The global nickel market is experiencing steady expansion, driven by rising demand in key industries such as electric vehicles (EVs), stainless steel, and renewable energy infrastructure. According to Grand View Research, the global nickel market size was valued at USD 21.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. This growth is underpinned by increasing nickel consumption in lithium-ion battery production, particularly for nickel-manganese-cobalt (NMC) chemistries, which are critical to advancing EV range and performance. Additionally, Mordor Intelligence forecasts heightened activity in nickel mining and processing, especially across Indonesia and the Philippines, which together account for over 70% of global nickel production. As demand for high-purity nickel and nickel alloys surges, a select group of manufacturers has emerged as leaders in producing nickel properties that meet rigorous industrial standards. These top nine nickel properties manufacturers are not only scaling output but also driving innovation in sustainability, extraction efficiency, and material science to maintain a competitive edge in a rapidly evolving market landscape.

Top 9 Nickel Properties Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Speciality Nickel Alloys by JLC Electromet Pvt. Ltd.

Domain Est. 2001

Website: jlcelectromet.com

Key Highlights: Complete range of speciality nickel alloys products. Nickel alloy technology and research technology. Our worldwide presence supplying nickel alloys….

#2 Properties of Nickel Alloys

Domain Est. 2004

Website: nickel-alloys.net

Key Highlights: JLC Electromet Pvt. Ltd. is one of the world’s leading manufacturers of Nickel and Nickel based Specialty Alloys in wire, rod, strip and ribbon forms. An ISO: ……

#3 Nickel Suppliers

Domain Est. 2005

Website: nickelsuppliers.com

Key Highlights: Nickel alloy suppliers blend nickel with metals such as copper, aluminum, titanium, chromium, and iron to create materials that meet demanding specifications….

#4 MatWeb

Domain Est. 1997

Website: matweb.com

Key Highlights: MatWeb’s searchable database of material properties includes data sheets of thermoplastic and thermoset polymers such as ABS, nylon, polycarbonate, polyester, ……

#5 Nickel Suppliers

Domain Est. 1998

Website: americanelements.com

Key Highlights: Nickel qualified commercial & research quantity preferred supplier. Buy at competitive price & lead time. In-stock for immediate delivery. Uses, properties ……

#6 High

Domain Est. 1999

Website: magellanmetals.com

Key Highlights: Magellan Metals is a worldwide, ISO 9001 certified supplier of nickel alloys and other superalloys, including Inconel®, Monel® and Hastelloy®, in multiple ……

#7 Nickel alloys supplier in the world

Domain Est. 2001

Website: international.myjacquet.com

Key Highlights: JACQUET offers a large stock of nickel alloy plates for applications requiring high resistance in aggressive environments such as : corrosion, high ……

#8 About nickel

Domain Est. 2002

Website: nickelinstitute.org

Key Highlights: Nickel is a metallic element with a silvery-white, shiny appearance. It is the fifth-most common element on earth and occurs extensively in the earth’s crust ……

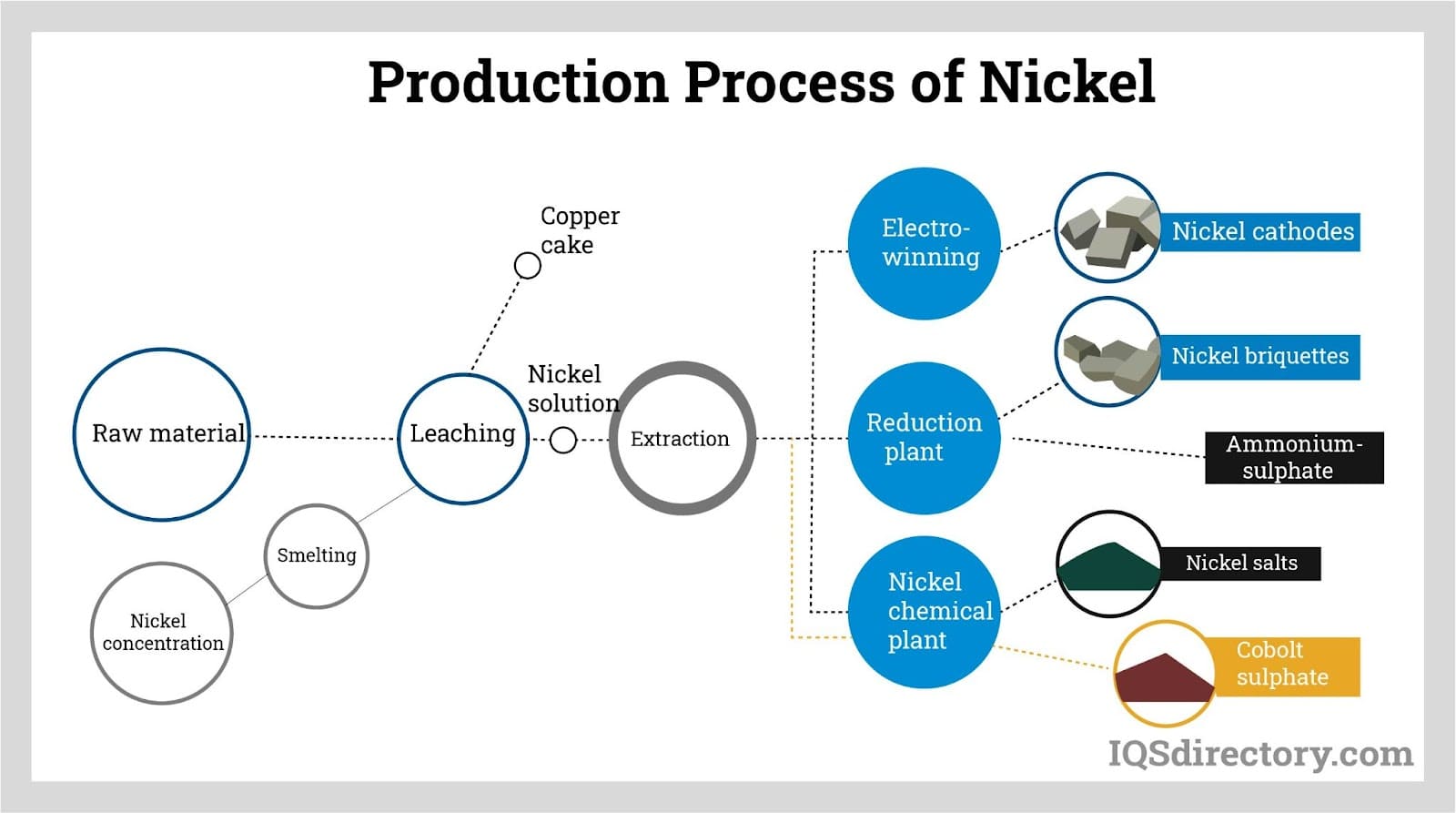

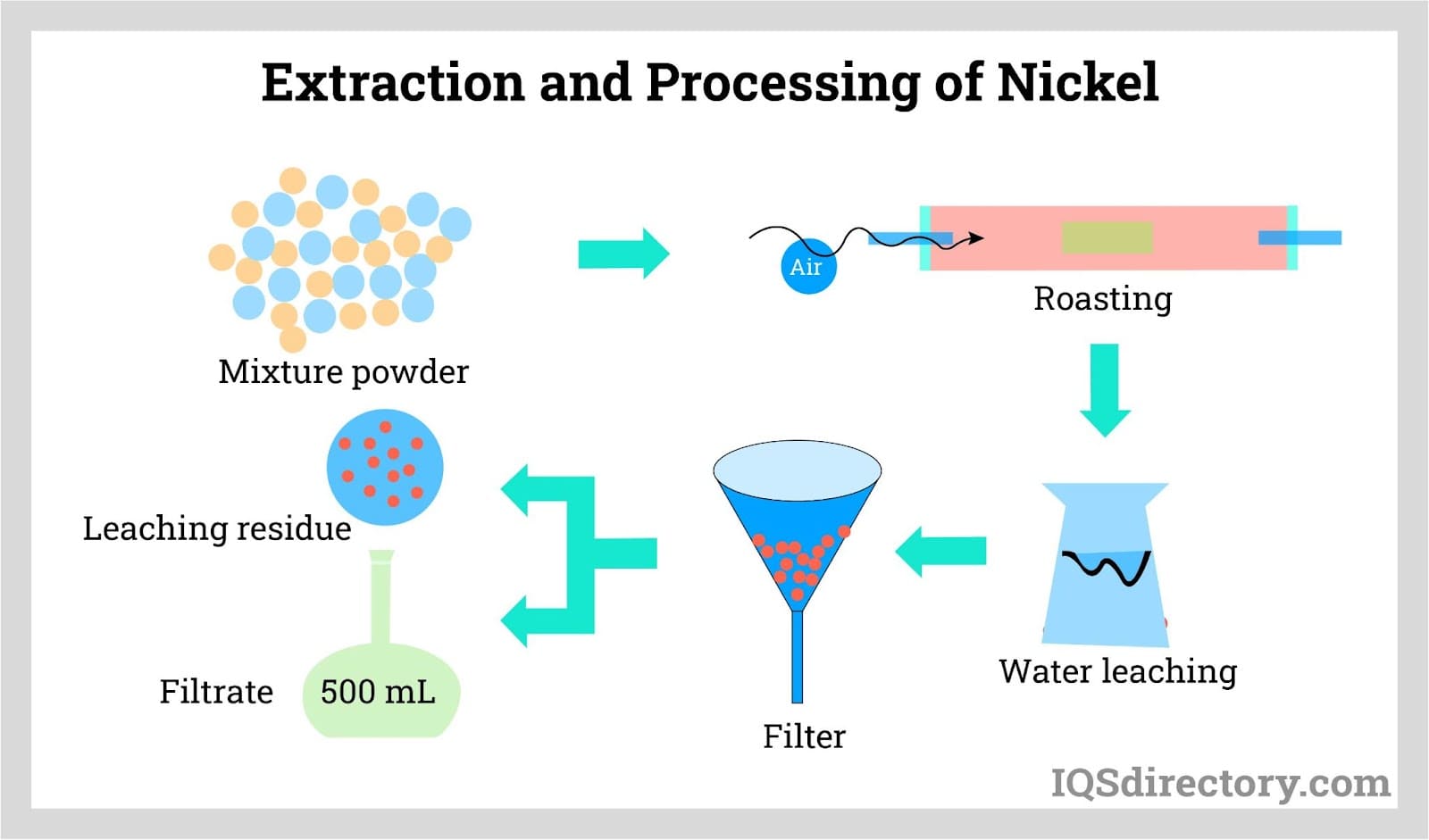

#9 Nickel Companies and Suppliers

Domain Est. 2004

Website: iqsdirectory.com

Key Highlights: IQS Directory implements a thorough list of nickel companies and suppliers. Utilize our listing to examine and sort top nickel suppliers….

Expert Sourcing Insights for Nickel Properties

H2: Market Trends for Nickel Properties in 2026

As the global economy advances toward decarbonization and electrification, nickel—a critical component in stainless steel and, increasingly, in lithium-ion batteries—remains at the center of evolving commodity dynamics. Heading into 2026, the nickel market is shaped by robust demand from the electric vehicle (EV) sector, tightening supply fundamentals, geopolitical shifts, and technological advancements in mining and processing. Here’s an in-depth analysis of key market trends influencing nickel properties in 2026:

1. Strong Demand from the EV and Battery Sector

The electric vehicle revolution continues to be the primary driver of nickel demand. High-nickel cathode chemistries such as NMC 811 (nickel-manganese-cobalt) and nickel-rich NCA (nickel-cobalt-aluminum) are now standard in long-range EVs due to their superior energy density. By 2026, EV production is projected to account for over 35% of global nickel demand, up from approximately 15% in 2022. This surge is supported by aggressive EV adoption targets in Europe, China, and North America, as well as falling battery costs.

As a result, nickel properties with the potential to produce Class 1 nickel (high-purity, battery-grade) are gaining significant strategic value. Projects capable of delivering low-cost, sulfate-ready nickel through hydrometallurgical or direct-to-cathode processes are attracting increased investment and joint ventures with battery and auto manufacturers.

2. Supply Constraints and Geopolitical Risks

Global nickel supply remains tight, with limited new large-scale discoveries and rising production costs. Indonesia, which dominates global nickel production (over 50% of supply in 2026), continues to restrict raw ore exports and push downstream processing within its borders. This policy has encouraged a wave of Chinese-backed HPAL (High-Pressure Acid Leach) projects in Indonesia but has also created bottlenecks in Class 1 nickel availability.

Meanwhile, supply from the Philippines and Russia remains volatile due to environmental regulations and geopolitical tensions, respectively. Western governments are increasingly prioritizing supply chain resilience, leading to renewed interest in nickel projects in Canada, Australia, and the United States. In 2026, North American nickel properties benefit from Inflation Reduction Act (IRA) incentives, which require battery materials to be sourced from free-trade partners to qualify for EV tax credits.

3. Rise of Sustainable and ESG-Compliant Projects

Environmental, Social, and Governance (ESG) criteria are now central to project valuation. Nickel properties that demonstrate low carbon footprints, ethical labor practices, and community engagement are more likely to secure financing and offtake agreements. In 2026, investors and off-takers increasingly favor projects using renewable energy, closed-loop water systems, and low-emissions processing technologies.

For example, laterite projects using HPAL are under scrutiny for their environmental impact, while sulfide deposits—though rarer—are gaining favor due to lower energy requirements and simpler processing. This shift enhances the value of high-quality sulfide assets in stable jurisdictions.

4. Technological Innovation and Processing Advancements

Innovations in mineral processing are reshaping the economics of nickel properties. Direct lithium and nickel extraction methods, bioleaching, and modular refining are gaining traction, reducing capital intensity and time to production. By 2026, several junior miners have successfully piloted hybrid processing routes that integrate conventional and novel techniques, improving recovery rates and reducing environmental impact.

Additionally, partnerships between mining companies and battery recyclers are emerging, creating circular supply chains. Recycled nickel from end-of-life batteries is expected to contribute up to 10% of total nickel supply by 2030, but in 2026, primary production still dominates—making high-potential greenfield properties highly strategic.

5. Price Volatility and Market Speculation

Nickel prices remain volatile due to structural imbalances and speculative trading. The 2022 LME short squeeze remains a cautionary tale, leading to improved market surveillance and position limits. In 2026, prices stabilize somewhat around $18,000–$24,000 per tonne, supported by strong fundamentals but tempered by recessionary risks and fluctuating stainless steel demand.

Hedging and offtake agreements are increasingly common, with automakers and battery producers locking in long-term supply at fixed or formula-based prices. This trend benefits developers with advanced projects capable of near-term production.

Conclusion

In 2026, nickel properties are valued not just for their resource size, but for their ability to deliver sustainable, battery-ready nickel in geopolitically secure regions. Projects with clear pathways to Class 1 production, strong ESG credentials, and strategic partnerships are best positioned to capture value. As the energy transition accelerates, nickel remains a cornerstone metal—and the most competitive properties will play a pivotal role in powering the future.

Common Pitfalls in Sourcing Nickel Properties (Quality, IP)

Sourcing accurate and reliable nickel material properties—especially concerning quality specifications and intellectual property (IP) considerations—can present significant challenges. Overlooking these aspects can lead to supply chain disruptions, product failures, legal risks, and increased costs. Below are key pitfalls to avoid:

Inadequate Verification of Material Quality and Specifications

One of the most frequent issues is assuming that supplied nickel meets required quality standards without rigorous verification. Nickel properties such as purity, chemical composition, mechanical strength, and corrosion resistance vary widely based on grade (e.g., Nickel 200, 201, 205), production method, and source. Relying solely on supplier-provided certificates of analysis (CoA) without third-party testing or audit trails can result in receiving substandard material. Additionally, inconsistent batch-to-batch quality—especially from less-established suppliers—can compromise product performance and regulatory compliance.

Overlooking Traceability and Certification Standards

Nickel used in high-integrity applications (e.g., aerospace, medical devices, nuclear) requires full traceability and certification to standards such as ASTM, ASME, or ISO. A common pitfall is sourcing nickel without proper documentation (e.g., 3.1 or 3.2 material test reports), which can invalidate certifications for end products. Failure to ensure documented traceability from mine to mill to finished product also increases exposure to sourcing risks, including conflict minerals and environmental, social, and governance (ESG) non-compliance.

Ignoring Intellectual Property (IP) Risks in Material Sourcing

When sourcing proprietary nickel alloys (e.g., Inconel®, Monel®, Hastelloy®), a critical pitfall is inadvertently infringing on IP rights. These trademarks and compositions are protected, and using non-licensed equivalents or misrepresenting material origin can lead to legal disputes, product recalls, or loss of customer trust. Additionally, reverse engineering or replicating patented alloy formulations—even for internal use—can expose companies to litigation if proper licensing is not obtained.

Relying on Unverified or Non-Exclusive Data Sources

Engineering teams often source nickel property data from public databases, technical manuals, or generic datasheets without verifying their accuracy or relevance to a specific grade or condition. This can lead to design miscalculations, especially when data lacks context (e.g., temperature dependence, anisotropy, or heat treatment effects). Furthermore, using data from non-exclusive or unlicensed sources may breach copyright or database rights, particularly when incorporated into commercial designs or software tools.

Failure to Secure IP Rights in Custom Alloy Development

Companies developing proprietary nickel-based alloys may fail to adequately protect their innovations through patents, trade secrets, or material-specific know-how. When sourcing raw materials or partnering with third-party foundries, insufficient contractual safeguards can lead to IP leakage or unauthorized use. Ensuring confidentiality agreements (NDAs) and clear IP ownership clauses in supply contracts is essential to prevent loss of competitive advantage.

Conclusion

To mitigate these risks, organizations should implement robust supplier qualification processes, demand full certification and traceability, conduct independent material testing, and consult legal experts when dealing with proprietary alloys or sensitive data. Proactive management of both material quality and IP considerations ensures reliable performance and protects long-term innovation value.

Logistics & Compliance Guide for Nickel Properties

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to nickel and nickel-containing materials. Adherence to these guidelines ensures operational efficiency, safety, and legal compliance across the supply chain.

Regulatory Compliance Framework

Nickel is subject to various international, national, and regional regulations due to its industrial use, environmental impact, and potential health hazards when improperly handled. Key compliance areas include:

- REACH (EU Regulation): Nickel is listed in Annex XVII of REACH, restricting its release from products that come into prolonged contact with skin (e.g., jewelry, watches). Exporters to the EU must ensure compliance with nickel release limits (≤ 0.5 µg/cm²/week).

- RoHS Directive (EU): Applies to electrical and electronic equipment; nickel itself is not restricted, but nickel plating may be subject to substance-of-concern assessments when combined with other restricted materials.

- TSCA (USA): The Toxic Substances Control Act requires reporting of significant new uses of nickel compounds under the Significant New Use Rule (SNUR).

- GHS & SDS Compliance: Nickel and its compounds must be classified and labeled according to the Globally Harmonized System (GHS). Safety Data Sheets (SDS) must be maintained and provided to downstream users, detailing hazards, handling, and emergency measures.

- Customs & Trade Regulations: Accurate HS codes (e.g., 7502.10 for unwrought nickel, 7503.00 for nickel waste and scrap) are required for import/export declarations. Country-specific restrictions may apply (e.g., export controls in Indonesia or the Philippines).

Transportation & Logistics Management

Safe and efficient transport of nickel materials—whether in ore, concentrate, cathode, powder, or alloy forms—requires adherence to specific protocols:

- Classification & Packaging: Nickel in powder form may be classified as a hazardous material (e.g., UN3089, ENVIRONMENTALLY HAZARDOUS SUBSTANCE, SOLID, N.O.S.) if it meets certain criteria. Bulk nickel ore may be classified as a Group A cargo under the IMSBC Code (IMO) due to potential liquefaction risks.

- IMO IMSBC Code Compliance: Shippers of nickel ore must provide a Cargo Declaration and Transportable Moisture Limit (TML) certificate. The moisture content must be below the TML to prevent cargo shift during maritime transport.

- ADR/RID/ADN (Inland Transport): For road, rail, or inland waterway transport in Europe, nickel compounds classified as hazardous must comply with ADR/RID/ADN regulations regarding packaging, labeling, and vehicle requirements.

- IATA/ICAO (Air Transport): Nickel powders or reactive compounds may be restricted or prohibited on passenger aircraft. Proper classification, packaging, and documentation are mandatory under IATA Dangerous Goods Regulations.

- Cold Chain & Environmental Controls: While most nickel forms do not require temperature control, nickel catalysts or fine powders may need protection from moisture and static. Use of desiccants and anti-static packaging is recommended.

Storage & Handling Procedures

Proper storage minimizes degradation, contamination, and safety risks:

- Segregation: Store nickel products away from strong oxidizers, acids, and moisture-sensitive materials. Nickel powders should be kept in sealed, non-reactive containers (e.g., HDPE or stainless steel).

- Environmental Conditions: Maintain dry, well-ventilated storage areas. Relative humidity should be controlled (<50%) to prevent oxidation or caking, especially for fine powders.

- Container Integrity: Use UN-certified packaging for hazardous nickel compounds. Inspect containers regularly for corrosion, leaks, or damage.

- Handling Equipment: Use non-sparking tools and grounded equipment when handling nickel powders to prevent dust explosions. Implement dust control measures (e.g., local exhaust ventilation).

Environmental, Health & Safety (EHS) Considerations

- Dust Control: Nickel dust is a respiratory irritant and potential carcinogen (IARC Group 1 for certain nickel compounds). Use PPE (N95 masks, gloves, eye protection) and engineering controls (ventilation, enclosed systems).

- Waste Management: Nickel-containing waste (e.g., sludge, spent catalysts) may be classified as hazardous. Follow local regulations for disposal; recycling is encouraged.

- Spill Response: In case of spills, avoid creating dust. Collect material using non-sparking tools and place in sealed containers. Decontaminate affected areas with water and detergent. Report significant spills per local environmental regulations.

Documentation & Recordkeeping

Maintain comprehensive records to support compliance audits and traceability:

- Safety Data Sheets (SDS) for all nickel forms

- Certificates of Analysis (CoA) and Origin (CoO)

- Transport documents (e.g., Dangerous Goods Note, Bill of Lading)

- REACH/RoHS compliance declarations for applicable products

- Training records for personnel handling nickel materials

Conclusion

Effective logistics and compliance management for nickel properties requires a proactive approach integrating regulatory awareness, safe handling practices, and accurate documentation. Regular training, internal audits, and engagement with regulatory updates are essential to maintain compliance and ensure the safe and sustainable movement of nickel materials across global supply chains.

In conclusion, sourcing nickel involves a comprehensive evaluation of its key properties—such as high corrosion resistance, excellent thermal and electrical conductivity, good strength at elevated temperatures, and ferromagnetic characteristics—which make it indispensable in various industries, including aerospace, automotive, electronics, and renewable energy. Sustainable and responsible sourcing must also consider geographic availability, environmental impact, ethical mining practices, and supply chain transparency, particularly given the increasing demand driven by electric vehicle batteries and stainless steel production. Ensuring a stable, ethical, and efficient nickel supply chain is critical to supporting global industrial growth and advancing clean energy technologies.