The global surgical sutures market, driven by rising surgical volumes, advancements in minimally invasive procedures, and increasing demand for absorbable and non-absorbable sutures, is experiencing steady growth. According to Grand View Research, the global surgical sutures market was valued at USD 3.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. Nylon sutures, as a key category within non-absorbable sutures, are widely used in cardiovascular, orthopedic, and general surgeries due to their high tensile strength, durability, and excellent handling properties. This sustained market expansion, coupled with increased healthcare access and aging populations worldwide, has intensified competition among manufacturers. Based on production capabilities, product innovation, regulatory compliance, and global distribution networks, the following eight companies have emerged as leading nylon suture manufacturers shaping the industry landscape.

Top 8 Nylon Sutures Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 nylon suture (monofilament)

Domain Est. 2004

Website: teleflexmedicaloem.com

Key Highlights: Teleflex Medical OEM’s nylon suture meets all requirements established by the USP for sterile, non-absorbable surgical sutures….

#2 NETPLAST®

Domain Est. 2012

Website: sutureplanet.com

Key Highlights: NETPLAST® sets the standard for surgical nylon suture, offering exceptional strength and pliability. With high in vivo tensile strength and a ……

#3 Sutures

Domain Est. 1990

Website: medtronic.com

Key Highlights: Surgilon™ braided nylon sutures are nonabsorbable surgical sutures indicated for use in general soft tissue approximation and/or ligation….

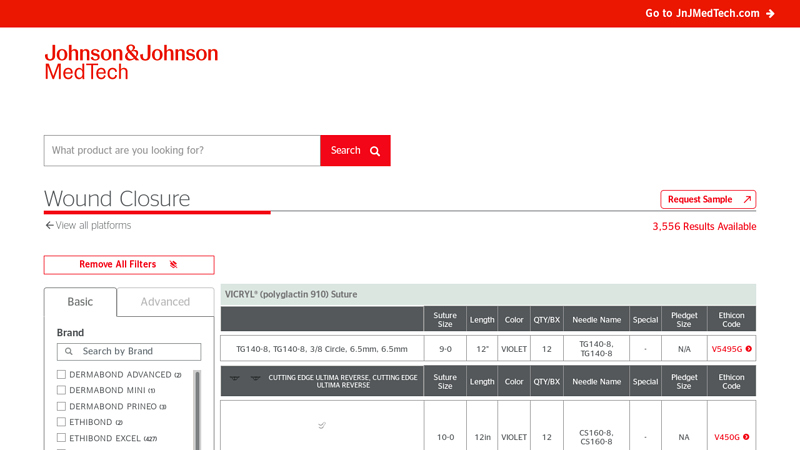

#4 Wound Closure Search

Domain Est. 1995

Website: ethicon.com

Key Highlights: This site is intended for Healthcare Professionals. Not all products are … ETHILON® Nylon Suture. Needle Image. Suture Size, 11-0. Length, 5in. Color, BLACK….

#5 Sutures

Domain Est. 1999

Website: securos.com

Key Highlights: 250 different suture options is made in the United States with premium materials, industry-leading tensile strength, and needles that require 12-20% less force ……

#6 SMI

Domain Est. 2003 | Founded: 1987

Website: sutures.be

Key Highlights: SMI AG was established in 1987 – the first Belgian company to manufacture surgical, ophthalmic and dental sutures. Today it is recognized as an experienced ……

#7 BOENMED® Nylon Suture

Domain Est. 2006

Website: boenmedical.com

Key Highlights: BOENMED manufactures NYLON SUTURE. The Nylon Sutures are high-quality, synthetic, non-absorbable monofilament sutures made from durable nylon (polyamide)….

#8 Nylon Sutures

Domain Est. 2008

Website: dolphinsutures.com

Key Highlights: Nylon sutures are also known as polyamide sutures. Nylon sutures are monofilament sutures and are remarkably smooth, soft and gives excellent knot security….

Expert Sourcing Insights for Nylon Sutures

H2: 2026 Market Trends for Nylon Sutures

The global market for nylon sutures is poised for steady growth and transformation by 2026, driven by advancements in surgical techniques, rising demand for minimally invasive procedures, and increasing healthcare infrastructure development, particularly in emerging economies. Nylon sutures—known for their high tensile strength, excellent knot security, and minimal tissue reactivity—remain a staple in both absorbable and non-absorbable suture categories, primarily used in dermatology, cardiovascular, ophthalmic, and general surgery.

1. Rising Surgical Volumes and Aging Populations

A key driver of nylon suture demand through 2026 is the global increase in surgical procedures. The aging population in North America, Europe, and parts of Asia-Pacific is contributing to higher incidences of chronic diseases such as cardiovascular disorders and cancer, necessitating more surgical interventions. According to the World Health Organization, surgical volumes are expected to grow by approximately 4–5% annually through 2026, directly boosting demand for reliable, cost-effective sutures like nylon.

2. Growth in Minimally Invasive Surgeries (MIS)

The shift toward minimally invasive surgical techniques—such as laparoscopic and robotic surgeries—is positively influencing the nylon suture market. These procedures require sutures with high precision, flexibility, and durability, which nylon provides. Innovations in monofilament nylon sutures, which offer reduced tissue drag and lower infection risks, are being increasingly adopted in MIS, further expanding market opportunities.

3. Emerging Markets as Growth Engines

Asia-Pacific (especially India, China, and Southeast Asian nations) is expected to witness the fastest market growth for nylon sutures by 2026. Expanding healthcare access, rising medical tourism, government investments in hospital infrastructure, and increasing surgeon training programs are key factors. Additionally, local manufacturing of medical devices—supported by favorable regulatory reforms and cost advantages—is enabling regional players to compete with global brands, increasing nylon suture availability and affordability.

4. Competitive Landscape and Product Innovation

Major medical device companies such as Ethicon (Johnson & Johnson), Medtronic, B. Braun, and Sutures India are investing in R&D to enhance nylon suture performance. Trends include antimicrobial coatings to reduce surgical site infections, improved dye formulations for better visibility, and hybrid suture designs combining nylon with other polymers for enhanced handling characteristics. These innovations are expected to differentiate products in a competitive market.

5. Regulatory and Sustainability Pressures

Regulatory bodies such as the FDA and EU MDR are enforcing stricter standards for medical device safety and traceability, impacting suture manufacturing and distribution. Additionally, environmental concerns are pushing companies to explore sustainable packaging and reduce single-use waste, though nylon—being non-biodegradable—presents challenges. Some manufacturers are responding with take-back programs and reduced packaging footprints.

6. Price Sensitivity and Market Penetration

While nylon sutures are generally cost-effective compared to newer synthetic alternatives (e.g., polydioxanone or polyglyconate), price sensitivity remains high in low- and middle-income countries. Generic and locally manufactured nylon sutures are gaining traction, pressuring multinational companies to adopt competitive pricing strategies or form partnerships with regional distributors.

Conclusion

By 2026, the nylon suture market is projected to grow at a CAGR of 5.2–6.1%, reaching an estimated market value of USD 1.1–1.3 billion. Despite competition from absorbable synthetics and bioengineered sutures, nylon’s proven reliability, versatility, and cost efficiency will sustain its dominant role in surgical practices worldwide. Strategic investments in innovation, emerging market expansion, and regulatory compliance will be critical for stakeholders aiming to capture long-term market share.

Common Pitfalls Sourcing Nylon Sutures (Quality, IP)

Sourcing Nylon sutures, especially for medical or surgical applications, involves navigating critical quality and intellectual property (IP) challenges. Overlooking these pitfalls can lead to product failures, regulatory non-compliance, legal liabilities, and reputational damage. Below are key areas to watch:

Quality-Related Pitfalls

Inconsistent Material Purity and Biocompatibility

Nylon sutures must meet stringent biocompatibility standards (e.g., ISO 10993). Sourcing from suppliers without certified quality management systems (e.g., ISO 13485) risks receiving material with impurities, inconsistent molecular weight, or residual monomers that can provoke adverse tissue reactions. Always verify material certifications and conduct biocompatibility testing for critical applications.

Non-Compliance with Regulatory Standards

Nylon sutures are often regulated as medical devices (e.g., FDA Class II, CE-marked). A common pitfall is sourcing from manufacturers who claim compliance but lack valid certifications or up-to-date technical documentation. Ensure suppliers provide full regulatory dossiers and evidence of conformity to relevant standards (e.g., USP <71>, ISO 14607).

Inadequate Sterilization Validation

Improper or inconsistently validated sterilization (e.g., ethylene oxide, gamma irradiation) can compromise sterility assurance levels (SAL). Suppliers may skip or falsify sterility validation data. Demand sterilization validation reports and batch-specific certificates of sterility.

Poor Manufacturing Controls and Traceability

Lack of robust process controls can result in variability in tensile strength, knot security, and needle attachment integrity. Suppliers without traceability systems (e.g., lot tracking, device history records) make recalls and root cause analysis nearly impossible.

Intellectual Property (IP)-Related Pitfalls

Infringement of Patented Designs or Processes

Nylon suture technologies—especially coated formulations, needle designs, or packaging systems—may be protected by patents. Sourcing from vendors using proprietary tech without licensing can expose your organization to infringement claims. Conduct freedom-to-operate (FTO) analyses and require suppliers to warrant IP non-infringement.

Counterfeit or Gray Market Products

The medical device supply chain is vulnerable to counterfeit sutures that mimic branded products. These may fail performance standards or lack proper documentation. Avoid unofficial distributors; source directly from OEMs or authorized partners with verifiable distribution agreements.

Misrepresentation of Brand or Origin

Suppliers may falsely claim affiliation with reputable brands or mislabel country of origin to bypass import restrictions or tariffs. This not only breaches IP but can also violate customs and regulatory requirements. Perform supplier audits and verify trademarks and registration details.

Lack of IP Ownership in Custom Designs

If you co-develop a suture product, failing to secure clear IP ownership or licensing rights in contracts can result in disputes. Ensure agreements explicitly assign IP rights and include confidentiality clauses to protect proprietary formulations or designs.

Avoiding these pitfalls requires due diligence: vet suppliers thoroughly, demand documentation, conduct audits, and involve legal and regulatory experts early in the sourcing process.

Logistics & Compliance Guide for Nylon Sutures

Product Overview

Nylon sutures are synthetic, non-absorbable surgical sutures composed of polyamide, known for their high tensile strength, excellent knot security, and minimal tissue reactivity. Commonly used in general closure, cardiovascular, ophthalmic, and plastic surgery procedures, nylon sutures are available in monofilament and braided forms and require strict adherence to regulatory and logistical standards to ensure patient safety and compliance.

Regulatory Classification

Nylon sutures are classified as medical devices under global regulatory frameworks:

– United States (FDA): Class II medical device regulated under 21 CFR 878.4465. Requires 510(k) premarket notification unless exempt.

– European Union (EU): Classified as Class IIa under Regulation (EU) 2017/745 (MDR). Requires CE marking via a Notified Body.

– Other Regions: Must comply with local regulations (e.g., Health Canada, TGA Australia, PMDA Japan), often requiring registration and conformity assessment.

Manufacturers must maintain a Quality Management System (QMS) compliant with ISO 13485.

Labeling Requirements

All packaging and labeling must conform to regional standards:

– FDA (21 CFR Part 801): Labels must include device name, intended use, manufacturer name/location, lot number, expiration date, sterile status, and single-use statement.

– EU MDR: Requires Unique Device Identification (UDI), CE mark, Basic UDI-DI, and information per Annex I. Must include symbols per ISO 15223-1.

– Global Harmonization: Include IFU (Instructions for Use) in local language(s), storage conditions, and contraindications.

Sterility and Packaging

- Sutures must be supplied sterile, typically via ethylene oxide (EtO) or gamma irradiation.

- Packaging must maintain sterility until point of use (integrity-tested blister packs or peel pouches).

- Validated shelf life (typically 3–5 years) based on stability and sterility studies.

- Storage: Keep in dry, cool conditions (typically 15–30°C), away from direct sunlight and radiation.

Transportation and Storage

- Ship under ambient or controlled room temperature; avoid freezing or excessive heat.

- Use validated cold chain logistics if required (rare for nylon sutures).

- Monitor and document temperature during transit if conditions are critical.

- Prevent physical damage (crushing, puncturing) during handling and warehousing.

- Segregate from hazardous or incompatible materials in storage.

Import and Export Compliance

- Verify destination country’s import regulations (e.g., import license, registration certificate).

- Prepare required documentation: Commercial Invoice, Packing List, Certificate of Origin, Certificate of Free Sale (CFS), and U.S. FDA Export Certificate (if applicable).

- For EU exports: ensure CE certification and declaration of conformity are available.

- Comply with customs tariff codes (e.g., HS Code 3006.40 for sutures in most jurisdictions).

Post-Market Surveillance and Vigilance

- Establish a system to monitor and report adverse events per regional requirements:

- FDA MedWatch: Report device-related deaths, serious injuries, and malfunctions (30-day or 5-day reporting depending on severity).

- EU MDR: Report serious incidents and field safety corrective actions (FSCAs) via EUDAMED.

- Maintain complaint handling procedures and conduct periodic safety update reports (PSURs) for EU.

Environmental and Disposal Considerations

- Unused sutures: Return per manufacturer’s policy or dispose as regulated medical waste if expired.

- Post-procedure: Discard used sutures as biohazardous waste in accordance with local regulations (e.g., OSHA, EPA, EU directives).

- Packaging: Follow local recycling guidelines; some components may be recyclable.

Audit and Documentation

- Retain records for minimum 10 years post-device expiration (per MDR) or as required locally.

- Documentation includes: design history file (DHF), device master record (DMR), device history record (DHR), UDI logs, complaint files, and shipping records.

- Be audit-ready for regulatory bodies (FDA, Notified Bodies, etc.).

Summary

Proper logistics and compliance for nylon sutures require attention to regulatory classification, labeling, sterility, transportation, import/export rules, and post-market obligations. Adherence to international standards ensures safety, effectiveness, and uninterrupted supply of these critical medical devices.

Conclusion for Sourcing Nylon Sutures:

Sourcing nylon sutures requires a strategic approach that balances quality, regulatory compliance, cost-efficiency, and supply chain reliability. Given their widespread use in surgical procedures due to their excellent tensile strength, knot security, and inert tissue reaction, selecting the right supplier is critical for ensuring patient safety and clinical outcomes. A thorough evaluation of potential vendors—assessing certifications (such as ISO 13485 and FDA approval), manufacturing standards, product consistency, and compliance with medical device regulations—is essential. Additionally, building relationships with reputable suppliers, considering both international and local options, can enhance supply stability and reduce lead times. Ultimately, effective sourcing of nylon sutures supports efficient healthcare delivery while maintaining the highest standards of quality and patient care.