The global nickel market is experiencing robust growth, driven by surging demand from the stainless steel, electric vehicle (EV) battery, and aerospace industries. According to Grand View Research, the global nickel market size was valued at USD 45.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. Similarly, Mordor Intelligence projects continued expansion, citing increased nickel consumption in lithium-ion battery production and infrastructure development, particularly across Asia-Pacific. As demand for high-purity nickel bars rises in industrial manufacturing and alloy production, a select group of global manufacturers has emerged as key suppliers, shaping the backbone of modern metallurgical supply chains. Here’s a data-informed look at the top 10 nickel bars manufacturers leading this critical sector.

Top 10 Nickel Bars Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Carpenter Technology

Domain Est. 1999

Website: carpentertechnology.com

Key Highlights: We grew to be one of the world’s leading specialty materials manufacturers by listening, learning, and solving extreme challenges….

#2 Nickel Bar Manufacturers

Domain Est. 2005

Website: nickelsuppliers.com

Key Highlights: Save time and promptly locate the leading nickel bar manufacturers and suppliers around the country who produce top-of-the-line products for competitive ……

#3 Manufacturer of Nickel Wire & Nickel Bars

Website: deutsche-nickel.de

Key Highlights: This is what you can expect from Deutsche Nickel GmbH in Schwerte. We manufacture Nickel wire and Nickel bars – always of the highest quality….

#4 Nickel Bar Supplier – DFARS – Special Sizes Distributor

Domain Est. 1997

Website: twmetals.com

Key Highlights: TW Metals stocks a variety of sizes and lengths of nickel bar, rod, and wire. If you are looking for special sizes or DFARS or domestic material, TW Metals has ……

#5 Nickel alloys

Domain Est. 1999

Website: rolark.com

Key Highlights: Rolark offers a wide range of grades in nickel alloy plate and bar ranging from 1/8″ to 2″ in plate and 1/2″ to 3″ in bar….

#6 Specialty Steel

Domain Est. 1999

Website: univstainless.com

Key Highlights: Universal Stainless produces semi finished and finished specialty steel including nickely alloy, aerospace grade low alloy and stainless steel….

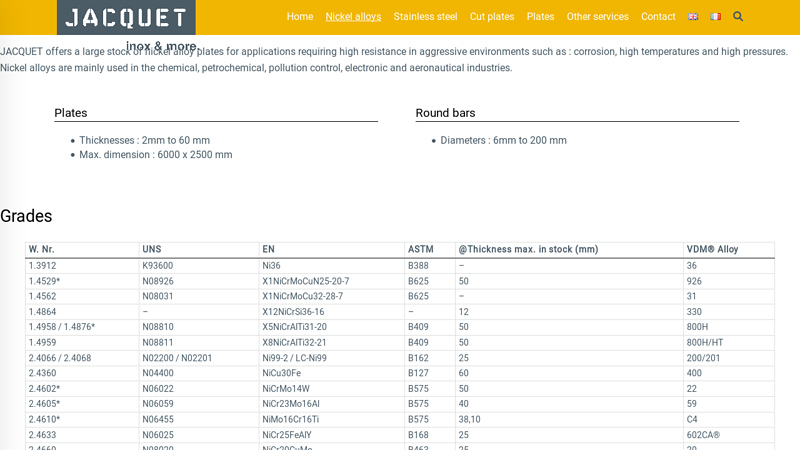

#7 Nickel alloys supplier in the world

Domain Est. 2001

Website: international.myjacquet.com

Key Highlights: JACQUET offers a large stock of nickel alloy plates for applications requiring high resistance in aggressive environments such as : corrosion, high ……

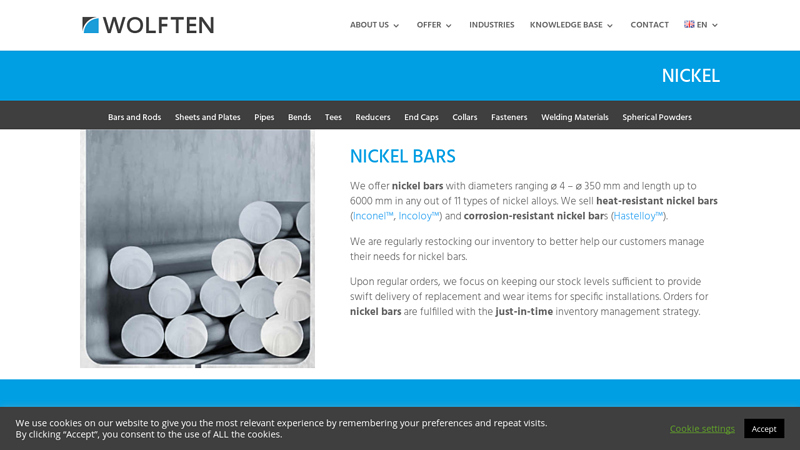

#8 Nickel bars

Domain Est. 2008

Website: wolften.pl

Key Highlights: We offer nickel bars with diameters ranging 4 – 350 mm and length up to 6000 mm in any out of 11 types of nickel alloys….

#9 NeoNickel

Domain Est. 2012

Website: neonickel.com

Key Highlights: NeoNickel are leading suppliers of speciality metals alloys and nickel alloys to industries across Europe. Contact us today for industry leading prices….

#10 Quarto North America

Domain Est. 2020

Website: quarto-na.com

Key Highlights: Quarto offers robust stock of nickel alloy bars and plates for extreme environments. Corrosion-resistant, heat-tolerant, and available in a wide range of sizes ……

Expert Sourcing Insights for Nickel Bars

H2: Market Trends for Nickel Bars in 2026

As we approach 2026, the global nickel bars market is poised for significant transformation, driven by evolving industrial demand, supply chain dynamics, technological advancements, and sustainability imperatives. Nickel bars—primarily used in stainless steel production, alloy manufacturing, and increasingly in clean energy technologies—are at the center of structural shifts in both supply and demand. Below is an analysis of the key trends shaping the nickel bars market in H2 2026.

1. Growing Demand from Electric Vehicle (EV) and Battery Sectors

The most influential driver of nickel demand in 2026 remains the expansion of the electric vehicle (EV) market. High-nickel batteries such as NMC 811 (Nickel-Manganese-Cobalt) and nickel-rich lithium-ion chemistries require significant quantities of refined nickel. Nickel bars, though not directly used in battery cathodes, are part of broader refined nickel supply chains that feed into nickel sulfate production. As EV production accelerates—particularly in China, Europe, and North America—the need for high-purity nickel forms, including those derived from nickel bars, continues to rise.

By H2 2026, battery-grade nickel demand is expected to account for nearly 30% of total refined nickel consumption, up from approximately 20% in 2023. This shift is pressuring traditional nickel producers to diversify into high-purity products, influencing the value and application of nickel bars in downstream processing.

2. Supply Constraints and Geopolitical Volatility

Indonesia continues to dominate global nickel production, primarily through laterite ore and ferronickel, but its focus on downstream processing (e.g., nickel pig iron and mixed hydroxide precipitate—MHP) has limited the availability of primary nickel bars. Meanwhile, traditional producers like Russia (Norilsk Nickel) and Canada (Vale, Glencore) remain key suppliers of high-grade nickel bars.

In H2 2026, geopolitical tensions—particularly sanctions on Russian metals and trade restrictions from Indonesia—are creating supply chain fragmentation. Western markets are increasingly seeking “sanction-free” and ESG-compliant nickel sources, boosting demand for nickel bars from Canada, Australia, and select African projects. This has put upward pressure on prices for certified low-carbon nickel bars, especially those with transparent supply chains.

3. Price Volatility and Market Speculation

Nickel prices have remained volatile through 2024–2025 due to speculative trading, inventory fluctuations on the London Metal Exchange (LME), and policy shifts in major producing countries. In H2 2026, prices are expected to stabilize moderately around $18,000–$22,000 per metric ton, depending on purity and origin, though risks remain from unforeseen supply disruptions or rapid EV adoption exceeding forecasts.

The LME has introduced stricter warehousing rules and new contracts for low-carbon nickel since 2024, improving market transparency. These reforms are helping industrial buyers of nickel bars hedge more effectively, reducing extreme price swings compared to the 2022 crisis.

4. Sustainability and ESG Pressures Reshape Sourcing

Environmental, Social, and Governance (ESG) criteria are increasingly influencing procurement decisions. Nickel bars produced via high-emission processes (e.g., coal-fired smelting in Indonesia) face growing resistance from European and North American manufacturers aiming for carbon-neutral supply chains. In response, producers are investing in low-carbon refining technologies, such as hydrometallurgical processing powered by renewable energy.

By H2 2026, a premium of 10–15% is observed for ESG-certified nickel bars, particularly those compliant with the Initiative for Responsible Mining Assurance (IRMA) or ISO 14064 standards. This trend is accelerating investment in sustainable nickel projects in Canada, Finland (e.g., Boliden’s Kevitsa), and Australia.

5. Technological Shifts in Stainless Steel and Aerospace

While stainless steel remains the largest consumer of nickel (accounting for ~70% of demand), growth is moderating due to market saturation in developed economies and competition from alternative materials. However, high-performance nickel bars are seeing increased use in aerospace, defense, and oil & gas sectors, where superalloys requiring precise compositions are critical.

Advances in additive manufacturing (3D printing) are also creating niche demand for high-purity nickel bar feedstock in powder form, further diversifying industrial applications and supporting premium pricing for specialty grades.

6. Regional Market Dynamics

- Asia-Pacific: Dominates both production and consumption. China’s continued push for vertical integration in the EV battery supply chain supports strong demand for refined nickel inputs, including bars.

- Europe: Focus on green steel and battery manufacturing is driving demand for low-carbon nickel bars. The EU’s Carbon Border Adjustment Mechanism (CBAM) incentivizes imports of cleaner nickel.

- North America: Reshoring of critical minerals supply chains under the U.S. Inflation Reduction Act (IRA) is boosting investment in domestic refining capacity, increasing demand for primary nickel bars as feedstock.

Conclusion: Outlook for H2 2026

In the second half of 2026, the nickel bars market is characterized by bifurcation: growing demand for high-purity, low-carbon nickel in advanced technology sectors, contrasted with slower growth in traditional industrial uses. Supply constraints, ESG compliance, and energy transition policies are reshaping trade flows and pricing structures. For stakeholders, success will depend on access to sustainable feedstock, transparent supply chains, and agility in responding to regulatory and technological changes.

Nickel bars may no longer be the headline product in the nickel space, but they remain a critical component in the transition to a low-carbon economy—especially as foundational inputs to higher-value refined products.

Common Pitfalls Sourcing Nickel Bars: Quality and Intellectual Property (IP) Risks

Sourcing nickel bars, especially for high-performance or regulated industries, involves significant risks related to material quality and intellectual property protection. Overlooking these areas can lead to production delays, compliance failures, safety hazards, and legal disputes. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Chemical Composition Verification

One of the most frequent issues is assuming supplier-provided certifications are accurate without independent verification. Impurities such as sulfur, carbon, or cobalt—even in trace amounts—can drastically affect the performance of nickel in applications like aerospace or chemical processing. Relying solely on mill test reports (MTRs) without third-party lab testing increases the risk of receiving substandard material.

2. Lack of Traceability and Certification Standards

Sourcing nickel bars without full material traceability (e.g., heat number tracking) can result in non-compliance with industry standards such as ASTM B160, ASME, or NACE. This is particularly critical in regulated sectors where auditable documentation is mandatory. Suppliers from regions with lax quality control may provide falsified or incomplete certifications.

3. Inconsistent Mechanical Properties

Nickel bars must meet specific mechanical requirements (e.g., tensile strength, hardness, elongation). Variability in manufacturing processes—especially in secondary or recycled nickel sources—can lead to inconsistent properties, compromising end-product reliability. Failure to specify and verify mechanical test requirements in procurement contracts is a common oversight.

4. Poor Surface Quality and Dimensional Tolerances

Surface defects such as cracks, pits, or scale can act as initiation points for corrosion or fatigue failure. Additionally, bars that don’t meet dimensional tolerances may require costly re-machining or lead to assembly issues. Clear specifications and incoming inspections are essential to avoid these pitfalls.

Intellectual Property (IP) Risks

1. Unauthorized Use of Proprietary Alloys

Some high-performance nickel alloys (e.g., Inconel, Monel) are trademarked and protected by IP rights. Sourcing equivalent-grade materials from unauthorized suppliers may result in counterfeit or infringing products. Using such materials can expose the buyer to legal liability, especially if the final product fails and is traced back to non-compliant materials.

2. Lack of Licensing Agreements

Manufacturers using proprietary nickel alloys in their designs must ensure their supply chain has proper licensing from the alloy developer (e.g., Special Metals Corporation for Inconel). Sourcing bars from unlicensed producers—even if chemically similar—can violate licensing terms and invalidate warranties or certifications.

3. Reverse Engineering and Trade Secret Exposure

When working with custom or proprietary nickel bar specifications, sharing detailed technical data with suppliers without non-disclosure agreements (NDAs) risks exposing trade secrets. Unsecured communication channels or partnerships with unvetted suppliers can lead to IP theft or unauthorized replication of materials.

4. Inadequate Contractual IP Clauses

Procurement contracts that fail to address IP ownership, usage rights, and liability for infringement leave companies vulnerable. Ensure agreements explicitly state that materials are genuine, licensed (if applicable), and that the supplier assumes responsibility for IP compliance.

Mitigation Strategies

- Conduct rigorous supplier audits and require ISO 9001 or AS9100 certification.

- Mandate third-party material testing and full traceability documentation.

- Use accredited laboratories for composition and mechanical verification.

- Include strong IP clauses and NDAs in supplier contracts.

- Source proprietary alloys only through authorized distributors or licensed producers.

Avoiding these pitfalls requires due diligence, clear specifications, and proactive risk management throughout the sourcing process.

Logistics & Compliance Guide for Nickel Bars

Overview of Nickel Bars in International Trade

Nickel bars are semi-finished metal products primarily used in the production of stainless steel, superalloys, batteries, and various industrial applications. Due to their high value and strategic importance, the logistics and compliance requirements for transporting nickel bars across borders are stringent. This guide outlines key considerations for safe, efficient, and compliant shipment of nickel bars.

Classification and Harmonized System (HS) Code

Accurate classification under the Harmonized System is essential for customs clearance and duty assessment. Nickel bars are typically classified under:

– HS Code: 7502.10 – Unwrought nickel, including nickel alloys.

Variations may apply based on purity, form, and alloy composition. Consult local customs authorities or a licensed customs broker to confirm the correct code for your specific product.

Packaging and Handling Requirements

Proper packaging ensures product integrity and safety during transit:

– Use moisture-resistant wrapping (e.g., plastic film or anti-corrosion paper) to prevent oxidation.

– Secure bars on wooden or steel pallets using strapping or shrink-wrapping.

– Label each package clearly with product details, weight, batch number, and handling instructions (e.g., “Keep Dry,” “Do Not Stack”).

– Comply with ISPM 15 standards for wooden packaging materials in international shipments.

Transportation Modes and Considerations

Choose the most suitable transportation method based on volume, destination, and cost:

– Maritime Shipping: Most common for bulk shipments. Use dry container loads (DCL) or flat rack containers for large or irregular bars.

– Rail or Road Freight: Suitable for regional or land-based transport. Ensure vehicles are equipped to handle heavy loads (typically 1–4 tons per bundle).

– Air Freight: Rare due to high cost and weight; generally used only for urgent, small-volume shipments.

Monitor temperature and humidity during transit to prevent corrosion.

Regulatory Compliance and Documentation

Ensure full compliance with international and local regulations:

– Export/Import Licenses: Some countries require permits for nickel exports due to its classification as a strategic material (e.g., China, Russia).

– Certificate of Origin: Required to determine tariff eligibility under trade agreements.

– Material Test Report (MTR): Provides chemical composition and mechanical properties; often required by buyers and customs.

– Safety Data Sheet (SDS): Required under GHS regulations. Nickel is classified as a health hazard (possible carcinogen, skin sensitizer).

– Customs Invoice and Packing List: Must detail weight, dimensions, value, and HS code.

Environmental and Safety Regulations

Nickel bars are subject to various environmental and workplace safety rules:

– REACH (EU): Requires registration of nickel substances and communication of safe use.

– RoHS (EU): Limits use in electrical/electronic equipment; less relevant for raw bars but important for downstream use.

– OSHA (USA): Regulates worker exposure to nickel dust or fumes during handling.

– IMDG Code: Applies if shipped by sea; classify nickel as non-hazardous for transport unless in powdered form.

Anti-Dumping and Trade Restriction Monitoring

Be aware of anti-dumping duties or safeguard measures:

– The U.S., EU, and other jurisdictions have previously imposed duties on nickel imports from certain countries.

– Monitor updates from the International Trade Administration (ITA) or World Trade Organization (WTO) for changes.

Due Diligence and Supply Chain Transparency

Implement responsible sourcing practices:

– Adhere to OECD Due Diligence Guidance for minerals.

– Verify that nickel originates from conflict-free sources.

– Maintain records of suppliers and smelter information for audit purposes.

Insurance and Risk Management

Secure comprehensive cargo insurance covering:

– Physical loss or damage (e.g., corrosion, theft, accidents).

– Delay in transit.

– General Average (in maritime transport).

Declare accurate value to ensure proper coverage.

Conclusion

Transporting nickel bars requires careful planning across logistics, regulatory compliance, and risk management. By adhering to international standards, maintaining accurate documentation, and partnering with experienced freight and customs professionals, businesses can ensure smooth and compliant movement of nickel bars across global supply chains.

Conclusion on Sourcing Nickel Bars

In conclusion, sourcing nickel bars requires a strategic approach that balances quality, cost, reliability, and sustainability. The selection of suppliers should be based on rigorous evaluation of their production standards, certifications (such as ISO and LME accreditation), and compliance with environmental and ethical mining practices. Key sourcing regions—such as Canada, Russia, Indonesia, and Australia—offer varying advantages in terms of purity, production capacity, and logistical efficiency.

Establishing long-term relationships with reputable suppliers, diversifying sources to mitigate geopolitical and supply chain risks, and staying informed about market dynamics—such as price volatility influenced by global demand from industries like electric vehicles and stainless steel—are essential for securing a stable nickel supply. Additionally, considering factors like shipment timelines, payment terms, and material traceability will enhance procurement efficiency and support corporate sustainability goals.

Ultimately, a well-structured sourcing strategy for nickel bars ensures operational continuity, cost-effectiveness, and alignment with both quality requirements and responsible sourcing principles.