The global abrasive wheels market is experiencing robust growth, driven by increasing demand across industries such as automotive, metal fabrication, and construction. According to Mordor Intelligence, the market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, with nylon abrasive wheels gaining prominence due to their durability, precision, and suitability for high-speed operations. Their ability to deliver consistent surface finishes on metals, composites, and hard plastics has made them a preferred choice in precision machining and finishing applications. As industrial automation rises and manufacturing standards become more stringent, the need for high-performance, long-lasting abrasive solutions continues to climb—particularly in emerging economies. With this growing demand, several manufacturers have distinguished themselves through innovation, material science, and rigorous quality control. Here are the top 9 nylon abrasive wheel manufacturers shaping the future of surface treatment and material removal technologies.

Top 9 Nylon Abrasive Wheel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Grade Abrasives

Domain Est. 1998

Website: unitedabrasives.com

Key Highlights: United Abrasives is a manufacturer of industrial-grade abrasives and accessories, producing a full line that includes grinding wheels, cutting ……

#2 Abrasive Brush Manufacturer

Domain Est. 1998

Website: gordonbrush.com

Key Highlights: Offering a wide selection of abrasive filament brushes, Gordon Brush is your choice abrasive brush manufacturer. Place your custom brush order today!…

#3 Dongge nylon wheels

Domain Est. 2023

Website: dgabrasive.com

Key Highlights: Dongge Abrasives, as a manufacturer of polishing and grinding products, has many years of experience in manufacturing nylon wheels….

#4 Wheel Brushes

Domain Est. 1994

Website: osborn.com

Key Highlights: Osborn’s aggressive ATB Fascut™ Wheel Brush is designed with short trim, premium nylon filament that is impregnated with abrasive material. Features high ……

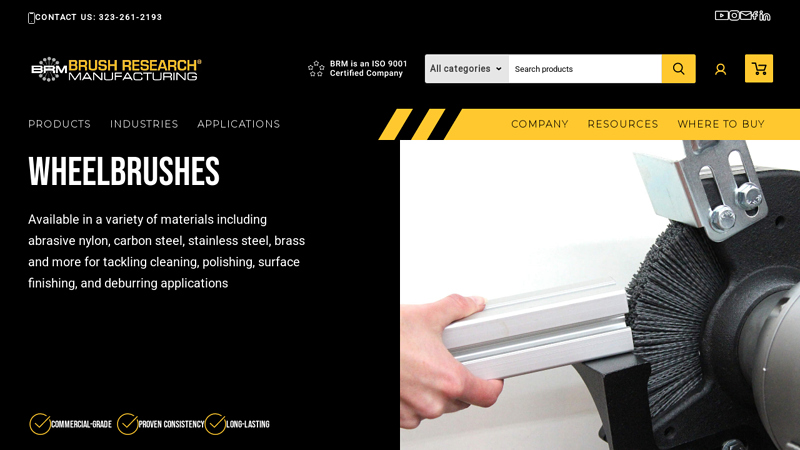

#5 Abrasive nylon wheel brushes are …

Domain Est. 1997

Website: brushresearch.com

Key Highlights: Nylon abrasive wheel brushes from Brush Research are perfect for light deburring and general surface finishing. Learn about abrasive nylon brushes today….

#6 ARC Abrasives

Domain Est. 1998

Website: arcabrasives.com

Key Highlights: ARC Abrasives goes beyond selling coated and surface conditioning products by evaluating applications to provide custom metalworking solutions….

#7 Abrasive Nylon Wheel Brushes

Domain Est. 1998

Website: spiralbrushes.com

Key Highlights: Abrasive Nylon Wheels are excellent for light deburring and decorative metal finishing. They can be used in either wet or dry application. Using an abrasive ……

#8 Weiler Abrasives

Domain Est. 1999

Website: weilerabrasives.com

Key Highlights: Weiler Abrasives is the industry leader in manufacturing abrasive products and brushes for every application. View our product selection today!!…

#9 Nylon Abrasive Wheels & Brushes

Domain Est. 2014

Expert Sourcing Insights for Nylon Abrasive Wheel

H2: 2026 Market Trends for Nylon Abrasive Wheels

The global nylon abrasive wheel market is poised for steady growth and transformation by 2026, driven by evolving industrial demands, technological advancements, and shifting regional dynamics. Key trends shaping the market include:

1. Rising Demand from High-Precision and Surface-Critical Industries:

The need for exceptional surface finishes and burr-free edges in sectors like aerospace (engine components, turbine blades), medical device manufacturing (surgical instruments, implants), and high-end automotive (transmission parts, fuel systems) will fuel demand. Nylon abrasive wheels excel in controlled stock removal and fine finishing, making them indispensable for these precision applications.

2. Growth in Automation and Robotic Finishing:

The increasing adoption of robotic systems for grinding, deburring, and polishing is a major driver. Nylon wheels are highly compatible with automation due to their consistent performance, long life, and ability to maintain shape under pressure. This trend is particularly strong in automotive and metal fabrication, boosting demand for wheels designed specifically for robotic arms.

3. Focus on Sustainability and Worker Safety:

Environmental regulations and corporate sustainability goals are pushing manufacturers towards solutions that reduce waste and improve workplace safety. Trends include:

* Longer-Lasting Wheels: Development of wheels with enhanced durability reduces consumption and waste.

* Low-Dust Formulations: Innovations in resin systems and abrasive grain bonding aim to minimize harmful dust generation during use, improving air quality and reducing reliance on PPE.

* Recyclability: Early-stage exploration into recyclable wheel components or more sustainable raw materials.

4. Advancements in Abrasive Grain and Bond Technology:

Innovation will focus on enhancing performance and efficiency:

* Engineered Abrasives: Increased use of ceramic alumina, silicon carbide, or hybrid grains for sharper cutting, cooler operation, and longer life compared to standard fused alumina.

* Optimized Resin Systems: Development of tougher, more heat-resistant resins to improve wheel integrity and performance at higher speeds or under heavy loads.

* Precision Manufacturing: Tighter control over grain distribution and wheel density for more consistent, predictable results, especially crucial for automation.

5. Shift Towards Customization and Application-Specific Solutions:

Suppliers are moving beyond standard offerings to provide wheels tailored to specific materials (e.g., stainless steel, titanium, exotic alloys), machine types (handheld, CNC, robotic), and finishing requirements (coarse deburring vs. mirror polishing). This trend emphasizes value-added services and technical support.

6. Regional Market Dynamics:

* Asia-Pacific (APAC): Expected to remain the largest and fastest-growing market, driven by industrialization in India, Vietnam, and Southeast Asia, coupled with strong manufacturing bases in China and Japan (especially in automotive and electronics).

* North America & Europe: Steady growth focused on high-precision industries (aerospace, medical) and automation. Demand will be driven by replacement cycles and technological upgrades, with a strong emphasis on safety and sustainability.

* Rest of World: Emerging opportunities in regions like Latin America and the Middle East, linked to infrastructure development and localized manufacturing growth.

7. Competitive Landscape Evolution:

The market will see consolidation among key players and increased competition from specialized regional manufacturers. Success will depend on R&D investment, strong distribution networks, technical expertise, and the ability to offer integrated finishing solutions rather than just products.

In summary, by 2026, the nylon abrasive wheel market will be characterized by a shift towards higher performance, greater automation compatibility, enhanced sustainability, and increased customization. Suppliers who innovate in materials, manufacturing, and application support will be best positioned to capture growth, particularly in high-value, precision-driven industrial sectors.

Common Pitfalls Sourcing Nylon Abrasive Wheels (Quality, IP)

Sourcing high-quality nylon abrasive wheels while protecting intellectual property (IP) involves navigating several critical challenges. Overlooking these pitfalls can lead to substandard products, supply chain disruptions, and potential IP theft.

Quality Inconsistencies from Unverified Suppliers

One of the most prevalent issues is inconsistent product quality. Many suppliers, especially in competitive low-cost markets, may provide samples that meet specifications but fail to maintain those standards during mass production. Variations in nylon resin grade, abrasive type (e.g., silicon carbide vs. aluminum oxide), fiber density, and bonding agents can significantly impact performance, durability, and safety. Without rigorous third-party testing and ongoing quality audits, buyers risk receiving batches that wear unevenly, generate excessive heat, or fail prematurely.

Lack of Traceability and Material Certification

Reputable applications—particularly in aerospace, medical, or automotive industries—require full material traceability and certifications (e.g., ISO 9001, REACH, RoHS). Some suppliers may not provide proper documentation or use recycled or uncertified raw materials to cut costs. This lack of transparency can compromise compliance, lead to rejected shipments, and expose the buyer to regulatory risks.

Inadequate Intellectual Property Protection

When customizing nylon abrasive wheels (e.g., specific grit patterns, densities, or proprietary formulations), sharing design details or technical specifications with suppliers poses a significant IP risk. Suppliers in regions with weak IP enforcement may replicate the design for other customers or sell them independently. Failure to establish clear legal agreements—such as Non-Disclosure Agreements (NDAs) and IP ownership clauses in contracts—can result in loss of competitive advantage and unauthorized product proliferation.

Overreliance on Sample Performance

Approving a supplier based solely on initial sample performance is a common mistake. Samples are often handcrafted under ideal conditions and do not reflect mass-production realities. Without production line audits and statistical process control (SPC) data, buyers may encounter dimensional inaccuracies, inconsistent abrasive distribution, or packaging defects in bulk orders.

Poor Communication and Technical Misalignment

Misunderstandings about technical requirements—such as durometer (hardness), abrasive concentration, or intended application (e.g., deburring vs. blending)—can lead to incorrect product specifications. Suppliers may interpret requirements differently, especially across language and cultural barriers. This results in rework, delays, and additional costs.

Hidden Costs and Supply Chain Vulnerabilities

Low initial quotes may hide additional expenses related to shipping, import duties, or minimum order quantities (MOQs). Moreover, concentrating sourcing in a single region or with a sole supplier increases exposure to geopolitical risks, logistics disruptions, and labor issues, jeopardizing continuity of supply.

To mitigate these pitfalls, buyers should conduct thorough due diligence, enforce strong IP safeguards, require comprehensive quality documentation, and maintain diversified supplier relationships with ongoing performance monitoring.

H2: Logistics & Compliance Guide for Nylon Abrasive Wheels

H2: Product Overview & Key Characteristics

Nylon abrasive wheels, also known as flap wheels or abrasive nylon wheels, consist of multiple layers of abrasive-coated nylon fibers bonded to a central hub. Commonly used for deburring, blending, surface finishing, and edge rounding on metals, plastics, and composites, these wheels are valued for their flexibility, consistent cutting action, and ability to conform to contours. Key components include:

– Nylon filaments: Impregnated with abrasive minerals (e.g., aluminum oxide, silicon carbide).

– Bonding resin: Holds filaments to the core.

– Reinforced core/hub: Typically made of fiber, plastic, or metal.

Understanding the material composition is essential for compliance with safety, transport, and disposal regulations.

H2: Regulatory Compliance Requirements

H2: Safety Standards & Certifications

- OSHA (Occupational Safety and Health Administration): Ensure wheels are used with appropriate personal protective equipment (PPE), including eye protection, hearing protection, and respiratory gear if dust is generated.

- ANSI B7.1 (American National Standards Institute): Mandates safe usage practices, including maximum operating speed (RPM), inspection for damage, and proper mounting.

- CE Marking (EU): Required for sale in the European Economic Area. Complies with Machinery Directive 2006/42/EC and may require assessment under the ATEX Directive if used in explosive atmospheres.

- UKCA Marking (UK): Equivalent to CE marking for products placed on the UK market post-Brexit.

- RoHS/REACH Compliance: Confirm absence of restricted substances (e.g., heavy metals) in materials, particularly relevant for EU/UK markets.

H2: Transportation & Shipping Guidelines

H2: Domestic & International Shipping

- UN Classification: Nylon abrasive wheels are generally not classified as hazardous materials under DOT (49 CFR) or IATA/IMDG regulations, provided they contain no flammable binders or hazardous additives.

- Packaging Requirements:

- Use durable, crush-resistant packaging to prevent damage during transit.

- Individual or grouped packaging with internal cushioning to avoid abrasion or filament deformation.

- Clearly labeled with product name, grit size, diameter, maximum RPM, and manufacturer details.

- Labeling: Include handling instructions (e.g., “Fragile,” “Do Not Stack,” “Keep Dry”) and compliance marks (CE, ANSI, etc.).

H2: Air, Sea, and Ground Transport

- Air Freight (IATA): Non-hazardous classification simplifies air transport. Ensure packaging meets IATA Packing Instructions for non-dangerous goods.

- Ocean Freight (IMDG): No special hazardous labeling required under standard conditions.

- Ground Transport (DOT/ADR): No hazardous material placarding needed. Follow general cargo safety standards.

H2: Storage & Handling Best Practices

- Environmental Conditions:

- Store in a dry, temperature-controlled environment (typically 10–30°C / 50–86°F).

- Avoid exposure to moisture, direct sunlight, or extreme heat, which can degrade bonding agents.

- Shelf Life:

- Most nylon abrasive wheels have a shelf life of 2–5 years from manufacture date. Check manufacturer specifications.

- Rotate stock using FIFO (First In, First Out) method.

- Handling Precautions:

- Avoid dropping or impact, which can damage filaments or core.

- Do not store near solvents or oils that may compromise bond integrity.

H2: Workplace Safety & Usage Compliance

- Machine Compatibility:

- Verify wheel speed rating (RPM) matches or exceeds machine operating speed.

- Use only on machines equipped with proper guards and safety interlocks.

- Operator Training:

- Train personnel on safe mounting, inspection, and operation per ANSI B7.1.

- Inspect wheels before each use for cracks, fraying, or core damage.

- PPE Requirements:

- Safety glasses or face shield.

- Hearing protection.

- Dust mask or respirator if grinding generates airborne particles.

H2: Environmental & Disposal Regulations

- Waste Classification:

- Used wheels are typically classified as non-hazardous industrial waste.

- Confirm absence of heavy metals (e.g., chromium, lead) before disposal; some abrasive minerals may require special handling depending on local regulations.

- Recycling & Disposal:

- Contact manufacturer or local waste management for recycling options.

- Follow local, state, and federal disposal regulations (e.g., EPA in the U.S., Environment Agency in the UK).

- Do not incinerate unless permitted—may release toxic fumes.

H2: Documentation & Recordkeeping

Maintain the following for full compliance:

– Safety Data Sheets (SDS): Required under GHS/HazCom 2012. While nylon wheels are often exempt from full SDS, a product-specific statement or simplified SDS may be needed.

– Certificates of Compliance: CE, ANSI, or other relevant certifications.

– Shipping Records: Include quantity, destination, and compliance declarations.

– Inspection Logs: Document regular equipment and wheel inspections.

H2: Import/Export Considerations

- Customs Classification (HS Code):

- Typical HS Code: 6804.21 or 6804.22 (Abrasive articles with a basis of plastics).

- Confirm exact code with customs broker based on composition and use.

- Import Duties & Tariffs: Vary by country; check with local authorities or trade databases.

- Import Restrictions: Some countries may require conformity assessment (e.g., UKCA, INMETRO in Brazil, KC Mark in South Korea).

H2: Summary of Key Compliance Actions

- Verify product meets ANSI, CE, or other regional safety standards.

- Ship using non-hazardous material protocols with proper labeling.

- Store in dry, stable conditions and monitor shelf life.

- Train operators in safe handling and PPE use.

- Dispose of used wheels according to local environmental regulations.

- Maintain up-to-date SDS, certifications, and shipping documentation.

By adhering to this guide, businesses can ensure safe, compliant logistics and use of nylon abrasive wheels across global operations. Always consult the manufacturer’s technical data and local regulatory authorities for region-specific requirements.

Conclusion on Sourcing Nylon Abrasive Wheels

After a thorough evaluation of suppliers, product specifications, quality standards, and cost considerations, sourcing nylon abrasive wheels from pre-qualified and reputable manufacturers ensures optimal performance, durability, and safety in various industrial applications. These wheels offer excellent flexibility, consistent cutting action, and resistance to heat and wear, making them ideal for surface preparation, deburring, blending, and finishing on metals, composites, and other materials.

It is recommended to partner with suppliers who comply with international quality certifications (such as ISO 9001), provide material test reports, and offer technical support for application-specific needs. Additionally, considering factors like fiber type, grit size, resin composition, and customization options will help match the wheel to the intended use, improving operational efficiency and reducing downtime.

Long-term benefits—including reduced maintenance, longer service life, and improved finish quality—justify a strategic sourcing approach that balances cost with performance. Establishing strong supplier relationships, conducting periodic quality audits, and staying updated on technological advancements will ensure a reliable and efficient supply chain for nylon abrasive wheels.