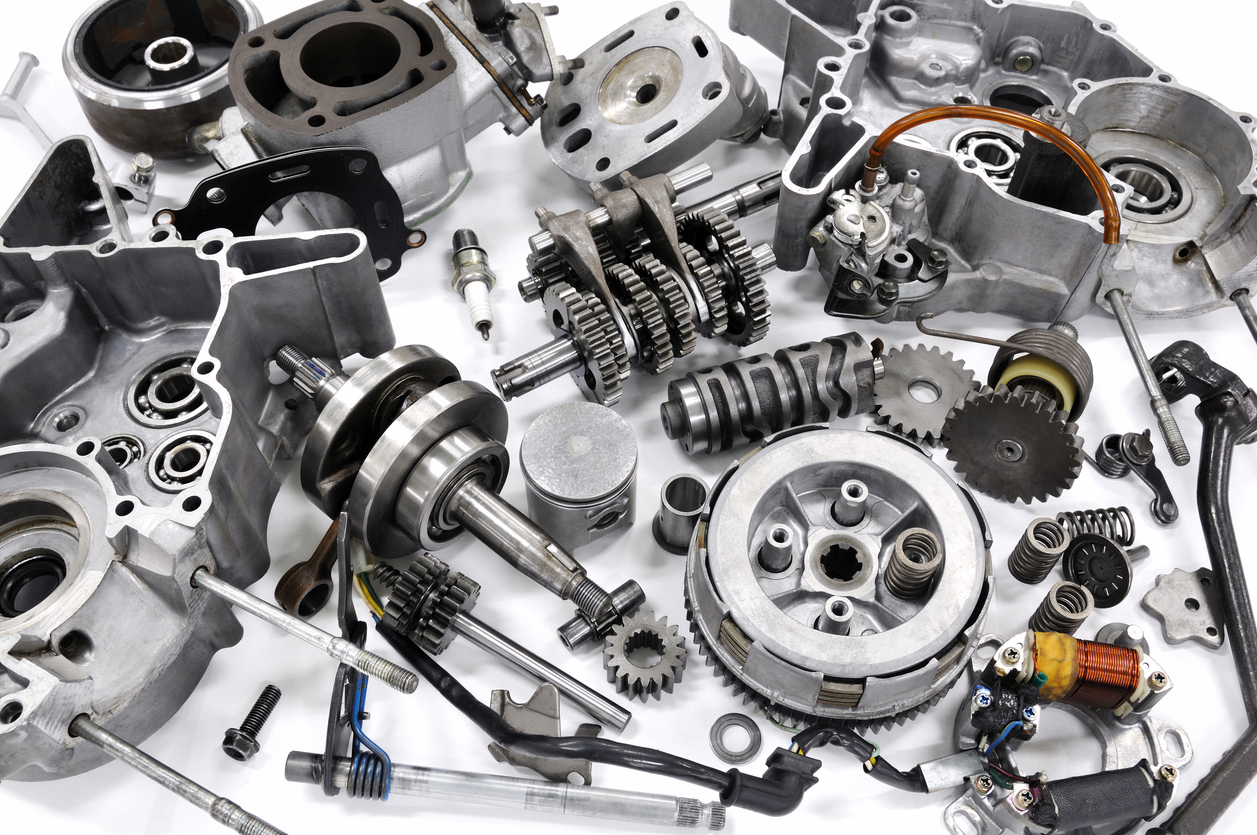

The global motorcycle engine parts market is experiencing steady growth, driven by rising motorcycle production, increasing demand for aftermarket components, and the expansion of mobility solutions in emerging economies. According to Mordor Intelligence, the motorcycle market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, directly influencing demand for high-performance and replacement engine parts. This growth is further supported by trends such as electric motorcycle development, stricter emission norms, and a growing culture of motorcycle customization and maintenance. As original equipment manufacturers (OEMs) and aftermarket suppliers ramp up production to meet evolving industry standards, identifying the leading players in engine component manufacturing becomes critical for industry stakeholders. Based on production scale, global reach, technological innovation, and OEM partnerships, the following list highlights the top 10 motorcycle engine parts manufacturers shaping the future of the two-wheeler industry.

Top 10 Motorcycle Engine Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OEM Motorcycle Parts

Domain Est. 2000

Website: motosport.com

Key Highlights: Save up to 40% on our huge inventory of OEM parts along with available OEM parts fiche for dirt bikes, motorcycles, ATVs and UTVs at MotoSport….

#2 Ken’s Factory USA: World Class Motorcycle Parts For Harley

Domain Est. 2014

Website: kensfactoryusa.com

Key Highlights: Free delivery over $30Ken’s Factory USA shop provides world-class styling for Harley-Davidson and custom motorcycles. Details create style….

#3 Double R Parts

Domain Est. 2017

Website: doublerparts.com

Key Highlights: Various OEM parts from a single supplier Double R Parts provides motorcycle industry companies with all their needs from a single supplier. With our webshop, ……

#4 Kuryakyn Motorcycle Parts

Domain Est. 1996

Website: kuryakyn.com

Key Highlights: We know you want to customize your bike and kick it up a notch, and with our Kuryakyn motorcycle parts, you can do just that! Explore our collection today….

#5 Arlen Ness Motorcycles

Domain Est. 1996

Website: arlenness.com

Key Highlights: Free delivery 365-day returnsQuality Motorcycle Parts From California Craftsmen 1970. For over 50 years Arlen Ness has designed and manufactured industry leading performance parts …

#6 MID

Domain Est. 1996

Website: mid-usa.com

Key Highlights: For over 41 years, Mid-USA Motorcycle Parts has proudly provided quality parts and accessories to the motorcycle industry. We look forward to becoming your one- ……

#7 Enduro Engineering

Domain Est. 1999

Website: enduroeng.com

Key Highlights: Welcome to Enduro Engineering, your source for top-quality off-road motorcycle accessories and parts. Discover our wide range of products designed to ……

#8 Brock’s Performance

Domain Est. 2003

Website: brocksperformance.com

Key Highlights: A world-respected leader in the innovation and the development of performance components. We design our products to reignite the motorcycle enthusiast’s soul….

#9 Daytona Corp.

Domain Est. 2008

Website: daytona-global.com

Key Highlights: Daytona motorcycle parts meet the wind excitement on every horizon. For HARLEY-DAVIDSON We offer high performance parts and repair parts….

#10 Motorcycle Special Parts, Accessories and Gear

Domain Est. 2009

Website: cncracing.com

Key Highlights: Special components tailored. CNC Racing is a guarantee of performance, strength, reliability, lightness and pure Italian design. Chooese the best for your ……

Expert Sourcing Insights for Motorcycle Engine Parts

2026 Market Trends for Motorcycle Engine Parts

As the global motorcycle industry evolves, the market for motorcycle engine parts is expected to undergo significant transformation by 2026. Driven by technological innovation, environmental regulations, shifting consumer preferences, and regional economic dynamics, the engine components sector is adapting to meet new demands. Below is an in-depth analysis of key trends shaping the 2026 landscape.

Rising Demand for Fuel-Efficiency and Emission-Compliant Components

With tightening global emission standards—such as Euro 5 and upcoming Euro 6 regulations in Europe, Bharat Stage VI in India, and EPA Tier 4 in the U.S.—manufacturers are redesigning engine parts to optimize combustion efficiency and reduce pollutants. Components such as high-efficiency pistons, advanced cylinder heads, lean-burn compatible valves, and electronic fuel injection (EFI) systems are seeing increased adoption. By 2026, engine parts engineered for lower emissions and better fuel economy will dominate both OEM and aftermarket segments, particularly in urban commuter motorcycles.

Electrification Impact on Engine Part Demand

Although electric motorcycles do not use traditional internal combustion engine (ICE) parts, the transition is gradual. While sales of electric two-wheelers are growing—especially in regions like China and India—ICE motorcycles will remain prevalent through 2026, particularly in emerging markets. However, demand for certain traditional engine components (e.g., carburetors, exhaust manifolds) may decline in developed markets. Conversely, hybrid systems and range-extender engines could create niche demand for specialized engine parts, blending legacy ICE technology with electrified systems.

Growth of the Aftermarket and Customization Culture

The global motorcycle aftermarket for engine parts is projected to expand at a CAGR of 5.2% through 2026. Enthusiasts and riders in North America, Europe, and parts of Asia are increasingly investing in performance-enhancing components such as aftermarket camshafts, high-compression pistons, performance exhaust systems, and turbocharger kits. The rise of online marketplaces and direct-to-consumer platforms is making it easier for riders to source and install upgraded engine parts, further boosting aftermarket growth.

Advancements in Material Science and Lightweight Components

Lightweighting is a key trend in motorcycle engineering. By 2026, engine parts made from advanced materials such as forged aluminum alloys, titanium, and composite ceramics will gain traction. These materials reduce overall engine weight, improve thermal efficiency, and enhance performance. For example, titanium connecting rods and nitride-coated piston rings are increasingly used in high-performance and racing applications, with spillover into premium consumer segments.

Regional Market Dynamics

Asia-Pacific, led by India, China, and Indonesia, will remain the largest market for motorcycle engine parts due to high motorcycle ownership and domestic manufacturing. In contrast, North America and Europe will see steady demand driven by aging fleets, vintage bike restoration, and performance tuning. Latin America and Africa present emerging opportunities, where affordability and durability of engine components are key purchasing factors.

Supply Chain Resilience and Localization

Post-pandemic disruptions and geopolitical tensions have prompted manufacturers to localize production. By 2026, more engine part suppliers are expected to establish regional manufacturing hubs to reduce dependency on single-source imports. This trend enhances supply chain resilience and reduces lead times, particularly for critical components like crankshafts, cylinder liners, and timing chains.

Digitalization and Smart Manufacturing

The integration of Industry 4.0 technologies—such as AI-driven quality control, IoT-enabled predictive maintenance, and 3D printing—is transforming engine part manufacturing. Custom or low-volume engine components can now be produced faster and more cost-effectively. By 2026, digital twins and real-time production monitoring will become standard in leading engine part factories, improving precision and reducing waste.

Sustainability and Circular Economy

Environmental concerns are pushing the industry toward sustainable practices. By 2026, remanufactured and recycled engine parts are expected to gain market share, especially in cost-sensitive regions. Companies are investing in closed-loop recycling systems for aluminum and steel engine components, reducing raw material consumption and carbon footprint.

Conclusion

The motorcycle engine parts market in 2026 will be shaped by a confluence of regulatory pressures, technological innovation, and changing consumer behavior. While electrification looms on the horizon, ICE-based engine components will remain vital, evolving to become cleaner, lighter, and smarter. Stakeholders who embrace sustainability, digital manufacturing, and regional customization will be best positioned to thrive in this dynamic market environment.

Common Pitfalls When Sourcing Motorcycle Engine Parts: Quality and Intellectual Property Risks

Sourcing motorcycle engine parts—especially from international or third-party suppliers—can present significant challenges. Two of the most critical areas where buyers encounter problems are part quality and intellectual property (IP) violations. Avoiding these pitfalls is essential for maintaining performance, safety, and legal compliance.

Poor Quality Control and Substandard Materials

One of the most frequent issues when sourcing motorcycle engine parts is receiving components that fail to meet required specifications or durability standards. This often stems from suppliers using low-grade materials, inadequate manufacturing processes, or lack of proper quality assurance. For example, counterfeit or imitation cylinder heads, pistons, or crankshafts may look identical to OEM parts but are made with inferior alloys, leading to premature failure, engine damage, or safety hazards. Buyers may also face inconsistent tolerances, improper heat treatment, or poor surface finishes—issues that can compromise engine performance and longevity. Without rigorous inspection protocols or trusted supplier vetting, businesses risk damaging their reputation and incurring costly warranty claims.

Intellectual Property Infringement and Counterfeit Goods

Another major pitfall is the unintentional procurement of parts that infringe on intellectual property rights. Many third-party manufacturers produce “compatible” or “pattern” parts that closely mimic branded OEM components, sometimes crossing the line into trademark or design patent violations. Distributing or installing such parts can expose businesses to legal liability, including fines, seizure of goods, or litigation from original equipment manufacturers. Additionally, counterfeit parts often lack traceability and quality certifications, increasing the risk of failure. Buyers may believe they are purchasing affordable alternatives, but unknowingly support illegal manufacturing practices and expose themselves to significant legal and financial risks. Verifying supplier legitimacy, requesting IP compliance documentation, and sourcing from authorized distributors are essential steps to avoid these issues.

Logistics & Compliance Guide for Motorcycle Engine Parts

Navigating the shipment and regulatory requirements for motorcycle engine parts requires careful planning and adherence to international and local standards. This guide outlines key considerations for safe, efficient, and compliant logistics operations.

Product Classification and HS Codes

Accurate classification under the Harmonized System (HS) is critical for customs clearance, duty assessment, and import/export control. Common HS codes for motorcycle engine parts include:

- 8409.91: Parts suitable for spark-ignition internal combustion engines (e.g., pistons, connecting rods, cylinder heads)

- 8409.99: Parts for other internal combustion engines (e.g., diesel components)

- 8714.19: Other parts and accessories of motorcycles (may apply to certain engine assemblies)

Always verify with local customs authorities or a licensed customs broker, as classifications can vary by country and part specificity.

Packaging and Handling Requirements

Proper packaging ensures parts arrive undamaged and reduces liability:

- Use moisture-resistant, shock-absorbent materials (e.g., foam inserts, desiccants)

- Clearly label packages with product description, part number, weight, and handling instructions (e.g., “Fragile,” “Do Not Stack”)

- Secure loose components to prevent internal movement

- Protect precision surfaces (e.g., cylinder bores, crankshaft journals) with protective caps or grease coatings

Transportation Modes and Considerations

Choose the appropriate transport method based on urgency, volume, and destination:

- Air Freight: Best for high-value or time-sensitive components; subject to IATA hazardous materials regulations if parts contain residual oils or fuels

- Ocean Freight: Cost-effective for bulk shipments; use sealed containers to prevent moisture and contamination

- Ground Transport: Ideal for regional distribution; ensure vehicles are equipped to handle heavy or sensitive cargo

Ensure temperature and humidity controls are maintained, especially for precision-machined parts.

Export and Import Documentation

Complete and accurate documentation is essential for customs compliance:

- Commercial Invoice (with detailed part descriptions, values, and currency)

- Packing List (itemized by package)

- Bill of Lading (for ocean) or Air Waybill (for air)

- Certificate of Origin (may affect duty rates under trade agreements)

- Export Declaration (required in many countries for shipments above a value threshold)

Some countries may require additional certifications for engine components, particularly emissions-related parts.

Regulatory and Environmental Compliance

Motorcycle engine parts may be subject to environmental and safety regulations:

- Emissions Standards: Components like carburetors, fuel injection systems, or catalytic converters may be regulated under EPA (USA), EURO (EU), or other regional standards. Verify if parts are legal for import/use in destination markets.

- REACH & RoHS (EU): Ensure materials used (e.g., coatings, alloys) comply with restrictions on hazardous substances.

- Proposition 65 (California): Disclose if parts contain chemicals known to cause cancer or reproductive harm.

- Waste & Recycling: Comply with local end-of-life vehicle (ELV) directives; some parts may require special handling at disposal.

Customs Clearance and Duties

- Pre-clear shipments using electronic customs systems (e.g., ACE in the USA, ATLAS in Germany)

- Be prepared to pay applicable import duties, VAT, or GST based on HS code and country of origin

- Some countries restrict or require permits for certain engine modifications (e.g., aftermarket performance parts)

Restricted and Controlled Parts

Certain engine components may be subject to additional scrutiny or restrictions:

- Turbochargers and superchargers (may impact emissions compliance)

- Modified camshafts or ECU chips (may be considered illegal modifications in some regions)

- Used or remanufactured parts (may require inspection or be banned in specific countries)

Verify import eligibility with destination country authorities before shipping.

Insurance and Liability

- Insure shipments for full replacement value

- Specify coverage for damage, theft, and delays

- Retain proof of compliance with packaging and handling standards to support claims if needed

Best Practices Summary

- Classify parts accurately using correct HS codes

- Package for protection and regulatory compliance

- Prepare complete documentation in advance

- Verify destination-specific regulations (emissions, materials, import bans)

- Work with experienced freight forwarders and customs brokers

- Maintain records for audit and compliance purposes

By following this guide, businesses can minimize delays, avoid fines, and ensure smooth global movement of motorcycle engine parts.

In conclusion, sourcing motorcycle engine parts requires careful consideration of quality, compatibility, reliability, and cost. Whether purchasing OEM (original equipment manufacturer) parts for authenticity or aftermarket components for affordability and availability, it is essential to verify the reputation of suppliers and ensure parts meet the required specifications for your motorcycle’s make and model. Online marketplaces, specialized retailers, salvage yards, and direct manufacturer channels each offer unique advantages, and combining these sources strategically can help secure the best value and performance. Proper research, attention to detail, and due diligence ultimately ensure a successful and cost-effective sourcing process, contributing to the optimal function, safety, and longevity of your motorcycle engine.