The global nebulizer market is experiencing steady growth, driven by the rising prevalence of respiratory disorders such as asthma, chronic obstructive pulmonary disease (COPD), and other chronic lung conditions. According to Grand View Research, the global nebulizer market size was valued at USD 2.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is further fueled by increasing air pollution, an aging global population, and heightened awareness of respiratory health, especially following the post-pandemic emphasis on pulmonary care.

As demand surges, innovation in nebulizer technology—particularly compact, quiet, and portable devices tailored for adult users—has become a key differentiator among manufacturers. In this evolving landscape, a select group of companies has emerged as leaders in producing reliable, efficient nebulizer machines for adults. Drawing on market data and product performance metrics, here are the top 9 nebulizer machine manufacturers for adults shaping the industry’s future.

Top 9 Nebulizer Machine Adults Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Asthma management

Domain Est. 1987

Website: usa.philips.com

Key Highlights: A nebulizer changes medication from a liquid to a mist so that it can be more easily inhaled into the lungs….

#2 Nebulizers

Domain Est. 1996

Website: binsons.com

Key Highlights: $5 delivery 30-day returnsPacifica Elite Nebulizer Product Image. Pacifica Elite Nebulizer. Drive Medical. Insurance Eligible. $198.00. View Details · Fish Pediatric Compressor Neb…

#3 Nebulizer Treatments, Machines & Supplies

Domain Est. 1996

Website: lincare.com

Key Highlights: Lincare offers a variety of nebulizer machines to fit your routine and respiratory needs for medicated breathing treatments. Learn more now….

#4 OMRON Respiratory Nebulizers & Devices for At

Domain Est. 1997

Website: omronhealthcare.com

Key Highlights: OMRON offers prescription-grade, at-home and portable nebulizer solutions to fit a variety of needs and budgets….

#5 Respiratory

Domain Est. 1997

Website: apria.com

Key Highlights: See Apria’s nebulizer products and get support through downloadable manuals….

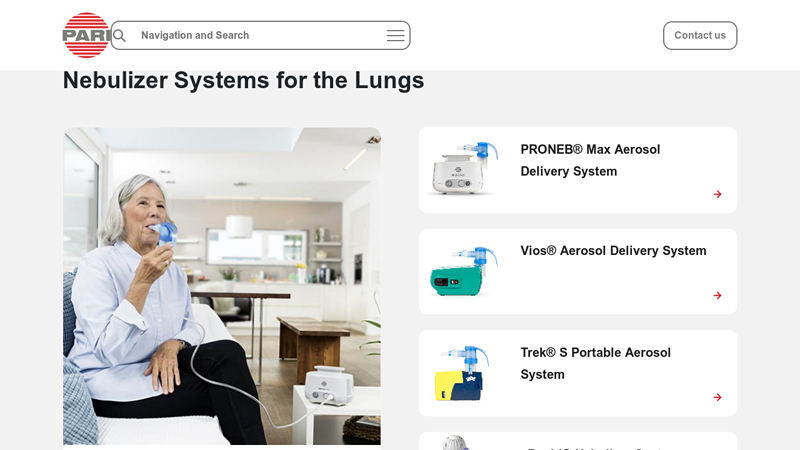

#6 Nebulizer Systems for the Lungs

Domain Est. 1998

Website: pari.com

Key Highlights: PARI has a wide range of aerosol delivery systems to meet the needs of every patient – whether pediatric, adult, or patients on the go….

#7 TYVASO® (treprostinil) Nebulizer

Domain Est. 2008

Website: tyvaso.com

Key Highlights: The TYVASO® (treprostinil) Inhalation System is a lightweight, handheld, portable nebulizer. It allows for dosing at home or on the go….

#8 Portable nebulizer Apowus

Domain Est. 2024

Website: myapowus.com

Key Highlights: Nebulizer Machine for Adults and Kids Travel and Household Use. The APOWUS portable nebulizer is ideal for both children and adults, offering convenience and ……

#9 PARI Authorized Nebulizer Machines & Supplies

Domain Est. 2012

Website: nebology.com

Key Highlights: Shop for PARI nebulizer systems, nebulizer cups, replacement parts, and accessories. Clinically proven, and available for shipment direct to your home….

Expert Sourcing Insights for Nebulizer Machine Adults

H2: Market Trends for Nebulizer Machines for Adults in 2026

The global market for nebulizer machines for adults is poised for significant transformation by 2026, driven by technological advancements, rising respiratory disease prevalence, and shifting healthcare dynamics. Below is an analysis of key trends expected to shape the adult nebulizer market in 2026.

1. Rising Prevalence of Chronic Respiratory Diseases

The increasing incidence of chronic obstructive pulmonary disease (COPD), asthma, and other respiratory conditions among adults is a primary driver of market growth. According to the World Health Organization (WHO), over 300 million people globally suffer from asthma, and COPD is the third leading cause of death worldwide. As aging populations grow—especially in North America and Europe—the demand for effective, at-home respiratory therapy devices like nebulizers is expected to surge.

2. Shift Toward Portable and Smart Nebulizers

By 2026, portable nebulizers are anticipated to dominate the market. Advancements in miniaturization and battery technology have led to the development of compact, lightweight devices that allow greater mobility and convenience for adult users. Additionally, integration with smart technology—such as Bluetooth connectivity, mobile app integration for treatment tracking, and dosage reminders—is becoming a standard. These smart nebulizers enhance patient adherence and enable remote monitoring by healthcare providers, aligning with the growing telehealth trend.

3. Growth of Home Healthcare and Self-Management

The shift from hospital-based care to home healthcare is accelerating, especially post-pandemic. Adults with chronic respiratory conditions are increasingly managing their conditions at home, fueling demand for user-friendly nebulization systems. Nebulizers that are easy to clean, operate quietly, and require minimal maintenance are gaining preference among consumers and caregivers alike.

4. Expansion in Emerging Markets

While North America and Europe remain dominant markets, Asia-Pacific and Latin America are expected to witness the highest growth rates by 2026. Increasing healthcare access, rising awareness of respiratory health, and government initiatives in countries like India, China, and Brazil are contributing to market expansion. Local manufacturing and lower-cost device options are making nebulizers more accessible to a broader adult population.

5. Focus on Aerosol Efficiency and Drug Delivery Optimization

Manufacturers are investing in improving nebulizer efficiency, with a focus on enhancing aerosol particle size and delivery speed. Devices that deliver medication more effectively to the lower airways—such as mesh nebulizers—are gaining traction due to their faster treatment times and higher drug deposition rates compared to traditional jet nebulizers.

6. Regulatory and Reimbursement Landscape

In 2026, regulatory approvals and favorable reimbursement policies will continue to influence market dynamics. In regions like the U.S. and EU, FDA- and CE-marked devices with proven clinical efficacy are preferred. Increasing insurance coverage for home-use respiratory devices is also expected to reduce out-of-pocket costs, encouraging greater adoption among adult patients.

7. Sustainability and Environmental Considerations

Environmental consciousness is beginning to impact the design and packaging of nebulizer machines. Companies are exploring recyclable materials, energy-efficient components, and reduced plastic usage. Reusable nebulizer kits and eco-friendly packaging are likely to become differentiating factors in competitive markets.

Conclusion

By 2026, the adult nebulizer machine market will be defined by innovation, accessibility, and patient-centric design. With continued emphasis on portability, digital integration, and improved therapeutic outcomes, manufacturers who align with these trends will be well-positioned to capture growing demand across both developed and emerging economies.

Common Pitfalls When Sourcing Nebulizer Machines for Adults: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Nebulizer Machines for Adults

This guide outlines key logistics considerations and regulatory compliance requirements for the distribution, handling, and use of nebulizer machines intended for adult patients. Ensuring proper logistics and adherence to compliance standards is critical for patient safety, product efficacy, and legal operation.

Regulatory Classification and Approval

Nebulizer machines are classified as medical devices and are subject to regulation by health authorities such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other national regulatory bodies. In the United States, most nebulizers are classified as Class II medical devices, requiring 510(k) premarket notification to demonstrate substantial equivalence to a legally marketed device. In the European Union, compliance with the Medical Device Regulation (MDR) (EU) 2017/745 is mandatory, including CE marking. Manufacturers and distributors must ensure devices are registered, labeled correctly, and accompanied by necessary documentation.

Labeling and Packaging Requirements

All nebulizer units must be labeled in accordance with regional regulations. Labels should include the device name, model number, manufacturer information, intended use, contraindications, warnings, and instructions for use. Language must be appropriate for the target market (e.g., English in the U.S., multilingual in the EU). Packaging must be tamper-evident, protect the device during transit, and include sterile components where applicable. Symbols per ISO 15223-1 (e.g., sterile, single use, manufacturer) must be present.

Import and Export Compliance

International shipments of nebulizers require compliance with import/export regulations. Key steps include:

– Valid medical device registration in the destination country.

– Proper Harmonized System (HS) code classification (e.g., 9018.90 for medical nebulizers).

– Compliance with customs documentation, including commercial invoices, packing lists, and certificates of origin.

– Adherence to restricted party screening and export control regulations (e.g., U.S. Department of Commerce, Bureau of Industry and Security).

Storage and Handling

Nebulizer machines must be stored in a clean, dry, temperature-controlled environment. Recommended storage conditions are typically 10°C to 30°C (50°F to 86°F) with low humidity to prevent damage to electronics and packaging integrity. Devices should be handled with clean gloves when possible and protected from physical shock, dust, and moisture. Inventory should follow FIFO (First In, First Out) principles to prevent expiration or obsolescence.

Transportation and Distribution

Transport of nebulizers must maintain product integrity throughout the supply chain. Use of validated packaging and climate-controlled vehicles or containers is recommended for long-distance or international shipping. Carriers must be trained in handling medical devices, and shipment tracking with real-time monitoring (e.g., temperature loggers) may be required for high-risk environments. Delivery to healthcare facilities or end users must comply with contractual and regulatory delivery standards.

Quality Management System (QMS)

Manufacturers and distributors must maintain a certified Quality Management System compliant with ISO 13485:2016. The QMS ensures consistent design, production, and distribution of medical devices under controlled conditions. Regular internal audits, supplier evaluations, and corrective action processes (CAPA) are required to maintain compliance and product quality.

Post-Market Surveillance and Adverse Event Reporting

Once in use, nebulizers are subject to post-market surveillance. Companies must establish procedures for monitoring device performance, collecting user feedback, and reporting adverse events to regulatory authorities (e.g., FDA’s MedWatch program, EUDAMED in the EU). Timely reporting of malfunctions, injuries, or deaths related to device use is mandatory and critical for patient safety.

Training and Documentation

Healthcare providers and patients must receive adequate training on proper use, cleaning, and maintenance of the nebulizer. Manufacturers must provide clear Instructions for Use (IFU), multilingual where necessary. Distributors and logistics personnel should be trained on handling, storage, and compliance protocols. All activities related to logistics and compliance must be documented and retained per regulatory requirements (typically 5–10 years).

Environmental and Disposal Compliance

End-of-life nebulizer units containing electronics or batteries must be disposed of in accordance with environmental regulations such as WEEE (Waste Electrical and Electronic Equipment) in the EU or state-specific e-waste laws in the U.S. Patients and facilities should be informed of proper disposal methods to prevent environmental contamination.

Conclusion

Effective logistics and strict compliance with medical device regulations are essential for the safe and legal distribution of nebulizer machines for adults. By adhering to these guidelines, stakeholders can ensure product integrity, regulatory adherence, and optimal patient outcomes. Regular review of evolving regulations and continuous improvement of supply chain practices are recommended.

Conclusion: Sourcing Nebulizer Machines for Adults

Sourcing nebulizer machines for adults requires careful consideration of several key factors, including clinical effectiveness, ease of use, portability, noise level, maintenance requirements, and cost. Adult patients often have chronic respiratory conditions such as asthma, COPD, or bronchitis, making reliable and efficient medication delivery essential. Therefore, selecting nebulizers that offer consistent particle size, short treatment times, and compatibility with prescribed medications is crucial.

When sourcing, it’s important to evaluate both compressor (jet) and mesh (ultrasonic) nebulizer types, weighing their pros and cons in terms of durability, portability, and medication compatibility. Reputable suppliers, medical device certifications (such as FDA or CE marking), and post-purchase support services—like warranty, customer service, and availability of replacement parts—should also be prioritized.

Additionally, involving healthcare professionals in the selection process ensures that the chosen devices meet clinical standards and individual patient needs. Whether for home use, clinics, or long-term care facilities, investing in high-quality nebulizer machines enhances treatment adherence, improves patient outcomes, and contributes to better respiratory health management for adults.

Ultimately, a strategic sourcing approach focused on performance, safety, and patient-centered design will ensure the delivery of effective and sustainable respiratory care.