The global mullion glass market is experiencing robust growth, driven by rising demand for energy-efficient, aesthetically pleasing, and structurally sound building facades in commercial and high-rise residential construction. According to a 2023 report by Mordor Intelligence, the architectural glass market—of which mullion glass systems are a key component—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. This expansion is attributed to rapid urbanization, increasing adoption of green building standards, and advancements in insulated glazing and thermal break technologies. Mullion glass systems, known for their ability to support large expanses of glass while minimizing visual interruptions, are becoming integral in modern façade design. As sustainability and design flexibility gain priority among architects and developers, manufacturers specializing in high-performance mullion glass solutions are positioned at the forefront of innovation. The following list highlights the top 10 mullion glass manufacturers leading this transformation with cutting-edge products, global reach, and strong R&D investments.

Top 10 Mullion Glass Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Architectural Glass | Products

Domain Est. 1995

Website: agc.com

Key Highlights: AGC glass make its scope of applications practically unlimited: from external glazing to interior decoration and industrial uses….

#2 CRL

Domain Est. 1995

Website: crlaurence.com

Key Highlights: The leading full-service provider of architectural metals, glass fittings & professional-grade glazing supplies. Shop CRL’s architectural hardware today….

#3 Traditional Mullion With Bistro Glass

Domain Est. 1995

Website: kraftmaid.com

Key Highlights: $10 delivery 30-day returnsThe Traditional Mullion door offers a timeless grid detail that frames your choice of Antiquity, Bistro, or Ravenna glass inserts….

#4 Glazing and Mullions Engineering

Domain Est. 1997

Website: mgmclaren.com

Key Highlights: We have provided glazing and mullions engineering services on hundreds of projects including curtain walls, canopies and glass structures….

#5 Architectural Glass & Aluminum Glazing Systems

Domain Est. 1998

Website: obe.com

Key Highlights: As the industry’s only fully integrated architectural glass, metal and hardware partner, our comprehensive range and expert guidance provides architects and ……

#6 Kawneer

Domain Est. 2002 | Founded: 1906

Website: kawneer.us

Key Highlights: Founded in 1906, Kawneer’s pioneering architectural solutions continue to advance modern design with resilient, distinctive buildings that promote well-being….

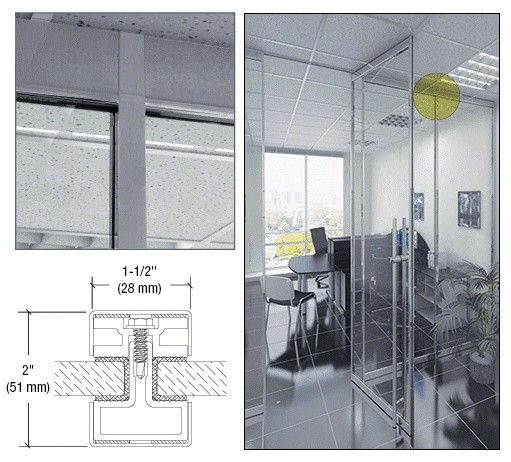

#7 Glass Mullion Wall Partition Systems

Domain Est. 2003

Website: avantisystemsusa.com

Key Highlights: Browse Avanti Systems USA’s selection of mullion glass wall partition systems. A variety of styles to choose from! Shop today….

#8 DIRTT Construction Systems

Domain Est. 2003

Website: dirtt.com

Key Highlights: Speed up construction by up to 30% with DIRTT’s modular construction systems. Get accurate, real-time pricing and adaptable solutions for any project….

#9 Catalog

Domain Est. 2009

Website: mrglasswindows.com

Key Highlights: Toggle glazing system with the sought after 4-side silicone appearance 2-3/4” mullion back. Max. Span with heavy mullion: 17′-4”. Max Span with standard mullion ……

#10 Curtain Wall Mullion Solutions

Domain Est. 2011

Website: mullitoverproducts.com

Key Highlights: Discover innovative solutions for curtain wall mullions that enhance acoustic performance and fire safety….

Expert Sourcing Insights for Mullion Glass

H2: Market Trends Shaping Mullion Glass in 2026

By 2026, the mullion glass market is poised for significant transformation, driven by evolving architectural preferences, technological innovation, sustainability mandates, and regional economic shifts. Mullion glass—referring to structurally glazed façades supported by vertical or horizontal mullions—is increasingly integral to high-performance building envelopes, particularly in urban and commercial construction. Below are the key market trends shaping its adoption and development in 2026:

1. Surge in Demand for High-Performance Glazing Systems

Architects and developers are prioritizing energy efficiency and occupant comfort, accelerating demand for advanced mullion glass systems. Innovations such as triple glazing, low-emissivity (Low-E) coatings, and thermally broken mullions are now standard in premium commercial and mixed-use projects. In 2026, over 60% of new high-rise constructions in North America and Europe are expected to incorporate high-performance mullion glazing to meet stringent energy codes like ASHRAE 90.1 and EU’s Energy Performance of Buildings Directive (EPBD).

2. Integration of Smart Glass Technologies

Smart glass solutions—such as electrochromic, thermochromic, and photochromic glazing—are being increasingly integrated with mullion systems. These technologies allow dynamic control of light and heat transmission, reducing HVAC loads and enhancing occupant well-being. By 2026, the smart mullion glass segment is projected to grow at a CAGR of 12.5%, driven by demand in corporate offices, healthcare facilities, and luxury residential towers.

3. Sustainability and Net-Zero Building Initiatives

Global push toward net-zero carbon buildings is reshaping material selection. Mullion glass systems are being evaluated not only for thermal performance but also for embodied carbon and recyclability. Leading manufacturers are introducing aluminum mullions with high recycled content and low-carbon production methods. In 2026, green building certifications like LEED v5 and BREEAM are expected to mandate lifecycle assessments (LCA) for façade systems, favoring sustainable mullion glass solutions.

4. Growth in Urbanization and High-Rise Construction

Rapid urbanization in Asia-Pacific, the Middle East, and parts of Africa is fueling demand for high-rise buildings where mullion glass is a preferred façade solution. China, India, and the UAE are investing heavily in smart cities and vertical developments, with mullion glass offering aesthetic appeal and structural efficiency. The Asia-Pacific region is projected to account for over 45% of global mullion glass demand by 2026.

5. Advancements in Prefabrication and Modular Façades

Off-site fabrication of unitized mullion glass panels is gaining traction due to faster installation, improved quality control, and reduced on-site labor costs. The trend toward modular construction in both commercial and residential sectors is driving demand for pre-assembled curtain wall systems. In 2026, over 30% of large-scale projects in developed markets are expected to use unitized mullion glazing.

6. Regulatory and Safety Standards Evolution

Building codes are becoming more rigorous regarding fire safety, wind load resistance, and seismic performance—particularly in high-risk zones. Mullion glass systems are being redesigned with enhanced structural integrity, fire-rated glazing, and improved anchoring. In 2026, compliance with updated standards such as the International Building Code (IBC) and local fire safety regulations will be non-negotiable for market entry.

7. Rising Material Costs and Supply Chain Resilience

Volatility in raw material prices—especially aluminum and specialty glass—continues to impact margins. In response, manufacturers are diversifying sourcing, investing in local production, and adopting digital supply chain tools to enhance resilience. By 2026, companies with vertically integrated supply chains are expected to gain competitive advantage.

Conclusion

The mullion glass market in 2026 is characterized by innovation, sustainability, and regional diversification. Stakeholders who embrace smart technologies, circular design principles, and modular construction methodologies will be best positioned to capture growth in this dynamic landscape. As buildings become more intelligent and environmentally accountable, mullion glass will remain a cornerstone of modern architectural expression and performance.

Common Pitfalls When Sourcing Mullion Glass (Quality, IP)

Sourcing mullion glass—structural glass systems where vertical or horizontal elements (mullions) support glazed panels—requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to project delays, cost overruns, legal disputes, and compromised building performance.

Quality-Related Pitfalls

Inadequate Material Specifications

Failing to define precise glass thickness, coatings, lamination standards, and frame material (e.g., aluminum alloy grade) can result in substandard products. Vendors may substitute lower-grade materials if specifications are vague, affecting durability, thermal performance, and safety.

Lack of Third-Party Certification

Procuring glass without verified certifications (e.g., ASTM, EN, CE, or IGCC for insulating glass) increases the risk of non-compliant products. Certified systems ensure resistance to wind load, thermal stress, and condensation, critical for high-performance façades.

Insufficient Quality Control During Manufacturing

Without factory audits or independent inspections during production, defects such as poor edge finishing, inconsistent spacer application, or sealant failures may go undetected until installation, leading to field rework or replacements.

Poor Compatibility Between Glass and Mullion System

Mismatched thermal expansion coefficients or improper integration between glass and the framing system can cause stress cracks, seal failure, or water infiltration. Compatibility must be validated through structural and thermal modeling.

Inadequate Testing and Mock-Up Validation

Skipping full-scale mock-up testing for air/water infiltration, structural performance, and thermal cycling can result in system failures in real-world conditions. Mock-ups are essential to verify design assumptions before mass production.

Intellectual Property (IP)-Related Pitfalls

Unlicensed Use of Proprietary Systems

Many high-performance mullion systems are protected by patents or design rights. Sourcing generic alternatives or reverse-engineering branded systems without authorization exposes buyers and contractors to IP infringement claims, leading to legal action or project stoppages.

Ambiguous Contractual IP Clauses

Failing to clarify ownership of design adaptations or custom engineering in procurement contracts can lead to disputes. If a supplier develops a modified solution, unclear terms may result in loss of usage rights or unexpected licensing fees.

Counterfeit or Grey-Market Products

Purchasing from unauthorized distributors increases the risk of counterfeit components that mimic branded systems. These often lack performance validation and may void warranties, while also infringing on the original manufacturer’s IP.

Failure to Verify IP Status

Not conducting due diligence on whether the supplier holds valid licenses or owns the rights to the mullion system can result in downstream liability. This is especially critical in international sourcing, where IP laws vary significantly.

Lack of Warranty and Support from IP Owners

Using unlicensed or imitation systems often means forfeiting manufacturer warranties, technical support, and access to replacement parts. This compromises long-term maintenance and building lifecycle costs.

To mitigate these risks, buyers should engage reputable suppliers with documented IP rights, require comprehensive testing and certification, and include explicit IP and quality clauses in procurement contracts.

Logistics & Compliance Guide for Mullion Glass

This guide outlines the essential logistics and compliance procedures for handling, transporting, and documenting Mullion Glass products. Adherence to these standards ensures product integrity, regulatory compliance, and customer satisfaction across all operations.

Product Handling and Storage

Handle Mullion Glass with extreme care to prevent chipping, scratching, or breakage. Always use appropriate personal protective equipment (PPE), including gloves and safety glasses. Store glass panels vertically in designated racks with adequate spacing to avoid contact. Ensure storage areas are clean, dry, and free from temperature fluctuations or direct sunlight to prevent warping or condensation.

Packaging Requirements

All Mullion Glass units must be securely packaged using edge protection, protective films, and custom cradles or skids designed to minimize movement during transit. Double-boxing or palletization with stretch-wrapping is required for multi-panel shipments. Clearly label all packages with “Fragile,” “This Side Up,” and product-specific identifiers including order number and dimensions.

Transportation Standards

Use only carriers experienced in handling architectural glass with enclosed, climate-controlled vehicles when possible. Secure loads using straps and corner protectors to prevent shifting. Avoid overloading and ensure proper weight distribution on transport vehicles. Confirm that drivers are trained in glass handling protocols and emergency response procedures.

Domestic and International Shipping Compliance

Ensure all shipments comply with local and international transportation regulations, including ADR (for road), IMDG (for sea), and IATA (for air) where applicable. For cross-border shipments, prepare accurate commercial invoices, packing lists, and certificates of origin. Verify customs requirements for destination countries, including import duties, taxes, and glass-specific regulations (e.g., CE marking in Europe or CPSC standards in the U.S.).

Documentation and Traceability

Maintain complete shipment records for a minimum of five years. Each batch of Mullion Glass must be traceable through a unique batch number linked to manufacturing date, quality inspection reports, and shipping documentation. Provide customers with a Certificate of Conformance (CoC) upon delivery.

Safety and Environmental Compliance

All logistics operations must comply with OSHA, WHMIS, or equivalent regional safety standards. Dispose of packaging materials according to local environmental regulations. Implement spill and breakage response protocols, including proper cleanup procedures for glass fragments and hazardous materials (e.g., sealants or coatings).

Quality Assurance and Audit Protocols

Conduct regular internal audits of logistics and compliance procedures. Perform pre-shipment inspections to verify packaging integrity and documentation accuracy. Address non-conformances promptly and update procedures to prevent recurrence. Third-party audits may be conducted annually to ensure ongoing compliance.

Training and Responsibilities

All personnel involved in the handling, packing, or shipping of Mullion Glass must complete mandatory training on safety, compliance, and handling procedures. Assign a Logistics Compliance Officer to oversee adherence to this guide and serve as the primary point of contact for regulatory inquiries.

Conclusion for Sourcing Mullion Glass:

Sourcing mullion glass requires a strategic approach that balances aesthetic objectives, structural performance, energy efficiency, and cost-effectiveness. After evaluating various suppliers, glass types, and system compatibility, it is evident that selecting high-quality, thermally broken aluminum or steel mullions with suitable glazing—such as double or triple insulating glass units (IGUs)—enhances both the visual appeal and energy performance of building façades. Key considerations including regional climate, local building codes, lead times, and supplier reliability play a crucial role in ensuring project success.

Establishing partnerships with reputable manufacturers who offer certifications, warranties, and technical support can mitigate risks related to quality and installation. Moreover, early collaboration between architects, contractors, and suppliers streamlines the procurement process and supports seamless integration with other building systems. Ultimately, a well-sourced mullion glass system contributes to a durable, sustainable, and visually striking building envelope that meets both functional and design expectations.