The global non-stranded wire market is experiencing steady growth, driven by rising demand across electrical, automotive, and construction industries. According to Mordor Intelligence, the global electrical wire and cable market—of which non-stranded (solid) wire is a key component—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. Similarly, Grand View Research valued the global wire and cable market at USD 188.4 billion in 2022 and forecast a CAGR of 4.9% from 2023 to 2030, citing infrastructure development and industrial automation as major growth catalysts. As demand for reliable, cost-effective conductors increases, manufacturers specializing in non-stranded wire are scaling production and innovating in materials and efficiency. From established industry leaders to regionally dominant players, the top nine non-stranded wire manufacturers are shaping the backbone of modern electrical systems—delivering performance and consistency in applications ranging from residential wiring to heavy-duty control circuits.

Top 9 Non Stranded Wire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wire and Cable Manufacturers

Domain Est. 1996

Website: encorewire.com

Key Highlights: Encore Wire is the leading manufacturer of copper and aluminum for residential, commercial and industrial wire needs. We’re unlike any other wire company….

#2 Polar Wire Products®

Domain Est. 1999

Website: polarwire.com

Key Highlights: We are a renowned manufacturer of premium industrial-grade wire designed to withstand even the harshest environments. Our finely stranded wire configurations ……

#3 Service Wire Company

Domain Est. 1996 | Founded: 1968

Website: servicewire.com

Key Highlights: Since 1968, we’ve built a reputation for safely manufacturing high-quality wire and cable, delivering industry-leading service levels.Missing: non stranded…

#4 Copperweld

Domain Est. 1998

Website: copperweld.com

Key Highlights: Copperweld is a bimetallic manufacturer specializing in power and grounding conductors for building construction, power grid, utilities, communications, ……

#5 Remington Industries

Domain Est. 2000

Website: remingtonindustries.com

Key Highlights: Our value-added services make us a one-stop-shop wire supplier; we offer customizations to your industrial and electrical wire, as well as 3D printing services….

#6 About International Wire

Domain Est. 2004

Website: internationalwire.com

Key Highlights: International Wire is the largest non-vertically integrated manufacturer of copper and copper-alloy wire products in the US….

#7 Wire and Cable Solutions from Performance Wire and Cable

Domain Est. 2004

Website: performancewire.com

Key Highlights: Custom USA cable manufacturer. Performance Wire and Cable is a wire & cable manufacturer of insulated copper and steel wire products. Get a Quote….

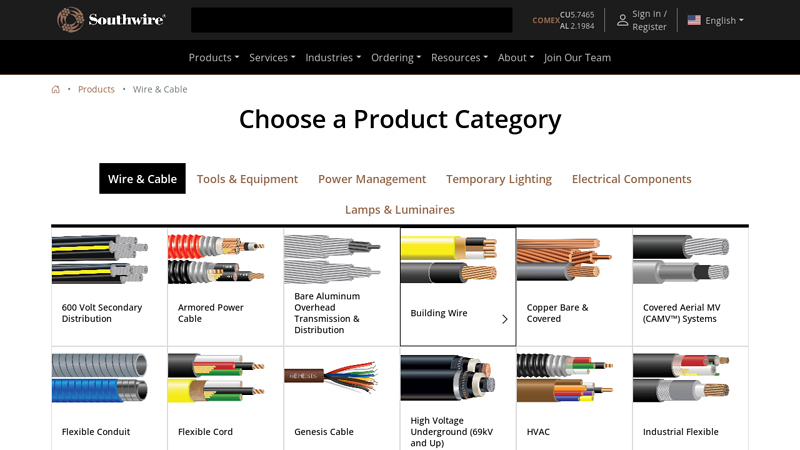

#8 Wire & Cable

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose a Product Category: Wire & Cable, Tools & Equipment, Power Management, Temporary Lighting, Electrical Components, Lamps & Luminaires….

#9 Non

Domain Est. 2012

Website: idealind.com

Key Highlights: 30-day returnsSafe, fast and cost-effective for grounding applications · Ensures compliance with Article 250 of the National Electric Code (NEC) · Heavy-duty fork terminal ……

Expert Sourcing Insights for Non Stranded Wire

H2: Market Trends for Non-Stranded Wire in 2026

The non-stranded wire (solid wire) market in 2026 is poised for steady growth, driven by foundational demand in construction, infrastructure, and industrial automation, while facing selective challenges from technological shifts. Here’s a breakdown of key trends:

1. Sustained Growth in Infrastructure & Construction:

* Core Driver: Massive global investments in electrification, grid modernization (including smart grid components), renewable energy integration (solar farms, wind turbine connections), and urban development remain the primary growth engine. Non-stranded wire’s cost-effectiveness and ease of termination make it ideal for building wiring (outlets, lighting fixtures, junction boxes) and fixed industrial installations.

* 2026 Outlook: Continued government stimulus (e.g., US IIJA, EU Green Deal, Asian infrastructure projects) will sustain demand, particularly for standard gauge copper solid wire in residential and commercial construction. Focus on energy efficiency standards may slightly favor higher-conductivity or insulated variants.

2. Resilience in Industrial Automation & Control:

* Core Driver: The relentless expansion of factory automation, process control systems, and machinery requires vast amounts of reliable, fixed wiring for power distribution, sensor connections, and control circuits within control panels and machinery.

* 2026 Outlook: Growth in Industry 4.0 and smart manufacturing will maintain strong demand. While some high-flex applications use stranded wire, the bulk of fixed internal wiring in panels, cabinets, and machine frames relies on solid wire for its stability and lower cost.

3. Impact of Stranded Wire Competition & Technological Shifts:

* Challenge: The most significant trend against non-stranded wire is the increasing preference for stranded wire in applications demanding flexibility, vibration resistance, or complex routing (e.g., robotics, automotive harnesses, appliance cords, data cables).

* 2026 Outlook: This substitution trend will continue, particularly in consumer electronics, advanced automotive systems (EVs, ADAS), and portable equipment. Non-stranded wire’s market share in these dynamic applications remains limited. However, it maintains a defensive position in static, high-volume applications where cost and simplicity are paramount.

4. Material & Cost Pressures:

* Challenge: Fluctuations in copper prices remain a major factor impacting production costs and pricing. Aluminum solid wire sees niche use in specific power transmission applications due to cost/weight advantages but faces limitations in conductivity and termination reliability compared to copper.

* 2026 Outlook: Manufacturers will focus on efficiency improvements, recycling, and potentially exploring alternative alloys or process optimizations to mitigate copper price volatility. Aluminum use may see slight growth in specific HVAC or feeder applications but won’t significantly displace copper in general non-stranded wire.

5. Standardization & Regional Dynamics:

* Trend: Demand is heavily influenced by regional building codes (NEC, IEC) and electrical standards. Emerging markets (Southeast Asia, Africa, parts of Latin America) present significant growth potential due to rapid urbanization and electrification projects.

* 2026 Outlook: Mature markets (North America, Western Europe) will see stable, replacement-driven demand. Higher growth rates are expected in developing regions, though often for lower-specification or locally produced wire. Compliance with evolving safety and environmental regulations (e.g., halogen-free insulation) will be crucial.

6. Sustainability & Recycling Focus:

* Trend: Increasing emphasis on environmental regulations and corporate sustainability goals.

* 2026 Outlook: The inherent recyclability of copper wire is a major advantage. Expect greater focus on closed-loop recycling systems within the supply chain and potential demand for wire produced with higher recycled content, though this primarily impacts the raw material sourcing rather than the solid vs. stranded form.

Conclusion for 2026:

The non-stranded wire market in 2026 will be characterized by stable, foundational growth anchored in the enduring needs of construction, infrastructure, and industrial fixed wiring. While it faces persistent competition from stranded wire in flexible applications, its advantages in cost, simplicity, and termination reliability ensure its dominance in static installations. Growth will be most robust in developing economies undergoing rapid electrification, while mature markets focus on replacement and upgrades. Success will depend on navigating copper price volatility, adhering to evolving standards, and leveraging the inherent sustainability of copper recycling. It’s a market of necessity rather than rapid innovation, but one with consistent underlying demand.

Common Pitfalls When Sourcing Non-Stranded Wire: Quality and Intellectual Property Concerns

Sourcing non-stranded wire—also known as solid wire—for industrial, electrical, or electronic applications requires careful evaluation to ensure reliability, safety, and compliance. While cost and availability are often primary considerations, overlooking quality and intellectual property (IP) aspects can lead to long-term risks. Below are key pitfalls to avoid.

Quality-Related Pitfalls

1. Substandard Material Composition

One of the most common issues is receiving wire made from impure or substandard conductive materials. For example, copper wire may be alloyed with cheaper metals or use recycled copper without proper certification. This compromises conductivity, increases resistance, and accelerates degradation. Always verify material specifications (e.g., ASTM B3 for copper) and request mill test reports.

2. Inconsistent Wire Gauge (AWG)

Non-stranded wire must adhere to precise diameter tolerances. Variations in gauge affect current-carrying capacity and can lead to overheating or circuit failure. Suppliers from less-regulated regions may produce wire with inconsistent gauges. Demand conformance to standards like ASTM B258 and conduct random inspections.

3. Poor Insulation Quality

Insulation defects—such as uneven thickness, inadequate dielectric strength, or poor heat resistance—can result in short circuits or fire hazards. Common issues include the use of recycled or off-spec insulation materials. Ensure compliance with UL, CSA, or IEC standards (e.g., UL 1063) and verify flame ratings (e.g., VW-1).

4. Lack of Traceability and Certifications

Reputable suppliers provide traceable batch numbers, RoHS/REACH compliance, and third-party test reports. Sourcing from suppliers without proper documentation increases the risk of receiving counterfeit or non-compliant materials. Always audit supplier certifications before procurement.

Intellectual Property and Compliance Risks

1. Counterfeit or Reverse-Engineered Products

Some suppliers may offer wires branded or specified to mimic proprietary or patented designs (e.g., high-performance insulation formulations or shielded solid-core cables). Using such products may expose the buyer to IP infringement claims. Ensure that products do not violate existing patents, especially in regulated industries like aerospace or medical devices.

2. Misrepresentation of Performance Claims

Suppliers may exaggerate performance metrics (e.g., temperature rating, signal integrity, or longevity) to match high-end products. These claims may be based on fabricated or unverified testing data. Validate claims through independent lab testing or request full technical documentation.

3. Unauthorized Use of Trademarks or Standards Logos

Unscrupulous vendors may display UL, CE, or other certification marks without proper authorization. This not only misleads buyers but also creates legal liability. Verify certifications directly through the issuing bodies’ online databases.

Conclusion

To mitigate these risks, establish a vetting process for suppliers that includes on-site audits, sample testing, and legal review of IP compliance. Prioritize long-term reliability and regulatory adherence over initial cost savings when sourcing non-stranded wire.

Logistics & Compliance Guide for Non-Stranded Wire

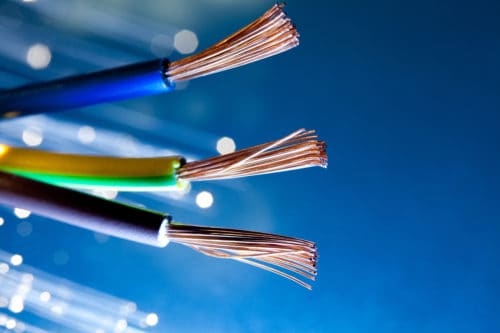

Overview of Non-Stranded Wire

Non-stranded wire, also known as solid wire, consists of a single solid conductor typically made from copper or aluminum. Due to its rigid structure, it is commonly used in applications such as building wiring, printed circuit boards, and fixed installations where flexibility is not required. Proper logistics handling and regulatory compliance are essential to ensure product integrity, safety, and adherence to international and regional standards.

Packaging Requirements

Proper packaging is critical to prevent damage during transportation and storage.

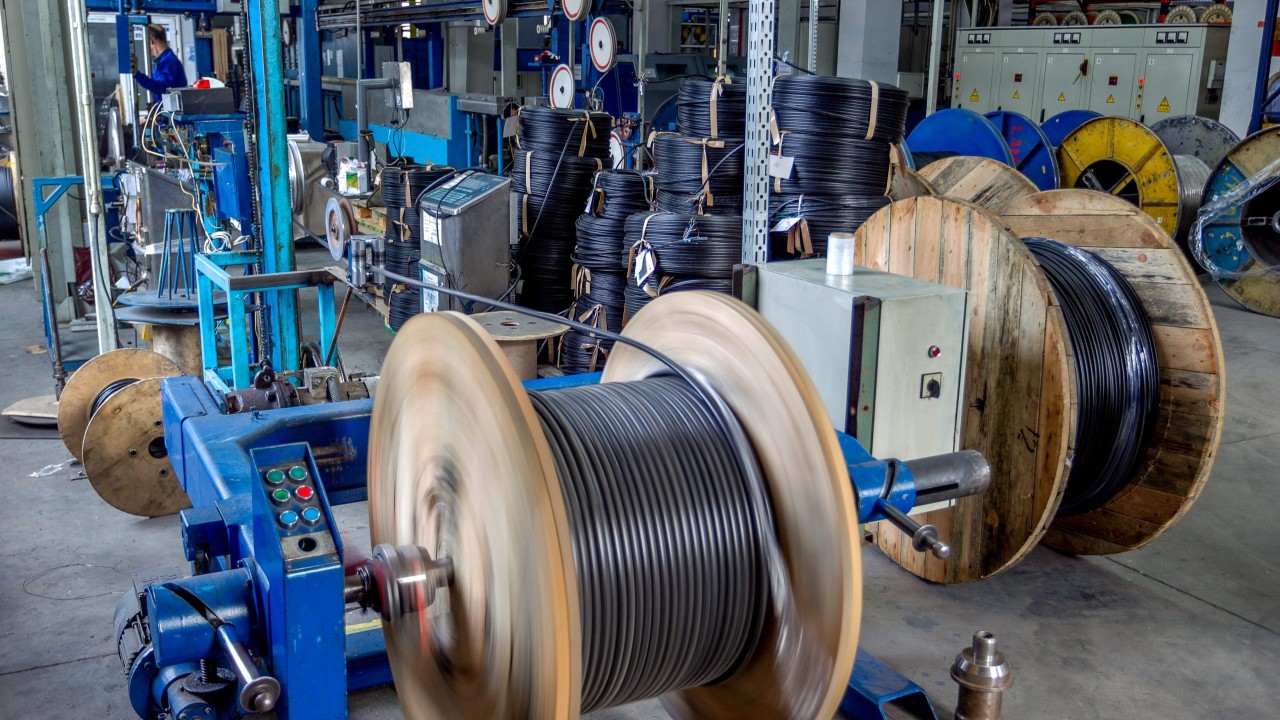

– Coil or Reel Packaging: Non-stranded wire should be wound on reels, spools, or coils to avoid kinking and deformation. Reels must be made from durable materials (e.g., wood, plastic, or composite) and include protective end caps.

– Moisture Protection: Use moisture-resistant wrapping (e.g., polyethylene film) to prevent corrosion, especially for copper conductors. Desiccants may be included in sealed packaging for extended storage or humid environments.

– Labeling: Each package must be clearly labeled with product specifications including wire gauge (AWG or mm²), material type, insulation type (if applicable), length, batch/lot number, and manufacturer details. Include handling symbols (e.g., “Fragile,” “This Way Up”) to guide logistics teams.

Transportation Guidelines

Transport conditions must maintain wire integrity and comply with shipping regulations.

– Loading and Securing: Reels must be securely fastened to prevent rolling or shifting during transit. Vertical loading is preferred to minimize stress on the wire.

– Environmental Controls: Avoid exposure to extreme temperatures, direct sunlight, and high humidity. Enclosed, climate-controlled vehicles are recommended for sensitive or long-distance shipments.

– Stacking: Limit vertical stacking of reels to prevent crushing. Follow manufacturer-recommended stacking heights based on reel strength.

– International Shipping: For cross-border shipments, comply with Incoterms (e.g., FOB, CIF) and ensure proper export documentation. Adhere to IATA (air) or IMDG (sea) regulations if applicable.

Regulatory Compliance

Non-stranded wire must meet various regional and international regulatory standards.

– Electrical Standards:

– North America: Comply with UL 1581, UL 83, and National Electrical Code (NEC) standards. Look for UL, CSA, or cUL certification marks.

– Europe: Must meet EN 60228 (conductor standards) and be CE-marked under the Low Voltage Directive (LVD) and RoHS for hazardous substances.

– International: IEC 60228 defines conductor classes; ISO and IEC standards may apply for performance and testing.

– Material Restrictions:

– RoHS (EU): Restricts lead, cadmium, mercury, and other hazardous substances.

– REACH (EU): Requires registration of chemical substances used in production.

– Conflict Minerals (U.S. Dodd-Frank Act): Requires reporting on sourcing of tin, tantalum, tungsten, and gold (if applicable).

– Country-Specific Certifications: Some markets require additional certifications (e.g., CCC for China, PSE for Japan, KC for South Korea).

Storage Recommendations

Proper storage prevents degradation and maintains product quality.

– Indoor Storage: Store in a dry, temperature-controlled environment away from corrosive chemicals, UV exposure, and mechanical stress.

– Rack Positioning: Place reels vertically on racks to prevent deformation. Avoid direct contact with concrete floors; use pallets or wooden blocks.

– Inventory Management: Use FIFO (First In, First Out) rotation to minimize aging. Monitor shelf life, especially for insulated wires.

Documentation and Traceability

Maintain comprehensive records to ensure compliance and support audits.

– Certificates of Conformity (CoC): Provide CoC for each batch, confirming compliance with relevant standards.

– Material Test Reports (MTRs): Include tensile strength, conductivity, and dimensional accuracy data.

– Batch/Lot Tracking: Implement a traceability system to track raw materials and finished goods from production to delivery.

– Customs Documentation: Prepare commercial invoices, packing lists, and certificates of origin for international shipments.

Handling and Safety Precautions

Ensure safety for personnel and product integrity during all logistics operations.

– Personal Protective Equipment (PPE): Use gloves and safety glasses to prevent cuts from sharp wire ends.

– Mechanical Handling: Use forklifts or drum movers to handle heavy reels; never roll reels on their side.

– Cutting and Stripping: Follow workplace safety protocols when preparing wire for use to avoid injury or damage.

Disposal and Environmental Responsibility

Follow environmental regulations for end-of-life wire.

– Recycling: Copper and aluminum wires are highly recyclable. Partner with certified e-waste recyclers to process scrap or obsolete inventory.

– Hazardous Waste: Insulated wires may contain materials subject to WEEE (EU) or EPA (U.S.) regulations. Dispose of properly through authorized channels.

Conclusion

Effective logistics and compliance management for non-stranded wire ensures product quality, regulatory adherence, and operational efficiency. By following packaging, transportation, storage, and documentation best practices, businesses can reduce risk, avoid customs delays, and maintain customer trust in global markets. Regular audits and staff training are recommended to stay current with evolving standards.

Conclusion for Sourcing Non-Stranded Wire:

Sourcing non-stranded (solid) wire requires careful consideration of application requirements, material specifications, and supplier reliability. Solid wire is ideal for stationary installations where durability and simplicity of termination are key, such as in residential wiring, printed circuit boards, and structured cabling systems. When sourcing, it is essential to prioritize wire gauge (AWG), insulation type, conductivity standards (e.g., copper purity), and compliance with regulatory codes (such as NEC, UL, or CSA). Establishing relationships with reputable suppliers who provide consistent quality, certifications, and traceable materials ensures long-term performance and safety. While solid wire may be less flexible than stranded alternatives, its cost-effectiveness and ease of use in fixed applications make it a preferred choice in many electrical and electronic systems. A strategic sourcing approach focused on technical alignment, quality assurance, and supply chain stability will support efficient and reliable project implementation.