The global electric motor market is experiencing robust growth, driven by increasing demand for energy-efficient solutions across industrial, automotive, and consumer sectors. According to Mordor Intelligence, the electric motor market was valued at USD 130.81 billion in 2023 and is projected to reach USD 186.15 billion by 2029, growing at a CAGR of 6.15% during the forecast period. This expansion is further fueled by regulatory push toward sustainability, growing automation in manufacturing, and the rise of electric vehicles. Within this dynamic landscape, Nordic manufacturers have emerged as key players, combining advanced engineering, sustainability leadership, and high reliability. Below are the top four electric motor manufacturers from the Nordics that are shaping the future of motion control and industrial efficiency.

Top 4 Nord Electric Motors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 NORD Drivesystems

Domain Est. 1995

Website: nord.com

Key Highlights: NORD Drivesystems is one of the world’s leading manufacturers of drive technology for mechanical and electronic solutions from NORD Gear Corporation….

#2 NORD Gear Corporation

Domain Est. 1994

Website: nema.org

Key Highlights: NORD Gear, part of the NORD DRIVESYSTEMS Group, manufactures gear drives, large industrial gearing, AC motors and AC drives….

#3 Nord Automobile

Domain Est. 2018

Website: nordmotion.com

Key Highlights: Nord Automobiles is a Nigerian automotive manufacturer with headquarters in Lagos, Nigeria. Our establishment was born out of the need for a remarkable made-in ……

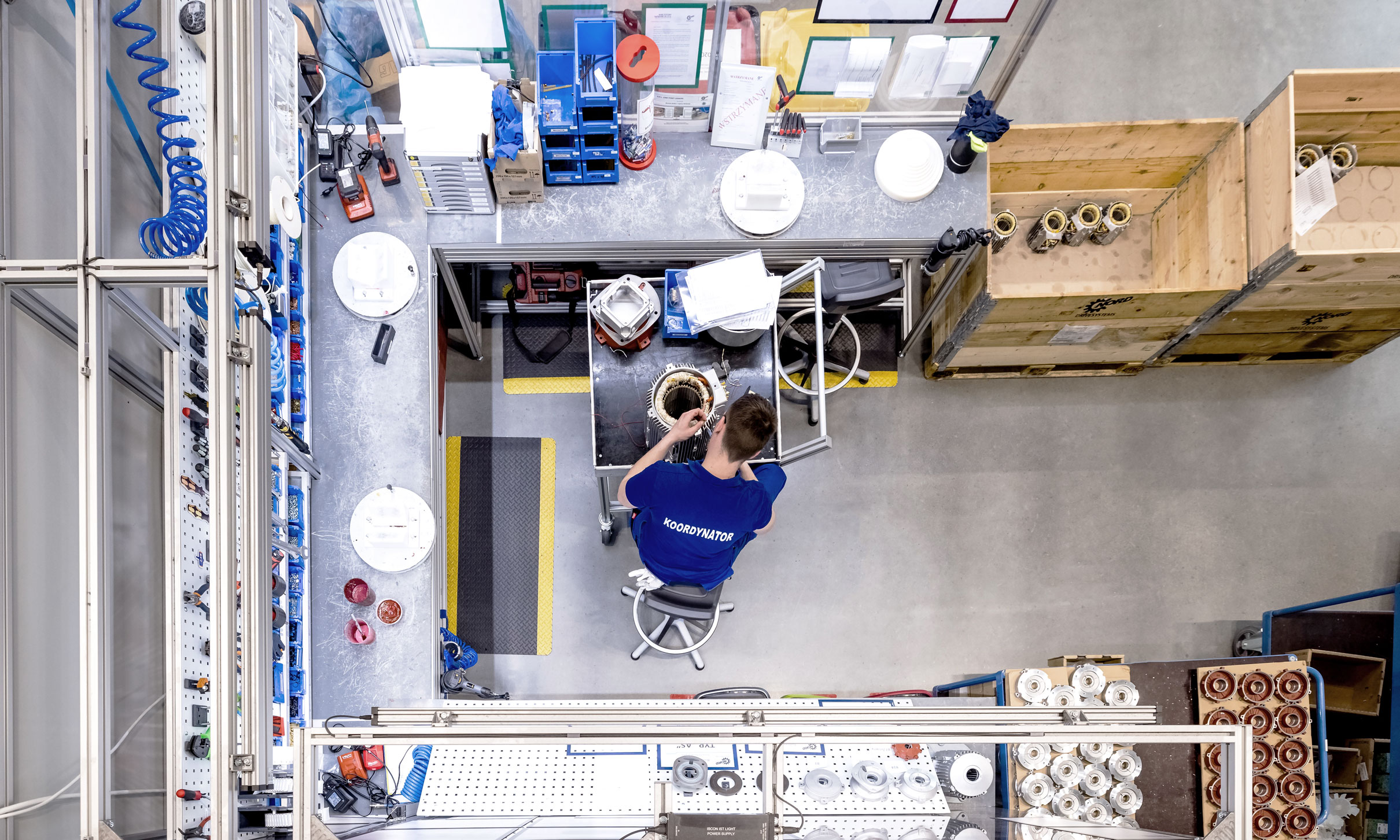

#4 catalog & manuals

Domain Est. 2013

Website: nordgearmotors.com

Key Highlights: NORD supplies electric motors in the power range from 0.16 hp to 250 hp. NORD motors are well suited for constant torque applications….

Expert Sourcing Insights for Nord Electric Motors

H2 2026 Market Trends Analysis for Nord Drivesystems (Nord Electric Motors)

Based on current industry trajectories, technological advancements, and macroeconomic factors, the second half of 2026 is expected to present a dynamic and growth-oriented market landscape for Nord Drivesystems (Nord) in the electric motors and drive systems sector. Here’s a detailed analysis of key trends:

1. Accelerated Industrial Automation & Smart Manufacturing:

* Trend: The global push towards Industry 4.0 and smart factories will intensify. Manufacturers will prioritize predictive maintenance, real-time data analytics, and seamless integration (OT/IT convergence).

* Impact on Nord: Nord’s integrated drive solutions (motors, gearboxes, inverters, software) are strategically positioned. Demand for Nord’s IE5/IE6 premium efficiency motors and NORDAC PRO/IEC motors with integrated intelligence will surge. The NORDAC LINK ecosystem and NORD CON software will be critical differentiators, enabling remote monitoring, condition monitoring, and seamless connectivity (e.g., via OPC UA, MQTT). Nord’s focus on compact, efficient, and “plug-and-play” solutions aligns perfectly with automation needs.

2. Dominance of Ultra-High Efficiency (IE5/IE6) & Sustainability Mandates:

* Trend: Global energy efficiency regulations (EU Ecodesign, US DOE, global EISA equivalents) will become stricter, effectively mandating IE5 (Super Premium Efficiency) and pushing adoption of IE6. Carbon reduction targets will drive investment in energy-saving technologies.

* Impact on Nord: Nord’s IE5 synchronous motors (especially IE5+ with magnet technology) will move from premium offerings to standard requirements in many applications. Nord’s reputation for efficiency and robustness will be a major competitive advantage. Expect strong demand in energy-intensive sectors (process industries, logistics, water/wastewater). Nord’s lifecycle cost (TCO) arguments will be highly persuasive.

3. Resilience of Decentralized Intelligence & Edge Computing:

* Trend: The shift towards decentralized drive systems (motors with integrated inverters/controllers at the machine level) will continue to grow, driven by reduced cabling, simpler machine design, improved EMC, and faster response times. Edge computing for local data processing will be key.

* Impact on Nord: Nord’s significant investment in decentralized inverter technology (e.g., NORDAC PRO SC, NORDAC PRO SK 500P) will pay off. Their compact, rugged, and IP65/IP66-rated inverters designed for direct motor mounting will see high demand. This trend favors Nord’s integrated engineering approach and reduces reliance on complex central control cabinets.

4. Growth in Electrification of Mobile & Off-Highway Machinery:

* Trend: Electrification beyond passenger vehicles will accelerate, including agricultural machinery, construction equipment, airport ground support, and material handling (AGVs/AMRs). This requires robust, high-torque, and often explosion-proof motors.

* Impact on Nord: Nord’s expertise in explosion-protected motors (ATEX, IECEx) and high-torque density solutions positions them well for this niche but growing market. Their scalable drive platforms can be adapted for mobile applications requiring high power density and reliability in harsh environments. Partnerships with OEMs in these sectors will be crucial.

5. Supply Chain Localization & Nearshoring:

* Trend: Geopolitical instability and past disruptions have solidified the trend towards supply chain resilience. Companies will prioritize suppliers with strong regional manufacturing and logistics networks to mitigate risks.

* Impact on Nord: Nord’s global production footprint (Germany, Brazil, USA, China) and regional distribution centers are a significant strength. Their ability to serve key markets (Europe, Americas, Asia) with localized production and support will be a major selling point, especially for customers prioritizing supply security over lowest initial cost.

6. Digitalization & Servitization:

* Trend: The shift from pure product sales to outcome-based services (e.g., “Power by the Hour,” predictive maintenance contracts) will gain traction. Digital platforms enabling remote support and performance optimization will be essential.

* Impact on Nord: Nord’s NORD LIFE service portfolio and digital tools (NORD CON, NORDAC LINK) provide the foundation. In H2 2026, expect Nord to further develop and market predictive maintenance packages and performance monitoring services leveraging their integrated drive data. This creates recurring revenue streams and strengthens customer lock-in.

7. Competitive Intensity & Technological Convergence:

* Trend: Competition will remain fierce, with traditional players (Siemens, ABB, WEG) and Chinese manufacturers (e.g., Wolong, Zhongdian) vying for market share. Convergence of drive technology with AI/ML for optimization will emerge.

* Impact on Nord: Nord’s differentiation through integration, reliability, efficiency, and service will be paramount. They must continue innovating in software, connectivity, and ease of use. While price pressure exists, Nord’s focus on total cost of ownership (TCO) and performance will help maintain premium positioning, particularly in demanding industrial applications.

Conclusion for Nord in H2 2026:

The H2 2026 outlook for Nord is overwhelmingly positive, driven by powerful secular trends in automation, energy efficiency, and digitalization. Nord’s core strengths – integrated solutions, ultra-efficient motors (IE5/IE6), decentralized intelligence, robust engineering, and a global footprint – align exceptionally well with these market demands.

Key Success Factors for Nord:

* Aggressively promote the value proposition of IE5/IE6 motors and integrated intelligence (NORDAC LINK) for TCO and sustainability.

* Expand and leverage digital service offerings (NORD LIFE, predictive maintenance).

* Strengthen partnerships in high-growth electrification segments (mobile machinery, logistics).

* Maintain focus on supply chain resilience and regional support.

* Continue investing in R&D for software, connectivity, and next-generation efficiency (IE6).

By capitalizing on these H2 2026 trends, Nord Drivesystems is well-positioned to solidify its leadership in the premium industrial drive systems market and achieve significant growth.

Common Pitfalls When Sourcing Nord Electric Motors: Quality and IP Concerns

Sourcing Nord electric motors—whether directly from NORD DRIVESYSTEMS or through third-party suppliers—can present significant challenges, particularly regarding quality assurance and intellectual property (IP) protection. Being aware of these pitfalls is essential to avoid operational disruptions, safety hazards, and legal complications.

Quality-Related Pitfalls

One of the most critical risks in sourcing Nord motors is the potential for compromised quality, especially when dealing with unauthorized distributors or counterfeit products.

Procuring Counterfeit or Replica Motors

The high reputation and performance standards of genuine NORD motors make them a target for counterfeiters. Imitation motors may mimic the外观 and branding but use inferior materials, substandard windings, and poor assembly practices. These replicas often fail prematurely, leading to unplanned downtime, safety risks, and increased maintenance costs. Buyers may unknowingly receive these from unreliable suppliers, especially in gray markets or online marketplaces.

Inconsistent Performance and Reliability

Even if a motor appears authentic, sourcing from non-certified channels increases the risk of receiving refurbished, reconditioned, or repackaged units passed off as new. These motors may not meet NORD’s original performance specifications, including efficiency ratings (e.g., IE3, IE4), thermal protection, and noise levels, leading to inefficiencies and premature failure in demanding applications.

Lack of Certification and Documentation

Genuine NORD motors come with traceable documentation, including CE, UL, or ATEX certifications where applicable. Sourcing through unofficial channels may result in missing or falsified documentation, making it difficult to verify compliance with regional safety and environmental regulations. This can lead to non-compliance penalties or rejected shipments.

Intellectual Property (IP) and Legal Pitfalls

Protecting intellectual property is crucial when sourcing branded components like Nord motors, as infringement risks can expose buyers to legal liability.

Unintentional IP Infringement

Using counterfeit or cloned Nord motors constitutes a violation of trademark and design patents. Even if a buyer is unaware of the infringement, they may still face legal action from NORD DRIVESYSTEMS or local authorities, particularly in regions with strict IP enforcement (e.g., EU, USA). This includes fines, seizure of equipment, or reputational damage.

Voided Warranties and Lack of Support

Motors sourced through unauthorized channels typically void the manufacturer’s warranty. Buyers lose access to technical support, spare parts, and repair services from NORD. This not only increases total cost of ownership but also complicates troubleshooting and maintenance.

Supply Chain Transparency Issues

A lack of traceability in the supply chain makes it difficult to verify the origin of motors. This opacity increases the risk of inadvertently supporting IP theft or unethical manufacturing practices, which can conflict with corporate compliance policies and sustainability goals.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Source exclusively through NORD-authorized distributors or directly from NORD DRIVESYSTEMS.

– Verify supplier credentials and request official documentation (e.g., certificates of authenticity, warranty cards).

– Inspect motors upon delivery for branding accuracy, build quality, and model number consistency.

– Use NORD’s official tools or contact their support team to validate product authenticity.

By prioritizing authorized channels and due diligence, organizations can ensure the reliability, safety, and legal compliance of their Nord motor procurement.

Logistics & Compliance Guide for Nord Electric Motors

This guide outlines key logistics and compliance considerations for the distribution, import/export, and operation of Nord Electric Motors across international markets. Adherence to these standards ensures smooth operations, regulatory compliance, and customer satisfaction.

Product Classification and Export Controls

Nord Electric Motors must be accurately classified under international trade systems such as the Harmonized System (HS) codes. Typical classifications fall under HS 8501 (Electric motors and generators). Depending on motor specifications (e.g., power output, speed, torque), export restrictions may apply under dual-use regulations like the EU Dual-Use Regulation or the U.S. Export Administration Regulations (EAR). Verify licensing requirements for destinations in embargoed or sanctioned countries.

Import Regulations and Duties

Each destination country has specific import duties, taxes, and documentation requirements. Ensure all shipments include a commercial invoice, packing list, bill of lading or airway bill, and, where required, a certificate of origin. Some markets may impose additional import licensing or energy efficiency certifications (e.g., CE marking in the EU, NRCan in Canada). Duty rates vary by country and trade agreements—leverage preferential tariffs where applicable.

Packaging and Shipping Standards

Motors must be packaged to withstand transport under IEC 60068 environmental conditions. Use moisture-resistant, shock-absorbent materials and secure crating for heavy-duty motors. Label packages with handling instructions (e.g., “Fragile,” “This Side Up”), product ID, serial number, weight, and Nord safety markings. Comply with International Safe Transit Association (ISTA) standards for testing. For international air freight, adhere to IATA regulations; for sea freight, follow IMDG Code if applicable (rare for motors unless containing oils or batteries).

Regulatory Compliance and Certifications

Nord motors must meet regional conformity standards:

– European Union: CE marking per Machinery Directive (2006/42/EC), Low Voltage Directive (2014/35/EU), and EMC Directive (2014/30/EU). Additional requirements under Ecodesign (EU) 2019/1781 for energy efficiency (IE3/IE4).

– North America: Certified to UL/CSA standards (e.g., UL 1004) for safety. Comply with EPA and DOE efficiency standards (e.g., 10 CFR 431).

– Other Markets: Check local requirements such as CCC (China), KC (Korea), or INMETRO (Brazil). Maintain valid test reports and technical files.

Environmental and RoHS Compliance

Nord motors must comply with the EU’s Restriction of Hazardous Substances (RoHS) Directive (2011/65/EU), restricting substances like lead, mercury, and cadmium. Provide RoHS compliance declarations upon request. Ensure adherence to WEEE (Waste Electrical and Electronic Equipment) Directive for end-of-life handling responsibilities in applicable markets.

Customs Documentation and Trade Facilitation

Maintain accurate records for audits and customs inspections. Use electronic data interchange (EDI) or integrated ERP systems for faster clearance. Employ Authorized Economic Operator (AEO) status where available to benefit from expedited customs processing. Retain shipping and compliance documents for a minimum of five years.

After-Sales Logistics and Spare Parts

Establish a spare parts distribution network aligned with service level agreements (SLAs). Ensure spare motors and components meet the same compliance standards as original products. Provide multilingual technical documentation, including user manuals, safety instructions, and maintenance guides, in accordance with local language regulations.

Compliance Monitoring and Continuous Improvement

Appoint a compliance officer or team to monitor regulatory changes globally. Conduct annual compliance audits and staff training on export controls, safety standards, and logistics best practices. Engage with legal counsel or trade consultants to address complex market entries or regulatory updates.

Conclusion for Sourcing Nord Electric Motors

Sourcing NORD electric motors presents a strategic advantage for organizations seeking reliable, energy-efficient, and durable drive solutions. NORD’s reputation for engineering excellence, comprehensive product range, and global service support makes it a preferred supplier in industrial automation, process engineering, and material handling sectors. The integration of energy-efficient technologies, such as IE3 and IE4 motors, aligns with global sustainability goals and helps reduce long-term operational costs.

Additionally, NORD’s ability to offer customized solutions, combined with robust build quality and adherence to international standards, ensures compatibility and performance across diverse applications. While initial costs may be higher compared to generic brands, the total cost of ownership is optimized through enhanced efficiency, reduced maintenance, and extended service life.

In conclusion, sourcing NORD electric motors supports operational reliability, energy conservation, and long-term cost savings. Establishing a partnership with NORD or its authorized distributors ensures access to technical expertise, timely support, and innovation-driven drive technology, making it a sound investment for businesses aiming for performance and sustainability in their operations.