The global motor boat engine market has experienced steady growth, driven by rising recreational boating activities, increasing disposable incomes, and advancements in marine propulsion technology. According to Grand View Research, the global marine propulsion engine market size was valued at USD 29.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is further supported by a shift toward fuel-efficient and low-emission engines, particularly in response to tightening environmental regulations across North America and Europe. Additionally, Mordor Intelligence projects that the demand for outboard motors will accelerate due to their ease of installation, maintenance, and versatility across small to medium-sized vessels. As the industry evolves, a select group of manufacturers have emerged as leaders, shaping innovation and capturing significant market share. Below, we explore the top 9 motor boat engine manufacturers leading this dynamic sector, leveraging strategic R&D, global distribution networks, and a strong focus on sustainability to maintain competitive advantage.

Top 9 Motor Boat Engine Types Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mercury Marine

Domain Est. 1995

Website: mercurymarine.com

Key Highlights: Mercury Marine is the world’s leading manufacturer of recreational marine propulsion engines. Get sales, service and parts info, and find a local dealer ……

#2 Products – Outboards

Domain Est. 1997

Website: global.yamaha-motor.com

Key Highlights: Yamaha outboards have become popular in regions throughout the world as engines for recreational boats, commercial fishing boats and transport boats….

#3 Reliable Marine Engines and Power Solutions

Domain Est. 1990

Website: cummins.com

Key Highlights: Our marine power solutions are designed to meet the challenges of commercial, government and recreational marine applications – from high output to light duty….

#4 Marine Engines

Domain Est. 1990

Website: deere.com

Key Highlights: Find John Deere marine propulsion, generator, and auxiliary engines for commercial and recreational applications, including; workboats, pleasure craft, ……

#5 Marine Power Systems

Domain Est. 1993

Website: cat.com

Key Highlights: Select from our wide range of Commercial Propulsion Engines, High Performance Propulsion Engines, Marine Generators, and Auxiliary Engines….

#6 Marine engines & boat motors for power

Domain Est. 1997

Website: volvopenta.com

Key Highlights: We offer state-of-the-art marine engines that deliver outstanding performance, reliability, and durability. Volvo Penta’s marine engines are designed to ……

#7

Domain Est. 1998

Website: mercuryracing.com

Key Highlights: Mercury Racing builds the best marine & automotive propulsion systems, accessories, and parts on the market. Learn the value of raw performance and power….

#8 Yamaha Outboards

Domain Est. 2002

Website: yamahaoutboards.com

Key Highlights: Yamaha Outboards provides industry-leading innovation, outstanding performance, NEW 4.3L V6 OFFSHORE 350. An online outboard maintenance resource 2026 Yamaha ……

#9 High

Domain Est. 2014

Website: coxmarine.com

Key Highlights: Advanced diesel outboard engines designed for commercial, governmental and recreational use. 300HP & 350HP Models. High torque at low RPM….

Expert Sourcing Insights for Motor Boat Engine Types

H2: 2026 Market Trends for Motor Boat Engine Types

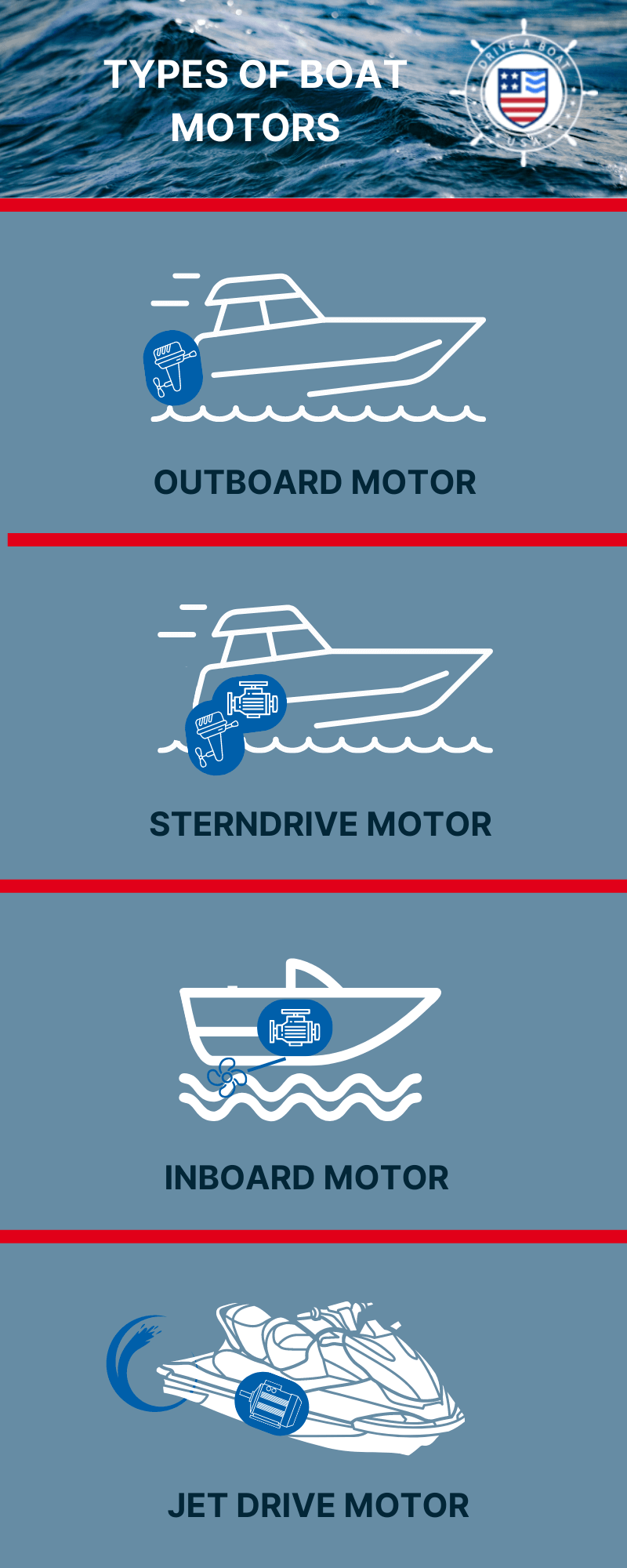

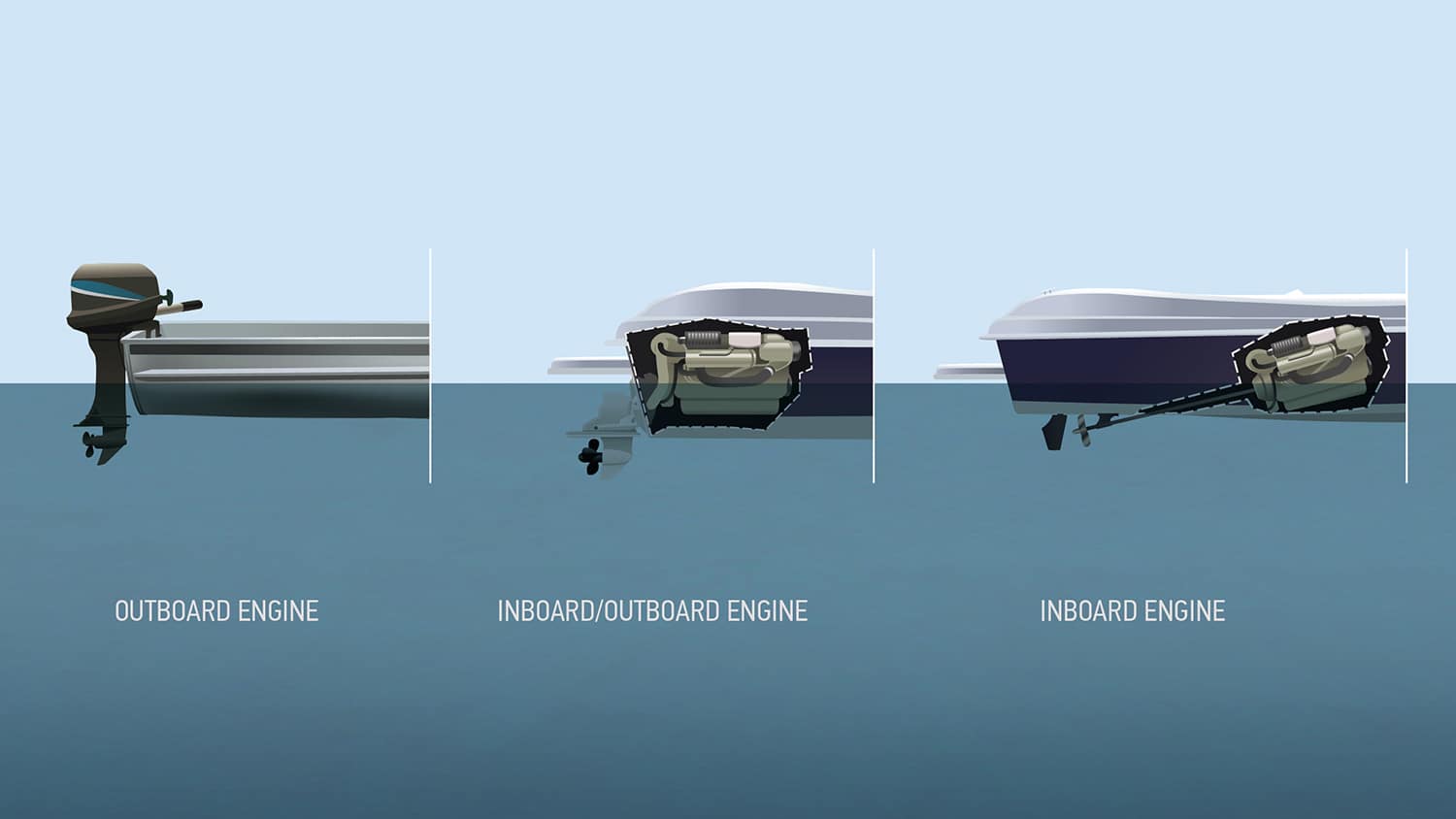

The global motor boat engine market is undergoing a transformative shift in 2026, driven by technological innovation, environmental regulations, and evolving consumer preferences. Key engine types—outboard, inboard, stern drive (inboard/outboard), and emerging electric/hybrid systems—are experiencing divergent growth trajectories, reflecting broader trends in sustainability, performance, and marine electrification.

1. Electric and Hybrid Engines: Accelerated Growth

Electric propulsion systems are poised for significant market expansion in 2026. With tightening emissions regulations—such as the EU’s Green Deal and U.S. EPA Tier 4 standards—marinas and coastal regions are increasingly restricting fossil fuel-powered engines. Major manufacturers like Torqeedo (a subsidiary of BMW), Mercury Marine, and Volvo Penta have launched high-performance electric outboards and hybrid inboard systems, targeting recreational and commercial fleets. The falling cost of lithium-ion batteries and improved energy density are enabling longer ranges and higher power outputs, making electric engines viable for day boats and small cruisers. In 2026, the electric boat engine segment is projected to grow at a CAGR of over 14% from 2021, with hybrid systems serving as a transitional solution for larger vessels.

2. Outboard Engines: Dominance Continues with Technological Upgrades

Outboard engines remain the most popular choice for motor boats, especially in the 15–35 foot range. In 2026, the outboard segment continues to dominate due to ease of maintenance, improved fuel efficiency, and advanced digital integration. Four-stroke engines now account for over 80% of outboard sales, displacing older two-stroke models. Innovations such as digital throttle and shift (DTS), joystick docking, and integration with navigation systems (e.g., Mercury’s Vessel View, Yamaha’s Helm Master) enhance user experience. Additionally, manufacturers are focusing on lightweight composite materials and turbocharged models (e.g., Evinrude’s legacy designs, Mercury’s 600HP Verado) to meet demand for high-speed and offshore fishing applications.

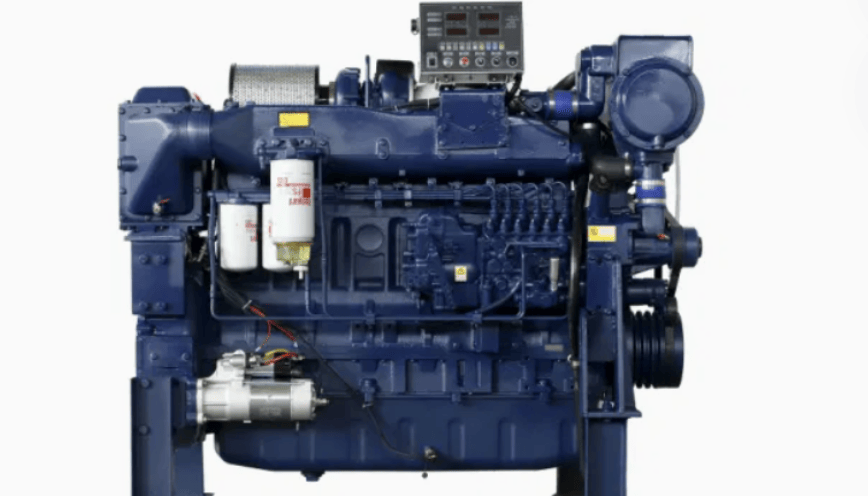

3. Inboard and Stern Drive Engines: Steady Demand in Niche Segments

Inboard and stern drive (I/O) engines maintain a loyal customer base in wake sports, luxury cruisers, and commercial workboats. While their market share is shrinking relative to outboards and electric systems, advancements in diesel inboard efficiency and emissions control—particularly with common rail injection and SCR systems—are sustaining demand in regions like Europe and North America. Stern drives offer a compromise between inboard performance and outboard serviceability, but face challenges from sterndrive corrosion and maintenance complexity. In 2026, demand is concentrated in wakeboarding and towed-sports boats, where precise weight distribution and thrust control are critical.

4. Sustainability and Regulatory Pressures Reshape Engine Development

Environmental regulations are a primary driver of product development. The International Maritime Organization (IMO) and regional bodies are extending emissions standards to smaller vessels, pushing manufacturers toward cleaner combustion technologies and zero-emission solutions. California’s Air Resources Board (CARB) has enacted stringent rules that are influencing national and global design standards. As a result, R&D investments are increasingly directed toward hydrogen fuel cells, solar-assisted charging, and shore-powered docking infrastructure.

5. Regional Market Variations

North America and Europe lead in adopting electric and hybrid systems, supported by government incentives and eco-conscious consumers. In contrast, emerging markets in Southeast Asia and Latin America still favor cost-effective, fuel-efficient gasoline outboards. However, as battery costs decline and charging infrastructure improves, these regions are expected to follow the electrification trend by late 2026.

Conclusion

By 2026, the motor boat engine market is characterized by a clear pivot toward electrification, digitalization, and sustainability. Electric and hybrid engines are gaining traction, especially in eco-sensitive zones and urban waterways. Outboards remain dominant but are evolving with smart technologies, while inboard and stern drive systems hold steady in performance-oriented niches. Overall, the convergence of regulatory pressure, consumer demand for cleaner technology, and rapid innovation is redefining the future of marine propulsion.

Common Pitfalls When Sourcing Motor Boat Engine Types (Quality, IP)

Sourcing marine engines—whether outboard, inboard, stern drive, or jet propulsion systems—requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, legal risks, and financial losses. Below are common pitfalls to avoid:

Inadequate Quality Verification

One of the most frequent issues in sourcing boat engines is assuming supplier claims without thorough validation. Buyers may rely solely on certifications or marketing materials without conducting independent quality assessments. This can result in receiving engines with substandard materials, poor craftsmanship, or non-compliance with marine safety standards (e.g., ISO, ABYC, or CE). Engines exposed to saltwater and high vibration require robust build quality; inadequate testing for corrosion resistance, thermal performance, and long-term durability increases the risk of premature failure.

Ignoring After-Sales Support and Spare Parts Availability

Even a high-quality engine becomes a liability if spare parts are unavailable or service support is limited. Sourcing from manufacturers or suppliers without a reliable service network—especially in remote or coastal regions—can lead to extended downtime. Buyers should verify the supplier’s global distribution channels, warranty terms, and technical support infrastructure before committing.

Overlooking Intellectual Property (IP) Infringement Risks

Purchasing engines that mimic branded designs (e.g., look-alike outboards resembling Yamaha or Mercury) may expose buyers to IP violations. These counterfeit or clone engines often infringe on patented technologies, trademarks, or design rights. Importing or selling such products can trigger legal action, customs seizures, and reputational damage. Due diligence should include verifying the engine manufacturer’s IP ownership, licensing agreements, and freedom to operate in target markets.

Relying on Unverified OEM Claims

Some suppliers claim to be original equipment manufacturers (OEMs) but are actually rebranded third-party producers. Without proper verification, buyers may unknowingly purchase engines from unqualified vendors lacking R&D capabilities or proper manufacturing controls. Requesting proof of manufacturing facilities, engineering documentation, and compliance test reports is essential to confirm authenticity and capability.

Failure to Match Engine Specifications to Vessel Requirements

Sourcing an engine without considering the boat’s weight, hull design, intended use (recreational, commercial, racing), and operating environment can lead to poor performance or safety hazards. Underpowered or overpowered engines increase fuel consumption, stress the drivetrain, or compromise handling. Proper technical vetting ensures compatibility with the vessel and avoids costly retrofits.

Bypassing Third-Party Inspections and Testing

Skipping independent quality inspections—such as pre-shipment inspections (PSI) or factory audits—increases the risk of receiving defective units. Marine engines should undergo performance tests, salt spray tests, and vibration analysis. Engaging a third-party inspection agency helps validate compliance and detect issues before shipment.

Neglecting Compliance with Environmental and Emission Regulations

Marine engines must meet emission standards such as EPA (USA), EU RCD, or IMO Tier norms. Sourcing non-compliant engines can block market entry or result in fines. Buyers must confirm that engines are certified for intended markets and that documentation (e.g., Declaration of Conformity) is provided.

By addressing these pitfalls proactively—through due diligence, technical verification, and legal review—buyers can ensure reliable, compliant, and IP-safe sourcing of motor boat engines.

Logistics & Compliance Guide for Motor Boat Engine Types

Understanding the logistics and compliance considerations for motor boat engines is essential for manufacturers, distributors, importers, and marine operators. Different engine types present unique requirements related to transportation, storage, environmental regulations, safety standards, and customs documentation. This guide outlines key factors by engine type.

Outboard Engines

Logistics Considerations:

Outboard engines are typically transported separately from the boat, often in upright, secured crates. Due to their exposed lower units, careful packaging is required to prevent damage during transit. Temperature-controlled environments may be necessary in extreme climates to protect seals and lubricants.

Compliance Requirements:

These engines must comply with EPA (Environmental Protection Agency) emission standards in the U.S. (e.g., EPA Marine Spark-Ignition Engine Regulations) and EU Directive 2016/1628 (Stage V emissions). Noise level certifications (ISO 14549) are also required in many regions. Importers must ensure CE marking (Europe), EPA labels (USA), and provide conformity documentation.

Inboard Engines

Logistics Considerations:

Inboard engines are usually shipped pre-installed in vessels or as fully assembled units on pallets. Due to their weight and size, heavy-duty lifting equipment and freight solutions (flatbed trucks, containerized shipping) are required. Proper bracing and moisture protection are crucial during ocean freight.

Compliance Requirements:

Inboard engines must meet international emission standards such as IMO Tier III (for commercial vessels) and EPA/CARB regulations. They are also subject to SOLAS (Safety of Life at Sea) requirements if installed on commercial craft. Electrical systems must comply with ABYC (American Boat & Yacht Council) or ISO 10133 standards for onboard safety.

Sterndrive (Inboard/Outboard) Engines

Logistics Considerations:

Sterndrives are often shipped attached to the boat transom or as complete drive systems. Sensitive drive components (trim rams, gimbal housings) require shock-absorbent packaging. Horizontal storage is preferred to avoid fluid leakage and seal deformation.

Compliance Requirements:

These hybrid systems must satisfy both inboard and outboard regulatory frameworks. Emission compliance follows EPA and EU marine engine directives. Additionally, sterndrives must adhere to safety standards for corrosion resistance (ISO 10088) and fire protection (ISO 14509). Recreational craft in the EU require CE marking under the Recreational Craft Directive (RCD).

Jet Drive Engines

Logistics Considerations:

Jet drives are typically integrated into personal watercraft or small vessels. When shipped separately, protection of the impeller and intake housing is critical. Crating must prevent axial or lateral stress on the drive shaft. Climate control may be needed to prevent rubber component degradation.

Compliance Requirements:

Emissions compliance is similar to outboard standards (EPA, EU Stage V). Jet drives used in personal watercraft must meet noise limits (e.g., U.S. Coast Guard and state-level regulations). Safety compliance includes backflow prevention and emergency shut-off requirements (ABYC A-30, ISO 16337).

Electric & Hybrid Marine Propulsion Systems

Logistics Considerations:

Electric motors are generally lighter and simpler to handle, but lithium-ion battery packs require special handling under IATA/IMDG regulations due to fire risks. Batteries must be shipped at ≤30% state of charge, in non-conductive packaging, and labeled as Class 9 hazardous materials. Climate-controlled transport prevents thermal runaway.

Compliance Requirements:

Electric systems must comply with marine electrical standards (ABYC E-11, ISO 13297). Battery systems require UN 38.3 certification for transportation safety. CE marking under the EU Battery Directive and EPA guidance for marine electrification apply. Charging systems may need compatibility with local grid standards (e.g., CE, UL).

General Compliance & Documentation

All marine engines require accurate technical documentation, including:

– Certificate of Conformity (CoC)

– Bill of Materials (BOM) with restricted substance compliance (RoHS, REACH)

– Engine emission certification labels

– User manuals in local languages (per EU RCD or U.S. Coast Guard requirements)

– HS Code classification (e.g., 8407.21 for outboard engines) for customs clearance

Environmental & Safety Notes:

Spill containment plans are required when transporting fuel-powered engines. Used oil and coolant must be disposed of per local environmental laws (e.g., RCRA in the U.S.). Operators must also comply with ballast water management (if applicable) and antifouling regulations (e.g., AFS Convention).

Best Practices:

– Partner with freight forwarders experienced in marine equipment

– Pre-clear customs using advance rulings where possible

– Maintain traceability through serialization and digital logs

– Conduct regular audits for regulatory updates (e.g., IMO, EPA, EU Commission)

Adhering to these logistics and compliance guidelines ensures safe, legal, and efficient handling of motor boat engines across global supply chains.

In conclusion, sourcing the right motor boat engine requires careful consideration of several key factors, including the boat’s intended use, size, performance requirements, fuel efficiency, maintenance needs, and budget. The three primary engine types—outboard, inboard, and sterndrive—each offer distinct advantages and limitations. Outboard engines provide excellent maneuverability, ease of maintenance, and space-saving benefits, making them ideal for smaller to mid-sized vessels and recreational use. Inboard engines deliver superior power, stability, and longevity, suited for larger boats and higher performance applications such as towing or offshore cruising. Sterndrive engines combine aspects of both, offering strong performance and better space utilization than inboards, though with higher maintenance demands.

Ultimately, the choice depends on balancing operational needs with long-term costs and reliability. Advances in engine technology, including fuel-injected systems, hybrid options, and electric motors, are expanding environmentally friendly and efficient alternatives. Therefore, thorough research, consultation with marine professionals, and evaluation of manufacturer reputation and after-sales support are essential steps in making a well-informed decision that ensures optimal performance, safety, and value for your boating investment.