The global motor coil market is experiencing robust growth, driven by increasing demand for electric motors across industrial, automotive, and consumer electronics sectors. According to Mordor Intelligence, the electric motor market—which relies heavily on precision-manufactured motor coils—was valued at USD 135.7 billion in 2023 and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. A key enabler of this expansion is the rising adoption of energy-efficient motors and the global shift toward electrification, particularly in electric vehicles and industrial automation. As motor coils serve as the core electromagnetic components in these systems, the manufacturers specializing in high-performance, reliable coil winding solutions are becoming increasingly critical in the supply chain. In this rapidly evolving landscape, a select group of companies has emerged as leaders through innovation, scalability, and advanced manufacturing capabilities. Here we present the top 10 motor coil manufacturers shaping the future of motion control and electromechanical systems.

Top 10 Motor Coil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Coil (edgewise, rectangular wire, rectangular copper wire, motor …

Domain Est. 2003

Website: uratani-eng.com

Key Highlights: This is the website of URATANI ENGINEERING, prototype manufacturer and mass producer of coils, motors and other products. LANGUAGE: JPEN · +81-75-575-1377 ……

#2

Domain Est. 1996

Website: transcoil.com

Key Highlights: TCI is the leading manufacturer of active filters and passive filters to mitigate harmonics and improve power quality….

#3 About Stimple and Ward

Domain Est. 1998

Website: swcoils.com

Key Highlights: Stimple & Ward is America’s oldest electric coil company manufacturing electric coils for industrial applications and specializes in edge wound coils….

#4 Form Coil Manufacturing

Domain Est. 1999

Website: pecoil.com

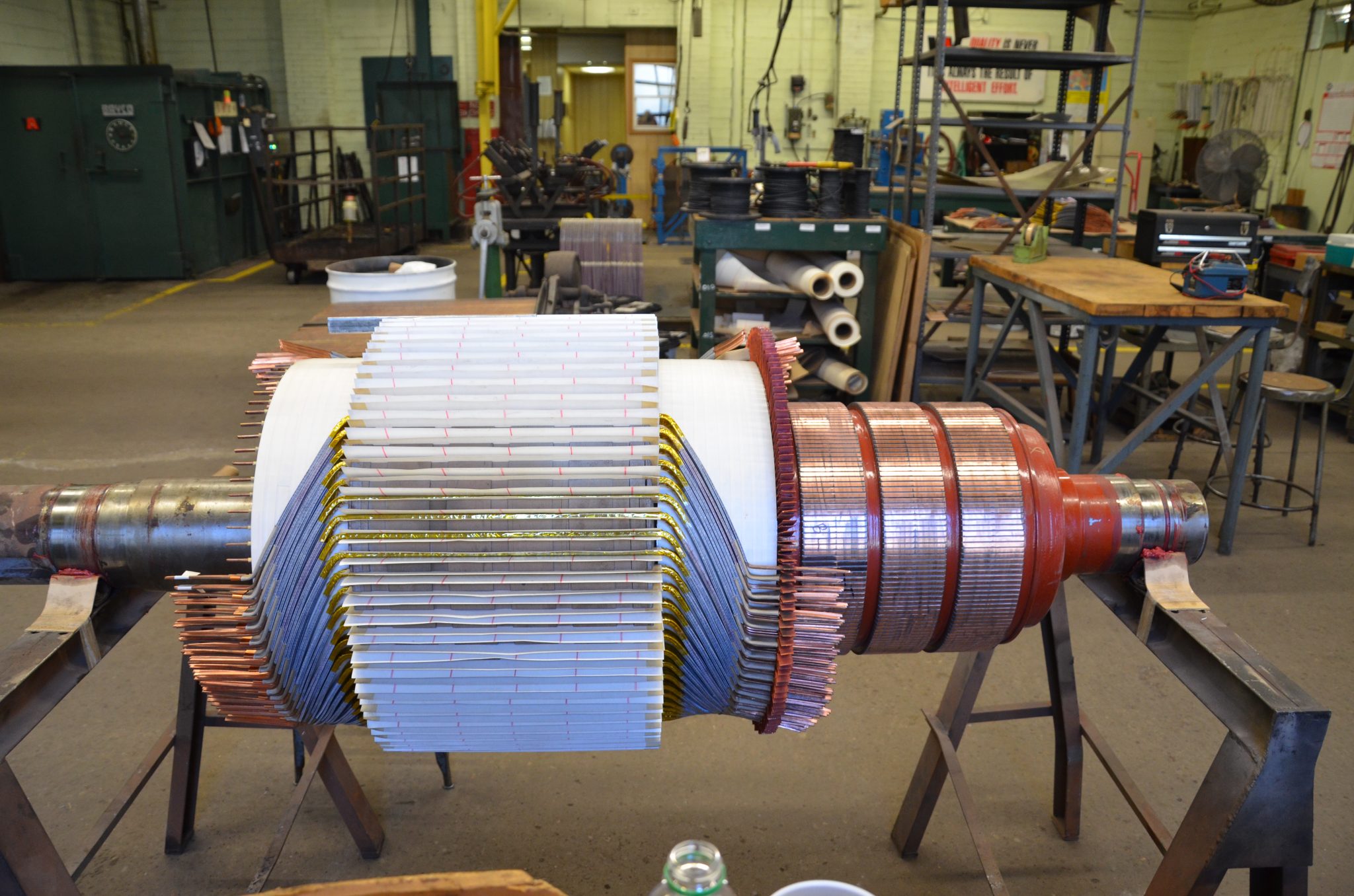

Key Highlights: Precision Coil and Rotor is a US industrial service company dedicated to manufacturing and rebuilding of component products for rotating electrical machines….

#5 Automatic Coil Winding Machine Manufacturer Supplier

Domain Est. 2000

Website: acmeengg.com

Key Highlights: At Acme Electronics, we specialize in offering a comprehensive range of coil winding machines tailored to meet diverse customer requirements. Our product lineup ……

#6 H2W Technologies: Linear Motors

Domain Est. 2000

Website: h2wtech.com

Key Highlights: H2W Technologies is a manufacturer of linear motors and positioning stages, which include: voice coils actuators, brushless linear motors, limited angle ……

#7 Electric Motor Coil Company: Coil Manufacturer

Domain Est. 2017

Website: emccltd.ca

Key Highlights: Coil Manufacturer – Supplier of Motor & Generator Stator Coils, Traction Coils, Armature Coils, & Commutators for winding rotating equipment….

#8 Synthesis

Domain Est. 2019

Website: synthesis-winding.com

Key Highlights: We specialize in designing and manufacturing winding machines like Coil Winding Machines, Transformer Winding Machines, Capacitor Winding Machines, Film Foil ……

#9 Motor Coils

Domain Est. 2005 | Founded: 1954

Website: motorcoils.com

Key Highlights: Established in 1954, Motor Coils Mfg Ltd. has been a staple in the local community and to the rail industry. We’ve recently been acquired by IEC Holden, ……

#10 Rivera Coil Manufacturing

Domain Est. 2022

Website: riveracoilmanufacturing.com

Key Highlights: We manufacture copper coils for pumps and motors and serve our customers in entire regions of Tamil Nadu, Karnataka, Kerala and Andhra Pradesh. Our Products ……

Expert Sourcing Insights for Motor Coil

H2 2026 Market Trends for Motor Coils

The motor coil market in H2 2026 is expected to be characterized by robust growth, technological refinement, and increasing strategic focus, driven by the accelerating global transition towards electrification and energy efficiency. While Q3 and Q4 typically see seasonal demand peaks in industrial sectors, the overarching trends shaping the market stem from deeper structural shifts. Here’s a breakdown of the key trends anticipated:

-

Accelerated EV and E-Mobility Adoption Driving Demand:

- Core Driver: The primary growth engine remains the electric vehicle (EV) market. By H2 2026, global EV penetration rates are projected to rise significantly beyond 2025 levels, particularly in regions like Europe, China, and North America. This directly translates to massive demand for high-performance stator and rotor coils.

- Beyond Passenger Cars: Demand is expanding into adjacent e-mobility segments: electric two/three-wheelers (especially strong in Asia), electric buses, and light commercial vehicles, requiring diverse coil specifications.

- Focus on Efficiency & Power Density: OEMs will push coil manufacturers for higher efficiency (reducing copper losses through optimized winding, better materials) and greater power density to extend range and reduce vehicle size/weight. Hairpin winding technology will be dominant for high-performance traction motors.

-

Industrial Automation & Energy Efficiency Regulations:

- Industrial Electrification: The ongoing push for smarter, more efficient factories drives demand for high-efficiency electric motors (IE4, IE5) in pumps, fans, compressors, and robotics. This necessitates advanced motor coils designed for lower losses and higher reliability.

- Stricter Global Standards: Enforcement and new iterations of energy efficiency regulations (like the EU’s Ecodesign Directive, US DOE rules, China’s GB standards) will mandate the use of higher-efficiency motors across industrial and commercial applications, boosting demand for premium coils.

- Predictive Maintenance & IoT: Increased integration of sensors within motor windings (embedded in coils or terminations) for condition monitoring (temperature, vibration) will grow, requiring coils designed with sensor integration in mind.

-

Material Innovation and Supply Chain Maturation:

- Copper Focus: Copper remains king due to its superior conductivity. While prices will fluctuate, the focus will be on optimizing material usage (thinner insulation, tighter winding) and exploring high-conductivity copper alloys. Significant shifts to alternatives like aluminum are unlikely in high-performance applications by 2026.

- Advanced Insulation Systems: Development and adoption of next-generation insulation materials (e.g., improved thermosets, nanocomposites, high-temperature polyimides) will continue to enhance thermal class (enabling higher operating temperatures), voltage endurance, and partial discharge resistance, crucial for EVs and high-efficiency motors.

- Supply Chain Resilience: Lessons from recent disruptions will lead to more diversified sourcing of copper and key raw materials (insulation resins, varnishes). Nearshoring/reshoring of coil manufacturing, particularly for the automotive sector, will be a notable trend in North America and Europe to mitigate geopolitical and logistical risks.

-

Manufacturing Advancements and Automation:

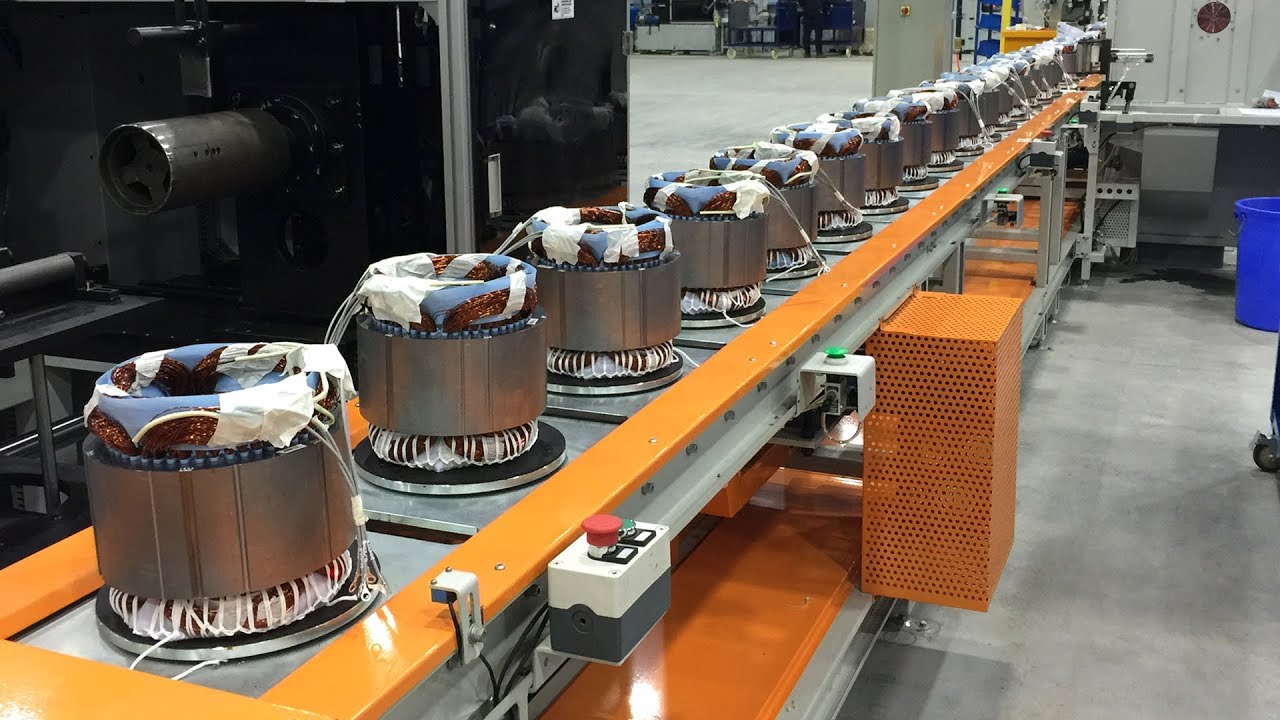

- High-Volume Precision: EV demand necessitates extremely high-volume, high-precision manufacturing. Automation in hairpin insertion, laser welding, vacuum pressure impregnation (VPI), and automated testing will be standard in leading facilities.

- Digitalization & AI: Wider adoption of digital twin technology for coil design and process simulation, along with AI/ML for predictive quality control (identifying defects in winding patterns or insulation) and process optimization, will improve yield and consistency.

- Sustainability in Production: Increased focus on reducing energy consumption in manufacturing processes (e.g., lower-temperature curing resins, optimized VPI) and improving recycling rates for copper and insulation waste.

-

Consolidation and Vertical Integration:

- Market Consolidation: The capital intensity and technological demands of serving the EV market are likely to drive further consolidation among motor coil suppliers, with larger players acquiring smaller, specialized firms.

- OEM-Supplier Partnerships: Deep, strategic partnerships (sometimes involving co-location or joint ventures) between major EV OEMs and key coil suppliers will solidify to ensure supply security, co-develop new technologies, and manage costs.

- Vertical Integration: Some large motor manufacturers or EV OEMs may increase vertical integration by bringing more coil manufacturing in-house or establishing captive supply agreements to control critical technology and supply.

Key Challenges in H2 2026:

- Copper Price Volatility: Despite efforts, significant fluctuations in copper prices will remain a major cost and margin pressure point.

- Talent Gap: Demand for engineers and technicians skilled in advanced motor design, high-precision manufacturing, and automation will outpace supply.

- Technological Pace: Keeping up with the rapid innovation cycle, especially in materials and manufacturing processes, requires continuous R&D investment.

Conclusion:

H2 2026 will see the motor coil market firmly entrenched as a critical enabler of the global electrification revolution. Growth will be strongest in the EV and high-efficiency industrial motor segments. Success will depend on suppliers’ ability to deliver highly reliable, efficient, and cost-effective coils at scale, leveraging advanced materials, automated manufacturing, and resilient supply chains, all while navigating material costs and intense competition. The market will be characterized by technological sophistication and strategic partnerships.

Common Pitfalls Sourcing Motor Coils: Quality and Intellectual Property Risks

Sourcing motor coils—critical components in electric motors and generators—presents several challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these pitfalls can lead to performance failures, supply chain disruptions, legal disputes, and reputational damage. Below are key risks to consider:

Quality Inconsistency and Substandard Materials

One of the most frequent issues when sourcing motor coils is inconsistent quality across batches. Suppliers may cut costs by using inferior materials such as lower-grade copper wire, subpar insulation, or inadequate varnish coatings. These compromises can lead to premature coil failure due to overheating, short circuits, or reduced efficiency. Additionally, poor winding techniques or lack of proper impregnation can compromise thermal performance and mechanical durability. Without rigorous quality audits and material certifications, buyers risk integrating unreliable components into their end products.

Lack of Compliance with Industry Standards

Motor coils must meet specific international or industry standards (e.g., IEC, NEMA, UL) for insulation class, temperature rise, dielectric strength, and ingress protection (IP ratings). A common pitfall is sourcing coils that claim compliance but fail independent testing. This is especially prevalent when working with new or low-cost suppliers who may falsify certifications. Non-compliant coils can result in safety hazards, regulatory non-approval, and product recalls.

Intellectual Property Infringement

Motor coil designs often involve proprietary winding patterns, core configurations, or insulation systems protected by patents or trade secrets. Sourcing from unverified suppliers increases the risk of unintentionally acquiring coils that infringe on third-party IP. This is particularly concerning when suppliers reverse-engineer branded components without authorization. Buyers may face legal liability, import bans, or cease-and-desist orders even if they were unaware of the infringement.

Inadequate IP Protection in Contracts

Even with original designs, buyers often fail to secure proper IP protection in supplier agreements. Without clear contractual clauses assigning ownership of design modifications, tooling rights, and confidentiality, suppliers may replicate or resell the coil design to competitors. This is especially risky when outsourcing manufacturing to regions with weaker IP enforcement. Always ensure that contracts include robust IP clauses, non-disclosure agreements (NDAs), and restrictions on secondary use.

Insufficient Testing and Validation

Many suppliers provide limited or no test data for motor coils, relying solely on visual inspection or basic continuity checks. Comprehensive validation—including hipot testing, insulation resistance measurement, and thermal cycling—is often skipped to reduce costs. Without access to detailed test reports or the ability to conduct independent verification, buyers cannot confidently assess long-term reliability.

Supply Chain Opacity and Traceability Gaps

A lack of transparency in the supply chain makes it difficult to trace raw materials or verify manufacturing processes. This opacity increases the risk of counterfeit components, unauthorized subcontracting, and inconsistent production practices. Without full traceability, diagnosing field failures or managing product recalls becomes significantly more complex.

To mitigate these risks, establish a structured sourcing strategy that includes supplier vetting, third-party audits, material certification requirements, enforceable IP agreements, and ongoing quality monitoring. Partnering with reputable suppliers and investing in due diligence upfront can prevent costly issues down the line.

Logistics & Compliance Guide for Motor Coil

Motor coils are critical electromechanical components used in a wide range of industrial, automotive, and consumer applications. Their transportation and regulatory compliance require careful planning due to factors such as weight, sensitivity to environmental conditions, and international trade regulations. This guide outlines key logistics and compliance considerations to ensure safe, efficient, and legal handling and shipment of motor coils.

Classification and Packaging

Proper classification and packaging are foundational to protecting motor coils during transit and ensuring regulatory compliance.

- HS Code Determination: Identify the correct Harmonized System (HS) code for the motor coil. Common codes may fall under 8505 (electromagnets, electromagnetic clutches, etc.) or 8503 (parts for motors and generators). Accurate classification is essential for customs clearance, duty calculation, and import/export documentation.

- Packaging Standards: Use robust packaging such as wooden crates or heavy-duty cardboard boxes with internal cushioning (foam, bubble wrap) to prevent physical damage. Ensure coils are secured against movement within the container.

- Moisture and Corrosion Protection: Seal coils in moisture barrier bags with desiccants to prevent corrosion, especially for ocean freight. Consider VCI (Vapor Corrosion Inhibitor) packaging for long-term storage or humid climates.

- Labeling: Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”), product details, weight, and barcodes. Include any hazardous material indicators if applicable (e.g., presence of varnish or resins).

Transportation Requirements

Motor coils vary in size and weight, which influences the choice of transportation mode and handling procedures.

- Mode of Transport:

- Air Freight: Suitable for high-value or time-sensitive shipments. Ensure compliance with IATA regulations, especially if varnishes or resins are classified as hazardous.

- Ocean Freight: Cost-effective for bulk shipments. Use moisture-resistant packaging and consider container desiccants.

- Land Freight: Ideal for regional distribution. Secure coils to prevent shifting during transit.

- Weight and Dimensions: Verify that coils are within the weight limits for handling equipment (e.g., forklifts, cranes) and transportation vehicles. Oversized coils may require special permits.

- Environmental Controls: Avoid exposure to extreme temperatures, humidity, or direct sunlight. Store and transport in dry, climate-controlled environments where possible.

Regulatory Compliance

Motor coils are subject to various international and regional regulations depending on destination and composition.

- Import/Export Licenses: Verify if export controls apply, especially for dual-use items or shipments to sanctioned countries. Check jurisdiction-specific requirements (e.g., U.S. EAR, EU Dual-Use Regulation).

- RoHS and REACH Compliance (EU): Ensure motor coils comply with Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) if destined for the European Union. Provide a DoC (Declaration of Conformity) when required.

- UL/CSA Certification (North America): For end-use in consumer or industrial equipment, confirm compliance with safety standards such as UL 1446 (insulating systems) or CSA C22.2 No. 0.15.

- Customs Documentation: Prepare accurate commercial invoices, packing lists, certificates of origin, and bills of lading. Include technical specifications and HS codes.

Safety and Handling

Due to their metallic content and potential chemical constituents, safety during handling is critical.

- Material Safety Data Sheets (MSDS/SDS): Provide Safety Data Sheets if the motor coil contains resins, varnishes, or other chemicals classified under GHS (Globally Harmonized System).

- Worker Safety: Train personnel in safe lifting techniques and the use of PPE (gloves, safety shoes) when handling heavy coils. Use mechanical aids to reduce injury risk.

- Electromagnetic Considerations: While not powered, large coils may retain residual magnetism. Keep away from sensitive electronic devices during transport.

Storage and Inventory Management

Proper storage ensures motor coils remain in optimal condition prior to use.

- Storage Environment: Store in dry, temperature-stable areas with minimal dust and vibration. Avoid stacking heavy items on top of packaged coils.

- Inventory Rotation: Use a first-in, first-out (FIFO) system to prevent long-term storage that could degrade insulation materials.

- Shelf Life Monitoring: Track shelf life of insulated components, typically 2–5 years depending on materials and storage conditions.

Sustainability and Disposal

Environmental responsibility extends to end-of-life considerations.

- Recyclability: Copper and steel components in motor coils are highly recyclable. Communicate recycling guidelines to end-users.

- Waste Disposal: If coils contain hazardous materials (e.g., lead-based solder, PCBs in older models), dispose of in compliance with local environmental regulations (e.g., EPA, WEEE).

By adhering to this logistics and compliance guide, manufacturers, distributors, and importers can ensure the safe, efficient, and lawful movement of motor coils across global supply chains. Regular audits and updates to compliance protocols are recommended to adapt to evolving regulations and standards.

Conclusion for Sourcing Motor Coils

After a thorough evaluation of suppliers, technical specifications, cost considerations, quality standards, and lead times, sourcing motor coils requires a balanced approach that ensures reliability, performance, and cost-efficiency. Selecting the right supplier involves assessing their manufacturing capabilities, adherence to industry standards (such as ISO, IEC, or NEMA), material quality, and track record in delivering consistent output.

Key takeaways include:

- Quality and Consistency: Prioritize suppliers that demonstrate robust quality control processes and can provide certifications and test reports for insulation class, thermal performance, and dielectric strength.

- Technical Compatibility: Ensure the motor coils match the required electrical and mechanical specifications (e.g., wire gauge, turns count, insulation type, and dimensional tolerances) for seamless integration into the final product.

- Cost vs. Value: While cost is a factor, long-term value—driven by durability, efficiency, and reduced failure rates—should outweigh initial price savings.

- Supply Chain Reliability: Choose partners with stable production capacity, short lead times, and contingency plans to mitigate supply disruptions.

- Sustainability and Compliance: Consider environmental standards and compliance with RoHS or REACH regulations, especially for international markets.

In conclusion, successful sourcing of motor coils hinges on building strategic partnerships with qualified suppliers who align with both technical requirements and business objectives. Continuous monitoring, periodic audits, and fostering strong supplier relationships will ensure sustained performance and support for motor manufacturing operations.