The global mooring chains market is experiencing steady growth, driven by rising offshore oil & gas exploration activities and the expanding deployment of offshore renewable energy projects, particularly floating wind turbines. According to Mordor Intelligence, the mooring chain market was valued at USD 550 million in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by increasing deepwater drilling operations and stringent regulations mandating high-strength, corrosion-resistant mooring systems. As energy infrastructure shifts toward deeper offshore environments, the demand for reliable, certified mooring solutions has intensified—positioning leading manufacturers at the forefront of technological innovation and quality assurance. In this competitive landscape, the top 10 mooring chains manufacturers are distinguished by their product durability, compliance with international standards (such as DNV, API, and ISO), and strategic investments in R&D to meet evolving industry needs.

Top 10 Mooring Chains Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DaiHan Anchor Chain, Anchor Chain, Mooring Chain, Offshore …

Domain Est. 1999

Website: dhac.co.kr

Key Highlights: … chain factory is a specialized manufacturer of anchor chains and offshore mooring chains. All of the korea anchor chain we offered are high-quality anchor chain…

#2 Eco

Domain Est. 2003

Website: hazelettmarine.com

Key Highlights: Hazelett Marine is the largest and most trusted manufacturer of Conservation Elastic Mooring Systems in North America with thousands of installations worldwide….

#3 Anchor marine chain manufacturer

Domain Est. 2005

Website: vicinaymarine.com

Key Highlights: We are a global leader in the design, manufacture and deliver of high-added value products and services for mooring floating solutions….

#4 Marine chain,Mooring chain,Anchor chain_Zhengmao Group Co., Ltd.

Domain Est. 2014

Website: en.zhengmao.net.cn

Key Highlights: The mooring chain and anchor chain developed and produced by the company are the two pillar products. The “Sanshan” brand logo used is a famous trademark in ……

#5 (Anchor Chain),(Mooring Chain),(Mooring Buoy),(Ship Anchor …

Domain Est. 2021

Website: en.csac-group.com

Key Highlights: China Shipping is the world’s leading manufacturer of ship anchor chain, offshore mooring chain and one-stop solutions for mooring systems….

#6 Chains

Domain Est. 1996

Website: trelleborg.com

Key Highlights: Trelleborg Marine and Infrastructure provides chains for various fender applications. They are available in open link or stud link and can be supplied in ……

#7 Bardex Corporation

Domain Est. 1997

Website: bardex.com

Key Highlights: Unwavering solutions: Mooring / Tensioning, SCR & Riser Pipeline, Pull-In Skidding, Load Handling, Shiplift Rig Leveling & Restraining….

#8 ASAC Global Leader Mooring Systems

Domain Est. 1998

Website: anchor-chain.com

Key Highlights: We strive to exceed our clients expectations by delivering economical & effective mooring solutions through quality products and services….

#9 Intermoor – Mooring and Anchor Systems for Offshore Energy

Domain Est. 2003

Website: acteon.com

Key Highlights: Intermoor, Acteon’s Moorings and Anchors business line, enables safe, efficient and cost-effective station keeping across offshore energy sectors….

#10 DCL Mooring & Rigging

Domain Est. 2004

Website: dcl-usa.com

Key Highlights: DCL Mooring & Rigging has been offering mooring & rigging products and services to a range of industries for over 750 years. Explore our offerings today!…

Expert Sourcing Insights for Mooring Chains

H2: Market Trends in the Mooring Chains Industry for 2026

As the offshore energy and maritime sectors evolve, the mooring chains market is poised for significant transformation by 2026. Driven by technological advancements, regulatory shifts, and growing demand for renewable energy, several key trends are expected to shape the industry in the coming years.

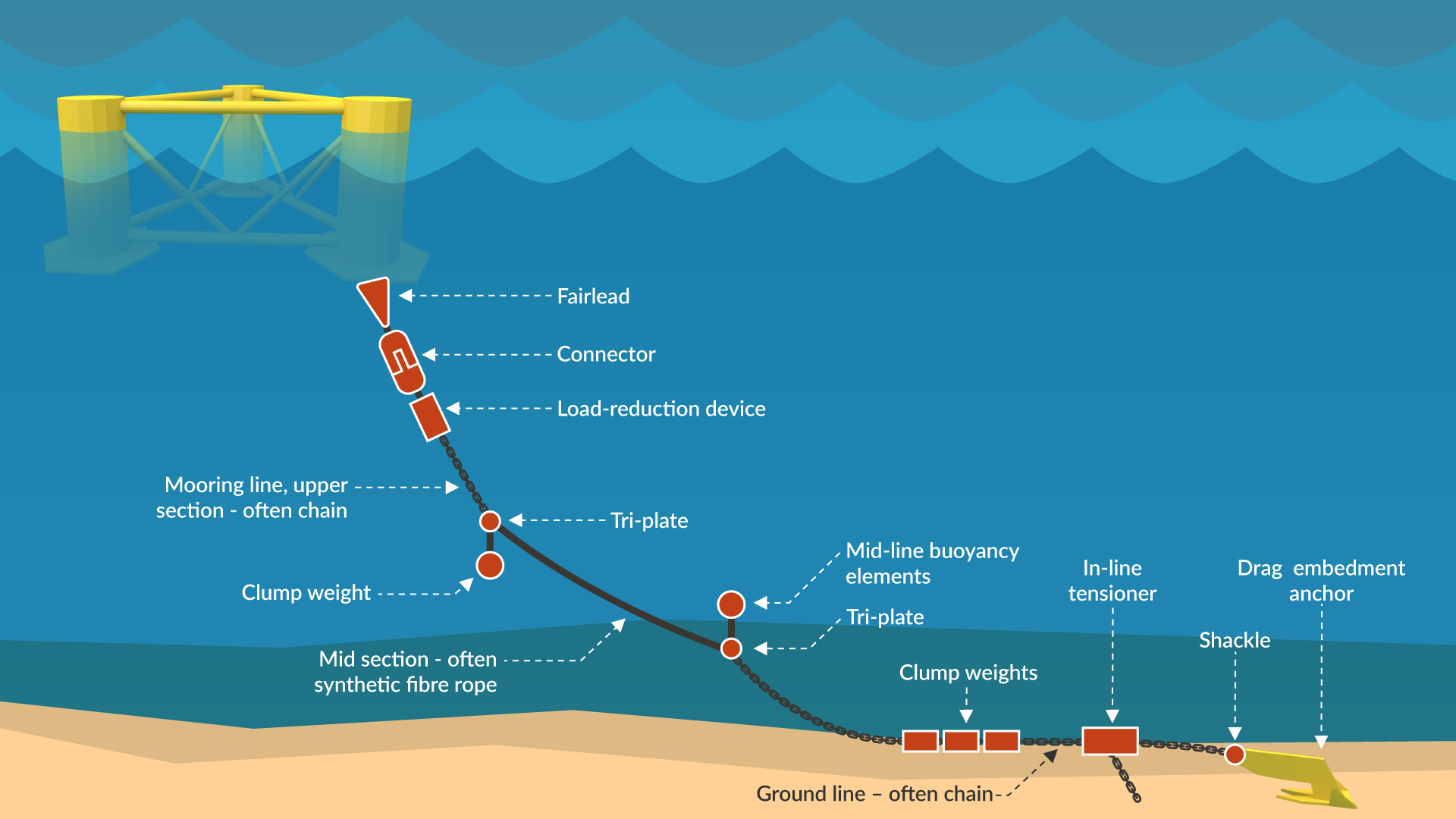

1. Surge in Offshore Wind Energy Deployment

The expansion of floating and fixed-bottom offshore wind farms—particularly in Europe, the U.S., and parts of Asia—will be a primary driver of mooring chain demand by 2026. Mooring systems are essential for anchoring floating wind turbines in deep waters where traditional foundations are unfeasible. With global offshore wind capacity projected to exceed 200 GW by 2030, the need for high-strength, corrosion-resistant mooring chains will grow steadily. This trend will particularly benefit manufacturers specializing in large-diameter chains (Class 3 and above) and dynamic mooring solutions.

2. Increased Demand for High-Performance and Lightweight Materials

While high-grade steel remains the dominant material, innovation in alternative materials such as advanced composites and hybrid mooring systems will accelerate. By 2026, there will be growing interest in lightweight, corrosion-resistant chains and chain-composite hybrids to reduce installation costs, extend service life, and improve performance in harsh environments. However, steel chains will retain market dominance due to proven reliability and lower upfront costs.

3. Expansion in Deepwater and Ultra-Deepwater Oil & Gas Projects

Despite the energy transition, deepwater oil and gas projects—especially in regions like the Gulf of Mexico, West Africa, and Brazil—will continue to require robust mooring systems. Floating Production, Storage, and Offloading (FPSO) units and Tension Leg Platforms (TLPs), which rely heavily on mooring chains, are expected to see renewed investment in 2026, supporting steady demand. Technological improvements in chain fatigue resistance and galvanic protection will be critical in these applications.

4. Regional Manufacturing and Supply Chain Localization

Geopolitical uncertainties and rising logistics costs are prompting a shift toward regional production hubs. By 2026, manufacturers in Southeast Asia (e.g., South Korea, China) and Europe (e.g., Norway, Germany) are expected to strengthen their supply chains to serve offshore wind and oil & gas markets closer to project sites. This localization trend will enhance delivery timelines and reduce dependency on global shipping bottlenecks.

5. Stringent Regulatory and Environmental Standards

Environmental regulations and safety standards are tightening worldwide, especially in the EU and North America. By 2026, mooring chains will need to comply with stricter certification protocols (e.g., DNV, API, ISO) emphasizing lifecycle durability, recyclability, and reduced environmental impact during production and decommissioning. This will encourage investment in green manufacturing processes and non-toxic anti-corrosion coatings.

6. Digitalization and Smart Mooring Systems

The integration of sensors and digital monitoring technologies into mooring chains will gain traction. By 2026, “smart mooring” systems capable of real-time load, tension, and corrosion monitoring will become more common, particularly in offshore renewables and high-value oil & gas operations. This data-driven approach improves predictive maintenance, enhances safety, and reduces downtime.

7. Competitive Pricing Pressure and Market Consolidation

Increased competition from emerging manufacturers in Asia and cost-sensitive project developers will exert downward pressure on prices. To maintain margins, leading players are likely to pursue vertical integration, R&D investment, and strategic partnerships. Market consolidation through mergers and acquisitions is expected to rise as companies aim to scale operations and diversify offerings.

Conclusion

By 2026, the mooring chains market will be shaped by the dual forces of energy transition and technological innovation. While traditional oil & gas applications will remain relevant, the rise of offshore wind will dominate growth. Companies that invest in R&D, sustainability, and digital solutions will be best positioned to capture value in this evolving landscape.

Common Pitfalls When Sourcing Mooring Chains: Quality and Intellectual Property Risks

Sourcing mooring chains—critical components in offshore and marine applications—exposes buyers to significant risks if due diligence is not rigorously applied. Two of the most pressing concerns are compromised quality and intellectual property (IP) infringement. Overlooking these areas can lead to catastrophic failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Inadequate Material Certification and Traceability

A frequent issue is the lack of proper material test reports (MTRs) or the submission of falsified documentation. Buyers may receive chains made from substandard steel that does not meet required specifications (e.g., ASTM, ISO, or API standards). Without full traceability from raw material to finished product, verifying compliance becomes nearly impossible.

2. Non-Compliance with International Standards

Some suppliers cut costs by producing chains that do not meet recognized offshore standards such as ISO 1704, API Spec 2F, or DNVGL-RP-0002. Deviations in heat treatment, mechanical properties (like tensile strength and elongation), or surface finish can severely reduce fatigue life and load capacity.

3. Poor Manufacturing and Inspection Practices

Inferior welding, inconsistent heat treatment, and inadequate non-destructive testing (NDT) are red flags. Many low-cost manufacturers skip essential quality control steps or employ unqualified personnel, increasing the risk of in-service failures under cyclic loading conditions.

4. Counterfeit or Recycled Materials

Unscrupulous suppliers may use recycled scrap metal or rebranded used chains. These materials often have unpredictable performance and are prone to premature failure. Visual inspection alone may not detect such practices without metallurgical analysis.

Intellectual Property (IP) Risks

1. Unauthorized Production of Proprietary Designs

Some manufacturers replicate patented chain designs, stud configurations, or proprietary alloy compositions without licensing. Sourcing such chains exposes the buyer to legal liability, especially if the end-user operates in jurisdictions with strong IP enforcement.

2. Use of Trademarked Branding or Specifications

Suppliers may falsely label their products with well-known brand names (e.g., “equivalent to X brand”) or claim compliance with specifications they are not authorized to use. This misrepresentation can mislead buyers and result in warranty or insurance complications.

3. Lack of Design Ownership and Documentation

When custom mooring chains are developed, unclear IP ownership agreements can lead to disputes. Buyers may assume they own the design, only to discover the supplier retains rights or has licensed the technology from a third party.

4. Reverse Engineering and Technology Theft

In some sourcing regions, there is a risk that technical drawings or samples provided for quotation could be used to reverse engineer products. Without robust non-disclosure agreements (NDAs) and IP protections, companies risk losing competitive advantages.

Mitigation Strategies

- Conduct third-party inspections and factory audits.

- Require full documentation, including MTRs, NDT reports, and certifications from accredited bodies.

- Engage legal counsel to vet supplier contracts for IP clauses and compliance warranties.

- Source from reputable, certified manufacturers with a proven track record in offshore applications.

- Use independent testing labs to verify material and mechanical properties.

Avoiding these pitfalls requires proactive risk management, stringent supplier qualification, and a clear understanding of both technical and legal requirements in mooring chain procurement.

Logistics & Compliance Guide for Mooring Chains

Mooring chains are critical components in marine and offshore operations, ensuring the secure anchoring of vessels, floating platforms, and offshore structures. Due to their high-stress applications, the logistics and compliance requirements for mooring chains are stringent. This guide outlines key considerations for safe handling, transportation, storage, and regulatory compliance.

Material Certification and Quality Standards

Mooring chains must meet internationally recognized standards to ensure structural integrity and performance. Key standards include:

– ISO 1704: Specifies requirements for stud link anchor chains used in marine applications.

– DNV-ST-EN 3:2015 (Det Norske Veritas): Covers design, material, manufacturing, and testing of mooring chains for offshore units.

– API Spec 2IEEE (American Petroleum Institute): Applies to steel mooring chain for use in deepwater offshore floating structures.

– Lloyd’s Register, ABS, and other Classification Societies: Provide certification and oversight for chain manufacture and traceability.

Suppliers must provide full material test reports (MTRs), including chemical composition, mechanical properties, and non-destructive testing (NDT) results. Each chain link should be traceable via heat number or serial marking.

Manufacturing and Inspection Requirements

Manufacturers must adhere to strict quality control processes:

– Chains are typically made from alloy steel (e.g., Grade R3, R3S, R4, R4S, R5) depending on application and required strength.

– Full load testing (proof load and tensile testing) must be conducted per classification society rules.

– Magnetic particle inspection (MPI) or ultrasonic testing (UT) is required to detect surface and subsurface flaws.

– Final inspection includes dimensional checks, surface finish verification, and marking per standards.

Packaging and Handling

Proper packaging and handling are essential to prevent damage:

– Chains should be coiled or spooled according to diameter and length to avoid kinking or deformation.

– Use wooden pallets or steel reels with protective padding to prevent corrosion and mechanical damage.

– Avoid dragging chains on the ground; use slings or lifting beams during handling.

– Protect end fittings and connections with protective caps or covers.

Transportation Logistics

Transport mooring chains with care to maintain integrity:

– Use flatbed trucks or specialized trailers for long or heavy chains.

– Secure chains to prevent movement during transit; use straps, chains, or lashing points.

– For international shipments, comply with IMDG Code (if applicable), though chains are generally non-hazardous.

– Provide clear labeling with weight, dimensions, handling instructions, and certification documents.

– For oversized loads, coordinate with transport authorities for route planning and permits.

Storage Guidelines

Store mooring chains in a controlled environment:

– Keep chains in a dry, covered area to prevent corrosion; avoid exposure to saltwater or high humidity.

– Elevate chains off the ground using wooden blocks or racks.

– Apply corrosion-inhibiting oils or coatings if long-term storage is expected.

– Regularly inspect stored chains for rust, deformation, or damage.

Traceability and Documentation

Maintain comprehensive records for compliance and safety:

– Each chain assembly must have a unique identification number linked to MTRs, test certificates, and inspection reports.

– Documentation should include manufacturer details, heat numbers, load test results, and classification society certification.

– Digital records (e.g., in a chain management system) are recommended for lifecycle tracking.

Regulatory and Environmental Compliance

Ensure adherence to environmental and safety regulations:

– Follow OSHA (U.S.) or equivalent national safety standards for handling heavy loads.

– Comply with MARPOL and local environmental regulations to prevent pollution during handling or storage.

– For offshore use, ensure mooring systems meet jurisdictional requirements (e.g., BSEE in the U.S., OSPAR in Europe).

End-of-Life and Recycling

Dispose of or recycle mooring chains responsibly:

– Decommissioned chains should be inspected for reuse or scrapped if damaged or fatigued.

– Recycle through certified metal recyclers; ensure hazardous coatings (e.g., lead-based paints) are handled properly.

– Maintain records of disposal for audit and compliance purposes.

By following this logistics and compliance guide, stakeholders can ensure the safety, reliability, and regulatory conformity of mooring chains throughout their operational lifecycle.

Conclusion for Sourcing Mooring Chains

In conclusion, sourcing high-quality mooring chains is a critical component in ensuring the safety, reliability, and operational efficiency of offshore and marine structures such as floating production units, floating wind turbines, and buoys. The selection process must consider key factors including material grade (e.g., Grade R3, R3S, R4, or R5), chain diameter, certification standards (e.g., DNV, ISO, API), corrosion resistance, and traceability. Working with reputable suppliers who adhere to international quality and testing protocols is essential to meet stringent offshore requirements.

Additionally, a strategic sourcing approach should balance cost-effectiveness with long-term performance, factoring in maintenance needs, environmental conditions (e.g., deepwater vs. shallow water, harsh climates), and lifecycle costs. As the demand for renewable offshore energy grows, particularly in floating wind, the need for advanced high-strength mooring chains will increase, driving innovation and more rigorous qualification processes.

Ultimately, successful sourcing of mooring chains involves thorough due diligence, collaboration with certified manufacturers, and a clear understanding of project-specific technical and regulatory demands—ensuring robust mooring integrity and marine operational safety.