The global motorized bicycle market is undergoing rapid expansion, fueled by rising demand for affordable, eco-friendly urban mobility solutions. According to a report by Mordor Intelligence, the global electric bicycle market—closely aligned with motorized bicycle technology—was valued at USD 43.48 billion in 2023 and is projected to grow at a CAGR of 7.14% from 2024 to 2029. Similarly, Grand View Research estimates the electric bicycle market will reach USD 85.1 billion by 2030, expanding at a CAGR of 7.2% over the decade. This sustained growth is driving increased demand for high-performance, durable components, creating a thriving ecosystem for motorized bicycle parts manufacturers. As both consumer adoption and regulatory support for micromobility rise worldwide, a select group of manufacturers has emerged as leaders in innovation, scalability, and quality—supplying critical components such as e-drives, motors, controllers, and conversion kits that power the next generation of motor-assisted bicycles.

Top 9 Motorized Bicycle Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shengyi

Domain Est. 2010

Website: syimotor.com

Key Highlights: Shengyi is a leading manufacturer specialized in the research, development, production, sales and service of electric bicycle motor, electric scooter motor ……

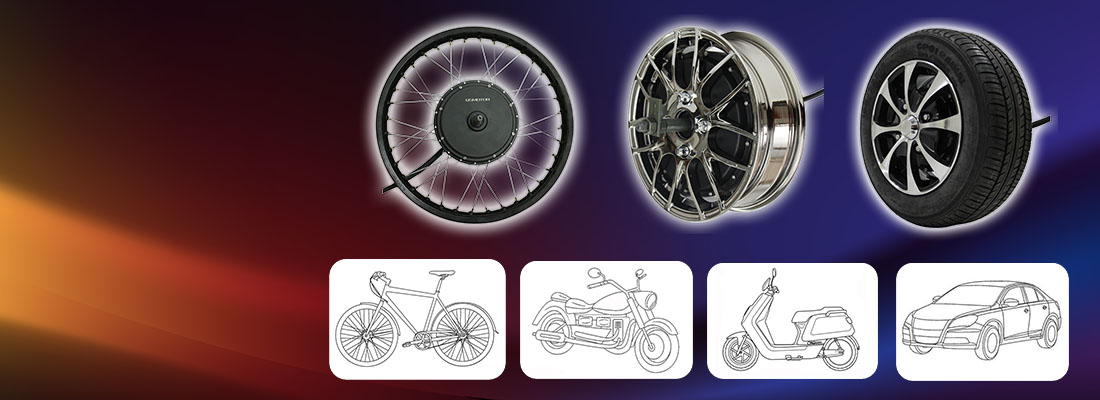

#2 QS Motor Ltd manufacture Bicycle Motor, Scooter Motor, Car Motor

Domain Est. 2014

Website: qsmotor.com

Key Highlights: QS Motor is the leading manufacturer of quality Bicycle Motor, Scooter Motor, Car Motor, Hub Motor in China. 500W to 24kw in power and 10″ to 17″ in size….

#3 BAFANG MOTOR

Domain Est. 2017

Website: bafang-e.com

Key Highlights: Bafang, one of the leading manufacturers of e-mobility components and complete e-drive systems, has been developing components and complete systems for electric ……

#4 e*thirteen

Domain Est. 2005

Website: ethirteen.com

Key Highlights: Premium mountain bike components engineered for performance. Shop e*thirteen’s innovative Sidekick hubs and MTB and eMTB parts trusted by riders & racers ……

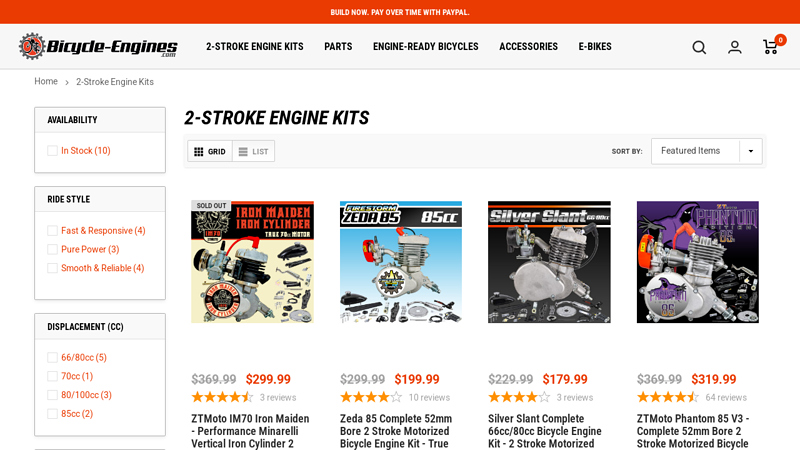

#5 2

Domain Est. 2007

Website: bicycle-engines.com

Key Highlights: Free delivery over $150Zeda Dio Kits – 2 Stroke Performance Upgrades Take your motorized bike to the next level with an affordable Dio Reed Valve & OKO carb performance kit….

#6 All Bicycle Engine Parts

Domain Est. 2007

Website: bikeberry.com

Key Highlights: Free delivery over $99Our Bikeberry engine kit parts are affordable quality components, perfect for DIY motorized bike projects of all kinds!…

#7 RDManu

Domain Est. 2019

Website: rdmanu.com

Key Highlights: Take your gas motorized bike to new heights with our innovative racing parts. Renowned for their superior performance and reliability….

#8 Lekkie

Domain Est. 2019

Website: lekkie.tech

Key Highlights: Lekkie makes high quality, high performance cranks and chainrings for Bosch, Shimano, DJI, CYC, Pinion and Bafang systems….

#9 Smolik Performance

Domain Est. 2020

Website: smolikperformance.com

Key Highlights: We leverage advanced manufacturing technologies—including CNC machining and 3D printing—to ensure exceptional performance, consistency, and innovation in every ……

Expert Sourcing Insights for Motorized Bicycle Parts

H2: 2026 Market Trends for Motorized Bicycle Parts

The global market for motorized bicycle parts is poised for significant transformation by 2026, driven by technological innovation, shifting consumer preferences, and supportive regulatory environments. As urbanization accelerates and sustainability becomes a top priority, motorized bicycles—especially e-bikes—are gaining traction as efficient, eco-friendly transportation alternatives. This section explores key market trends shaping the demand, supply, and innovation landscape for motorized bicycle parts in 2026.

1. Surge in E-Bike Adoption Fuels Component Demand

By 2026, the rising popularity of electric bicycles is expected to directly boost demand for motorized bicycle parts such as electric motors, battery systems, controllers, and drivetrain components. Urban commuters, delivery services, and recreational riders are increasingly turning to e-bikes to reduce travel time and carbon footprints. This widespread adoption is driving manufacturers to scale up production of high-performance, lightweight, and durable parts.

2. Advancements in Battery and Motor Technology

Innovation in lithium-ion and solid-state batteries is a key trend, with manufacturers focusing on increasing energy density, reducing charging time, and enhancing safety. Integrated mid-drive and hub motors are becoming more efficient and compact, improving overall bike performance. By 2026, expect wider adoption of modular and plug-and-play motor systems, allowing for easier upgrades and maintenance.

3. Smart Integration and Connectivity

Motorized bicycle parts are increasingly incorporating smart technologies. Components such as intelligent controllers, GPS-enabled displays, and app-connected diagnostics are becoming standard. These features allow riders to monitor battery life, track performance, and customize riding modes. The integration of IoT in parts will enhance user experience and support predictive maintenance, a key selling point for premium e-bike models.

4. Growth of the Aftermarket and Customization

The aftermarket for motorized bicycle parts is expanding rapidly as users seek to retrofit traditional bikes or upgrade existing e-bikes. DIY conversion kits, high-torque motors, and enhanced braking systems are in high demand. Customization trends are encouraging niche manufacturers to offer specialized components tailored for cargo bikes, mountain e-bikes, and urban commuters.

5. Regulatory Support and Infrastructure Development

Government incentives, tax breaks, and investment in cycling infrastructure across North America, Europe, and parts of Asia-Pacific are accelerating e-bike adoption. Regulations favoring low-emission transport are indirectly boosting the motorized bicycle parts market. By 2026, harmonized safety and performance standards are expected to streamline part compatibility and improve consumer confidence.

6. Sustainability and Circular Economy Initiatives

Environmental concerns are pushing manufacturers toward sustainable sourcing and recyclable materials. Battery recycling programs and the use of bio-based composites in part manufacturing are emerging trends. Companies that emphasize circular economy principles—such as repairability, upgradability, and end-of-life recycling—are gaining competitive advantage.

7. Regional Market Diversification

While Europe remains the largest market for motorized bicycles, regions like North America and Southeast Asia are experiencing rapid growth. In 2026, localized production hubs and regional supply chains will reduce dependency on single-source suppliers, enhancing resilience and enabling faster response to market demands.

In conclusion, the 2026 market for motorized bicycle parts is defined by innovation, connectivity, and sustainability. Stakeholders—from component manufacturers to retailers—must adapt to evolving technologies and consumer expectations to capitalize on this dynamic and expanding market.

Common Pitfalls When Sourcing Motorized Bicycle Parts (Quality, IP)

Sourcing motorized bicycle parts, especially from international suppliers, involves several risks related to component quality and intellectual property (IP) protection. Being aware of these common pitfalls can help buyers avoid costly mistakes, delays, and legal complications.

Poor Component Quality and Inconsistent Manufacturing Standards

One of the most frequent issues is receiving parts that do not meet expected performance or safety standards. Suppliers may use substandard materials, lack proper quality control processes, or produce inconsistent batches. For example, motors, batteries, and drivetrain components may fail prematurely or underperform, leading to safety hazards and customer dissatisfaction. Inadequate documentation, lack of certifications (such as CE, UL, or RoHS), and absence of testing reports further compound this risk.

Misrepresentation of Technical Specifications

Suppliers sometimes exaggerate or falsify technical data—such as motor power, battery capacity, or range estimates—to secure sales. This misrepresentation can result in non-compliant products that fail regulatory inspections or do not integrate properly with other components. Buyers may discover discrepancies only after assembly or during field testing, leading to project delays and additional costs.

Lack of Intellectual Property Safeguards

Sourcing from regions with weak IP enforcement exposes buyers to the risk of unintentionally purchasing counterfeit or cloned parts. Many suppliers replicate branded designs (e.g., motor controllers or throttle systems) without authorization, potentially exposing the buyer to legal liability. Furthermore, custom-designed parts may be reverse-engineered and sold to competitors, eroding competitive advantage and brand value.

Inadequate Contracts and IP Clarity

Without clear contractual agreements, ownership of tooling, designs, and custom-developed components may remain with the manufacturer. This can limit future production flexibility and lead to disputes. Suppliers may also refuse to sign non-disclosure agreements (NDAs) or design assignment clauses, leaving the buyer vulnerable to IP theft.

Supply Chain and Compliance Risks

Components may not comply with regional regulations (e.g., EU’s EN 15194 standard or U.S. state e-bike laws), resulting in customs delays, fines, or product recalls. Additionally, reliance on single-source suppliers without auditing or backup options increases vulnerability to disruptions and quality lapses.

Failure to Verify Supplier Authenticity

Some suppliers operate as intermediaries without direct manufacturing capabilities, increasing the risk of miscommunication and reduced oversight. Fake certifications, stock photos, and fabricated references are common red flags. Without on-site audits or third-party inspections, buyers may struggle to verify supplier credibility.

To mitigate these risks, conduct thorough due diligence, require product samples and certifications, use legally binding IP agreements, and consider third-party quality inspections before large-scale orders.

Logistics & Compliance Guide for Motorized Bicycle Parts

Navigating the logistics and compliance landscape for motorized bicycle parts requires careful attention to international trade regulations, transportation requirements, and safety standards. This guide provides essential information for manufacturers, distributors, and importers to ensure smooth operations and legal compliance.

Classification and Harmonized System (HS) Codes

Accurate classification of motorized bicycle parts under the Harmonized System (HS) is critical for determining import duties, taxes, and regulatory requirements. Key examples include:

- Electric Motors (for bicycles): HS Code 8501.31 or 8501.32 (depending on power output and type)

- Lithium-Ion Batteries: HS Code 8507.60 (commonly used in e-bikes)

- Controllers and Electronic Speed Regulators: HS Code 8537.10

- Frames and Forks (specific to motorized bikes): HS Code 8714.10

- Pedal-Assist Sensors: Typically classified under 8543.70 (electronic components)

Always verify HS codes with local customs authorities, as interpretations may vary by country.

Import/Export Regulations

Different countries impose specific rules on motorized bicycle components, especially those related to electric powertrains:

- United States: The Consumer Product Safety Commission (CPSC) oversees safety standards. The National Highway Traffic Safety Administration (NHTSA) does not regulate e-bikes as motor vehicles, but state laws may apply. Ensure compliance with DOT labeling if applicable.

- European Union: Parts must comply with the EU Machinery Directive (2006/42/EC) and the Low Voltage Directive (2014/35/EU). CE marking is mandatory. EN 15194 is the key standard for pedal-assisted electric bikes.

- Canada: Transport Canada follows the Motor Vehicle Safety Act. E-bike parts must meet the requirements of the Canadian Electric Bicycles Standard (CSA C22.2 No. 251).

- Australia/New Zealand: Must comply with AS/NZS 5193:2022 for power-assisted pedal cycles.

Verify destination-specific documentation, such as certificates of conformity, test reports, and technical files.

Battery Shipping and Safety Compliance

Lithium-ion batteries are subject to strict international shipping regulations due to fire risk:

- UN38.3 Testing Certification: Required for all lithium batteries shipped by air or sea. This includes tests for vibration, shock, altitude, and thermal stress.

- IATA Dangerous Goods Regulations (Air): Batteries must be shipped at ≤30% state of charge, properly packaged, and labeled with Class 9 hazardous material labels.

- IMDG Code (Sea): Governs maritime transport of lithium batteries, with similar packaging and documentation requirements.

- Special Provisions: Some carriers restrict battery shipments unless they are installed in equipment (PI 965–PI 970).

Ensure all battery shipments include proper Safety Data Sheets (SDS) and shipper declarations.

Packaging and Labeling Requirements

Proper packaging protects components during transit and ensures regulatory compliance:

- Use durable, moisture-resistant packaging with cushioning to prevent damage.

- Label packages with:

- Product name and part number

- HS code and country of origin

- Weight and dimensions

- Handling symbols (e.g., “Fragile,” “This Way Up”)

- Battery-specific labels (if applicable): “Lithium Ion,” “Dangerous Goods,” UN number

- Include bilingual labeling where required (e.g., English/French in Canada).

Customs Documentation

Complete and accurate documentation minimizes delays at borders:

- Commercial Invoice (with detailed descriptions, values, and HS codes)

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin (to claim preferential tariffs under trade agreements)

- Test Reports and Compliance Certificates (e.g., CE, FCC, RoHS)

- Dangerous Goods Declaration (for batteries)

Maintain records for at least five years for audit purposes.

Environmental and Chemical Regulations

Motorized bicycle parts may be subject to environmental and chemical restrictions:

- RoHS (EU): Restricts hazardous substances (e.g., lead, cadmium, mercury) in electrical components.

- REACH (EU): Requires disclosure of Substances of Very High Concern (SVHC) in articles.

- Proposition 65 (California): Requires warnings if products contain listed chemicals.

- WEEE (EU): Producers may be responsible for recycling electronic waste.

Ensure suppliers provide material declarations and compliance certificates.

Quality and Safety Standards

Adherence to safety standards reduces liability and enhances market access:

- EN 15194 (Europe): Performance, safety, and labeling requirements for e-bikes.

- UL 2849 (North America): Standard for safety of electric bicycle systems, including electrical drive assemblies and software.

- FCC Part 15 (USA): Electromagnetic interference (EMI) compliance for electronic components.

Conduct regular third-party testing and maintain up-to-date certification.

Conclusion

Successfully managing the logistics and compliance of motorized bicycle parts involves proactive planning across classification, transportation, safety, and regulatory domains. Partner with experienced freight forwarders, stay updated on regional regulations, and maintain thorough documentation to ensure reliable and compliant supply chain operations.

In conclusion, sourcing motorized bicycle parts requires careful consideration of quality, compatibility, cost, and reliability of suppliers. Whether purchasing individual components for a custom build or seeking complete kits, it is essential to verify specifications, prioritize safety-certified parts, and choose reputable vendors—whether local shops or trusted online platforms. Evaluating customer reviews, warranty options, and after-sales support can further ensure a successful and cost-effective build. With the growing availability of aftermarket and OEM parts, enthusiasts and entrepreneurs alike can assemble efficient, high-performance motorized bicycles tailored to specific needs. Ultimately, thorough research and strategic sourcing lead to a durable, compliant, and satisfying motorized biking experience.