The global filtration systems market is experiencing robust expansion, driven by increasing demand for clean energy, stringent environmental regulations, and rising industrialization. According to Mordor Intelligence, the global air filter market was valued at USD 14.5 billion in 2023 and is projected to grow at a CAGR of over 6.8% through 2029. A significant contributor to this growth is the surge in power generation and marine applications, where high-performance filtration is critical for operational efficiency—especially in systems utilizing MTU engines. As a trusted provider of diesel and gas-powered engines within the power generation, marine, and rail sectors, MTU relies on advanced filtration technologies to ensure optimal performance and longevity. This growing demand has elevated the prominence of specialized MTU filter manufacturers capable of meeting exacting OEM standards. Below, we highlight the top three manufacturers leading in innovation, market reach, and technical precision within this niche but critical segment.

Top 3 Mtu Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MTU worldwide

Website: mtu.de

Key Highlights: MTU Aero Engines is Germany’s leading engine manufacturer and an established global player in the industry….

#2 Downloads and Resources

Domain Est. 1987

Website: mtu.edu

Key Highlights: Michigan Tech provides a variety of social media assets and resources to help communicators maintain a strong, consistent, and branded online presence….

#3 Filters

Domain Est. 2018

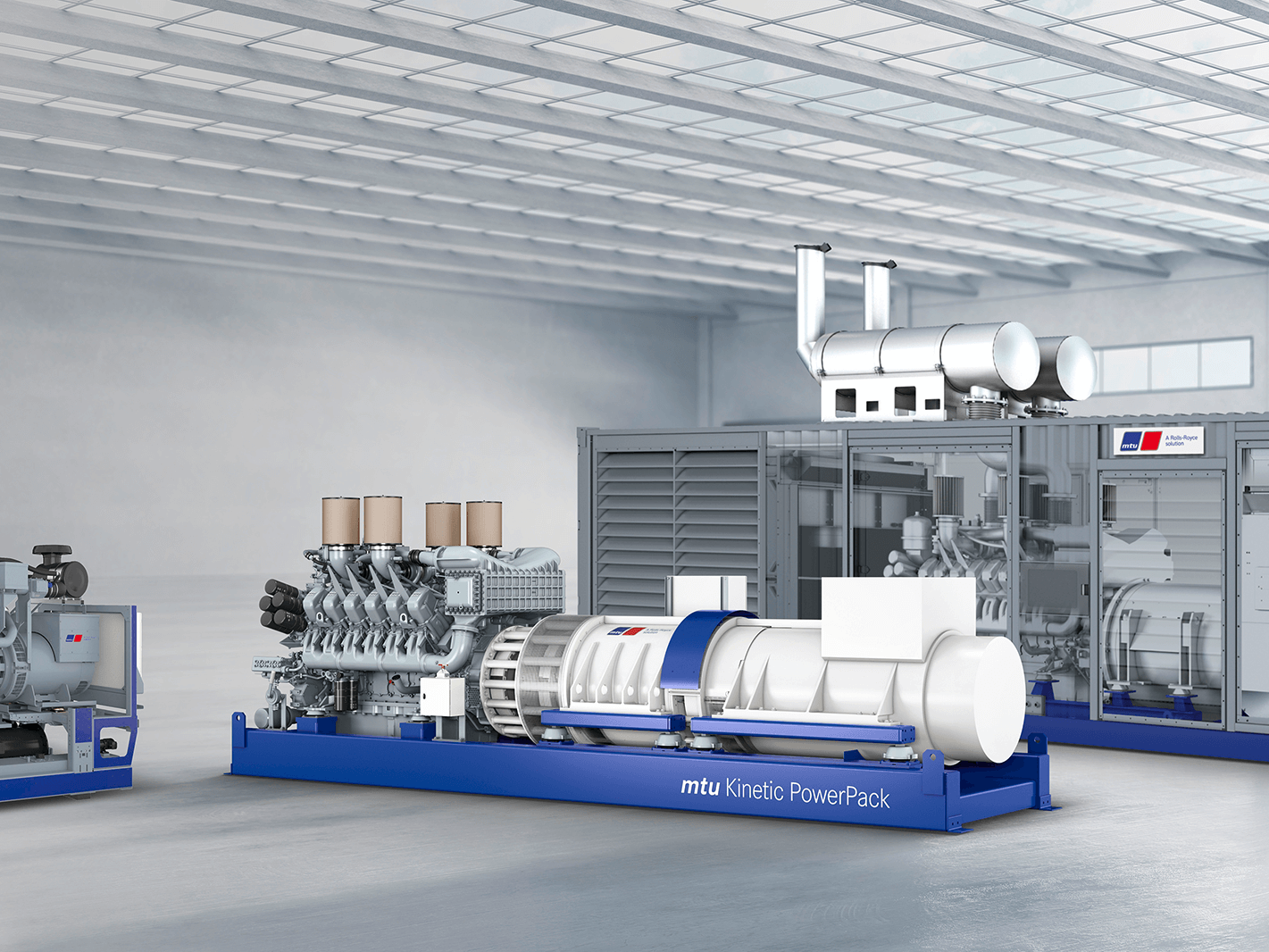

Website: mtu-solutions.com

Key Highlights: As the only filters approved by mtu for use in mtu engines, mtu filters are tested to provide high quality filtration. Every component is designed and ……

Expert Sourcing Insights for Mtu Filter

H2: 2026 Market Trends for MANN+HUMMEL (MTU Filter)

Note: “MTU Filter” is a common misattribution. MTU Friedrichshafen (now part of Rolls-Royce Power Systems) is a major customer and former division user of filtration systems. The leading filtration technology provider in this space is MANN+HUMMEL. This analysis focuses on MANN+HUMMEL’s market position and trends relevant to its core filtration businesses, including those serving industrial power, transportation, and MTU-type applications.

H2: Key 2026 Market Trends Shaping MANN+HUMMEL’s (MTU Filter) Landscape

By 2026, the global filtration market, particularly for industrial and mobile power applications served by companies like MANN+HUMMEL, will be driven by powerful, interconnected trends. Success will depend on navigating these dynamics:

-

Accelerating Decarbonization & Powertrain Diversification:

- Hybrid & Electric Transition: Demand for filtration in traditional internal combustion engines (ICE) for heavy-duty trucks, off-highway, and marine (MTU’s core markets) will plateau or decline in some regions. However, hybrid powertrains will see significant growth, requiring complex filtration solutions for both ICE components and new battery/power electronics cooling systems. MANN+HUMMEL is investing heavily in battery and power electronics cooling filters and thermal management systems, a critical growth vector by 2026.

- Alternative Fuels Adoption: Increased use of natural gas (CNG/LNG), hydrogen (H2), and synthetic fuels (e-fuels) in industrial and marine applications (including MTU engines) will create demand for specialized filtration. Hydrogen, in particular, requires ultra-pure air intake and unique fuel cell air filtration systems, representing a major opportunity for MANN+HUMMEL’s expertise.

- Focus on Efficiency: Even for ICEs, stricter efficiency standards will persist. This drives demand for advanced air intake systems (like MANN+HUMMEL’s “Econic”) that optimize airflow and reduce engine load, improving fuel economy and lowering emissions.

-

Stringent Emissions & Air Quality Regulations:

- Global Stringency: Regulations like Euro VII (expected ~2026/27), US EPA standards, and China 6b/VII will push the boundaries of particulate matter (PM), nitrogen oxides (NOx), and ammonia (NH3) control. This necessitates more sophisticated exhaust after-treatment systems (EATS) where diesel particulate filters (DPFs) and selective catalytic reduction (SCR) components remain critical.

- Non-Exhaust Emissions: Regulations are expanding to cover tire and brake wear particles. MANN+HUMMEL is developing brake dust extraction systems (e.g., “Brake Dust Filter”) for vehicles, a nascent but potentially significant market by 2026.

- Indoor & Industrial Air Quality: Growing awareness of health impacts drives demand for advanced HVAC and industrial air filtration in buildings, factories, and cleanrooms, benefiting MANN+HUMMEL’s Life Sciences and Indoor Air business units.

-

Circular Economy & Sustainability Imperatives:

- Recyclability Focus: Regulatory pressure (e.g., EU End-of-Life Vehicles Directive) and customer ESG goals demand more recyclable filter materials. MANN+HUMMEL is actively developing filters with higher recycled content and improved recyclability (e.g., mono-material designs).

- Lifecycle Management: Services around filter lifecycle management, including collection, recycling, and remanufacturing, will become increasingly important differentiators. MANN+HUMMEL’s “Circular Economy” initiatives will be crucial for customer partnerships.

- Sustainable Manufacturing: Reducing the carbon footprint of filter production (energy, materials, logistics) will be a key competitive factor and internal KPI.

-

Digitalization & Smart Filtration:

- Condition Monitoring: Integration of sensors into filters (e.g., pressure differential, temperature, humidity, even particle load) will become more common. This enables predictive maintenance, optimizing service intervals, reducing downtime, and improving total cost of ownership for fleet operators (a key MTU customer base).

- Data Services: MANN+HUMMEL can leverage filter data to provide value-added services like fleet health monitoring, usage analytics, and automated reordering, moving beyond pure component supply.

- Digital Twins: Using digital models to simulate filter performance under various conditions will accelerate development and optimization.

-

Geopolitical & Supply Chain Resilience:

- Regionalization: Ongoing supply chain disruptions and geopolitical tensions will push OEMs (like Rolls-Royce Power Systems/MTU) towards more regionalized or near-shored sourcing. MANN+HUMMEL’s global footprint with local manufacturing (e.g., in Germany, US, China, India) is a significant advantage for securing long-term contracts.

- Raw Material Volatility: Fluctuations in prices for materials like specialty papers, non-wovens, and plastics necessitate strong supplier relationships and hedging strategies.

Conclusion for 2026:

By 2026, MANN+HUMMEL’s success in markets historically associated with “MTU Filter” will hinge on its ability to pivot from a traditional ICE filter supplier to a comprehensive clean technology partner. The core trends point towards:

- Diversification: Expanding beyond engine air/oil into battery cooling, hydrogen systems, brake dust, and cabin air.

- Innovation: Leading in digital filtration (sensors, data) and sustainable material solutions.

- Partnership: Deepening integration with OEMs like Rolls-Royce Power Systems on decarbonization strategies (hybrids, hydrogen, e-fuels).

- Resilience: Maintaining a robust, geographically balanced supply chain.

Companies clinging solely to traditional ICE filtration will face significant headwinds. MANN+HUMMEL, by proactively addressing these H2 trends, is positioned to leverage its engineering strength and global reach to capture new growth areas in the evolving power and mobility landscape by 2026.

Common Pitfalls Sourcing MTU Filters (Quality, IP)

Sourcing MTU filters—especially for critical applications in marine, power generation, or industrial settings—comes with several risks, particularly concerning quality assurance and intellectual property (IP) protection. Being aware of these pitfalls helps avoid costly failures, legal complications, and operational downtime.

Poor Quality Components

One of the most frequent issues when sourcing MTU filters is receiving substandard or counterfeit products. Many third-party suppliers offer “compatible” or “MTU-style” filters at lower prices, but these often use inferior materials such as low-grade filter media, weak end caps, or subpar seals. This can lead to premature failure, reduced engine protection, and increased maintenance costs. Always verify that filters meet OEM specifications and are tested to industry standards (e.g., ISO 4020 for diesel fuel filters).

Lack of Genuine OEM Certification

Genuine MTU filters are produced under strict quality controls and carry certifications that ensure compatibility and performance. Sourcing from unauthorized distributors increases the risk of receiving non-certified or gray-market products. Without proper documentation or traceability, proving authenticity in case of a failure becomes difficult. Always require documentation such as certificates of conformance, batch numbers, and supplier warranties.

Intellectual Property Infringement

MTU, a subsidiary of Rolls-Royce Power Systems, holds design and trademark rights on its filter products. Sourcing generic filters that closely mimic MTU’s design may inadvertently violate IP rights, especially if they use protected logos, part numbers, or proprietary engineering. This exposes buyers and resellers to legal risks, including cease-and-desist orders or liability claims. Ensure suppliers are not infringing on MTU’s IP by using authorized branding or patented designs.

Inadequate Supply Chain Transparency

A lack of transparency in the supply chain makes it difficult to verify the origin and authenticity of MTU filters. Intermediaries or online marketplaces may obscure the manufacturer’s identity, increasing the risk of counterfeit goods. Establish direct relationships with authorized distributors or certified resellers to ensure traceability and reduce exposure to fraud.

Mismatched Specifications

Even if a filter appears physically compatible, differences in filtration efficiency, flow rate, or bypass valve settings can impact engine performance and longevity. Using non-OEM filters without thorough validation may void warranties or lead to system contamination. Always cross-check technical specifications with MTU’s official documentation before procurement.

Conclusion

To mitigate risks, prioritize sourcing MTU filters through authorized channels, demand full product traceability, and conduct periodic quality audits. Protecting both equipment integrity and intellectual property compliance ensures long-term operational reliability and legal safety.

Logistics & Compliance Guide for MTU Filters

Overview

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and documentation of MTU filters. Adherence to these guidelines ensures product integrity, regulatory compliance, and efficient supply chain operations.

Packaging and Labeling Requirements

All MTU filters must be shipped in original, undamaged packaging that protects against moisture, dust, and physical impact. Each package must include clear labeling with the following:

– MTU part number

– Serial number (if applicable)

– Batch or lot number

– Manufacturing date

– Expiration date (if relevant)

– Handling instructions (e.g., “Fragile,” “This Side Up”)

– Country of origin

Labels must comply with international standards (e.g., ISO 780 for handling symbols) and local regulatory requirements.

Storage Conditions

MTU filters must be stored under controlled environmental conditions:

– Temperature: 5°C to 35°C (41°F to 95°F)

– Relative humidity: Up to 70% (non-condensing)

– Protection from direct sunlight and corrosive substances

– Stored off the floor on pallets or shelves

Inventory should follow FIFO (First In, First Out) principles to prevent aging and obsolescence.

Transportation Guidelines

- Use only carriers certified for industrial component transport.

- Ensure secure loading to prevent shifting during transit.

- Avoid exposure to extreme temperatures, moisture, or vibration.

- For international shipments, use climate-controlled or insulated containers when necessary.

- Maintain a chain of custody documentation for high-value or critical components.

Import/Export Compliance

All cross-border shipments of MTU filters must comply with applicable trade regulations:

– Verify correct HS (Harmonized System) codes for MTU filters (e.g., 8421.39 for air filtration equipment parts).

– Obtain required export licenses based on destination country and end-use (check EAR, ITAR, or local regulations).

– Complete accurate commercial invoices, packing lists, and certificates of origin.

– Comply with sanctions and embargo restrictions (e.g., OFAC, EU dual-use regulations).

Work with certified customs brokers to ensure timely clearance and avoid penalties.

Regulatory and Environmental Compliance

MTU filters may contain materials subject to environmental regulations:

– Comply with REACH (EU) and RoHS directives for restricted substances.

– Adhere to WEEE (Waste Electrical and Electronic Equipment) for end-of-life disposal in applicable regions.

– Provide Safety Data Sheets (SDS) upon request, especially for filters with coated or treated media.

– Follow local waste disposal regulations for used filters, particularly if contaminated with oils or hazardous fluids.

Documentation and Traceability

Maintain complete records for a minimum of 7 years, including:

– Shipping manifests and delivery confirmations

– Certificates of Conformance (CoC) from MTU or authorized suppliers

– Inspection and quality control reports

– Customs documentation and import/export filings

– Recall and non-conformance reports (if applicable)

Ensure full traceability from manufacturing to end-user.

Quality and Handling Procedures

- Train logistics personnel on proper handling of MTU filters to prevent damage.

- Conduct regular audits of storage and transportation partners.

- Report and investigate any deviations, damages, or compliance issues promptly.

- Follow MTU’s technical service bulletins and field notifications related to filter handling.

Contact and Support

For compliance or logistics inquiries, contact:

MTU After Sales Support

Email: [email protected]

Phone: +49 800 123 4567 (24/7)

Refer to the latest MTU Product Information Bulletin (PIB) and Terms & Conditions for updates.

Conclusion on Sourcing MTU Filters

In conclusion, sourcing MTU filters requires a strategic approach that balances quality, cost, reliability, and compatibility. MTU filters play a critical role in ensuring the efficient and safe operation of various engine systems, especially in marine, power generation, and heavy-duty applications. To maintain equipment performance and longevity, it is essential to source filters that meet or exceed OEM specifications from reputable suppliers or authorized distributors.

Key considerations include verifying product authenticity, evaluating supplier credentials, ensuring timely delivery, and assessing total cost of ownership—factoring in maintenance intervals and equipment downtime. Additionally, prioritizing suppliers with global reach and technical support can provide added value, particularly for operations in remote or demanding environments.

Ultimately, investing in high-quality, properly sourced MTU filters not only protects critical assets but also enhances operational efficiency and reduces long-term maintenance costs. A well-informed sourcing strategy ensures reliability, compliance, and optimal system performance across the lifecycle of the equipment.