The global welding equipment market continues to gain strong momentum, driven by rising demand in construction, automotive, heavy machinery, and infrastructure development. According to Grand View Research, the market was valued at USD 27.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Growth is further fueled by the increasing adoption of automated and robotic welding systems, particularly in advanced manufacturing hubs across North America, Europe, and Asia-Pacific. As industries prioritize precision, energy efficiency, and operator safety, innovation in inverter technology, digital controls, and portable welding solutions has intensified competition among manufacturers. This evolving landscape has paved the way for both established players and agile newcomers to introduce high-performance, smart-enabled welding machines. In this context, we spotlight the top 10 emerging welding machine manufacturers that are leveraging technological advancements and strategic market positioning to capture growing demand and reshape the future of metal fabrication.

Top 10 New Welding Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Custom Automated Welding Manufacturer

Domain Est. 1999

Website: ametinc.com

Key Highlights: AMET is a welding manufacturer that provides custom automated welding machines. Our engineers design state of the art welding systems for various ……

#2 HobartWelders

Domain Est. 1999

Website: hobartwelders.com

Key Highlights: Hobart Welders is a leading welding manufacturer in the U.S. Browse a variety of welders, welding equipment, gear and projects to find the best match for ……

#3 Everlast Inverter Welders Equipment

Domain Est. 2007

Website: everlastgenerators.com

Key Highlights: Everlast Power Equipment, manufacturers of MIG, TIG & Stick welders. For reliable welding machines and supplies shop Everlast Power Equipment….

#4 Equipment & Systems

Domain Est. 2019

Website: amadaweldtech.com

Key Highlights: Manufacturer of equipment and systems for welding, cutting, marking, micromachining, sealing, and bonding. Resistance welding. Laser….

#5 Welding Equipment – Machines and Gear

Domain Est. 1996

Website: millerwelds.com

Key Highlights: Shop our complete selection of welding equipment, including welders, plasma cutters, oxy-fuel outfits, training solutions and welding automation systems….

#6 Welding Equipment

Domain Est. 1996

Website: esab.com

Key Highlights: ESAB is a world leader in welding and cutting equipment and consumables. We offer a complete line of fabrication solutions for virtually every application….

#7 Welding Equipment

Domain Est. 1996

Website: lincolnelectric.com

Key Highlights: Welders and welding equipment from Lincoln Electric including stick, MIG, TIG, advanced and multi-purpose machines, engine drives, submerged arc equipment, ……

#8 Fronius welding machines and welding equipment

Domain Est. 1997

Website: fronius.com

Key Highlights: Optimally equipped: with Fronius welding machines for MIG/MAG, TIG, and MMA welding as well as welding torches, welding accessories, and much more….

#9 Kemppi – Welding Equipment and software

Domain Est. 1998

Website: kemppi.com

Key Highlights: Kemppi offers wide range of welding machines for manual and automated welding. In addition, our offering includes welding torches, welding safety, ……

#10 Sunstone Welders

Domain Est. 2008

Website: sunstonewelders.com

Key Highlights: Sunstone designs and manufactures high-tech micro welding and engraving solutions for many different industries. In short, wherever a very small spot weld ……

Expert Sourcing Insights for New Welding Machine

H2: 2026 Market Trends for New Welding Machines

As we approach 2026, the global welding machine market is undergoing a transformative shift driven by technological innovation, industrial automation, and evolving manufacturing demands. Key trends shaping the adoption and development of new welding machines include advancements in automation and robotics, increased demand for energy-efficient and portable solutions, integration of smart technologies, and growth in high-value industries such as electric vehicles (EVs), renewable energy, and aerospace.

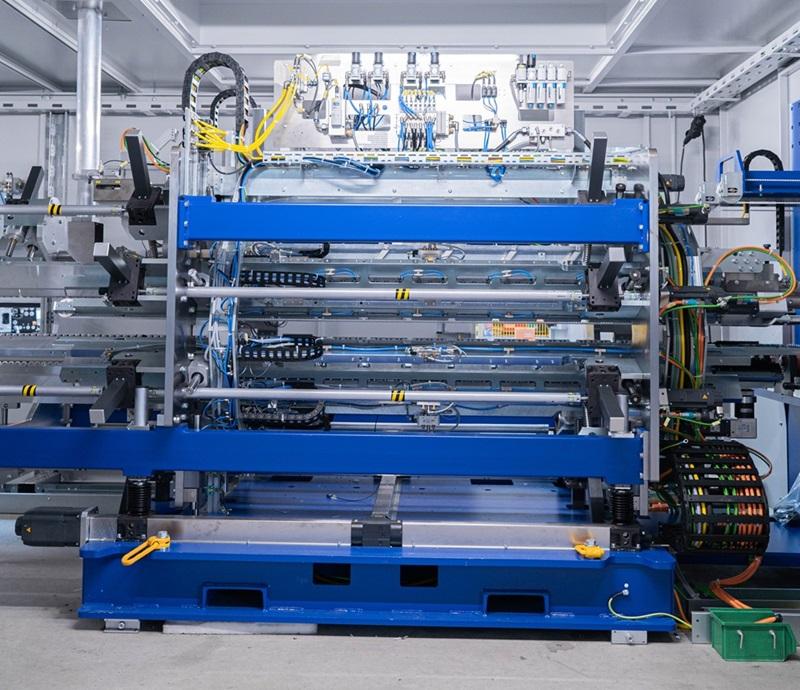

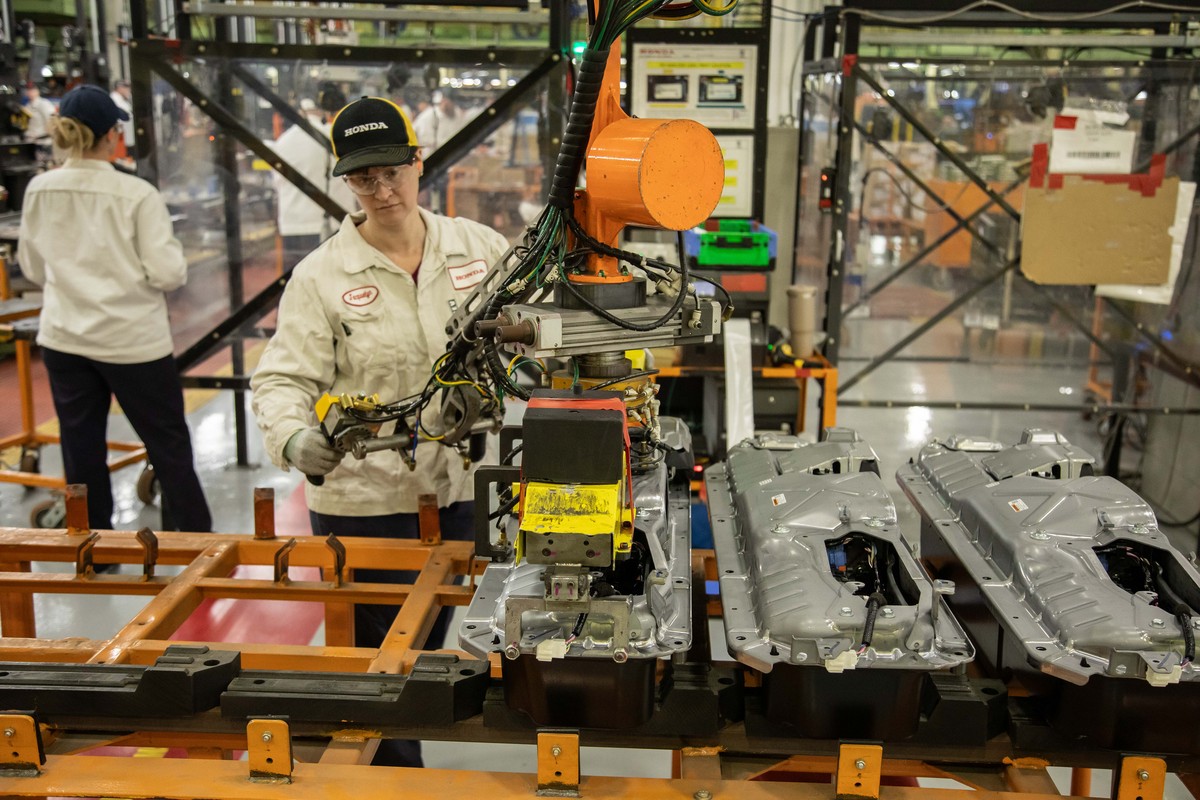

1. Rise of Automation and Robotic Welding

By 2026, fully automated and robotic welding systems are expected to dominate industrial applications, particularly in automotive and heavy manufacturing. Collaborative robots (cobots) equipped with advanced arc and laser welding capabilities are becoming more affordable and accessible, enabling small and medium enterprises (SMEs) to adopt automated welding solutions. This trend enhances precision, productivity, and worker safety while reducing long-term operational costs.

2. Growth in Smart and IoT-Enabled Welding Machines

The integration of Internet of Things (IoT) and cloud-based monitoring in welding machines is a defining trend. Smart welding systems now offer real-time data collection, remote diagnostics, predictive maintenance, and performance analytics. By 2026, these connected devices will be standard in advanced fabrication environments, allowing for better quality control, reduced downtime, and seamless integration into Industry 4.0 production ecosystems.

3. Demand for Energy Efficiency and Sustainability

Environmental regulations and corporate sustainability goals are pushing manufacturers toward energy-efficient inverter-based welding machines. These systems consume less power, generate lower emissions, and offer superior control over the welding process. The shift toward green manufacturing is expected to accelerate the replacement of older transformer-based units with digital, energy-saving alternatives.

4. Expansion in Electric Vehicle and Battery Manufacturing

The booming EV market is creating unprecedented demand for precision welding in battery pack assembly and lightweight vehicle frame construction. Laser welding and micro-TIG technologies are gaining traction due to their ability to join dissimilar and thin materials (e.g., aluminum and high-strength steel) with minimal heat distortion. By 2026, welding machine manufacturers will increasingly tailor solutions for EV production lines.

5. Portable and Multi-Process Welding Solutions

There is a growing preference for compact, multi-process welding machines (e.g., MIG, TIG, Stick) that offer versatility for fieldwork, construction, and repair operations. Advances in inverter technology have made these machines lighter, more efficient, and suitable for use in remote or mobile applications, further boosting their adoption across industries.

6. Regional Market Dynamics

Asia-Pacific, led by China, India, and Japan, remains the largest market for welding equipment due to rapid industrialization and infrastructure development. Meanwhile, North America and Europe are focusing on high-tech, automated solutions driven by reshoring trends and advanced manufacturing initiatives. Government investments in infrastructure under stimulus programs are also expected to boost welding machine demand through 2026.

In conclusion, the 2026 welding machine market will be characterized by intelligent, automated, and sustainable solutions tailored to meet the needs of next-generation manufacturing. Companies that innovate in digital integration, energy efficiency, and application-specific designs will be best positioned to capture market share in this evolving landscape.

Common Pitfalls When Sourcing a New Welding Machine (Quality & IP)

Sourcing a new welding machine involves more than just selecting a model and placing an order. Overlooking critical aspects related to quality and intellectual property (IP) can result in performance issues, safety hazards, legal risks, and long-term cost overruns. Below are common pitfalls to avoid:

1. Ignoring Build Quality and Component Sourcing

Purchasing a machine based solely on price or brand recognition without evaluating the actual build quality can lead to frequent breakdowns and inconsistent performance. Low-cost machines often use inferior components (e.g., substandard transformers, cooling fans, or wire feeds), which reduce reliability and increase downtime.

Best Practice:

Inspect the materials and components used. Opt for machines with robust enclosures, high-duty cycle ratings, and reputable internal components. Request third-party certification (e.g., CE, UL, ISO) to verify build standards.

2. Overlooking IP Infringement Risks

Some suppliers, particularly in emerging markets, may offer machines that mimic patented designs, software, or user interfaces from established brands. Purchasing such equipment can expose your company to intellectual property infringement claims, especially in regulated industries or export markets.

Best Practice:

Verify that the manufacturer holds legitimate IP rights or appropriate licensing. Request documentation on software origin, firmware compliance, and design patents. Avoid vendors offering “compatible” or “clone” versions of well-known models at suspiciously low prices.

3. Assuming All Digital Controls Are Equal

Modern welding machines often feature digital interfaces, programmable parameters, and connectivity (IoT). However, not all systems are created equal. Poorly implemented software can lead to calibration drift, data logging errors, or cybersecurity vulnerabilities.

Best Practice:

Evaluate the software’s reliability and update policy. Check whether firmware updates are provided securely and regularly. Inquire about data export compliance (e.g., GDPR, NIST) if integrating with production monitoring systems.

4. Neglecting After-Sales Support and Spare Parts Availability

High-quality machines lose value if spare parts are unavailable or repair services are slow. Some manufacturers restrict part distribution or charge premium prices due to IP-protected components, creating long downtimes.

Best Practice:

Assess the supplier’s service network, spare parts inventory, and warranty terms. Confirm whether third-party repairs are permitted or if IP locks (e.g., encrypted control boards) prevent independent servicing.

5. Falling for Misleading IP-Related Marketing Claims

Vendors may exaggerate innovation or claim proprietary technology without substantiation. Phrases like “patent-pending” or “exclusive technology” can be used deceptively to imply uniqueness or superiority.

Best Practice:

Request actual patent numbers and verify them through public databases (e.g., USPTO, WIPO). Distinguish between true innovation and rebranded generic technology.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure they invest in welding equipment that is reliable, legally compliant, and aligned with long-term operational goals.

Logistics & Compliance Guide for New Welding Machine

Unpacking and Inspection

Upon delivery, carefully unpack the welding machine in a clean, dry area. Verify the contents against the packing slip, ensuring all components—welding torch, power cables, grounding clamp, user manual, and accessories—are present. Inspect the unit for any visible damage incurred during transit. Report discrepancies or damage to the supplier and carrier immediately.

Transportation and Handling

Use appropriate lifting equipment (e.g., forklift, pallet jack) to move the machine, adhering to weight limits and center-of-gravity guidelines. Never tilt or drop the unit. Secure the machine during transport to prevent shifting. Always follow manufacturer-recommended handling procedures to avoid damage to internal components.

Site Preparation and Installation

Ensure the installation site meets electrical requirements (voltage, phase, amperage) specified in the manual. Provide adequate ventilation to disperse fumes and maintain ambient temperature within operational limits. Position the machine on a stable, level surface away from moisture, flammable materials, and high-traffic areas. Ground the unit properly per local electrical codes and manufacturer instructions.

Regulatory Compliance

Confirm the welding machine complies with relevant safety and performance standards, such as:

– OSHA 29 CFR 1910.254 (U.S. welding, cutting, and brazing standards)

– NFPA 51B (Fire Prevention in Welding, Cutting, and Allied Processes)

– ANSI Z49.1 (Safety in Welding, Cutting, and Allied Processes)

– CE Marking / EU Machinery Directive 2006/42/EC (for European installations)

– CSA W186 (Canadian welding safety standard)

Retain all compliance documentation, including certificates of conformity and technical files, for audit purposes.

Operator Training and Certification

Only trained and authorized personnel should operate the welding machine. Provide comprehensive training on startup, operation, shutdown, maintenance, and emergency procedures. Ensure operators are certified per company policy and regulatory requirements (e.g., AWS, ASME, or internal qualification programs).

Safety Equipment and PPE

Mandate the use of appropriate personal protective equipment (PPE), including:

– Welding helmet with proper shade lens

– Flame-resistant clothing

– Gloves, safety boots, and hearing protection

– Respiratory protection if ventilation is inadequate

Ensure fire extinguishers and first-aid kits are readily accessible in the work area.

Maintenance and Recordkeeping

Follow the manufacturer’s maintenance schedule for routine inspections, cleaning, and part replacement. Keep a log of all maintenance, repairs, and compliance checks. Retain records to demonstrate due diligence and support warranty claims.

Disposal and End-of-Life

At end-of-life, dispose of the welding machine in accordance with local environmental regulations. Recycle components such as copper cables and metal casings through certified e-waste handlers. Do not discard in regular trash.

Conclusion on Sourcing a New Welding Machine

After a thorough evaluation of operational requirements, technical specifications, budget constraints, and long-term maintenance considerations, sourcing a new welding machine is a necessary and strategic investment to enhance productivity, ensure weld quality, and support future growth. The selection process has identified a machine that aligns with our production needs, offering advanced features such as improved energy efficiency, better arc stability, and compatibility with multiple welding processes.

Additionally, the chosen supplier provides reliable after-sales support, comprehensive warranty coverage, and readily available spare parts—critical factors for minimizing downtime. By upgrading our welding capabilities, we position the organization to meet stringent quality standards, increase throughput, and maintain a competitive edge in the market.

In conclusion, proceeding with the procurement of the recommended welding machine is a well-justified decision that supports operational excellence and long-term sustainability.