The global monochrome display monitor market continues to hold a niche yet resilient position within the broader display technology landscape, driven by demand in industrial, medical, and legacy system applications. According to a report by Grand View Research, the global display market—encompassing both monochrome and color technologies—was valued at USD 142.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. While full-color displays dominate consumer electronics, monochrome displays maintain steady relevance in sectors requiring high reliability, low power consumption, and readability under extreme conditions. Mordor Intelligence further highlights a sustained demand in embedded systems, factory automation, and medical instrumentation, where simplicity and durability outweigh the need for color complexity. This enduring utility has allowed key manufacturers to specialize and innovate within the monochrome space. Based on production scale, technological expertise, and industry footprint, the following nine companies stand out as leading monochrome display monitor manufacturers shaping this specialized segment today.

Top 9 Monochrome Display Monitor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Orient Display

Domain Est. 1999

Website: orientdisplay.com

Key Highlights: Orient Display is a company that specializes in manufacturing custom display technology solutions such as LCD modules, active color TFT LCD displays, monochrome ……

#2 LCM Display, LCD Panel & Modules Manufacturer & Supplier …

Domain Est. 1998

Website: winstar.com.tw

Key Highlights: Our offerings include a wide range of LCD modules and LCM displays such as monochrome TN/STN/FSTN, FSC-LCD, and TFT displays (color and monochrome), as well as ……

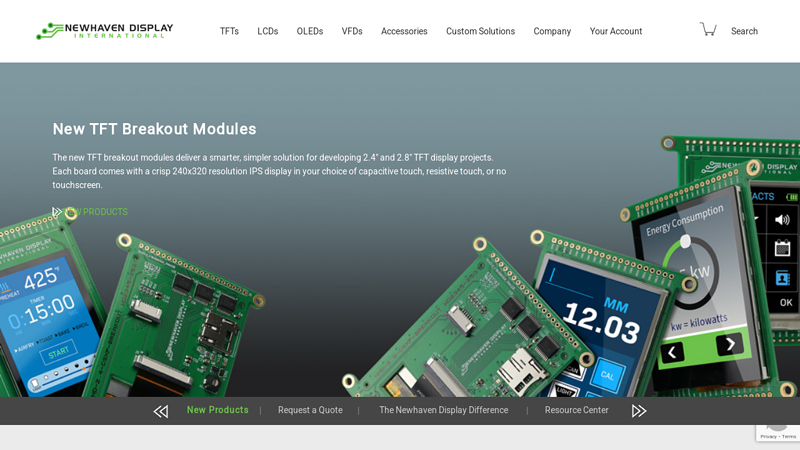

#3 Newhaven Display

Domain Est. 2001

Website: newhavendisplay.com

Key Highlights: We are a US based display manufacturer, supplier, and distributor of LCD, TFT, OLED & VFD solutions worldwide. Explore our high-quality displays today!…

#4 ProArt Display PA329CRV|Monitors|ASUS Global

Domain Est. 1995

Website: asus.com

Key Highlights: ProArt Display PA329CRV is a 31.5-inch 4K HDR monitor designed for professional video editors. This Calman Verified display boasts a wide color gamut with 98% ……

#5 Sitemap

Domain Est. 1996

Website: densitron.com

Key Highlights: Home; Products. Displays and Computers. TFT Displays; OLED Displays; TFT Monitors; Monochrome Displays; Arm computers; X86 computers….

#6 2402L 24″ Touchscreen Monitor

Domain Est. 1996

Website: elotouch.com

Key Highlights: The Elo 2402L is a 24-inch touchscreen monitor featuring a slim professional-grade design and long lifecycle that’s energy efficient and well-suited for ……

#7 Premium Computer Displays and LCD Monitors

Domain Est. 1997

Website: eizo.com

Key Highlights: EIZO is a global leader in display monitors and LCD displays for a wide variety of industries, including business, medical, graphics, gaming, ATC and more….

#8 Mimo

Domain Est. 2009

Website: mimomonitors.com

Key Highlights: Enhance your productivity with monitors and displays from Mimo. They are used in various industries, including hospitality and entertainment….

#9 MMD Corporate

Domain Est. 2020

Website: mmdmonitors.com

Key Highlights: MMD exclusively markets and sells Philips branded displays worldwide. By combining the Philips brand promise with TPV’s manufacturing expertise in displays….

Expert Sourcing Insights for Monochrome Display Monitor

H2: 2026 Market Trends for Monochrome Display Monitors

Despite the widespread adoption of color and high-resolution displays, monochrome display monitors are expected to maintain a niche yet stable presence in the global market by 2026. Several key trends are shaping the trajectory of this segment, driven by specific industrial, medical, and specialized applications where simplicity, reliability, and cost-efficiency remain paramount.

1. Sustained Demand in Industrial and Embedded Systems

Monochrome displays continue to be widely used in industrial control panels, automation systems, and embedded devices. Their durability, low power consumption, and readability in extreme lighting conditions make them ideal for factory floors, outdoor equipment, and legacy manufacturing machinery. As industries pursue cost-effective upgrades without full system overhauls, demand for monochrome monitors in retrofitting and maintenance applications is projected to remain steady through 2026.

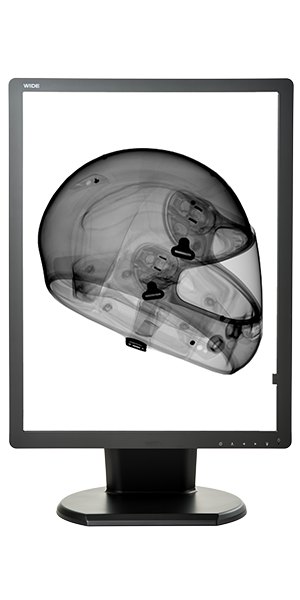

2. Growth in Medical and Diagnostic Equipment

In the healthcare sector, monochrome monitors—especially high-brightness, grayscale displays—are still preferred for certain diagnostic imaging applications, such as X-ray and ultrasound systems. These monitors offer high contrast ratios and precise grayscale reproduction, which are critical for accurate image interpretation. Regulatory compliance and long product life cycles in medical devices support continued deployment of monochrome technology in this domain.

3. Decline in Consumer and Commercial Applications

The consumer electronics market has almost entirely transitioned to color LCD and OLED displays. As a result, monochrome monitors are no longer relevant in mainstream computing, retail, or home environments. By 2026, their presence in these sectors is expected to be negligible, with the exception of low-cost or ultra-low-power IoT devices, such as digital signage in constrained environments or basic information kiosks.

4. Technological Stagnation and Shift to Alternatives

Innovation in monochrome display technology has slowed, with manufacturers focusing resources on advanced color and touch-enabled displays. However, some replacements, like e-Ink and segmented OLEDs, are beginning to take over in areas where monochrome LCDs were traditionally used—such as smart meters, wearables, and electronic shelf labels—due to better energy efficiency and contrast.

5. Regional Market Dynamics

Emerging markets in Asia-Pacific, Africa, and parts of Latin America may still see modest demand for monochrome monitors due to lower infrastructure costs and longer technology adoption cycles. These regions often rely on legacy systems in public utilities and transportation, where monochrome displays remain functional and economically viable.

6. Sustainability and Longevity as Competitive Advantages

One of the enduring strengths of monochrome monitors is their long operational life and minimal environmental footprint. As sustainability becomes a higher priority in electronics manufacturing, the longevity and repairability of monochrome systems may appeal to industries focused on reducing electronic waste.

Conclusion

While the monochrome display monitor market is not poised for significant growth in 2026, it will persist in specialized applications where performance, reliability, and cost outweigh the need for color or high-definition visuals. The market will likely consolidate around industrial automation, medical imaging, and legacy system support, serving as a testament to the enduring value of simple, purpose-built technology.

Common Pitfalls When Sourcing Monochrome Display Monitors (Quality, IP Rating)

Inadequate Assessment of Display Quality Metrics

One major pitfall is failing to thoroughly evaluate key display quality parameters such as contrast ratio, brightness, viewing angles, and pixel integrity. Monochrome displays, especially those used in industrial or outdoor environments, require high contrast and sufficient luminance to remain legible under varying lighting conditions. Overlooking these specifications can result in monitors that are difficult to read in bright sunlight or dim settings, compromising usability and safety.

Misunderstanding or Overlooking IP (Ingress Protection) Ratings

A critical mistake is not verifying the appropriate IP rating for the intended operating environment. Sourcing a monitor with insufficient IP protection—such as selecting IP54 instead of IP65 or higher—can expose the device to dust, moisture, or water ingress, leading to premature failure. Conversely, over-specifying an unnecessarily high IP rating can inflate costs without added benefit, especially in climate-controlled indoor applications.

Prioritizing Cost Over Long-Term Reliability

Choosing the lowest-cost option without considering component durability, manufacturer reputation, or warranty terms often leads to higher total cost of ownership. Cheaply sourced monochrome displays may use inferior backlights or driver electronics that degrade quickly, increasing maintenance and replacement frequency—especially in mission-critical applications.

Ignoring Environmental and Operational Conditions

Sourcing without accounting for temperature extremes, humidity, vibration, or chemical exposure can result in poor performance. Monochrome monitors designed for standard office use may fail in industrial settings unless specifically rated for wide operating temperature ranges and ruggedized construction.

Lack of Compliance and Certification Verification

Failing to confirm regulatory compliance (such as CE, UL, RoHS) or industry-specific certifications (e.g., for medical or transportation use) can lead to integration issues, legal liabilities, or rejection during audit processes. This oversight is especially critical when sourcing from non-certified or offshore suppliers.

Poor Supplier Due Diligence

Working with suppliers who lack transparency about manufacturing processes, quality control procedures, or component sourcing increases the risk of receiving counterfeit or substandard products. This is particularly relevant for legacy or specialized monochrome displays where second-tier vendors may offer non-genuine replacements.

Underestimating Longevity and Availability Risks

Monochrome displays are often used in long-lifecycle equipment. Sourcing from suppliers without clear product roadmaps or end-of-life (EOL) policies can disrupt operations when replacements are no longer available, necessitating expensive redesigns or retrofits.

Logistics & Compliance Guide for Monochrome Display Monitor

This guide outlines key logistics and compliance considerations for the import, export, distribution, and operation of monochrome display monitors. Adherence to the following requirements ensures regulatory compliance, smooth supply chain operations, and product safety.

Product Classification and Tariff Codes

Accurate classification is essential for customs clearance and duty assessment. Monochrome display monitors are typically classified under the Harmonized System (HS) code 8528.50, which covers “Monitors and projectors, not incorporating television reception apparatus.”

– Confirm classification with your local customs authority or a licensed customs broker.

– Some countries may apply sub-category distinctions based on screen size, resolution, or intended use (e.g., industrial vs. consumer).

– Maintain product specifications (screen type, size, input type, power consumption) to justify classification.

Import/Export Regulations

- Export Controls: Verify if the product contains controlled components (e.g., radiation-emitting elements or encryption features). Most monochrome monitors do not require export licenses under EAR (Export Administration Regulations), but confirm with your national export agency.

- Import Requirements: Check destination country requirements for electronic imports. Some countries may require:

- Certificate of Conformity (CoC)

- Pre-shipment inspection

- Local representative or importer of record

- Maintain accurate commercial invoices, packing lists, and bills of lading.

Electromagnetic Compatibility (EMC) Compliance

Monochrome display monitors must comply with EMC regulations to limit electromagnetic interference.

– Key Standards:

– EU: EN 55032 (EMI), EN 55035 (Immunity) — required for CE marking

– USA: FCC Part 15, Subpart B — Class B for residential environments

– Canada: ICES-003 (Industry Canada)

– Testing must be performed by an accredited laboratory.

– Documentation (test reports, technical files) must be retained for market surveillance.

Safety Standards and Certifications

Electrical safety certification is mandatory in most markets.

– Key Certifications:

– CE Marking (EU): Comply with Low Voltage Directive (LVD) under EN 62368-1 (Audio/Video, Information and Communication Technology Equipment — Safety)

– UL/ETL Listing (USA/Canada): UL 62368-1

– PSE Mark (Japan): Mandatory for AC-powered devices; requires METI notification

– KC Mark (South Korea): Required under Korea’s Electrical Safety Control System

– Use certified power supplies and ensure grounding and insulation meet regional standards.

RoHS and Environmental Compliance

Restriction of Hazardous Substances (RoHS) directives apply to electronic displays.

– EU RoHS Directive (2011/65/EU): Limits lead, mercury, cadmium, hexavalent chromium, PBB, and PBDE in electrical equipment.

– Other regions with similar regulations: China RoHS, UK RoHS, California RoHS.

– Ensure suppliers provide RoHS compliance declarations and material declarations (e.g., via IPC-1752 format).

– Label products appropriately (e.g., crossed-out wheelie bin symbol).

Energy Efficiency and Labeling

Energy performance may be regulated depending on market.

– EU: Energy-related Products (ErP) Directive — may require energy label and eco-design compliance under Regulation (EU) 2019/2021 for electronic displays.

– USA: ENERGY STAR® certification is voluntary but beneficial; check DOE minimum efficiency standards if applicable.

– South Korea, Japan, Canada: May require energy labeling or reporting.

– Measure and document typical energy consumption (TEC) in kWh/year.

Packaging and Transportation

- Packaging Requirements:

- Use anti-static and shock-resistant materials to protect sensitive components.

- Clearly label with handling symbols (e.g., “Fragile,” “This Side Up”).

- Include country-of-origin marking and barcodes.

- Hazardous Materials: Monochrome CRT monitors (if applicable) contain leaded glass and may be classified as hazardous waste; LCD-based monochrome displays typically do not.

- Transportation: Ship via standard electronic goods logistics (air, sea, or ground). No special hazardous shipping required for modern LCD monochrome monitors.

Waste Electrical and Electronic Equipment (WEEE)

Producers are responsible for end-of-life take-back and recycling.

– EU WEEE Directive (2012/19/EU): Register with national WEEE authorities; affix the WEEE symbol (crossed-out bin).

– Other Regions: Check producer responsibility schemes in countries like Switzerland (SWICO), Japan (Home Appliance Recycling Law), or U.S. state laws (e.g., California).

– Provide take-back information to customers or partner with certified e-waste recyclers.

Documentation and Record Keeping

Maintain the following for compliance audits and customs:

– Technical construction file (TCF) including design drawings, BOM, test reports

– Declaration of Conformity (DoC) for CE, FCC, etc.

– RoHS and REACH compliance documentation

– Import/export licenses and customs filings

– Safety and EMC test reports (retain for at least 10 years)

Summary

Compliance for monochrome display monitors involves accurate classification, adherence to regional safety and EMC standards, environmental regulations (RoHS, WEEE), and proper logistics handling. Engage certified testing labs, maintain thorough documentation, and stay updated on regulatory changes in target markets to ensure uninterrupted distribution and legal operation.

In conclusion, sourcing a monochrome display monitor presents a reliable and cost-effective solution for applications where color reproduction is unnecessary and durability, readability in extreme lighting conditions, and low power consumption are prioritized. These displays excel in industrial, medical, aviation, and legacy systems where clarity, longevity, and performance under challenging environments are critical. While the market has shifted toward color and high-resolution technologies, monochrome monitors remain relevant due to their functional advantages and ease of integration into specialized systems. When sourcing, it is essential to consider factors such as compatibility, resolution, brightness, supplier reliability, and long-term support to ensure seamless implementation and sustained operation. With careful evaluation, a monochrome display monitor can be a strategic choice that delivers efficiency, reliability, and value over time.