The global non-destructive testing (NDT) services market is experiencing robust expansion, driven by increasing regulatory mandates for infrastructure and equipment safety, growing industrial automation, and rising demand for quality assurance across sectors such as aerospace, oil & gas, and power generation. According to Grand View Research, the global NDT market was valued at USD 24.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030. This growth trajectory is further fueled by technological advancements in digital radiography, phased array ultrasonic testing (PAUT), and automated inspection systems. As industries prioritize asset integrity and risk mitigation, the reliance on third-party NDT service providers has intensified, elevating the strategic importance of leading manufacturers. In this competitive landscape, innovation, certification standards (such as ISO 17025 and ASNT compliance), and global service reach are key differentiators. The following list highlights the top 10 NDT services manufacturers shaping the industry through technological leadership, comprehensive service portfolios, and strong regional footholds.

Top 10 Ndt Services Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TesTex Inc.

Domain Est. 1998

Website: testex-ndt.com

Key Highlights: TesTex Inc specializes in Electromagnetic Non Destructive Testing equipment and services. We build and use all of our own equipment….

#2 NDT Global Pipeline Diagnostic & Inspection

Domain Est. 2007

Website: ndt-global.com

Key Highlights: Services · Pipeline Threats · Technology. Integrity Management. Back. All Integrity Management · Engineering Advisory Services · Predictive Analytics · Pipeline ……

#3 Non-Destructive Testing Solutions and Technologies

Domain Est. 2010

Website: eddyfi.com

Key Highlights: Eddyfi Technologies provides the highest performance non-destructive testing (NDT) inspection technologies in the world, helping OEMs, asset owners and service ……

#4 ASNT

Domain Est. 1995

Website: asnt.org

Key Highlights: ASNT is the global leader in nondestructive testing (NDT), providing certifications, education, and a strong membership network. Our members gain access to ……

#5 NDT.net

Domain Est. 1996

Website: ndt.net

Key Highlights: The Largest Portal of Nondestructive Testing (NDT) Open Access Database: Conference Proceedings, Journal Articles, News, Products, Services….

#6 NDT Services, Inspection, Integrity Engineering, Wind, Software

Domain Est. 1997 | Founded: 1953

Website: irisndt.com

Key Highlights: Discover our expert NDT & Rope Access Services. Providing comprehensive inspection, asset integrity, and engineering solutions since 1953….

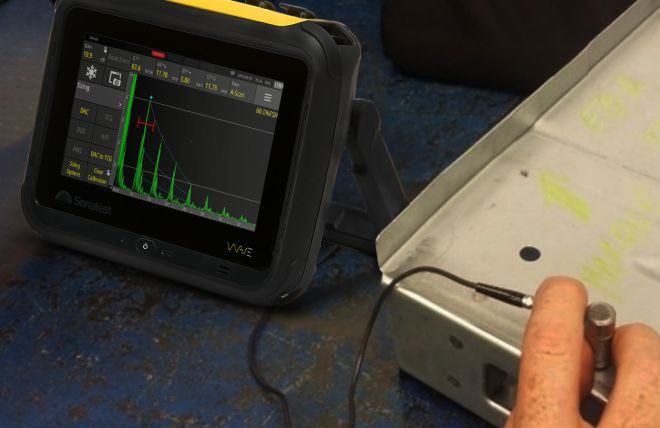

#7 Sonatest: Advanced NDT Testing & Non

Domain Est. 1997

Website: sonatest.com

Key Highlights: Sonatest delivers advanced NDT solutions: ultrasonic, eddy current, radiography, penetrant & magnetic particle testing for quality and safety compliance….

#8 NDT Solutions

Domain Est. 1998

Website: ndts.com

Key Highlights: We specialize in developing and deploying innovative NDT systems and services to support the aerospace, defense, energy, and transportation sectors. Our ……

#9 NDT Services

Domain Est. 2005 | Founded: 1976

Website: ndtservices.co.in

Key Highlights: Non destructive testing services provider since 1976. Providing conventional and advanced non destructive testing services….

#10 NDT.org Nondestructive Testing and NDT Jobs, News, Training …

Domain Est. 1997

Website: ndt.org

Key Highlights: NDT Jobs, News, Companies and Equipment for Industrial Inspection, Welding, and Nondestructive Testing. Jobs · Resumes · News · Education · Advertise….

Expert Sourcing Insights for Ndt Services

H2: 2026 Market Trends for NDT Services

The non-destructive testing (NDT) services market is poised for significant transformation by 2026, driven by technological advancements, increasing regulatory demands, and growing industrial safety consciousness across key sectors such as aerospace, energy, automotive, and infrastructure. Below are the major trends shaping the NDT services landscape in 2026:

1. Accelerated Adoption of Digital and Automated NDT Technologies

By 2026, digital transformation will be a cornerstone of NDT services. The integration of technologies such as Artificial Intelligence (AI), Machine Learning (ML), and robotics into NDT processes will enhance inspection accuracy, reduce human error, and improve data interpretation. Automated systems, including robotic crawlers and drone-based inspections, are increasingly used for hard-to-reach or hazardous environments—especially in oil & gas and power generation facilities.

2. Growth in Advanced NDT Methods

Traditional methods like ultrasonic and radiographic testing remain essential, but advanced techniques such as Phased Array Ultrasonic Testing (PAUT), Time-of-Flight Diffraction (TOFD), and Eddy Current Array (ECA) are gaining traction. These methods offer faster inspection cycles, real-time data analysis, and improved defect detection, making them preferable in high-integrity applications like aerospace components and offshore platforms.

3. Rising Demand from Renewable Energy Sectors

The global push toward clean energy is fueling demand for NDT in wind, solar, and hydroelectric infrastructure. Wind turbine inspections—particularly blade and tower integrity assessments—are expected to be a major growth driver. As offshore wind farms expand, subsea and structural NDT services will see increased deployment to ensure safety and longevity.

4. Stringent Regulatory and Safety Standards

Regulatory bodies worldwide are tightening compliance requirements across industries. In aerospace, energy, and transportation, the need for certification and routine inspection is spurring demand for NDT services. ISO, ASME, and API standards are being updated to include digital data documentation and traceability, pushing service providers to adopt cloud-based reporting and digital twin technologies.

5. Expansion of Predictive Maintenance and Condition Monitoring

The shift from scheduled to predictive maintenance models is reshaping NDT service delivery. Embedded sensors and continuous monitoring systems, combined with periodic NDT inspections, enable early detection of material degradation. This trend is particularly strong in the manufacturing and petrochemical industries, where minimizing downtime is critical.

6. Geographic Shifts and Emerging Markets

While North America and Europe remain dominant due to mature industrial infrastructure and strict regulations, the Asia-Pacific region is expected to witness the fastest growth in NDT services by 2026. Countries like China, India, and South Korea are investing heavily in infrastructure, nuclear energy, and aerospace, creating robust demand for high-quality inspection services.

7. Workforce Challenges and Upskilling Needs

Despite technological advances, the NDT industry faces a shortage of certified technicians, particularly those skilled in advanced methods and digital tools. By 2026, investment in training, remote mentoring, and virtual reality (VR)-based simulations will become essential to bridge the skills gap and maintain inspection quality.

8. Sustainability and Environmental Compliance

Environmental concerns are influencing NDT practices, especially the phasing out of traditional radiographic testing in favor of safer alternatives like ultrasonic and electromagnetic methods. Service providers are adopting greener inspection protocols and reducing hazardous waste, aligning with corporate sustainability goals.

Conclusion

The NDT services market in 2026 will be defined by digitalization, regulatory rigor, and expanding applications in emerging industries. Companies that embrace innovation, invest in workforce development, and align with global sustainability trends will be best positioned to capture growth opportunities in this evolving landscape.

Common Pitfalls When Sourcing NDT Services: Quality and Intellectual Property Risks

When sourcing Non-Destructive Testing (NDT) services, organizations must navigate several critical risks that can impact safety, compliance, and competitive advantage. Two of the most significant areas of concern are service quality and intellectual property (IP) protection. Overlooking these aspects can lead to costly failures, legal disputes, or compromised innovations.

Inadequate Certification and Personnel Qualifications

A major quality pitfall is failing to verify the certifications and qualifications of NDT personnel. NDT methods such as ultrasonic testing, radiography, or magnetic particle inspection require technicians certified to recognized standards (e.g., ISO 9712, ASNT SNT-TC-1A, or NAS410). Sourcing from providers whose staff lack proper certification increases the risk of inaccurate inspections, missed defects, and regulatory non-compliance, potentially leading to equipment failure or safety incidents.

Lack of Standardized Procedures and Method Validation

Another quality issue arises when NDT service providers use non-standardized or unvalidated inspection procedures. Without documented, industry-approved methods tailored to the specific material and component, results may lack consistency and reliability. Customers should ensure that the provider follows approved work instructions and validates techniques for the intended application.

Insufficient Traceability and Reporting

Poor documentation practices can compromise the integrity of NDT results. Incomplete or unclear reports lacking traceability—such as equipment calibration records, inspector credentials, or environmental conditions—hinder audit readiness and regulatory compliance. This lack of transparency makes it difficult to verify results or defend inspection outcomes during disputes or failure investigations.

Inadequate Equipment Calibration and Maintenance

Using improperly calibrated or poorly maintained NDT equipment leads to inaccurate readings and unreliable data. Sourcing from vendors who do not adhere to regular calibration schedules or fail to maintain equipment logs introduces significant measurement uncertainty. Clients should audit calibration records and ensure equipment meets relevant standards (e.g., ASTM, EN).

Intellectual Property Exposure Through Data Handling

NDT often involves access to sensitive design data, proprietary components, or critical infrastructure details. A key IP risk occurs when service providers fail to implement proper data security measures. Sharing CAD models, inspection plans, or test results without non-disclosure agreements (NDAs) or secure data transfer protocols can lead to unauthorized access, reverse engineering, or IP theft.

Ambiguous Ownership of Inspection Data and Reports

Another IP pitfall is unclear ownership of NDT deliverables. Without explicit contractual terms, disputes may arise over who owns inspection reports, digital scans, or evaluation methodologies. Clients should define data ownership, usage rights, and retention policies in service agreements to protect their proprietary information.

Third-Party Subcontracting Without Oversight

Many NDT providers subcontract work to third parties without client approval. This practice risks both quality and IP exposure, as subcontractors may not adhere to the same standards or confidentiality requirements. Clients should require transparency in subcontracting arrangements and ensure all parties meet contractual and compliance obligations.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure reliable, compliant NDT services while safeguarding their technical and commercial interests.

Logistics & Compliance Guide for NDT Services

This guide outlines key logistics and compliance considerations for Non-Destructive Testing (NDT) services to ensure safe, efficient, and legally sound operations.

Service Planning and Scheduling

Coordinate testing requirements with project timelines, ensuring NDT activities are scheduled without disrupting production or construction workflows. Confirm site access, power availability, environmental conditions, and any required permits before mobilization. Establish clear communication channels between NDT providers, clients, and site supervisors.

Personnel Qualifications and Certification

Ensure all NDT personnel are certified in accordance with recognized standards such as ASNT SNT-TC-1A, ISO 9712, or EN 4179. Maintain up-to-date certification records and verify that technicians are qualified for the specific NDT method (e.g., UT, RT, MT, PT, ET) and industry sector (e.g., aerospace, oil & gas, power generation).

Equipment Calibration and Maintenance

All NDT equipment must be regularly calibrated and maintained according to manufacturer recommendations and industry standards. Maintain detailed logs of calibration dates, results, and maintenance activities. Use only equipment that meets applicable technical specifications and safety requirements.

Regulatory and Industry Compliance

Adhere to all relevant local, national, and international regulations, including OSHA, EPA, and nuclear regulatory body requirements (e.g., NRC, CNSC) where applicable. Comply with industry-specific codes such as ASME, API, AWS, and ASTM. For radiographic testing, follow strict radiation safety protocols and licensing requirements.

Health, Safety, and Environmental (HSE) Protocols

Implement comprehensive HSE procedures, including hazard assessments, personal protective equipment (PPE) requirements, emergency response plans, and site-specific safety inductions. For radiographic testing, establish controlled exclusion zones, use signage and barriers, and monitor radiation exposure with dosimeters.

Documentation and Reporting

Generate accurate, traceable, and tamper-proof test reports that include method used, equipment details, personnel certifications, acceptance criteria, and results. Reports must comply with client specifications and relevant standards. Maintain secure records for audit and regulatory purposes, per retention policies.

Transportation of Equipment and Materials

Safely transport NDT equipment, especially radioactive sources or hazardous chemicals, in accordance with DOT, IATA, or ADR regulations as applicable. Use approved containers, proper labeling, and documentation (e.g., shipping manifests, transport licenses) for all regulated materials.

Client and Regulatory Audits

Be prepared for client or third-party audits by maintaining organized records of certifications, procedures, equipment logs, and test reports. Demonstrate ongoing compliance with quality management systems such as ISO 9001 or API Q1.

Continuous Improvement and Training

Regularly review logistics processes and compliance performance. Provide ongoing training for NDT personnel on technical updates, safety procedures, and regulatory changes to ensure service excellence and regulatory adherence.

Conclusion for Sourcing NDT Services

In conclusion, sourcing Non-Destructive Testing (NDT) services is a critical component in ensuring the safety, integrity, and reliability of industrial assets, structures, and systems. The selection of the right NDT provider involves a thorough evaluation of technical expertise, certification standards, service capabilities, equipment technology, and compliance with industry regulations.

Partnering with a qualified and experienced NDT service provider not only enhances operational safety and reduces the risk of unexpected failures but also contributes to cost savings through preventive maintenance and extended asset life. Factors such as method suitability (e.g., ultrasonic, radiographic, magnetic particle, or liquid penetrant testing), turnaround time, reporting accuracy, and on-site flexibility must be carefully assessed to meet specific project or operational requirements.

Ultimately, a strategic approach to sourcing NDT services—prioritizing quality, compliance, and technical competence—ensures long-term value, regulatory adherence, and peace of mind for stakeholders across industries such as oil and gas, aerospace, manufacturing, power generation, and construction. By investing in reliable NDT solutions, organizations demonstrate a commitment to safety, efficiency, and excellence in asset management.