-known brands but fail to meet performance standards. These often lack proper testing and can jeopardize system reliability.

Intellectual Property (IP) Pitfalls

1. Copying Proprietary Designs or Trademarks

Some suppliers replicate branded O-rings (e.g., Parker, SKF) and sell them under misleading names or packaging. This not only violates trademark laws but can also mislead customers about performance and origin.

2. Using Patented Material Formulations

Certain elastomer compounds are patented. Using or sourcing O-rings made with protected formulations without licensing can result in legal action, especially in regulated industries.

3. Misrepresentation of Equivalent Products

Suppliers may claim their O-rings are “equivalent” to a branded product without sufficient testing or validation. This can lead to performance discrepancies and potential IP disputes if the comparison implies endorsement or direct substitution without authorization.

4. Inadequate Due Diligence on Suppliers

Failing to verify a supplier’s legitimacy, manufacturing rights, or compliance with IP laws exposes the buyer to legal and reputational risks. This is especially important in global sourcing where IP enforcement varies by region.

Best Practices to Avoid Pitfalls

- Source O-rings from certified, authorized suppliers with documented quality management systems (e.g., ISO 9001).

- Require material certifications, test reports, and full traceability.

- Verify compliance with industry standards and environmental regulations.

- Conduct audits or third-party testing for critical applications.

- Consult legal counsel when sourcing “equivalent” products or when IP concerns arise.

Avoiding these common pitfalls ensures reliable performance, regulatory compliance, and protection against legal exposure when sourcing O-rings.

Logistics & Compliance Guide for O-Rings

Overview

O-rings are critical sealing components used across industries such as automotive, aerospace, oil & gas, and medical devices. Due to their application in regulated environments, adherence to logistics and compliance standards is essential for quality, safety, and legal conformity.

Material & Regulatory Compliance

O-rings must comply with industry-specific material standards depending on their application. Common compliance standards include:

– ASTM D2000: Standard classification for rubber products in automotive applications.

– FDA 21 CFR 177.2600: Required for O-rings used in food, beverage, or pharmaceutical processing.

– USP Class VI: Applicable for medical-grade silicone O-rings.

– NSF/ANSI 61: Relevant for O-rings in potable water systems.

– REACH & RoHS: Ensures absence of restricted substances in the EU market.

– ATEX & IECEx: Required for O-rings used in explosive atmospheres.

Ensure material certifications (e.g., Certificate of Conformance, Material Test Reports) are available and traceable for each production batch.

Packaging & Labeling Requirements

Proper packaging protects O-rings from contamination, deformation, and environmental damage. Guidelines include:

– Use sealed, anti-static, and moisture-resistant packaging for sensitive materials (e.g., silicone, FFKM).

– Label packages with:

– Part number and size

– Material type (e.g., NBR, Viton®, EPDM)

– Batch/lot number

– Date of manufacture

– Compliance markings (e.g., FDA, NSF, RoHS)

– Storage conditions (e.g., “Store in a cool, dry place away from direct sunlight”)

Storage & Shelf Life Management

Rubber O-rings degrade over time. Follow these storage protocols:

– Store in a dark, dry, and temperature-controlled environment (typically 15–25°C).

– Avoid exposure to ozone, UV light, and incompatible chemicals.

– Keep O-rings flat or loosely coiled; never hang or stretch.

– Observe shelf life:

– NBR, EPDM: Up to 10 years

– Silicone: Up to 20 years

– FKM (Viton®): Up to 15 years

Refer to manufacturer data sheets for exact shelf life. Rotate stock using FIFO (First In, First Out) principles.

Transportation & Handling

During shipping, protect O-rings from:

– Extreme temperatures (avoid freezing or overheating)

– Pressure changes (especially air freight)

– Vibration and physical impact

Use temperature-controlled or insulated containers when necessary. Handle packages with care to prevent compression or deformation of contents.

Import/Export Considerations

International shipments of O-rings may be subject to:

– Customs Documentation: Commercial invoice, packing list, and certificate of origin.

– HS Code Classification: Typically under 4016.93 (other articles of vulcanized rubber).

– Export Controls: Verify no ITAR or dual-use restrictions apply, especially for aerospace-grade components.

– Country-Specific Regulations: Some countries require local certification (e.g., KC Mark in Korea, INMETRO in Brazil).

Quality Assurance & Traceability

Implement a traceability system that links each O-ring batch to:

– Raw material source

– Manufacturing date and location

– Test results (e.g., hardness, tensile strength, compression set)

– Compliance documentation

Maintain records for at least 10 years, or as required by industry standards (e.g., ISO 9022, AS9100).

Environmental & Disposal Compliance

Used or non-conforming O-rings must be disposed of according to local environmental regulations:

– Do not incinerate halogenated rubbers (e.g., FKM) without proper emission controls.

– Follow waste classification guidelines (non-hazardous vs. hazardous based on additives).

– Consider recycling programs for scrap rubber where available.

Conclusion

Adhering to logistics and compliance protocols ensures O-rings perform reliably and meet global regulatory expectations. Always consult manufacturer specifications and regional regulations to maintain compliance throughout the supply chain.

Conclusion for Sourcing O-Ring Manufacturers

Sourcing reliable O-ring manufacturers is a critical step in ensuring the performance, durability, and safety of mechanical and industrial systems across various sectors such as automotive, aerospace, oil and gas, pharmaceuticals, and manufacturing. A successful sourcing strategy involves a thorough evaluation of manufacturers based on key criteria including material expertise, quality certifications (e.g., ISO 9001, AS9100, FDA compliance), production capabilities, testing standards, and global supply chain reliability.

After careful assessment, it is evident that partnering with manufacturers who demonstrate technical proficiency, consistent quality control, and the ability to customize solutions according to specific application requirements leads to long-term operational efficiency and cost savings. Additionally, establishing relationships with suppliers who adhere to environmental and ethical manufacturing practices enhances corporate responsibility and brand integrity.

In conclusion, effective sourcing of O-ring manufacturers should prioritize quality, reliability, and collaboration. By selecting partners with proven track records, advanced engineering support, and responsive customer service, organizations can mitigate risks, reduce downtime, and ensure the integrity of their sealing solutions under demanding conditions. Continuous supplier evaluation and fostering strong supply chain partnerships remain essential to maintaining a competitive edge in today’s dynamic industrial landscape.