The nutraceuticals market has experienced robust expansion in recent years, driven by increasing consumer awareness around preventive healthcare, rising demand for dietary supplements, and growing interest in personalized nutrition. According to Grand View Research, the global nutraceuticals market size was valued at USD 340.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. Similarly, Mordor Intelligence forecasts continued momentum, attributing growth to innovations in functional foods, rising R&D investments, and regulatory support in key regions such as North America and Asia-Pacific. As demand surges, manufacturers that combine scientific rigor, scalable production, and compliance with international quality standards are emerging as leaders. Based on market presence, product innovation, and global reach, the following three nutra solutions manufacturers stand out in this rapidly evolving landscape.

Top 3 Nutra Solutions Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Nutra Solutions USA, Inc.

Domain Est. 2000

Website: fda.gov

Key Highlights: The inspection revealed serious violations of FDA’s regulations for the Current Good Manufacturing Practice (CGMP) in Manufacturing, Packaging, ……

#2 About Us

Domain Est. 2014

Website: nutrasolutionsusa.com

Key Highlights: Nutra Solutions is dedicated to delivering innovative, high-quality supplement manufacturing solutions with a focus on customization, compliance, and customer ……

#3 Nutraresolutions

Domain Est. 2016

Website: nutraresolutions.com

Key Highlights: OFFERING TURNKEY SOLUTIONS. Contract Manufacturing services that deliver high-quality lifestyle and dietary supplements from concept to completion….

Expert Sourcing Insights for Nutra Solutions

H2: Market Trends Shaping Nutra Solutions in 2026

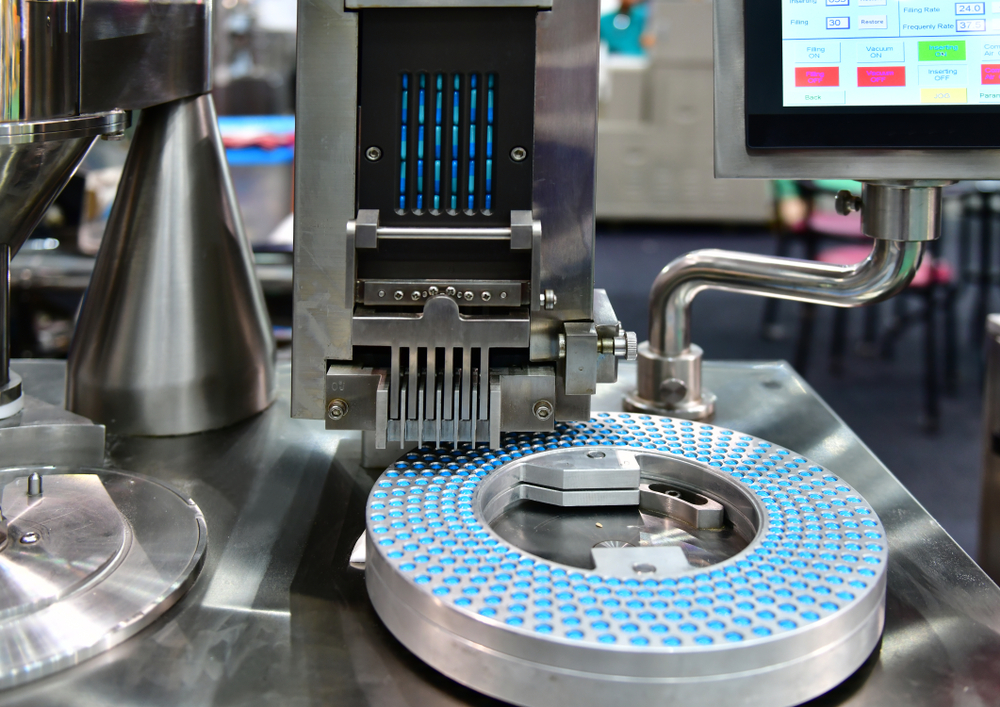

As we approach 2026, the nutraceuticals industry—encompassing dietary supplements, functional foods, and personalized nutrition—is undergoing transformative shifts driven by evolving consumer behavior, technological innovation, and regulatory developments. Nutra Solutions, as a forward-thinking player in this space, must align its strategy with these emerging trends to maintain competitiveness and capture growth opportunities. Below is an analysis of key market trends shaping the landscape for Nutra Solutions in 2026.

1. Personalized Nutrition Goes Mainstream

By 2026, personalized nutrition is transitioning from niche to norm. Advances in genomics, microbiome testing, and AI-powered health platforms enable companies to offer tailored supplement regimens based on individual biomarkers, lifestyle, and genetic predispositions. Nutra Solutions can leverage partnerships with digital health providers or in-house data analytics to deliver customized product bundles, enhancing consumer engagement and loyalty.

2. Demand for Science-Backed, Clinically Proven Formulations

Consumers are increasingly skeptical of vague health claims and demand transparency and clinical validation. In 2026, products supported by peer-reviewed research, third-party testing, and clear labeling of bioactive ingredients will dominate the market. Nutra Solutions should invest in clinical trials and obtain certifications (e.g., NSF, USP) to build trust and differentiate from competitors relying on marketing over science.

3. Rise of Cognitive and Mental Wellness Supplements

Mental health awareness continues to grow, driving strong demand for nootropics, adaptogens, and mood-supporting supplements such as ashwagandha, lion’s mane, and magnesium blends. By 2026, cognitive wellness is expected to be one of the fastest-growing segments. Nutra Solutions can expand its portfolio with evidence-based formulations targeting focus, stress resilience, and sleep quality—areas of high consumer interest post-pandemic.

4. Sustainability and Clean Label Expectations

Eco-conscious consumers are prioritizing sustainability in their purchasing decisions. In 2026, clean-label products—free from artificial additives, non-GMO, vegan, and sustainably sourced—are no longer optional. Packaging innovations, such as compostable pouches and refill systems, will also play a critical role. Nutra Solutions should emphasize earth-friendly sourcing, carbon-neutral operations, and transparent supply chains to appeal to environmentally aware demographics.

5. Expansion of E-Commerce and DTC (Direct-to-Consumer) Models

The digital health ecosystem continues to mature, with e-commerce and DTC channels dominating supplement sales. Subscription models, personalized dashboards, and AI chatbot consultations are enhancing customer experience. By 2026, Nutra Solutions must optimize its digital footprint, invest in omnichannel marketing, and utilize customer data to drive retention and lifetime value.

6. Regulatory Scrutiny and Global Harmonization

Regulatory bodies worldwide are tightening oversight of health claims and product safety. In 2026, companies face increased pressure to comply with evolving standards in key markets like the U.S. (FDA), EU (EFSA), and Asia-Pacific. Nutra Solutions should proactively monitor regulatory changes, ensure compliance across regions, and engage in industry advocacy to shape favorable policy frameworks.

7. Integration of AI and Predictive Analytics

Artificial intelligence is revolutionizing product development, customer targeting, and inventory management. By 2026, AI tools will enable Nutra Solutions to forecast trends, optimize formulations, and personalize marketing at scale. Implementing AI-driven insights can reduce time-to-market and improve product-market fit.

Conclusion

In 2026, Nutra Solutions must embrace innovation, transparency, and sustainability to thrive in a dynamic and competitive market. By focusing on personalization, scientific credibility, mental wellness, and digital engagement, the company can position itself as a trusted leader in the next generation of nutraceuticals. Strategic investments in technology, regulatory compliance, and consumer education will be essential to long-term success.

Common Pitfalls Sourcing Nutra Solutions (Quality, IP)

Sourcing nutraceutical solutions—ranging from dietary supplements to functional foods—can present significant challenges, particularly in the areas of quality assurance and intellectual property (IP) protection. Overlooking these critical aspects can lead to regulatory setbacks, reputational damage, and legal disputes. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Supplier Vetting

Failing to conduct thorough due diligence on manufacturers or raw material suppliers can result in substandard ingredients. Many suppliers, especially in regions with lax oversight, may not adhere to Good Manufacturing Practices (GMP) or may provide falsified certificates of analysis (CoA). Always verify third-party certifications (e.g., NSF, USP, ISO) and perform on-site audits when possible.

Inconsistent Product Potency and Purity

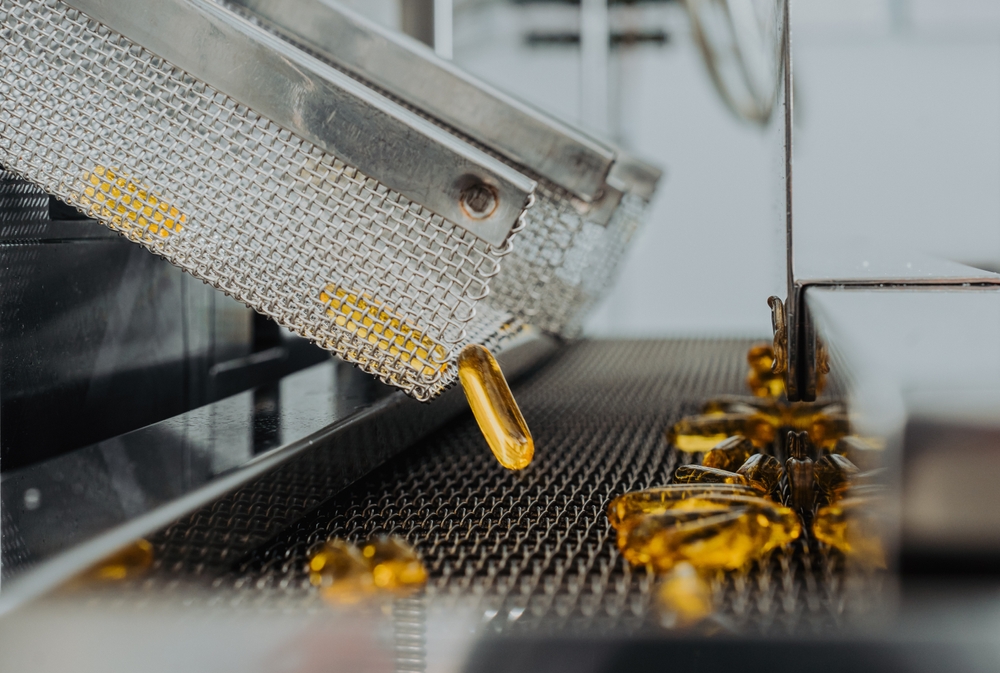

Nutra solutions often suffer from batch-to-batch variability due to poor process controls. This inconsistency affects efficacy and safety. Ensure suppliers implement rigorous quality control protocols, including HPLC testing, heavy metal screening, and microbial analysis, with transparent documentation.

Contamination Risks

Cross-contamination with allergens, pathogens, or undeclared substances (e.g., pharmaceuticals in herbal supplements) is a serious concern. Confirm that suppliers have allergen control programs, dedicated production lines where necessary, and robust sanitation standard operating procedures (SSOPs).

Lack of Traceability

Without full supply chain transparency—from raw material origin to finished product—recalls and quality investigations become difficult. Demand complete traceability systems, including ingredient sourcing records and batch tracking.

Intellectual Property-Related Pitfalls

Failure to Secure IP Rights Early

When sourcing formulations or proprietary blends, companies often neglect to formally assign IP ownership in contracts. This can lead to disputes over formula rights, especially if the manufacturer develops or modifies the product. Always include clear IP clauses in sourcing agreements.

Unprotected Formulations and Methods

Many nutraceutical innovations involve unique blends or delivery systems that may be patentable. Failing to file patents or maintain trade secrets (e.g., through NDAs and restricted access) exposes companies to copying. Conduct IP landscaping before finalizing partnerships.

Generic or Unverified Claims

Sourcing products with unsubstantiated health claims can lead to regulatory action (e.g., FDA warning letters). Ensure that any marketed benefits are backed by scientific evidence and compliant with jurisdictional regulations (e.g., FDA DSHEA, EFSA health claims). Avoid suppliers who promote misleading labeling.

Reverse Engineering and Formula Theft

Contract manufacturers with access to proprietary formulas may replicate or sell them to competitors. Protect sensitive information through confidentiality agreements, limited data sharing, and monitoring for market duplicates.

By proactively addressing these quality and IP pitfalls, companies can mitigate risks, ensure product integrity, and safeguard their competitive advantage in the nutraceutical market.

Logistics & Compliance Guide for Nutra Solutions

This guide outlines the essential logistics and compliance protocols for Nutra Solutions to ensure the safe, legal, and efficient handling of dietary supplements and related products throughout the supply chain.

Product Handling & Storage

All products must be stored in a clean, dry, temperature-controlled environment, ideally between 15°C and 25°C (59°F to 77°F), away from direct sunlight and moisture. Segregate raw materials, work-in-progress, and finished goods to prevent cross-contamination. Implement a first-expired, first-out (FEFO) inventory system to minimize product expiration and waste.

Transportation & Distribution

Use only certified carriers experienced in handling health and wellness products. All shipments must maintain required temperature conditions (if applicable) and be protected from contamination, damage, and tampering. Ensure all vehicles are sealed upon dispatch and inspected upon arrival. Maintain accurate shipping records, including temperature logs for sensitive goods.

Regulatory Compliance

Adhere strictly to all applicable regulations, including:

– U.S. FDA regulations under 21 CFR Part 111 (Current Good Manufacturing Practice for Dietary Supplements)

– Labeling requirements per the Dietary Supplement Health and Education Act (DSHEA)

– FTC guidelines for marketing and advertising claims

– International regulations (e.g., EU Novel Foods, Health Canada Natural Health Products Regulations) for exported products

Ensure all products have accurate Supplement Facts panels, ingredient lists, and appropriate disclaimers (e.g., “These statements have not been evaluated by the Food and Drug Administration…”).

Documentation & Recordkeeping

Maintain comprehensive records for a minimum of three years (or as required by jurisdiction), including:

– Certificates of Analysis (CoAs) for all raw materials and finished products

– Batch production records

– Supplier qualification and audit documentation

– Distribution logs and chain-of-custody records

– Complaints and adverse event reports

All records must be legible, accurate, and readily accessible for internal audits or regulatory inspections.

Supplier & Vendor Management

Only source ingredients and packaging from approved, vetted suppliers who comply with cGMP and provide full traceability. Conduct regular audits and require current CoAs for every shipment. Maintain a qualified supplier list and reassess vendors annually.

Labeling & Packaging Compliance

Ensure all packaging and labels meet regulatory standards for:

– Product name and net quantity

– Manufacturer or distributor information

– Lot number and expiration date

– Usage instructions and cautionary statements

– Allergen declarations (e.g., soy, milk, shellfish)

Labels must not contain unapproved health claims or misbrand the product.

Recall & Crisis Management

Maintain a documented product recall plan outlining procedures for identifying, containing, and notifying authorities and customers of a product issue. Conduct annual mock recalls to test effectiveness. Report serious adverse events to the FDA within 15 business days per 21 CFR 111.207.

Training & Accountability

All personnel involved in logistics, warehousing, and quality assurance must receive regular training on cGMP, sanitation, labeling compliance, and emergency procedures. Training records must be maintained and updated annually.

Audits & Continuous Improvement

Conduct internal audits at least twice a year to assess compliance with this guide and regulatory standards. Use audit findings to drive corrective and preventive actions (CAPAs) and improve operational effectiveness. Prepare for unannounced regulatory inspections by maintaining constant readiness.

Conclusion for Sourcing Nutra Solutions:

Sourcing nutraceutical solutions requires a strategic, informed, and compliance-driven approach to ensure product quality, efficacy, and market success. Partnering with reliable suppliers who adhere to stringent manufacturing standards—such as GMP (Good Manufacturing Practices) and regulatory guidelines from authorities like the FDA or EFSA—is critical. Evaluating factors such as ingredient transparency, scientific backing, scalability, and supply chain reliability enables brands to deliver safe and effective products that meet consumer expectations.

Moreover, investing in innovation, sustainability, and traceability not only strengthens brand credibility but also aligns with the growing demand for clean-label and science-based nutraceuticals. As the industry continues to evolve, businesses that prioritize ethical sourcing, robust quality control, and regulatory compliance will be best positioned to thrive in the competitive global nutraceutical market. Ultimately, successful sourcing is not just about cost-efficiency—it’s about building long-term partnerships that support health, wellness, and trust.