The global lock market is undergoing significant transformation, driven by rising security concerns, advancements in smart lock technology, and increased construction activity worldwide. According to a report by Mordor Intelligence, the global door locks market was valued at USD 18.67 billion in 2023 and is projected to reach USD 25.84 billion by 2029, growing at a CAGR of 5.7% during the forecast period. This growth is particularly evident in the demand for high-security locking solutions, with mortise lock cylinders remaining a preferred choice in commercial, institutional, and high-end residential applications due to their durability and enhanced security features. As urbanization accelerates and smart building integrations become standard, manufacturers are investing heavily in precision engineering, anti-pick mechanisms, and electronic compatibility. In this evolving landscape, a select group of manufacturers have emerged as leaders in innovation, quality, and market reach—shaping the future of access control. Here are the top 9 mortise lock cylinder manufacturers driving this industry forward.

Top 9 Mortise Lock Cylinder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GMS Lock

Domain Est. 1998

Website: gmslock.com

Key Highlights: Manufacturer of relilable, high quality lock cylinders. At GMS, we are committed to quality, value, and the needs of our customers….

#2 Commercial Mortise Locks & Cylinders

Domain Est. 2008

Website: rockwellsecurityinc.com

Key Highlights: Rockwell Security, Inc. is a vertically integrated manufacturer of commercial and residential door hardware with ISO 9001:2015 certified manufacturing ……

#3 Lockmasters. Mortise Locks

Domain Est. 1997

Website: lockmasters.com

Key Highlights: 2-day deliveryManufacturers. Accentra ; Product Type. Cylinder Cam ; Series. 45H ; Finish. Aluminum (673, US92) ; Lock Function. Apartment…

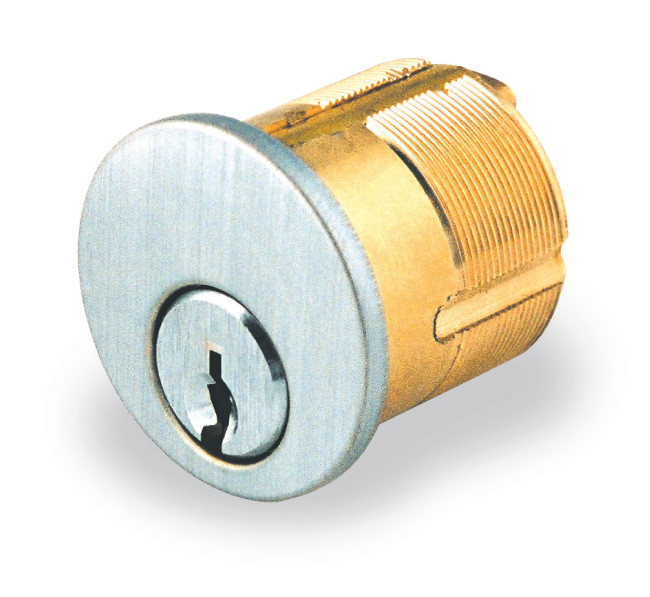

#4 Mortise Cylinder

Domain Est. 2002

Website: ilco.us

Key Highlights: Styles include keyed, turn knob, and dummy. Ilco Mortise Cylinder are machines from solid brass bar stock, engineered and manufactured to OEM specifications….

#5 Mortise Locks

Domain Est. 1996

Website: assaabloy.com

Key Highlights: ASSA ABLOY provides you with the widest range of locks in order to meet each and every need regarding security….

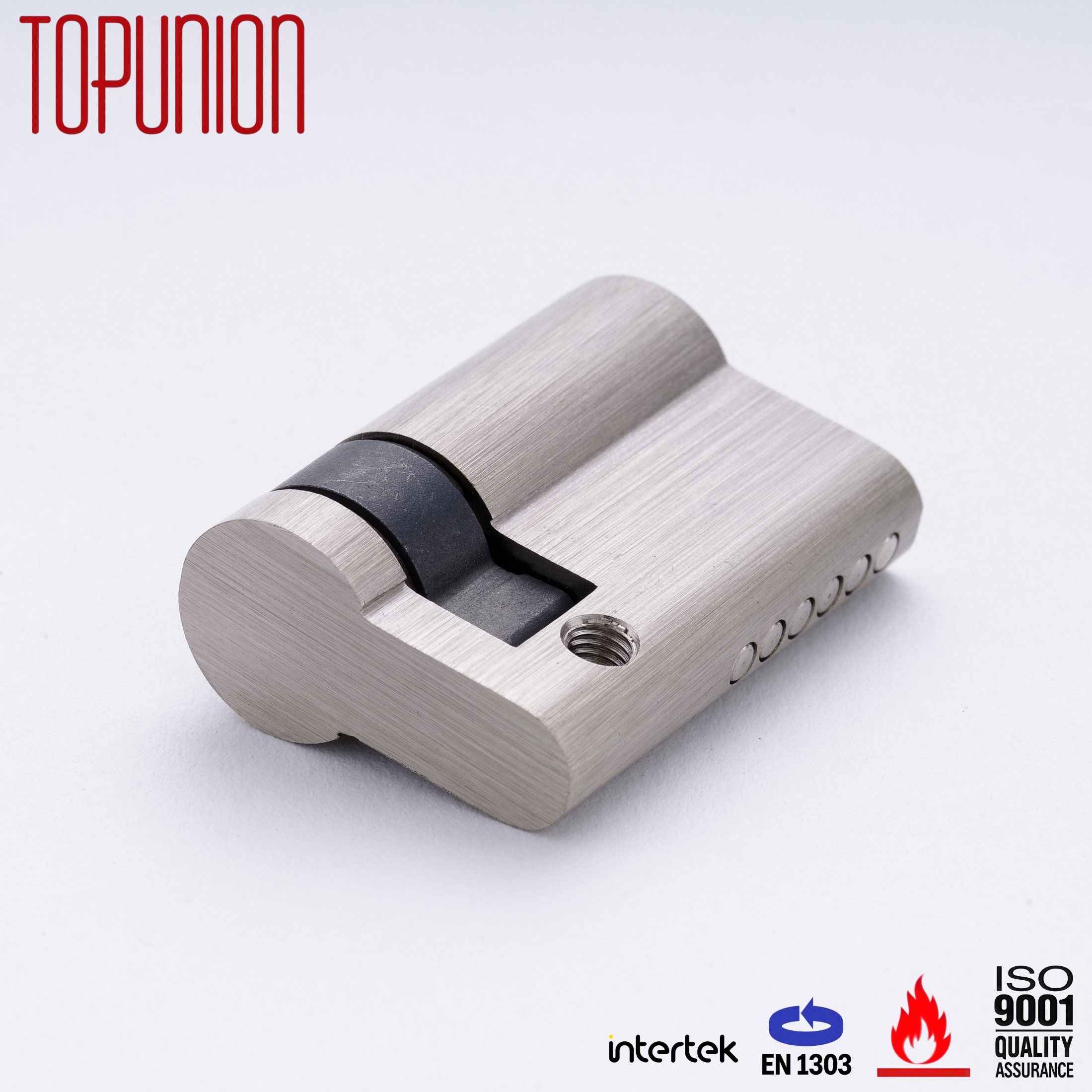

#6 Mortise

Domain Est. 1997

Website: marksusa.com

Key Highlights: Marks USA has been making mortise locks for over 30 years. From their introduction, our mortise locks have enjoyed a reputation for long life and their ability ……

#7 Mortise Locks

Domain Est. 2006

Website: inoxproducts.com

Key Highlights: INOX Innovation in Mortise Locks. Beautiful locks and trim with patented innovations that ensure reliability and functionality for the life of the product….

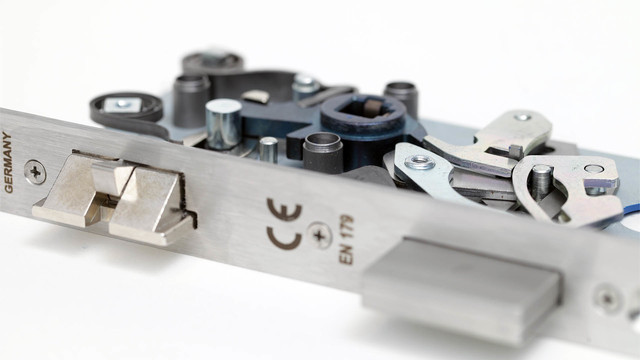

#8 CES

Domain Est. 2010

Website: bridgeportworldwide.com

Key Highlights: Bridgeport Worldwide is the official North American distributor CES European profile cylinders and mortise locks….

#9 40H Mortise Series

Domain Est. 1996

Website: bestaccess.com

Key Highlights: This durable mortise lock is reliable and flexible in any commercial or industrial setting. Heavy duty in both protection and performance….

Expert Sourcing Insights for Mortise Lock Cylinder

2026 Market Trends for Mortise Lock Cylinders: Key Developments and Forecasts

As the global security and building infrastructure landscape evolves, the mortise lock cylinder market is poised for significant transformation by 2026. Driven by technological innovation, shifting consumer preferences, and regulatory changes, several key trends are expected to shape the industry in the coming years.

Rising Adoption of Smart and Electronic Mortise Lock Cylinders

By 2026, the integration of smart technology into traditional mortise lock systems will be a dominant trend. Demand for electronic mortise cylinders with features such as Bluetooth, Wi-Fi, and Zigbee connectivity is accelerating, particularly in commercial buildings, multifamily housing, and high-end residential properties. These systems enable remote access control, integration with building management systems (BMS), and real-time monitoring—offering enhanced security and operational efficiency. The increasing proliferation of the Internet of Things (IoT) in smart buildings is a primary driver, with electronic mortise cylinders becoming a critical component of unified access control platforms.

Growth in Commercial and Institutional Applications

The commercial real estate sector—including offices, hotels, healthcare facilities, and educational institutions—will continue to be a major growth engine for mortise lock cylinders. These settings require durable, high-security locking mechanisms, and mortise locks are preferred for their robustness and longevity. Post-pandemic, there is heightened emphasis on touchless access and hygiene, spurring demand for electronic or keyless mortise solutions. Additionally, aging infrastructure in developed markets is prompting retrofitting projects, creating opportunities for upgrading legacy mechanical systems to modern electronic cylinders.

Focus on Cybersecurity and Data Privacy

As electronic mortise cylinders become more connected, cybersecurity will emerge as a critical concern by 2026. Stakeholders—manufacturers, installers, and end users—will prioritize systems with end-to-end encryption, secure firmware updates, and compliance with data protection regulations (e.g., GDPR, CCPA). Manufacturers will invest in secure-by-design architectures and third-party certifications to build trust. This trend will differentiate premium brands and influence procurement decisions, especially in government and enterprise environments.

Sustainability and Eco-Friendly Materials

Environmental regulations and green building certifications (such as LEED and BREEAM) are pushing the lock industry toward sustainable practices. By 2026, manufacturers will increasingly adopt recyclable metals, low-impact plating processes, and energy-efficient electronic components in mortise cylinder production. Demand for long-lasting, serviceable designs that reduce replacement frequency will also grow, aligning with circular economy principles.

Regional Market Divergence and Emerging Opportunities

While North America and Europe remain mature markets with steady demand driven by renovations and smart building adoption, the Asia-Pacific region—especially China, India, and Southeast Asia—is expected to witness the fastest growth. Rapid urbanization, expanding construction sectors, and government initiatives in smart cities will fuel demand for both mechanical and electronic mortise cylinders. Latin America and the Middle East will also present opportunities, particularly in hospitality and infrastructure development.

Supply Chain Resilience and Localization

Ongoing geopolitical tensions and supply chain disruptions have prompted manufacturers to reevaluate sourcing strategies. By 2026, there will be a greater emphasis on regional production and inventory diversification to mitigate risks. This shift may lead to increased local manufacturing of mortise lock cylinders in key markets, reducing dependency on single-source suppliers and improving delivery timelines.

Conclusion

The mortise lock cylinder market in 2026 will be defined by digital transformation, heightened security requirements, and sustainability imperatives. While traditional mechanical cylinders will retain relevance in cost-sensitive and legacy applications, the future lies in intelligent, connected, and secure electronic solutions. Companies that innovate in smart integration, cybersecurity, and sustainable design will lead the market, capturing value in both new construction and retrofit segments across commercial and residential domains.

Common Pitfalls When Sourcing Mortise Lock Cylinders: Quality and IP Rating Issues

Logistics & Compliance Guide for Mortise Lock Cylinder

Product Classification and HS Code

Determine the correct Harmonized System (HS) code for the mortise lock cylinder to ensure accurate international shipping and customs clearance. Typical classifications fall under HS Code 8301.40 (Locks for doors, windows, furniture, and the like, of base metal). Confirm the exact code with your customs broker or local authorities, as variations may apply based on material composition (e.g., brass, stainless steel) and locking mechanism type.

Packaging and Shipping Requirements

Package mortise lock cylinders securely to prevent damage during transit. Use sturdy corrugated boxes with internal dividers or foam inserts to avoid movement. Label each package with product details, quantity, weight, and handling instructions (e.g., “Fragile,” “Do Not Stack”). For international shipments, ensure packaging complies with ISPM 15 regulations if using wooden materials.

Import/Export Documentation

Prepare essential documentation for smooth customs processing, including:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (if claiming preferential tariff treatment)

– Import/Export License (if required by destination country)

Ensure all documents reflect accurate product descriptions, values, and HS codes to avoid delays or penalties.

Regulatory Compliance (Safety and Security Standards)

Verify that the mortise lock cylinder meets relevant safety and performance standards in the target market:

– North America: Comply with ANSI/BHMA A156.5 standards for cylindrical and tubular locksets.

– European Union: Adhere to EN 1303:2015 for cylinder locks; CE marking may be required.

– United Kingdom: Follow UKCA marking requirements post-Brexit, aligned with BS EN 1303.

– Other Regions: Check local building codes and security certifications (e.g., SIN in Singapore, AS in Australia).

Environmental and Chemical Compliance

Ensure materials used in manufacturing meet environmental regulations:

– RoHS (EU/UK): Restrict hazardous substances like lead, cadmium, and mercury.

– REACH (EU): Register and disclose SVHCs (Substances of Very High Concern).

– Proposition 65 (California, USA): Provide warnings if components contain listed chemicals.

Maintain documentation of material safety data sheets (MSDS) and compliance certificates.

Labeling and Marking Requirements

Clearly label each mortise lock cylinder with:

– Manufacturer name or trademark

– Model number and keying specification

– Compliance marks (e.g., CE, UKCA, ANSI)

– Country of origin

Labels must be durable and legible to meet regulatory and traceability requirements.

Tariff and Duty Considerations

Research applicable import duties, VAT, or GST based on the destination country and declared product value. Utilize free trade agreements (e.g., USMCA, CPTPP) where eligible to reduce or eliminate tariffs. Consider bonded warehouses or duty drawback programs for cost optimization.

End-of-Life and Recycling Obligations

In regions with extended producer responsibility (EPR) laws (e.g., EU WEEE Directive), assess whether mortise lock cylinders fall under take-back or recycling schemes. While typically not classified as electronic waste, metal components may still require responsible disposal planning.

Recordkeeping and Audit Trail

Maintain comprehensive records of compliance documentation, test reports, shipping logs, and supplier certifications for a minimum of 5–7 years. This supports audit readiness and demonstrates due diligence in global trade operations.

Contact Information for Compliance Support

Designate a compliance officer or team responsible for monitoring regulatory updates and addressing logistics issues. Provide contact details for customs brokers, testing laboratories, and regulatory consultants to ensure rapid response to compliance inquiries.

Conclusion for Sourcing Mortise Lock Cylinders

In conclusion, sourcing mortise lock cylinders requires a careful evaluation of quality, compatibility, security standards, and supplier reliability. It is essential to select cylinders that meet industry certifications (such as ANSI, BHMA, or EN standards) and are compatible with existing lock bodies and access control systems. Prioritizing durable materials and anti-pick, anti-bump, and anti-drill features enhances overall security. Additionally, establishing relationships with reputable suppliers ensures consistent product quality, timely delivery, and technical support. By balancing cost-efficiency with performance and security, organizations can make informed procurement decisions that contribute to long-term safety and operational reliability.