The motorized bicycle market is experiencing robust expansion, fueled by rising demand for sustainable urban mobility and advancements in electric and high-performance components. According to Grand View Research, the global electric bicycle market was valued at USD 41.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030. This surge is driving innovation in high-performance parts such as motor kits, drivetrains, battery systems, and control electronics. As consumers increasingly seek enhanced speed, range, and durability, manufacturers are prioritizing lightweight materials, efficiency, and integration capabilities. In this rapidly evolving landscape, a select group of component suppliers are leading the charge in engineering excellence and scalability. Based on market presence, technological innovation, and performance metrics, the following ten companies represent the forefront of motorized bicycle high-performance parts manufacturing.

Top 10 Motorized Bicycle High Performance Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

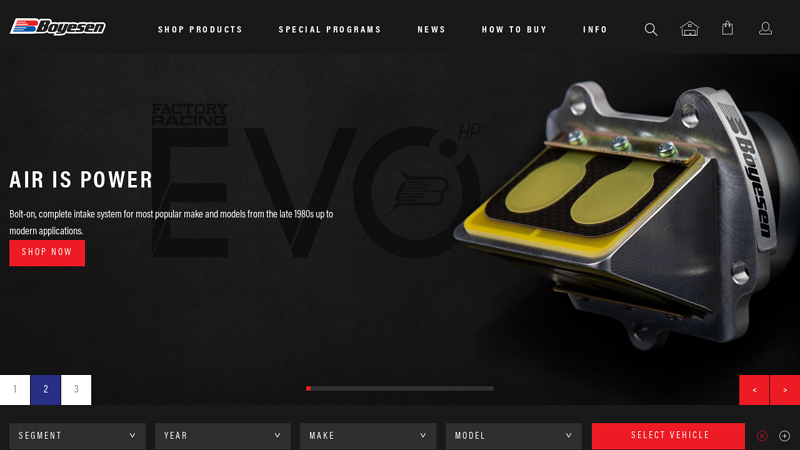

#1 Boyesen Factory Racing Dirt Bike Parts

Domain Est. 1995

Website: boyesen.com

Key Highlights: “Factory Racing” has stood for years as an iconic symbol of performance in the hearts and minds of MX and Offroad riders around the world….

#2 SLF Motion

Domain Est. 2015

Website: slfmotion.com

Key Highlights: SLF Motion in Pawnee, Illinois manufactures bicycle parts built for Speed and Durability. Competitive parts that set the industry standard….

#3 48cc & 80cc Gasoline Bicycle Engine Parts

Domain Est. 2004

Website: monsterscooterparts.com

Key Highlights: Free delivery over $100 · 60-day returns…

#4 CeramicSpeed

Domain Est. 2004 | Founded: 2004

Website: ceramicspeed.com

Key Highlights: Free delivery over $199 Free 14-day returnsCrafting the fastest bearing products for cycling and industry since 2004. Hand built in Denmark. Never Compromise….

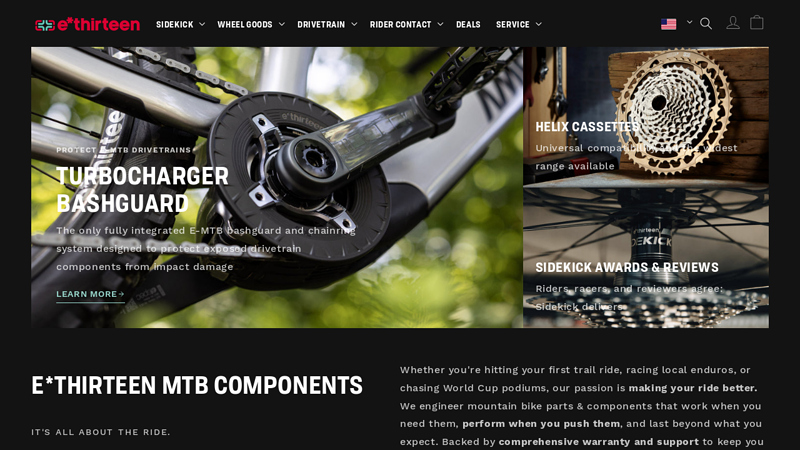

#5 e*thirteen

Domain Est. 2005

Website: ethirteen.com

Key Highlights: Premium mountain bike components engineered for performance. Shop e*thirteen’s innovative Sidekick hubs and MTB and eMTB parts trusted by riders & racers ……

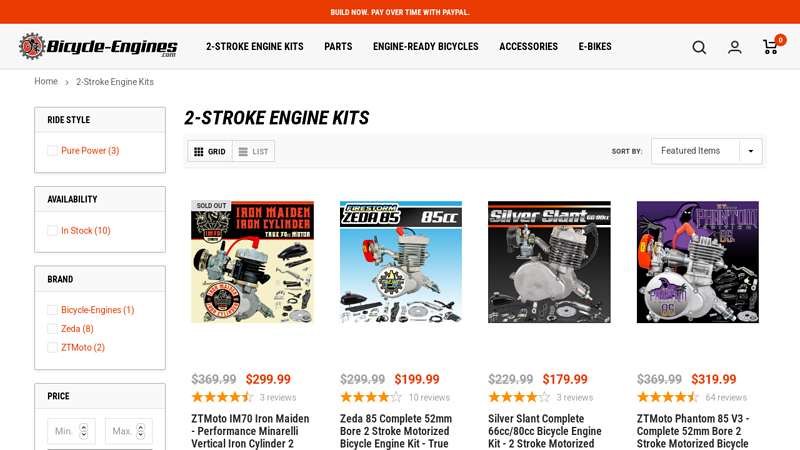

#6 2

Domain Est. 2007

Website: bicycle-engines.com

Key Highlights: Free delivery over $150Zeda Dio Kits – 2 Stroke Performance Upgrades Take your motorized bike to the next level with an affordable Dio Reed Valve & OKO carb performance kit….

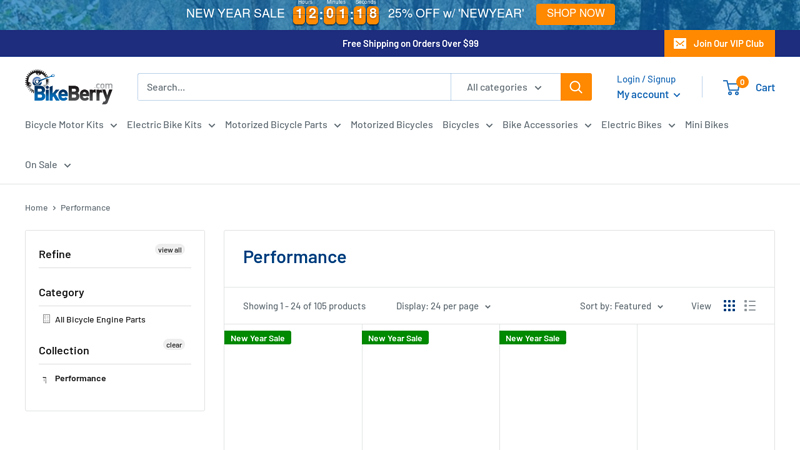

#7 Motorized Bike Performance Parts

Domain Est. 2007

Website: bikeberry.com

Key Highlights: Free delivery over $99We’re your one-stop shop for performance parts like DIO Cylinders and Reeds, high compression cylinder heads, high-performance carburetors ……

#8 LMX Bikes

Domain Est. 2014

Website: lmxbikes.com

Key Highlights: LMX Bikes develops high-performance speed bikes and reinvents the practice of off-road electric two-wheelers….

#9 RDManu

Domain Est. 2019

Website: rdmanu.com

Key Highlights: Take your gas motorized bike to new heights with our innovative racing parts. Renowned for their superior performance and reliability….

#10 Smolik Performance

Domain Est. 2020

Website: smolikperformance.com

Key Highlights: We leverage advanced manufacturing technologies—including CNC machining and 3D printing—to ensure exceptional performance, consistency, and innovation in every ……

Expert Sourcing Insights for Motorized Bicycle High Performance Parts

H2: 2026 Market Trends for Motorized Bicycle High-Performance Parts

The global market for motorized bicycle high-performance parts is poised for significant transformation by 2026, driven by technological innovation, shifting consumer preferences, and evolving regulatory landscapes. As urban mobility demands intensify and sustainability becomes a central focus, high-performance components for motorized bicycles—particularly electric and hybrid powertrain systems—are expected to dominate growth trajectories. Below is an analysis of key trends shaping the H2 2026 market landscape.

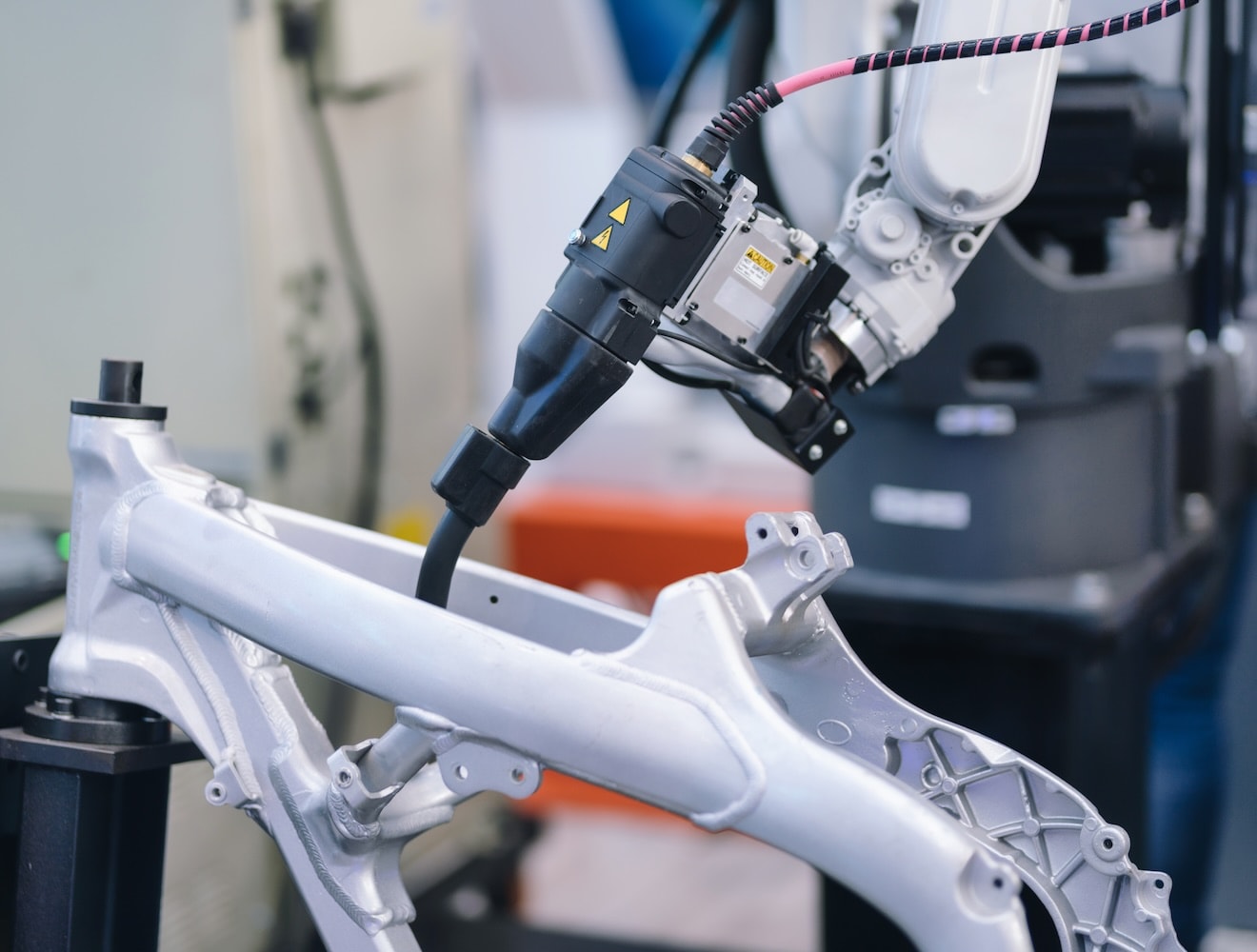

1. Surge in Demand for Lightweight, High-Efficiency Components

By H2 2026, manufacturers are increasingly prioritizing lightweight materials such as carbon fiber, aerospace-grade aluminum, and advanced composites in high-performance parts like frames, drivetrains, and motor casings. These materials enhance speed, acceleration, and energy efficiency—critical for performance-oriented riders. Demand is being driven by both recreational enthusiasts and last-mile delivery services seeking faster, longer-range solutions.

2. Advancements in Electric Powertrain Technology

High-performance electric motors, controllers, and battery systems are undergoing rapid innovation. In H2 2026, expect broader adoption of 750W+ hub and mid-drive motors offering extended torque and hill-climbing capabilities. Integration with smart battery management systems (BMS) enables improved thermal regulation and longer cycle life. The rise of modular battery packs allows riders to swap and upgrade power sources easily, boosting customization and performance.

3. Integration of Smart Connectivity and IoT

High-performance motorized bicycles are increasingly equipped with IoT-enabled components. By H2 2026, parts such as smart throttles, regenerative braking systems, and GPS-enabled motor controllers will feature real-time performance analytics, over-the-air (OTA) updates, and mobile app integration. This trend supports predictive maintenance, security tracking, and personalized riding modes—enhancing both usability and resale value.

4. Growth of the Premium Aftermarket Sector

As consumer interest in customization grows, the aftermarket for high-performance upgrades is expanding rapidly. Aftermarket parts such as performance tires, suspension systems, high-capacity battery extenders, and upgraded braking systems (e.g., hydraulic disc brakes) are seeing increased demand. Online marketplaces and specialty retailers are capitalizing on this trend, offering globally sourced components tailored to enthusiast communities.

5. Regulatory Influence and Standardization

By H2 2026, stricter regulations in North America, Europe, and parts of Asia are shaping the design and certification of high-performance parts. Governments are introducing power output limits (e.g., 750W in the U.S., 250W in EU with pedal assist) and safety standards for motorized components. This is prompting manufacturers to innovate within compliance frameworks, leading to the development of “legal high-performance” kits that maximize efficiency without exceeding regulatory thresholds.

6. Regional Market Diversification

While North America and Western Europe remain key markets due to high disposable income and cycling infrastructure, emerging markets in Southeast Asia and Latin America are gaining traction. In countries like Indonesia, India, and Colombia, urban congestion and rising fuel costs are fueling demand for affordable yet high-performance motorized bicycle conversions. Localized production and distribution of parts are expected to rise to meet this demand.

7. Sustainability and Circular Economy Initiatives

Environmental concerns are pushing manufacturers toward sustainable production practices. By H2 2026, leading brands are adopting recyclable materials, energy-efficient manufacturing, and take-back programs for obsolete batteries and motors. This aligns with consumer demand for eco-conscious performance upgrades, reinforcing brand loyalty and market differentiation.

Conclusion

The H2 2026 market for motorized bicycle high-performance parts reflects a convergence of innovation, regulation, and consumer-driven customization. As electric mobility matures, the sector will continue to evolve beyond basic functionality toward integrated, intelligent, and high-output systems. Companies that invest in R&D, adhere to global standards, and engage with enthusiast communities are best positioned to lead in this dynamic and expanding market.

Common Pitfalls When Sourcing High-Performance Motorized Bicycle Parts

Sourcing high-performance parts for motorized bicycles—such as powerful motors, advanced controllers, lightweight frames, and high-capacity batteries—can significantly enhance performance. However, buyers often encounter critical pitfalls related to quality and intellectual property (IP) that can compromise safety, legality, and long-term reliability.

Quality-Related Pitfalls

Overstated Performance Specifications

Many suppliers, particularly on online marketplaces, exaggerate key metrics like motor power (e.g., labeling a 500W motor as 2000W), battery capacity (using nominal vs. actual mAh), or top speed. These inflated claims can mislead buyers into purchasing underperforming or unsafe components that fail prematurely or overheat. Always verify specifications through independent reviews, third-party testing, or trusted distributors.

Inconsistent Manufacturing Standards

Low-cost suppliers, especially those in regions with lax oversight, may lack rigorous quality control. This results in inconsistent tolerances, poor soldering, substandard materials, and unreliable electronic components. Such inconsistencies increase the risk of mechanical failure, electrical shorts, or fire hazards—particularly dangerous in high-voltage systems like lithium-ion batteries and motor controllers.

Lack of Certification and Compliance

High-performance parts should comply with safety standards such as UL, CE, or RoHS. However, many aftermarket components lack proper certification or use counterfeit marks. Using non-compliant parts can void warranties, lead to legal liability, and pose safety risks, especially during high-load operation or in regulated jurisdictions.

Poor Thermal and Mechanical Durability

Performance parts generate significant heat and mechanical stress. Low-quality motors or controllers may lack proper heat dissipation, leading to thermal throttling or burnout. Similarly, frames or drivetrain components made from inferior alloys can crack or deform under load. Always assess real-world durability, not just peak performance under ideal conditions.

Intellectual Property (IP) Pitfalls

Counterfeit or Cloned Components

Many high-performance parts, such as motor controllers or battery management systems (BMS), are reverse-engineered copies of patented designs. These clones often mimic the appearance and branding of reputable brands (e.g., Kelly Controller, Bafang) but lack engineering integrity and firmware support. Using counterfeit components can expose buyers to legal risk and deprive innovators of fair compensation.

Unlicensed Use of Proprietary Technology

Some suppliers integrate patented technologies—such as regenerative braking algorithms or proprietary motor windings—without licensing. While this reduces cost, it violates IP rights and may result in limited technical support, no firmware updates, or sudden product discontinuation due to legal action.

Ambiguous or Missing Documentation

Genuine high-performance parts come with detailed technical documentation, firmware access, and SDKs for customization. Cloned or IP-infringing parts often lack proper documentation, making integration difficult and troubleshooting nearly impossible. This is especially problematic when tuning performance parameters or diagnosing system errors.

Risk of Legal and Warranty Issues

Using IP-infringing parts may void warranties on other system components and expose end-users or resellers to intellectual property litigation, particularly in commercial applications. Brands that invest in R&D may pursue legal action against distributors or integrators using counterfeit or cloned technology.

Conclusion

Avoiding these pitfalls requires due diligence: source from reputable suppliers, request verifiable test data and certifications, and confirm IP legitimacy. Investing in authentic, high-quality components ensures better performance, safety, and long-term support—critical for any serious motorized bicycle build.

Logistics & Compliance Guide for Motorized Bicycle High Performance Parts

Understanding Regulatory Classifications

Motorized bicycles and their high-performance components are subject to diverse regulations depending on the jurisdiction. Before shipping or selling, determine whether your product falls under “motorized bicycle,” “moped,” “electric bicycle (e-bike),” or “motor vehicle” classifications. In the United States, federal law defines e-bikes based on speed (typically 20 mph for Class 1 and 2, 28 mph for Class 3) and motor power (usually limited to 750 watts). The European Union follows EN 15194 standards, which cap e-bike motors at 250 watts with speed limiting at 25 km/h. High-performance parts such as high-torque motors, high-capacity batteries, or performance controllers may push a vehicle beyond these thresholds, reclassifying it as a motor vehicle—subjecting it to additional requirements like registration, insurance, and licensing.

Safety and Certification Standards

Ensure all high-performance parts meet applicable safety certifications. In North America, UL 2849 certification is increasingly required for e-bike electrical systems, including motors, batteries, and charging components, particularly by major retailers and insurers. The FCC regulates electromagnetic interference (EMI) for electronic components, requiring compliance with Part 15 rules. For international markets, CE marking (EU), UKCA (UK), and other regional certifications may be mandatory. Components such as lithium-ion batteries must comply with UN 38.3 testing for transportation safety. Documentation including test reports, conformity declarations, and user manuals must accompany shipments to demonstrate compliance.

Packaging and Transportation Logistics

Proper packaging is critical for protecting high-performance components during transit and meeting shipping regulations. Lithium-ion batteries are classified as dangerous goods under IATA, IMDG, and ADR regulations, requiring specific packaging standards (e.g., UN-certified boxes, insulation of terminals, state-of-charge limits). Shipments must be labeled with proper hazard class 9 labels and include required documentation like Shipper’s Declaration for Dangerous Goods when shipping by air. For ground transportation, ensure compliance with local hazardous materials regulations. Clearly mark packages as containing high-performance parts that may affect legal vehicle classification.

Import and Export Compliance

When moving high-performance motorized bicycle parts across borders, ensure compliance with customs regulations. Accurate Harmonized System (HS) codes are essential—examples include 8711.60 (cycles with auxiliary motors) or 8501.31 (electric motors). Misclassification can lead to delays, fines, or seizure. Export controls may apply if components have dual-use potential (e.g., high-efficiency motors). Verify if licenses are needed under regimes like the U.S. Export Administration Regulations (EAR). Additionally, import duties, value-added taxes (VAT), and country-specific conformity assessments (e.g., INMETRO in Brazil, KC in South Korea) may apply.

End-User Responsibility and Documentation

Provide clear warning labels and instructions indicating that modifying a bicycle with high-performance parts may void local regulatory compliance and manufacturer warranties. Include compliance statements specifying that the part is intended for off-road or private-use applications if it exceeds legal road-use limits. Maintain records of compliance testing, supply chain due diligence (especially for battery materials), and product liability insurance. Transparent documentation protects your business and informs consumers of legal and safety implications.

Ongoing Regulatory Monitoring

Regulations for motorized bicycles and performance components are rapidly evolving. Subscribe to regulatory updates from agencies such as the NHTSA (U.S.), Transport Canada, the European Commission, and standards bodies like UL and CEN. Regular compliance audits and engagement with industry associations help ensure long-term market access and reduce legal risk.

In conclusion, sourcing high-performance motorized bicycle parts requires careful consideration of quality, compatibility, and reliability. Prioritizing reputable suppliers and manufacturers ensures access to durable components such as high-torque motors, efficient drivetrains, advanced controllers, and robust frames designed to handle increased power. Researching customer reviews, verifying certifications, and comparing technical specifications will help in making informed decisions. Additionally, balancing performance enhancements with safety, legality, and budget constraints is essential for an optimal build. By strategically sourcing components from trusted vendors—whether through specialty retailers, online marketplaces, or direct manufacturers—enthusiasts can create a powerful, reliable, and customized motorized bicycle that meets both performance expectations and real-world riding demands.