The global neoprene fabric market has experienced steady growth, driven by increasing demand across industries such as automotive, healthcare, sports & recreation, and electronics. According to Mordor Intelligence, the global neoprene market was valued at approximately USD 7.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. The rise in demand for high-performance elastomers in specialty applications—particularly for wetsuits, protective gear, and insulation materials—has significantly contributed to this expansion. Additionally, Grand View Research highlights the growing adoption of synthetic rubber alternatives in sustainable manufacturing processes as a key trend boosting neoprene’s market trajectory. With Asia-Pacific emerging as a dominant production and consumption hub, manufacturers are enhancing production capacities and investing in innovation to meet evolving regulatory and performance standards. In this competitive landscape, the following list highlights the top 10 neoprene fabric manufacturers leading the market through technological advancement, global supply chain reach, and consistent quality output.

Top 10 Neoprene Fabrics Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Your Trusted Custom Neoprene Fabric Products Manufacturer

Domain Est. 2023

Website: neoprene-bag.com

Key Highlights: We offer OEM neoprene fabric products in a broad range of types, artwork, packaging and other accessories. Also, we have a strong fabric supply chain….

#2 Neoprene Wetsuit Material Manufacturer

Domain Est. 1999

Website: monmouthrubber.com

Key Highlights: Neoprene Sponge Wetsuit Material We make it in America and Ship Worldwide. Call Toll Free: (888) 362-6888 for Free Samples and Tech Support….

#3 Neoprene Fabric Manufacturer

Domain Est. 2021

Website: vastopneoprene.com

Key Highlights: A wide range of neoprene fabric for orthosis, sports braces, wetsuits, electronic cases, shapewear, water softener jackets, and much more….

#4 neoprene material Manufacturers & Suppliers

Domain Est. 2023

Website: jbneoprene.com

Key Highlights: Our premier products include CR Smooth Skin Neoprene, renowned for its shiny, waterproof, and super-stretch attributes, making it ideal for diving suits, ……

#5 Neoprene Sheet

Domain Est. 1996

Website: pacificeagle.com

Key Highlights: Pacific Eagle has been supplying our first-rate neoprene sheets to customers all over the world for more than 30 years….

#6 Macro International

Domain Est. 1997 | Founded: 1984

Website: macrointlco.com

Key Highlights: Since 1984, Macro International has been the leading supplier of neoprene rubber sheets in North America. With our warehouse located in Irvine, CA, we can ……

#7 YAMAMOTO – Neoprene Specialist

Domain Est. 2004

Website: yamamoto-bio.com

Key Highlights: 100% Limestone-based. The main ingredient is Japanese limestone, which is advantageous in environmental and quality aspects….

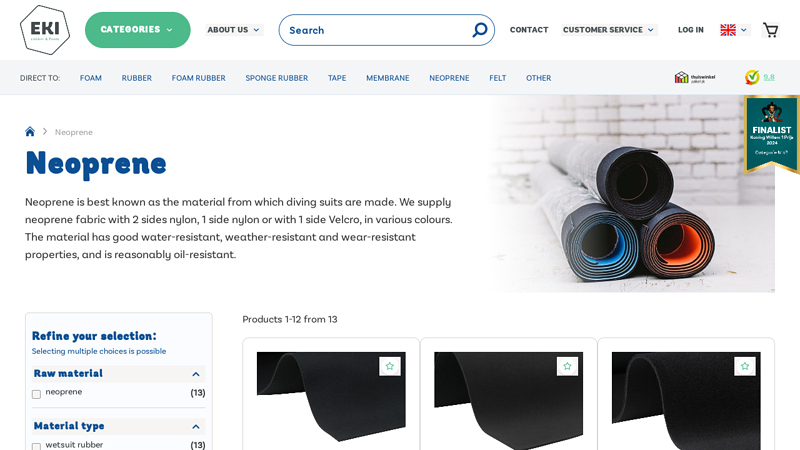

#8 Neoprene fabric for various applications

Domain Est. 2004

Website: ekibv.com

Key Highlights: 14-day returnsWe supply neoprene fabric with 2 sides nylon, 1 side nylon or with 1 side Velcro, in various colours. The material has good water-resistant, weather-resistant ……

#9 Derwei

Domain Est. 2012

Website: derweitex.com

Key Highlights: Our neoprene materials fabric are waterproof, breathable and high stretchable. Derwei is a renowned neoprene textile fabric supplier provide a series of ……

#10 Neoprene Fabric By The Yard

Domain Est. 2014

Website: fabricwholesaledirect.com

Key Highlights: Free delivery over $99 · 30-day returns…

Expert Sourcing Insights for Neoprene Fabrics

H2: Projected Market Trends for Neoprene Fabrics in 2026

The global neoprene fabric market is poised for continued evolution by 2026, driven by shifting consumer preferences, technological advancements, and sustainability imperatives. As industries ranging from sportswear to automotive adapt to new regulatory and environmental standards, neoprene—a synthetic rubber known for its durability, flexibility, and thermal insulation—is experiencing both challenges and opportunities.

One of the key drivers shaping the 2026 market is the growing demand in the activewear and fashion sectors. Neoprene’s use in high-performance sportswear, wetsuits, and fashion-forward apparel remains strong, particularly with the rise of athleisure trends. Innovations in lightweight, breathable neoprene variants are enabling designers to expand its application beyond traditional uses, enhancing comfort and aesthetic appeal.

Sustainability concerns are also influencing market dynamics. While traditional neoprene is petroleum-based and not biodegradable, there is increasing R&D investment in eco-friendly alternatives. Chloroprene rubber producers are exploring bio-based feedstocks and closed-loop recycling systems to reduce environmental impact. By 2026, we expect to see a greater commercial presence of “green neoprene” derived from limestone or recycled materials, particularly in eco-conscious markets such as Europe and North America.

Another trend is the expansion of neoprene applications in industrial and automotive sectors. Its resistance to oil, heat, and weathering makes it ideal for gaskets, seals, and insulation components. As electric vehicle (EV) production scales globally, demand for durable, heat-resistant materials like neoprene is expected to rise, especially in cable insulation and vibration-damping components.

Regionally, Asia-Pacific is anticipated to maintain its dominance in both production and consumption, fueled by manufacturing hubs in China, Japan, and South Korea. Meanwhile, North America and Europe are expected to lead in innovation and sustainable product adoption, with stricter environmental regulations pushing manufacturers toward greener formulations.

In summary, the 2026 neoprene fabric market will be characterized by a dual focus on performance enhancement and environmental responsibility. Companies that invest in sustainable innovation, diversify applications, and align with circular economy principles are likely to gain competitive advantage in this evolving landscape.

Common Pitfalls Sourcing Neoprene Fabrics (Quality, IP)

Sourcing neoprene fabrics can be complex, with significant risks related to both material quality and intellectual property (IP). Avoiding these common pitfalls is crucial for ensuring product performance, compliance, and brand protection.

Inconsistent Material Quality and Performance

One of the most frequent challenges is receiving neoprene fabric that fails to meet specified performance standards. Variations in thickness, density, cell structure, and tensile strength can occur between batches or suppliers, leading to inconsistent end-product performance. Poor quality neoprene may degrade quickly under UV exposure, lose elasticity, or delaminate—especially in demanding applications like wetsuits or protective gear. Always request physical samples and conduct third-party testing for critical properties such as elongation, compression set, and chemical resistance before committing to large orders.

Lack of Certification and Compliance Verification

Many neoprene applications—especially in sportswear, medical, or industrial use—require compliance with safety and environmental standards (e.g., REACH, RoHS, OEKO-TEX). A common pitfall is assuming supplier claims without verifying certifications. Some vendors provide falsified or outdated documentation. Always demand current, traceable compliance certificates and consider independent lab testing to confirm adherence to regulatory requirements.

Misrepresentation of Neoprene Type and Composition

Suppliers may mislabel or misrepresent the type of neoprene, such as passing off lower-grade recycled or blended foam as virgin or limestone-based neoprene. Limestone neoprene is often marketed as more sustainable and higher performing, but without proper verification (e.g., manufacturer batch records or material data sheets), buyers risk paying a premium for inferior materials. Clearly define the required neoprene chemistry and source from reputable, audited suppliers.

Intellectual Property Infringement Risks

Sourcing neoprene from unauthorized or counterfeit suppliers can expose your business to IP violations. Patented technologies—such as specific lamination techniques, eco-friendly production processes (e.g., Yulex®), or branded fabric finishes—are often copied without license. Using such materials, even unknowingly, can result in legal action, product seizures, or reputational damage. Ensure your supplier has legitimate rights to the technology and request proof of IP clearance, especially when using performance-enhancing or eco-labeled materials.

Inadequate Supply Chain Transparency

A lack of visibility into the full supply chain—from raw material sourcing to final fabrication—increases risks related to quality control and ethical sourcing. Some suppliers outsource production to unvetted subcontractors, leading to inconsistencies and potential labor or environmental violations. Conduct supplier audits and require detailed traceability documentation to mitigate these risks and support sustainability claims.

Poor Lamination and Fabric Backing Quality

Neoprene is often laminated with textiles (e.g., nylon, polyester) for durability and comfort. A frequent quality issue is poor adhesion between layers, causing delamination after minimal use or washing. Inconsistent lamination pressure, low-grade adhesives, or improper curing processes contribute to this defect. Inspect bonded samples under stress and washing simulations before approving production.

By proactively addressing these pitfalls through due diligence, testing, and legal verification, businesses can secure reliable, high-quality neoprene supplies while protecting their brand and compliance standing.

Logistics & Compliance Guide for Neoprene Fabrics

Neoprene fabrics, valued for their durability, flexibility, and insulating properties, are widely used in industries ranging from sportswear and wetsuits to industrial applications and medical devices. Efficient logistics and strict compliance are essential for successful international trade and regulatory adherence. This guide outlines key considerations for managing the transportation, handling, and regulatory compliance of neoprene fabrics.

Regulatory Classification & Tariff Codes

Correct classification is the foundation of compliance. Neoprene fabrics are typically classified under the Harmonized System (HS) based on composition, weight, and finish:

- HS Code Example: 5903.20 (Impregnated, coated, covered or laminated textile fabrics with rubber or plastics, of man-made fibers)

- Sub-classification: May vary by country; confirm local customs regulations.

- Importance: Accurate classification affects duty rates, import quotas, and eligibility for trade agreements (e.g., USMCA, RCEP).

- Action: Work with customs brokers to classify goods properly and maintain technical specifications for verification.

Chemical Compliance & Safety Regulations

Neoprene (polychloroprene) is a synthetic rubber, and its production and content may be subject to chemical regulations:

- REACH (EU): Ensure compliance with Registration, Evaluation, Authorization and Restriction of Chemicals. Check for Substances of Very High Concern (SVHCs) in additives (e.g., phthalates, accelerators).

- RoHS (EU & China): Restricts hazardous substances; may apply if fabric is used in electronic enclosures.

- Proposition 65 (California, USA): Requires warnings if products contain listed chemicals (e.g., certain accelerators in rubber).

- Action: Request a Supplier Declaration of Conformity (SDoC) and Safety Data Sheet (SDS) from manufacturers. Conduct third-party testing if necessary.

Environmental & Sustainability Standards

Environmental regulations are increasingly relevant for synthetic materials:

- PFAS Restrictions: Some neoprene finishes may contain PFAS; monitor EU and U.S. state-level bans.

- Waste & Recycling: Neoprene is not biodegradable; comply with local waste disposal regulations.

- Eco-Labels: Consider certifications like Bluesign® or OEKO-TEX® Standard 100 to demonstrate environmental and human-ecological safety.

- Action: Evaluate supply chain sustainability and document environmental compliance for corporate social responsibility (CSR) reporting.

Packaging & Handling Requirements

Proper packaging ensures product integrity during transit:

- Moisture Protection: Neoprene can be sensitive to moisture; use moisture-resistant wrapping or desiccants.

- Roll Protection: Fabrics are typically shipped in rolls; use edge protectors and sturdy cardboard cores.

- Stacking & Weight Limits: Avoid deformation by adhering to pallet stacking limits and using reinforced pallets.

- Labeling: Include handling labels (e.g., “This Way Up”, “Protect from Moisture”) and barcodes for tracking.

Transportation & Logistics

Neoprene fabrics require careful logistical planning:

- Mode of Transport: Suitable for sea, air, and land freight. Sea freight is cost-effective for bulk shipments.

- Temperature Control: Store and transport in dry, temperature-stable conditions; avoid prolonged exposure to extreme heat or cold.

- Documentation: Prepare commercial invoice, packing list, bill of lading/air waybill, and certificate of origin.

- Incoterms: Clearly define responsibilities using terms like FOB, CIF, or DDP to avoid disputes.

Import/Export Documentation

Ensure all required paperwork is accurate and complete:

- Commercial Invoice: Must include detailed product description, HS code, value, and country of origin.

- Packing List: Specifies dimensions, weight, and number of packages.

- Certificate of Origin: May be required for preferential tariff treatment under free trade agreements.

- Import Licenses: Not typically required for neoprene fabrics, but verify based on destination country and end-use.

Country-Specific Compliance

Regulatory requirements vary by market:

- United States: Comply with CPSC guidelines if used in children’s products; FTC labeling rules for fiber content.

- European Union: Follow EU Customs Code and ECHA guidelines; CE marking not typically required unless part of a regulated product.

- China: Requires CCC certification only if integrated into regulated products (e.g., protective gear).

- Action: Consult local legal counsel or trade consultants for market-specific rules.

Risk Mitigation & Best Practices

- Supplier Audits: Verify manufacturing processes and compliance capabilities.

- Insurance: Cover cargo for loss, damage, or delay.

- Traceability: Maintain batch records for quality control and recall readiness.

- Stay Updated: Monitor changes in regulations (e.g., EU Green Deal, SCIP database).

By following this guide, businesses can ensure compliant, efficient, and secure logistics for neoprene fabrics across global supply chains.

Conclusion for Sourcing Neoprene Fabrics

Sourcing neoprene fabrics requires a strategic approach that balances quality, cost, sustainability, and reliability. As a versatile material widely used in fashion, sportswear, wetsuits, and industrial applications, neoprene must meet specific performance standards such as durability, flexibility, and thermal insulation. Key considerations in the sourcing process include selecting reputable suppliers, verifying material certifications (e.g., RoHS, REACH, or eco-friendly alternatives), and assessing customization options like thickness, lamination, and color.

Establishing long-term relationships with manufacturers, particularly those offering vertical integration or sustainable production practices, can enhance supply chain stability and support corporate social responsibility goals. Additionally, conducting sample testing and on-site audits helps ensure consistency and compliance with product specifications.

In conclusion, successful neoprene fabric sourcing hinges on thorough due diligence, clear communication with suppliers, and a commitment to quality and sustainability. By adopting a proactive and informed procurement strategy, businesses can secure high-performing materials that meet both functional requirements and market demands.